Capital market comprises the sources of long-term finance for industry and Government. It is the market that attracts savings from various sources and makes them available to the sectors of the economy requiring funds for productive uses. The savings and other funds are converted into investments through the issue of new securities by the Government, public bodies and industrial and commercial companies.

The major constituents of the capital market are the savers and the bodies which mobilise savings and canalise them into investment channels. Savers of funds may be individuals or institutions and the mobilisers of savings include banks, investment trusts, mutual funds, specialised finance corporations and insurance companies.

The capital market needs to be distinguished from the money market which is concerned with the supply of short-term funds to trade and industry and from the discount market which consists in dealings in bills of different kinds and supply of money to discount houses for discounting of bills.

In an economy, the process of economic development requires continuous structural changes with changing scenarios of the global economy and its subsequent impact on the home country. The balanced growth of the economy can be achieved only with the proper support of a strong capital market.

The working of the capital market is also governed by the long term prospects of the economy. The capital market ensures the availability of a proper channel for mobilising capital from different sources

Contents

- Introduction to Capital Market

- Meaning of Capital Market

- Emerging Role of Capital Market

- Nature of Capital Market

- Factors Influencing Capital Market

- Components of Capital Market

- Functions of Capital Market

- Importance of Capital Market

- Significance of Capital Market

- Uses of Capital Market

- Instruments of Capital Market

- Constituents of Capital Market

- Reasons of Capital Market

- Interdependence of Money Market and Capital Market

- The Capital Market and Stock Exchange

- Amount Raised in the Capital Market

- Primary Issues of Capital Market

- Reform Measures and Financial Stability

- The Securities and Exchange Board of India (SEBI)

- Listing of Securities

- Benefits of Capital Market in India

- Distinction between Money Market and Capital Market

- Difference between Capital Market and Money Market

What is Capital Market: Meaning, Nature, Factors, Components, Functions, Importance, Difference, Significance, Uses, Instruments, Constituents and More…

Capital Market – Introduction (With Basic Considerations)

In an economy, the process of economic development requires continuous structural changes with changing scenarios of the global economy and its subsequent impact on the home country. The balanced growth of the economy can be achieved only with the proper support of a strong capital market.

“After independence, the rapid growth and expansion of the corporate and public enterprises has necessitated the development of the capital market in India. An ideal and sound capital market always tries to offer adequate quantities of capital to any industrial and business house at a reasonable rate which is expected to result in high prospective yield to make the borrowing worthwhile.”

It is necessary for the capital market to work for the supply of funds at minimum possible costs with a high rate of return as yield. The requirement of capital depends on the changing structure of the investment environment.

“Structure of the capital market varies from country to country, depending upon a wide variety of factors – the history of the country, including banking history, the extent and type of business experience, the role of political factors, and the role of government”.

The working of the capital market is also governed by the long term prospects of the economy. The capital market ensures the availability of a proper channel for mobilising capital from different sources.

The growth and development of a country leading to greater economic activity depends on the introduction of a vast array of investment outlets. In India, where all business activities are marked by social, economic and political considerations, it is important that the investment market has a favorable environment to be able to function effectively and efficiently.

The four basic considerations such as:

(i) Legal safeguards,

(ii) Stable currency,

(iii) Existence of financial institution to aid savings, and

(iv) Forms of business organizations, have directly influenced the faster growth of investments.

It would be highly justified to state that a sound investment programme can be prepared if the investor can familiarize himself with the various alternatives of investment opportunities available. In this sense, securities present a wide range of risk and risk-free instruments to highly speculative shares and debentures.

The success of every investment decision has become increasingly important in recent times. Making sound investment decisions requires both knowledge and skill. Keeping these things in mind, the Government has come up with the necessary legislations for the sound financial institutions in the form of stock exchange under its own control.

The Indian financial system is both developed and integrated today when compared to the initial period in 1950. So far the capital market is concerned, the Securities Exchange Board of India (SEBI) has also been formed with the view that the mechanics of buying and selling shares nominations and transfer of shares are made simpler.

The Indian Capital Market is undergoing fast changes since the economic and financial reforms started in July 1991. With the liberalization of industrial and financial sectors, a new era ushered in for the capital market. This process got further accelerated with the trend towards the globalization of the economy and the markets.

Privatization, free and unfettered inflows and outflows of funds following the rupee convertibility in current account since March 1994 have added new dimensions to the growth of the capital market.

The permission granted to the Foreign Financial Institutions (FFIs) to enter the Indian capital market and for the Indian companies to borrow abroad has opened up new vistas for expansion and growth of the capital market in India.

Capital Market – Meaning

Capital market comprises the sources of long-term finance for industry and Government. It is the market that attracts savings from various sources and makes them available to the sectors of the economy requiring funds for productive uses. The savings and other funds are converted into investments through the issue of new securities by the Government, public bodies and industrial and commercial companies.

The major constituents of the capital market are the savers and the bodies which mobilise savings and canalise them into investment channels. Savers of funds may be individuals or institutions and the mobilisers of savings include banks, investment trusts, mutual funds, specialised finance corporations and insurance companies.

The capital market needs to be distinguished from the money market which is concerned with the supply of short-term funds to trade and industry and from the discount market which consists in dealings in bills of different kinds and supply of money to discount houses for discounting of bills.

The money market comprises the commercial banks, exchange banks, co-operative banks, etc., and the central bank (i.e., the Reserve Bank of India in India). The discount market consists of brokers, banks discounting bills, discount houses, etc.

Emerging Role of Capital Market (With Examples)

The capital market is the place from where finance is raised by companies for meeting their requirement of funds for new products, modernization and expansion programmes, long-term working capital requirements, repayment of loans and various other purposes.

The capital market mobilizes the long-term savings of individuals for investments in shares, debentures, units of mutual funds and other financial instruments, which are ultimately deployed for productive purposes in various sectors of the economy. Capital market thus plays a vital role in channelizing the savings of individuals for investment in the economic development of the country.

Broadly, the capital market comprises two segments-the new issue market, which is commonly known as primary market, and the stock market, which is known as secondary market. The primary market consists of the companies making the issue of securities and the members of the public subscribing to them.

Primary market also includes the offer of securities to the shareholders of the company on a rights basis. Secondary market involves the purchase and sale of securities already issued on the stock exchanges.

The brokers and the investors comprising the financial and investment institutions, mutual funds and the general investing public are the important constituents of the secondary market. The primary market and the secondary market supplement and complement each other.

The health of the secondary market is one of the biggest factors influencing the primary market. Similarly, the growth of the secondary market is influenced by the development of the primary market.

Some of the points relating to the emerging role of Capital Markets are listed here:

1. As per the existing Law the stock exchange is an association of member brokers for the purpose of facilitating and regulating trading in securities. It is thus a Self-Regulatory Organization (SRO). The traditional emphasis was on regulation by the SRO in the interests of the members.

2. The worldwide trend is now towards greater self-regulation by the SROs along with the co-coordinating and supervisory role of the Government. At the same time, the role of the SROs including those of the merchant bankers and mutual funds has increased in the direction of stricter enforcement of a code of conduct and the rules of the games in the conduct of their business. The SEBI is, however, moving in the direction of more regulations.

3. In the evolution of the role of the stock exchanges, the trend is moving in the direction of the public interest. The investor population has increased and their interests have become paramount both in the eyes of the government and the SROs for reasons of promoting the Capital Market.

This has led to a greater emphasis on the developmental role of stock exchanges. The representation of public on the Board of Directors, the facilities provided to redress their grievances through the grievances cell of stock exchanges have all proved to be in this direction.

4. The stock exchanges have been growing as public service institutions by providing a variety of services to the investors.

To give examples of such services, mention may be the following:

(a) Provision of Directory of Corporate information useful for a scientific assessment of the fundamentals of the companies before making investment.

(b) Publication of share prices at which trade took place daily in various scrip traded-open, high, low and closing along with the volume.

(c) Publication and supply to the public of useful handouts/handbooks/pamphlets giving out information on the stock exchanges—the operations and developments in the Capital Market etc.

(d) Investor education and training programme for investors.

(e) Settlements of disputes between member brokers and their clients and investors.

(f) Attending the investor complaints against registered members and listed companies.

5. The future role of stock exchange will be radically different from the present, as their developmental role will be increasing much faster than their regulatory role. Along with increasing self-regulation and stricter enforcement of a code of conduct on the members, the stock exchange will emerge as public service institutions catering to increasing demands of investors in the country.

Of the developmental activities, education, training and research will dominate in the years to come bringing the stock exchanges and the public nearer and together. This is conspicuous by its absence now.

6. With the increasing emphasis on the national market system and the growth of automation, the new trend would be integration and interlinking of stock exchanges at the regional and national level.

This trend would be beneficial to investors. In that they would enjoy a better market and fair play. Quicker services and better price realization at lower costs could be achieved by the new system.

The stock exchanges would thus move in the direction of the national market system through mutual cooperation, coordination and electronic linkages of the trading floors through the satellite telecommunication system and quicker display of information.

An inter-connected stock exchange is already set up with a few regional stock exchanges like Hyderabad, Cochin, Bangalore, Vadodara, etc. as members.

7. Where there are no stock exchanges, trading floors would be provided and electronic display of the prices of shares in the national market would help trade in the local trading floors.

In the computer-aided trading system, there will be no need even for the trading floor, but until the complete automation takes place, the trading floor system may continue, as it is more economical than setting up of separate stock exchanges at innumerable centers.

Nature of Capital Market

The Nature of Capital market refers to the market mechanism which provides institutional support systems for marketing of long term and equity claims e.g., equity shares, preference shares, debentures, bonds, etc.

“In the widest sense it consists of a series of channels through which the savings of the community are made available for industrial and commercial enterprises, and public authorities.”

Thus, the capital market is a broad term which includes primary markets, secondary markets, and term lending institutions, banks, investors and all those entities who are engaged in providing long-term capital to the corporate sector.

Factors Influencing Capital Market

The growth of the capital market is influenced by various factors such as the level of savings and investment of the household sector, health of the economy, corporate performance and trends in industry.

The investment pattern of the household sector, in turn, is governed by various factors such as the state of the capital market, the government policy for promotion of the capital market, the political stability and the performance of the economy and corporate sector.

The performance of the economy is measured by various economic indicators such as growth in gross domestic product, agricultural production, inflation, position of balance of payments and balance of trade, foreign exchange reserves and growth in capital formation.

Corporate fundamentals embrace performance indicators like gross profits, operating profits, return on capital employed and net worth, earnings per share book value per share profitability ratios etc. to evaluate the performance.

Components of Capital Market – Primary and Secondary Capital Market (With Features, Methods and Conditions)

Components of Capital Market are as follows:

Component # 1. Primary Capital Market:

Primary market also known as new issues market deals in financial instruments being issued for the first time. It facilitates the transfer of investible funds from household savers to entrepreneurs seeking funds to establish new business enterprises or expand or diversify the existing enterprise by issuing financial instruments or securities for the first time.

Main features of primary capital market are:

(i) It provides funds for medium term and long term capital requirements.

(ii) It raises funds by issue of financial instruments or securities for the first time.

(iii) Major financial instruments used to raise finance are equity shares, preference shares, debentures, loans and deposits.

(iv) Main participants in the primary capital market are banks, financial institutions, insurance companies, mutual funds and individuals.

(v) It facilitates to raise funds for setting up new projects, expansion, diversification, modernisation of existing projects, mergers and takeovers etc.

Methods of Floatation of New Issues in the Primary Market:

There are various methods of floating new issues in the primary market:

(i) Offer through Prospectus – Initial Public Offer (IPO):

IPO is a process through which the public companies raise funds in the primary market by issuing financial instruments like shares, debentures, bonds etc. for the first time. The company issues prospectus through advertisement in the leading newspapers or magazines to invite or appeal to the public to subscribe for the capital.

The contents of prospectus must be in accordance with the provisions of the Companies Act and SEBI disclosure and investor protection guidelines. The company raising funds through the public must be listed with at least one stock exchange and may get the issue underwritten.

(ii) Offer for Sale:

Under this method, public companies offer the financial instruments to be issued to issuing houses or stock brokers at an agreed sale price. These intermediaries resell the securities to investors. Thus in ‘Offer for Sale’ companies indirectly raise finance from the public with the help of intermediaries and save themselves from the formalities and complexities of an IPO.

(iii) Private Placement:

Under this method, companies raise funds by issuing securities to institutional investors and selected individuals. In this method, there is no need to follow the formalities and complexities of public issues thus facilitating to raise finance quickly and at lesser cost. This method is followed by companies who cannot afford the floating cost related to public issues.

Examples of institutional investors – UTI; LIC; GIC.

(iv) Rights Issue:

Rights Issue refers to the issue of new shares to the existing shareholders in accordance to the terms and conditions of the company. The existing shareholders can use this privilege to apply for new shares in proportion to the number of shares held by them.

Raising capital through Rights Issue saves a company from the formalities and complexities of an IPO leading to saving cost and time to raise finance.

Companies Act requires every company to offer subsequent issues of shares to its existing shareholders before it offers to the general public. If the existing shareholders refuse to take up new shares then the company can offer shares to the general public. This is done to protect the control and capital share of existing shareholders.

(v) e-IPOs:

e-IPOs is a method of raising finance by issue of capital to the public through the on-line system of the stock exchange. The company enters into an agreement with a stock exchange to offer its securities and appoints brokers who take forward the issue with the registrar having electronic connectivity with the stock exchange. The lead manager coordinates with all the intermediaries related with the issue.

For e-IPOs the company has to fulfill below listed conditions:

(i) It has to enter into an agreement with the stock exchange.

(ii) It has to appoint brokers who are registered with SEBI to accept investors’ applications and place orders with the company.

(iii) A company has to appoint a registrar to the issue who has electronic connectivity with the exchange.

(iv) The company has to apply for listing of its securities on any exchange other than the exchange through which it has offered its securities.

Component # 2. Secondary Capital Market:

Secondary market — a component of capital market deals with sale and purchase of financial instruments which already exist in the financial market. It is also known as the stock market or stock exchange.

Main features of secondary market are:

(i) It deals in securities present in the financial market.

(ii) It helps existing investors to disinvest and provides opportunities to fresh investors to enter the financial market.

(iii) It facilitates selling of securities as and when required thus provides liquidity and marketability to existing securities.

(iv) It channelizes finance towards most productive investments through the process of disinvestment and reinvestment leading to growth and development of the economy.

(v) All securities in the secondary market are traded, cleared and settled within the regulatory framework prescribed by SEBI.

(vi) Growth of primary market contributes to the growth of secondary market.

(vii) The process of sale or purchase of securities does not involve issuing company. The securities can be exchanged between investors at prevailing prices.

(viii) The advancement in information technology has made it possible to access stock exchanges from anywhere in the country and trade securities through trade terminals.

(ix) Secondary markets are also called stock markets or stock exchange.

Functions of Capital Market – Allocation, Liquidity, Merger and Indicative Function

The capital market performs the following functions:

i. Allocation Function:

Capital market canalizes the savings of innumerable investors into various productive avenues of investment. Thus the savings are allocated amongst the various users and uses. In this way, it provides opportunity to all investors, both individual and institutional to invest their surplus funds into various financial instruments. Thus capital markets assist in the capital formation process in the economy.

ii. Liquidity Function:

Capital market provides a means whereby buyers and sellers can exchange securities at mutually satisfactory prices. This allows better liquidity for the securities that are traded. It provides a continuous, ready, open and broad market for securities. In this way liquidity, marketability and uniformity in prices is ensured for securities.

iii. Merger Function:

Capital market encourages voluntary or coercive takeover of companies. Companies view acquisitors as an opportunity to expand product lines, increase distribution channels, hedge against volatility, increase its market share, or acquire other necessary business assets.

A takeover bid or a merger agreement through the stock market is one of the simplest and most common ways for companies to grow by acquisition or fusion.

iv. Indicative Function:

Capital market acts as a barometer of the business conditions and progress of the business in the country. The movement of share prices and in general of the stock indices can be an indicator of the general trend in the economy.

Top 7 Importance of Capital Market

The importance of capital market can be briefly summarized as follows:

(i) The capital market serves as an important source for the productive use of the economy’s savings. It mobilizes the savings of the people for further investment and thus avoids their wastage in unproductive uses.

(ii) It provides incentives to saving and facilitates capital formation by offering suitable rates of interest as the price of capital.

(iii) It provides an avenue for investors, particularly the household sector to invest in financial assets which are more productive than physical assets.

(iv) It facilitates increase in production and productivity in the economy and thus enhances the economic welfare of the society. Thus, it facilitates ‘the movement of stream of command over capital to the point of highest yield’ towards those who can apply them productively and profitably to enhance the national income in the aggregate.

(v) The operations of different institutions in the capital market induce economic growth. They give quantitative and qualitative directions to the flow of funds and bring about rational allocation of scarce resources.

(vi) A healthy capital market consisting of expert intermediaries promotes stability in values of securities representing capital funds.

(vii) Moreover, it serves as an important source for technological up-gradation in the industrial sector by utilizing the funds invested by the public.

Thus the capital market serves as an important link between those who save and those who aspire to invest these savings.

Significance of Capital Market – Link between Savers and Investors, Encouragement to Saving, Encouragement to Investment, Promotes Economic Growth, Stability in Security Prices and Benefits to Investors

Capital market plays an important role in mobilising resources, and diverting them in productive channels. In this way, it facilitates and promotes the process of economic growth in the country.

Significance of capital market are discussed below:

Significance # 1. Link between Savers and Investors:

The capital market functions as a link between savers and investors. It plays an important role in mobilising the savings and diverting them in productive investment. In this way, the capital market plays a vital role in transferring the financial resources from surplus and wasteful areas to deficit and productive areas, thus increasing the productivity and prosperity of the country.

Significance # 2. Encouragement to Saving:

With the development of the capital market, the banking and non-banking institutions provide facilities which encourage people to save more. In the less- developed countries, in the absence of a capital market, there are very little savings and those who save often invest their savings in unproductive and wasteful directions, i.e., in real estate (like land, gold, and jewellery) and conspicuous consumption.

Significance # 3. Encouragement to Investment:

The capital market facilitates lending to the businessmen and the government and thus encourages investment. It provides facilities through banks and nonbank financial institutions. Various financial assets, e.g., shares, securities, bonds, etc., induce savers to lend to the government or invest in industry. With the development of financial institutions, capital becomes more mobile, interest rate falls and investment increases.

Significance # 4. Promotes Economic Growth:

The capital market not only reflects the general condition of the economy, but also smoothens and accelerates the process of economic growth. Various institutions of the capital market, like nonbank financial intermediaries, allocate the resources rationally in accordance with the development needs of the country.

The proper allocation of resources results in the expansion of trade and industry in both public and private sectors, thus promoting balanced economic growth in the country.

Significance # 5. Stability in Security Prices:

The capital market tends to stabilise the values of stocks and securities and reduce the fluctuations in the prices to the minimum. The process of stabilisation is facilitated by providing capital to the borrowers at a lower interest rate and reducing the speculative and unproductive activities.

Significance # 6. Benefits to Investors:

The credit market helps the investors, i.e., those who have funds to invest in long-term financial assets, in many ways:

(a) It brings together the buyers and sellers of securities and thus ensures the marketability of investments.

(b) By advertising security prices, the Stock Exchange enables the investors to keep track of their investments and channelise them into most profitable lines,

(c) It safeguards the interests of the investors by compensating them from the Stock Exchange Compensating Fund in the event of fraud and default.

4 Main Uses of Capital Market

Uses of the capital market are as follows:

(i) It maintains liquidity and fair pricing of available securities in the market.

(ii) It facilitates the buying and selling of securities.

(iii) It helps to reduce transaction costs.

(iv) It ensures a required level of liquidity in the market.

It ensures availability of certain investors known as market makers.

A market where the financial instruments of long-term maturity are issued and traded is known as the capital market. These instruments like shares or bonds are expected to generate a higher annualized return compared to money market instruments because of their long term tenure as well as higher element of risk.

These instruments are created to meet the shortfall of the internal funds of companies, financial institutions like banks and insurance companies and even the government.

These instruments can be floated in the domestic markets as well as the international markets. These capital market instruments are Equity Shares, Preference Shares, and Depository receipts-ADRs, GDRs, IDRs, Domestic Debentures/Bonds, Euro bonds, Foreign Currency Convertible bonds (FCCB’s).

Some of the Capital Market Instruments are as Follows:

Instrument # 1. Equity Shares:

The most popular method of raising finance in the capital market is issuance of fresh shares. Equity shareholders are owners of the firm, Public sector and Private sector companies issue equity shares in order to raise capital from the public. For example, HUDCO or Coal India are public sector companies which issued shares to the public which are traded on stock markets like NSE and BSE.

Similarly, Private sector companies like Reliance Industries, S. Chand and Infosys issued their shares to the public which are traded on stock markets. Equity shareholders get dividends from the profits earned by the company. They make Capital gains when prices of these shares go up in the stock markets. However, they also carry the risk of losses if prices of these shares happen to go down.

Equity shares enjoy tax benefits in India where the dividends are exempted from Income- tax and Long term capital gains by holding shares beyond one year. Once equity shares are made available to the public, and the shares are listed, they are freely traded on the recognized stock exchanges.

These shares are considered to be risky investments because they will be paid dividends only after the payment of interest and preference dividend. If a company does not generate profit or run into losses the company may not pay any dividend. The prices of these shares may also go down after listing on the stock exchanges if the company makes losses.

Instrument # 2. Preference Shares:

Another form of capital can be raised through preference shares which also form part of the share capital of the company. Preference shareholders get preference for dividends and repayment of capital over equity shareholders. However, they do not have any voting rights and are not a very popular method of raising finance in Indian capital markets.

In case of liquidation, the shareholder has a residual claim over the assets of the company and if after paying the debt nothing is left for shareholders they lose all of their investment. They are considered as hybrid securities having characteristics of bonds as well as equity shares. They must be paid dividends before dividends to equity shareholders are paid which is a characteristic of bonds.

Instrument # 3. Depository Receipts:

A domestic company can raise equity funds in the international markets through an instrument called Depository receipts. Instruments which are used to raise money in the international markets are known as GDRs or ADRs.

i. Global Depository Receipts (GDRs):

GDRs are a global depository receipts against the underlying shares and are used by Issuer Company to raise capital in the international markets. For example, HDFC issued its shares to the international investors which are known as HDFC GDRs. These GDRs are negotiable certificates which represent company’s equity shares. The underlying shares correspond to the GDRs in a fixed ratio.

For example, it can be 1 GDR=1 share or 1 GDR = 5 shares depending upon the price at which GDR is issued. These are issued in any of the countries like, Hong Kong, UK, France, and Australia, USA or any other country.

These GDRs are listed in the stock markets like NYSE, LSE, Luxembourg Stock Exchange and Hong Kong Stock Exchange and are traded like any other share listed on the markets. It makes the shares accessible for investment and trading to the international investors in their home country. There are around 104 Indian GDRs listed at various international stock exchanges.

ii. American Depository Receipts (ADRs):

ADRs are certificates traded in U.S. markets that represent ownership of shares of a foreign company (for example, ADRs of TCS). ADRs provide U.S. investors a convenient way to invest in overseas securities and to trade non-U.S. securities in the U.S. itself on the American Stock markets.

These ADRs are listed on the USA stock markets like New York Stock Exchange (NYSE) or National Association of Securities Dealers Automated Quotes (NASDAQ) and are traded like any other shares. Compared to direct investing in the international market in India, ADR’s route is a simpler and convenient route for American investors in Indian markets.

For example Dr. Reddy’s labs ADR is trading in US markets at $40.4 which was issued at $10. Some of the prominent ADRs are Wipro, Vedanta, HDFC Bank and Dr. Reddy’s amongst others

iii. Indian Depository Receipts (IDRs):

When a foreign company is interested to issue shares for the Indian Investing public, they issue a quasi-equity known as IDR’s. IDRs are instruments like Global Depository Receipts (GDRs) which have shares as the underlying asset and denominated in the local currency i.e. Indian Rupee.

These instruments help Indian investors buying the shares of an international company in India itself. These IDRS are listed at NSE for trading. Standard Chartered Bank is the only IDR which rose close to $700 million from the Indian investors and listed for trading at National Stock Exchange of India.

Instrument # 4. Debentures/Bonds:

A bond or a debenture is a basic fixed income security which is issued by a borrowing company to investors under a borrowing agreement. The owners of the bonds are debt holders or creditors of the issuing company. The borrower company (issuer) has to pay periodic interest payments to the registered bond holders on specified date.

The rate of interest is called the coupon rate and is generally fixed. These bonds are generally having a maturity period after which the bond holders shall be paid back the principal amount of the bond. This period is known as tenure of the bond. These bonds/debentures can be issued at par and redeemed at par or at premium.

This borrowing instrument when issued by the government or Government Company is known as bonds. If they are issued by a private sector company, they are known as debentures. Corporate bonds unlike equity shares do not have any ownership interest in the company. The maturity period is generally 1 to 20 years. Corporate bonds are listed for trading at BSE or NSE.

Debentures can be of different types:

a. Convertible and Non-convertible debentures:

Convertible debentures-are exchangeable to equity shares of the company, at the holder’s option after some period of time. The possibility of realizing a long term capital gain or increase in market value after conversion makes these convertible debentures an attractive form of investment. The holder gets interest till the date of conversion and receives dividend on shares so converted after conversion.

Non-Convertible Debentures (NCD) is the purest form of debt instrument and is redeemed by repayment after its maturity. Since these debentures are not convertible into equity shares they are known as Non-Convertible Debentures (NCDs). Majority of the corporate bonds in the domestic markets are of the category of NCDs.

It is a debt instrument that is issued by a corporation for a fixed time period and in which no part of the debenture is convertible into equity. The face value of the debenture is redeemed in one installment (a bullet payment) or in tranches.

Normally, they can be bought from and redeemed to the issuer company. In case of listed debentures, they can be traded like equity shares on the exchange.

The market price of NCDs is determined by the existing interest rate on Govt, securities. If the interest rate on Govt, securities increases as compared to the coupon rate of the debenture, the NCD market price decreases.

If the interest rate on Govt securities decreases, the market price of the NCD increases. To better understand the NCDs, let’s take an example of Tata Capital NCD issue (details at the time of IPO Issue) –

i. Secured:

The debentures are “secure”, meaning that the amount Tata Capital accepts from investors is tied to (or backed by) some assets of the company. This makes them better than company FDs (and even bank FDs) in terms of their risk profile.

ii. Non-Convertible:

The Tata Capital debentures are non-convertible. This means that the debentures are more like traditional fixed deposits. Investors cannot convert them into shares of Tata Capital at a later date Investors get back the principal amount at the time of maturity.

iii. Credit Rating:

This issue has been rated “LAA+” by ICRA, which means “high credit quality and low credit risk”. It has been rated “AA+” by CARE, meaning “high safety for timely servicing of debt obligations”. These indicate that the issue is quite safe.

iv. Tenure/Redemption:

The tenor of the debentures is 5 years the debentures would be redeemed 5 years after the date of allotment if the put or call option is not exercised.

v. Put and Call Options:

The Tata Capital debentures have both put and call options so investors have an option to surrender the debenture before its maturity (after the pre-specified period) if investors want to. Similarly, the company can ask investors to surrender the debenture before its maturity (after the pre- specified period). That means both investors and the company have flexibility!

vi. Listing on Stock Exchange:

Tata Capital debentures are listed on the National Stock Exchange (NSE).

vii. Options and Minimum Investment Amount:

There are four options available to investors, the major difference being the interest payment frequency. Investors can choose to receive the interest monthly, quarterly, annually, or the interest can be cumulative. Depending on the option investor chooses, the minimum application amount varies (it is either Rs.10,000 or Rs.1, 00,000). Also, the time when the put and call options can be exercised also depends on the option investor chooses (it can be either after 36 months or after 42 months).

viii. Rate of Return:

The interest rate offered (or the coupon rate) varies from 11% per year to 12% per year, and again depends on the option investor chooses. The effective yield (considering the interest payment frequency) ranges from 11.57% to 12% per annum.

ix. Buy Back of NCDs:

The Company may from time to time, consider subject to all statutory approvals, buyback of NCDs on terms and conditions to be decided by the Company.

Holding the Debentures:

The debentures would be issued only in dematerialized (demat) form. Thus, if the investor does not have a demat account, he would not be able to apply for these.

x. Deep Discount Bonds:

These bonds are issued at discount and are redeemed at the face value at the expiry of a specified period. No interest is payable during the tenure of these bonds. Deep Discount Bond is also called a Zero Coupon Bond. This means the deposit does not give any interest payouts. Instead the interest is accumulated and paid out at the time of maturity. It is very similar to a fixed deposit with cumulative options.

Deep discount bonds were quite popular in India during the early 1990s. There was the Narmada bond, which on an investment of Rs.3600 promised to give Rs.1.10 lakhs, 20 years after 1993. The ICICI Children’s Bond promised Rs.1 lakh on an investment of Rs.7,000/- 18 years after 1995.

IDBI issued in 1992, deep discount bonds of face value of Rs.1,00,000 redeemable in 25 years at an issue price of t 2700/- per bond. These deep discount bonds look very impressive on the face of it though the returns are similar to that of the regular income bonds. Most of these bonds were subscribed by retail investors. The bonds served the purpose of long term planning well as they offered very good guaranteed returns.

xi. Callable Bonds:

Callable bonds are bonds wherein the issuer has an option to redeem the bonds at any time after an initial stipulated period. If the company opts to redeem these bonds prematurely, the holders have no option but to accept the redemption value. In case market interest rates falls below the coupon rate, the issuer thinks it is financially prudent to call back the bonds. For example, if the bonds have a fixed coupon of 9% and the market interest rates (yields) have dropped to 1%, the issuing company shall prefer to callback these callable bonds, prematurely.

b. Puttable Bonds:

Puttable bonds are those bonds where terms & conditions of the bond allow the holder to exercise an option to get the bond redeemed at any time after the stipulated period but before the maturity.

If the coupon rate is lesser than the prevailing market interest rate at any time, then the bond holder may prefer to get the bonds redeemed. The amount generated from this redemption can be reinvested elsewhere at the current higher market rate of interest (yields) and thus the bond holder gets benefitted.

Now-a-days most of the bonds issued in India have both the option call as well as put.

c. Junk Bonds:

These bonds have no credit rating or very poor credit rating and therefore carry a very high default risk. They are generally issued at deep discount and redeemed at par giving high return to the investor. These bonds are also known as high risk high return bonds. They are highly speculative in nature.

d. Government Bonds:

Government bonds also known as G Sees or Gilts are issued by or on behalf of the Central or State Government. Since, these bonds are considered to be more secure and safe than other bonds; they carry a low coupon rate. The payment of interest is guaranteed by the government. These government bonds are also listed on the stock markets like other private sector bonds for trading.

e. Masala Bonds:

The rupee denominated bonds (or masala bonds) are instruments through which Indian entities can raise funds by accessing the international markets. Recently, HDFC (3000 crore) and NTPC (2000 crore) issued these bonds with the launch of green masala bond on London Stock Exchange.

Instrument # 5. Derivatives:

A derivative is a financial instrument or a financial contract, whose value is derived from one or more underlying assets. Derivatives can be tangible assets like wheat, cotton or any other commodity and intangible like interest rates, weather or index etc.

The underlying assets can be financial instruments like equity or bond. Financial derivatives include forward, futures, options, swaps etc.

These contracts can be undertaken between person to person directly which is known as forward contract. This forward Contract is an agreement between a buyer and a seller wherein the seller is under obligation to deliver a specified financial or physical asset to the buyer on a future date and place as specified. The buyer in return has to pay the seller a pre- negotiated price in exchange for the delivery of the financial or physical asset.

Since forward contracts are one to one contracts between buyers and sellers they are not marketable. Once a buyer or seller enters into a forward contract there is no convenient way to trade out of it or sell it to somebody else.

They are OTC or over the counter contracts without the involvement of any intermediary like an exchange market. Since they are one to one contracts they carry counterparty risk.

a. Future Contracts:

A futures contract is a standardized contract between two parties at a price to buy or sell a specified asset of standardized quantity (and quality in case of commodity) agreed today (the futures price) for delivery and payment at a specified date in the future. A forward contract when entered through an exchange is known as futures contract.

b. Options Contracts:

Option contracts are further extensions of future contracts which give the buyer the right but no obligation to buy the asset at a future date at a specific price at a cost known as premium. There are two types of options, Call and Put Options. Each option gives an opportunity to take advantage of future price movement without actually having a position in the asset.

A call option gives the holder (buyer) the right to buy (go long) an underlying at a specific price on or before an expiration date but doesn’t create any obligation on his part to compulsorily buy the asset. A Put option, on the other hand, gives the holder the right to sell (go short) an underlying at a specific price on or before the expiration date.

These options are exercised only if it is profitable to exercise. Otherwise they are allowed to expire/lapse on their own. There is no compulsion to exercise them. That’s why they are known as options.

Constituents of Capital Market – Meaning and Highlights

Meaning of Constituents of Capital Market:

The constituents of the Capital Market comprise of development banks, specialised financial institutions, investment institutions, state level development banks, mutual funds, lease companies, financial service companies, commercial banks and other specialised institutions were set up by development banks for the growth of the capital market, notably, SEBI, SHCI, CRISIL, IICRA, I-Sec, AMC, OTCEI and the National Stock Exchange.

Highlights:

(i) There has been an accelerated growth of the long-term capital market in India in the recent years. But the absolute size in relation to the economy is still small and the institutional structure inadequate.

(ii) In this purpose, we must reach out and activate the potential investors in parts of the country other than the western region and in rural and semi-urban areas. This could be done, if a few large reliable national level private sector investing or promoting companies are established, which would have the capability of establishing branches in several centres and in training and appointing its own agents in the smaller towns.

(iii) The desirability of introducing the new instruments. In this, the non-voting shares and the equity warrant may be considered. With the introduction of non-voting shares in a company, the controlling groups could be persuaded to reduce their holdings correspondingly.

(iv) Supply of venture capital is a high risk business, but the reward would also be high. Government must allow private investing agencies to be set up which could supply this capital to new ventures.

(v) A major deficiency in our capital market is the absence of a well developed housing finance system. In relation to demand, the flow of institutional funds into the housing sector has been quite meagre. The housing finance system that we build up must facilitate an adequate flow of institutional finance to the housing sector as one of the priority sectors.

(vi) “Commercial Paper” having a maturity period ranging from 30 days to a year may be introduced, as it would relieve pressure in the long-term or medium-term funds.

The healthy growth of the capital market rests on broad-basing and mature development of the banking system in the country. As such, both are complementary and supplementary.

The term capital market is used to designate activities in long-term credit, which is characterised by securities. It comprises specialised financial institutions including investment and trust companies, banks, stock exchanges and other institutions.

The capital market is classified into two categories, viz., organised and unorganised. With the emergence of development banks, commercial banks, Life Insurance, Unit Trust, the unorganised sector seems to have become isolated. In the organised sector, development banks are the key institutions.

Top 4 Reasons for Requirement of Capital Market

Capital market is required due to the following reasons:

(i) To determine a fair price for the securities it trades (price discovery).

(ii) To enable transactions to be made at a particular price quickly and easily (the provision of liquidity).

(iii) To enable transactions to be made at as low a cost as possible (minimization of trading costs).

(iv) It facilitates the buying and selling of securities by a large number of investors continuously and instantaneously without incurring significant costs.

The financial resources raised through the capital market is used for investment. Productive activities generate further outputs and incomes of the people and promote growth. Thus, economic growth and activities in the capital markets are closely related. It helps in reducing transaction costs.

The availability of certain investors is a must to ensure a required level of liquidity in the market. These investors are always ready to buy or sell securities. They are known as market makers and support to enhance the liquidity and reduce the transaction costs of the securities.

Capital Market – Interdependence of Money Market and Capital Market

Money market and capital market are playing a crucial role in the financial market. Financial market needs both types of funds – short term funds as well as long term funds. Money market arranges short term funds while capital market is responsible for medium and long term funds.

Both markets are supportive to each other and are interdependent. “The existence of a capital market is dependent upon the existence of a well-organized money market and capital market and the two markets together play an important role in the economic development of a country.”

Both markets contribute to the flow of funds and liquidity in the varying periods. They affect and are also affected by each other. “A relative rise in the rate of interest in the money market may increase the demand in the capital markets, and a relative increase in the rate of interest or yield in the capital market will increase demand in the money market.”

Thus, both money market and capital market play in tandem and provide strength to the financial market with continuity in operational behaviour

The Capital Market and Stock Exchange (With Functions of Stock Exchange)

If domestic savings are to be mobilized for development through the agencies of democratic corporate enterprise, a continuous well-organized security market is very much essential where business in ownership rights may be transferred.

Essentially the Stock Exchange is a market for shares and securities. There are many people who consider the Stock Exchanges as a racecourse of a gambling den where fortunes are made or lost. Many others consider it as a “thieves’ kitchen” or as “open sesame for treasure”.

Therefore it can be broadly said that a stock exchange is indispensable for a commercial banker, an insurance company, a unit trust, a provident fund, a building society and a large number of other thrift promoting institutions.

It is the suitable place for a commercial banker to build his “second and third lines of defense” and to regulate his cash resources in accordance with the seasonal variations in the economic demand.

It also enables the banker and other financial institutions to make advances to their business aliens against listed stocks and shares. Hence it provides a means for readily meeting the needs of business firms for working capital. In other words it can also be said that the Stock Exchange provides liquidity to the listed companies.

It is obvious to state that it also refers to the money value of the assets and thus, Capital Market, or Stock Exchange can be taken to mean the markets in which the instruments in the form of the stocks and shares are exchanged.

To be more specific, the capital markets comprise the complex of institutions and the mechanism through which intermediate term funds and long-term funds are pooled and made available to business, governments and individuals.

Since capital market instruments represent long-term funds, they necessarily involve economic capital. Funds raised through debt instruments by business and individuals are normally invested in fixed assets and inventories.

The process of government bonds and corporate shares are often used to finance a variety of expenditure or assets. Briefly, Stock Market or Capital Market usually refers to the secondary markets for share and stock.

Broadly speaking a Stock Exchange discharges some broad functions:

These are discussed below:

1. Liquidity and Price Continuity:

Generally a Stock Exchange gives existing securities, sufficient marketability and price continuity. The fundamental object of a Stock Exchange is to impact the ability of the investors to withdraw their capital from investments just when they need it, with least possible loss to their value in terms of investment worth.

In fact, the main economic significance of the Stock Exchange lies in the provision of liquidity to invested capital, which in turn, encourages productive investment of cash balances and facilitates large-scale production with its attendant economies.

However, it must be noted that the Stock Exchange is able to provide liquidity and price continuity to the listed scripts only. But it cannot provide the same in times of national and international crises or in times of political and communal upheaval.

2. Safety of Dealings:

Obviously a stock exchange provides safety for and equity in dealings. The basic objective of a capital market is to make a high standard of commercial honour and integrity amongst its members and to inculcate just and equitable principles of trade and business.

Therefore it is well operated under well-defined rules and regulations in order to control the danger inherent in speculative dealings and manipulations. Membership of the Stock Exchange is rightly guarded on their dealings and contracts under the authority of the committee of the management.

In real life, the standards imposed by some well-organized stock exchanges have been more stringent than those of law itself and do give the investor a considerable degree of protection against investment in an insecure enterprise. All these lead to inspire confidence in the minds of the investing public.

3. Directions of Savings into the Most Productive Channel:

In the due course of discharging its functions, the stock exchange induces, directs and allocates the flow of savings into the most productive channels. An ideal stock exchange serves to allocate only just enough funds for any line of industries and checks the flow of capital just when an industry begins to show diminishing or uneconomic return.

This is determined through keeping an eye on the price movements on the exchange. The savings of the community would be used much less completely and more wastefully.

Well-regulated stock exchanges provide safe and liquid investment outlays at home, which in turn, not only encourage productive utilization of the available savings but also may even stimulate in course of time, the rate of capital formations.

Therefore, a well-designed stock exchange is an essential to any plan of economic development and primarily not a result or reflection of it.

Capital Market – Amount Raised in the Capital Market

The capital market, which has gained momentum since the mid-80s mobilized a higher quantum of financial resources for financing the corporate sector. The fundamental factors contributed for such a rapid growth were opening up of the economy, increasing diversity of financial instruments and changing asset preferences of investors.

Capital market depends on the efficient functioning of the stock exchanges. To facilitate a healthy growth of the capital market and to restructure stock exchanges, various committees or working groups appointed from time to time made a series of recommendations and the government has taken a number of policy initiatives.

The future growth and development of the capital market would certainly depend not only on the maintenance of investor’s confidence over the security market but also on the performance of the economy and corporate sector. Setting up a national securities market would go a long way in improving the functioning of stock markets.

At the beginning of the study period, the amount raised through equity both in public and right issues has been Rs.710.7 crores as compared to Rs.128.9 crores in case of debenture. The total amount of capital raised in 1994-95 amounted to Rs.30, 821.9 crores as compared with Rs.839.6 crores in 1985-86.

But the year 1987-88 was a year of trial and adjustment for the capital market and has passed through an erratic and inevitable corrective phase following a steep rise in 1991-92.

The above change in the Capital Market is due to the liberalization of Indian economy and abolition of the controller of capital issue. The year 1992-93 showed a significant change in the capital market. In this year, investors came forward with increased confidence in the capital market and corporate sector.

Both equity and debentures issues have dramatically increased to facilitate capital requirements of the corporate sector. It is also a matter of fact that debenture has become more acceptable on the part of both individual and institutional investors after the year 1990-91. With increased popularity and higher potentiality, the debenture market is definitely likely to be a keyhole at the beginning of the 21st Century.

At the end of this century, the amount raised through equity issues has been estimated to reach at Rs.21769.7 crores with an increase of nearly 10.5% over the year 1994-95. On the other hand amount raised through debenture is expected to be Rs.14310.2 crores, which is nearly 29% more over the year 1994-95, in this capital market.

Hence, the overall picture witnesses a spectacular growth in the Indian Capital Market, especially in the debenture sector.

During the period the investors have made up their mind to change their choice of instrument of investment. Factors like high yield, low risk, and potential capital appreciation, safety of principal and to share the growth of the enterprise are responsible for the wide acceptance of debenture as the first choice of investors.

Considering the other part i.e. equity issue, it is felt that steady conditions in capital markets is the best incentive to attract investors towards equity cult. But development of equity cult lies in the liquidity of shares on the stock exchanges.

The efficiency thus depends on how fast a buyer/seller would get his money back and at an acceptable price. But quite often, barring new expectations, investors find it difficult to sell these shares because brokers/Jobbers do not locate a buyer, leading to “liquidity crises.”

Primary Issues of Capital Market

Indian Capital Market is one of the leading emerging markets and ranks high in terms of price (in terms of U.S. Dollars). It has a massive investment potential. The foreign institutional investors, who have been allowed in the Indian market since September 1992, have been making investments over wide-ranging counters.

Their response has been quite encouraging, particularly in the recent periods. The primary market in India has witnessed phenomenal progress during 1985-95, in quantitative terms, in number of issues and amount. In qualitative and structural terms, it has established a number of specialized institutions and introduced innovative financial instruments to attract more investors.

In the year 1985-86, total equity issues in the capital market amounted to Rs.429 crores as compared to Rs.1873 crores in 1994-95. It highlights that there has been more than 4 times increase over the period under study.

On the other hand debenture issues increased from Rs.25 crores in 1985-86 to Rs.105 crores with an increase of more than 4 times in 1994-95. From among the proportion of increase in between equity and debenture, it is found to be more in case of debenture.

Therefore it can well be said that Indian Capital Market is in debenture grip. The equity issues have experienced unusual fluctuation in 1985-86, which is stimulated by high market expectations and to some extent excessive speculative influences. Subsequently, there is a long phase of adjustments in 1986-87 and selling pressure in the market aggravated by excess short sales and bear speculation.

The same is not true in case of debenture. But after 1988-89, the growth of the debenture issue has not seen the back by showing an increasing trend. In case of equity issues, the growth is fluctuating.

From this, one can easily predict the fate of both equity and debenture issues. By the end of this century, a total of Rs.1554 crores is estimated on the part of equity issues.

On the other hand, debenture issues are likely to be at Rs.210 crores. But the most remarkable point is that equity issues have sharply declined from 1994-95 to projected figures of the year 1999-2000. On the other hand the debenture issues have shown a significant increase from the period 1994-95 to the projected figure of the year 1999-2000.

The relative role of debenture presents certain interesting features. The abnormal acceptance of debenture among the Indian investors can be attributed to inherent merits and growing awareness of its advantages.

Convertible debenture provides an ideal combination of high yield, low risk and potential capital appreciation. It ensures safety of principal and provides an opportunity to share the growth of the company.

Capital Market – Reform Measures and Financial Stability

Reform Measures:

i. With the repeal of the Capital Issues (Control) Act, 1947, companies were given freedom to price their issues. The book-building process in the new issue of capital was introduced with a view to further strengthen the price discovery process.

ii. In the secondary market, the floor-based open outcry trading system was replaced by an electronic trading system in all the stock exchanges.

iii. The account period settlement system was replaced by rolling settlement, thus, reducing the scope for speculation. The rolling settlement cycle was shortened from T+5 to T+3 with effect from April 1, 2002. This process was enabled by a shift to electronic book entry transfer system through depository mechanism.

iv. The risk management system was made more comprehensive with trading members being subject to margins based on trading volumes and some other parameters and exposure norms based on the capital deposited with the exchange. The mark-to-market margins based on 99 per cent value at risk were introduced to capture the risk profile of trading members.

v. The Indian companies were allowed to raise funds from abroad, through American/Global Depository Receipts (ADRs/GORs), foreign currency convertible bonds (FCCBs) and external commercial borrowings (ECBs). The Reserve Bank allowed two-way fungibility of ADRs/GDRs in February 2002.

vi. Foreign Institutional Investors (FIIs) were allowed to participate in the capital market.

vii. For strengthening the process of information flows from the listed companies, several measures were introduced-

(a) while sufficient disclosures are mandatory for the companies at the stage of public issue, the listed companies are also required under the listing agreement to make disclosures on a continuing basis;

(b) for ensuring quick flow of information to the public, the decision pertaining to dividend, bonus and right announcements or any material event are now required to be disclosed to the public within 15 minutes of the conclusion of the board meeting in which the decisions are taken;

(c) the accounting practices were streamlined with norms introduced for segment reporting, related party transactions and consolidated balance sheets.

viii. Insider trading was made a criminal offence. The regulations governing substantial acquisition of shares and takeovers of companies were also introduced aimed at protecting the interests of minority shareholders by making the takeover process more transparent.

ix. For providing market participants instruments for hedging and risk management, several types of derivative products on equities were introduced. Non-transparent products like ‘badla’ were banned.

x. Measures to expand the market for corporate bonds: Exchange-traded currency and interest rate futures are to be launched and a transparent credit derivatives market is to be developed with appropriate safeguards;

xi. Tradability of domestic convertible bonds is to be enhanced through the mechanism of enabling investors to separate the embedded equity option from the convertible bond, and trade it separately;

xii. Development of a market-based system for classifying financial instruments based on their complexity and implicit risks is to be encouraged.

xiii. Permanent Account Number (PAN) – Requirement of PAN has been extended to all transactions in the financial market, subject to suitable threshold exemption limits.

xiv. National market for securities – Empowered Committee of State Finance Ministers to be requested to work with the Central Government to create a pan-Indian market for securities that will expand the market base and enhance the revenues of the State Governments.

The impact of various reform measures could be seen in the primary as well as secondary segments of the capital market.

The reform in the Indian capital market would gain added significance in the context of a measure of internationalisation of Indian capital markets. For the Indian system to derive the full benefits and avert risks involved in the process, a structured and sequenced integration would be needed. The greater interaction of Indian and international markets would necessarily involve further improving our procedures, and practices.

Foreign investors are used to open trading systems within the framework of prudential regulation. Their markets are also characterized by adequate disclosure and research based information and severe penalties for insider trading. Our markets would need, both for their own development and to promote fruitful linkages with foreign capital markets, to conform to these principles.

Financial Stability:

From a financial stability perspective, it is necessary to have a balanced financial system whereby both financial markets and financial institutions play an important role. Notwithstanding a long history, the capital market in India remained on the periphery of the financial system. However, a series of reforms introduced since the early 1990s has brought about a structural transformation of the capital market.

Free pricing in the primary capital market has allowed corporations to price their issues based on their fundamentals and conditions in the market. In the secondary market, the move to an electronic trading system has resulted in transparency in trades, better price discovery and lower transaction costs. The efficiency of the market has improved through faster execution of trades.

The operational efficiency of the stock market has also been strengthened through improvements in the clearing and settlement practices and the risk management process. Almost the entire delivery of securities now takes place in dematerialised form.

During the last ten years or so, there has been no instance of postponement or clubbing of settlements at two major stock exchanges (BSE and NSE), despite defaults by brokers. The cases of bad deliveries have become almost nil.

The setting up of trade/settlement guarantee funds has considerably reduced the settlement risk. The integrity and transparency of the market has improved with the wider availability of information regarding the corporates’ performance at quarterly intervals, which has improved the price discovery process. The trading and settlement framework in the Indian stock exchanges now compares favourably with the international best frameworks.

Capital Market – The Securities and Exchange Board of India (SEBI): Emergence, Functions and Objectives

Emergence of SEBI:

The need for setting up an independent government agency to regulate and develop the stock and capital market in India as in many developed countries has been recognized since 1985 when some major industrial policy changes like opening up of the economy to the outside world and greater role to the private sector are initiated.

The rampant malpractices noticed in the stock and capital market stood in the way of infusing the confidence of investors, which is necessary for mobilizing larger quantities of funds from the public and helps the growth of the country.

The government set up the Securities & Exchange Board of India (SEBI) in April 1988. For more than three years, it had no statutory powers.

Its interim functions during the period were:

(i) To collect information and advice the government on matters relating to stock and capital markets,

(ii) Licensing and regulation of merchant banks, mutual funds, etc.

(iii) To prepare the legal drafts for regulatory and developmental role of SEBI, and

(iv) To perform any other functions as may be entrusted to it by the government.

The SEBI, now, has been entrusted with both the regulatory and development functions.

The objectives of SEBI are as follows:

1. Investor protection, so that there is a steady flow of savings into the capital markets.

2. Ensuring the fair practices by the issuers of securities, namely, companies so that they can raise resources at least cost.

3. Promotion of efficient services by brokers, merchant bankers and other intermediaries so that they become competitive and professional.

The SEBI powers on stock exchanges and their member brokers and sub-brokers are exercised under SEBI (stock brokers and sub brokers) Regulation Act, 1992. These relate to registration, licensing, code of conduct, inspection of books of accounts, etc.

It has been entrusted with some powers in respect of many provisions including recognition of stock exchanges, control and regulations of stock exchanges, etc.

Capital Market – Listing of Securities: Meaning, Objectives and Table

Meaning:

In fact stock exchange is a place where securities are normally bought and sold with its permission. Only listed stock and securities are permitted to be dealt with in a stock exchange. Generally listing of securities means the admission of securities of a company on the stock exchange, which provides a proper forum to buy and sell such shares and securities.

The companies are interested to get their securities listed on a stock exchange with the following objectives:

(A) To provide easy and quick liquidity to the investors,

(B) To help in getting an official quotation for the purpose of wealth tax etc.

(C) To use the official quotation of shares and securities for determining the amount of stamp duty payable on transfer, and

(D) To help the bankers for valuation of shares on the basis of official quotations for grant of loans and advances against the security/debentures etc.

When listing is granted to a company, it means that the securities are included in the official list of the stock exchange for the purpose of trading. Security listing ensures that a company is solvent and its existence is legal.

It benefits both the investor as well as the company, listing on stock exchange is done only when the company follows the statutory rules laid down under the Securities Contact (Regulation) Act.

A Company requiring a quotation for its shares (i.e. desiring its securities to be listed) must apply in the prescribed form supported by the documentary evidence given below:

i. Copies of Memorandum and Articles of Association, Prospectus or Statement in lieu of Prospectus, Director’s Report, Balance Sheets and Agreement with Underwriters etc.

ii. Specimen copies of shares and Debentures Certificates, Letters of Allotment, Acceptance, Remuneration etc.

iii. Particulars regarding its capital structure.

iv. A statement showing the distribution of shares.

v. Particulars of dividends and cash bonuses during the last ten years.

vi. Particulars of shares and debentures for which permission to deal is applied for.

vii. A brief history of the company’s activities since operations.

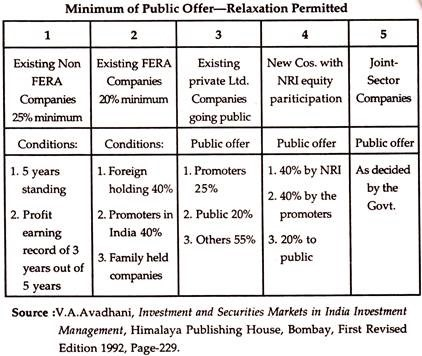

To be eligible, the company should be a public limited company with minimum paid-up capital of Rs.5 crores. The company must have to offer the public for subscription through prospectus at least 25% of its paid-up capital.

The provisions are, however, relaxed in the case of foreign collaboration companies and those other companies, which come under MRTP and FERA regulations or those in which the Govt. has an interest.

The public offer of existing FERA companies for getting listed on the stock exchange is only a minimum of 20% whereas the existing non-FERA companies have to subscribe for a public offer of 40%.

Perhaps the basic reason behind this is that the public limited companies should follow fair methods of public share ownership. For this, there should be 10 public shareholders for every Rs.1 lakh of fresh issue and 20 shareholders for every Rs.1 lakh of existing capital.

It becomes very clear from the information given in Table below that new companies with foreign equity participation of 33 ½ per cent and shares of Indian promoters at 40% have to make a public offer of only 33 1/3 percent. On the other hand NRI equity participants have to make a minimum public offer of 20%.

The listed companies are expected to have a standard denomination at share of Rs.100 and Rs.10. The minimum lots of allotment should be in multiples of that face value. The requirement of minimum public offer (25 percent) is flexible and modified according to the govt. policy and departs on the capital structure of the company and the nature of activities of industry to which it belongs. In the case of listing on OTC Exchange of India, only a minimum of 20% of equity paid up should have been offered to the public.

The stock exchange has the power not only to list but also to delist after giving a notice of six months, subject to certain conditions such as decline of the share ownership below a minimum level and non-payment of listing fees. There is a schedule of fees to be paid for listing and for annual fees.

Top 7 Benefits of Capital Market in India

The capital market in India has exhibited some benefits in the recent past which are worth noting here:

1. Capital market promotes capital formation and thereby economic growth.

2. It mobilizes savings for the people for investment.

3. It channelizes the funds to the most productive sector.

4. It increases production and productivity and enhances economic welfare of the society.

5. It facilitates technological upgradation in the industrial sector with the channelized funds.

6. It helps the corporate sector expand and grow and diversify leading to the growth of the economy.

7. It provides provision to the borrowers with deficits in order to have funds from lenders with surplus in the capital market.

Distinction between Money Market and Capital Market

Distinction between money market and capital market are as follows:

(i) Money market includes all agencies responsible for providing short-term capital to the industry at large. The investors once invested in the short-term instruments having less than 12 months maturity periods.

Capital market is concerned with long term funds required by the industry. But it ensures liquidity to the instruments by providing trading facilities to them. It deals with those financial instruments which have maturities greater than one year.

(ii) Level of risk in the money market is low as compared to the capital market.

(iii) Time to maturity and the financial soundness of issuers decides the level of risks in these two markets.

(iv) In the money market each single money market instrument is of large amount while in the capital market each single instrument holds a small amount.

(v) Generally, money market instruments do not have any secondary market but capital market instruments have secondary markets.

(vi) In the money market there is no formal place for transactions while in capital markets the transactions take place in formal places like stock exchanges.

(vii) The instruments dealt in the money market are bills of exchanges, treasury bills, commercial papers, certificate of deposits etc. The instruments generally dealt in the capital market are shares, debentures, government bonds etc.

(viii) In money markets, transactions have to be conducted without the help of brokers while in case of capital markets, transactions have to be conducted only through authorized dealers.

Difference between Capital Market and Money Market

Difference between Capital Market and Money Market are as follows:

Difference # Capital Market:

1. Purpose – To raise funds from sale/purchase of debt and equity.

2. Duration – Used for a long-term basis for assets with maturity greater than a year.

3. Participants – Financial institutions, banks, corporations, foreign investors, etc.

4. Instruments traded – Equities, notes, bonds, debentures, mutual funds, etc.

5. Expected return – Returns vary with changes in prices and are available immediately following the sale of securities.

6. Safety – Subject to risk and volatility.

7. Liquidity – Liquidity is subjective but restricted.

8. Regulatory bodies – SEBI.

9. Price determination – Demand and supply forces between participants.