Management and Accounting have been closely associated for a long time. Historically, the functions of accounting have been to record, analyze, and report the results of business operations in various units of measurement, such as rupees, units of production, standard hours and kilowatts.

With such information, management can:

(1) Plan future operations,

(2) Control key variables,

ADVERTISEMENTS:

(3) Decide among alternative courses of action, and

(4) Analyze past performance.

The viewpoint of managerial/management accounting is different from that of financial accounting. The management accountant’s purpose is to provide information for one user – the firm’s management; the financial accountant’s purpose is to provide information for a variety of users.

In this article, we will concentrate on managerial accounting and the functions of planning, controlling, decision-making and analyzing with the use of accounting data.

1. Planning:

ADVERTISEMENTS:

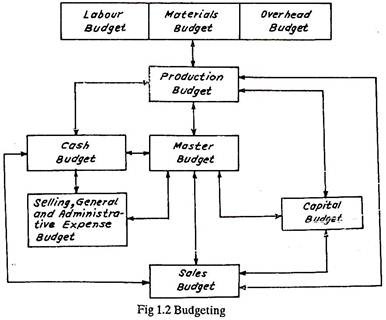

Business budgets are the principal financial means by which the manager can formalize and express a plan. Moreover, once budgets are established, they serve as a control technique by setting predetermined criteria against which managers can compare actual results. In addition, the budgeting process serves as a tool for coordinating the activities of various functions and operating segments of the firm.

Fig. 1.2 shows that comprehensive budgeting consists of a number of budgets with the sales budget, based upon a sales forecast, usually serving as the starting point in the process. The production budget is based on the sales budget and, all others are, in turn, constructed on consistent assumptions concerning the future.

2. Control:

Control involves the comparison of actual performance with some predetermined criterion. Obviously budgeting is a control device, because management compares the actual costs and revenues with the budgeted amounts.

ADVERTISEMENTS:

Other accounting techniques that provide management with control information are:

a. Standard Cost:

Standard Costs are predetermined costs developed from past experience, motion and time study, expected future manufacturing costs, or some combination of these. They contrast with actual costs, which are the amounts actually incurred in the manufacturing process. Examples of Standard Costs are – standard labour costs, standard material cost and standard overhead costs.

b. Responsibility Accounting:

ADVERTISEMENTS:

In responsibility accounting costs are identified with those individuals who are responsible for their control. The authority of the person being considered must be recognized; thus, responsibility accounting classifications must fit the organization structure. Furthermore, a minimum of cost allocation should be employed; that is, consideration should be given only to those costs that are clearly influenced by a particular individual.

3. Deciding:

The manager can obtain accounting information designed to aid him in deciding between alternative courses of action in two ways:-

(i) The reutilized collection of relevant data for certain types of anticipated decisions is called programmed analysis.

(ii) Non- programmed analysis develops special cost information for specific decisions.

ADVERTISEMENTS:

The relevant cost information for decision-making should pertain to those costs that will be different under alternative actions not yet taken. Thus the central idea in accounting for decision-making (whether programmed or non-programmed) is the incremental concept – that is – the analysis of changes in total costs and in total revenues.

4. Analysis of Past Performance:

Financial accounting statements contain valuable information that managers can use to analyse past performance.

Management can analyze financial data by:

(i) Comparisons of two or more periods, and

ADVERTISEMENTS:

(ii) Comparison within one period.

The former includes the analysis of successive balance sheets and income statements to determine trends in individual items. The latter involves the analysis of current financial statements to determine the state of the firm with respect to its solvency, stability and profitability. Another very useful technique of the managerial accountant is called source and application of funds analysis.

This technique involves the determination of where funds (working capital) have come from and how they were used, that is, a focus on cash flow. Most of the information needed for analysis can be obtained from a comparison of two balance sheets plus some supplemental information added to reflect the flow of funds. From managements point of view, the value of the analysis of source and use of funds is that it gives valuable insight on the efficiency of management in allocating funds.