Meaning of Social Control of Company:

Despite the defects commonly admitted in the management of companies, the suitability of company as the superior form of business organisation cannot be disputed. The processes of democratisation should however be initiated in the conduct of company’s affairs in order to remedy the oligarchic malaise.

Democratisation or social control of company is inevitable to make the business a tool for economic betterment and social stability. Investors’ confidence, consumers’ goodwill and workers’ co-operative response are essential for corporate management.

Democratic spirit is more important than more formal or procedural powers of election of directors, adoption of accounts etc. The management should display its awareness of responsibility to shareholders, its willingness or readiness to strive hard for promoting their interests through the honest and competent conduct of the company’s business.

Identifying the policies, designing the programmes, sincerely initiating the productive efforts in organisation in such a manner as to sub-serve the basic interest of the shareholders is the essence of democratisation.

ADVERTISEMENTS:

Shareholders have risked their money in the company’s capital and the entrusted assets worth enormous value to a handful of directors. Hence it is morally the duty of the latter to justify the confidence reposed in them by the former. The company is an undertaking of the shareholders, by the sharehoders and should be for the benefit of shareholders too.

An American business executive Oven D. Young once said, “There are three groups of people who have an interest in the institution (General Electric Co. of which he was an executive). One is the group of 50,000 people who have put their capital in the company— namely the shareholders. Another is group of well 1,00,000 people who are putting their labour and their lives into the business of the company. The third group is of customers and the general public.

I conceive my first trust to be to see to it that the capital which is put into this concern is safe, honestly and wisely used and paid a fair rate of return. Otherwise we cannot get capital.

Second, the people who put their labour in this concern get fair wages, continuity of employment. Third, that the customers get consistent with the obligation as capital and labour.

Responsibilities of Truly Democratic Company Management:

ADVERTISEMENTS:

Company management is answerable to the interests of shareholders, employees, consumers and the State must be alive to its responsibilities listed below:

A. Responsibilities towards Shareholders:

(1) Enterprise should be kept solvent by judicious use of capital and assets.

(2) Enterprise should be managed efficiently.

ADVERTISEMENTS:

(3) Fair return on the investments must be ensured.

(4) Adequate information on the present standing, and future plans of the company must be provided to the shareholders.

(5) Optimum utilisation of the resources and the created capacity must be achieved.

B. Responsibilities towards Workers:

ADVERTISEMENTS:

(1) Steady employment must be ensured.

(2) Fair wages for fair day’s work should be paid.

(3) Workers must participate in the profit of the company.

(4) Protection against the hazards of accidents while at work; security and relief against sickness, old age, unemployment etc.

ADVERTISEMENTS:

(5) Increasing involvement of workers in administration of the company should be secured.

(6) Right of organisation and collective bargaining should be granted and machinery for settlement of grievances of workers must be provided.

C. Responsibilities towards the Consumers:

(1) Continuous supply of goods and services required must be ensured.

ADVERTISEMENTS:

(2) Fair prices and trading on fair and competitive terms should be assured

(3) Improvement in quality of goods and services.

(4) Monopolistic practices in business should be avoided.

Methods of Democratisation or Social Control:

1. “Shareholders Associations”:

The root cause of ills in company management lies in the lack of unity and collective action on the part of shareholders. It is essential that a class of equity shareholders have their own organisation providing a forum for discussing the common problems and working to mould the corporate policies conducive to their legitimate interests.

ADVERTISEMENTS:

Shareholders’ association is a useful device of giving a really democratic touch to corporate management. The association aims at educating the shareholders in matter of company finance and accounts and enlightening them on the position and progress of the company.

Difficulties and doubts experienced by the shareholders in getting information about company’s business, profit, future policies legal enactments affecting the company, proxies, voting, dividend etc., can be represented through the association.

Function of Shareholders’ Association would include the following:

(1) Collection of information about the company’s policies, programmes and future plans.

(2) Keeping track of changes in market value of shares of the company and informing the shareholders of the underlying causes and implications of such changes.

(3) In case the market value of shares is declining, clarification about the depressing trend can be obtained from the management.

ADVERTISEMENTS:

(4) Educating the members on technical matters relating to production growth, rate of turnover, profit ratio, valuation of assets, provision of resources so that they can clearly or vividly visualise the financial position of the company.

(5) Persuading the members to attend the Annual General Meeting and explaining to them the procedures followed at the meeting, the rights they can exercise in respect of election of directors, appointment of auditors, approval of accounts, declaration of dividend etc.

(6) Collection of proxies from those who do not desire to attend the meeting and using the voting potential for benevolent objectives of common interest.

(7) Taking precautionary steps against possible ultra virus acts of the management.

(8) Legal measures against the company if the affairs are being mismanaged or if the interests of shareholders are being ignored by oppressive policies of the management.

(9) Representation to the Government on issues connected with the company’s functioning and seeking its interference if necessary to set right the defective policies or procedures.

ADVERTISEMENTS:

(10) Giving suggestions to the government regarding changes required in Company Law to make the management responsible to the shareholders’ interests.

(11) Explaining to the members of the significance of any observations made in the Auditors’ Report on Company’s accounts.

(12) Compelling the management to make comprehensive, clear and factual reporting.

(13) Asking the companies to send proceedings of Annual General Meeting to those shareholders who did not attend the meeting.

The association should be led by well-informed shareholders who can objectively and constructively analyse and comment on the working of the company. These associations can be formed company wise industry wise or region-wise. Integrity of the organisers and loyalty and support of large number of shareholders would be essential for the success of such associations.

2. Protection of the Rights of Shareholders:

Although shareholders cannot be granted right of active participation in day- to-day control of the company, it is quite essential to confer on them certain basic rights and privileges that would keep them correctly informed of the company’s business, financial position, physical assets, the level of profits etc., and would enable them to take corrective action to remedy malevolent effects of wrong policies, in different attitudes, hasty decisions of directors and other office-bearers in charge of company management.

ADVERTISEMENTS:

These rights have the following objectives in view:

Giving opportunity to the shareholders:

(a) To know and to discuss the affairs of the company;

(b) To elect directors etc. as per democratic procedures in the best interests of the company, and

(c) To approach the Government or the Court for preventing or curbing incompetent and oppressive management, i.e., countervailing rights to secure better management.

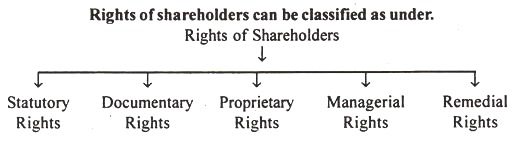

Rights of shareholders in company management strictly as per the law are as under:

ADVERTISEMENTS:

(i) Right to expect impartial management by the Board of Directors for the benefit of all shareholders.

(ii) A share in profit when dividends are declared as recommended by the Board of Directors and in assets (if any) if the company is dissolved.

(iii) Subscription to additional shares offered by the company before sale to the public.

(iv) The right to vote on amendments to the Articles and the Memorandum.

(v) The right to vote for election of members of the Board of Directors and on company’s policies.

As these rights are essential for the democratic functioning of the management of a company they are discussed here at some length.

(A) Statutory Rights:

These rights are contained in the Indian Companies Act. They cannot be revoked or modified by the Memorandum or Articles of the company.

Some of the statutory rights under Indian Companies Act, 1956, are specified below:

(a) The right to receive a share certificate.

(b) The right to receive notices and circulars of the general meetings, statutory report, annual accounts, audit report, to his registered address.

(c) The right to transfer the shares.

(d) The right to inspect the statutory books free of charge.

(e) The right to demand poll on any resolution moved in the General Meeting.

(f) The right to demand or call an Extraordinary General Meeting to consider any urgent or special matters [Section 169],

(g) Alteration of Memorandum and/or Articles of Association of the company.

(h) Pre-emptive right—right of priority to have shares offered and allotted in case of additional issue of shares [Section 81).

(B) Documentary Rights:

They refer to the rights granted to the members by the basic documents of the company, viz., Memorandum and Articles of Association. These rights may pertain to dividend, voting, moving of resolutions of the meetings, election of directors, approval of accounts etc., and they should not conflict with any statutory requirements laid down in the Companies Act.

(C) Proprietary Rights:

Following are the rights conferred on the shareholders as a sequel to their holding proprietary interest in the capital and assets of the company:

(a) Right to receive dividend duly declared by the company subject to Sections 93, 205, 206 and 207 of the Companies Act, 1956. The members have the right to receive dividend warrant within 42 days of its declaration.

(b) Right to allotment of bonus shares in case the profits or reserves of undistributed profits are capitalised.

(c) Right to participate in the distribution of assets in the event of the liquidation of the company. This right is exercisable over such of the assets as are left over after winding up of the company but on the assets as a whole.

(d) Right to transfer the shares as per Articles and in case the company refuses to register the transfer, the right to appeal to Central Government against such refusal.

(e) Right to get Share Register duly rectified, if need be.

(f) Right to get his name entered in the Register of Members subject to valid and authorised transfer of shares.

(g) The privilege of immunity from personal liability for the company’s debt.

(h) Right to allotment of new shares issued by the company prior to their offer to public.

(i) Right to equality and honesty of treatment by the Directors.

(D) Managerial Rights:

These include the following:

(a) Voting rights to elect or remove directors.

(b) Voting right as to the approval of alteration in Memorandum and Articles of Association and similar charges in corporate set-up.

(c) The basic rights as to the control of the company’s management are: Election of Directors, Appointment of Auditors, Approval of Accounts, Removal of Directors, etc.

(d) Right to have the company managed honestly and carefully for the benefit and profit of the shareholders within permitted scope of the business.

(E) Remedial Right (to prevent oppressive management of companies):

The Indian Companies Act, 1956, has made provision for collective appeal by shareholders against fraudulent and oppressive practices indulged in by directors, or other top office-bearers of the company.

Investigation:

Sections 235 to 251 pertain to right of getting the affairs of a company investigated by the Central Government.

The Central Government may appoint inspector or inspectors to inquire into affairs of any company and to report thereon:

(i) When not less than 200 members holding not less than 1/10th of the total voting power apply.

(ii) In the case of a company not having share-capital when not less than l/5th of the members apply.

(iii) When a Registrar has submitted a report under Section 234 (to the Government) setting forth his findings of unsatisfactory state of affairs, failure of the company to give information asked for, etc.

(iv) When the company by special resolution or the court by order declares that the affairs be investigated by Central Government.

Under the following circumstances also the Government may order investigation:

(a) If the business of the company is being conducted with an intention to defraud its creditors, members or any other persons.

(b) If the affairs of the company are being conducted for a fraudulent purpose or carried on in a manner oppressive of any of its members.

(c) If the persons concerned in the formation or management of the company are found guilty of fraud, misfeasance or other misconduct toward the company or its members.

(d) If the members of the company have not been given all the information with respect to its affairs which they can reasonably expect.

The inspector so appointed by the Central Government has the power to investigate the affairs of allied companies if he deems necessary with the prior approval of the Government. It is the duty of all officers and other employees and agents of the company to preserve and produce to the inspector all the books and papers in their custody and otherwise have to render all assistance to the inspector in his investigation.

If need be, inspector can examine on oath any officers, employees and agents of the company and can keep all records, books, etc. with him during the course of investigation.

Report by Inspectors:

The inspector has to make a final report of the Government. If required by the Government he may give interim reports as well.

If from the report it appears to the Central Government that any person has in relation to the company or any other body corporate (whose affairs have been investigated) been guilty of any criminal offence, the Government may prosecute such person.

The Government may also, on the basis of the report, apply to the court for winding up of the company.

If from the report it appears that a fraud has been committed, property has been misappropriated or wrongfully retained or mis-applied, the Government may itself bring suit in the name of the company to recover the damage from the guilty persons.

The Government has also the power to investigate through inspectors on matters concerning the membership pattern of any company in order to find out those who are able to really control or influence the policy of the company and the effect of such control on the interests of members.

3. Prevention of Oppression and Mismanagement:

It is likely that the directors may twist the majority of shareholders for their own ulterior ends. Any decision by majority many times affects the interests of minority section of the shareholders. The directors may indulge in fraudulent activities seeking shelter behind a credulous majority or sometime manipulated majority of shareholders. The management thus tends to be oppressive of the minority interests and may also turn out to be detrimental to the general interests of the business as such.

The Companies Act had made provision for checkmating the oppressive tactics or the incidence of mismanagement of a company. Sections 397 to 409 of the Companies Act, 1956, authorise the court and the Central Government to apply legislative sanctions against the instances of oppression or mismanagement.

As per Section 397, only member of a company who feels that the affairs of the company are being conducted in a manner prejudical to the public interest or in a manner oppressive to any member or members may apply to the court for appropriate relief.

Oppressive management means harsh or burdensome policies, practices or decisions pressured by the management leading to exploitation of shareholders or resulting in wrongful acts detrimental to the public interest.

The conduct of management must be such as would involve a visible departure from the standards of fair dealing and a violation of the conditions of fair play on which every shareholder who entrusts his money to the company must rely. Unfair practices; discrimination, manipulation of votes, undue influence in order to capture the majority votes will mean oppressive to the other shareholders.

Similarly under Section 398, any member can apply to the Government for suitable relief on the ground of mismanagement of the company. Mismanagement may mean carelessness, indifference, lack of integrity, misapplication of money, wrong policy making etc., which will prejudice the public interests, prejudice the interests of the company, or a change in management which is likely to prejudice the public and the corporate interest.

The court may issue orders suitable to curb the matters against which complaints might have been received.

Relief can be sought from the court against oppression and mismanagement on application by not less than 100 members or not less than 1 /10th of the total number (whichever is less), or by any member or members holding not less than 1/10th of the issued capital on which all calls are paid. If a company has no share- capital, there should be an application by not less than 1/5th of the total number of members.

Power of the Court:

(1) As per Section 402, the court may issue orders for the regulation of the conduct of the company’s affairs in future.

(2) Purchase of shares of any member of the company by other members or by the company itself.

(3) Reduction of capital in case the company itself buys the shares held by other members.

(4) Termination or alteration of any agreement made between the company and the managing director, manager etc.

(5) Setting aside any fraudulent preference made within three months prior to the date of application.

(6) Any other matter for which, in the opinion of the court, it is just and equitable that provisions should be made.

Powers of the Central Government:

According to Section 408 and 409, the Central Government also can step in to correct any instance of oppression and mismanagement. Central Government may hold inquiry into the affairs of a company when not less than 100 members or members holding not less than 1/10th of total voting power apply to the Government for relief from oppressive type of management.

If the Government finds substance in the representation of the shareholders, it may appoint two persons as directors of the company to prevent such oppression or mismanagement. Central Government can also prevent any change in the Board of Directors consequent to changes in share-ownership if such change is found to be prejudicial to the interests of the company.

4. Regulation of Management:

The Companies Act, 1956, has sought to place a number of restrictions on managerial personnel of a company in order to ensure healthy management by men of integrity and responsibility. Important provisions regulating the appointment, remuneration, powers and liabilities of Directors, Managing Directors and Manager have been summarised earlier.

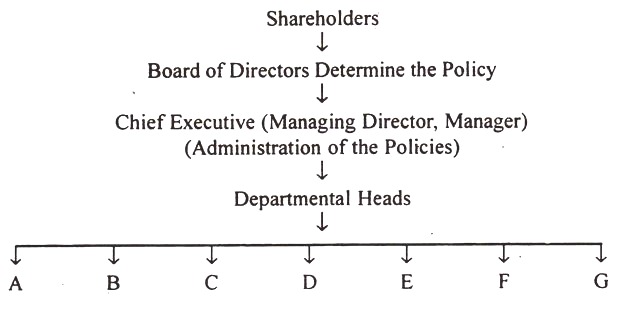

Managerial set-up of a company in India consists of Board of Directors and Chief Executives assisted by various “departmental heads.”

Following chart depicts this set-up:

Legal measures undertaken to regulate the company management are as under:

(1) Company cannot appoint too many top executives. It can opt either for Managing Director or Manager.

(2) Abolition of Managing Agency system in toto.

(3) Limiting the number of Directorship to 20 companies.

(4) Restricting the remuneration to Directors, Managing Directors, and Manager subject to the overall limit of 11 percent of net profits of the company.

(5) Prescribing qualification shares for the incumbents of the office of Directors.

(6) Restrictions on the powers of the Board of Directors, i.e., power regarding selling or leasing of the property of the company, remission in the dues of the Directors, investment, borrowing more than the paid-up capital and reserves etc. cannot be exercised without the consent of shareholders in the general meeting.

(7) Prohibition of loans by the company to any director or the concern in which he is interested.

(8) Insisting on the directors to disclose their interests, if any, in any of the contracts entered into by or on behalf of the company.

(9) Vacation of the office of a director on his failure to pay the calls on his shares, to obtain qualification shares, or when he becomes a lunatic, insolvent or is convicted for an immoral offence etc.

(10) Directors are legally bound to act honestly and exercise reasonable degree of skill and diligence in performing their duties as the ‘top brass’ of the company.

They are accountable to the shareholders about their official conduct, i.e., neglect of or failure to perform their duties in management and disposition of the funds and property entrusted to their charge or care.

They are liable to pay money or value of the assets which they have misused or compensate the company for any loss resulting from this negligence or from neglect of their duties.

These regulation by themselves cannot fully democratise the company management. There is need for the proper constitution of the Board of Directors in order to make it an instrument of economic growth and stability consistent with the legitimate rights and interests of shareholders, workers and consumers at large.