Dividend refers to that portion of profit (after-tax) which is distributed among the owners or shareholders of the firm. The finance manager has to take few decisions which are inter-related like investment, financing and dividend decisions. Dividend decision is related to the shareholders’ expectation from the shareholder’s share in the profits of the company.

The focus of the dividend decision is on the dividend paid to the equity shareholders, as preference shareholders are entitled to a fixed rate of dividend.

Dividend policy determines the amount of earnings to be distributed amongst the shareholders and the amount of earnings to be retained. Retained earnings are that portion of earnings which is to be ploughed back in the firm as reinvestment.

Dividend Policy refers to the policy chalked out by firms regarding the amount they would pay to their shareholders as dividend. Once firms make profits, they have to decide on what to do with these profits.

ADVERTISEMENTS:

Dividend policy of a company is the strategy followed to decide the amount of dividends and the timing of the payments. There are various factors that frame a dividend policy of the company.

According to Weston and Brigham, “Dividend policy determines the division of earnings between payments to shareholders and retained earnings”.

Contents

- Dividend Policy – An Overview

- Introduction to Dividend Policy

- Meaning of Dividend

- Definition of Dividend

- Meaning of Dividend Policy

- Definition of Dividend Policy

- Objectives of Dividend Policy

- Factors to be Considered While Framing Dividend Policy in an Organization

- Types of Dividends Offered to The Shareholders

- Significance of Dividend Policy

- Importance of Dividend Decision

- Forms of Dividend in a Company

- Alternate Forms of Dividend

- Informational Contents of the Dividend

- Theories of Dividend Policies

- Modigliani-Miller’s Model (M-M’s Model)

- Factors Affecting the Dividend Division of a Firm

- Approaches to Dividend Policy

- Approaches to Dividend Decisions

- Dividend Payout Ratio

- Right Issue of Shares

- Cash Dividend

- Stock Dividends

- Bonus Shares

- Formulating Optimal Dividend Policy

- Benefits of Dividend Payment in a Company

- Stability of Dividend

- Stable Dividend Policy

- Importance of Stable Dividend Policy in Companies

- Corporate Dividend Practice in India

- Informational Contents of the Dividend

- Interdependence of Dividend, Investment and Financing Decisions

- Payment of Dividends and Dividend Distribution Procedure

- Difference between Cash Dividend and Stock Dividend

- Considerations

- Multiple Choice Questions and Answers

What is a Dividend Policy: Meaning, Definition, Objectives, Types, Significance, Forms, Theories, Factors, Approaches, Stable Dividend Policy and More…

Dividend Policy – An Overview

A question arises before the management of a company that what should be its dividend policy and what should be the considerations before the dividend is declared? One thing is sure that the shareholders have a preference for cash dividend and it is necessary to meet their expectations. They are not satisfied by a promise of capital gains because ‘a bird in hand is better than two in the bush’. Secondly, dividend is an important signaling device.

ADVERTISEMENTS:

Since, most of the shareholders, do not understand accounting concepts like book-value per-share, return on equity, earnings per share etc., they tend to measure a company’s performance in terms of dividend distributed by it. A company giving high dividend is perceived to be performing well and a none or low dividend paying company is perceived to be a non-performer.

A company which is consistently increasing its dividend payment is considered to be a growing company and vice versa. Under this situation, it is essential for a company to pay some dividend to its shareholders. The only consideration before them is to decide how much dividend should be paid for the given year?

In its decision to pay dividend to its shareholders, a company should, therefore, consider the following points:

(i) The first thing is to consider the relationship between r and k. If r > k, low dividend should be recommended and vice versa if r < k.

ADVERTISEMENTS:

(ii) The second point to consider in deciding the dividend payout is to look at funds availability. Dividend payment entails an immediate payment of cash and if the funds position is tight, then it is not advisable to give a high dividend.

Similarly, if huge idle funds are available anytime during a year, a company’s management may consider payment of an interim dividend based on its assessment of profit for the year. This relieves the pressure on the company to pay a dividend after the accounting year is over.

(iii) Another consideration before a company is to look at the availability of funds from outside. If funds from outside are not available, then the company has to entirely depend on its internal accruals to meet the requirement of funds.

In such a situation, payment of dividend may be avoided to conserve its financial resources. If, on the other hand, a company can have easy recourse to funds from outside, it may be liberal in giving dividends because any requirement of funds can be easily met by borrowings.

ADVERTISEMENTS:

(iv) Taxation of dividends is also a consideration in deciding the dividend policy. In many countries dividends are taxed in the hands of shareholders. This reduces after tax returns to them. In such a situation, companies may give returns to the shareholders in the form of bonus shares or share buyback. Both these methods give a ‘capital gain.’ in the hands of shareholders, which are taxed at a lower rate rather than the incomes which entail a higher tax rate.

In India, under the present tax laws, dividends are tax free in the hands of shareholders but the company is required to pay a ‘dividend distribution tax’ (DDT), which creates a wedge between burden to the company and the return to the shareholders. This DDT is a disincentive to a company to pay a high dividend to the shareholders.

(v) Before declaring a dividend, a company’s management has to consider whether they will be able to maintain the dividend in future also. If a high dividend is followed by a low dividend in future, it is considered a poor reflection on the working of a company and that has an adverse impact on the market price of the share. It is, therefore, considered better to be conservative i.e. give a low but continuously growing dividend to the shareholders.

(vi) It is also necessary to look at the preference of the shareholders. Do the shareholders prefer cash dividend or do they prefer capital gains. If they prefer cash dividends then the management should adopt a high dividend policy and if they prefer capital gains then it is better to follow a low dividend policy.

ADVERTISEMENTS:

Age profile of the shareholders also has an impact on the preference of the shareholders. If the majority of shareholders are young, they would have a natural preference for growth rather than immediate cash dividend. If they are old, they would have a natural preference for cash dividend rather than growth in future. The dividend policy of a company should take into consideration this factor also.

(vii) There are certain statutory rules and regulations which the governments make with regard to transfer of a portion of profits to statutory and other reserves and for paying dividends. Similarly, the governments often have MOUs with some statutory entities and government corporations. It is necessary to adhere to these regulations, in making dividend decisions.

Dividend Policy – Introduction

Dividend refers to that portion of profit (after-tax) which is distributed among the owners or shareholders of the firm. The finance manager has to take few decisions which are inter-related like investment, financing and dividend decisions. Dividend decision is related to the shareholders’ expectation from the shareholder’s share in the profits of the company.

The focus of the dividend decision is on the dividend paid to the equity shareholders, as preference shareholders are entitled to a fixed rate of dividend.

ADVERTISEMENTS:

Dividend policy determines the amount of earnings to be distributed amongst the shareholders and the amount of earnings to be retained. Retained earnings are that portion of earnings which is to be ploughed back in the firm as reinvestment.

Dividend is important to equity shareholders as it increases their current income. Thus, the crucial issue of financial management is how the earnings of the firm should be divided between retention in the firm and payment to the owners.

Dividends are distributed out of the profits earned by the company. Cash inflows generated by the business are used for payment of dividend to its equity shareholders. Dividend payment is a cash outflow. Dividends are periodic cash payments by the company to its shareholders.

Dividend payment to the equity shareholders are made after making fixed financial payments like interest on debt and dividend on preference shares. To distribute the dividends, company must earn profits.

ADVERTISEMENTS:

Alternative to the distribution of dividend is retained earnings or retention of profits. The choice between payment of dividend and retained earning depends on the effect of this decision on the maximisation of shareholder’s wealth. If the decision to pay the dividend maximises the wealth of the owners then the firm should pay the dividend to its shareholders.

If dividend payment does not maximise the wealth of the owners then firms should retain the earnings and invest these funds in the projects where maximum returns can be gained. A company can declare the dividend in its general body meeting as per the rate recommended by the Board of Directors.

Further the dividend can be interim or final. Board of Directors can pay interim dividend before finalisation of accounts, if they expect sufficient profit in a particular year. Dividends can also be paid in the form of stock i.e. bonus shares.

Dividend Policy – Meaning of Dividend

The term dividend refers to that part of the profit (after tax) which is distributed among the owners/ shareholders of the firm. In other words, it is a taxable payment declared by a firm’s board of directors and given to its shareholders out of the firm’s current or retained earnings, usually quarterly.

Dividends are usually given as cash (cash dividend), but they can also take the form of stock (stock dividend) or other property. Dividends provide an incentive to own stock in stable firms even if they are not experiencing much growth. Firms are not required to pay dividends.

The firms that offer dividends are most often firms that have progressed beyond the growth phase and no longer benefit sufficiently by reinvesting their profits. So they usually choose to pay them out to their shareholders, also called payout.

Dividend Policy – Definition of Dividend

Dividend may be defined as “Divisible profit distributed amongst the members of a company, in proportion to their share in such a manner as is prescribed by the memorandum and Articles of Association of the company”.

ADVERTISEMENTS:

A very brief definition is “a dividend is a share of the profits of a company dividend amongst the shareholder”.

Dividend Policy – Meaning

Dividend Policy refers to the policy chalked out by firms regarding the amount they would pay to their shareholders as dividend. Once firms make profits, they have to decide on what to do with these profits.

The firms have two options with them:

a. They can retain these profits within the firm.

b. They can pay these profits in the form of dividends to their shareholders.

ADVERTISEMENTS:

The dividend policy to be adopted by the firm is based on these two options. If the firm pays dividends, it affects the cash flow position of the firm but earns goodwill among the investors who, therefore, may be willing to provide additional funds for the financing of investment plans of the firm.

On the other hand, the profits which are not distributed as dividends become an easily available source of funds at no explicit costs. However, in the case of ploughing back of profits, the firm may lose the goodwill and confidence of the investors and may also defy the standards set by other firms.

Therefore, in taking the dividend policy, the finance manager has to strike a balance between distribution and retention. He should allocate the earnings between dividends and retained earnings in such a way that the value of the firm (i.e., wealth of shareholders) is maximised.

Dividend Policy – Definitions

Dividend policy of a company is the strategy followed to decide the amount of dividends and the timing of the payments. There are various factors that frame a dividend policy of the company.

Availability of better investment opportunities, estimated volatility of future earnings, tax considerations, financial flexibility, flotation costs and various other legal restrictions affect a company’s dividend policy.

The term dividend policy has been defined by some authors as given below:

ADVERTISEMENTS:

(i) Weston and Brigham: Dividend policy determines the division of earnings between payments to shareholders and retained earnings.

(ii) Gitman: The firm’s dividend policy represents a plan of action to be followed whenever the dividend decision must be made.

Definition:

According to Weston and Brigham, “Dividend policy determines the division of earnings between payments to shareholders and retained earnings”.

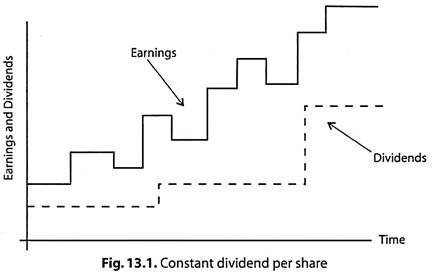

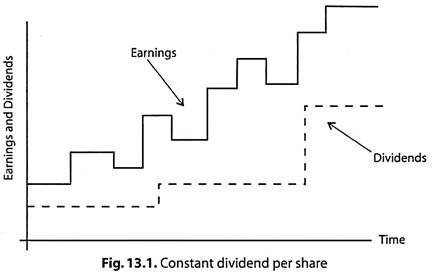

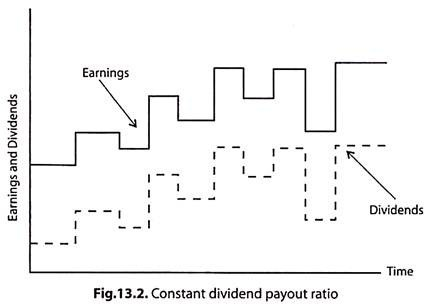

While determining the dividend policy, the dividend declared during previous years may be taken as a base and the same rate is followed in the coming years. Generally the Board of Directors aims at maintaining the dividend rate, which we may call a stable Dividend Policy.

For this purpose a dividend equalisation fund is created out of profits, to equalise the profits of the coming years.

Top 4 Objectives of Dividend Policy

The main objective of financial management is to maximize the value (wealth) of the company. The market value of equity shares of a company is greatly affected by its policy regarding allocation of net profit/surplus between pay-out (dividend) and plough-back (retained earnings).

ADVERTISEMENTS:

“Whether to distribute dividend or not” is not the alternative available to management. Of course, the real question is as to how much to distribute as dividend Answer to this question lies in the dividend policy.

While chalking out dividend policy the following points of objectives must be considered:

(i) Whether the payment of dividend should be made from the initial years of operations (i.e., should there be regular dividend).

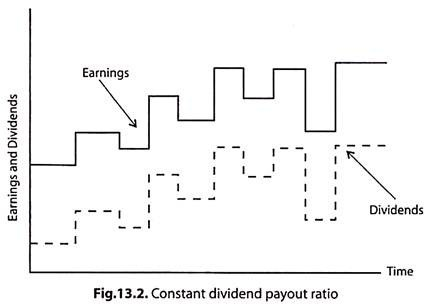

(ii) Whether a fixed amount of dividend or fixed percentage of dividend should be given irrespective of the amount (volume) of profit earned (i.e., should there be constant dividend).

(iii) Whether a definite percentage of profit should be given as dividend which means variable dividend per share (i.e., a definite pay-out ratio should be there).

ADVERTISEMENTS:

(iv) Whether the dividends be paid in cash or in other forms.

Before framing dividend policy, the organization should take into consideration the following factors:

Factor # 1. Fund Requirements:

Refer to the availability of funds with the organization so that it can distribute dividends. If the organization does not have sufficient funds then it cannot distribute dividends.

Factor # 2. Expectations of Shareholders:

Influence the decision of the board of directors to distribute dividends. If the organization generates more profit, then the expectations of the shareholders increase and they demand a high dividend.

Generally, the shareholders prefer to receive a regular amount of dividend. Therefore, the organization should take into consideration the expectations of shareholders while determining the dividend policy.

Factor # 3. Status quo Factor:

Refers to different factors, which the organization needs to consider while determining dividend policy. There is no strict law regarding the formulation of dividend policy. However, in general, rate of dividend increases with the increase in profit and decreases with the decrease in profit.

According to professor I. M. Pandey, organizations should know the answers of following questions before formulating dividend policy:

i. What are the preferences of shareholders: dividend income or capital gain?

ii. What are the financial needs of the company?

iii. What are the constraints on paying dividends?

iv. Should the company follow a stable dividend policy?

v. What should be the form of dividend (i.e., cash or bonus shares)?

Following are the different types of dividends offered to the shareholders of the firm:

Type # (i) Regular Dividend:

It is paid annually, proposed by the board of directors and approved by the shareholders in general meeting. It is also known as final dividend because it is usually paid after the finalisation of accounts.

It is generally paid in cash as a percentage of paid up capital, say 10% or 15% of the capital. Sometimes it is paid per share. No dividend is paid on calls-in-advance or calls-in-arrear.

Type # (ii) Interim Dividend:

If Articles permit, the directors may decide to pay a dividend at any time between the two Annual General Meetings before finalising the accounts. It is generally declared and paid when the firm has earned heavy profits or abnormal profits during the year and directors wish to pay the profits to shareholders. Such payment of dividend in between the two Annual General meetings before finalisation of accounts is called Interim Dividend.

No interim dividend can be declared or paid unless depreciation for the full year (not proportionately) has been provided for. It is thus an extra dividend paid during the year requiring no need of approval of the Annual General Meeting. It is paid in cash.

Type # (iii) Stock Dividend:

Stock dividend is in the form of issue of bonus shares to the equity shareholders in lieu or addition to the cash dividend. It is a permanent capitalization of earnings. It will increase the capital and reduce reserves and surpluses. It has no impact on the wealth of shareholders.

Shareholders who receive stock dividends receive more shares of the firm’s stock, but because the firm’s assets and liabilities remain the same, the price of the stock must decline to account for the dilution.

For shareholders, this situation resembles a slice of cake. You can divide the slice into two, three or four pieces and no mallei how many ways you slice it, its overall size remains the same.

After a stock dividend, shareholders receive more shares, but their proportionate ownership interest in the firm remains the same and the market price declines proportionately

Stock dividends usually are expressed as a percentage of the number of shares outstanding. For example, if a firm announces a 10% stock dividend and has 1 million shares outstanding, the total shares outstanding are increased to 1.1 million shares after the stock dividend is issued.

Type # (iv) Bond Dividend:

In rare instances, dividends are paid in the form of bonds for a long term period. The firm generally pays interest on these bonds and repays the bonds on maturity. Bond dividend enables the firm to postpone payment of cash.

Type # (v) Property Dividend:

Sometimes, dividend is paid in the form of assets instead of payment of dividend in cash. The distribution of dividend is made whenever the asset is no longer required in the business such as investment or stock of finished goods.

But it is however important to note that in India, distribution of dividend is permissible in the form of cash or bonus shares only. Distribution of dividend in any other form is not allowed.

Top 6 Significance of Dividend Policy – Resolves Investors’, Uncertainty, Investors’ Desire for Current Income, Institutional Investors’ Requirement and More…

Investors prefer stable dividend policy of the company and will be willing to pay a premium on shares of a company having stable dividend policy. The stable dividend policy is also in interest of the company itself, as it enhances the reputation of the company in the market.

Significance of dividend policy are as follows:

Significance # 1. Resolves investors’ uncertainty

The investors do not like the unstable dividend policy of the company. Stable dividend policy of the company boosts the confidence of shareholders and they make in mind that the company will also pay a dividend in a non-profit period.

In case of abnormal profits, the amount of dividend is increased by the company. Thus, the stable dividend policy of the company removes uncertainty of payments in the mind of shareholders.

Significance # 2. Investors’ desire for current income

Investors, usually, prefer current income over the capital gains. Dividends are like wages and salaries for many investors, like—old age and retired persons, women investors. This class of investors needs the regular income to meet their living expenses.

The stable dividend policy provides regular and upward moving income to the investors. Unstable dividend policy creates uncertainty about dividend payments. The investors believe that current income is better than future income because the future is uncertain.

Significance # 3. Institutional investors’ requirement

The institutional investors also invest in shares of the companies. Various government bodies prepare a list of companies/securities in which institutional investors, like—pension funds, insurance companies, banks and other institutional investors may invest. The recommendatory list is prepared on certain criteria including uninterrupted pattern of dividends.

Significance # 4. In India, financial institutions

Like—IDBI, LIC, IFCI and certain other financial institutions, invest in corporate securities. These institutional investors generally invest in shares of companies that use to pay regular dividends. Thus, the stable dividend policy of a company is a pre-requirement for investment by institutional investors in its securities.

Significance # 5. Raising additional finances

The stable dividend policy is advantageous to the company in raising further funds from the market. The investors preferably invest in securities of a company paying regular dividends.

The stable dividend policy also enhances the reputation of the company in the market and market may have more confidence in the company. These factors help in raising additional finances when the company requires these for investment in profitable opportunities.

Significance # 6. Informational contents

The stable dividend policy of a company generally conveys the view of management that the future of the company is better. A company not performing well cannot sustain the stable dividend payments. Thus, stable dividend policy signals the informational contents about the performance of the company.

If a company is making loss or earning lower profits and paying stable dividends for a number of years, then there is something wrong in the function of the firm. The market evaluates the companies on the basis of informational contents of the companies. Stable dividend policy signals positive contents about the company.

Dividend Policy – Importance of Dividend Decision: Investors’ Preference for Dividends, Informational Content of Dividend and More…

Importance of dividend decision are as follows:

i. Investors’ Preference for Dividends:

There is a class of investors who prefer dividends over capital gain. This class primarily includes old aged, retired and more risk averse investors who need current income in the form of dividends to meet their expenses.

ii. Informational Content of Dividend (Information Signaling):

Dividend payments convey important information about the company’s performance and future prospects. Hence For example- if a firm followed a stable dividend policy over a long period of time and now it is increased then investors may think that the future prospects of the company are promising.

Basically, the idea is that management, instead of announcing about the company’s future prospects can increase or decrease dividends depending on the situation and convey important information.

It is said that action speaks louder than words. Hence if a company increases its amount of dividend in expectation for higher profitability then the impact would be much better than when it reports in its annual report about the expected profitability. Moreover, statements or words may be misinterpreted while dividend payments convey the precise and correct information.

iii. Bird-in-Hand is Better than Two in Bush I.E. Resolution of Uncertainty:

It is often said that a bird in hand (i.e. dividends) is better than two in bush (i.e. capital gain). Payment of dividends resolves uncertainty about the future. Capital gains are realized in the future and future is uncertain, while dividends are paid at present and hence payment of dividends is considered better than capital gain from the viewpoint of a risk averse investor.

iv. Distribution of Temporary Excess Cash:

Payment of dividends is a good usage of temporary excess cash. This is because if the company does not have profitable investment opportunities then it makes sense to distribute excess cash to the shareholders so that they can invest it somewhere else and earn a good return. Cash rich companies which do not distribute dividends are not considered good by investors.

Dividend Policy – Forms of Dividend in a Company: Scrip, Bond, Property, Cash and Stock Dividend

Dividend that is being distributed by a company may take several forms, viz.:

(a) Scrip dividend,

(b) Bond dividend,

(c) Property dividend,

(d) Cash dividend, and

(e) Stock dividend.

In India, only cash dividends and stock dividends are declared and paid.

We shall give here a brief explanation of these forms of dividend:

Form # (a) Scrip Dividends:

When earnings of the company justify dividend, but the company’s cash position is temporarily weak and does not permit cash dividend, it may declare dividend in the form of scrips. In this method of dividend, the shareholders are issued transferable promissory notes which may or not be interest bearing.

Scrip dividends are justified only when the company has really earned profit and has only to wait for the conversion of other current assets into cash in the course of operations.

Form # (b) Bond Dividends:

Sometimes, the dividends are paid in bonds or notes then have a long enough term to fall beyond the current liability group. Effect of both scrip dividends and bond dividends is the same except that the payment is postponed in the bond dividends.

Form # (c) Property Dividends:

This involves a payment with assets other than cash. This form of dividend may be followed wherever there are assets that are no longer necessary in the operation of the business.

Form # (d) Cash Dividend:

Cash dividend is the dividend which is distributed to the shareholders in cash out of the earnings of the business.

Form # (e) Stock Dividend (Bonus Shares/Share):

Bonus shares are additional shares given to the shareholders without any additional cost, based upon the number of shares that a shareholder owns.

An offer of free additional shares to existing shareholders. A company may decide to distribute further shares as an alternative to increasing the dividend payout. Also known as a “scrip issue” or “capitalization issue”.

Alternate forms of dividend are as follows:

1. Bonus Shares:

Bonus shares are issued out of the firm’s reserves & surplus. In other words through bonus issues, firms capitalize their reserves. Recently Reliance Industries Ltd. announced a huge bonus of one share for every share held by its shareholders. After issue of bonus shares proportionate holding of a shareholder remains the same.

However, EPS, market price and value per share declines. A firm can issue bonus shares only out of its reserves created from profits and share premium collected in cash only. There are certain regulations on issue of bonus shares.

Similarly, a firm can issue bonus only if its article of association authorizes it to do so. In addition, bonus cannot be given to partly paid shares and it cannot be issued in lieu of dividend. There are certain benefits of bonus shares.

For example, higher dividend income to the shareholders in future that is exempt in the hands of shareholders. After bonus issues, no. of shares outstanding in the market is increased in the market. This promotes more trading in the firm’s shares.

Price after bonus issue = (No. of shares before bonus issue ‘”‘current market price)/No. of shares after bonus issue.

2. Stock Split:

Stock split means reduction in the par value of shares. For example, par value of a share is X 100 and there is a 4:1 split. In this case, every shareholder will get four shares with a par value of Rs. 25 in lieu of every share with a par value of Rs. 100. In the share split, firm’s reserves remain intact because there is no capitalization of reserves as in the case of bonus shares.

The book value, EPS and market price reduces as in case of bonus issue due to increase in no. of shares. After splitting the shares the shareholder’s fund remain same as before share split.

Price after stock split = (No. of shares before stock split *current market price)/No. of shares after stock split.

3. Reverse Split:

It is the opposite of a stock split. In stock split, par value is reduced but in case of reverse split, par value is merged. For example, if a company’s share’s par value is Rs. 10 each and there is 1: 4 reverse split.

The par value of shares will increase to Rs. 40 per share because four shares with par value of Rs. 10 each will be merged into a single share with par value Rs. 40.

Price after reverses split = (No. of shares before reverses split *current market price)/No. of shares after reverse split.

4. Buy Back:

Buy back of share means purchasing of its own shares by the company from its shareholders. Buy back can be done by two methods. First is the Tender method in which the company offers to buy its shares back, directly from shareholders, at a specified price in a specified period, which is usually one month.

Second method is an open market purchase method in which the company buys back its shares from the secondary market. The buyback causes reduction in capital of the company and increase in EPS.

Generally companies buy back their shares when a) it has surplus cash b) it wants to increase its market price and c) wants to maintain its capital structure in the current form. There are certain advantages like increase in future dividends and strong cash flow position in future.

Price after buy back = No. of shares before buy back *current market price/No. of shares after buy back.

Dividend Policy – Informational Contents of the Dividend

Informational contents of the dividend are summarized below:

There is a wide gap in respect of availability of true information regarding the internal functioning of a company between the managers (insiders) and the shareholders (outsiders).

Thus, asymmetry exists between the managers of the company and shareholders of the company so far the availability of information is concerned.

In such a scenario, the announcement of dividend or change in dividend policy by the managers act as a medium of communication regarding prosperity or probable financial condition to the shareholders. Thus, payment of dividend has embedded in it informational content regarding proper functioning of the company.

The expression “information content of dividends” refers to the hypothesis according to which unexpected dividends are believed to convey information about future unexpected earnings in a company. This new information should allow market participants to forecast future earnings more precisely.

The hypothesis is based on the assumption that an asymmetric situation exists between corporate managers and the market participants or shareholders in the way that corporate managers possess inside information about the future prospects of the company and any change in dividend policy has signaling effects.

Signaling is the idea that one agent conveys some information about itself to another party through an action. It is used in situations where asymmetric information exists between two interested parties.

In this case, since managers know more about the internal affairs of the company than investors, investors will find “signals” in the managers’ actions to get clues about the firm.

For instance, when managers are apprehensive or doubtful about the firm’s ability to generate cash flows in the future they may keep dividends constant or may even reduce the amount of dividends . The investors will take note of this action and may choose to sell the shares of the firm.

However, if the dividends have been reduced or retained for reinvestment purposes by the company, the share price may react upwards also if the rate at return on investments by the company happens to be higher than expected rate of return of the shareholders.

In view of the above, finance managers very cautiously and carefully deal in framing dividend policy of a company since managers believe that dividend policy influences the value of their company and hence the wealth of their shareholders. However, academicians (and even some managers) question the value added by a cautiously chosen dividend policy.

Some researchers have even suggested that dividend policy is irrelevant for the value of the company. As already explained, there are different opinions with regard to the relationship between payment of dividend and value of the firm.

In real life situations, dividend decisions are seen by investors as revealing information about a firm’s prospects therefore firms are very particular about these decisions.

From the above, we can conclude that payment of dividend by a company to its shareholders not only rewards the shareholders but also conveys information about the future prospects of the company.

Theories of Dividend Policies – Tax Differential Theory, Residual Theory, 100% Payout Theory, 100% Retention Theory, Investor Rationality Theory and Span of Control Theory

The important theories of dividend policy are discussed in brief as follows:

Theory # 1. Tax Differential Theory:

According to this theory, since dividends are effectively taxed at higher rates than capital gains, investors require higher rates of return on stocks with high dividend yields. According to this theory, a firm should pay a low (or zero) dividend in order to minimize its cost of capital and maximize its value.

The tax system may tend to favour retention, and hence low dividend yield shares have been likely to be in great demand by high rate taxpayers, who prefer a low dividend payout and a high rate of earnings retention in the hope of an appreciation in the capital value of the company. Small shareholders may prefer a relatively high dividend payout rate. The dividend policy of such a firm may be a compromise between a low and a high payout.

Theory # 2. Residual Theory:

According to the residual theory of dividends, the firm should follow its investment policy of accepting all positive NPV projects, and paying out dividends if, and only if, funds are available. If the firm treats dividends as a residual, the dividend can vary highly from period to period, depending upon the investment plan and operating results of the firm.

If a firm attracts investors falling into a particular ‘dividend clientele’, it suggests that the firm should maintain a fairly stable dividend policy. The residual dividend policy is used by most firms to set a long-run target payout.

Theory # 3. 100% Payout Theory:

Rubner (1966) argued that shareholders prefer dividends and directors requiring additional finance would have to convince investors that proposed new investments offer positive increases in wealth.

This would encourage the rejection of projects which serve mainly to enhance the status and job security of managers and employees and the company can adopt a policy of 100% payout. In practice, companies do not generally pursue a target payout ratio of 100%.

Theory # 4. 100% Retention Theory:

Clarkson and Elliot (1969) put forth their argument that given taxation and transaction costs, dividends are a luxury that neither shareholders nor companies can afford and hence the firm can follow a dividend policy of 100% retention.

They argue further that successful investment opportunities are open to the firm and that there is no point in paying dividends and raising additional capital.

Theory # 5. Investor Rationality Theory:

Shefrin and Statman (1984) supported their argument based on the psychological preferences of individual investors. Their argument is that an investor who wishes to conserve his/her long-run wealth could stipulate that portfolio capital should not be consumed, only dividends.

The investor can select a dividend payout ratio that conforms to his/ her desired consumption level. Thus, even though taxes and transaction costs may favour capital gains, an investor may find cash dividends attractive and, therefore, be willing to pay the appropriate premium.

Theory # 6. Span of Control Theory:

Managers in an organization look at the cash flows generated from the operations as an important and convenient source of new capital. The professional managers prefer to have a large span of control as measured by the number of employees, sales, market value, total assets or total expenditure.

In pursuit of the managerial objective of increasing the span of control, directors are expected to prefer retention to distributions. Retentions increase status, remuneration and security of managers. Also increases in the firm’s investment schedule should result in growth in the value of shares to the extent that retained cash flows are reinvested in profitable projects.

Dividend Policy – Modigliani-Miller’s Model (M-M’s Model): Meaning, Assumptions, Example and Evaluation

Meaning:

Modigliani-Miller’s (M-M’s) thoughts for the irrelevance of dividends are most comprehensive and logical. According to them, dividend policy does not affect the value of a firm and is, therefore, of no consequence.

They are of the view that the sum of the discounted value per share after dividend payments is equal to the market value per share before dividend is paid. It is the earning potential and investment policy of a firm rather than its pattern of distribution of earnings that affects the value of the firm.

Basic Assumptions of M-M Approach:

(1) There exists a perfect capital market where all investors are rational. Information is available to all at no cost; there are no transaction costs and floatation costs. There is no such investor as could alone influence the market value of shares.

(2) There does not exist taxes. Alternatively, there is no tax differential between income on dividend and capital gains.

(3) Firm’s investment policy is well planned and is fixed for all the time to come.

(4) There is no uncertainty as to future investments and profits of the firm. Thus, investors are able to predict future prices and dividends with certainty. This assumption is dropped by M-M later.

M-M’s irrelevance approach is based on an arbitrage argument. Arbitrage is the process of entering into such transactions simultaneously as exactly balance or completely offset each other. The two transactions in the present case are payment of dividends and garnering funds to exploit investment opportunities.

Suppose, for example, a firm decides to invest in a project it has two alternatives:

(1) Pay out dividends and raise an equal amount of funds from the market;

(2) Retain its entire earnings to finance the investment programme. The arbitrage process is involved where a firm decides to pay dividends and raise funds from outside.

When a firm pays its earnings as dividends, it will have to approach the market for procuring funds to meet a given investment programme. Acquisition of additional capital will dilute the existing share capital which will result in drop in share values.

Thus, what the stockholders gain in cash dividends they lose in decreased share values. The market price before and after payment of dividend would be identical and hence the stockholders would be indifferent between dividend and retention of earnings. This suggests that the dividend decision is irrelevant.

M-M’s argument of irrelevance of dividend remains unchanged whether external funds are obtained by means of share capital or borrowings. This is for the fact that investors are indifferent between debt and equity with respect to leverage and the real cost of debt is the same as the real cost of equity.

Finally, even under conditions of uncertainty, dividend decisions will be of no relevance because of operation of arbitrage. Market value of shares of the two firms would be the same if they are identical with respect to business risk, prospective future earnings and investment policies.

This is because of rational behaviour of investors who would prefer more wealth to less wealth. Difference in respect of current and future dividend policies cannot influence share values of the two firms.

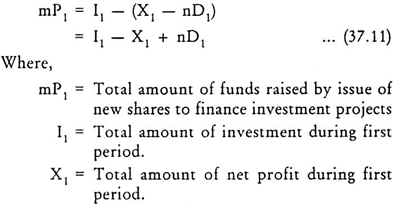

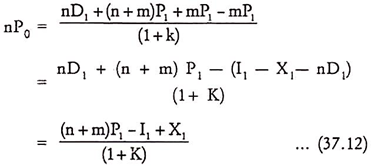

M-M approach contains the following mathematical formulations to prove irrelevance of dividend decision.

The market value of a share in the beginning of the year is equal to the present value of dividends paid at the year-end plus the market price of the share at the end of the year, this can be expressed as below –

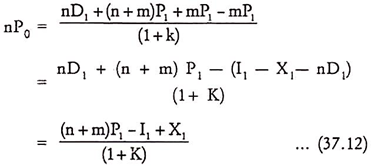

Thus, the total value of the firm as per equation (37.2) is equal to the capitalised value of the dividends to be received during the period, plus the value of the number of shares outstanding at the end of the period, less the value of the newly issued shares.

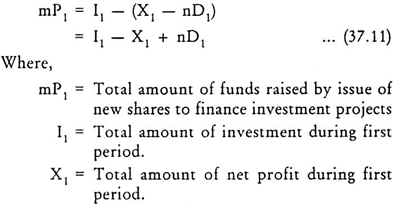

A firm can finance its investment programme either by ploughing back of its earnings or by issue of new shares or by both. Thus, total amount of new shares that the firm will issue to finance its investment will be –

On comparison of equation (13) with equation (11) we find that there is no difference between the two valuation equations although equation (13) has expressed the value of firm without dividends. This led M-M to conclude that dividend policy has no role to play in influencing share value of a firm.

Evaluation of M-M’s Model:

M-M model of dividend irrelevance is laid down on a number of simplifying and potentially restrictive assumptions. In a world where taxes, transaction costs and a host of other complexities do exist, it should come as no surprise that the irrelevance proposition is only a starting point for our discussion.

The following paragraphs are devoted to review and critically examine the more important arguments against irrelevance.

(a) Risk Aversion:

The first argument set forth in support of the relevance of dividend policy is that investors are always cautious about the future which is uncertain and unpredictable. They are interested more in short-run income which is more certain and assured than in the long-run earnings that are highly unpredictable.

Since dividend averts risk in respect of availability of income to investors, they may give greater weightage to expectation concerning present dividends than to beliefs as to what the trend in price and dividends might be over the long-run.

Furthermore, the present value of income received in the short-run is higher than the value of future earnings. In view of this, Gordon holds that stockholders can remain neutral between dividends and capital gains. They prefer early resolution of uncertainty and are willing to pay a higher price for the stock that offers greater current dividend all other things remaining constant.

(b) Desire for Current Income:

Investors also prefer regular dividend payment to future capital gains because that helps them to satisfy their current requirements. However, this argument is not accepted universally.

It is argued that stockholdings can liquidate a portion of their stockholders at times when they need money to meet their requirements. Since with perfect markets and no taxes the homemade dividends are perfect substitutes for corporate dividends, there is no reason to anticipate that increasing risk and desire for current income will alone create investor dividend preferences.

It is true that stockholders can procure funds by liquidating their shares and make use of these in whatever manner they like as in the case of dividend income. But under conditions of uncertainty, share prices oscillate and certain stockholders may be averse to disposing off shares for income at fluctuating prices.

Alongside this, it is not always easier to sell a small portion of stock periodically incurred for sale of securities which will consume a portion of income. Thus, to avoid risks and inconveniences and costs involved in liquidation of shares, stockholders have definite preference for dividend income.

(c) Information Content of Dividends:

In arguing for the significance of dividend policy it has been contended that dividend decision affects share values because amount of dividends and the manner in which they are distributed are considered a significant piece of information regarding the future earnings capacity of the firm; a high dividend exhibiting small but steady growth is looked upon as an index of stability of the organisation.

Empirical study of Richardson Pettit has substantiated this notion. The main finding of Pettit’s study is that the market reacts to announcements of dividend changes and these announcements convey significantly more information than earnings announcements.

M-M do not disagree with the possibility of the information effect of the dividend but they continue to maintain that it is not dividend as such but present and expected future performance of the organisation which affects value of the firm and dividend is only a reflector of these variables.

(d) Sale of Additional Stocks at Lower Prices:

Irrelevance doctrine is based on the argument that the firm distributing all of its earnings will be able to sell additional stocks at current prices. In order to tempt new investors or existing ones to buy new stocks the company may offer lower price.

Linter argues that the equilibrium price of a share of stock will tend to decline in correspondence to sale of additional stocks for replacement of dividend. Thus, ceteris paribus, this mix of equity share capital in capital structure would result in a fall in total value of equity of the corporation which implies a definite preference for retention as opposed to dividend payments.

(e) Differential Tax Treatment of Dividends and Capital Gains:

The tax treatment of dividends as distinct from capital gains explains investors preference for income retention. Under the existing provision of Indian Income- tax Act an investor is required to pay tax on dividend income at an ordinary income-tax rate applicable to the investor’s income which is usually higher than the capital gains tax rate.

Moreover, capital gains will be taxable only when stocks are sold while dividend income is taxed immediately when it is paid. For these reasons, there is a propensity among some stockholders to prefer retention of earnings to current dividends.

Despite the pervasiveness of the differential tax effect, there are two tax provisions that have an opposite effect. One is the tax exemption of dividend income up to Rs.7,000. Although dividends are treated as ordinary income for tax purposes, there is Rs.10,000 ceiling up to which dividend income is not taxed at all.

This provision is very likely to create a preference for current dividends on the part of small investors. For corporate investors, intercompany dividends received by a domestic company from domestic companies belonging to certain priority industries like fertilizers, paper and pulp, cement and pesticides are totally exempted.

Accordingly, there would be a preference for current dividends on the part of these investors. However, relatively larger investors will continue to have definite preference for retention of earnings.

Furthermore, since inter corporate dividends received from non-specified companies continue to be taxed at 60 per cent rate, corporate investors having employed their resources in the above group of companies would have preference for retention of earnings.

(f) Transaction Costs:

Existence of transaction costs in the stock market also justifies the strong bias of investors for retention of earnings. Two types of transaction costs are relevant for dividend policy — one is the cost borne by the company when it visits the market for securing funds and the other is the cost borne by investors when they trade securities.

The costs to a company of raising external capital are of four basic types: legal, selling, underwriting and underpricing. These costs vary significantly with quantum and kinds of capital raised.

In view of this, the firm gets less than a rupee after floatation cost per rupee of external financing. These costs can be avoided in case the firm decides to retain earnings. This is why internal financing is always cheaper than external financing.

Transaction costs, which investors desiring to liquidate a portion of his holdings have to bear, tend to restrict the arbitrage process. Because of this, such stockholders with high consumption desires in excess of current dividend income would like the firm to pay additional dividend rather than liquidate his holdings. In contrast to this, the stockholders not desiring dividends for current consumption would prefer to reinvest funds in the company.

Thus, due to transaction cost factor, while certain groups of investors have definite bias for dividend income, others would have preference for retention of earnings.

(g) Erratic Behaviour of Investors:

M-M’s proposition that investors always act rationally is not necessarily true. An investor may buy an undervalued stock even though he expects the share price to fall further and he may sell an overvalued stock even though he expects the market to show a rising tendency.

The above analysis posits that in the real world, capital market conditions are neither perfect nor does the investor always behave rationally and taxes and floatation costs do exist. In view of these factors, it would be reasonable to contend that dividend policy does affect the price of a share of stock.

Informational contents to dividend further add to the significance of dividend decision. During a period of uncertainty the importance of dividend decision becomes more pronounced because dividend income currently available minimises risks involved in future gains.

Miller and Modigliani’s arguments of irrelevance of dividend decision are based on such assumptions as are not found in the real world. Thus, dividend policy decisions would have a definite impact on share values.

Dividend Policy – 8 Major Factors Affecting the Dividend Division of a Firm: Liquidity, Requirement of Funds, Cost, Control, Expectation, Taxes and More…

The following factors affect dividend decision of a firm:

Factor # 1. Liquidity:

Liquidity plays an important role in dividend decisions. A company will have to pay a dividend within 14 days from the date of declaration. A firm, having high liquidity despite low profitability, prefers high payout and a firm, having low liquidity, despite high profitability prefers low payout.

Factor # 2. Requirement of Funds:

The firms preferring to finance its capital expenditure out of its internal resources will go for a low payout ratio.

Factor # 3. Cost:

Financing from external equity is costlier than financing from retained earnings because fresh issues are made at a discount. This leads to underpricing of IPOs.

Factor # 4. Control:

Financing from external equity causes loss in control except in case of right issues. This is so because in case of fresh issue, existing shareholders share their control with new shareholders, but in case of financing from internal sources shareholding is not affected.

Factor # 5. Expectation:

Shareholders expectations also play a very important role in determining dividend payout ratio. In case shareholders show their interest in the current dividend, the companies pay a higher dividend. However, in case shareholders are more interested in capital gains, firms may declare lower payout.

Factor # 6. Taxes:

Dividend from any domestic company is exempt in the hands of the recipient. However, the company paying dividends has to pay a distribution tax on its distributed profit @ 16.995%. The long-term capital gain arising on transfer of these shares is also exempt in the hands of the transferor.

Factor # 7. Access to external financing:

If a firm has easily accessible external financing resources then that firm may declare higher payout. However, in case of a firm not having access to external financing, lower payout is declared. It is because these types of firms mainly depend upon their internal sources.

Factor # 8. Inflation:

During the period of inflation, generally, companies declare lower payout or no dividend. It is because companies may find their depreciation provision not enough to replace its assets. The depreciation provisions are made based on original cost of assets.

Approaches to Dividend Policy – Irrelevance Approach (Modigliani and Miller) and Relevance Approach (Walter and Gordon)

One group of economists believes that there is no impact of dividend policy on the value of the organization. It means that whether the management retains the profit in the business or distributes it among shareholders, the value of the organization would not be affected by it. This is known as the irrelevance approach.

On the other hand, other groups of economists believed that dividend policy influences the value of the organization. It implies that if the profit would be retained or distributed among the shareholders, it affects the value of the organization. This is known as the relevance approach.

Let us now discuss these approaches in detail:

Approach # 1. Irrelevance Approach (Modigliani and Miller):

The irrelevance approach states that the dividend policy does not influence the value of an organization. It argues that the dividend is a residual, which is paid after paying rate of interest, corporation tax and other liabilities out of profit.

The irrelevance approach states that the decision to pay the dividend depends upon the availability of investment opportunities. If the organization has profitable investment opportunities then the profit would be ploughed back in the business.

Otherwise, the dividend would be distributed among the shareholders, so that they can invest in other profitable projects and earn high returns. The organization takes the decision to invest profit by comparing the return on the investment (r), and the cost of the capital (k).

If r > k, then the profit would be ploughed back in the business. However, if the r < k, then the profit would not be invested further in the organization.

This approach is based on the assumption that the shareholders prefer appreciation in the capital rather than regular dividend. If the shareholders are convinced that the organization would generate more profit by investing the profit then they would not demand a dividend.

This happens because the shareholders believe that more profit would result in the capital appreciation, which increases the market value of their shares. However, if the investment project of the organization starts incurring loss, the shareholder would prefer to get back their dividend.

There is a very popular theory in support of this approach given by Modigliani and Miller. This theory is also known as the MM model. As per the MM model, the dividend policy has no impact on the value of an organization (or market price of shares); rather it is the investment decision that affects the organization’s value.

According to Modigliani and Miller’s hypothesis “under condition of perfect capital market, rational investors, absence of tax discrimination between dividend income and capital appreciation, given the firm’s investment policy, its dividend policy may have no influence on market price of shares”

The MM model of irrelevance approach is based on the following assumptions:

i. The conditions of perfect market exist

ii. Investors are rational and the securities are infinitely divisible

iii. Absence of transaction and flotation cost

iv. Corporation tax does not exist

v. Investment policy would not change

vi. Investors’ future earnings can be predicted with perfect certainty

The MM model is based on the arbitrage process to determine the irrelevance of the dividend decision. In the arbitrage process, the organization enters into two transactions, which completely offset each other.

These two transactions are paying dividends and raising external loans. It has been assumed that the organization distributes dividends among the shareholders, and raises the same amount of capital from the market.

The arbitrage condition involved in these transactions states that the payment of the dividend would be offset by external borrowing of the fund. When the organization pays a dividend, then the market value of its shares decreases. Therefore, the gain of the shareholders in the form of dividend would be neutralized by decrease in the value of shares due to dividend distribution.

As a result of this, the position of the shareholders would remain unchanged. Therefore, the decision to distribute dividends is irrelevant, as it does not affect the value of an organization.

The mathematical representation of the irrelevance approach is as follows:

P0= [1 / (1+Ke)] x (D1 + P1)

Where,

P0 – Current Market Price

Ke – Cost of Equity Capital

D1 – Dividend received at the end of period 1

P1 – Market price of a share at the end of period 1

However, this approach is criticized on the following grounds:

i. Believes that the perfect market conditions exist, which is a rare phenomenon

ii. Assumes that there is no taxation and transaction cost, which is not possible in a real situation

iii. Does not differentiate between retained earnings and cost of capital

iv. Assumes that information is freely available about all the transactions, which is not possible in a real situation

v. Ignores the risk involved in the future investments

Approach # 2. Relevance Approach (Walter and Gordon):

The relevance approach states that the dividend policy plays an important role in determination of the value of an organization. It is based on the assumption that the shareholders give priority to current consumption rather than future earning, which involve the risk element.

The economists who were in support of the relevance approach include Walter and Gordon. They have given their hypothesis in favor of the relevance approach separately as Walter’s model, and Gordon’s model.

According to the model given by Walter, dividends are considered as relevant and the dividend policy and investment policy of an organization are interrelated. The Walter model lays emphasis on the relationship between return on organization’s investment (r) and the cost of capital (K).

At any point of time, dividend policy can be determined by finding relationship between r and K, which has been explained in the following points:

i. r > K – Implies that the rate of investment is greater than the cost of capital. In such a situation, the organization would retain its earnings to invest in the project and does not distribute dividends.

ii. K> r – Implies that the rate of investment is lesser than the cost of capital. In such a situation, the organization would not retain its profit to invest in the project and may distribute the dividend.

iii. K= r – Implies that the rate of investment is equal to the cost of capital. In such a situation, the organization would not generate either profit or loss from the project. Therefore, the organization would be indifferent whether to retain the earnings or distribute the dividend.

The Walter’s model is based on the following assumptions:

i. External sources of capital are not used, only retained earnings are used to distribute the dividend or finance a project

ii. The values of r and k remain constant

iii. An organization exists for a long period

iv. Earnings per Share (EPS) remains constant in a given period

The formula used to make dividend decision is as follows:

P= D / (KE – g)

Where,

P – Price of Equity Shares

D – Initial Dividend

Ke – Cost of Capital

g – Retained Earning

The limitations of the Walter model are as follow:

i. Assumes that only retained earnings have been used for the investment, which is a hypothetical situation

ii. Uses unrealistic assumption that the value of r remains constant

iii. Does not consider risk factor as it assumes the EPS is constant

Gordon’s model also upholds the view that dividend policy is relevant for the organization. The model is also known as bird in the hand argument because this model is based on the assumption that shareholders prefer to receive dividend in the present situation.

As per Gordon’s model, the shareholders believe that the future earning is uncertain in nature because it involves risk factors. If the organization needs to invest the retained earnings in projects then it should ensure the shareholders that they would be paid a premium for bearing the risk of future investment.

The Gordon’s model is based on the following assumptions:

i. The organization has existed for a long period.

ii. Increase in investment would not affect the value of r and k.

iii. No external fund, such as debt or equity, would be used to finance various investments.

iv. Retention ratio (br) and retained earnings (g) are constant and g = br

The formula used for the determination of the dividend decision is as follows:

P = D / (Ke – g)

When the organization invests retained earnings and earns more profit, then it may pay more dividend to shareholders.

This increase in dividend is calculated with the help of following formula:

P= [E (1 – b)] / (ke – br)

Where,

P – Price of the Share

E – EPS

B – Retention Ratio

(1-b) – Dividend Payout

Ke – Cost of Capitalization

br = g – Growth Rate

Dividend Policy – 2 Possible Approaches to Dividend Decisions: As a Long-Term Financing Decision and As a Maximisation-of-Wealth Decision

Two Possible Approaches to Dividend Decisions:

Dividend policies affect both the long-term finance and returns available to shareholders.

Therefore, management can follow two possible approaches while making a dividend decision:

(1) As a Long-Term Financing Decision:

As per this approach, all earnings after taxes can be seen as long-term funds for the business. By paving cash dividends, the available resources of the firm decrease. Less funds become available for the development of the firm as a result of which either the growth of the firm slows down or the firm has to procure funds from other sources.

Firm can take decision to retain its profits in the following two situations:

(i) Sufficient Profitable Projects are Available:

Various firms can attain their growth goal by accepting highly profitable projects. Till such projects are available, the firm may decide to retain its profits to the maximum extent for financing them.

(ii) Capital Structure Needs Equity Funds:

Firm has various available sources for long-term funds. Use of excessive loan capital in the capital structure increases risk. Therefore, in order to save the firm from risk, proper balance between equity funds and debt funds is to be maintained.

Besides, to issue equity share capital, issuing expenses have to be borne by the firm. But retained earnings are cheaper because for it no such issuing expenses are to be incurred. In such a case also, firms can decide to retain the profits.

(2) As a Maximisation-of-Wealth Decision:

From this viewpoint, management feels that dividend causes a great impact on the market price of the shares. High rate of dividend raises the price of shares. Therefore, management should declare a maximum dividend to the shareholders to meet their expectations.

Dividend Policy – Dividend Payout Ratio (With Significance and Interpretation)

Dividend Payout Ratio is summarized below:

The dividend payout ratio is a way of measuring the fraction of a company’s earnings that are paid to investors in the form of dividends rather than being reinvested in the company in a given time period (usually one year). In other words, this ratio shows the portion of profits the company decides to keep for funding operations and the portion of profits that is given to its shareholders.

The amount that is not paid out in dividends to shareholders, is held by the company for reinvestment in the business concern, or may be used for any other purposes, such as retirement of debt and so on. The amount that is kept by the company to be ploughed back is called retained earnings.

The dividend payout ratio (D/P ratio) is calculated by dividing the total dividend paid to equity shareholders by the net income available to them for that period as follows –

= Total dividends paid/Net income after tax

Net income shown in the formula may be found in the company’s income statement. It is commonly expressed as a percentage. To illustrate, let us assume that the M/s Angad Ltd. is Rs.25,00,000 in the previous year and it paid out Rs.10,00,000 as dividends to its equity shareholders.

The dividend payout ratio is:

= (10,00,000 / 25,00,000) x 100 = 40%

The dividend payout ratio should be analyzed over multiple years so that trend, if any, may be interpreted. Dividend payout ratio can also be calculated by dividing the dividends per share by the earnings per share.

= Annual dividend paid per share/Earnings per share

The numerator in the above formula is the dividend per share paid to equity shareholders only. It does not include any dividend paid to preference shareholders.

Alternatively, it can also be found by subtracting retention ratio from 1

= 1 – retention ratio

The retention ratio = Retained earnings/Net income and the dividend payout ratio together equals to 1 or 100% of net income as whatever amount not paid in dividends is retained by the company to reinvest for expansion. Thus, when the dividend payout ratio is 1 or 100%, the retention ratio is 0 or 0% as it implies that no earnings have been retained for growth.

Alternatively, a company that pays no dividends would have a retention ratio of 1, which means that the company reinvests all of their net income for growth. However, a negative retention ratio implies that the payout ratio is greater than 100% and the company is using its cash reserves to pay dividends. This situation is not sustainable, and may result in the eventual termination of all dividends or the financial decline of the business.

Significance and Interpretation:

The determination of D/P ratio is referred to as the dividend decision of the firm or dividend policy. The dividend payout ratio is an important indicator of the company’s performance from an investor’s point of view. It also provides an indication of future growth potential of a company.

People invest in a company expecting a return on their investment, which comes from two sources- capital gains and dividends. The return from these two sources is interrelated. A high dividend payout ratio means that the company is reinvesting less earnings in future projects, which in turn means fewer capital gains in future periods.

Similarly, a low dividend payout ratio means that the company is keeping a large portion of its earnings for growth in future and thus, may result in higher capital gains in future.

Some investors prefer companies that provide high potential for capital gains while others prefer companies that pay high dividends. Dividend payout ratio helps each class of investors to identify the companies to invest in. Whether a payout ratio is good or bad depends on the intention of the investor.

A high payout ratio is usually preferred by those investors who purchase shares to earn regular dividend income and a low ratio is good for those who seek appreciation in the value of equity shares in future.

Therefore, the dividend payout ratio is used by the investors to decide whether to invest in a profitable company that pays out dividends or in a profitable company that has a high growth potential.

The dividend payout ratio analysis is important as the investors are mainly concerned with a steady stream of sustainable dividends from a company. A consistent trend in this ratio is usually more important than a high or low ratio. For instance, investors can assume that a company that has a payout ratio of 20% for the last ten years will continue giving 20% of its profit to the shareholders.

Conversely, a company that has a downward trend of payouts sends a wrong signal to investors. For example, if a company’s ratio decreases by a percentage point every year for the last five years, this may be an indication of poor operating performance of the company.

The dividend payout ratio should be analyzed in the context of industry and other ratios. Such as dividend yield ratio, P/E ratio and so on.

Meaning of Rights Issue of Shares:

A rights issue is when a company issues its existing shareholders a right to buy additional shares in the company. The company will offer the shareholder a specific number of shares at a specific price.

The company will also set a time limit for the shareholder to buy the shares. The shares are often offered at a discounted price to encourage existing shareholders to take the company up on their offer.

If a shareholder does not take the company up on their rights issue then they have the option to sell their rights on the stock market just as they would sell ordinary shares, however their shareholding in the company will weaken.

Reasons for a Rights Issue of Shares:

A company will offer more shares to its shareholders to raise extra money for the company. Compa-nies with a poor cash flow will often use a rights issue to increase cash flow and pay off existing debts.

Rights issues however are sometimes issued by companies with healthy balance sheets in order to fund research and development projects or to purchase new companies.

Discounted shares issued by a company can be tempting but it is important to find out first the reason for the rights issue of shares. A company, for example, may be using the rights issue as a quick cash fix to pay off debts masking the real reason for the company’s cash flow failing such as bad leadership. Caution is advised when offered with a rights issue.

Example of a Rights Issue of Shares:

i. Company ABC Mining’ has 10 million shares at a share price of Rs.8 (market capitalization Rs80million).

ii. Joe Bloggs owns 1,000 shares worth Rs.8,000.

iii. ABC Mining needs to raise Rs.30 million to research new mining locations.

iv. ABC Mining issues 5 million new shares @ Rs. 6 each (to raise Rs. 30 million, a 25% discounted price).

v. This is classed a 2 to 1 rights issue (10 million old shares : 5 million new shares)

vi. Which means every 2 shares you own ABC mining will issue another 1 share.

vii. This means Joe Bloggs is being issued with the right to buy a further 500 shares at $ 6 (Rs. 3,000)

Joe Bloggs can either-

1. Buy the further 500 shares for Rs. 3,000.

2. Ignore ABC Mining’s rights issue. This will result in Joe Bloggs shareholding will be diluted along with the value of his current shareholding. This option is not usually advised.

3. Sell his rights on the stock market and make a profit (providing the rights are renounceable, if a company issues non-renounceable right then they cannot be traded

As you can imagine the stock price is likely to change after a rights issue of shares. This is called the ex-rights share price. It is possible to estimate the ex-rights share price by;

i. Taking Joe Bloggs original shareholding of 1000 shares @ Rs. 8.00 worth Rs. 8,000

ii. Taking Joe Bloggs new 500 shares @ Rs. 6.00 worth Rs. 3,000

iii. Adding the total values together Rs. 8,000 + Rs. 3,000 = Rs. 11,000

iv. Dividing the total value (Rs. 11,000) by the total number of shares (1500) = Rs. 7.33 per share.

However the ex-rights price can be influenced by many other factors such as the reason for the rights issue, the general direction of the stock market etc.

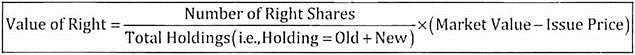

Valuation of Right Shares:

According to Sec. 81 of the Companies Act, 1956, a company, if it so desires, can increase its share capital by issuing new shares. In that case, the existing shareholders must be given the priority of purchasing those shares according to their paid-up value. Since the existing shareholders have got such right to purchase the newly issued shares, they are called Right Shares.

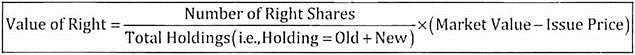

In order to make a proper valuation of rights relating to Right Shares, the market value of the old hold-ings and the total issue price of the new holdings must be added and the same must be divided by the total number of new and old holdings. Value of right will be the difference between the result that is obtained and market value of shares. Hence,

The Value of a Right:

To make the offer relatively attractive to shareholders, new shares are generally issued at a discount on the current market price.

Value of a right = theoretical ex rights price – issue (subscription) price

Since rights have a value, they can be sold on the stock market in the period between

i. The rights issue being announced and the rights to existing shareholders being issued, and

ii. The new issue is actually taking place.

Advantages and Disadvantages of Rights Issues:

Advantages:

i. It is cheaper than a public share issue.

ii. It is made at the discretion of the directors, without consent of the shareholders or the Stock Exchange.

iii. It rarely fails.

iv. Existing shareholders’ equity stakes are not diluted, provided they take up their rights.

Disadvantages:

i. There is a limit to how much can be raised through this method as existing shareholders are only willing to invest so much. A rough rule of thumb is that a rights issue could raise up to 25% of the existing equity value of the firm.

ii. If shareholders do not take up their rights, then their shareholding will be diluted.

Dividend Policy – Cash Dividend: Meaning and Forms

Meaning of cash dividend:

We have seen that Dividend is the return that a company pays to its members or shareholders at the end of a year as a share of profit. However, cash is not the only form in which the shareholders may be rewarded. The dividend or reward to the shareholders may be given in the form of stocks or shares of the company. This is known as the stock dividend.

Cash dividend may be given in forms:

(a) Bonus Shares

(b) Stock Split.

Let us first look at ‘Bonus Shares’. These are the fully paid- up shares, which a company gives to its shareholders free of any charge. If a company does not pay its full profit to its shareholders the amount is transferred to its reserves.

Over the years the reserves accumulate and the book value of the share increases. No doubt, the companies reward the shareholders by way of higher dividends, but another way, which is preferred by the shareholders, is to give bonus shares.

These bonus issues increase the equity holdings of the shareholders and, therefore, in the eyes of the shareholders, are more rewarding. However, technically speaking, bonus shares should have no effect on shareholders’ wealth, because only the reserves are being converted into shares and it is only an accounting entry. It is generally experienced that, after the bonus issue, there is a corresponding fall in the price of the share and, therefore, shareholders’ wealth, remains the same.

However, there are psychological reasons because of which shareholders attach a higher value to a bonus issue. Firstly, they have a psychological satisfaction of having a greater number of shares of the company without spending anything and secondly, an issue of bonus shares is an assurance of higher dividend income to the shareholders in the future. Thirdly, it is a tax saving exercise also.

Although, dividends are tax-free in the hands of shareholders in many countries, companies have to pay a tax on dividend distribution. In contrast, bonus shares are tax free and shareholders can earn a tax-free income by selling the shares in the market, if they so wish, That is why; bonus issues may sometimes be preferred over cash dividend.

Another method of rewarding the shareholders, by way of stocks is called the ‘stock split’. In this case, the stocks are divided into smaller denominations. For example, a fully paid up share of Rs.10 each may be subdivided into 5 shares of Rs. 2 each.