The term ‘Capital Structure’ refers to the proportion between the various long-term sources of finance in the total capital of the firm. The major sources of long-term finance include ‘Proprietor’s Funds’ and ‘Borrowed Funds’.

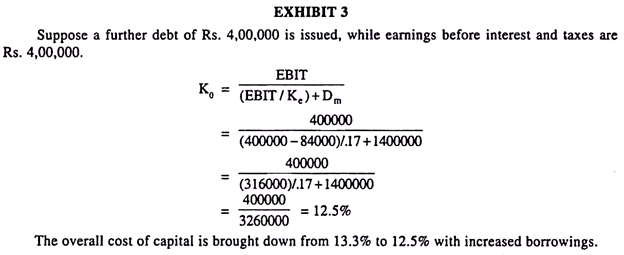

“Capital structure is the makeup of a firm’s capitalization i.e. it represents the mix of different sources of long term funds in the total capitalization of the company.” — Gerstenberg.

Capital structure represents only long term funds i.e. long term debts; shareholder’s equity etc., and excludes all short term loans and advances.

The selection of an appropriate capital structure is a very crucial decision and depends on a number of factors such as the nature of the company’s business; the risks involving the requirements of the government, regularity of earnings condition of the money market and the terms that prevails in the industry and the attitude of the investor etc.

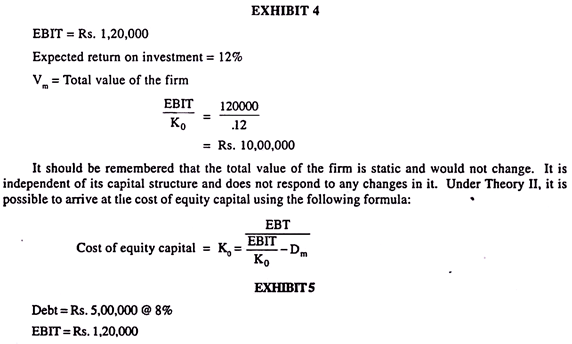

ADVERTISEMENTS:

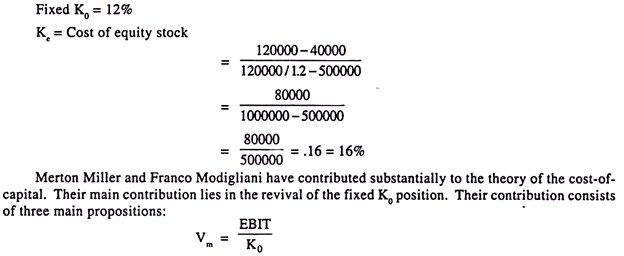

Capital structure is the permanent financing of the firm, represented primarily by long term debt, preferred stock, and common equity, but excluding all short term credit. Common equity includes common stock, capital surplus and accumulated earnings.

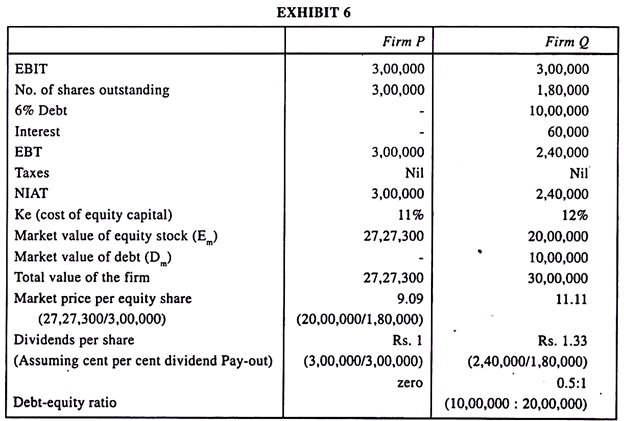

From a strictly financial point of view, the optimum capital structure is achieved by balancing the financing so as to achieve the lowest average cost of long term funds.

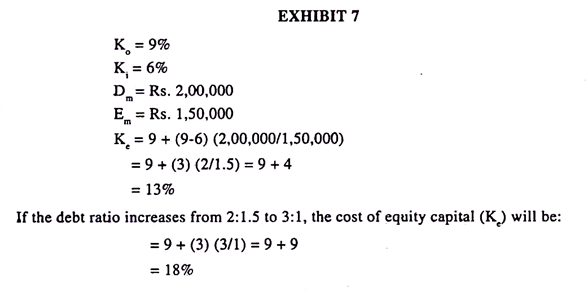

This, in turn, produces the maximum market value of the total securities issued against a given amount of corporate finance. We can thus define capital structure as the overall mix of components of capitalisation.

What is Capital Structure: Meaning, Definitions, Features, Significance, Patterns, Principles, Tools, Factors, Optimal Capital Structure, Decisions, Theories, Distinctions and More…

Capital Structure – Meaning

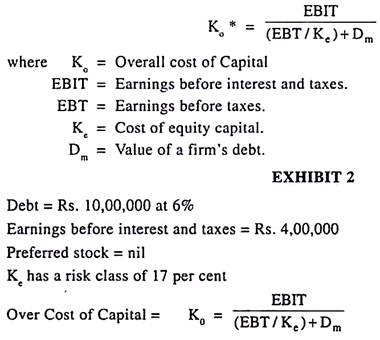

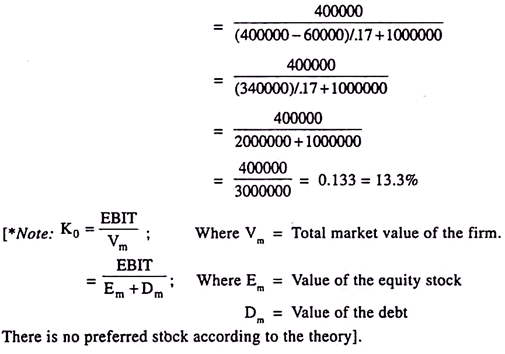

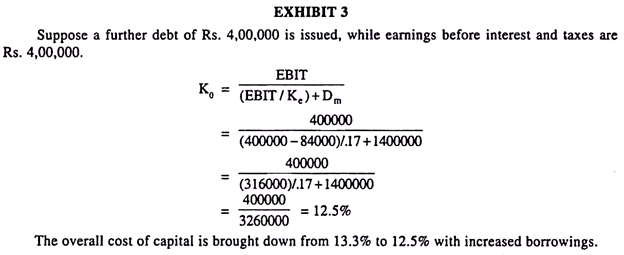

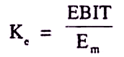

Since the finance manager is responsible to procure- tin- required funds for a firm from different sources, he has to select a finance mix or capital structure which maximizes shareholders wealth. For designing the optimum capital structure, he is required to select such a mix of sources of finance so that overall cost of capital is minimum.

ADVERTISEMENTS:

Capital structure refers to the mix of sources from which the long term funds required by a business are raised.

Capital structure decision is concerned with the sources of long term funds such as debt and equity capital. Capital structure is defined as the mix of various long term sources of funds broadly classified as debt and equity. Hence capital structure is also referred to as ‘Debt Equity Mix’ of a company.

In other words, capital structure represents the proportional relationship between debt and equity in the total capitalisation of the company. Equity capital includes paid up share capital, share premium, reserves and surplus (retained earnings) while debt capital includes bonds, loans, debentures etc.

For the purpose of capital structure, preference shares are also classified in the category of debt capital. This is because preference shares also bear a fixed rate of dividend and they are generally redeemable.

ADVERTISEMENTS:

Hence capital structure of a company is the composition of debt and equity capital in total capitalization of the company. Debt and equity capital differ in terms of costs and risks. From the viewpoint of the company raising funds, debt is considered to be a cheaper source than equity capital. However debt also increases the financial risk of the company and may be responsible for increase in cost of equity.

Capital structure decision, in turn, affects the overall cost of capital of a company. This overall cost of capital is generally used as a discount rate while evaluating capital projects under capital budgeting decisions.

The term ‘Capital Structure’ refers to the proportion between the various long-term sources of finance in the total capital of the firm. The major sources of long-term finance include ‘Proprietor’s Funds’ and ‘Borrowed Funds’.

Proprietors Funds include equity capital, preference capital, reserves and surpluses (i.e., retained earnings) and Borrowed Funds include long-term debts such as loans from financial institutions, debentures etc.

ADVERTISEMENTS:

In the capital structure decisions, it is determined as to what should be the proportion of each of the above sources of finance in the total capital of the firm. In other words, how much finance is to be raised from each of these sources.

These sources differ from each other in terms of risk and their cost to the enterprise. Some sources are less costly but more risky whereas others are more costly but less risky.

Capital structure refers to the mix of sources from where the long term funds required in a firm may be raised i.e. what should be the proportions of equity share capital, preference share capital, internal sources, debentures and other sources of funds in the total amount of capital which a firm may raise for establishing its business.

“Capital structure is the makeup of a firm’s capitalization i.e. it represents the mix of different sources of long term funds in the total capitalization of the company.” — Gerstenberg.

ADVERTISEMENTS:

Capital structure represents only long term funds i.e. long term debts; shareholder’s equity etc., and excludes all short term loans and advances. The selection of an appropriate capital structure is a very crucial decision and depends on a number of factors such as the nature of the company’s business; the risks involves the requirements of the government, regularity of earnings condition of money market and the terms that prevails in the industry and the attitude of the investor etc.

Capital Structure – Definitions

The term capital structure has been defined by several authors differently.

Some of the definitions are as follows:

(i) I.M. Pandey:

ADVERTISEMENTS:

Capital structure refers to the composition of long term sources of funds such as debentures, long term debt, preference share capital and ordinary share capital including reserves and surpluses (retained earnings).

(ii) Weston and Brigham:

Capital structure is the permanent financing of the firm, represented primarily by long term debt, preferred stock, and common equity, but excluding all short term credit. Common equity includes common stock, capital surplus and accumulated earnings.

(iii) John J. Hampton:

ADVERTISEMENTS:

Capital structure is the combination of debt and equity securities that comprise a firm’s financing of its assets.

(iv) R.H. Wessel:

The term capital structure is frequently used to indicate the long term sources of funds employed in a business enterprise.

(v) W.Gerstenberg:

Capital structure refers to the kind of securities that make up the capitalization.

(vi) Guthman and Dougall:

ADVERTISEMENTS:

From a strictly financial point of view, the optimum capital structure is achieved by balancing the financing so as to achieve the lowest average cost of long term funds.

This, in turn, produces the maximum market value of the total securities issued against a given amount of corporate finance. We can thus define capital structure as the overall mix of components of capitalisation.

Capital Structure – Top 6 Features

The features of capital structure are as as follows:

(i) It allows maximum possible use of leverage.

(ii) It involves minimum possible risk of loss of control.

(iii) It helps to avoid undue restrictions in agreement of debt.

ADVERTISEMENTS:

(iv) It helps avoid undue financial risk with the increase of debt.

(v) It takes care that the use of debt is within the capacity of a firm.

(vi) The firm should be in a position to meet its obligations in paying the loan and interest charges as and when they fall due.

Features of an Appropriate Capital Structure

The features of an appropriate capital structure are as follows:

Features # (i) Minimum cost:

An appropriate capital structure should attempt to establish the mix of securities in such a way as to raise the requisite funds at the lowest possible cost. As the cost of various sources of capital is not equal in all circumstances, it should be ascertained on the basis of weighted average cost of capital.

The management should aim at keeping the issue expenses and fixed annual payments at a minimum in order to maximize the return to equity shareholders.

Features # (ii) Maximum return:

ADVERTISEMENTS:

An appropriate capital structure should be devised in such a way so as to maximize the profit of the firm. In order to maximize profit, the firm should follow a proper policy of trading on equity so as to minimize the cost of capital.

Features # (iii) Minimum risk:

An appropriate capital structure should possess the quality of minimum risk. Risk, such as increase in taxes, rates of interest, costs etc. and decrease in prices and value of shares as well as natural calamities adversely affects the firm’s earnings.

Therefore, the capital structure should be devised in such a way as to enable it to afford the burden of these risks easily.

Features # (iv) Maximum control:

An appropriate capital structure has also the quality of retaining control of the existing equity shareholders on the affairs of the firm. Generally, the ultimate control of the firm rests with the equity shareholders who have the right to elect directors. Thus while determining the issue of securities, the question of control in management should be given due consideration.

In case the firm issues a large number of equity shares, the existing shareholders may not be able to retain control. The firm should, therefore, issue preference shares or debentures to the public instead of equity shares because preference shares carry limited voting rights and debentures do not have any voting rights.

Thus the capital structure of a firm should not be changed in such a way which would adversely affect the voting structure of the existing shareholders, dilute their control on the firm’s affairs.

Features # (v) Flexibility:

ADVERTISEMENTS:

An appropriate capital structure should have the quality of flexibility in it. A flexible capital structure enables the firm to make the necessary changes in it according to the changing conditions. In other words, under flexible capital structure, a firm can procure more capital whenever required or redeem the surplus capital.

Features # (vi) Proper liquidity:

An appropriate capital structure has to maintain proper liquidity which is essential for the solvency of the firm. In order to achieve proper liquidity, all debts which threaten the solvency of the firm should be avoided and a proper balance between fixed assets and current assets should be maintained according to the nature and size of business.

Features # (vii) Conservatism:

A firm has to follow the policy of conservatism in devising the capital structure. This would help in maintaining the debt capacity of the firm even in unfavourable circumstances.

Features # (viii) Full utilisation:

An appropriate capital structure is needed for optimum utilization of financial resources of a firm. Both under capitalization and over capitalization are injurious to the financial interest of a firm.

Thus there should be a proper coordination between the optimum of capital and the financial needs of a firm. A fair capitalization enables a firm to make full utilization of the available capital at minimum cost.

Features # (ix) Balanced leverage:

An appropriate capital structure should attempt to secure a balanced leverage by issuing both types of securities i.e. ownership securities and creditorship securities. Generally, shares are issued when the rate of capitalization is high, and debentures are issued when rate of interest is low.

Features # (x) Simplicity:

ADVERTISEMENTS:

An appropriate capital structure should be easy to understand and easy to operate. For this purpose, the number and type of securities issued should be limited.

Decisions Included in Capital Structure – Type of Securities to be Used or Issued and Ratio or Proportion of Securities

Capital Structure includes the following decisions:

(i) Type of securities to be used or issued: e.g.

(a) Shares: Equity shares, Preference shares.

(b) Debt: Debentures, bonds, public deposits, loans from banks and financial institutions.

(ii) Ratio or proportion of securities:

The ratio or proportion of securities in any capital structure is an important decision. The decision of capital mix is called capital gearing.

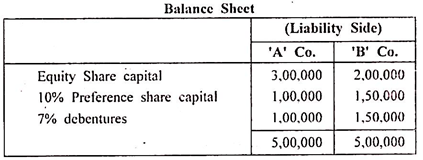

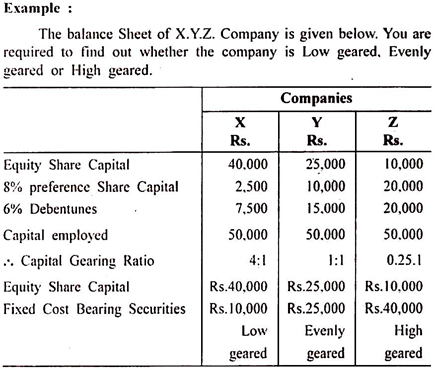

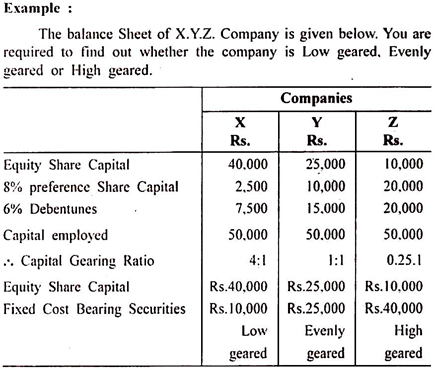

The capital gearing may be high, low or even. When the proportion of equity share capital is high in comparison with other securities in the total capitalization, it is low geared and in the opposite case, it is high geared and at the same time, if equity share capital is equal to the other securities, it is called evenly geared.

Capital Structure Importance – Maximisation of Returns to Owners, Minimisation of Risks, Increasing Value of the Firm, Proper Utilisation of Funds and More…

Capital Structure decisions of a firm have a far reaching impact on different aspects of a firm’s operation and long-term growth. Capital Structure significantly affects the return to shareholders, cost of financing and most importantly, the value of the firm.

In addition, it casts a great impact on the existing ownership structure and associated control.

The importance of capital structure may be summarised as follows:

Importance # 1. Maximisation of Returns to Owners:

A properly designed Capital Structure offering a judicious use of fixed charge capital and owned capital can maximise the return on equity. This is because a firm with a Rate of Return on assets higher than the cost of debt and cost of Preference Share Capital can significantly increase the return to shareholders by increasing the proportion of debt and Preference Share Capital in its total capital even in the absence of taxes.

In the presence of tax, the increase is found to be even higher as interest on debt is a tax deductible item and as a result, the resultant tax savings goes to the equity shareholders.

Importance # 2. Minimisation of Cost of Capital:

Cost of debt is generally found to be cheaper than cost of equity. Moreover, it is also range bound, that is to say, it remains relatively constant within a given range.

As a result, an increase in the proportion of Debt Capital keeping the total capital unaltered contributes significantly to reduce the overall Cost of Capital. Hence, an optimal debt equity mix in a Capital Structure can minimise the overall Cost of Capital.

Importance # 3. Minimisation of Risks:

A business is subject to two types of risks – business risk and financial risk. Business risk arises from factors like sudden fall in demand, falling prices of goods, non-availability of raw materials, etc. On the other hand, financial risk arises due to inclusion of fixed charge capital in the Capital Structure.

Since a proper balance must be maintained between these two risks to minimise their overall impact, Capital Structure can play an important role here. Thus, a firm with high business risk resulting in higher variability in operating income may use lesser debt to reduce the impact of financial risk and vice-versa to balance the overall risk profile of the firm.

Importance # 4. Increasing Value of the Firm:

Value of the firm or more precisely market value of the firm largely depends on its performance. Since properly designed Capital Structure can significantly reduce the overall Cost of Capital, return to shareholders increases. This, when recognised by the market, improves the market price of shares and accordingly the total value of the firm.

Importance # 5. Ensuring Liquidity:

The Capital Structure of any firm has significant bearing on a firm’s short-term and long-term liquidity in terms of buyback of equity shares, redemption of preference shares and debentures, repayment of loan and payment of dividend and interest.

A properly designed Capital Structure, commensurate with earnings and cash availability, takes care of these factors and ensures liquidity.

Importance # 6. Preservation of Control:

In many situations, large borrowings come with certain debt covenants (i.e., restrictions imposed by lenders). As a result, debt providers interfere in major company decisions and absolute control by equity shareholders is compromised.

A well planned Capital Structure keeps a balance between equity and Debt Capital and thereby preserves the control of owners in the company.

Importance # 7. Proper Utilisation of Funds:

An ideal Capital Structure always takes into account the actual reason behind a fund procurement decision thereby establishes proper coordination between the quantum of capital and financial need of the business. As a result, both undercapitalisation and overcapitalisation can be avoided.

Importance # 8. Financing Long-Term Growth:

Firm’s existing Capital Structure plays an important role in attracting finance for long-term expansion and growth programmes. A firm with sound Capital Structure gets finances (both in form of issue of shares or raising new debt) easily as compared to a firm with unplanned Capital Structure.

Capital Structure – Top 7 Essentials

The management of a company should try to develop a capital structure which is most advantageous for the company and its equity shareholders. It should aim at maximising the long-term market value of its equity shares.

A sound capital structure must possess the following essentials:

Essentials # (i) Economy

A capital structure must ensure the minimum cost of capital to enable the firm to generate more surplus and wealth.

Essentials # (ii) Clear-cut objectives

A capital structure of a company should be guided by clear-cut objectives. It should aim at maximising the long-term market price per share as far as possible.

Essentials # (iii) Balance

The capital structure should represent a balance between different types of ownership and debt securities. This is necessary to reduce risk on the use of debt capital.

Essentials # (iv) Flexibility

The capital structure of a company should be capable of being adjusted in accordance with the changing conditions with a minimum cost and delay. It should be continuously revised as per the changes in the business conditions. It should also be possible for the company to provide funds whenever needed to finance the profitable ventures.

Essentials # (v) Control

The capital structure should involve minimum risk of loss of control of the company. The dilution of control is a major problem for the management of closely held companies.

Essentials # (vi) Safety

A sound capital structure should ensure safety on investment. It should be such that the fluctuations in the earnings of the company do not put stress on its financial structure.

Essentials # (vii) Dynamic

The capital structure should be revised periodically depending upon the changes in the business conditions. The company should have the capacity to repay its debts and reduce interest obligations.

Capital Structure Aspects – Profitability and Liquidity Aspects

These two aspects have been analyzed in the following paragraphs:

1. Profitability and

2. Liquidity.

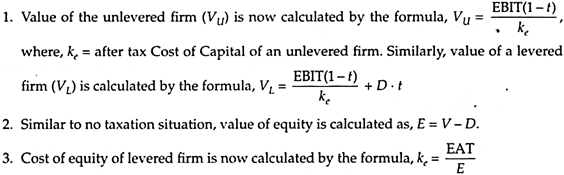

1. EBIT-EPS Analysis (Profitability Aspect):

A firm has different options regarding the combinations of various sources to finance its projects.

The cost of finance varies depending on the source of finance because –

(a) There is no fixed cost in case of equity.

(b) Interest on debt, besides being tax deductible, carries a fixed charge.

(c) Dividend on preference shares, in case of equity dividend paying firms, is a fixed charge.

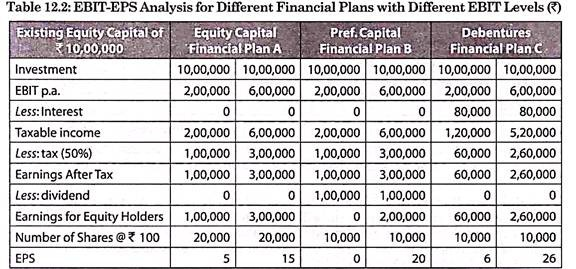

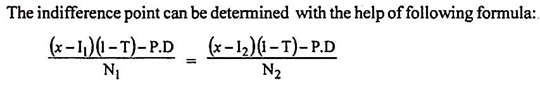

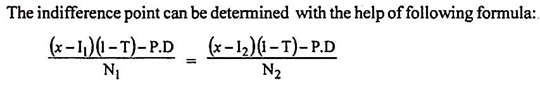

EBIT-EPS analysis is an analytical mechanism that seeks to examine the effect of financing alternatives on EPS for different levels of EBIT. Thus, different financing patterns shall have different EPS for a given level of EBIT.

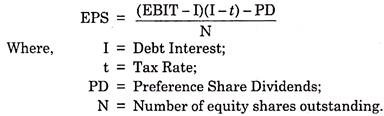

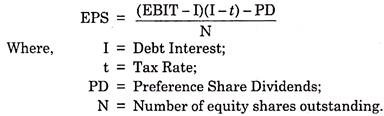

EPS reflects a company’s net income (EAT) divided by the number of shares outstanding. EBIT reflects operating income because it is the amount of profit that remains after adjusting all operating expenses (that is, interest and taxes are excluded). The basic objective behind every financing plan is to maximize the earning per share (EPS).

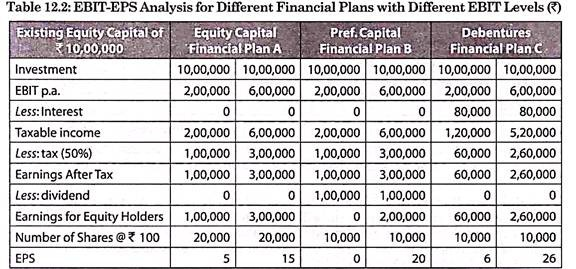

EBIT-EPS Chart:

The EBIT-EPS analysis is also made by graphing the relationship between EBIT and EPS for different financial plans.

The relationship between EPS and EBIT for each financing method is as follows:

This relationship is linear as all the values-interest, preference dividend and numbers of shares are given for each financing method and the tax rate is assumed to be constant. Therefore, if EPS is computed for two different levels of EBIT for each financing method, the line representing each financial plan can be obtained.

To illustrate, let us take two EBIT levels Rs.2,00,000 and Rs.6,00,000 for the three financial plans given above and compute the respective EPS as follows –

Limitations of EBIT-EPS Analysis:

EBIT-EPS analysis is an important tool in the hands of the finance manager to make a capital structure decision. However, achieving the highest EPS need not be the only goal of the firm.

The main shortcomings of the EBIT-EPS analysis are discussed in the following paragraphs:

(a) Ignores the Risk Factor:

Leverage increases the level of risk, but the risk factor. As the debt component in the capital structure increases, the financial risk faced by the shareholders also increases. The EBIT-EPS analysis fails to deal with the variability of EPS and the risk return trade-off.

(b) Overemphasis on EPS:

The EPS is computed from the operating profits so it is more of an indicator of operational performance. It may not be the correct basis for a capital structure decision.

(c) Inconsistent Results:

If the firm has to decide between alternative financial plans that do not consist of the issue of equity shares, EBIT-EPS analysis shall not help in making capital structure decisions. For instance, if a company wishes to raise finance either by the issue of preference shares or debt finance only, EBIT-EPS lines of the two plans drawn graphically will be parallel and no intersection point shall emerge. This implies that there is no indifference level of EBIT for the two plans.

In spite of the shortcomings of the EBIT-EPS analysis, it is considered to be an important mechanism in capital structure decision-making.

EBIT-EPS analysis favours debt financing if the return on investment is more than the cost of financing. However, it is not appropriate to ignore the increased risk of the shareholders that emanates from the increase in fixed financial charges, which are associated with debt.

In order to make EBIT-EPS analysis more meaningful, the ability of the firm to use fixed charge finance may be assessed with the help of a coverage ratio –

Coverage Ratio = EBIT / I + (PD/1-t)

Where,

I = Interest on Debentures

t = Tax rate

PD = Dividend on Preference Shares

The coverage ratio measures the margin of safety a firm has for paying fixed charges in the form of interest and preference dividend during a given period. A firm needs this margin of safety in order to survive during any adverse economic conditions. The lower the coverage ratio, the higher is the firm’s debt burden and greater the possibility of bankruptcy or default.

A higher ratio indicates a better financial health as it means that the firm is more capable to meet the fixed charges from operating earnings. It may be calculated for various levels of EBIT. This gives a better picture of the firm’s most likely EBIT to meet its commitments.

A firm’s ability to meet its financial obligations is an aspect of a firm’s solvency, and is thus a very important factor in the return to the shareholders.

EBIT-EPS analysis and the coverage ratio, both emphasize the importance of profitability for designing the capital structure of a firm. It is possible that the firm has adequate EBIT to meet its debt obligations, but may not have sufficient cash to make the actual payments. Such a situation may arise if the income of the firm is blocked in receivables, inventory and so on.

Also, the firm should not only be capable of meeting the interest and dividend payments, it should also have enough cash flow for the repayment of debt or redemption of preference shares as and when they become due. Therefore, it is important to consider the liquidity aspect along with the profitability aspect of the firm in order to make sound capital structure decisions.

2. Cash Flow Analysis (Liquidity Aspect):

Cash flow analysis measures a firm’s ability to meet the fixed obligations like interest and principal amount of debt, dividend on preference shares and their redemption and so on. If a company employs a higher proportion of fixed charge finance, but does not have sufficient and stable cash flows, it may face financial distress leading to insolvency. Hence, the liquidity aspect is an important consideration to determine the firm’s ability to make timely payments.

The liquidity analysis is best achieved with the help of cash flow information as it is more reliable than a balance sheet or income statement information. It includes analysis of the generation and use of cash from operating, investing or financing activities.

The major categories of cash flows from these activities are as follows:

(a) Operating Cash Flows:

These relate to cash flows from day-to-day operations of the business. They are determined by converting the items reported on the income statement from accrual basis to cash. For instance, cash received and disbursed for product sales, royalties, commissions, payroll, and so on over the period of analysis.

(b) Non-Operating Cash Flow:

These constitute payments made to acquire long-term assets; cash received from their sale and working capital changes. These are non recurring in nature but important for maintaining the operational efficiency of a firm. For instance, the purchase of fixed assets and the purchase or sale of securities issued by other entities is non-operational transactions.

(c) Financial Cash Flows:

These include financial obligations of the firm that have to be paid as and when they fall due. For instance, interest, repayment of debt, dividends and so on.

The analysis of different components of cash flows gives a clear picture of the firm’s ability to meet its financial obligations in favourable as well as unfavourable economic conditions. Thereafter, the firm is in a better position to decide the debt-equity proportion in its capital structure.

Some of the measures that help in analyzing cash flows are as explained below:

(i) Fixed Charges to Net Cash Inflow Ratio:

This ratio compares a company’s available cash resources with its current interest, principle, and other fixed financial obligations. It is a debt service coverage ratio and it indicates the number of times the fixed financial requirements are covered by its net cash inflows. A higher ratio indicates higher debt content in the capital structure. This also has a bearing on the firm’s debt capacity, that is, its ability to borrow.

(ii) Cash Budget:

A cash budget may be prepared to find out the expected cash inflows and cash outflows (including interest and repayments). Cash flow forecasts aim to predict future financial liquidity over a specific period of time. The cash flows that are forecasted for operating, investing and financing activities should be adjusted for the risk factor associated with cash inflows as well as cash outflows.

The deviations between the actual and expected cash flows may arise due to many reasons like increased competition, inflation and increased fixed charges. Therefore, the companies prefer to make cash budgets for a range of possible cash inflows giving due consideration to different operating conditions. Such projected cash budgets help the finance manager to assess the liquidity capacity of the firm and design the capital structure accordingly.

The designing capital structure evaluates different aspects of the capital structure. The EBIT-EPS analysis stresses the profitability of the proposed financing mix and analyses it from the point of view of equity shareholders. The cash flow analysis stresses the importance of liquidity in debt financing and thus, it emphasizes the debt servicing aspect of financing.

Capital Structure – Significance or Benefits

The significance or benefits of capital structure are as follows:

In the area of financial management, capital structure decisions are of utmost significance. But some companies do not plan their capital structure. These companies may be able to succeed in the short period, but they may feel difficult to get necessary finance for their activities in future.

Therefore, for the maximum profitable use of resources and to adjust according to changing requirements, planning of capital structure is necessary. Management can determine the optimum capital structure by proper decision on the capital structure in which the aggregated cost of capital is minimum and the value of ordinary shares is maximum.

Through the right decision on the capital structure, management can increase the return for its shareholders by using financial leverage. Management can determine the debt capacity of the business.

By not fully utilizing the debt capacity, firms can be saved from the financial distress. If a company has growth opportunities in the future, additional finance can be raised at the right time. Firm can save itself from the restrictive conditions of the financial institutions at the time of loans, etc.

If a company uses more debt in its financial structure, it increases financial risk. As a result, the debt and share capital in future is available at high cost. Financial risk can be kept at an appropriate level by proper decision on the capital structure.

Capital Structure – Patterns (with its Advantages and Disadvantages)

Pattern of Capital Structure is the various combinations of forms of capital sources for a newly formed company, which is preferred by the company based on its requirement or preference.

(a) Capital structure with Equity Share Capital only.

(b) Capital structure with Equity Share Capital & Preference Share Capital.

(c) Capital structure with Equity Share Capital, Preference Share Capital & Debentures.

(d) Capital structure with Equity Share Capital & Debentures.

For an existing company the same patterns of capital structures are used by substituting equity capital for debenture share capital.

Advantage and Disadvantages of Different Patterns of Capital Structure

The selection of an appropriate pattern of capital structure is governed by a number of factors, such as amount of capital required, nature and size of business enterprise, regularity of earnings, cost of financing, conditions of the money market, and the attitude of the investors.

The following are the relative merits and demerits of the various patterns of the capital structure of the company:

(a) Capital Structure With Equity Shares Only

Merits:

a) A company can raise fixed capital without creating a charge on the assets of the company.

b) Equity shares do not impose any fixed liabilities like assured rate of dividend on preference shares, or interest on debentures.

c) The directors have greater discretion in declaration of dividend. In this regard they can protect the interest of the company, by creating reserves, and surpluses, out of divisible profits.

d) Equity share capital attracts bold, adventurous, and speculative investors, with more profits, and controlling power.

e) Like debentures, there is no obligation to return the money raised as equity capital.

Demerits:

a) Cost of financing equity share capital is relatively more.

b) Companies cannot enjoy the benefit of trading on equity.

c) Equity share capital does not attract cautious investors, because they prefer safety of investment, and stable dividend.

d) Excessive issue of equity share capital may lead to over capitalization, if the earnings, does not justify the issue.

e) Management may lose grip over the affairs of the company, if at all the funds are raised only by equity shares.

(b) Capital Structure With Both Equity and Preference Shares

Merits:

a) This type of capital structure attracts both bold, adventurous, and cautions investors. Bold, adventurous investors will go in for equity share capital, as they are ready to take risk. While cautious investors would buy preference shares, with fixed dividend.

b) The inclusion of both equity and preference shares, in the capital mix ensures the greater flexibility in the capital structure.

c) Company can raise preference share capital without creating charge on its assets.

d) Preference shares will have better demand, because equity shares will provide a sound base for the issue of preference shares.

e) Control of the company’s affairs will be vested in equity shareholders, while preference shareholders do not enjoy such rights, because they are non-voters.

f) To some extent it facilitates trading on equity.

Demerits:

a) This scheme is costlier compared to the issue of debentures.

b) It affects the interest of equity shareholders, because they get their dividend, after payment of fixed dividend to preference shareholders.

c) Company cannot enjoy the advantage of trading on equity at fuller extent.

d) There is possibility of exploitation of the preference shareholders.

e) Cumulative preference share my impose the liability of payment of accumulated dividend, and redeemable preference share increase the liability of repayment.

(c) Capital Structure With Equity Shares, Preference Shares And Debentures

Merits:

a) Company can raise the finance at cheaper cost through issue of debentures.

b) Companies can enjoy the benefit of trading on equity.

c) This type of capital structure satisfies all types of investors. Equity shares attract venture investors, preference shares assure guaranteed dividend to cautious investors, and debentures attract the most conservative investors, who insist on safety of investment and definite return.

d) The inclusion of debentures in the capital structure does not dilute the controlling power of the management, because debentures have no voting rights.

e) During depression the company can raise debenture finance easily.

Demerits:

a) It may affect the goodwill and borrowing power of the company, because company’s assets are changed, or mortgaged to debentures.

b) Trading on equity often leads to losses.

c) Debenture finance becomes a burden on the company, because interest is to be paid irrespective of the profits of the company.

d) Under this type of capital structure, the company is likely to become over capitalized.

e) Slackness in earnings capacity of the company magnifies losses, and further it may leads to insolvency and liquidation.

4 Fundamental Patterns of Capital Structure

There may be four fundamental patterns of capital structure as follows:

(i) Equity share capital only (including Reserves & surplus)

(ii) Equity share capital and preference share capital.

(iii) Equity, preference share capital and long term debt. i.e. Debentures, bonds and loans from financial institutions etc.

(iv) Equity share capital and long term debt.

Capital Structure – Top 5 Principles: Cost, Risk, Control, Flexibility and Timing

The principles of capital structure are as follows:

For considering the suitable pattern of capital structure, it is necessary to consider certain basic principles which are militant to each other. It is necessary to find a golden mean by giving proper weightage to each of them.

(1) Cost Principle:

According to this principle, ideal capital structure should minimize cost of financing and maximize earnings per share. Debt capital is a cheaper form of capital due to two reasons. First, the expectations of returns of debt capital holders are less than those of Equity shareholders. Secondly, interest is a deductible expenditure for tax purposes whereas dividend is an appropriation.

(2) Risk Principle:

According to this principle, ideal capital structure should not accept unduly high risk. Debt capital is a risky form of capital, as it involves contractual obligations as to the payment of interest and repayment of principal sum irrespective of profits or losses of the business.

If the organization issues large amounts of preference shares, out of the earnings of the organization, less amount will be left out for equity shareholders as dividend on preference shares are required to be paid before any dividend is paid to equity shareholders. Raising the capital through equity shares involves least risk as there is no obligation as to the payment of dividend.

(3) Control Principle:

According to this principle, ideal capital structure should keep the controlling position of owners intact. As preference shareholders and holders of debt capital carry limited or no voting rights, they hardly disturb the controlling position of residual owners. Issue of equity shares disturb the controlling position directly as the control of the residual owners is likely to get diluted.

(4) Flexibility Principle:

According to this principle, ideal capital structure should be able to cater to additional requirements of funds in future, if any. E.g. If a company has already raised too heavy debt capital, by mortgaging all the assets, it will be difficult for it to get further loans in spite of good market conditions for debt capital and it will have to depend on equity shares only for raising further capital.

Moreover, organizations should avoid capital on such terms and conditions which limit a company’s ability to procure additional funds.

E.g. If the company accepts debt capital on the condition that it will not accept further loan capital or dividend on equity shares will not be paid beyond a certain limit, then it loses flexibility.

(5) Timing Principle:

According to this principle, ideal capital structure should be able to seize market opportunities, should minimize cost of raising funds and obtain substantial savings.

Accordingly, during the days of boom and prosperity, companies can issue equity shares to get the benefit of investors’ desire to invest and take the risk. During the days of depression, debt capital may be used to raise the capital as the investors are afraid to take any risk.

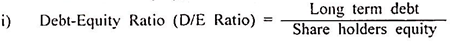

2 Important Tools to Assess the Quality of Capital Structure (With Formula of Capital Gearing)

Capital structure in finance indicates sources of funds through which a firm finances its assets using a blend of debt, equity or hybrid securities. A company’s capital structure consists of equity and preferred stock plus retained earnings, which are summed up in the shareholders’ equity account on a balance sheet.

Capital structure of the organization is very hard to determine because it can influence the return a company earns for its shareholders and also the firm survival of the firm in the long term.

One of the advantages of having more equity financing in capital structure is that it doesn’t have to be repaid and the risks and liabilities of company ownership is shared with the investors. However equity financing may take away the freedom as some level of decision-making authority is given to investors, further the cost of raising funds through equity is very huge.

Debt financing has a lower total financing cost and helps keep profits within a company and increases returns on equity for company owners and helps secure tax savings. The most obvious disadvantage of debt financing is that it needs to repay with interest and failure to do so attracts the risk of financial distress and insolvency leading to bankruptcy.

Therefore one of the challenges financial managers face is precisely determining the correct capital structure.Capital structure should be constituted in such a way that it minimizes cost of capital and maximizes the value of organization.

In order to assess the quality of capital structure financial management provides two important tools, they are as follows:

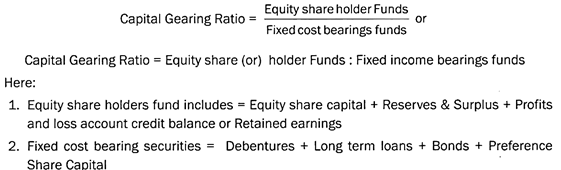

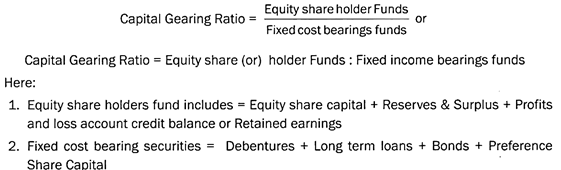

i. Capital Gearing:

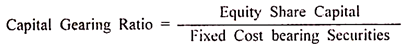

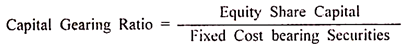

One of the key aspects that financial managers should consider while planning capital structure of the company is capital gearing. Capital gearing is a financial tool that compares the proportion of finance procured through equity capital with other fixed cost bearing securities.

Fixed cost securities provide a fixed and periodic return to security holders, for example preference shares, debentures and bonds or long term loans carry fixed income paid in the form of interest to its providers.

Tools for Assessing Capital Structure:

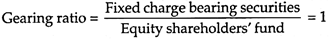

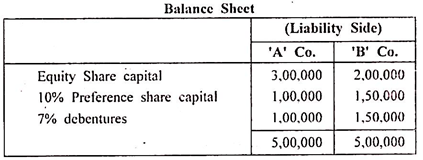

Thus, capital gearing focuses on the capital structure by establishing relationships between equity shares to other fixed income bearing securities. Capital gearing ratio is a useful tool to analyze the capital structure of a company and is computed by dividing the equity capital by fixed cost funds.

The gearing ratio is the proportion of a company’s fixed cost bearing funds to its equity, in the above equation, the numerator consists equity capital and the denominator consists fixed income bearing funds. All the information required to compute capital gearing ratio is available from the balance sheet.

Interpretation:

If the proportion of equity capital in comparison with total fixed income bearing capital is lesser, then a company is on high gearing of capital. On the other hand if a company’s capital structure has a high proportion of equity capital in comparison to fixed cost bearing capital it is an indication of low gearing of capital.

a. Highly geared—Less equity capital and more fixed cost bearing capital

b. Low geared—More equity capital and less fixed cost bearing capital

Significance and Implication of Capital Gearing:

An ideal capital gearing is very essential to facilitate comfortable functioning of business as it affects the profitability of the concern. The concept of capital gearing can be linked to bike, in order to run a bike efficiently proper shifting of gears is very essential. When the bike is started it is switched from neutral gear to first gear, as soon as it gets moving the first gear gradually shifts to high gears.

Likewise, a business enterprise begins with a low gear, i.e., with equity capital and as soon as the business gets progressive, it may consequently need more injection of funds which is met through issuing fixed cost securities, i.e., preference shares or bonds or debentures and Long term loans.

However if the business enterprise continues using more fixed cost securities to fund its continuing operations and if the sales fail then it may have serious problems in meeting its obligation in the form of paying interest and principal amount. Further Banks and other financial institutions may not come forward to give loans to companies that are already highly geared.

ii. Leverages:

Apart from capital gearing, leverage is another financial tool in the hand of a finance manager to assess the efficacy of capital structure of a company. The concept of leverages revolves around two aspects, first—the effects that fixed interest cost capital (preference shares, debentures and bonds or long term loans) have on the returns that shareholders earn. Second, impact of fixed costs on the earnings of the company and shareholders.

Generally, leverage magnifies both returns and risks. A business enterprise with higher degree of leverage may earn more returns on average than a firm with lower leverage, but the returns on the higher leveraged firm will also be more volatile.

Therefore the prime objective of leverage assessment is to maximize the earning of shareholders and reduce the risk of the company. In order to accomplish this, the finance manager determines the degree of leverage by assessing three types of leverages and then uses them for taking decisions in favour of the company’s shareholder.

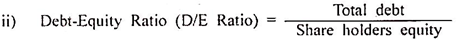

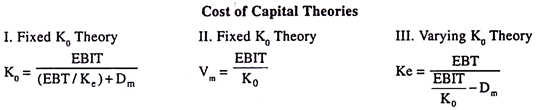

Capital Structure – Optimal Capital Structure: Definitions, Objectives, Characteristics and Computation

Definitions:

The optimal or the best capital structure implies the most economical and safe ratio between various types of securities. It may be defined as that mix of debt and equity which maximizes the value of the company and minimizes the cost of capital.

According to Solomon Ezra, “Optimum capital structure can be defined as that mix of debt and equity which will maximize the market value of a company and minimize its cost of capital.”

According to E. W. Walker, “An optimum capital structure can be properly defined as that security-mix that minimizes the firm’s cost of capital and maximizes firm’s value.” Hence, the optimal capital structure is concerned with the two important variables at one time the minimization of cost as well as maximization of worth.

Objectives of an Optimum Capital Structure:

The main objectives of management in devising a sound and balanced capital structure are as follows:

1) Minimization of Capital Cost:

One of the major objectives of a business enterprise is to raise capital at the lowest possible capital cost under a given set of circumstances in terms of interest and dividend and the relationship of earnings to the prices of shares.

2) Minimization of Risk:

Business operations are constantly subject to various risks, which have a direct bearing on the capital structure of the firm. These various risks are business risks, poor management risks, cycle risks, purchasing power risks, interest rate risk and tax risk so on.

A prudent management tries to minimize all such risks by making suitable adjustments in the various components of capital structure.

3) Maximization of Return:

The third main aim of management is to provide the maximum earnings or return to the real owners of the business, i.e., equity – shareholders. The earnings of the enterprise should permit the maximum possible return to equity shareholders.

4) Preservation of Control:

One of the main aims in designing sound capital structures is to preserve the control of the firm. Capital structure should be so designed as to prevent the erosion of control from the hands of equity-shareholders. It must ensure maximum control in their hands. This requires that a proper balance is to be maintained between the voting right and non-voting right capital.

Characteristics:

An optimum capital structure should have the following characteristics:

(1) Simplicity:

The capital structure should be simple, so far as possible. Simplicity means that in addition to equity and preference capital, the minimum type of long-term securities should be issued. Initially only equity and preference shares should be issued and debt instruments should be issued at a later stage.

(2) Flexibility:

The capital structure should be adequately flexible so that it may be altered when needed. It should be possible for a company to change its capital structure with minimum cost and delay if warranted by changed circumstances. Use of debt makes the capital structure more flexible because it can be raised when needed and redeemed when not required.

(3) Minimum Risk:

Capital structure should ensure minimum risk. The use of excessive debt threatens the solvency of the firm because it involves a fixed commitment to pay the interest irrespective of the profits. Debt should be used to the extent it does not add significant risk. Beyond this, the use of debt should be avoided.

(4) Minimum Cost of Capital:

Cost of capital means interest on debts or dividend on shares. Debt is a cheaper source of finance in comparison to equity capital because the rate of interest is lower than the return expected by equity shareholders and the tax deductibility of interest further reduces the cost of debt.

The preference share capital is also cheaper than equity capital, but not as cheap as debt. Thus, optimum capital structure should include sufficient debt since it is the cheapest source of finance.

(5) Sufficient Liquidity:

Liquidity means the ability of the firm to pay interest as well as principal in time. A firm is considered liquid if it is able to pay the interest and principal under reasonably predicted adverse conditions. Hence, while determining the optimum amount of debt it should be carefully analysed as to how a firm’s liquidity will be maintained under recession conditions.

(6) Maximum Profitability:

Capital structure of the company must provide maximum return to equity shareholders. If there is a probability of earning a higher return on a company’s assets in comparison to the cost of debt, a large amount of debt can be used by the firm to maximise its profitability, otherwise the firm should refrain from employing debt capital.

(7) Retaining Control:

Capital structure should help the present management in retaining the control over the company. For this purpose debt should be preferred in comparison to issue of equity capital while raising further funds. Debt holders do not possess voting rights in company’s meetings and hence cannot elect the directors of the company whereas equity shareholders possess voting rights.

(8) Avoidance of Unnecessary Restrictions:

Capital structure should avoid un- necessary restrictions on the firm. For instance, term loans from financial institutions should be avoided because these institutions impose a number of restrictions on further borrowing of the company.

(9) Legal Requirements:

Capital structure should fulfil all the legal requirements. Securities and Exchange Board of India (SEBI) issues certain guidelines from time to time. These should be followed while designing a capital structure.

Computation of Optimum Capital Structure:

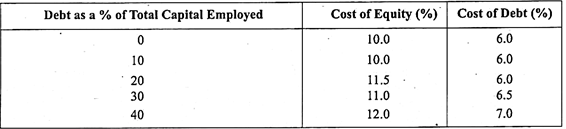

Optimum capital structure represents a combination of debt-equity proposition, at which market value per share, firm value is maximum or the overall cost of capital is minimum. We propose to discuss the capital structure based on the overall cost of capital.

Illustration:

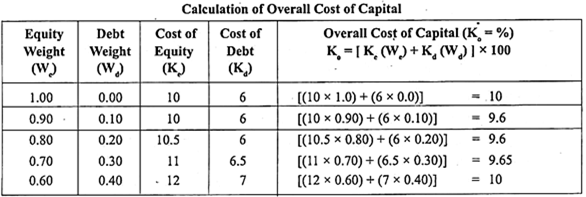

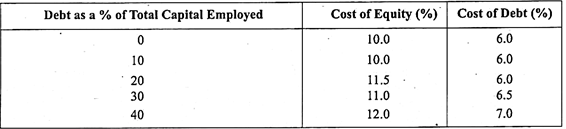

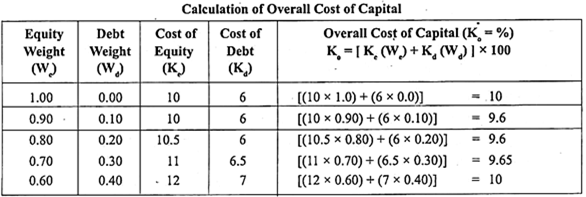

In considering the most desirable capital structure of a company, the finance manager has estimated the following –

You are required to determine (optimal debt-equity mix) optimal capital structure by calculation of overall cost of capital.

Solution:

Here optimal capital structure is one, with 90 per cent equity, 10 per cent debt, since Ko is minimum at this debt-equity mix.

Classification of Capital Structure – According to Nature, Composition and Resultant Risk (With Example and Formula of Gearing Ratio)

Classification of capital structure are as follows:

1. Nature-Based Classification:

According to nature, a capital structure can be either:

(i) Simple, or

(ii) Complex.

(i) Simple Capital Structure:

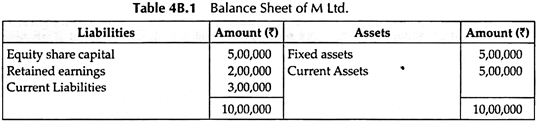

When a firm procures capital only from one source (e.g., equity share capital and retained earnings), the resulting Capital Structure is said to be a simple Capital Structure.

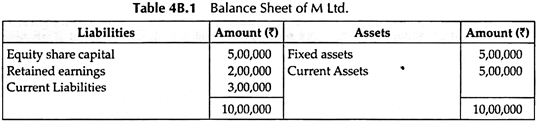

An example is given in Table 4B.1 –

The above Capital Structure is simple as capital is procured only from the equity shareholders (retained earnings represent the undistributed profit distributable to equity shareholders).

(ii) Complex Capital Structure:

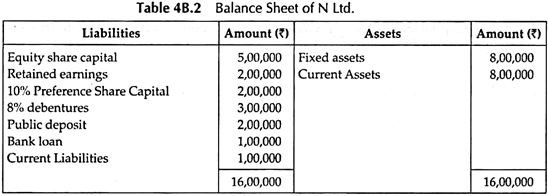

When a firm procures capital from more than one source, the resulting Capital Structure is called complex Capital Structure.

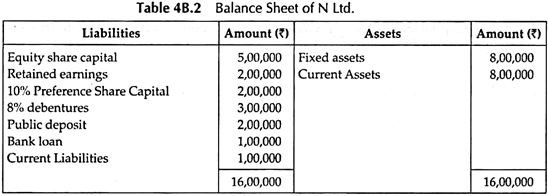

An example is given in Table 4B.2 –

In the above example, the firm has procured capital from different sources including shareholders, debenture holders and financial institutions, etc. Thus, the Capital Structure is considered complex.

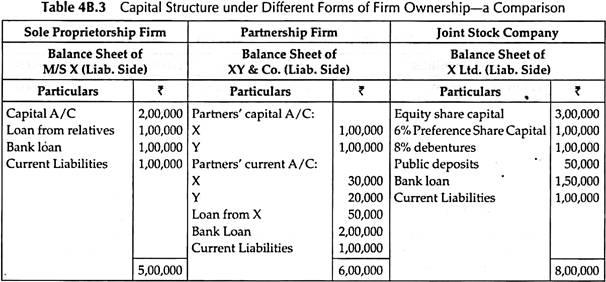

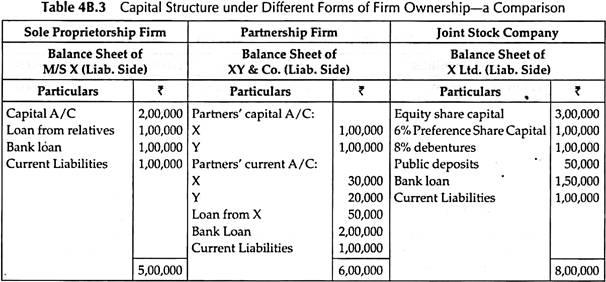

Table 4B.3 depicts the comparison of Capital Structure under different forms of firm ownership –

2. Based on Composition and Resultant Risk:

Based on the composition, i.e., relative share of own capital and fixed charge capital and resultant risk, Capital Structure (necessarily complex Capital Structure) can be divided into –

(i) Highly-geared,

(ii) Low-geared and

(iii) Evenly-geared Capital Structure.

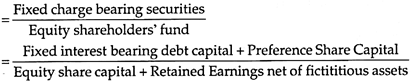

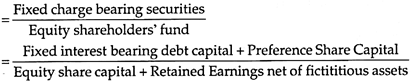

Here, gearing ratio is defined as the ratio of fixed charge bearing securities, i.e., fixed interest bearing Debt Capital and Preference Share Capital to equity shareholders’ fund.

That is, Capital Gearing Ratio –

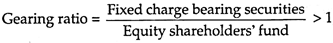

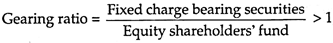

(i) Highly Geared Capital Structure:

A Capital Structure is called highly geared when the proportion of fixed charge bearing securities is higher than the equity shareholders’ fund.

In other words, a Capital Structure is said to be highly geared if

A highly geared Capital Structure is generally considered to be highly risky, however, at the same time, it offers the benefits of Trading on Equity which helps to maximise the return to shareholders.

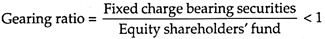

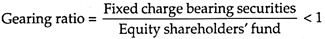

(ii) Low-Geared Capital Structure:

A Capital Structure is called low geared when the proportion of fixed charge bearing securities is lower than the equity shareholders’ fund.

In other words, a Capital Structure is said to be low geared if

A low geared Capital Structure is considered to be conservative rather than risky.

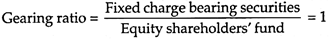

(iii) Evenly Geared Capital Structure:

A Capital Structure is called evenly geared when the proportion of fixed charge bearing securities and equity shareholders’ funds are the same.

In other words, a Capital Structure is said to be evenly geared if

An evenly geared Capital Structure shows that the firm is dependent equally on equity shareholders’ fund and fixed charge capital and hence represents a balanced financial risk profile.

10 Factors Affecting Capital Structure

The effective capital structure is based on certain basic factors, which have a bearing on the capital combination. These factors may be internal or external. The factors which are external, where there will be no hold on the companies and companies should change their functions based on the prevailing factors.

As in case of internal factors, where the company has control and can change based on the prevailing circumstances. External factors are the factors which are over and above the control of individual firms. These factors have a bearing on the capital structure of the individual firm.

The following are the factors:

Factors # 1. Market:

It plays a vital role in terms of the sources of finance. Efficient markets can always provide the required quantum of funds in different combinations. When the firm formulated the capital structure, it has to consider the prevailing market environment and act accordingly.

Factors # 2. Investor’s Behaviour:

Capital structure of the firm is purely based on the behavioural aspect of the investor. It is proven from many theories that human behaviour changes frequently and one will not have control on the behaviour of the human being. This aspect is more emphasized in behavioural finance.

According to the circumstances, an investor changes his attitude towards his investment in the market. This may be due to the competition, which educates the investors about the prevailing rate of return in the market.

Thereby investors demand on the rate of return on investment may change frequently. Company has to change its capital structure policy according to the behaviour of the investors.

Factors # 3. Required Rate of Return:

The investors required rate of return will be volatile frequently in the market. As the investors well informed about the investment opportunities in the market is the demand for the return on investment increases. The company’s capital structure should provide for the variation in the rate of return.

Factors # 4. Business Risk:

The greater the firm’s business risk, the lower its debt ratio. It is the risk which is measured by determining the inability of the firm to generate profit to cover up its operating cost. This can be quantified by determining the degree of operating leverage.

Greater the degree of operating leverage, higher is the business risk and which leads to greater fluctuation in the operating profit of the firm. This variation in EBIT due to operating leverage is called business risk.

Factors # 5. Taxation Policy:

Each component of capital may demand for different kinds of return. For example, equity demands for dividend, debt demands for interest. In case of interest on debt, the corporate tax is exempted, but in case of dividends on equity, it is taxable.

Due to changes in the corporate tax rate the investor may opt for appropriate capital components. This may lead to capital structure adjustment.

Factors # 6. Competition:

The volatile capital structure is purely based on the market competition. Due to the available opportunity for the investor in the competitive market, he has a different option for his investment.

Thereby the demand for the required rate of return will be highly volatile. This leads to change in the capital combination in accordance with highly expected returns.

Factors # 7. Legal Issues:

Due to the change in the legal aspects by the statutory governing bodies like SEBI, company law board etc., the corporate companies have to plan for the issuance of capitals. This may have an impact on the capital structure of the firm. Higher the restriction on the capital issues, higher the variability in capital structure.

Factors # 8. Inflation:

Inflation may have an impact on the investment pattern of an individual. If an individual investor has higher borrowing capacity, he goes for a risky return by borrowing funds at the lower rate of interest.

In case of inflation, the borrowing interest rate may go high and thereby the investors may refrain from borrowing funds and reinvesting in the market. This will have an impact on the capital market and this may lead to change in the capital structure of the corporate firm.

Factors # 9. Conservatism or Aggressiveness:

Some managers are more aggressive than others therefore some firms are inclined to use debt in an effort to boost profits. This factor does not affect the true optimal or value maximizing capital structure, but it does influence the manager’s determined target capital structure.

Factors # 10. Growth Opportunities:

The mix of assets in place versus growth opportunities has four implications for capital structure. First high assets in place make the firm have better collateral for loans. Second bankruptcy costs and disruption caused by financial distress are much worse for a firm with high growth opportunities.

Third, managers know more about their company’s prospectus than outsiders. Fourth, financial flexibility is more important for firms with growth opportunities. Thus firms, with many growth opportunities need more financial flexibility than assets in place.

Factors Determining Capital Structure – Degree of Control, Choice of Investors, Sizes of a Company and More…

The factors determining capital structure are:

1. Trading on Equity:

The word “equity” denotes the ownership of the company. Trading on equity means taking advantage of equity share capital to borrow funds on a reasonable basis. It refers to additional profits that equity shareholders earn because of issuance of debentures and preference shares.

It is based on the thought that if the rate of dividend on preference capital and the rate of interest on borrowed capital is lower than the general rate of company’s earnings, equity shareholders are at advantage which means a company should go for a judicious blend of preference shares, equity shares as well as debentures. Trading on equity becomes more important when expectations of shareholders are high.

2. Degree of control:

In a company, it is the directors who are so-called elected representatives of equity shareholders. These members have got maximum voting rights in a concern as compared to the preference shareholders and debenture holders.

Preference shareholders have reasonably less voting rights while debenture holders have no voting rights. If the company’s management policies are such that they want to retain their voting rights in their hands, the capital structure consists of debenture holders and loans rather than equity shares.

3. Flexibility of financial plan:

In an enterprise, the capital structure should be such that there are both contractions as well as relaxation in plans. Debentures and loans can be refunded back as the time requires.

While equity capital cannot be refunded at any point which provides rigidity to plans. Therefore, in order to make the capital structure possible, the company should go for issue of debentures and other loans.

4. Choice of investors:

The Company’s policy generally is to have different categories of investors for securities. Therefore, a capital structure should give enough choice to all kinds of investors to invest. Bold and adventurous investors generally go for equity shares and loans and debentures are generally raised keeping into mind conscious investors.

5. Capital market condition:

In the lifetime of the company, the market price of the shares has got an important influence. During the depression period, the company’s capital structure generally consists of debentures and loans.

While in periods of boons and inflation, the company’s capital should consist of share capital generally equity shares.

6. Period of financing:

When a company wants to raise finance for a short period, it goes for loans from banks and other institutions; while for a long period it goes for issues of shares and debentures.

7. Cost of financing:

In a capital structure, the company has to look to the factor of cost when securities are raised. It is seen that debentures at the time of profit earning of a company prove to be a cheaper source of finance as compared to equity shares where equity shareholders demand an extra share in profits.

8. Stability of sales:

An established business which has a growing market and high sales turnover, the company is in position to meet fixed commitments. Interest on debentures has to be paid regardless of profit.

Therefore, when sales are high, thereby the profits are high and the company is in a better position to meet such fixed commitments like interest on debentures and dividends on preference shares. If a company is having unstable sales, then the company is not in position to meet fixed obligations. So, equity capital proves to be safe in such cases.

9. Sizes of a company:

Small size business firms capital structure generally consists of loans from banks and retained profits. While on the other hand, big companies having goodwill, stability and an established profit can easily go for issuance of shares and debentures as well as loans and borrowings from financial institutions. The bigger the size, the wider is total capitalization.

Capital Structure – Capitalisation: Meaning and Theories

Meaning:

Capitalisation refers to the total capital employed in a business. More preferably, it refers to the total amount of long-term capital invested in the business.

According to Gerstenberg, for all practical purposes, capitalisation means the total accounting value of all the capital regularly employed in the business.

Thus, the term ‘capitalisation’ may be defined as the total fund invested in the business and includes owner’s funds, borrowed funds, long-term loans, any other surplus earnings, etc.

Symbolically:

Capitalisation = Share capital + Debenture + Long-term borrowing + Reserve & Surplus.

Theories on Capitalisation:

The problems of determining the amount of capitalisation is worth mentioning both for a newly started company and for an established concern. In case of the new enterprise, however, the problem is more severe in so far as it requires the reasonable provision for future as well as for current needs and there arises the danger of either raising excessive or insufficient capital.

Thus, in order to estimate the right amount of capitalisation, two theories have been pronounced, namely:

1. Cost Theory, and

2. Earnings Theory.

1. Cost Theory of Capitalisation:

Under this theory, the capitalisation of a company is determined by adding the initial actual expenses to be incurred in setting up a business as a going concern. It is the aggregate of the cost of fixed assets (plant, machinery, building, furniture, goodwill, and the like), the amount of Working Capital (investments, cash, inventories, receivables) required to run the business, and the cost of promoting, organising and establishing the business.

For example, if a company requires Rs. 1,00,000 for fixed assets, Rs. 30,000 for regular Working Capital, Rs. 40,000 for promotion and development expenses and Rs. 10,000 for raising funds, total capitalisation under cost theory will be = (Rs. 1,00,000 + 30,000 + 40,000 + 10,000) = Rs. 1,80,000.

Cost theory, no doubt, gives a concrete idea to determine the magnitude of capitalisation, but it fails to provide the basis for assessing the net worth of the business in real terms. The capitalisation determined under this theory does not change with earnings. Moreover, it does not take into account the future needs of the business.

This theory is not applicable to the existing concerns because it does not suggest whether the capital invested justifies the earnings or not. Moreover, the cost estimates are made at a particular period of time. They do not take into account the price level changes.

For example, if some of the assets may be purchased at inflated prices, earnings will be low and the company will not be able to pay a fair return on the capital invested.

2. Earnings Theory of Capitalisation:

This theory assumes that an enterprise is expected to make profit. According to it, its true value of a company depends upon its earning capacity. Thus, the capitalisation of the company is equal to the capitalised value of its estimated earnings.

To find out this value, a company, while estimating its initial capital needs, has to prepare a projected profit and loss account to complete the picture of earnings or to make a sales forecast.

Having arrived at the estimated earnings figures, the financial manager will compare with the actual earnings of other companies of similar size and business with necessary adjustments.

Finally, the above earnings are capitalised with the help of a fair return similar to the peers. The resultant value is the capitalisation. For example, if a company expects to earn Rs. 1, 00,000 p.a. with an annual normal Rate of Return of 10%, then (1, 00,000 / 10%) = Rs. 10, 00,000 will be the required capitalisation of the firm.

Though earning theory is more appropriate for going concerns, it is difficult to calculate the amount of capitalisation under this theory. This is because it is based upon a ‘normal Rate of Return’ by which earnings are capitalised. This rate is difficult to estimate so far as it is determined by a number of factors not capable of being calculated quantitatively.

These factors include nature of industry/financial risks, competition prevailing in the industry and so on.

Overcapitalisation:

When the actual capitalisation of a company is more than the required capitalisation as per the earnings capacity of the company, the situation is called overcapitalisation.

For example, if the estimated earnings of the company is Rs. 2,00,000 and normal Rate of Return is 10%, then capitalisation actually required is Rs. (2,00,000 + 10%) = Rs. 20,00,000. However, if actual capital employed is Rs. 23,00,000, then the company is said to be overcapitalised by Rs. (23,00,000 – 20,00,000) = Rs. 3,00,000.

Causes of Overcapitalisation:

Following are the major causes of overcapitalisation:

1. Over issue of capital

Defective financial planning may lead to excessive issue of shares or debentures. As a result, a significant amount of funds remains idle causing decline in returns and accordingly a state of overcapitalisation.

2. Acquiring assets at inflated prices

Assets may be acquired at inflated prices or at a time when the prices were at their peak. In both the cases, the real value of the assets is much below their book value causing low Return on Investment and a state of overcapitalisation.

3. Formation during the boom period

If the establishment of a new company or the expansion of an existing concern takes place during the boom period, it may be a victim of overcapitalisation. The assets are acquired at fabulous prices. But when boom conditions cease, prices of products decline, resulting in lower earnings. The original value of assets remains in books while earning capacity erodes due to depression. Such a state of affairs results in overcapitalisation.

4. Overestimation of earnings

The promoters or the directors of the company may overestimate the earnings of the company and raise capital accordingly. If the company is not in a position to invest these funds profitably, the company will have more capital than required and will become overcapitalised.

5. Inadequate depreciation

Absence of suitable depreciation policy may make the asset- values unrealistic. If the depreciation or replacement provision is not adequately made, the productive worth of the assets is diminished which depresses the earnings. Lowered earnings bring about fall in share values, which represents overcapitalisation.

6. Liberal dividend policy

The company may follow a liberal dividend policy and may not retain sufficient funds for self-financing. As a result, the company may need to raise additional funds at a high cost resulting in decline in returns and a state of overcapitalisation.

7. Lack of reserves

Certain companies do not believe in making adequate provision for various types of reserves and distribute the entire profit in the form of dividends. Such a policy reduces the real profit of the company and the book value of the shares lags much behind its real value. It represents overcapitalisation.

8. Heavy promotion and organisation expenses

“A certain degree of overcapitalisation,” says Beacham, “may be caused by heavy issue expenses”. If expenses incurred for promotion, issue and underwriting of shares, promoters’ remuneration, etc., prove to be higher compared to the benefits they provide, the enterprise will find itself overcapitalised.

9. Shortage of capital

If a company has small share capital, it will be forced to raise loans at a heavy rate of interest. This would reduce the net earnings available for dividends to shareholders. Lower earnings bring down the value of shares leading to overcapitalisation.

10. Taxation policy

High rates of taxation may leave little in the hands of the company to provide for depreciation and replacement and dividends to shareholders. This may adversely affect its earning capacity and lead to overcapitalisation.

11. Taking high interest loans

When a company raises a loan at a very high rate of interest and the actual Rate of Return falls short of that, the company becomes overcapitalised.

Remedies for Overcapitalisation:

The only effective remedy to cure overcapitalisation lies in implementing a scheme of capital reduction to reduce the excess capital.

In specific, the following measures may be helpful:

1. The company may redeem its long-term debts like debentures and other institutional loans at the earliest to reduce the burden of high interest cost. As an alternative, however, the company may restructure its Debt Capital by substituting the existing high interest debts by debts of lower interest rates.

2. The company may redeem its preference shares carrying a high rate of dividends out of the profits available in retained earnings.

3. The company may reduce the paid up value of its equity shares to reduce the over capitalisation and still maintain the same proportionate holding of the shareholders.

Though capital restructuring is likely to do the best as a remedy to overcapitalisation, a company may try the following means also:

1. Instead of distributing high dividends, the company may plough back profits to earn higher returns and thereby justify the high amount of capital.

2. The company may also put its best to manage the resources more efficiently to increase the returns and thereby justify the excess capital.

Effect of Overcapitalisation:

Effects of Overcapitalisation on Shareholders:

1. Profitability decreases, the rate of earning of shareholders also decreases.

2. The market price of shares goes down because of low profitability.

3. With profitability going down shareholders’ earnings become uncertain.

4. Loss of reputation may cause shares to become illiquid.

Effects of Overcapitalisation on Company:

1. Low profitability hampers the reputation of the company.

2. The company’s shares cannot be easily marketed.

3. With degradation in credit rating fresh borrowings are difficult to be made.

4. To retain its image, the company may indulge in malpractices like manipulation of accounts to show high earnings.

5. The company cuts down it’s expenditure on maintenance, replacement of assets, depreciation, etc.

Effects of Overcapitalisation on Public:

1. In order to cover up their earning capacity, the management indulges in tactics like increase in prices or decrease in quality of products.

2. Return on capital employed is low. This gives an impression to the public that their financial resources are not utilised properly.

3. Low earnings of the company affect the credibility of the company and increases credit risks.

4. Working conditions may get affected and wages and salaries may come down.

Capital Structure – Undercapitalisation: Meaning, Causes, Remedies and Effects

Meaning:

When the actual capitalisation of a company is found to be less than the required capitalisation as per the earnings capacity of the company, the situation is called over capitalisation.

In other words, undercapitalisation arises when a company is found to be earning exceptionally higher profits as compared to other companies or the value of its assets is significantly higher than the capital raised.

For example, if the estimated earnings of the company is Rs. 2,00,000 and normal Rate of Return is 10%, then capitalisation actually required is Rs. (2,00,000 + 10%) = Rs. 20,00,000. However, if actual capital employed is Rs. 19,00,000, then the company is said to be undercapitalised by Rs. (20,00,000 -19,00,000) = Rs. 1,00,000.

Causes of Undercapitalisation:

Following are the major causes of undercapitalisation:

1. Low promotion costs

When a company incurs a relatively low amount of promotional expenditure but the resultant Rate of Return is convincingly large, the company is undercapitalised.

2. Purchase of assets at deflated rates

When a company purchases assets at a deflated rate, the result is that the book value of assets is less than the real value. This situation gives rise to undercapitalisation of companies.

3. Conservative dividend policy

The management may follow a conservative dividend policy leading to higher rates of ploughing back of profits. This would increase the earning capacity of the company significantly as a result of which the real value of assets will increase leading to undercapitalization.

4. Floatation of company in depression stage

If the establishment of a new company or the expansion of an existing concern takes place during the recession period, it may acquire at a very low price. Subsequently, when recession ceases, the real value of assets become much higher than their book value and the company becomes undercapitalised.

5. High efficiency of directors

The management of a company may be highly efficient. It may issue the minimum share capital and may meet the additional financial requirements through borrowings at lower rates of interest.

Moreover, by using modern production technology, efficient job allocation, etc., it may generate above average returns. As a result, value of shares increases significantly and the company enters a state of undercapitalisation.

6. Adequate provision of depreciation

By undertaking a prudent depreciation and maintenance policy, a company may ensure best utilisation of its fixed assets. As a result, the company may generate higher than expected earnings and become undercapitalised.

7. Large secret reserves are maintained

A company may have a large amount of secret reserves. Though illegal from a regulatory viewpoint, this may result in a high Rate of Returns with a significantly lower amount of published value of assets creating a situation of undercapitalisation.

Remedies for Undercapitalisation:

The following remedial steps may be taken to correct undercapitalisation of a company:

1. Undercapitalisation may be remedied by increasing the par value and/or number of equity shares by revising upward the value of assets. This will lead to a decrease in the rate of earnings per share.

2. Management may capitalise the earnings by issuing bonus shares to the equity shareholders. This will also reduce the rate of earnings per share without reducing the total earnings of the company.

3. Where under capitalisation is due to insufficiency of capital, more shares and debentures may be issued to the public.

Effect of Undercapitalisation:

Effects of Undercapitalisation on Shareholders:

1. Company’s profitability increases. As a result, the rate of earnings go up.

2. Market value of share rises.

3. Financial reputation also increases.

4. Shareholders can expect a high dividend.

Effects of Undercapitalisation on Company: