Capital rationing refers to a condition where a firm is not in a position to invest in all profitable projects due to the constraints on accessibility of funds. It is a known fact that the financial resources are always inadequate and the demand for them far exceeds their availability.

It is for this reason that the firm cannot take up all the projects though profitable and has to select the combination of proposals that will yield the maximum profitability.

Capital rationing is a situation where a constraint or budget ceiling is placed on the total size of capital expenditures during a particular period.

In a capital rationing situation a company may have to forego some of the projects whose IRR is above the overall cost of the firm due to a ceiling on budget allocation for the projects which are eligible for capital investment.

ADVERTISEMENTS:

Capital rationing is a business decision to limit the amount available to spend on new investments or projects. The practice describes restricting channels of outflow of funds by placing a cap on the number of new projects.

Capital rationing has to be done in situations when the requirement of funds is more than the availability of funds.

The theory behind capital rationing practices is that, when fewer new projects are undertaken, the company is better able to manage them through more time and resources dedicated to existing projects and each new project.

What is Capital Rationing: Meaning, Problems with Solutions, Internal and External Factors, Principles and More.. (With Examples and Illustrations)

Capital Rationing – Meaning

Capital rationing refers to a condition where a firm is not in a position to invest in all profitable projects due to the constraints on accessibility of funds. It is a known fact that the financial resources are always inadequate and the demand for them far exceeds their availability.

ADVERTISEMENTS:

It is for this reason that the firm cannot take up all the projects though profitable and has to select the combination of proposals that will yield the maximum profitability.

What is Capital Rationing – Meaning, Factors, Classifications and Situations

Meaning of Capital Rationing:

Capital rationing is a situation where a constraint or budget ceiling is placed on the total size of capital expenditures during a particular period.

It refers to the selection of the investment proposals in a situation of constraint on availability of capital funds, to maximize the wealth of the company by selecting those projects which will maximize overall NPV of the concern.

In a capital rationing situation a company may have to forego some of the projects whose IRR is above the overall cost of the firm due to a ceiling on budget allocation for the projects which are eligible for capital investment.

ADVERTISEMENTS:

Capital rationing refers to a situation where a company cannot undertake all positive NPV projects it has identified because of shortage of capital.

Under this situation, a decision maker is compelled to reject some of the viable projects having positive net present value because of shortage of funds.

Factors Leading to Capital Rationing:

Capital rationing may arise due to:

(i) External constraints or

ADVERTISEMENTS:

(ii) Internal constraints imposed by management.

(i) External Factors:

External capital rationing arises out of the inability of the firm to raise sufficient funds from the market at a given cost of capital. Capital rationing may arise due to external factors like imperfections of capital market or deficiencies in market information which might have for the availability of capital.

Generally, either the capital market itself or the government will not supply unlimited amounts of investment capital to a company, even though the company has identified investment opportunities which would be able to produce the required return. Because of these imperfections the firm may not get necessary capital funds to carry out all the profitable projects.

ADVERTISEMENTS:

(ii) Internal Factors:

Internal capital rationing is caused by self-imposed restriction by management to its capital expenditure outlays.

Capital rationing is also caused by internal factors which are as follows:

1. Reluctance to take resort to financing by external equities in order to avoid assumption of further risk.

ADVERTISEMENTS:

2. Reluctance to broaden the equity share base for fear of losing control.

3. Reluctance to accept some viable projects because of its inability to manage the firm in the scale of operation resulting from inclusion of all the viable projects.

The capital rationing is answered by a reference to the capital budget.

The level of capital budget will tend to depend on the quality of investment proposals submitted to top management; in addition it will also tend to depend on the following factors:

ADVERTISEMENTS:

1. Top management philosophy towards capital spending.

2. The outlook for future investment opportunities that may be unavailable if extensive current commitments are undertaken.

3. The funds provided by current operations.

4. The feasibility of acquiring additional capital through borrowing or share issues.

Under capital rationing, the management has to determine not only the profitable investment opportunities but also decide to obtain that combination of the profitable projects which yields highest NPV within the available funds by ranking them according to their relative profitability.

Theoretically, projects should be undertaken to the point where the return is just equal to the cost of financing these projects. Even though the enterprise may wish to raise external finance for its investment program, there are many reasons why it may be unable to do this.

ADVERTISEMENTS:

Examples include:

a. The enterprise’s past record and its present capital structure may make it impossible or extremely costly to raise additional debt capital.

b. Its record may make it impossible to raise new equity capital because of low yields or even no yield.

c. Covenants in existing loan agreements may restrict future borrowing. Furthermore, in the typical company, one would expect capital rationing to be largely self-imposed.

Classification of Capital Rationing:

For capital rationing purpose, the investment proposals are classified as under:

1. Single Period – Divisible Projects:

ADVERTISEMENTS:

In this case, funds are limited only in the initial period, and projects can be accepted in parts also i.e. partial or proportionate investment is possible.

2. Single Period – Indivisible Projects:

In this case, funds are limited only in the initial period, but projects must be accepted in full i.e. partial or proportionate investment is not possible.

3. Multiperiod – Divisible Projects:

In this case, funds are limited in more than one period, and projects can be accepted in parts also i.e. partial or proportionate investment is possible.

4. Multiperiod – Indivisible Projects:

ADVERTISEMENTS:

In this case, funds are limited in more than one period, and projects must be accepted in full i.e. partial or proportionate investment is not possible.

Situations of Capital Rationing:

Capital rationing decisions can be studied under the following three situations:

Situation I: Projects are Divisible and Constraint is a Single Period One:

The following are the steps to be adopted for solving the problem under this situation:

Step 1:

Calculate the profitability index of each project.

ADVERTISEMENTS:

Step 2:

Rank the projects on the basis of the profitability index calculated in Step-1 above.

Step 3:

Choose the optimal combination of the projects.

Situation II: Projects are Indivisible and Constraint is a Single Period One:

The following steps to be followed for solving the problem under this situation:

ADVERTISEMENTS:

Step 1:

Construct a table showing the feasible combinations of the project (whose aggregate of initial outlay does not exceed the fund available for investment).

Step 2:

Choose a combination whose aggregate NPV is maximum and consider it as the optimal project mix.

Situation III: Projects are Divisible and Constraint is Multi-Period One:

Under this situation, the problem of capital rationing can be solved with the help of linear programming. It is a mathematical programming approach.

Capital Rationing – Meaning, Factors and Steps

Meaning of Capital Rationing:

Often firms draw up their capital budget under the assumption that the availability of financial resources is limited. Capital rationing refers to the selection of the investment proposals in a situation of constraint on availability of capital funds, to maximize the wealth of the company by selecting those projects which will maximize overall NPV of the concern.

In a capital rationing situation a company may have to forego some of the projects whose IRR is above the overall cost of the firm due to a ceiling on budget allocation for the projects which are eligible for capital investment. Capital rationing refers to a situation where a company cannot undertake all positive NPV projects it has identified because of shortage of capital.

Under this situation, a decision-maker is compelled to reject some of the viable projects having positive net present value because of shortage of funds. It is known as a situation involving capital rationing.

In terms of financing investment projects, the following important questions is to be answered:

1. What would be the requirement of funds for capital investment decisions in the forthcoming planning period?

2. How much is the quantum of funds available for capital investment?

3. How to assign the available funds to the acceptable proposals which require more funds than are available?

The answer to the first and second questions is given with reference to the capital investment appraisal decisions made by the top management. The third question is answered with specific reference to the appraisal of investment decisions from the angle of capital rationing.

The selection process under capital rationing will involve two steps:

1. Ranking of projects according to some measure of profitability – PI, NPV, IRR etc.

2. Selecting projects in descending order of profitability until the budget figures are exhausted keeping in view the objective of maximising the value of the firm.

Factors Leading to Capital Rationing:

Internal Factors:

Capital rationing is also caused by internal factors which are as follows:

(i) Reluctance to take resort to financing by external equities in order to avoid assumption of further risk.

(ii) Reluctance to broaden the equity share base for fear of losing control.

(iii) Reluctance to accept some viable projects because of its inability to manage the firm in the scale of operation resulting from inclusion of all the viable projects.

External Factors:

Capital rationing may arise due to external factors like imperfections of capital market or deficiencies in market information which might have for the availability of capital. Generally, either the capital market itself or the government will not supply unlimited amounts of investment capital to a company, even though the company has identified investment opportunities which would be able to produce the required return. Because of these imperfections the firm may not get the necessary amount of capital funds to carry out all the profitable projects.

Capital Rationing – Meaning (With Illustration, Problem and Solution)

Meaning:

Capital Rationing is a situation, when there is some ceiling on the availability of funds. This may be externally imposed, e.g. the financial institutions fix a limit of Rs. 10 lacs that can be given for a project or projects, or it may be internally imposed also, e.g. the company has decided to utilise only the internally available funds and the availability of funds is Rs. 5 lacs.

This situation we will call capital rationing. When capital is rationed, the NPV rule needs modification.

This is because, in the absence of Capital Rationing, all the proposals, giving a positive NPV are acceptable without any limit. When a ceiling of funds is imposed, this cannot be done because we may not be in a position to accept all the acceptable proposals if the total investment amount exceeds the ceiling amount.

Decision making under this situation may be explained by the following illustration:

Illustration:

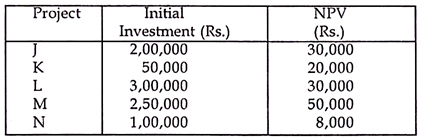

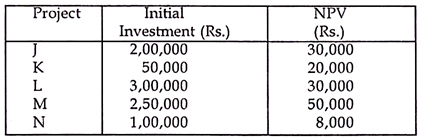

A firm is considering the following investment proposals for which initial investment and NPV has been calculated as follows, and only Rs. 5,00,000 are available for investment.

In the above example all the projects are acceptable because they yield positive NPV. If we calculate funds required for these projects it comes to Rs. 9 lacs, which is clearly beyond the limit of available funds. Hence, all of them cannot be accepted and, therefore, selection has to be done from the given alternative proposals based on relative profitability.

Since, NPV is not the correct method to judge the profitability, especially when the projects are of unequal size, we have to take the help of a method which can judge the relative profitability of different proposals and rank them accordingly. Both, PI and IRR techniques can be used for the purpose. However, PI is considered a more suitable technique for this purpose because of its closeness to NPV method.

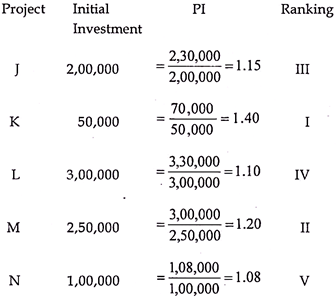

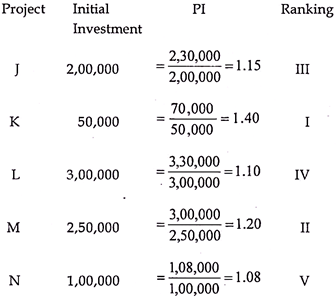

Now, in the above illustration, we will find out the PI of each proposal and rank them accordingly:

Now the project can be arranged in order of their profitability and investment requirement. We can then decide the number of projects that can be accepted under various ceiling amounts.

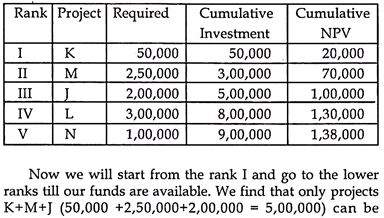

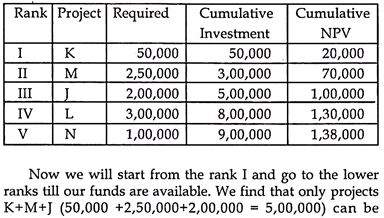

Now we will start from the rank 1 and go to the lower ranks till our funds are available. We find that only projects K+M+J (50,000 +2, 50,000+2, 00,000 = 5, 00,000) can be accepted within the existing ceiling. Projects L and N, even though profitable cannot be adopted because of funds’ constraint.

However, if more funds become available they can be adopted. The NPV for the adopted projects (K+M+J is Rs. 20,000+50,000+30,000=1, 00,000) is the highest and no other combination of projects can give this level of NPV. In this way, the objective of value maximization is also satisfied.

Capital Rationing – Meaning and Types

Meaning of Capital Rationing:

Capital rationing is a business decision to limit the amount available to spend on new investments or projects. The practice describes restricting channels of outflow of funds by placing a cap on the number of new projects. Capital rationing has to be done in situations when the requirement of funds is more than the availability of funds.

The theory behind capital rationing practices is that, when fewer new projects are undertaken, the company is better able to manage them through more time and resources dedicated to existing projects and each new project.

Types of Capital Rationing:

Reasons can be of two types namely internal and external.

1. Internal Reasons:

It includes management’s decision to curtail expansion plans, budgetary constraints put by seniors on departments, fear of losing control of the company by management if further debt is taken, non-availability of human resources etc.

2. External Reason:

It includes the company’s inability to get more debt from outside sources such as creditors or banks etc.

In capital rationing, it may also be more desirable to accept several small investment proposals than a few large investment proposals so that there may be full utilization of budgeted amount. This may result in accepting relatively less profitable projects if full utilization of budget is a primary consideration.

Thus, capital rationing foregoes the next most profitable investment, not always leading to optimal results.

Capital Rationing – Meaning and Kinds

Meaning of Capital Rationing:

Capital Budgeting Decisions are often characterised by limited availability of financial resources or fund constraint. As a result, even if all the available projects have positive NPV, a firm may have to forego a few of them just because of non-availability of funds.

The firm, in such a case, selects projects to maximise the overall NPV subject to the fund constraint and thereby ensures maximum return to the wealth of shareholders. This type of Capital Budgeting Decision is known as Capital Rationing.

Kinds of Capital Rationing Decisions:

Capital rationing decisions can be studied under the following two situations:

Situation 1 – When Projects are Divisible:

A project is considered to be divisible if it can be accepted in part also.

In such a situation the principle of capital rationing can be applied through the following steps:

(i) Calculate the Profitability Index (PI) for each project.

(ii) Rank the projects in descending order of PI.

(iii) Go on accepting the projects based on the above ranking until the funds are fully exhausted.

(iv) In case the available fund is inadequate to accept the next project fully, accept it to the extent of the fund available, i.e., proportionately.

(v) Aggregate of NPV of projects thus selected will be the maximum NPV subject to the fund constraint.

Situation 2 – When Projects are not Divisible:

A project is considered to be indivisible if it cannot be accepted in part, i.e., either to accept it in full or to reject it.

In such a situation, the principle of capital rationing can be applied through the following steps:

(i) Make a list of the possible combinations of available projects that can be taken up with the available funds.

(ii) Calculate the total outlay and aggregate NPV of each combination.

(iii) The combination that yields the highest aggregate NPV is considered the best.

Capital Rationing – Meaning, Problems, Classifications, Principles, Internal and External Factors, Examples and Conclusion

Capital Rationing Meaning:

Capital rationing means distribution of capital in favour of more acceptable proposals. A firm determines a certain cut-of-point for selecting accepted proposals. The basic reason for capital rationing is that funds to be invested over a long period of time must be distributed most judiciously.

The capital rationing problem is one where not all projects with positive present values (items at the pre-rationing discount rate) can be taken up because of limits on the funds available for investment. It is also a situation in which some projects, with negative present or terminal values, may be expected if they generate funds at crucial times.

There are two problems in capital rationing:

1. Given the cost of capital, which group of investments should be selected? The principle of accepting all the proposals have a positive present value of the firm’s cost of capital is obvious, for a failure to do so would prove critical. Adherence to this principle results in the present value of a firm’s net worth being at a maximum at all points of time.

2. Given a fixed sum for capital investment, which group of investment proposals should be undertaken?

(a) When there is one accounting period, investment proposals should be ranked according to their present values, until the fixed sum is exhausted,

(b) The problem becomes more difficult when the choice is between a single big proposal and a combination of small proposals, though the latter may yield an increment in present values,

(c) There may be increment proposals, some of which require net cash outlays in more than one accounting period. In such cases, a constraint is imposed not only by the fixed sum for capital investment but also by the fixed sums available to carry out present commitments in subsequent time periods,

(d) The selection of the best among mutually exclusive alternatives is done on the basis of a rate of return available among different mutually exclusive projects.

The problems of capital rationing are felt more by firms with fixed capital budgets and a large variety of alternative opportunities which constrain them to take various investment decisions. Proposals are selected from among independent alternatives. Investments may be single-period and multi-period investments.

In single-period investments, proposals are ranked according to their profitability index, which also maximises the present value of the owners’ equity. However, the situation involves outlay in several periods. Multi-period investments have to be accepted because they ensure multiple ratios of returns.

There is a need for capital rationing during a period of budget constraints. During other periods, there may not be any need for capital rationing. However, it is likely that budget constraints may arise during several periods. In that case, rationing brings forth complicated problems.

Proposals may be selected from among inter-dependent alternatives. There may be investment proposals where one cannot be abandoned at the cost of the other. Similarly, there may be contingent projects which are combined with each other.

The existing and new asset selection may also raise unique problems in terms of the variability of their future flows. In this case, a firm should resort to portfolio selection. It may be possible for a firm to select proposals from among inter-dependent alternatives.

At the same time, in relationships, there are three broad classifications of interdependence:

(i) Structural Inter-dependence

It refers to the interaction of the inputs and output among firms and industries. The future earnings from potential investments are likely to be affected by this

inter-dependence, which is also referred to as ‘business risk’. These difficulties might as well make a firm’s flows vulnerable to a collective disaster, which is referred to as ‘portfolio risk’. Added to this, if a firm is highly indebted or levered, the financial risk becomes indispensable.

(ii) Macro-Economic Interdependence

It refers to the interaction of cyclical and seasonal effects on products and markets.

(iii) Demographic Inter-dependence

It refers to the concentration and mobility of the population. This might affect both the product and labour markets. This, in turn, is bound to influence investment decisions.

Complications beset investment decisions under uncertainty.

There are three major problems:

(i) Limited availability of capital;

(ii) Indivisibility of investment projects;

(iii) Inter-dependence of investment proposals.

Limited availability of capital brings to light what is known as capital rationing, which refers to the allocation of a firm’s budgeted investment funds among the most desirable projects. As projects are accepted in ranked order, the cost of some far exceeds the budget for them.

Moreover, certain projects cannot be accepted partially. In this connection, George Phillippatos says, “Investments in plant and equipment are typically all-or-none propositions-hence fractional solutions may not be meaningful for most long-term investment decisions, and the all-or-none ritual may become very important”.

Projects may be mutually exclusive or mutually dependent. It is possible to accept one and reject another, how so ever profitable they might be to the company. Mutually exclusive investments compete in offering services to a firm and hence the acceptance of one may satisfy its demand. In the case of mutually dependent or contingent proposals, one project cannot be undertaken without the other.

Principles of Capital Rationing:

(i) Capital investments are usually planned. The first step in planning capital investments is to fix the selection criteria to determine the acceptability of various proposals. A corporation’s development plant, the size and duration of projects, the expenditure to be incurred on them, the expected rate of return or any other special problems are considered while fixing the selection criteria, which should be flexible enough to accommodate the changes that might take place in a company’s plans from time to time.

(ii) Capital investment proposals are submitted by different departmental heads, including production, market research and development. The proposals of other organisations may also be studied to facilitate comparison with the proposals invited from the firm’s departments.

(iii) At this stage, the feasibility study of each proposal is undertaken to substantiate the estimates of various departmental heads.

(iv) The different proposals are compared to facilitate a better allocation of investment funds. The merits and demerits of each proposal are studied to enable a firm to make comparative recommendations.

(v) A firm measures its ability to finance proposals. It ensures that there is an ample cushion of existing and estimated fund resources to implement a proposal.

(vi) Approved proposals are recommended to the top management in order to enable it to take a final decision.

(vii) The requisite funds are provided as budgeted. The management may provide the resources through internal financing or external financing. It should also time the allocation of funds on different proposals.

(viii) At the final and critical stage, the progress of the project is reviewed and forecasts are reevaluated. If necessary, projects are altered and even suspended.

Factors Leading to Capital Rationing:

Two different types of capital rationing situation can be identified, distinguished by the source of the capital expenditure constraint.

i. External Factors:

Capital rationing may arise due to external factors like imperfections of capital market or deficiencies in market information which might have for the availability of capital. Generally, either the capital market itself or the government will not supply unlimited amounts of investment capital to a company, even though the company has identified investment opportunities which would be able to produce the required return. Because of these imperfections the firm may not get the necessary amount of capital funds to carry out all the profitable projects.

ii. Internal Factors:

Capital rationing is also caused by internal factors which are as follows:

(i) Reluctance to take resort to financing by external equities in order to avoid assumption of further risk.

(ii) Reluctance to broaden the equity share base for fear of losing control.

(iii) Reluctance to accept some viable projects because of its inability to manage the firm in the scale of operation resulting from inclusion of all the viable projects.

The second question is answered by a reference to the capital budget. The level of capital budget will tend to depend on the quality of investment proposals submitted to top management; in addition it will also tend to depend on the following factors-

(a) Top management philosophy towards capital spending.

(b) The outlook for future investment opportunities that may be unavailable if extensive current commitments are undertaken.

(c) The funds provided by current operations.

(d) The feasibility of acquiring additional capital through borrowing or share issues.

Under capital rationing, the management has to determine not only the profitable investment opportunities but also decide to obtain that combination of the profitable projects which yields highest NPV within the available funds by ranking them according to their relative profitability.

Theoretically, projects should be undertaken to the point where the return is just equal to the cost of financing these projects. If safety and the maintaining of, say, family controls are considered to be more important than additional profits, there may be a marked unwillingness to engage in external financing, and hence a limit will be placed on the amounts available for investment. Even though the enterprise may wish to raise external finance for its investment program, there are many reasons why it may be unable to do this.

Examples include:

(a) The enterprise’s past record and its present capital structure may make it impossible or extremely costly to raise additional debt capital.

(b) Its record may make it impossible to raise new equity capital because of low yields or even no yield.

(c) Covenants in existing loan agreements may restrict future borrowing. Further more, in the typical company, one would expect capital rationing to be largely self-imposed

Conclusion:

After going through the detailed analysis of different methods available for evaluating investment proposals it can be concluded that NPV, IRR and PI are the most appropriate techniques. These techniques will give identical results in most of the project evaluation situations.

This means a proposal with positive NPV will have PI > 1 and IRR > cost of capital. But different techniques have their relative merit as per the demand of different decision situations.

If one is asked to decide one technique then NPV method can be described as the best method. Whenever a conflict arises between NPV and IRR then the results given by the NPV method are relied upon. This is because of the fact that NPV of an investment proposal is indicative of its net contribution in absolute terms towards the value of the firm.

Hence NPV method is the best criterion for achieving the objective of the maximization of wealth of shareholders. However, it is always advisable that a finance manager should evaluate investment proposals on more than one criterion before making a final choice.

Capital rationing refers to a condition where a firm is not in a position to invest in all profitable projects due to the constraints on accessibility of funds. It is a known fact that the financial resources are always inadequate and the demand for them far exceeds their availability.

It is for this reason that the firm cannot take up all the projects though profitable and has to select the combination of proposals that will yield the maximum profitability.

Capital rationing is a situation where a constraint or budget ceiling is placed on the total size of capital expenditures during a particular period.

In a capital rationing situation a company may have to forego some of the projects whose IRR is above the overall cost of the firm due to a ceiling on budget allocation for the projects which are eligible for capital investment.

Capital rationing is a business decision to limit the amount available to spend on new investments or projects. The practice describes restricting channels of outflow of funds by placing a cap on the number of new projects.

Capital rationing has to be done in situations when the requirement of funds is more than the availability of funds.

The theory behind capital rationing practices is that, when fewer new projects are undertaken, the company is better able to manage them through more time and resources dedicated to existing projects and each new project.

What is Capital Rationing: Meaning, Problems with Solutions, Internal and External Factors, Principles and More.. (With Examples and Illustrations)

Capital Rationing – Meaning

Capital rationing refers to a condition where a firm is not in a position to invest in all profitable projects due to the constraints on accessibility of funds. It is a known fact that the financial resources are always inadequate and the demand for them far exceeds their availability.

It is for this reason that the firm cannot take up all the projects though profitable and has to select the combination of proposals that will yield the maximum profitability.

What is Capital Rationing – Meaning, Factors, Classifications and Situations

Meaning of Capital Rationing:

Capital rationing is a situation where a constraint or budget ceiling is placed on the total size of capital expenditures during a particular period.

It refers to the selection of the investment proposals in a situation of constraint on availability of capital funds, to maximize the wealth of the company by selecting those projects which will maximize overall NPV of the concern.

In a capital rationing situation a company may have to forego some of the projects whose IRR is above the overall cost of the firm due to a ceiling on budget allocation for the projects which are eligible for capital investment.

Capital rationing refers to a situation where a company cannot undertake all positive NPV projects it has identified because of shortage of capital.

Under this situation, a decision maker is compelled to reject some of the viable projects having positive net present value because of shortage of funds.

Factors Leading to Capital Rationing:

Capital rationing may arise due to:

(i) External constraints or

(ii) Internal constraints imposed by management.

(i) External Factors:

External capital rationing arises out of the inability of the firm to raise sufficient funds from the market at a given cost of capital. Capital rationing may arise due to external factors like imperfections of capital market or deficiencies in market information which might have for the availability of capital.

Generally, either the capital market itself or the government will not supply unlimited amounts of investment capital to a company, even though the company has identified investment opportunities which would be able to produce the required return. Because of these imperfections the firm may not get necessary capital funds to carry out all the profitable projects.

(ii) Internal Factors:

Internal capital rationing is caused by self-imposed restriction by management to its capital expenditure outlays.

Capital rationing is also caused by internal factors which are as follows:

1. Reluctance to take resort to financing by external equities in order to avoid assumption of further risk.

2. Reluctance to broaden the equity share base for fear of losing control.

3. Reluctance to accept some viable projects because of its inability to manage the firm in the scale of operation resulting from inclusion of all the viable projects.

The capital rationing is answered by a reference to the capital budget.

The level of capital budget will tend to depend on the quality of investment proposals submitted to top management; in addition it will also tend to depend on the following factors:

1. Top management philosophy towards capital spending.

2. The outlook for future investment opportunities that may be unavailable if extensive current commitments are undertaken.

3. The funds provided by current operations.

4. The feasibility of acquiring additional capital through borrowing or share issues.

Under capital rationing, the management has to determine not only the profitable investment opportunities but also decide to obtain that combination of the profitable projects which yields highest NPV within the available funds by ranking them according to their relative profitability.

Theoretically, projects should be undertaken to the point where the return is just equal to the cost of financing these projects. Even though the enterprise may wish to raise external finance for its investment program, there are many reasons why it may be unable to do this.

Examples include:

a. The enterprise’s past record and its present capital structure may make it impossible or extremely costly to raise additional debt capital.

b. Its record may make it impossible to raise new equity capital because of low yields or even no yield.

c. Covenants in existing loan agreements may restrict future borrowing. Furthermore, in the typical company, one would expect capital rationing to be largely self-imposed.

Classification of Capital Rationing:

For capital rationing purpose, the investment proposals are classified as under:

1. Single Period – Divisible Projects:

In this case, funds are limited only in the initial period, and projects can be accepted in parts also i.e. partial or proportionate investment is possible.

2. Single Period – Indivisible Projects:

In this case, funds are limited only in the initial period, but projects must be accepted in full i.e. partial or proportionate investment is not possible.

3. Multiperiod – Divisible Projects:

In this case, funds are limited in more than one period, and projects can be accepted in parts also i.e. partial or proportionate investment is possible.

4. Multiperiod – Indivisible Projects:

In this case, funds are limited in more than one period, and projects must be accepted in full i.e. partial or proportionate investment is not possible.

Situations of Capital Rationing:

Capital rationing decisions can be studied under the following three situations:

Situation I: Projects are Divisible and Constraint is a Single Period One:

The following are the steps to be adopted for solving the problem under this situation:

Step 1:

Calculate the profitability index of each project.

Step 2:

Rank the projects on the basis of the profitability index calculated in Step-1 above.

Step 3:

Choose the optimal combination of the projects.

Situation II: Projects are Indivisible and Constraint is a Single Period One:

The following steps to be followed for solving the problem under this situation:

Step 1:

Construct a table showing the feasible combinations of the project (whose aggregate of initial outlay does not exceed the fund available for investment).

Step 2:

Choose a combination whose aggregate NPV is maximum and consider it as the optimal project mix.

Situation III: Projects are Divisible and Constraint is Multi-Period One:

Under this situation, the problem of capital rationing can be solved with the help of linear programming. It is a mathematical programming approach.

Capital Rationing – Meaning, Factors and Steps

Meaning of Capital Rationing:

Often firms draw up their capital budget under the assumption that the availability of financial resources is limited. Capital rationing refers to the selection of the investment proposals in a situation of constraint on availability of capital funds, to maximize the wealth of the company by selecting those projects which will maximize overall NPV of the concern.

In a capital rationing situation a company may have to forego some of the projects whose IRR is above the overall cost of the firm due to a ceiling on budget allocation for the projects which are eligible for capital investment. Capital rationing refers to a situation where a company cannot undertake all positive NPV projects it has identified because of shortage of capital.

Under this situation, a decision-maker is compelled to reject some of the viable projects having positive net present value because of shortage of funds. It is known as a situation involving capital rationing.

In terms of financing investment projects, the following important questions is to be answered:

1. What would be the requirement of funds for capital investment decisions in the forthcoming planning period?

2. How much is the quantum of funds available for capital investment?

3. How to assign the available funds to the acceptable proposals which require more funds than are available?

The answer to the first and second questions is given with reference to the capital investment appraisal decisions made by the top management. The third question is answered with specific reference to the appraisal of investment decisions from the angle of capital rationing.

The selection process under capital rationing will involve two steps:

1. Ranking of projects according to some measure of profitability – PI, NPV, IRR etc.

2. Selecting projects in descending order of profitability until the budget figures are exhausted keeping in view the objective of maximising the value of the firm.

Factors Leading to Capital Rationing:

Internal Factors:

Capital rationing is also caused by internal factors which are as follows:

(i) Reluctance to take resort to financing by external equities in order to avoid assumption of further risk.

(ii) Reluctance to broaden the equity share base for fear of losing control.

(iii) Reluctance to accept some viable projects because of its inability to manage the firm in the scale of operation resulting from inclusion of all the viable projects.

External Factors:

Capital rationing may arise due to external factors like imperfections of capital market or deficiencies in market information which might have for the availability of capital. Generally, either the capital market itself or the government will not supply unlimited amounts of investment capital to a company, even though the company has identified investment opportunities which would be able to produce the required return. Because of these imperfections the firm may not get the necessary amount of capital funds to carry out all the profitable projects.

Capital Rationing – Meaning (With Illustration, Problem and Solution)

Meaning:

Capital Rationing is a situation, when there is some ceiling on the availability of funds. This may be externally imposed, e.g. the financial institutions fix a limit of Rs. 10 lacs that can be given for a project or projects, or it may be internally imposed also, e.g. the company has decided to utilise only the internally available funds and the availability of funds is Rs. 5 lacs.

This situation we will call capital rationing. When capital is rationed, the NPV rule needs modification.

This is because, in the absence of Capital Rationing, all the proposals, giving a positive NPV are acceptable without any limit. When a ceiling of funds is imposed, this cannot be done because we may not be in a position to accept all the acceptable proposals if the total investment amount exceeds the ceiling amount.

Decision making under this situation may be explained by the following illustration:

Illustration:

A firm is considering the following investment proposals for which initial investment and NPV has been calculated as follows, and only Rs. 5,00,000 are available for investment.

In the above example all the projects are acceptable because they yield positive NPV. If we calculate funds required for these projects it comes to Rs. 9 lacs, which is clearly beyond the limit of available funds. Hence, all of them cannot be accepted and, therefore, selection has to be done from the given alternative proposals based on relative profitability.

Since, NPV is not the correct method to judge the profitability, especially when the projects are of unequal size, we have to take the help of a method which can judge the relative profitability of different proposals and rank them accordingly. Both, PI and IRR techniques can be used for the purpose. However, PI is considered a more suitable technique for this purpose because of its closeness to NPV method.

Now, in the above illustration, we will find out the PI of each proposal and rank them accordingly:

Now the project can be arranged in order of their profitability and investment requirement. We can then decide the number of projects that can be accepted under various ceiling amounts.

Now we will start from the rank 1 and go to the lower ranks till our funds are available. We find that only projects K+M+J (50,000 +2, 50,000+2, 00,000 = 5, 00,000) can be accepted within the existing ceiling. Projects L and N, even though profitable cannot be adopted because of funds’ constraint.

However, if more funds become available they can be adopted. The NPV for the adopted projects (K+M+J is Rs. 20,000+50,000+30,000=1, 00,000) is the highest and no other combination of projects can give this level of NPV. In this way, the objective of value maximization is also satisfied.

Capital Rationing – Meaning and Types

Meaning of Capital Rationing:

Capital rationing is a business decision to limit the amount available to spend on new investments or projects. The practice describes restricting channels of outflow of funds by placing a cap on the number of new projects. Capital rationing has to be done in situations when the requirement of funds is more than the availability of funds.

The theory behind capital rationing practices is that, when fewer new projects are undertaken, the company is better able to manage them through more time and resources dedicated to existing projects and each new project.

Types of Capital Rationing:

Reasons can be of two types namely internal and external.

1. Internal Reasons:

It includes management’s decision to curtail expansion plans, budgetary constraints put by seniors on departments, fear of losing control of the company by management if further debt is taken, non-availability of human resources etc.

2. External Reason:

It includes the company’s inability to get more debt from outside sources such as creditors or banks etc.

In capital rationing, it may also be more desirable to accept several small investment proposals than a few large investment proposals so that there may be full utilization of budgeted amount. This may result in accepting relatively less profitable projects if full utilization of budget is a primary consideration.

Thus, capital rationing foregoes the next most profitable investment, not always leading to optimal results.

Capital Rationing – Meaning and Kinds

Meaning of Capital Rationing:

Capital Budgeting Decisions are often characterised by limited availability of financial resources or fund constraint. As a result, even if all the available projects have positive NPV, a firm may have to forego a few of them just because of non-availability of funds.

The firm, in such a case, selects projects to maximise the overall NPV subject to the fund constraint and thereby ensures maximum return to the wealth of shareholders. This type of Capital Budgeting Decision is known as Capital Rationing.

Kinds of Capital Rationing Decisions:

Capital rationing decisions can be studied under the following two situations:

Situation 1 – When Projects are Divisible:

A project is considered to be divisible if it can be accepted in part also.

In such a situation the principle of capital rationing can be applied through the following steps:

(i) Calculate the Profitability Index (PI) for each project.

(ii) Rank the projects in descending order of PI.

(iii) Go on accepting the projects based on the above ranking until the funds are fully exhausted.

(iv) In case the available fund is inadequate to accept the next project fully, accept it to the extent of the fund available, i.e., proportionately.

(v) Aggregate of NPV of projects thus selected will be the maximum NPV subject to the fund constraint.

Situation 2 – When Projects are not Divisible:

A project is considered to be indivisible if it cannot be accepted in part, i.e., either to accept it in full or to reject it.

In such a situation, the principle of capital rationing can be applied through the following steps:

(i) Make a list of the possible combinations of available projects that can be taken up with the available funds.

(ii) Calculate the total outlay and aggregate NPV of each combination.

(iii) The combination that yields the highest aggregate NPV is considered the best.

Capital Rationing – Meaning, Problems, Classifications, Principles, Internal and External Factors, Examples and Conclusion

Capital Rationing Meaning:

Capital rationing means distribution of capital in favour of more acceptable proposals. A firm determines a certain cut-of-point for selecting accepted proposals. The basic reason for capital rationing is that funds to be invested over a long period of time must be distributed most judiciously.

The capital rationing problem is one where not all projects with positive present values (items at the pre-rationing discount rate) can be taken up because of limits on the funds available for investment. It is also a situation in which some projects, with negative present or terminal values, may be expected if they generate funds at crucial times.

There are two problems in capital rationing:

1. Given the cost of capital, which group of investments should be selected? The principle of accepting all the proposals have a positive present value of the firm’s cost of capital is obvious, for a failure to do so would prove critical. Adherence to this principle results in the present value of a firm’s net worth being at a maximum at all points of time.

2. Given a fixed sum for capital investment, which group of investment proposals should be undertaken?

(a) When there is one accounting period, investment proposals should be ranked according to their present values, until the fixed sum is exhausted,

(b) The problem becomes more difficult when the choice is between a single big proposal and a combination of small proposals, though the latter may yield an increment in present values,

(c) There may be increment proposals, some of which require net cash outlays in more than one accounting period. In such cases, a constraint is imposed not only by the fixed sum for capital investment but also by the fixed sums available to carry out present commitments in subsequent time periods,

(d) The selection of the best among mutually exclusive alternatives is done on the basis of a rate of return available among different mutually exclusive projects.

The problems of capital rationing are felt more by firms with fixed capital budgets and a large variety of alternative opportunities which constrain them to take various investment decisions. Proposals are selected from among independent alternatives. Investments may be single-period and multi-period investments.

In single-period investments, proposals are ranked according to their profitability index, which also maximises the present value of the owners’ equity. However, the situation involves outlay in several periods. Multi-period investments have to be accepted because they ensure multiple ratios of returns.

There is a need for capital rationing during a period of budget constraints. During other periods, there may not be any need for capital rationing. However, it is likely that budget constraints may arise during several periods. In that case, rationing brings forth complicated problems.

Proposals may be selected from among inter-dependent alternatives. There may be investment proposals where one cannot be abandoned at the cost of the other. Similarly, there may be contingent projects which are combined with each other.

The existing and new asset selection may also raise unique problems in terms of the variability of their future flows. In this case, a firm should resort to portfolio selection. It may be possible for a firm to select proposals from among inter-dependent alternatives.

At the same time, in relationships, there are three broad classifications of interdependence:

(i) Structural Inter-dependence

It refers to the interaction of the inputs and output among firms and industries. The future earnings from potential investments are likely to be affected by this

inter-dependence, which is also referred to as ‘business risk’. These difficulties might as well make a firm’s flows vulnerable to a collective disaster, which is referred to as ‘portfolio risk’. Added to this, if a firm is highly indebted or levered, the financial risk becomes indispensable.

(ii) Macro-Economic Interdependence

It refers to the interaction of cyclical and seasonal effects on products and markets.

(iii) Demographic Inter-dependence

It refers to the concentration and mobility of the population. This might affect both the product and labour markets. This, in turn, is bound to influence investment decisions.

Complications beset investment decisions under uncertainty.

There are three major problems:

(i) Limited availability of capital;

(ii) Indivisibility of investment projects;

(iii) Inter-dependence of investment proposals.

Limited availability of capital brings to light what is known as capital rationing, which refers to the allocation of a firm’s budgeted investment funds among the most desirable projects. As projects are accepted in ranked order, the cost of some far exceeds the budget for them.

Moreover, certain projects cannot be accepted partially. In this connection, George Phillippatos says, “Investments in plant and equipment are typically all-or-none propositions-hence fractional solutions may not be meaningful for most long-term investment decisions, and the all-or-none ritual may become very important”.

Projects may be mutually exclusive or mutually dependent. It is possible to accept one and reject another, how so ever profitable they might be to the company. Mutually exclusive investments compete in offering services to a firm and hence the acceptance of one may satisfy its demand. In the case of mutually dependent or contingent proposals, one project cannot be undertaken without the other.

Principles of Capital Rationing:

(i) Capital investments are usually planned. The first step in planning capital investments is to fix the selection criteria to determine the acceptability of various proposals. A corporation’s development plant, the size and duration of projects, the expenditure to be incurred on them, the expected rate of return or any other special problems are considered while fixing the selection criteria, which should be flexible enough to accommodate the changes that might take place in a company’s plans from time to time.

(ii) Capital investment proposals are submitted by different departmental heads, including production, market research and development. The proposals of other organisations may also be studied to facilitate comparison with the proposals invited from the firm’s departments.

(iii) At this stage, the feasibility study of each proposal is undertaken to substantiate the estimates of various departmental heads.

(iv) The different proposals are compared to facilitate a better allocation of investment funds. The merits and demerits of each proposal are studied to enable a firm to make comparative recommendations.

(v) A firm measures its ability to finance proposals. It ensures that there is an ample cushion of existing and estimated fund resources to implement a proposal.

(vi) Approved proposals are recommended to the top management in order to enable it to take a final decision.

(vii) The requisite funds are provided as budgeted. The management may provide the resources through internal financing or external financing. It should also time the allocation of funds on different proposals.

(viii) At the final and critical stage, the progress of the project is reviewed and forecasts are reevaluated. If necessary, projects are altered and even suspended.

Factors Leading to Capital Rationing:

Two different types of capital rationing situation can be identified, distinguished by the source of the capital expenditure constraint.

i. External Factors:

Capital rationing may arise due to external factors like imperfections of capital market or deficiencies in market information which might have for the availability of capital. Generally, either the capital market itself or the government will not supply unlimited amounts of investment capital to a company, even though the company has identified investment opportunities which would be able to produce the required return. Because of these imperfections the firm may not get the necessary amount of capital funds to carry out all the profitable projects.

ii. Internal Factors:

Capital rationing is also caused by internal factors which are as follows:

(i) Reluctance to take resort to financing by external equities in order to avoid assumption of further risk.

(ii) Reluctance to broaden the equity share base for fear of losing control.

(iii) Reluctance to accept some viable projects because of its inability to manage the firm in the scale of operation resulting from inclusion of all the viable projects.

The second question is answered by a reference to the capital budget. The level of capital budget will tend to depend on the quality of investment proposals submitted to top management; in addition it will also tend to depend on the following factors-

(a) Top management philosophy towards capital spending.

(b) The outlook for future investment opportunities that may be unavailable if extensive current commitments are undertaken.

(c) The funds provided by current operations.

(d) The feasibility of acquiring additional capital through borrowing or share issues.

Under capital rationing, the management has to determine not only the profitable investment opportunities but also decide to obtain that combination of the profitable projects which yields highest NPV within the available funds by ranking them according to their relative profitability.

Theoretically, projects should be undertaken to the point where the return is just equal to the cost of financing these projects. If safety and the maintaining of, say, family controls are considered to be more important than additional profits, there may be a marked unwillingness to engage in external financing, and hence a limit will be placed on the amounts available for investment. Even though the enterprise may wish to raise external finance for its investment program, there are many reasons why it may be unable to do this.

Examples include:

(a) The enterprise’s past record and its present capital structure may make it impossible or extremely costly to raise additional debt capital.

(b) Its record may make it impossible to raise new equity capital because of low yields or even no yield.

(c) Covenants in existing loan agreements may restrict future borrowing. Further more, in the typical company, one would expect capital rationing to be largely self-imposed

Conclusion:

After going through the detailed analysis of different methods available for evaluating investment proposals it can be concluded that NPV, IRR and PI are the most appropriate techniques. These techniques will give identical results in most of the project evaluation situations.

This means a proposal with positive NPV will have PI > 1 and IRR > cost of capital. But different techniques have their relative merit as per the demand of different decision situations.

If one is asked to decide one technique then NPV method can be described as the best method. Whenever a conflict arises between NPV and IRR then the results given by the NPV method are relied upon. This is because of the fact that NPV of an investment proposal is indicative of its net contribution in absolute terms towards the value of the firm.

Hence NPV method is the best criterion for achieving the objective of the maximization of wealth of shareholders. However, it is always advisable that a finance manager should evaluate investment proposals on more than one criterion before making a final choice.