Budget is a plan of operations to be carried out during a specified future period and this plan comprises all aspects of business activities and summarizes the result of carrying out this plan.

The word Budget is derived from a French word Bougette representing a leather pouch into which funds were appropriated to meet the anticipated expenses. However the word ‘Budget’ in the case of business enterprises refers to a plan in the form of quantitative and financial statements, of the firm about the work to be done by the executives and their officials.

The Chartered Institute of Management Accountants (CIMA), London has, therefore, defined Budget as a financial and/or quantitative statement prepared and approved prior to a defined period of time, of the policy to be pursued during that period for the purpose of attaining a given objective. It may include income, expenditure and the employment of capital. This is a comprehensive definition of Budget which reveals some of the important features of a Budget.

John R. Bertizel has viewed the Budget as … a forecast, in detail, of the results of an officially recognized programme of operations based on the highest reasonable expected operating efficiency. That means, the Budgets incorporate the forecasts about the sales revenue, expenses, purchases, etc.

What is Budget: Meaning and Definitions, Objectives, Purpose, Features, Steps, Sales Budget, Zero Based Budgeting, Control Ratios, Limitations and More…

What is Budget – Meaning and Definitions

The word Budget is derived from a French word Bougette representing a leather pouch into which funds were appropriated to meet the anticipated expenses. However the word ‘Budget’ in the case of business enterprises refers to a plan in the form of quantitative and financial statements, of the firm about the work to be done by the executives and their officials.

ADVERTISEMENTS:

The Chartered Institute of Management Accountants (CIMA), London has, therefore, defined Budget as a financial and/or quantitative statement prepared and approved prior to a defined period of time, of the policy to be pursued during that period for the purpose of attaining a given objective. It may include income, expenditure and the employment of capital. This is a comprehensive definition of Budget which reveals some of the important features of a Budget.

Anyhow, it is a guide for the future. In order to plan for the future activities, it is necessary to undertake an exhaustive survey of the past events, present happenings and the future things. Because, past experience of the company provides a good and sound base for the future plan of action.

Dr. Gupta has rightly opined, past is the father of present and to a greater extent, present is the guide of future. On the basis of these, a forecast is made about the future.

ADVERTISEMENTS:

John R. Bertizel has viewed the Budget as … a forecast, in detail, of the results of an officially recognized programme of operations based on the highest reasonable expected operating efficiency. That means, the Budgets incorporate the forecasts about the sales revenue, expenses, purchases, etc.

Gordon and Shilling law have gone a step further to state Budget… as a … basis for the subsequent evaluation of performance.

In brief, Budget is a plan of operations to be carried out during a specified future period and this plan comprises all aspects of business activities and summarizes the result of carrying out this plan.

What is Budget – Objectives of Budgetary Control

(1) Planning:

ADVERTISEMENTS:

It is an important managerial function. Every enterprise should plan in advance what it must do and how it will achieve it. While determining the factors that will help achieve the target, the enterprise should anticipate many problems which would make the process of reaching the target difficult.

Solutions of such problems can be sought through careful study well in advance. Hence, budgeting forces management to think in advance, to anticipate and prepare for contingencies.

(2) Coordination:

It involves perfect balancing of all factors and co-ordinating the efforts put together by different departments and employees to achieve the target of the organisation.

ADVERTISEMENTS:

Coordination helps

(i) each department to work in harmony with others;

(ii) each department to know the specific role that it has to play to achieve the organisational goals; and

(iii) to avoid overlapping of activities and wastage of time and labour.

ADVERTISEMENTS:

Effective planning and organisation helps to achieve coordination, e.g., purchase managers should integrate their plan with the production requirements and production managers should plan manpower and facilities according to the sales budget.

(3) Communication:

A budget is a communicating device. The goals of the organisation cannot be achieved unless its employees are aware of the organisational goals and objectives of budget centres. Budgets effectively communicate this information to the employees.

Copies of budgets should be made available to all management personnel to make them understand the plans and policies of the organisation and also about the restrictions to which the organisation is expected to adhere, e.g., maximum amounts that can be spent on maintenance, advertisement, etc.

ADVERTISEMENTS:

(4) Motivation:

Employees will be motivated if they actively participate in budget preparation and if they feel that their personal interests are closely associated with the success of the organisational plan. The degree of motivation of the employees depends on how the employees are mentally and physically involved in the process of budgeting.

(5) Control:

It means keeping a constant watch over the actions and taking corrective actions as and when deviations from the planned course of action occur. Thus, all events are directed to conform to plans.

ADVERTISEMENTS:

(6) Approved Plan:

A master budget gives an approved summary of results expected from the proposed plan of operations. It includes all the functions of the organisation and serves as a guide to all departmental heads and executives.

What is Budget – Purpose

Budget serves as a tool of planning and control. If the production manager has a budget of producing say 10,000 units for the month of January, his performance is evaluated based on the number of units produced during that particular period. Top level management delegates the authority to the production managers and empowers them so that they can achieve their targets.

Budgetary control is defined as the process of formulating budgets for a future period and measuring the actual performance as against the budgets and taking remedial measures, if any, for effective performance.

If they are important, they will be considered or otherwise they are dropped. In other words, the budget for each item starts from zero; costs are calculated afresh based on the requirements for the budget period. It avoids the tendency of taking the previous data as a base to work for the future.

If there is a requirement, then only provisions are made otherwise, they are not considered. This makes the managers plan each programme package afresh.

Essential Features of Budget

Essential features of Budget are:

ADVERTISEMENTS:

1. Budget is a comprehensive and coordinated plan of action, and it is based on the objectives which the enterprises aim to achieve during the plan period (or Budget Period),

2. Budget is expressed in quantitative and financial terms,

3. Budget is a plan for the operations and resources of the company, and

4. Budget is always for a future specified period.

Importance of Budgeting

The importance of budgeting are:

1. Planning

ADVERTISEMENTS:

Setting up of objectives and proper organisation of various factors is known as planning. Budgets play an important role in the attainment of determined objectives. Production cost, research etc. help in the attainment of objectives related to business planning.

2. Control

Control is very essential for the growth of business. Functions of control can be performed better with the help of budget. Under it targets, objectives and policies are ascertained and reasons of variation are located and efforts are made to control them.

3. Coordination

It is a system under which every department functions for its own interest and for that purpose mutual cooperation is required. Budgeting helps in bringing coordination amongst various business activities.

Important Aspects of Budgetary Control System

In order to introduce a Budgetary Control System, it is necessary for the organizations to consider and decide about the following. These can, therefore, be called pre-requisites for the introduction of an effective Budgetary Control System.

ADVERTISEMENTS:

The important aspects to be considered are identified below followed by a brief analysis of the same:

1. Budget Centres,

2. Organization Chart,

3. Budget Committee,

4. Budget Manual,

5. Budget Period,

ADVERTISEMENTS:

6. Principal Budget Factor Budget Centres.

1. Budget Centres:

Budget Centre represents a part/section of an organization for which Budget is prepared and where Budgetary Control measures are applied. It may be in the form of a division or department or section or process or any other convenient form.

CIMA, London defines Budget Centre as a section of the organization of an undertaking defined for the purpose of budgetary control.

That means, in an undertaking one can find a number of Budget Centres and it facilitates the preparation of various Budgets for various Budget Centres with the help of the heads of these centres. For instance, the Production Department may be considered as a Budget Centre.

The Budget for the Production Department (viz., Production Budget) is prepared in consultation with the Production Manager.

ADVERTISEMENTS:

In the same way, the Sales Department may be recognized as a Budget Centre and the Sales Budget may be prepared, and finalized after consulting the sales manager as it is this manager who has to achieve this sales target. It is, therefore, necessary to determine the number of Budget Centres clearly demarcating their area of operation and coverage.

2. Organization Chart:

In order to introduce a Budgetary Control System, the company should have a clear organizational structure explaining clearly the position of each member in the organizational hierarchy and his relationship with other members of the Budget Committee. Of course, authority and responsibility of members differ from one company to another.

While specifying the duties and responsibilities of the members, it is necessary to ensure that there is a clear cut division of responsibility and authority, and there is no overlapping. This creates an environment wherein all the persons know their responsibility and work as a team, and try to achieve the desired target result.

It may be noted here that the Budget Officer, also called Budget Controller, plays an important role in the successful introduction of the Budgetary Control System.

Because, he acts as a link among all the functions/departments/heads coordinating various functions and/or functional heads. He is expected to provide the requisite details about the past performance and also the targets for the budget period.

In brief, he has to perform the following functions:

i. Help the functional managers in preparing the functional budgets by providing the necessary data/details about past performance of the respective departments, current targets, what does the company expect from the departments to achieve its current target, etc., and extending the requisite assistance,

ii. Receive the draft functional budgets from the functional managers and take necessary steps to get them finalized and approved by the top management (i.e., Board of Directors, Chairman or Managing Director),

iii. Prepare the Master Budget after taking into account different functional budgets,

iv. Receive the details about the actual performance on continuous basis from the departments, compare them with the targets set for them in the budgets, find out the variations, analyze the probable reasons dividing them into avoidable and unavoidable reasons, etc.,

v. Prepare a report based on the comparison of actual performance with the budgeted and also incorporating –

(a) the findings of his analysis of reasons for variations, and

(b) the suggested revisions in the budgets for the attention of the management, and

vi. Monitor the working of different departments on a continuous basis. The entire exercise shall be directed towards achieving the target results.

3. Budget Committee:

This is the Committee comprising all the executives in charge of major functions, and entrusted with the preparation and finalisation of Budgets for various Centres and also for the whole company called, Master Budget. Usually, the Chief Executive of the organization will be the Chairman of the Committee and the Accounts Officer serves as the Budget Officer. All the functional managers and important executives are the members of the Committee.

But in the case of small scale organizations, the entire work may be entrusted to an individual (normally, chief of the organization) assisted by the accounts officer. The Committee requests the functional managers to prepare, and submit to it, Budgets for their respective departments.

After the receipt of these Budgets, the Committee undertakes a detailed analysis of the same and makes necessary revisions/modifications/adjustments in consultation with the functional managers. Then it coordinates all the Budgets and prepares the Master Budget. Once these Budgets are approved by the Committee, they are implemented.

Further, it is also entrusted with the responsibility of monitoring the work of different Budget Centres to ensure that they are working in accordance with the Budgets. They also receive the reports of actual performance from all the Centres, compare them with the budgeted performance and find out how far the Centres have achieved their targets.

On the basis of this, the Committee advises the Budget Centres about the remedial measures, if necessary.

In brief, the important functions of the Budget Committee are as follows:

i. Provision of past details relating to the performance, costs, etc., to the heads of the departments to enable them to prepare their departmental budgets,

ii. Receive and review the departmental/functional budgets in the light of the company’s policy and objectives including the targets,

iii. To approve the functional/departmental budgets with necessary modifications. Of course, the modifications, if any, in the functional budgets shall be made in consultation with the functional managers,

iv. Prepare and finalize the Master Budget on the basis of the functional/departmental budgets. Of course, the draft Master Budget together with all the functional budgets shall be placed before the Board of Directors for approval with or without any modification,

v. Receive the data from different departments about the actual performance regularly and monitor their performance to ensure that they are functioning properly,

vi. Compare the actual performance with the budgeted and find out the difference, if any. Analyze the reasons for the difference in the results and recommend the remedial measures.

4. Budget Manual:

Budget Manual is a written document which guides and helps the executives in the preparation and execution of various Budgets. Further, it spells out the duties and responsibilities of various executives and also the inter-relationships among themselves.

The Institute of Cost and Works Accountants of India has, therefore, defined Budget Manual as … a document which sets out the responsibilities of the persons engaged in the routine of, and the forms and records required for, budgetary control.

The following aspects are normally covered in the Budget Manual:

i. A brief explanation about the objectives, benefits and the principles of Budgetary Control System,

ii. A clear and unambiguous explanation of the procedure to be followed not only for the preparation of Budgets but also throughout the system,

iii. The dates by which the functional managers have to finalize and submit their draft budgets,

iv. An Organizational Chart clearly spelling out the duties and responsibilities of each member of the management team and relationship with each other. This is very essential for a manager to know precisely whom he should obey and whom he can command, and also his position in the organization,

v. Purpose, format, number of copies and frequency of each report and statement,

vi. Spelling out of accounts code in use,

vii. The issues which shall be settled only with the consent of the top management and/or functional managers,

viii. Frequency, format, contents, etc., of performance reports from the departments to the Budget Committee, etc.

The Budget Manual is normally prepared in the form of loose-leaf so that alterations, modifications, etc., can be incorporated easily whenever the changes are necessary. It also facilitates the handing over of the relevant portion to the executives whenever they ask for the same.

5. Budget Period:

One of the pre-requisites for the preparation of Budgets is the decision about the Budget Period. This Budget Period represents the length of the period for which the Budget is to be prepared. Though it is influenced by a number of factors, the nature of business and the degree of control which the company wishes to exercise play a decisive role in deciding the Budget Period.

Normally, the business enterprises prepare the Budgets for a period of more than one year, for one year and for less-than one year (say, quarterly, monthly or weekly). A company may have all the three types of Budgets (which is normally observed in the corporate sector) and another may have only one or two.

There is no hard and fast rule. It all depends upon the nature of activity for which the business organization is intending to prepare the Budget.

However, the companies normally prepare the following three types of Budgets:

i. Weekly, Monthly and/or Quarterly Budgets (which fall into the category of Short-term Budgets) are normally prepared and adopted by the companies for the purpose of exercising control.

These Budgets are necessary for watching progress in the actual performance against the budgeted performance. This helps the companies to ensure that the actual performance is progressing as budgeted and to take early corrective measures if there is any deviation.

ii. Annual Budgets (which coincide with the Accounting year) are prepared for operating activities such as sales, purchase, production, etc. When Annual Budgets are adopted, the Budget Period is usually the fiscal year, i.e., the financial year commencing from April 1 in a year and ending with March 31 of the following year (e.g., April 1, 2010 – March 31, 2011).

iii. Long-term Budgets for three to five years are prepared for capital expenditure programmes like expansion and modernization of the company, introduction of new products, undertaking of new projects, etc.

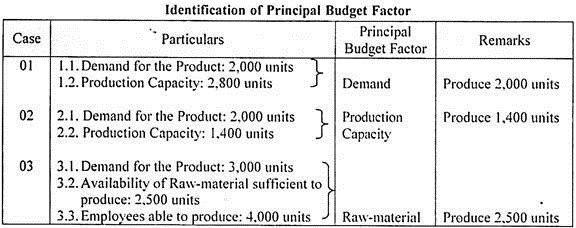

6. Principal Budget Factor:

Principal Budget Factor which is also called limiting factor, key factor or governing factor is a factor which, at a particular point of time or over a period of time, limits the business operations and which acts as an obstacle or impediment in accomplishing the desired result specified in the company’s Budget.

For instance, assume that the company can easily sell 1, 00,000 units of its product but the availability of a raw-material is sufficient to produce only 65,000 units. In this case, raw-material acts as the Principal Budget Factor as the Budget is to be prepared keeping in mind the availability of raw-material.

CIMA, London, has, therefore, defined limiting factor as the factor in the activities of an undertaking which at a particular point in time or over a period will limit the volume of output.

Therefore, the Budget pertaining to the key factor should be prepared first and other Budgets should be prepared in the light of the influence of the Principal Budget Factor. In other words, in the light of the Principal Budget Factor, all Budgets are to be coordinated if a company plans to reap the full benefits of the Budgetary Control System.

That means, the relevant Budgets are to be prepared and integrated with others only after the identification of the Principal Budget Factor.

Demand for the product, production capacity, skilled labour force, raw-material, capital, government restrictions, etc., are examples of Key Factor. The Limiting Factor, in majority of the cases, is of temporary nature.

That means, this can be overcome, over a period of time, by suitable managerial policies and actions. For instance, lack of adequate demand is the key factor for the majority of the companies and this can be overcome, to a greater extent, by taking appropriate steps to promote the sales.

In the same way, production capacity can be increased by expanding the plant. Another important point is the presence of two or more Limiting Factors in a company. In this case, it is necessary to analyse them properly to find out the most dominant Key Factor.

The details presented in the following statement shed light on this aspect:

From the above analysis, it is obvious that the Budgets, to be realistic, shall be prepared after considering the Limiting Factors. Otherwise, the Budgets do not reflect the reality.

This way, a systematic attempt should be made to introduce a scheme of Budgetary Control System.

Effective and Successful System of Budgetary Control

The main essentials for an effective and successful system of budgetary control can be given as follows:

1. Support of Top Management:

In order to make the budgeting system successful, it is necessary that it must have the whole hearted support of every person involved in the organisational set up. In this regard, the initiative must come from the top management.

The budgetary control system can be effective if the persons at the various levels of management feel that the top management considers the system as valuable. For this purpose, it is necessary that the top management must show its commitment to the ideas, principles and philosophy of budgeting and budgetary control.

2. Definite and Reasonable Targets or Goals:

For the successful operations of the budgetary control system, the targets fixed in the budgets should be definite, realistic and attainable. This feeling should come from the various executives who have been assigned the responsibility of various budget centres.

3. Well-Defined Organisation:

In order to ensure maximum benefits from the budgeting system, well defined budget centres should be created within the organisation so that the responsibility of each executive in the organisation may be clearly laid down.

4. Well Defined Policy:

The budgets are prepared to establish the responsibilities of executives to the requirements of a particular policy. As such the policy of the business to be followed during the budget period should be clearly defined.

5. Active Participation by Executives:

The various executives who are made responsible for different budget centres, should be actively involved in the preparation of the budget. It will ensure the proper implementation of the business policy as laid down in the budget.

6. Efficient Budget Education:

The various executives responsible for putting into effect the budgetary proposals, should take active interest in the operation of the budgeting system. It is possible only if these executives are constantly educated about the objectives, potentials and techniques of budgeting. It can be done through regular meetings of executives where all matters regarding preparation of budgets and actual results achieved can be discussed.

7. Adequate Accounting System:

Budgeting is closely related to accounting since compilation of budget is done on the basis of historical data provided by the Accounting Department. These data form the basis for making estimates. As such the accounting system should be designed to the requirements of responsibility accounting.

8. Cost of the Budgeting System:

The cost of operation of the budgeting system should be within the financial capability of the business and should not exceed, in any case the total benefits accruing from it to the organisation.

9. Efficient Reporting:

It is necessary that prompt reports on the comparison of actual performance with the budgeted figures should be made available to the management for ensuring timely action on the points of inefficiency.

10. Flexibility:

The budget programme of the business concern should not be too rigid. It should be flexible and should provide for possible contingencies.

11. Integration with Standard Costing System:

If the business concerned decides to introduce a standard costing system, it should be completely integrated with the budgetary control system in respect of compilation of budgets and analysis of variances.

Steps Involved in Preparation of Budget

Step # (a) Definition of Objectives:

Objectives should be defined precisely. Budgets should be prepared in written form, with the areas of control clearly demarcated; and stating the items of revenue and expenditure to be covered by the budget. This will give a clear understanding of the plan and its scope to all those who must cooperate to make its implementation a success.

Step # (b) Identification of Key (or Budget) Factor:

A key factor represents a resource whose availability is less than its requirement and puts a limit on the firm’s objective of maximum profitability. For proper budgeting, the key factor must be located and estimated properly.

Step # (c) Budget Committee and Controller:

Formulation of a budget usually requires whole time services of a senior executive; he/she must be assisted in this work by a Budget Committee, consisting of heads of all departments along with the Managing Director as the Chairman. The Controller is responsible for coordination and development of budget programmes and preparing the Budget Manual.

Step # (d) Budget Manual:

The Budget Manual is a schedule, document or booklet, which shows in written form, the budgeting procedures. The manual should be well written and indexed, and a copy thereof may be given to each departmental head for guidance.

Step # (e) Budget Period:

The period covered by a budget is known as its budget period. Normally, a calendar year or a period co-terminus with the Financial Year is adopted as the budget period. It is then subdivided into shorter periods – it may be months or quarters or such periods that coincide with the period of trading activity.

Step # (f) Standard of Activity or Output:

Based on past statistics, known market changes, and current conditions and forecasts of future situations, the standards of activity levels for future periods should be laid down. In a progressive business, the achievement of a year must exceed those of earlier years.

Top 5 Steps Involved in Budgetary Control System

The steps involved in the budgetary control system are presented below:

1. Preparation of Budgets,

2. Measurement of actual performance at the end of the budget period,

3. Comparison of actual performance with the targets (budgeted performance) to find out whether the company (or a part of it; i.e., department, section, etc.,) has achieved the target set in the Budget,

4. Analysis of the reasons for the variation (i.e., the difference between actual performance and targets) and identification of exact reasons for the variations, and

5. Initiation of remedial/corrective measures.

Flexible Budget

Definition of Flexible Budget:

The term flexible budget was defined as “A budgeted designed to change in accordance with the level of activity actually attained.”

Thus a flexible budget has different budgeted costs for different levels of activity. It permits easy adjustment of budget according to changed business conditions. Often, it is difficult to forecast correctly the level of activity which a firm will be able to attain in the future. The firm, therefore, makes an estimate of its costs at various possible levels of activity.

The ascertainment of the costs at different levels of activity is the main objective of a flexible budget. For preparing a flexible budget, costs are classified into fixed, variable and semi-variable. The degree of variability of the semi-variable costs is also determined.

By recognizing the difference between fixed and variable costs, a flexible budget is designed to change in relation to the level of activity attained. The technique of flexible budgeting makes it possible for a business undertaking operating in a dynamic economic environment to prepare a realistic budget and control costs by comparing the actual results with budgeted estimates. Flexible budget is essential for meaningful control over expenses.

Such control is not possible in a fixed budget which shows the estimates only at one level of activity. For example, if a fixed budget is drawn up on the basis of production and sale of 1,00,000 units and the actual production and the sales are only 80,000 units, a comparison of the actual figures with budgeted figures would not yield any useful information.

For a meaningful comparison a fresh budget must be drawn up on the basis of the annual production and sales of 80,000 units. This, however, cannot be done mechanically by reducing the budgeted figures proportionately since a distinction is to be made among variable, semi-variable and fixed cost. All these costs do not behave in the same manner as the level of output changes.

A flexible budget is a useful device by which estimates can be quickly altered to conform to actual level of activity. It is very useful in industries, where the level of activity during the year varies from period to period either due to variation in the demand or due to the seasonal nature of the industry.

It is also desirable in a company which keeps introducing new products or makes changes in the design of its products frequently, such as industries engaged is made to order business, industries which are influenced by changes in fashion, a new firm with uncertain demand or in an industry facing shortage of factors of production such as materials, labour and plant capacity.

A flexible budget is drawn up after ascertaining the relationship of various items of cost with the varying level of output. The cost behaviour analysis is done on the basis of statistical analysis or through direct estimates. In other words, each item of expense is carefully studied and its behaviour determined for each successive small change in the level of activity.

Flexible budgeting is desirable in the following cases:

(i) Where on account of typical nature of the business the sales are unpredictable e.g., in luxury or semi-luxury trades.

(ii) Where the venture is a new one and therefore, it is almost impossible to foresee the public demand, e.g., novelties in the fashion.

(iii) Where the business is subject to the vagaries of nature such as soft drinks etc.

(iv) Where the progress depends on adequate supply of labour and the business is in an area which is already suffering from shortage of labour.

(v) Where organisation is a dynamic one, keeps on introducing new products/new designs.

(vi) Where undertakings are in ‘make to order’ business like ship building.

Advantages of Flexible Budget:

(a) It gives a consolidated picture of all functional budgets.

(b) It helps to ascertain the profit or loss for the budget period.

(c) It helps to check the arithmetical accuracy of all budgets.

(d) It helps to find the financial position of the business by preparing a budgeted balance sheet.

(e) A projected cash flow statement can also be prepared to find the liquidity position of the business.

What is Budget – Behavioural Aspects

The system should consider the effect on people.

Following behavioural aspects are important in this regard:

(i) Creation of Urge:

No system can be effective unless and until human beings involved are motivated—cooperation is to be sought from every nook and corner to create an urge among all and sundry. If off-budget variances are there, employees are pulled up; maybe the middle level management or top level management is at fault or uncontrollable factors are there.

However if results are favourable, there is no patting to the workforce from the above. This results in lack of enthusiasm and mars the incentive to work harder in future. Budget shouldn’t be used by the management as a pressure device—as a stick therapy to beat the workforce on non-fulfilment of targeted work or non-timely performance.

It leads to trade unionism and sabotaging the work, which becomes counterproductive. At times, different departments work fast and/or use undesirable ways to meet the deadlines and reach the target—it may deteriorate quality. Therefore, the psychological barriers must be removed with active cooperation of all concerned.

(ii) Performance Evaluation:

The business activities alone are not to be evaluated but the managers responsible to perform those activities are also to be evaluated. Hence, the budgetary control system must encourage managers to behave in a fashion which is in the best interests of the organisation. Performance related rewards may be embedded in the system.

(iii) Budget Negotiation:

Normally, departmental heads project an artificially higher level of expenditure, which is finalised after negotiations by the higher ups. Budget sanctions or approvals are generally of an attainable figure. The process is known as ‘padding the budget’.

In case, the departmental manager succeeds to claim an escalated figure, the control exercise suffers. Inefficiencies can’t be located and performance evaluation is distorted. On occasions, infighting among colleagues leaves a bitter taste, vitiating the congenial atmosphere. It should be prevented.

(iv) Accounting Policies:

It is an acknowledged fact that accounting policies can be twisted to suit the management—if depreciation and inventory valuation policies are changed, the effect on profit and financial position is bound to be there. The budgets are also affected as a result.

Cost allocation to a different cost centre, cost unit, process, department or a person is possible by laying down accounting policies accordingly—it will have a significant impact on the performance of the responsibility centres. Blame for the shortfall in targets can be shifted to others this way. Suitability should not be the criterion, but appropriateness should be the guiding principle.

(v) Budget Construed as Cash Pot:

Environmental feeling, in general, in most of the cases is that budget means how much money is required to be spent on different items and accordingly, even performance is measured by the level of actual spendings vis-a-vis budgeted ones. If there has been a saving, it means good performance, whereas, it could have resulted because of not taking up specific projects or leaving some assigned jobs.

On several occasions, departmental heads deliberately incur the budgeted expenditure, as they apprehend the sanction of a lower budget during the ensuing budget period. Psychologically also, they feel nervous in explaining their positions and satisfy the upper echelons of management.

(vi) Constraint in Management Styles:

If budget is not met, it is treated as a failure on the part of the person responsible, he hesitates in undertaking entrepreneurial jobs and his style of functioning changes.

All the above aspects which pertain to human behaviour are crucial in a system of budgetary control and must be taken adequate care of.

Principal Budget Factor

Principal budget factor or a key factor is defined as the factor in the activities of an undertaking which, at a particular point of time or cover a period will limit the volume of output.

In every case, the budget must be prepared according to the key factor. In most of the companies, the key factor is sales. In some cases, a shortage of capital or some element of production, e.g., materials, labour, machine, or space, may be the key factor. It is not fixed for all times.

Key factors may be different from one organisation to another organisation and within the organisation, it may be different from one year to another year. Previously, sales was the limiting factor in BHEL and now the production capacity is the limiting factor. Key factor is also called the “principal budget factor”.

Budgets should cover all the functions of a business. Individual budgets for each item should be coordinated and inter-related. Because of this inter-link, the key factor affecting a particular budget has its influence on the other budgets. Hence, the influence must first be assessed in order to ensure the correct preparation of functional budgets.

Examples- Scarce raw material, shortage in skilled labour, limited machine capacity, imbalance in plant and equipment, shortage of capital, lack of market demand or a Government policy, etc.

Note- The budget relating to this factor should be prepared first and other budgets should be prepared in the light of the principal Budget Factor. Then, the Master Budget is to be prepared.

A correct identification of the key factor is of vital importance to the management in profit planning.

Sales Budget

If the sales is the limiting factor, the sales budget is first prepared and then the production budget is prepared taking the opening and closing stock of finished goods into consideration. For many types of business, the sales budget is the commencement of budgeting.

The Sales Budget is a forecast of total sales of all the products expressed in terms of physical quantities, prices and values in respect of each product for a future budget period.

The Sales Manager should be made responsible for the Sales Budget and he is assisted by the Market Research Officer. The choice of method to employ for forecasting sales is influenced by a number of factors- external as well as internal.

The degree of competition, the nature of the product, the methods of distribution, the size of the business, plant capacity and financial aspects are some of the considerations.

While preparing the sales budget, the sales manager has to bear in mind the following factors:

1. Market Research:

The purpose of market research is to find out which of the company’s products can be sold in a period and in what quantities at what prices and in which market. Such an analysis is made to assess the potential demand according to customers, territories, salesmen, channels of distribution, size of orders or terms of sales.

2. Analysis of Past Sales and Trends of Past Sales:

Details of sales over past periods of 5 to 10 years will play an important role in preparation of the sales budget.

The details of sales are to be collected and prepared under the following headings:

(a) By products or class of products

(b) By territories- national and international.

(c) By branches analysed by salesmen.

(d) By types of customers- wholesale, retail, government, foreign, etc.

In studying the trend of past sales, the factors affecting the figures, e.g., long-term trend, seasonal fluctuations, trade cycles, growth of market, growth of business, etc., should be borne in mind.

3. Opinions and field estimates of salesmen.

4. Plant capacity and other production facilities.

5. General trade prospects- demand for and supply of the product.

6. Potential market- Purchasing power and capacity should be estimated.

7. Product Mix, i.e., proposed expansion or discontinuance of products.

8. Proposed alteration in quality and price.

9. Long-term trends, trade cycles and seasonal fluctuations.

10. Availability of men, materials and machines.

11. Profits desired by the management.

12. External factors such as Government policy, imports and exports policy of Government, economic cycle of the nation, change in buying habits of customers, change in fashion trends of public, monopoly conditions, competitions, competitors, substitutes in market, inventions, new products in the market, etc.

13. Special Conditions:

Introduction of special discounts, a new design of the product, new or additional advertisements, improved deliveries, after-sales service, term of payment including extension of credit periods, guarantee terms, etc., will also have an influence on the sales budget.

14. Financial Aspects:

Sales expansion, extension of credit, purchase of new plants, opening of new sales offices, and new or additional advertising campaigns etc., will involve capital outlay. Hence, the sales budget will require to be kept within the financial limits. The sales budget should be prepared in such a manner that it will produce an adequate return on capital employed.

A preliminary sales budget is prepared product-wise and then a detailed budget is also prepared on the basis of Salesmen’s estimates. Both are to be compared and adjusted for preparation of the final sales budget after considering the top management policy.

It is worthwhile to make up the sales budget again-

(a) by products,

(b) by territory, and

(c) by types of customers.

Then, the sales budget will be submitted to the Budget Committee for approval and incorporation in the Master Budget. In order to show responsibilities, the budget is divided into sales areas and sales quotas showing the responsibilities of individual salesman.

Master Budget Definition by CIMA

The basic steps in developing a master budget begin with the sales forecast. The process ends with the preparation of budgeted profit and loss account, budgeted balance sheet and budgeted cash flow statement.

The master budget is thus a summary of the other budgets as prepared by the departmental managers.

The CIMA Official Terminology defines a master budget as “the budget into which all subsidiary budgets are consolidated, normally comprising budgeted profit and loss account, budgeted balance sheet and budgeted cash flow statement. These documents, and the supporting subsidiary budgets, are used to plan and control activities for the following year.”

Cash Budget

It is one of the most important budgets. It accounts for the sources and requirements of cash. For effective control, the cash budget is prepared for a short period, generally a month. Many firms prepare weekly or even daily cash budgets. It indicates whether the firm has adequate cash to meet its needs during the budget period.

Cash budget also shows how cash shortages are to be met and how surplus cash is to be used. Without a cash budget, the master budget cannot be completed.

The most popular method of preparing a cash budget is the receipts and payments method. In this method, first of all, expected cash receipts including cash in hand in the beginning of the budget period and then all cash payments are listed.

The excess of cash receipts over cash payments represents cash balance in hand at the end of budget period and excess of cash payments over cash receipts would indicate the overdraft requirements.

Other methods of preparing cash budgets are:

(i) Adjusted profit and loss method or cash flow statement method and

(ii) Balance sheet method

A cash budget serves the following purposes:

i. It allows sufficient time to arrange for additional financing that may be necessary for large inventories, for acquisition of plant and machinery, etc.

ii. It helps the smaller organisations and those with seasonal business (like sugar manufacturing) to avoid high cost of emergency borrowing.

iii. It shows the availability of excess cash which can be invested to earn the highest possible return.

iv. It indicates the availability of cash in the short run to take advantage of discounts offered.

v. It helps the management to explore the different sources of finance (e.g., overdraft facility / cash credit/ short-term bank loan etc.,) to meet future requirements.

Preparation of Cash Budget:

The period of time covered by a cash budget depends upon the nature of the business and the cash position of the organisation. Generally, a monthly cash budget is prepared if the cash position is good and consistent. Where cash position is not good a weekly cash budget or even a daily cash budget may be necessary.

At the time of preparing a cash budget, a careful review of all budgets is extremely important to identify all revenue, expenses and other transactions that involve cash. It should be observed that a cash budget should not include any ‘outstanding /prepaid’ items and non-cash expenses such as – depreciation.

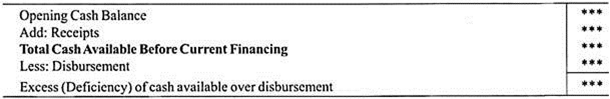

The cash budget is composed of four major sections:

i. The ‘Receipts’ section;

ii. The ‘Disbursements’ section;

iii. The Cash ‘Excess’ or ‘Deficiency’ section;

iv. The ‘Financing’ section.

i. The Receipts Section:

In this section all anticipated cash receipts are shown.

These may include:

(a) Cash sales

(b) Cash collected from debtors

(c) Sale of investment, assets, etc.

(d) Dividends

(e) Interest on investments

(f) Royalties, etc.

ii. The Disbursements Section:

In this section all anticipated cash payments are shown.

These may include:

(a) Cash purchases

(b) Cash paid to creditors

(c) Payment of wages, taxes, insurance, etc.

(d) Purchase of assets, investments

(e) Repayment of loans

(f) Redemption of debentures, etc.

(g) Payment of dividends, etc.

iii. The Cash Excess or Deficiency Section:

In this section the difference between the receipts section (after taking into consideration the opening cash) and disbursement section is shown.

The excess or deficiency is calculated as follows:

iv. The Financing Section:

If there is excess cash, it is transferred to next month / week as an opening cash balance. Where the cash balance is more than the requirement of the next period, it is generally invested in short-term securities / deposit. If there is deficiency, the company will go for short-term borrowings. The investments and borrowings are shown in the Financing Section.

Sources of Data for the Preparation of Cash Budget:

The data required for the preparation of the cash budget is gathered from different budgets.

These are:

(i) Sales Budget – It shows the quantity of goods to be sold and the amount of cash which is expected to be collected from customers during the budget period.

(ii) Purchase Budget – It shows the amount of cash to be paid for the purchase of materials and suppliers during the budget period.

(iii) Various Expenditure Budgets – Direct labour budget, production overhead budget, selling and distribution overhead budget, administrative overhead budget will indicate the cash expenses expected to be incurred during the budget period.

(iv) Capital Expenditure Budget – It will indicate the amount to be needed for purchasing plant and machinery, equipment, land and building, etc., during the budget period.

(v) Executives Budget – It will indicate the amount to be needed for payment of dividend, donations and income-tax etc., during the budget period.

Format of a Cash Budget:

Cash budget is prepared in column form. There will be four sections showing receipt, disbursement, excess or deficiency and financing. It will start with the cash at the beginning of the budget period. The closing cash balance of the current period will become the opening cash balance of the next period. No non-cash items (e.g., depreciation on plant and equipment) will be taken into consideration for preparing the cash budget.

The main functions of this budget may be summarised as follows:

(i) It ensures that sufficient cash is available to meet the requirements of the organisation.

(ii) It reveals any expected shortage of cash so as to enable the management to arrange for cash in time by means of bank overdraft or loan etc.

(iii) It reveals any expected surplus of cash available for investment outside the business.

The cash budget offers the following advantages:

a. It ensures that sufficient cash is available when required.

b. It reveals any expected shortage of cash, so that action may be taken in time, e.g., a bank overdraft or loan may be arranged.

c. It reveals any surplus of cash so that surplus cash may be invested or loaned for a short period.

d. It shows whether cash expenditure projects can be financed internally.

e. It reveals the availability of cash so that advantage may be taken of cash discounts.

Performance Based Budgeting

Meaning of Performance-Based Budgeting:

Performance-based Budgeting refers to the statement of a mission and objectives that explain why organizational resources have been used. The performance standards laid down in budgets serve as yardsticks to measure how far the actual performance has achieved the level of planned performance, highlighting the extent of deviations. In this sense, performance-based budgeting is an instrument of control.

Performance-Based Budgeting Mainly in Non-Financial Areas:

Standards in the case of performance budgeting are mainly non-financial—though these standards are related to financial standards to measure deviations from the planned performance and to plan the necessary corrective action.

For example, in the case of the education budget, the number of school-going children, or the number of schools and teachers, may help in explaining how the financial resources allocated for the purpose in the past have been used, and the need to make further allocations for the future.

Elements of Performance-Based Budgeting:

According to Segal and Summers, Performance-based Budget comprises the following:

(a) Results sought to be achieved;

(b) Strategies or different ways to achieve the results; and

(c) Activities undertaken to achieve the results.

Zero Based Budgeting

Zero based budgeting is a new technique which was first introduced in the USA by Peter Pyhrr of Texas Instruments in 1969. This technique is useful both in government and organizations involved in non-manufacturing activities like selling and administration. It is a new technique in which all the activities are re-evaluated each time a budget is prepared. Each budget is started with the assumption that the function does not exist and it is at zero level of cost.

Each manager has to justify his entire budget from zero base. In a zero based budget, the previous year expenditure is not taken as granted and each manager has to explain the entire expenditure included in the budget.

The steps to implement Zero Based Budgeting are as follows:

i. Identify each function and activity of the organization.

ii. Evaluate each decision package so as to ensure that it is cost effective.

iii. Compare each activity with possible alternatives.

iv. Rank each activity in terms of profitability or for cost benefit analysis.

v. Allocate the resources in accordance with the ranking of activities and with the resources available with the organization.

Control Ratios

Concept of Control Ratios:

Control Ratio is a tool by which operation of any organisation is controlled. The efficiency of the organisation can be measured easily. These ratios are used for inter firm, interdepartmental and inter product comparisons.

They are measured by comparison of one period with the other period, and they are presented in terms of percentages. Any ratio more than 100% shows the better efficiency and better performance and a ratio below 100% shows deficiencies and inefficiencies. These ratios are compared with the standard hours.

Classification of Control Ratios:

The various types of control ratios are as under:

(1) Capacity ratio,

(2) Efficiency ratio,

(3) Activity ratio, and

(4) Calendar ratio.

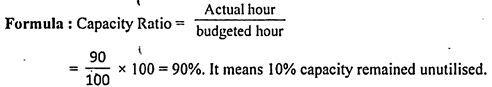

(1) Capacity Ratio:

It shows the relationship between budgeted and actual hours and it indicates the use of capacity of any concern. If standard hours are 100 and actual hours are 90, then the work is done 10 hours less than the standard.

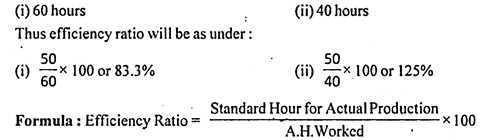

(2) Efficiency Ratio:

It measures the efficiency of any concern. In this process actual hours are compared with the budgeted hours and the efficiency of the concern is calculated.

For example budgeted hours are 50 hours but actual hours taken are:

(3) Activity Ratio:

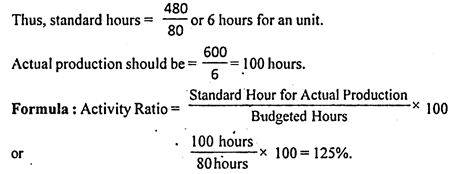

This ratio shows the difference between budgeted and actual performance. It explains the relation between budgeted production and actual production. Suppose 480 units are budgeted to be produced in 80 hours in a week, but actual production is 600 units.

(4) Calendar Ratio:

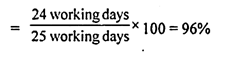

This ratio provides the relation between budgeted and actual working days. It shows the difference between budgeted and actual working days. If any organisation works for 24 days, while the budgeted days are 25, then Calendar ratio will be –

Difference Between Forecast and Budget

1. Forecast is mainly concerned with probable events; but budget is concerned with planned events.

2. Forecast may be done for a longer time; but budget is prepared for shorter periods.

3. Forecast is only a tentative estimate and can be revised; but the budget remains unchanged for the budget period.

4. Forecast results in planning and the planning results in budgeting.

5. Forecast is a prediction or an estimate of changes, if any, in characteristics, economic phenomena which may affect one’s business plans. It is a study into the future, when the forecasts are given a shape and approved by the management as a commitment, they become budgets. For example, a sales forecast is an estimate for future sales, while a sales budget is a commitment with an objective to reach certain sales figures.

6. Forecast is the base while a budget is the structure built on the base.

7. Forecast is not used for evaluating the efficiency of performance while a budget is always used for this purpose.

8. Forecast refers to the events over which there is no control, (for example, forecast of restricted import) while a budget is an endeavor to control the events.

Precautions in Budget

1. Budget Period

In every business house, long term as well as short term budgets are needed. Sales budget, cost budget are short term, whereas capital expenditure, research budget and development budgets are known as long term budgets.

2. Flexibility of Budget

Budget should not be rigid but proper flexibility should be there in the budget. When budgets are prepared efforts should be made to have proper flexibility in it.

3. Statistical Information

Necessary information relating to every department should be made available at the time of preparation of budget.

4. Top Management Support

Support from all the heads of departments should be ensured, while preparing budgets and proper coordination amongst them, is to be maintained.

5. Proper Knowledge and Limitation of Budgeting

Every officer should know the use and limitations of budgeting. It should be known that how budgets help in planning, coordination and control.

6. Business Policy

Budget is prepared for the attainment of business objectives. While preparing the budget, objectives of the business should be given proper attention.

7. Persons Responsible for Budgets

Persons who are responsible for the preparation of budget, should be unbiased and neutral. These people should possess full knowledge of business and they should be capable of preparing balanced budgets.

8. Sound Forecasting

Due consideration should be given to past records also. Knowledge of past conditions is necessary for the budget. Forecasts should be based on statistical methods.

9. Adequate Accounting System

Correct and up-to-date figures are necessary for the preparation of budget and on the basis of that forecasting is made. Thus the accounting system should be adequate and planned one for the preparation of the budget.

10. Budget Committee

A budget committee is to be formed for the preparation of the budget. In this committee all departmental heads should be taken. The officer in charge should collect the budgets from all the departments and should present them before the budget committee.

Limitations of Budget

The following are the limitations of a budget:

1. Lack of coordination between different departments may create problems in achieving the desired results.

2. A budget is based on estimates. In a dynamic environment, it is very difficult to make the right estimate. Wrong estimates may create more problems than solutions.

3. In many cases, a budget is formulated by the superior executive without consulting the achievers.

For example, the chief sales manager may set a high sales target to avoid embarrassment without consulting field people. The non-achievement of such a sales budget may demoralise a good sales personnel.

4. A budget may encourage rivalry among the departments which may hamper the working environment of the organisation.

5. A budget may prevent achieving the full potential of the organisation.