Techniques of Managerial Control: Traditional and Modern Techniques!

1. Traditional Techniques:

Traditional techniques refer to the techniques that have been used by business organisation for longer period of time and are still in use.

Such techniques are:

ADVERTISEMENTS:

a. Personal Observation

b. Statistical Reports.

c. Breakeven Analysis.

d. Budgetary Control.

(a) Personal Observation:

ADVERTISEMENTS:

This is the most traditional technique of control. It helps a manager to collect first hand information about the performance of the employees. It also creates psychological pressure on the employees to improve their performance as they are aware that they are being observed personally by the manager. However, this technique is not to be effectively used in all kinds of jobs as it is very time consuming.

(b) Statistical Reports:

Statistical analysis in the form of percentages, ratios, averages etc. in different areas provides useful information regarding performance of an organisation to its managers. When such information is presented in the form of tables, graphs, charts etc., it facilitates comparison of performance with the standards laid and with previous years’ performance.

(c) Breakeven Analysis:

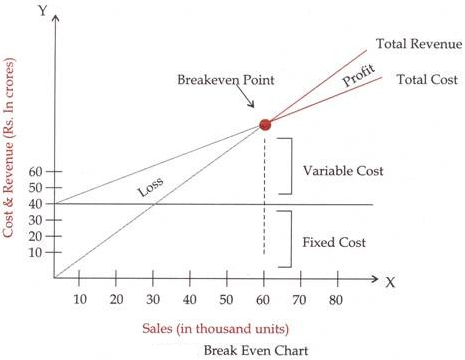

The technique used by managers to study the relationship between sales volume, costs and profit is known as Breakeven Analysis. This technique helps the managers in estimating profits at different levels of activities. The following figure shows breakeven chart of a firm.

The point at which the total revenue and total cost curves intersect is breakeven point. The figure shows that the firm will have the breakeven point at 60,000 units of output. At this point, there is neither profit nor loss. The firm starts earning profit beyond this point.

ADVERTISEMENTS:

Breakeven Point= Fixed Cost/ (Selling Price per unit- Variable cost per unit).

Through breakeven analysis, a firm can keep a check on its variable cost and can also determine the level of activity at which it can earn its profit target.

(d) Budgetary Control:

Under this technique, different budgets are prepared for different operations in an organisation in advance. These budgets act as standards for comparing them with actual performance and taking necessary actions for attaining organisational goals.

ADVERTISEMENTS:

A budget can be defined as a quantitative statement of expected result, prepared for a future period of time. The budget should be flexible so that necessary changes, if need be, can be easily made later according to the requirements of the prevailing environment.

Types of Budgets:

Different types of budget are as follows:

(i) Sales Budget:

ADVERTISEMENTS:

Expected sales in terms of quantity as well as volume.

(ii) Production Budget:

Expected production in the budgeted period.

(iii) Material Budget:

ADVERTISEMENTS:

Expected quantity and cost of material required for production.

(iv) Cash Budget:

Expected inflow and outflow of cash for the budgeted period.

(v) Capital Budget:

ADVERTISEMENTS:

Estimated spending on fixed assets.

(vi) Research and Development Budget:

Expected spending on research and development work.

Advantages of Budgetary Control:

The following are the main advantages of budgetary control:

1. Helps in Coordination:

It helps in establishing coordination and interdependence among various departments. For example, purchase budget cannot be prepared without knowing quantity of materials required and that information comes in from production budget. Latter in turn is based on sales budget.

ADVERTISEMENTS:

2. Optimum Utilization of Resources:

Budgeting ensures fuller utilization of resources by allocating the resources according to the needs of various departments.

3. Motivating Employees:

Budgeting helps in motivating the employees to perform better as they know the standards against which their performance will be judged.

4. Helps in Attaining Targets:

Budgeting ensures attainment of organisational goals by focusing on specific and time bound targets.

ADVERTISEMENTS:

5. Facilitates Management by Exception:

By stressing on the operations which deviate from budgeted standards, it facilitates management by exception in the organisation.

Limitations of Budgetary control:

Some of the defects of budgetary control are as follows:

1. Rigidity:

Budgets are often too rigid & restrictive and supervisors are given little freedom in managing their resources. The budgets may either be changed too often or not at all, making it difficult for employees to meet performance level expected of them.

ADVERTISEMENTS:

2. Lack of Action:

Only preparing budgets cannot lead to success unless & until these are not put into action. There is a need to translate these budget figures into results.

3. Time consuming:

Preparing different kind of budgets is not an easy thing as it involves a lot of time, money and efforts.

4. Estimate:

Generally, Budgets are prepared on the basis of the price level prevailing at a particular time period but these estimates may become useless during subsequent inflation or depression in the market.

2. Modern Techniques:

Modem techniques are those techniques which are very new in management world. These techniques provide various new aspects for controlling the activities of an organisation.

ADVERTISEMENTS:

These techniques are as follows:

(a) Return on Investment.

(b) Ratio Analysis.

(c) Responsibility Accounting.

(d) Management Audit.

ADVERTISEMENTS:

(e) PERT and CPM.

(f) Management Information System.

(a) Return on Investment:

Return on investment is very useful technique for determining whether the capital invested in the business has been effectively used or not for generating reasonable amount of return.

Return on Investment= (Net Income / Total Investment) X 100 Net Income before or after tax can be used for calculating ROI. Total investment includes investment in fixed Assets as well as working capital.

It acts as an effective control device in measuring and comparing the performance of different departments. It also helps departmental managers to find out the problems which adversely affect ROI.

(b) Ratio Analysis:

Ratio Analysis is a technique of analyzing the financial statements of a business firm by computing different ratios.

The most commonly used ratios have been grouped under following categories:

(i) Liquidity Ratios:

Liquidity ratios are calculated to know short term financial position of business and its ability to pay short term liabilities. It includes current ratio and quick ratio.

a. Current Ratio = Current Assets/Current Liabilities

b. Quick Ratio = Cash + Bills Receivable/Current Liabilities

(ii) Solvency Ratios:

Solvency ratios are calculated to know long term solvency of the business and its ability to pay its long term debts. It includes debt equity ratio, proprietary ratio, interest coverage ratio etc.

a. Debt Equity Ratio= Debt/Equity Share Holders Fund

b. Proprietary Ratio = Shareholders fund/Total Assets

(iii) Profitability Ratios:

Profitability ratios like gross profit ratio, net profit ratio, operating ratio, etc. help to analyze the profitability position of a business.

a. Gross Profit Ratio = Gross Profit/Net Sales × 100

b. Net Profit Ratio = Net Profit/Net Sales x 100

(iv) Turnover Ratios:

The various turnover ratios like Inventory turnover ratio, debtors turnover ratio, fixed assets turnover ratio etc. help in knowing whether the resources are effectively used for increasing the efficiency of operations of business or not. Higher turnover indicates better utilization of resources.

a. Inventory Turnover Ratio = Cost of goods sold/Average Stock

b. Debtors Turnover Ratio = Net Credit Sales/Average Accounts Receivables

(c) Responsibility Accounting:

Under this system of accounting, various sections, departments or divisions of an organisation are set up as ‘ Responsibility Centers’. Each centre has a head who is responsible for attaining the target of his centre.

The various responsibility centres are as follows:

(i) Cost Centre:

Cost centre, also known as expense centre, refers to a department of an organisation whose manager is held responsible for the cost incurred in the centre but not the revenues. For example, Production department of an organisation may be classified as Cost Centre.

(ii) Revenue Centre:

A revenue centre refers to a department which is responsible for generating revenues. For example, marketing department.

(iii) Profit Centre:

A profit centre refers to a department whose manager is responsible for both cost and revenues. For example, Repair and Maintenance department.

(iv) Investment Centre:

An investment centre is responsible for profits as well as investments made in the form of assets. For judging the performance of investment centre, return on investment (ROI) is calculated and compared with similar data for previous years for one’s own centre as well as other similar enterprises. It is also compared with current data of competing enterprises.

(d)Management Audit:

Management Audit is a process of judging the overall performance of the management of an organisation. It aims at reviewing the efficiency and effectiveness of management and improving its future performance. Its basic purpose is to identify the deficiencies in the performance of management functions. It also ensures updating of existing managerial policies.

Following are the main advantages of management audit:

(i) It identifies the deficiencies in the performance of management functions.

(ii) It helps in improving coordination among the functions of various departments.

(iii) It ensures required modification in the existing managerial policies and techniques according to environmental changes.

(iv) The continuous monitoring of the performance of management helps in improving control system.

There is no proper technique of management audit and also it is not compulsory under any law.

(e) PERT and CPM:

PERT (Programme Evaluation and Review Technique) and CPM (Critical Path Method) are two important techniques used in both planning and controlling. These techniques are used to compute the total expected time needed to complete a project & it can identify the bottleneck activities that have a critical effect on the project completion date. Such techniques are mainly used in areas like construction projects, aircraft manufacture, ship building etc.

The various steps involved in using these techniques are as follows:

(i) The project is first divided into various activities and then these activities are arranged in a logical sequence.

(ii) A network diagram is prepared showing the sequence of activities.

(iii)Time estimates are laid down for each activity. PERT prepares three time estimates-(i) Optimistic (shortest time) (ii) Most likely time & (iii) Pessimistic (longest time).In CPM, only one time estimate is prepared. Along with this, CPM also lays down the cost estimates for completing the project.

(iv) The most critical path in the network is the longest path. Longest path consists of those activities which are critical for completing the project on time; hence the name CPM.

(v) If required, necessary changes are made in the plan for completing the project on time.

(f) Management Information System (MIS):

Management Information System (MIS) is a computer based information system which provides accurate, timely and up-to-date information to the managers for taking various managerial decisions. Thus, it is an important communication tool as well as an important control technique. It provides timely information to the managers so that they can take appropriate corrective measures in case of deviations from standards.

Advantages of management information system are as follows:

(a) It provides only relevant information to the managers thus saving them him from information overload.

(b) It facilitates collection and management of information at different levels and departments of the organisation.

(c) It helps in planning, controlling and decision making at all levels of an organisation.

(d) It helps in improving the quality of information.

(e) It ensures cost effectiveness by providing all important information to the management in time.

(ii) Taking Corrective Action:

The final step in the process of controlling involves taking corrective action. If the deviations are within acceptable limits no corrective measure is required.