A mutual fund is a financial intermediary in the capital market that pools collective investments in form of units from retail and corporate investors and maintains a portfolio of various schemes which invest that collective investments in equity and debt instruments on behalf of these investors.

Mutual fund is an expert entity which helps an investor invest in equity and debt instruments indirectly rather than taking risk of investing money directly in these instruments. An ordinary investor has no expertise or knowledge to invest money directly into the equity market in India and most of the time investors lose their money due to wrong selection of equity shares, or bonds.

A mutual fund is a professionally managed type of collective investment plan that pools money from many investors and invests typically in investment securities (stocks, bonds, short-term money market instruments, other mutual funds, other securities, and/or commodities such as precious metals).

Praveen N Shroff defines a mutual fund as “a portfolio of stock market instruments built with funds collected from investors whose primary concern is security of investment.”

ADVERTISEMENTS:

Contents

- Introduction to Mutual Fund

- Meaning of Mutual Fund

- Definitions of Mutual Fund

- Concept of Mutual Funds

- Features of Mutual Fund

- Importance of Mutual Funds

- Significance of Mutual Funds

- Types of Mutual Funds

- Classification of Mutual Funds

- Kinds of Mutual Funds

- Portfolio Classification of Mutual Funds

- Legal Framework of Mutual Funds

- Categories of Mutual Funds

- Parties to a Mutual Fund

- Criterias in Selection of Mutual Fund

- SEBI Guidelines for Mutual Funds

- Net Asset Value of a Mutual Fund

- Mutual Funds in India

- Historical Evolution and Growth of Mutual Funds in India

- History of Mutual Funds in India

- Organisation Structure of Mutual Funds in India

- Policies and Strategies of Mutual Funds in India

- Performance of Mutual Funds in India

- Money Market Mutual Funds in India

- Mutual Funds Good or Bad for India

- Role of Mutual Funds in Indian Capital Market Development

- Suggestions to Make Indian Mutual Funds More Effective

- Evolution and Growth of Mutual Funds Abroad

- Components of Fee Structure of Mutual Fund

- Mutual Funds vs. Other Investments

- Advantages of Mutual Funds for the Capital Market

- Advantages of Mutual Funds

- Benefits of Mutual Funds

- Disadvantages of Mutual Fund

- Drawbacks of Mutual Funds

What are Mutual Funds: Meaning, Definition, Concept, Features, Importance, Types, Classification, Legal Framework, Categories, Advantages, Drawbacks and More…

Mutual Fund – Introduction

A mutual fund is a financial intermediary in the capital market that pools collective investments in form of units from retail and corporate investors and maintains a portfolio of various schemes which invest that collective investments in equity and debt instruments on behalf of these investors.

Mutual fund is an expert entity which helps an investor invest in equity and debt instruments indirectly rather than taking risk of investing money directly in these instruments. An ordinary investor has no expertise or knowledge to invest money directly into the equity market in India and most of the time investors lose their money due to wrong selection of equity shares, or bonds.

Hence, mutual funds as intermediary provide expertise of portfolio management actively and diversify risk by spreading investments from all investors in various equity shares and debt instruments. This helps investors earn good returns at low risk compared to returns at high risk if investors invest on their own directly in the capital market.

ADVERTISEMENTS:

A mutual fund is a collective reservoir or pool of funds which is managed by a qualified and expert Fund Manager. It is a trust that takes funds from a number of investors who have a common investment goal and invests those funds in equities, bonds, money market instruments and other securities.

The income generated from this combined portfolio is distributed proportionately amongst the investors after subtracting relevant expenses and levies, by calculating a scheme’s ‘Net Asset Value’ or NAV. Simply placed, the money pooled in by a large number of investors are allotted in units by a mutual fund scheme.

This pooled money invested in equity or bonds or short term securities shall grow or go down depending upon the performance of these investments. This shall get reflected in the value of NAV.

Mutual funds are perfect for investors who either lack large sums for investment, or for those who neither have the knowledge nor the time to research the market, yet want to grow their wealth. In return, the fund house charges a small fee for their professional expertise which is subtracted from the investment.

ADVERTISEMENTS:

The fees charged by mutual funds are restricted to certain limits stated by the Securities and Exchange Board of India (SEBI). During the past few years mutual funds have achieved a favoured status when investors have been investing regularly in equity/balanced schemes through them.

Mutual Fund – Meaning

A mutual fund is a professionally managed type of collective investment plan that pools money from many investors and invests typically in investment securities (stocks, bonds, short-term money market instruments, other mutual funds, other securities, and/or commodities such as precious metals).

The mutual fund will have a fund manager that trades (buys and sells) the fund’s investments in accordance with the fund’s investment objective. In the U.S., a fund registered with the Securities and Exchange Commission (SEC) under both SEC and Internal Revenue Service (IRS) rules must distribute nearly all of its net income and net realized gains from the sale of securities (if any) to its investors at least annually.

Most funds are overseen by a board of directors or trustees (if the U.S. fund is organized as a trust as they commonly are) which is charged with ensuring the fund is managed appropriately by its investment adviser and other service organizations and vendors, all in the best interests of the fund’s investors.

ADVERTISEMENTS:

Since 1940 in the U.S., with the passage of the Investment Company Act of 1940 (the ’40 Act) and the Investment Advisers Act of 1940, there have been three basic types of registered investment companies- open-end funds (or mutual funds), Unit Investment Trusts (UITs); and closed-end funds.

Other types of funds that have gained in popularity are Exchange Traded Funds (ETFs) and hedge funds. Similar types of funds also operate in Canada, however, in the rest of the world, mutual fund is used as a generic term for various types of collective investment vehicles, such as unit trusts, Open- Ended Investment Companies (OEICs), unitized insurance funds, Undertakings for Collective Investments in Transferable Securities (UCITS, pronounced “YOU-sits”) and SICAVs.

Mutual Fund – Definitions

1. “Mutual fund is a non-depository non-banking financial Intermediary”

2. “Mutual funds are corporations which pool funds and reduce risk by diversification”.

ADVERTISEMENTS:

Mutual Fund is a professionally managed company that combines the money of people whose goals are similar. It invests this money in a wide variety of securities. There are different kinds of mutual funds to serve the needs of different investors with diverse objectives.

A mutual fund pools the savings of the community and invests them after careful research and analysis, in various types of securities and offers the individual saver advantages of reasonable dividends and capital appreciation, coupled with safety and liquidity.

Basically, the mutual fund is similar, in structure and objective, to an investment club. The investor, instead of making direct purchases of shares and bonds through original subscription or stock exchanges and taking the risk of loss, can do so now through mutual funds.

Praveen N Shroff defines a mutual fund as “a portfolio of stock market instruments built with funds collected from investors whose primary concern is security of investment.”

ADVERTISEMENTS:

A mutual fund is an indirect investment where individual investor’s investment is invested by professionals and experts in the capital market investments.

Formation and Management of Mutual Fund:

Mutual Funds in India are established under Indian Trust Act of 1882. They are registered and regulated by SEBI under SEBI (MUTUAL FUNDS) Regulations 1996. A mutual fund is formed by a Trust. Mutual Fund business is established by the sponsor. The money collected from the investors invested by AMC (Asset. Management Company). The mutual fund operations are managed by trustees.

Concept of Mutual Funds

Mutual fund concept, which has been in vogue in the Western world since long, is gaining popularity in developing countries including India as an institutional device to bridge the gap between supply and demand of capital in the market. An understanding of the concept of the mutual fund and its significance in economic development and state of mutual fund in India is, therefore, inescapable.

ADVERTISEMENTS:

Mutual fund is an American concept and the terms, ‘Investment Trust’, ‘Investment company’, ‘Mutual fund’, ‘Money Fund’, etc., are used interchangeably in American literature. Mutual funds are corporations which accept dollars to buy stocks, long-term bonds, and short-term debt. Instruments issued by business or government units.

These corporations pool funds and thus, reduce risk by diversification. The term ‘mutual’ signifies that all gains or losses resulting from the investment accrue to all the investors in proportion to their subscription. Mutual fund is thus, a concept of mutual help of the subscribers for portfolio investment and management of these investments by experts in the field.

According to Hirch, a mutual fund is a professionally managed investment company that combines the money of many people whose goals are similar and invest this money in a wide variety of securities.

As per the UK Investment Trust and Companies, a mutual fund is a vehicle that enables a number of investors to pool their money and have it jointly managed by professional money managers.

Investment company institute, USA defines the term mutual fund as a type of Investment Company that gathers assets from investors and collectively invests those assets in stock, bonds or money market instruments.

Securities and Exchange Board of India (Mutual Fund) Regulations, 1996 defines a mutual fund as a fund established in the form of a trust to raise monies through the sale of units to the public or a section of the public under one or more schemes for investing in securities including money market instruments.

ADVERTISEMENTS:

Mutual fund generally refers to an open-end investment trust whose distinctive feature is regular sale and purchase of securities. Further, mutual funds must redeem their shares at the funds current net asset value at the time the shareholders request redemption.

In sum, mutual funds are a form of collective investment brought in by a large group of investors for the mutual benefit of savers as well as investors. Each fund is divided into equal portions or units. Anyone investing in the fund is allocated units in proportion to the size of one’s investment.

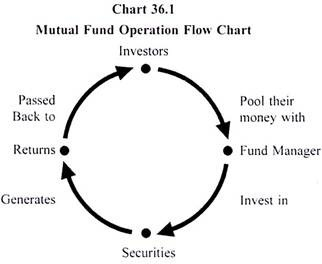

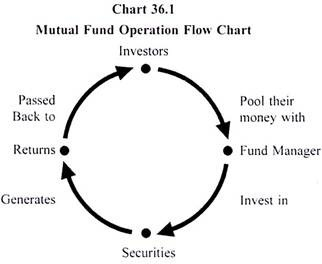

The price of these units is governed principally by value of the underlying investment held by the fund. The flow chart, as brought out in Chart 36.1 presents the working of mutual funds.

The above chart throws lurid light on the rationale of mutual funds. They receive money from many investors, pool them and then purchase securities. The individual investors receive the benefits of professional management and diversified portfolios at relatively low cost with much convenience and flexibility.

Top 8 Features of Mutual Fund

Following are the features of mutual fund:

1. The mutual fund is a trust.

ADVERTISEMENTS:

2. It is a financial intermediary.

3. Ownership is joint and proportional to the amount contributed.

4. The investor gets back units of the mutual funds in return for the money invested.

5. Dealings in units are on the basis of the net market value of the investment.

6. The managers of the mutual funds are obliged to redeem any units in issue on demand or on certain specified periods.

7. All dividend income that the mutual fund receives on its investment is paid out to unit holders.

ADVERTISEMENTS:

8. Professionally qualified fund managers manage the funds of mutual funds.

Importance of Mutual Funds

Importance of mutual funds are summarized below:

Mutual funds are financial intermediaries concerned with mobilizing savings of those who have surplus income and channelization of these savings in those avenues where there is demand for funds.

These institutions employ their resources in such a manner as to afford for their investors the combined benefits of low risk, steady return, high liquidity and capital appreciation through diversification and expert management.

Savers of moderate means in the underdeveloped regions are generally reluctant to invest in corporate securities because of their lack of adequate knowledge about complicated investment affairs.

Moreover, their resources being small, they can at best hold securities of one or two or just a few industrial concerns only and as such, the fate of their savings and prospects of earnings therefore are tied to the fate of such units or units.

ADVERTISEMENTS:

Investment in securities of mutual funds takes care of both these problems, for such investment, in effect, represents a part of the funds’ entire portfolio diversified in terms of securities, units, industries and geographical regions.

These institutions employ expert investment analysts and thus professional knowledge and expertise go into the selection and supervision of their investment portfolio. Diversification and expert investment knowledge ensure steady and regular earnings to the fund and a share in the general prosperity.

Accordingly, investors in shares of mutual funds are assured of low risk, steady return, liquidity and capital appreciation. By taking upon themselves the problems which confront the small savers in investing their savings and dealing with them effectively, mutual funds help mobilize savings of the people and promote thrift.

Mutual funds also provide benefits of flexibility in as much as investors can systematically invest or withdraw funds, or switch to other schemes according to their needs, through features provided under their different schemes, such as regular investment, withdrawal plans and dividend reinvestment options.

Tax benefits to investors in certain schemes constitute an added attraction for mutual funds. Dividends paid by mutual funds to unit holders are taxed only at the time of distribution of dividends. These dividends after this deduction are tax-free in the hands of investors. On the contrary, investment in bonds or other deposits that earn interest (over and above Rs.12,000 that is eligible for exemption under section 80L) is taxed at 30 per cent.

Savings pooled by mutual funds are invested largely in industrial securities. They usually finance long-term business requirements largely by way of direct subscription to share capital of industrial enterprise.

ADVERTISEMENTS:

Mutual funds, while themselves raising resources from a large number of small savers, make funds available to industrial concerns in relatively bigger lots and thus reduce their burden and botheration involved in raising finance directly from individual savers.

Thus, by playing the role of financial intermediation mutual funds provide a convenient and effective link between savings and investment. Well managed mutual funds would be mutually beneficial arrangement.

While, on the one hand, they help the investing community by offering share of corporate growth, on the other they have a salutary impact on the stock markets. By blending caution with aggression and analysis with intuition, the funds can successfully convert market opportunities into lucrative returns for the investors.

Role of the mutual funds is not limited to the domestic sphere only. In addition to attracting domestic savings, these funds can offer their units abroad and attract foreign capital just as UTI has recently done by offering India Fund, and India Growth fund schemes. Similarly, they may serve as useful institutions for securing profitable investment avenues abroad for domestic savings.

Investment in foreign industrial securities requires fairly detailed knowledge of the state of the foreign economy in general and of industries in particular as also of the fiscal position of industrial enterprises and their future prospects.

As a result, despite attractive investment prospects abroad for surplus domestic savings, individual investors would find it an extremely difficult task to make foreign investment on their own. Mutual funds have, as in the case of domestic investment, stepped in to solve these problems for the savers.

7 Main Significance of Mutual Funds

Capital market growth is a necessity for economic progress of a nation. Growth of the capital market is directly connected with the savings of the public. The savings are to be channelized to the capital market.

Investing in the capital market requires necessary know how and financial expertise. An average investor in India doesn’t have this technical knowhow. Hence, a special agency, who has this expertise, takes up these works to help the investor. Mutual funds provide this agency service. Thus, mutual funds provide an opportunity to the small investor to participate in the corporate activities. It serves as a financial intermediary for the development of the capital market.

A small investor has only limited access to price sensitive information on the stock exchanges. He is unable to minimize his risk by spreading his limited funds over different industries. This forces him to depend heavily on brokers whose transactions are not transparent enough and who may charge high brokerage.

In this situation, the mutual funds come to the help of small investors. Thus, mutual funds serve as a suitable investment channel for the common man. It offers him an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost.

The significance of Mutual fund is summarized in the following points:

1. Growth and diversification of the economy of the country.

2. Channelization of resources to the growing sectors of economy.

3. With limited resources a small investor may not be able to buy blue chip shares. But buying the units of mutual funds will help him to get the benefits of blue chip shares.

4. In some cases a small investor may get full allotment of dead shares. He may not be able to diversify his funds. But while participating in the mutual funds he can get the benefits of diversification also.

5. An average investor will have only limited access to price sensitive information. But the mutual funds will be able to get all the sensitive information and will know all the new developments in the capital market and in the industry.

6. MF is an ideal investment route for conservative investors and retired persons and pensioners. These categories of persons do not like to take risks. In an inflationary economy and in the absence of any source of income these categories of investors switch over from the bank deposits and fixed deposits of companies to MFs.

7. It provides security and liquidity to the funds of investors.

Top 12 Types of Mutual Funds

Types of mutual funds are as follows:

Type # 1. Gilt Funds:

Gilts are Government securities with medium to long-term maturities. Gilt funds invest in government securities. Since Government is the issuer these funds have little risk of default.

Type # 2. Diversified Debt Funds/Equity Funds:

A debt/Equity Fund that invests in all available types of debt/securities, issued by entities across all industries and sectors is a properly diversified debt/equity fund. It has the benefit of risk reduction through diversification.

Type # 3. Mortgage Backed Bond Funds:

These funds invest in special securities created after securitization of loan receivables of housing finance companies.

Type # 4. Assured Return Funds:

In this fund, Returns were indicated in advance for all of the future years of these close end schemes. Assured return or guaranteed monthly plans are essentially Debt/Income funds. E.g. Monthly income plans of UTI.

Type # 5. Mid-Cap or Small-Cap Equity Funds:

These funds invest in shares of companies with relatively lower market capitalization. In terms of risk characteristics, small company funds may be aggressive growth or just growth types.

Type # 6. Option Income Fund:

A mutual fund often attempts to increase current income through continual option writing. Option income funds write options on a significant part of their portfolio. Conservative option funds invest in large dividend paying companies, and then sell options against their stock positions. This ensures a stable income stream in the form of premium income through selling options and dividends.

Type # 7. ELSS Fund:

ELSS means Equity Linked Saving Schemes. It is a sub-class of diversified equity funds. Investments in an ELSS fetch tax deduction U/S 80C of the Income Tax Act. An ELSS fund operates much like an equity fund, except a lock-in-period of three years.

Type # 8. Value Funds:

Value funds are diversified equity funds, which pursue the value style of investing. It involves identifying fundamentally sound companies whose shares are currently under priced in the market. Usually the fund manager buys these stocks and holds them until the mis-pricing in the stock value gets corrected E.g. Templeton India Growth Fund.

Type # 9. Balanced Funds:

A balanced fund is one that has a portfolio comprising debt instruments convertible securities, and preference and equity shares. Their assets generally held m more or less equal proportions between debt/money market securities and equities.

By investing in a mix of debt and equity, balanced funds seek to attain the objectives of income, moderate capital appreciation and preservation of capital and are ideal for investors with a conservative and long-term orientation. It is a category of hybrid funds.

Type # 10. Commodity Funds:

Commodity funds specialize in investing in different commodities directly or through shares of commodity companies or through commodity futures contracts e.g. Gold Fund.

Type # 11. Exchange Traded Funds (ETF):

An exchange traded fund is a mutual fund scheme which combines the best features of open end and close end schemes. It tracks a market index and trades like a single stock on the stock exchange. Its pricing is linked to the index and units can be bought/sold on the stock exchange. It is different from index funds which can be brought directly from the AMC at a unique net asset value. But ETFs are traded on stock exchanges and its unit price is determined in the market place and will keep changing from time to time.

Type # 12. Gold Exchange Traded Fund (GTF):

In 2006 RBI permitted the introduction of GTFs. They primarily invest in gold and gold related instruments. It is a listed security backed by allocated gold held in the custody of a bank on behalf of the investor. GTFs allow the investor to participate in the bullion market without taking physical delivery of gold E.g., GOLD BEes.

One of the long term measures invariably suggested to boost the present capital market is the setting up of Mutual Funds to encourage investors with substantial liquidity to enter the share market.

The experience of some of the advanced countries, especially the US, has been very encouraging and within a short period of time excellent results have been achieved in mobilising resources for faster economic growth and investors are being given the widest ever opportunity to invest their funds to best serve their purpose.

Statistics revealed that mutual funds have witnessed phenomenal growth in many countries during the last five years ranging from 80 percent of the total investments in the USA to 70 per cent in Italy, 60 per cent in Japan and 50 per cent in the UK are institutionalized in mutual funds. In US, there were 1531 mutual funds, with 30 million fund investors and $ 252 billion in assets at the end of 1986.

The objectives of this two-fold:

1. To attempt to study various advantages of mutual funds as a financial service to boost the capital market; and

2. To study its suitability for investors in Indian financial environment.

3 Major Classification of Mutual Funds – Functional, Portfolio and Geographical Classification

So as to cater to the varying needs and preferences of a large number of savers across the country and abroad, many types of mutual funds have come into existence. Choice of a fund by a saver would depend on what he desires his money to earn for him and how much risk he is willing to assume.

Three major classification of mutual funds are as follows:

1. Functional classification

2. Portfolio classification

3. Geographical classification

1. Functional Classification:

Functional classification, based on basic characteristic of the mutual fund schemes opened for public subscription, can be grouped into-

i. Open-ended funds

ii. Close-ended funds

iii. Interval funds

i. Open-Ended Funds:

It continuously offers new shares for sale and always stands ready to buy securities at any time. The capitalization of the funds is constantly changing as investors buy and sell their shares directly with the fund. US-64, CanClgr and Franklin Blue Chip are examples of such funds.

Open-Ended Dynamic Bond Funds:

In view of uncertainty of interest rates, a number of fund houses (IDBI Mutual Fund, Pramerica MF Union KBC, Daiwa MF and Principal MF) have, of late, launched open-ended dynamic bond funds.

Dynamic bond funds are able to take advantage of rate cuts or rises by altering their portfolio. But here lies the danger as well. Sometimes, fund managers can get their churning right or it can go haywire as well.

So returns can widely fluctuate. The trick in these funds lies in being made to predict the fluctuations correctly and change the portfolio. When the interest rate is rising, bond prices fall and the fund manager should be able to decrease the duration of the bond; short-term bonds face a lower impact. In contrast when the interest rate is falling, they should be able to increase the duration of the bond.

ii. Closed-Ended Mutual Funds:

They are open for subscription only once and can be redeemed only after a fixed investments period. These funds have a fixed number of shares that can be owned by the investing public. Morgan Stanley Growth fund, Canpep 95, UTI Master Equity 98, Pru ICICI premier, UTI/UGS — 5,000 are some examples of such funds.

iii. Interval Funds:

They are the variations of the above stated two concepts. Some funds are close-ended for the first couple of years and become open-ended after some time, some funds allow fresh subscriptions and redemptions as fixed intervals every year in order to reduce the hassles of daily entry and exist, yet providing reasonable liquidity.

2. Portfolio Classification:

Mutual funds can be categorized according to the type of instruments in which the funds have been invested. As such, different funds are designed to meet the diverse notions of savers and generally designated as Stock funds, Bond funds, Balanced funds, Money market / liquid funds and other funds.

i. Stock Funds:

These funds invest primarily in common stocks. There is a broad range of common stock funds from those that invest solely in the new, un-established companies. There may be several sub-divisions of stock funds. Thus, Growth and Income funds place relatively equal weight on capital growth and dividend income and accordingly invest in equity stock and preference shares.

Growth funds invest their funds in common stocks primarily for capital growth purposes. They meet the investors’ need for appreciation, high risk-bearing capacity and ability to defer liquidity. As such, the investments by growth-oriented funds are predominantly made in equities. Income funds aim at ensuring to their investors high current income; growth in the value of the portfolio is of small importance.

Such funds employ their funds in high yielding common stock. There are two basic groups within the income funds: those that focus on constant income possible even with the use of leverage. Naturally, the greater the anticipated return of any investment, the higher the potential risk of the investment.

ii. Bond Funds:

Bond funds obviously employ their funds in bonds so as to ensure regular and fixed income to their investors. In the U.S.A., it is common to have two types of bond funds, one emphasizing high-yielding but risky bonds and the other low-yielding but high grade bonds.

iii. Balanced Funds:

Balanced funds combine bonds and/or preferred stocks with the ownership of common stock, usually at some pre-determined percentage relationship. Several balanced funds keep one-half of the portfolio in common stocks and one-half in bonds and preferred stocks. Balanced portfolios are more conservative than common stock funds and they generally do not have significant price movement either up or down.

The main purpose of balanced funds is to earn an adequate return in the form of interest and dividends from the fixed portion of the portfolio, while at the same time gaining a modest growth in the common stock portion. Balanced funds are most suited for the investors who have an appetite for some risk, but are wary of taking the 100 percent equity route through an equity fund.

iv. Money Market/Liquid Funds:

These funds invest in highly liquid money market instruments such as Treasury Bills (issued by the Government), certificates of deposits (issued by banks) and commercial papers (issued by companies). Hallmarks of such funds are safety and high liquidity. Pru ICICI liquid funds, Birla Cash plus and Templeton India Liquid fund are some examples of liquid funds.

Other Schemes:

Within each of the above categories, there can be further variants of the funds, For instance, debt funds may be diversified debt funds, focused debt funds and high yield debt funds. Likewise, equity funds may be diversified funds, sector funds, index funds and equity linked savings schemes.

a. Diversified Funds:

It has investment portfolios spread across industries and companies. Choice of stock is the discretion of the fund managers. An equity diversified fund is the example of such funds. HDFC Top 200 fund is another diversified equity fund.

b. Sector Funds:

It deploys funds in stocks of a particular business sector or industry, like information technology (IT), fast moving consumer goods (FMCG) or pharma. The degree of diversification of risk is very limited in this type of fund, making it extremely risky.

Of course, the potential earnings can be high if the sector does very well. Franklin pharma, Franklin FMCG, Franklin Infotech, Kotak Tech, Tata Life Science and Tech, UTI Petro and UTI Pharma and Health-care are some examples of this type of fund.

c. Index Funds:

Index funds are equity funds that replicate a particular equity index by investing in stocks that the index tracks. As each stock has different weight age in an index, the portfolio of an index fund is allocated in a way to mirror that of the index.

For example, if Reliance Industries has a weightage of 10 per cent in an index, a fund based on the index would also allocate 10 percent of its portfolio to the stock. Investing in index funds has the advantages of no risk for fund management, lesser portfolio churning, low expense ratio and greater marketability.

3. Geographical Classification:

Mutual funds can also be grouped according to geographical boundaries of their operations, as domestic mutual funds, off-shore funds and overseas funds.

i. Domestic Funds:

They are open for mobilizing savings for nationals within the country. These funds may be of various kinds, as outlined above under the portfolio and functional groups.

ii. Off-Shore Funds:

It represents mutual funds with investments source abroad. Thus, subscription to these funds is mobilized from international financial markets for its investment in the economies and capital market instruments of specific countries.

These funds are cross border investments facilitating capital movement of investible surpluses from cash rich countries to high growth or potentially high growth economies of the world. Kotak Global India Fund, SBI’s Magnum Global and Global Opportunity Fund are few examples of overseas funds.

Indian mutual funds have been permitted to invest in foreign debt securities in countries with fully convertible currencies. In the recent past, mutual funds have also been permitted to invest in equity shares of listed overseas companies having shareholding of at least 10 per cent in an Indian company listed on a recognized stock exchange in India.

Thus, a host of mutual funds have come into existence to garner savings from the savers for investment outside the country. Such kinds of mutual funds are called ‘Overseas’ funds. There are three types of overseas funds, viz., global funds, international funds and country funds.

While global funds invest in the domestic funds as well as foreign stocks and bonds, international funds invest strictly in foreign countries. Country funds invest in the stocks and bonds of a particular country or region.

The basic idea underlying formation of overseas mutual funds is to exploit the bright investment opportunities abroad and thereby augment the fund’s overall rate of return.

Top 7 Kinds of Mutual Funds

Kinds of mutual funds are as follows:

Kind # 1. Open-End Fund, Forms of Organization, Other Funds:

The term mutual fund is the common name for what is classified as an open-end investment company by the SEC. Being open-ended means that, at the end of every day, the fund continually issues new shares to investors buying into the fund and must stand ready to buy back shares from investors redeeming their shares at the then current net asset value per share.

Mutual funds must be structured as corporations or trusts, such as business trusts, and any corporation or trust will be classified by the SEC as an investment company if it issues securities and primarily invests in non-government securities.

An investment company will be classified by the SEC as an open-end investment company if they do not issue undivided interests in specified securities (the defining characteristic of unit investment trusts or UITs) and if they issue redeemable securities. Registered investment companies that are not UITs or open-end investment companies are closed-end funds.

Closed-end funds are like open end except they are more like a company which sells its shares a single time to the public under an initial public offering or “IPO”.

Subsequently, the fund’s shares trade with buyers and sellers of shares in the secondary market at a market-determined price (which is likely not equal to net asset value) such as on the New York or American Stock Exchange. Except for some special transactions, the fund cannot continue to grow in size by attracting more investor capital like an open-end fund may.

Kind # 2. Exchange-Traded Funds:

A relatively recent innovation, the exchange-traded fund or ETF, is often structured as an open-end investment company. ETFs combine characteristics of both mutual funds and closed-end funds.

ETFs are traded throughout the day on a stock exchange, just like closed-end funds, but at prices generally approximating the ETF’s net asset value. Most ETFs are index funds and track stock market indexes. Shares are issued or redeemed by institutional investors in large blocks.

Most investors purchase and sell shares through brokers in market transactions. Because institutional investors normally purchase and redeem in kind transactions, ETFs are more efficient than traditional mutual funds (which are continuously issuing and redeeming securities and, to effect such transactions, continually buying and selling securities and maintaining liquidity positions) and therefore tend to have lower expenses.

Exchange-traded funds are also valuable for foreign investors who are often able to buy and sell securities traded on a stock market, but who, for regulatory reasons, are limited in their ability to participate in traditional U.S. mutual funds.

Kind # 3. Equity Funds:

Equity funds, which consist mainly of stock investments, are the most common type of mutual fund. Equity funds hold 50 Per cent of all amounts invested in mutual funds in the United States. Often equity funds focus investments on particular strategies and certain types of issuers.

Capitalization:

Fund managers and other investment professionals have varying definitions of mid-cap, and large-cap ranges.

The following ranges are used by Russell Indexes:

1. Russell Microcap Index – micro-cap ($54.8 – 539.5 million)

2. Russell 2000 Index – small-cap ($182.6 million – 1.8 billion)

3. Russell Midcap Index – mid-cap ($1.8 – 13.7 billion)

4. Russell 1000 Index – large-cap ($1.8 – 386.9 billion)

Growth vs. Value:

Another distinction is made between growth funds, which invest in stocks of companies that have the potential for large capital gains, and value funds, which concentrate on stocks that are undervalued. Value stocks have historically produced higher returns; however, financial theory states this is compensation for their greater risk.

Growth funds tend not to pay regular dividends. Income funds tend to be more conservative investments, with a focus on stocks that pay dividends. A balanced fund may use a combination of strategies, typically including some level of investment in bonds, to stay more conservative when it comes to risk, yet aim for some growth.

Index Funds versus Active Management:

An index fund maintains investments in companies that are part of major stock (or bond) indexes, such as the S&P 500, while an actively managed fund attempts to outperform a relevant index through superior stock-picking techniques.

The assets of an index fund are managed to closely approximate the performance of a particular published index. Since the composition of an index changes infrequently, an index fund manager makes fewer trades, on average, than does an active fund manager.

For this reason, index funds generally have lower trading expenses than actively managed funds, and typically incur fewer short-term capital gains which must be passed on to shareholders. Additionally, index funds do not incur expenses to pay for selection of individual stocks (proprietary selection techniques, research, etc.) and deciding when to buy, hold or sell individual holdings. Instead, a fairly simple computer model can identify whatever changes are needed to bring the fund back into agreement with its target index.

Certain empirical evidence seems to emphasise that mutual funds do not beat the market and actively managed mutual funds under-perform other broad-based portfolios with similar characteristics. One study found that nearly 1,500 U.S. mutual funds under-performed the market in approximately half of the years between 1962 and 1992. Moreover, funds that performed well in the past are not able to beat the market again in the future.

Kind # 4. Bond Funds:

Bond funds account for 18% of mutual fund assets. Types of bond funds include term funds, which have a fixed set of time (short, medium, or long-term) before they mature. Municipal bond funds generally have lower returns, but have tax advantages and lower risk. High-yield bond funds invest in corporate bonds, including high-yield or junk bonds. With the potential for high yield, these bonds also come with greater risk.

Kind # 5. Money Market Funds:

Money market funds hold 26% of mutual fund assets in the United States. Money market funds entail the least risk, as well as lower rates of return. Unlike certificates of deposit (CDs), money market shares are liquid and redeemable at any time.

Kind # 6. Funds of Funds:

Funds of funds (FoF) are mutual funds which invest in other mutual funds (i.e., they are funds composed of other funds). The funds at the underlying level are often funds which an investor can invest in individually, though they may be ‘institutional’ class shares that may not be within reach of an individual shareholder.

A fund of funds will typically charge a much lower management fee than that of a fund investing in direct securities because it is considered a fee charged for asset allocation services which is presumably less demanding than active direct securities research and management.

The fees charged at the underlying fund level are a real cost or drag on performance but do not pass through the FoF’s income statement (statement of operations), but are usually disclosed in the fund’s annual report, prospectus, or statement of additional information.

FoF’s will often have a higher overall/combined expense ratio than that of a regular fund. The FoF should be evaluated on the combination of the fund- level expenses and underlying fund expenses, as these both reduce the return to the investor.

Most FoFs invest in affiliated funds (i.e., mutual funds managed by the same advisor), although some invest in unaffiliated funds (those managed by other advisors) or both.

The cost associated with investing in an unaffiliated underlying fund may be higher than investing in an affiliated underlying because of the investment management research involved in investing in a fund advised by a different advisor.

Recently, FoFs have been classified into those that are actively managed (in which the investment advisor reallocates frequently among the underlying funds in order to adjust to changing market conditions) and those that are passively managed (the investment advisor allocates assets on the basis of on an allocation model which is rebalanced on a regular basis).

The design of FoFs is structured in such a way as to provide a ready mix of mutual funds for investors who are unable to or unwilling to determine their own asset allocation model. Fund companies such as TIAA-CREF, American Century Investments, Vanguard, and Fidelity have also entered this market to provide investors with these options and take the “guesswork” out of selecting funds.

The allocation mixes usually vary by the time the investor would like to retire- 2020, 2030, 2050, etc. The more distant the target retirement date, the more aggressive the asset mix.

Kind # 7. Hedge Funds:

Hedge funds in the United States are pooled investment funds with loose, if any, SEC regulation, unlike mutual funds. Some hedge fund managers are required to register with the SEC as investment advisers under the Investment Advisers Act of 1940.

The Act does not require an adviser to follow or avoid any particular investment strategies, nor does it require or prohibit specific investments. Hedge funds typically charge a management fee of 1% or more, plus a “performance fee” of 20% of the hedge fund’s profit.

There may be a “lock-up” period, during which an investor cannot cash in shares. A variation of the hedge strategy is the 130-30 fund for individual investors.

Portfolio Classification of Mutual Funds

Portfolio classification of mutual funds are as follows:

1. Equity Fund:

Those mutual funds who invest only in equity shares of companies are known as equity funds.

2. Growth Fund:

Mutual funds which invest their funds in growth securities which assure capital appreciation in the long run are known as growth funds. These are also known as “Nest eggs.” The portfolio of such funds may mainly contain equities with good growth potential, smaller proportion of fixed income securities and money market instruments.

3. Income Fund:

Mutual funds which invest in high yielding securities are income funds. The objective of such a fund is to maximize the current income of the investors.

4. Real Estate Fund:

These are close-ended mutual funds with investments in real estates and properties only.

5. Off-Shore Fund:

These kinds of mutual funds mobilize saving from foreign countries in foreign currencies. They may invest them in Indian companies. The company needs RBI permission for operation of the scheme.

6. Leverage Fund:

In this type, investable funds are borrowed from the market. These are used to increase the size of the value of a portfolio. Members benefit by gains arising out of excess of gains over the cost of borrowed funds. Such mutual funds make capital gains by speculative trading, short selling, etc.

7. Hedge Funds:

Mutual funds which employ their funds by speculative trading are known as Hedge funds.

8. Tax Exempt Funds:

They invest their funds in such investments which receive tax benefits.

9. Liquid Funds:

They are specialized in investing short term money market instruments like certificates of deposits, T Bills, etc. The emphasis is given on liquidity even though there is a low rate of return for this.

10. Special Funds:

This type of funds invests only in specialized channels like Gold & Silver or a specified country (India Development Fund) or a specific category of companies etc.

11. Index-Linked Funds:

This fund invests only in those shares which are included in the market indices. Whenever the market index goes up, the value of such index linked funds also goes up.

12. Funds of Funds:

Mutual funds which invest only in other mutual funds are called funds of funds.

13. Capital Appreciation Fund:

These funds invest only in such securities where capital appreciation is assured.

14. Load and No-Load Funds:

Load funds are funds with sales charge. No load funds are bought and sold at NAV without any sales charge or commission.

4 Legal Framework of Mutual Funds – Sponsors, Trustees, Asset Management Company and Custodian

Mutual funds have to work in a legal framework. SEBI has constituted a four-tier system for managing the affairs of mutual funds.

Accordingly, there are 4 legal framework to MF, viz.:

I. The Sponsor

II. The Trustees

II. The Asset Management Company (AMC)

IV. The Custodian.

I. Sponsors:

Sponsor means any company who, acting alone or in collaboration with another body corporate, establishes a MF. They are the promoters of mutual funds. The sponsor has to abide by the rules and regulations of SEBI and other related agencies for promoting a MF. The authorization is given by SEBI. An application in prescribed form accompanied with fees should be forwarded for registration.

SEBI will grant registration on the basis of the sound track record of the sponsor. 5 years’ experience in the field of financial services is a requirement for this. Professional competence, financial soundness, dividend paying capacity, fairness and integrity in business transactions are other criteria for granting registration. Every registered MF is also required to pay annual fee. In case of default SEBI will prohibit launching of new schemes. The sponsor should contribute 40% of the net worth of AMC. The sponsor will be liable for any loss of the scheme up to this initial contribution.

II. Trustees:

The board of trustees of the MF is persons who hold the property of mutual fund. They keep the properties in trust for the benefit of unit holders. They have responsibility to safeguard the interest of investors. They should see that the AMC acts in the best interest of the investors.

The trustees shall consist of eminent independent members who are not in any way affiliated to the sponsoring company. They should also have wide experience in investment matters, finance, administration etc. The management of the MF is subject to the control and superintendence of the board of trustees.

The trustees should act as per the regulations of the trust deed.

The trust deed shall contain the following points:

1. Board policies regarding allocation of payments to capital.

2. It should forbid the MF or the AMC making or guaranteeing loans except with the prior approval of trustees and SEBI.

3. No amendment to the trust deed shall be carried out without the prior approval of SEBI and unit holders.

4. The removal of the trustees would also require the prior approval of SEBI.

5. The trust deed shall be available for inspection to any member of the public at the registered office.

6. It shall not contain a clause limiting or extinguishing the obligations and liabilities of the trust.

7. It should not indemnify the trustees or the AMC for loss or damage caused by their negligence.

Obligations of the Trustee:

The trustees are responsible for ensuring that the AMC complies with SEBI registration. They are also accountable for and be the custodian of the property of the respective schemes. They shall get executed all documents necessary to secure the acquisition, disposal etc. of the property.

They shall ensure that the transactions are in accordance with the provisions of the trust deed. The trustee shall be the responsible for the calculation of any income to be paid to the MF.

The trustees have a right to obtain the information from the AMC concerning the management of the MF. They may also call for periodical reports from AMC. The trustees are liable to submit a six monthly report to the SEBI on the activities of the MF.

III. Asset Management Company (AMC):

An Asset Management Company is formed and registered under the Companies Act, 1956 and approved by the SEBI for managing the funds of the various schemes of a MF. A MF can operate only by a separately established agency. AMC operates under the supervision and guidance of the trustees. The AMC has the specific task of mobilizing funds under various schemes.

The primary objective of an AMC is to manage the assets of MF and other activities, viz., managing the pension fund, entering into venture capital funds etc. SEBI insists that an AMC should have a minimum net worth of Rs. 10 crores. This has to be available with the AMC on a continuous basis and to be monitored by the board of trustees.

The sponsor or the trustees, if authorized by the sponsor, shall appoint the AMC. It should be approved by the SEBI. The application for approval must be submitted to SEBI along with the copies of Memorandum of Association and Articles of Association.

Approval of SEBI:

SEBI will grant approval to an AMC basing on the following particulars:

1. A sound track record, general reputation and fairness in transaction. A sound track record means net worth, dividend paying capacity, profitability etc.

2. The directors of AMC should be persons of high repute, professional expertise, administrative abilities etc.

3. 50% of the directors should not be in any way affiliated or associated with sponsors or trustees or any of its subsidiaries.

4. The Chairman of AMC should not be the director of the Trustee Company.

5. The AMC shall have a minimum net worth of Rs. 10 crore. Disclosure to unit holders

The AMC shall disclose the basis of calculating the repurchase price and net asset value of the various schemes to the unit holders.

The trustee shall have the power to dismiss the agency under specific events with the approval of SEBI. The agency may also give a notice in writing for terminating the assignment.

IV. Custodian:

A custodian means any person carrying on the activities of safe keeping of the securities or participating in any clearing system on behalf of the clients to effect deliveries of the securities. The custodian shall be registered with SEBI.

SEBI will particularly look into the following matters while granting registration:

1. Sound track record, general regulation, and fairness in transaction.

2. The custodian has experience in the field.

3. They have sufficient infrastructure, office and personnel to provide custodian service.

4. The custodian is not found guilty of any economic offence.

5. The approval is not in any way associated with AMC.

6. The custodian is not the sponsor or trustee of any other MF.

7. The custodian cannot act as custodian of more than one MF without prior approval of SEBI.

4 Major Categories of Mutual Funds – Liquid Funds, Ultra-Short Term Debt Funds, Short Term Debt Funds and Long Term Debt Funds

We shall now discuss the various categories of open-ended mutual funds. If we speak exclusively of Fixed Income Securities, Mutual Fund products can be categorized based on their ‘portfolio maturity’ and the extent of ‘mark to market’. Portfolio maturity is the weighted average maturity of the securities in the portfolio.

Mark to market refers to the extent to which the daily NAV of the mutual fund is based on the movements in the underlying market. But first, let us understand the various categories of Fixed Income Mutual Funds based on their portfolio maturity.

The need for bringing out different categories of mutual funds is that they cater to specific investment and risk objectives of investors. Clearly, ‘one size can’t fit all’. These categories ensure that the investors’ funds are managed in line with their objectives.

Category # 1. Liquid Funds:

Liquid Funds cater to the needs of investors with very short investment horizon. If you are in a situation where you may need your money any time soon but don’t want to keep your money idle till then, liquid funds are for you. Liquid Funds are a type of Open-Ended Mutual fund. These funds exclusively invest in the short-duration money market instruments.

The average maturity of the instruments in the portfolio ranges from as low as a month or so, to as much as 91 days. As per the SEBI Guidelines, if a mutual fund wants to be classified as a ‘liquid fund’ it cannot invest in securities with residual maturity of more than 91 days.

This means that the portfolio maturity of a liquid fund can never exceed 91 days. It may be lower since there would be securities in the fund with maturity less than 91 days and after all, portfolio maturity is only a weighted average number.

People are used to keeping temporary surplus cash balances at the Bank, as a matter of habit, convenience and also due to the safety offered by Banks. To make it more attractive, interest rates on savings accounts of Banks are going up as well. Once upon a time, the interest on savings accounts balances used to be calculated on the minimum balance between the 10th and last day of the month.

This method of calculation was changed to the average balance method by the regulators. The rate of interest, which used to be 3.5% p.a. earlier, was raised to 4% and has now been deregulated altogether by the RBI, giving Banks the freedom to offer a higher rate of interest as per market competition. Few Banks have already raised the rate of interest on savings accounts to 6% and other Banks may follow suit as per their requirements of funds and competition.

Category # 2. Ultra-Short Term Debt Funds:

Ultra Short Term Debt Funds are non-liquid debt funds which have the flexibility of investing in securities with more than 91 day maturity. However, the portfolio managers normally do not invest in much longer maturities in order to maintain the fund in line with its conservative positioning.

The motivation for investing in ‘ultra-short term funds’ instead of ‘liquid funds’ is that their returns are marginally higher than those of liquid funds. In case you want to keep your money readily available but do not have any specific expenditure to be met in a very short time, investing in these ultra-short term funds would be a good option. Like liquid funds, these ultra-short term debt funds are also a type of open-ended fund.

Category # 3. Short Term Debt Funds:

The next in line, in terms of portfolio maturity are the short term debt funds. These too are a type of open-ended fund. These funds have a portfolio maturity ranging between one to four years depending on the portfolio manager’s view of the market. Like ultra-short term funds, these funds also have the freedom to invest in any fixed income security – money market instruments, dated government securities or other corporate securities.

However, to ensure that the portfolio remains in line with the objective of the fund, these funds too are tilted more toward short term debt instruments and money market instruments.

You should invest in these funds only when your target investment horizon is adequate to cover market cycles, typically 6 months, by which time the portfolio accrual usually catch up with any adverse market movement.

Category # 4. Long Term Debt Funds:

For longer portfolio maturities, the fund is usually classified as a long term fund. Long term debt funds are those mutual funds that invest in longer duration securities – dated government securities, corporate bonds / debentures et cetera. Their returns are usually higher than the short term debt funds, provided the investment horizon is 1 year and longer.

The reason for this is that in case when interest rates move in an unfavorable direction, the required holding period, to achieve the desired returns, could be longer than one year (say two or even three) to benefit from favorable market movement.

Their portfolio maturity is usually in the range of two to three years at the lower end and seven to eight years at the higher end. The portfolio maturity that the manager wishes to have depends on his view of the market.

When the portfolio manager has a bullish view on the market (he expects yields to fall) he would increase the portfolio maturity while if he has a bearish view on the market (he expects yields to rise) he would reduce the portfolio maturity. The reason for this is based on the concept of duration. The higher the duration, the magnified is the impact of interest rate movements.

While this covers the types of mutual funds in terms of portfolio maturities, it is important that we clarify a few points before we proceed.

5 Major Parties to a Mutual Fund – Sponsor, Asset Management Company (AMC), Trustees, Unit Holder and Mutual Fund

For the total functioning of a mutual fund (including formation), there are five major parties and three market agents or intermediaries.

The major parties to a Mutual Fund:

1. Sponsor

2. Asset Management Company (AMC)

3. Trustees

4. Unit-holder

5. Mutual Fund

The three market intermediaries:

(a) Custodian

(b) Transfer Agents

(c) Depository

1. Sponsor:

A sponsor is similar to a promoter of a company. The sponsor initiates the idea of setting up a mutual fund. Sponsor means an individual or a body corporate or body corporates establishes a mutual fund. Sponsor also creates a Board of Trustees. Every mutual fund is established with the name of a sponsor.

E.g. UTI Sponsored UTI Mutual Fund, HDFC Sponsored HDFC Mutual Fund, Canara Bank sponsored can bank Mutual Fund etc.

Functions of a Sponsor:

(i) Promotion of a mutual fund as per Indian Trust Act.

(ii) Sponsor appoints, Trustees, AMC, Brokers, agents, depository participants, bankers, Auditors etc. as per SEBI guidelines.

(iii) Sponsor must have a track record of operating in the stock market for at least 5 years.

(iv) Out of 5 years of track record, he must earn profit at least in 3 years.

(v) He must contribute at least 40% of the capital of AMC.

2. Asset Management Company (AMC):

Asset Management Company is a company registered under Indian Companies Act. to manage the money invested in mutual funds and to operate the schemes of the mutual fund. The AMC has skilled professional money managers who look after the corpus of mutual funds which are invested in profitable avenues of investment.

The AMC has three departments:

(i) Fund Management

(ii) Sales and Marketing

(iii) Operating and Accounting

AMC has a minimum net worth of Rs.10 crore and at least 40% of this is to be contributed by the sponsor. In the Board of Director of AMC, at least 50% must be independent i.e., not associated with the sponsor.

3. Trustees:

A mutual fund is established as a trust. This trust is headed by the Board of Trustees. The trustees look after the property of the mutual fund in trust for the benefit of unit holders.

The trustees have the duty to regulate and monitor the operating functions of AMC as per SEBI Regulations and see that the operations and functions of AMC are not against the interest of the unit holders. They must safeguard the interests of the unit holders.

4. Unit Holder:

A unit holder is an individual or an entity holding an undivided share in the total assets of a mutual fund scheme.

5. Mutual Fund:

A mutual fund is established under the Indian Trust Act to raise the money through the sale of units to the public for investing in the capital market. The funds collected are passed on to the AMC for investment purposes. A mutual fund has to be registered with SEBI.

The three market intermediaries to a mutual fund are:

(a) Custodian:

A custodian is a person who renders custodial services to the investors. He has been granted a Certificate of Registration to conduct the business of custodial services under SEBI (Custodial of Services) Act 1996.

Functions:

(i) A custodian maintains accounts of clients’ securities.

(ii) He converts the securities purchased into demat form.

(iii) He receives interest and dividend on mutual fund investments.

(iv) He takes necessary steps as regards to bonus issue, right issue, buy-back of shares etc.

(b) Transfer Agents:

A transfer agent performs the function of transfer of investment documents and records. A transfer agent has been granted a Certificate of Registration to conduct the business of transfer under SEBI Regulations.

He performs the following duties:

(i) Issue and redemption of mutual fund units for unit holders.

(ii) Preparation of transfer documents

(iii) Maintenance of Investment records.

(c) Depository:

A depository is a corporate or a bank or a financial service company who carries out the transfer of units to the unit holders in dematerialised form and maintains the records.

Depository participants are opening and operating demat accounts on behalf of the inventors either with the NSDL (National Securities Depository Limited) or CDSL (Central Depository Securities Limited).

The other functionaries of mutual funds are brokers, selling agents and distributors, legal advisors, bankers and auditors.

Top 7 Criterias in Selection of Mutual Fund

It is very important to carefully analyze a mutual fund before one selects the right fund for himself.

The following are a set of criterias to be looked into in a mutual fund:

Criteria # 1. Fund Manager’s Track Record:

The fund manager should have a proven track record as efficient fund management is able to create confidence in the mind of the investor.

Criteria # 2. Portfolio Quality:

If the poor quality investments don’t backfire, a fund might generate high returns. High credit ratings of investments, means that the fund is investing in low risk instruments, indicating portfolio safety.

Criteria # 3. Number of Retail Investors and Average Holding Size:

It is easier to deploy and manage a small fund but even if a few investors leave it, a small fund could be in trouble.

Criteria # 4. Size of Fund:

Critical mass gives access to opportunities not available to smaller funds.

Criteria # 5. Weighted Average Maturity:

Longer maturities hedge against downward movement in interest rates while it could lose out on short-term upswings in interest rates. Short maturities protect against rising interest rates.

Criteria # 6. Sudden Change in Portfolio or NAV:

This might be a case of a revamp of the portfolio for good but also beware that it might suddenly be open to more risk due to a change in investments.

Criteria # 7. Dividend Frequency:

Tax-free dividends are good for those looking for regular returns but frequent dividends can hinder capital growth through redeployment.

SEBI Guidelines for Mutual Funds

SEBI (Mutual Funds) Regulations 1996 lays down the following guidelines:

i. A mutual fund should be constituted in the form of a trust, duly registered under the provisions of the Indian Registration Act, 1908 and managed by separately formed AMC. The minimum net worth of AMC shall be 10 Crores of which the sponsor should contribute 40%.

ii. The sponsor should have a good track record with minimum experience of 5 years in the relevant field of financial services.

iii. The MF should have a custodian not in any way associated with AMC.

iv. Schemes of Mutual funds launched by the asset management company should be approved by the trustees.

v. MFs cannot deal in carry forward transactions on securities.

vi. A MF may enter into short selling or derivatives transactions subject to the framework specified by SEBI.

vii. The offer document of New Fund Offer (NFO) should contain disclosures which are adequate in order to enable the investors to make informed investment decision

viii. Investments under an individual scheme should not exceed 5% of the corpus of any company’s share.

ix. Investment under all the schemes cannot exceed 15% of the funds in the shares and debentures of a single company.

x. Every close ended scheme, other than an equity linked savings scheme, should be listed on a recognized stock exchange.

xi. The minimum amount to be raised in a close-ended scheme is 20 crores and in open- ended scheme are 50 crores. In case a minimum amount is not collected within the prescribed time limit which is different for various schemes, the entire amount shall be refundable.

xii. A MF should maintain books of accounts, expenses and appropriation of expenses among individual schemes.

xiii. MFs are obliged to publish scheme wise annual reports, annual statements of accounts, furnish half yearly unaudited accounts, quarterly statements of movements and Net Asset Value (NAV) and quarterly portfolio statements to SEBI.

xiv. The Net Asset Value of the scheme shall be calculated and published at least in two daily newspapers at intervals of not exceeding one week. NAV of a close ended scheme shall be calculated on daily basis and published in at least two daily newspapers having circulation all over India.

xv. SEBI is empowered to appoint one or more persons as inspecting authority to inspect the MF.

xvi. SEBI is empowered to appoint an auditor to investigate into the books of account.

xvii. SEBI can suspend registration in case of violations of the provisions.

Net Asset Value of a Mutual Fund (NAV) – Meaning, Formula and Computation

What is ‘NAV’?

Just like an equity share has a market price which is determined through trading in stock exchanges, a mutual fund unit has Net Asset Value per Unit (NAV) based on the closing price of shares and bonds which are part of the respective portfolio of a mutual fund scheme.

The NAV is the combined market value of the shares, bonds and securities held by a fund on any particular day in a portfolio of a particular mutual fund scheme (as reduced by legitimate expenses and charges).

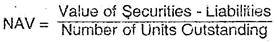

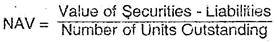

NAV per Unit denotes the market value of all the shares/debentures/bonds or any other instrument in a mutual fund scheme on a given day, net of all expenses and liabilities plus income accrued, divided by the outstanding number of Units in the scheme.

NAV = Market Price of Securities + Other Assets – Total Liabilities + Units Outstanding as at the NAV date

NAV = Net Assets of the Scheme + Number of units outstanding, that is, Market value of investments + Receivables + Other Accrued Income + Other Assets – Accrued Expenses – Other Payables – Other Liabilities + No. of units outstanding as at the NAV date

Net Asset Value (NAV) of a Mutual Fund:

The investors are the owners of the mutual fund. Funds collected on a particular scheme are known as “Corpus” or “Assets” under management. The corpus is invested in different securities. The ownership interest of the unit holders is represented by these securities. The investment made by the investors is represented by the units. A unit is a currency of a fund.

Net Asset Value (NAV) refers to the ownership interest per unit of the mutual fund. In other words, the NAV refers to the amount which a unit holder would receive per unit if the scheme is closed.

The NAV of any scheme tells us how much each unit is worth.

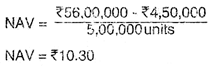

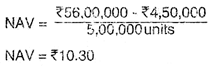

Computation of NAV:

E.g. An amount of Rs.50,00,000 collected by a mutual fund by the issue of 5,00,000 units of Rs.10 each. The amount is invested in different securities and market value of these securities at present Rs.56,00,000 and the mutual fund has a liability of Rs.4,50,000 in respect of expenses. The NAV of the fund i.e.-

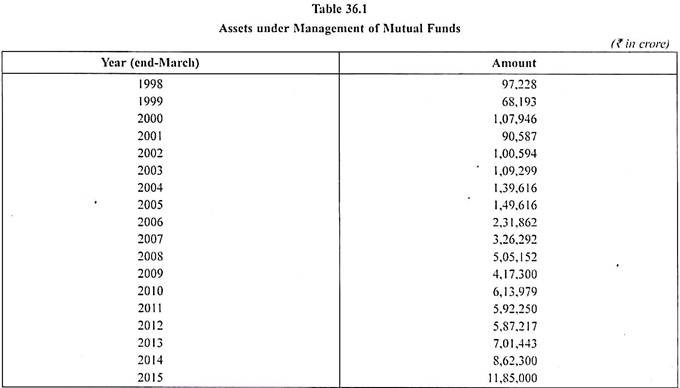

Mutual Funds in India – Unit Trust of India, Offshore Funds, SBI Mutual Fund, India Magnum Fund N.V. and Other Funds

Mutual funds in india are as follows:

1. Unit Trust of India:

The UTI was created with the aim of tapping the savings of the small man and to deploy the funds for productive purposes, offering an attractive return and growth to the investors while minimising the risk element for individual investors.

Being the first of its kind and that too in the public sector, the UTI has been vested with both management and trusteeship functions in one body which is the Board of Trustees. The Unit Trust of India Act, 1963, under which UTI was constituted, did not initially permit it to take up activities other than dealing in “units” defined under the Act, investment and dealing in securities and other business arising out of the formulation of any unit scheme.

These restrictions have now been removed and the UTI has been permitted to take up such other activities as direct lending of funds, bill rediscounting, leasing, financing of housing projects, and hire-purchase financing and to set up subsidiaries for many financial services and banking.

The growth in the business of UTI, especially during the eighties, has been spectacular. The gross sales of units (under all schemes) which has amounted to Rs. 10 crores in the first year, i.e., in 1964-65, recorded a rapid growth, especially since 1982-83 and rose to Rs. 3,701 crores in 1988-9, and further to Rs. 4,122 crores in 1990-91. UTI along with all its funds have a total investible funds of about Rs. 70,000 crores, at end March 2002, when it was split up into two units UTI-I and UII-II.

UTI Schemes for Resident Indians:

The UTI offers a variety of investment schemes (funds) to the investing public. As in March 2002, It had, in all, six open-ended investment schemes, viz., Unit Scheme 1964, Unit Scheme 1971 (Unit-Linked Insurance Plan), Unit Scheme for Charitable and Religious Trusts and Registered Societies 1981, Capital Gains Unit Scheme 1983, Children’s Gift Growth Fund Unit Scheme 1986 and Parents’ Gift and Growth Fund Unit Scheme 1987, catering to the various sections of society.

A special mention needs to be made here of the more popular amongst the open-ended schemes, viz., those of 1964, 1971 and 1983. The US 64 of UTI was involved in a scam in 2000-01 due to gross mismanagement. UTI has lost the confidence of investors and was in for liquidity problems.

Of the close-ended schemes, a majority are Monthly Income Schemes, specifically aimed at the retired and aged investors, giving the latter an assured level of income with a total safety of capital. Among the close-ended ones, the Monthly Income Schemes with Extra Bonus and Growth benefits seem to be more popular with the investors.

For domestic investors, the UTI introduced a growth-oriented mutual fund known as “Master-shares” in September 1986. The scheme was very popular, attracting funds of Rs. 1.58 billion against the original target of Rs. 500 million. The NAV of master-shares has moved up and down many times since then, but is even quoted below par value of Rs. 10, many times before its closure.

2. Offshore Funds:

The Unit Trust of India took the initiative of entering the international arena by launching the close-ended ‘India Fund’, in 1986, providing an opportunity for non-resident Indians and other foreign individuals and institutions to make portfolio investments in the Indian capital market. The fund is quoted on the London Stock Exchange.

This was followed in July 1988 by the ‘India Growth Fund’, also close-ended, and quoted on the New York Exchange. The issue price for the fund is $10 and the NAV and the current quotations are substantially higher.

The initial subscriptions to the two funds were limited to £128 million $60 million, respectively. There are presently more than six off-shore funds setup since 1984, by the UTI whose market value has crossed 1 billion by end January 2000. There are of course many other offshore funds, set up by SBI, IDBI and other public sector units.

3. SBI Mutual Fund:

The SBI Markets Limited, SBI’s merchant banking and leasing arm, floated the SBI Mutual Fund (SBIMF) as manager and trustee in 1987. The SBIMF has so far developed many schemes for the benefit of the domestic investing public: Magnum Regular Income Scheme (MRIS), 1987, Magnum Tax Saving Scheme (MTSS) 1988-89, Magnum Regular Income Scheme (MRIS) 1989 and Magnum Monthly Income Scheme (MMIS) 1989 (MTSS) 1990, (MRIS) 1990 etc. The last mentioned scheme was kept open for more than a month.

All the four schemes are basically income-oriented in nature, although an element of capital appreciation is built into them. As the name itself suggests, MTSS 1988- 89 provided for a tax rebate of 50% of the amount invested therein under Section 80 CC of the Income Tax Act, 1961, subject to a maximum of Rs. 20,000, inclusive of other investments eligible under this Section.

Similarly, the two MRIS conferred on investors a rebate on income up to Rs. 12,000 under Section 80L of the Income-tax Act, 1961. The first three close-ended funds launched by SBIMF in the span of a year and a quarter enabled it to mobilise funds to the tune of Rs. 2.47 billion and created investible resources of about Rs. 2.60 billion by March 1989. There are a number of other Schemes floated by the SBI cap later on.

4. India Magnum Fund N.V.:

Although a relatively new entrant in the mutual fund industry, the SBI Mutual Fund has made remarkable strides in a short span of time. The government has approved the State Bank of India’s proposal to launch an off-shore Mutual Fund named “Indian Magnum Fund N.V.”

This close-ended fund, constituted in Netherlands Antilles, is managed by the SBI Capital Markets Limited, in association with Morgan Stanley Asset Management, New York, a well-known international investment management institution. The targeted amount of mobilisation is US$ 100 million and the duration of the fund is 25 years. It garnered $ 157 million by end-October, 1989, when it was closed.

5. Other Funds:

Another public sector bank to enter the mutual fund field is Canara Bank who, through its subsidiary Canbank Financial Services Limited, has created the Canbank Mutual Fund (CMF). The Canbank Mutual Fund has launched many schemes so far, viz., “Canshare”, a growth-oriented fund with no guaranteed fixed return and “Canstock”, a purely income-oriented fund on the lines of SBIMF’s Magnum 1.

Both these close-ended funds have fared well in the market and have declared handsome return to the investors. To cater to the demands of the corporate sector, the CMF floated two other pure money market funds — Cancigo and Cangilt — which are purely liquid funds created to attract the surplus funds of the corporate sector. Other funds called “CanGrowth” and “CanStar” were floated in 1989, for the public investors and a host of other schemes were floated later on.

Close on the heels of these mutual fund companies, the Life Insurance Corporation of India (LIC) has also constituted its own mutual fund named “LIC Mutual Fund” (LICMF). The fund was launched, on June 19, 1989, and many products have been offered for investment.

The three schemes opened first for investment are:

(i) “Dhanashree” close-ended income and growth-oriented scheme, open till October 31, 1989, of units with a face value of Rs. 10 each and a minimum number of units 100, with a guaranteed rate of return of 11% p.a.;

(ii) “Dhanaraksha” — open-ended recurring investment scheme, the maximum amount of investment under which is Rs. 60,000 (spread over a period of 10 or 15 years), and which offers life and accident cover;

(iii) “Dhanvriddhi” — an open- ended fixed investment scheme with investment spread over 7 years to 10 years, the starting insurance cover being equal to the amount invested, subject to a maximum of Rs. 40,000. All these schemes of the LICMF are similar to the schemes offered by other mutual funds, with the additional benefit of life and accident insurance cover in the case of “Dhanraksha” and “Dhanvriddhi.”

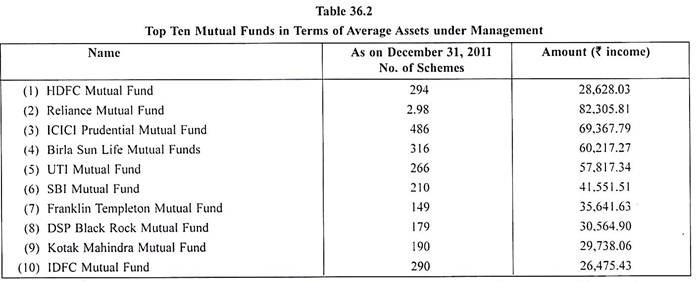

While several mutual funds as above are already in operation other commercial banks like the Indian Bank, Central Bank of India, Punjab National Bank of Baroda and Bank of India and financial institutions like the General Insurance Corporation of India, have either singly or jointly, taken steps to set up their own mutual funds and their schemes were also in operation.