Essay on Mutual Funds in India!

Mutual funds were first started in England during 19th century. These funds could not succeed due to highly speculative nature. Mutual funds started in USA during 1900 but they picked up only after 1924 when a number of such funds were started. After World War II mutual funds expanded rapidly.

In India first mutual fund was started in 1964 when Unit Trust of India was established to mop up savings of small investors and channelise them into productive avenues. UTI brought out a number of schemes beneficial to every category of investors.

There are schemes for those who prefer safe steady returns and those who prefer high growth. UTI has brought schemes for non-resident Indians too for mopping up their resources.

ADVERTISEMENTS:

The Government of India has amended Banking Regulation Act in 1987 to enable commercial banks to launch mutual funds in India. A number of commercial banks have started mutual funds to mop up savings of every section of society.

Canara Bank formed Canbank Mutual fund with the objective of housing investment expertise under a single roof with the objectives of housing investment expertise under a single roof for the benefit of investors.

It started two close-ended schemes Canstock and Canshare in 1987. The object of these schemes was a long term capital appreciation by adopting flexible and pragmatic investment strategies. Canstock was to raise Rs. 50 crores through scrips of Rs. 100 each. The objective is to secure regular income and growth.

An investor in this scheme is assured of a minimum interest rate of 12.5 percent. There is a provision of re-purchase after the expiry of one year at a price notified periodically. Canshare is also a close end funds raising Rs. 50 crores through canshares of Rs. 100 each.

ADVERTISEMENTS:

This is purely growth scheme. The capital gains from the scrips are reinvested. The trustees may declare a reasonable dividend before re-investment. These shares are listed at stock exchanges for enduring liquidity.

The State Bank of India has also launched a mutual fund called SBI Mutual Fund in 1987. The first scheme launched was known as ‘Magnum Regular Income Scheme’ while another was named ‘Magnum Monthly Income Scheme’. It has also introduced ‘Magnum Tax Savings Scheme’ with a tax benefit under section 80CC and ‘Magnum Regular Income’ with 12 per cent minimum assured rate of return per annum.

Indian Bank established a mutual fund called Indian Bank Mutual Fund in 1980. It floated schemes such as Swarana Pushap: Ind Ratna; Ind. 88A; Ind Jyoti. Swarana Jyoti is a close-ended monthly income and growth scheme assuring a minimum return of 12.68 per cent per annum.

Ind Ratna is also a closed end growth scheme with a loyalty dividend on redemption with a buy back facility after one year. Ind 88A is tax saving growth scheme.

ADVERTISEMENTS:

Ind Jyoti is a closed end annual income and growth scheme assuring a minimum return of 12.75 per cent per annum. Punjab National Bank also set up a mutual fund called PNB Mutual Fund in 1990. It has floated a PNB Regular Income plus Scheme. It is a closed end income and growth scheme with minimum return of 12.5 per cent per annum. It has a buy back facility after one year.

Bank of India introduced Rising Monthly Income Schedule with varying rate of return between 12% to 13.5% over a period of 5 year and also assuring the doubling of amount after this period.

LIC Mutual Fund was set up in 1989 by LIC. It has introduced open-ended schemes such as Dhanraksha, 1989; Dhanvirdhi; Dhansagayog and Dhanvidya. The close-ended schemes included Dhanshree, 1989; Dhan 80 CCB, Dhansamridhi, Dhan tax Saver, 1995 etc.

GIC Mutual Fund was set up in 1990. It has launched schemes like GICSAFE; GIC RISE. The first scheme is insurance-cum-income plan with regular income of 12 per cent per annum and a buyback facility after one year. The second scheme allows the rising of income from 13 to 14 per cent per annum or cumulative bonds increasing original investment by 4 times on maturity at the end of 10 years.

ADVERTISEMENTS:

Thus, an era began for UTI to face competition from banking and insurance sectors. Seeing the success and growth of ‘mutual funds’, the Government of India allowed the Private Sector Corporates to join the mutual fund industry on February 14, 1992. Since then a number of private sector companies have approached SEBI for permission to set up private mutual funds.

In November 1995, the Government has permitted Private Sector Mutual Funds to set up Money Market Mutual Funds. SEBI (Mutual Funds) Regulations, 1993 which were replaced by SEBI (Mutual Fund) Regulations, 1996 provide guidelines for registration, constitution, management and schemes of mutual funds in India.

In all 31 mutual funds (excluding, the Unit Trust of India) were registered with SEBI as of December 1996, under the SEBI (Mutual Funds) Regulations, 1993. Of these 10 belong to the public sector and 21 are in private sector. 16 private sector mutual funds and 1 public sector mutual fund have foreign participation in their asset management companies (AMCs).

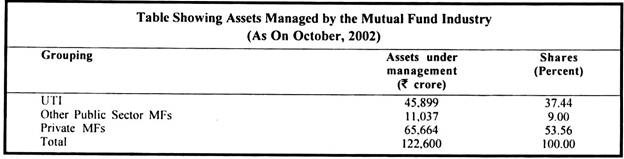

Over the last five years, mutual funds have become a significant mechanism for financial intermediation in the economy. The following table summarises the assets managed by the mutual fund industry, which now offers over 450 products to consumers and manages Rs. 122,600 crores of assets.

The table suggests that private mutual funds, which are all relatively recent entrants into the industry, now account for over 50 percent of mutual funds assets. This is in contrast with banking and insurance and pension funds, all of which are dominated by the public sector.

In absolute terms, the stock of assets managed by mutual funds works out to only 9% of the assets of the banking industry. This suggests the role of mutual funds in the economy continues to be small when compared with banking, industry.

In March 2002, guidelines were issued to enable the mutual funds to invest in rated securities in countries with fully convertible currencies. This marks an important development, through which mutual funds will be able to deliver better risk and return trade off through international diversification.

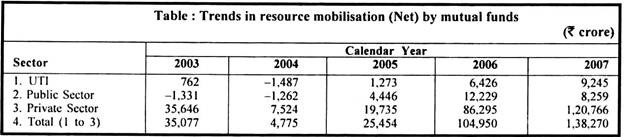

Net mobilisation of resources by mutual funds increased by more than four-fold to Rs. 104,950 crore in 2006 from Rs. 25,454 crore in 2005. The sharp rise in mobilisation by mutual funds was due to buoyant inflows under both income/debt oriented schemes and growth/equity oriented schemes.

ADVERTISEMENTS:

After suffering negative inflows in 2003 and 2004, inflows turned positive for public sector mutual funds in 2005 and accelerated in 2006. The share of UTI and other public sector mutual funds in the total amount mobilised gradually declined over the years from 22.5 per cent in 2005 to 17.8 per cent in 2006 and further to 12.7 per cent in 2007.

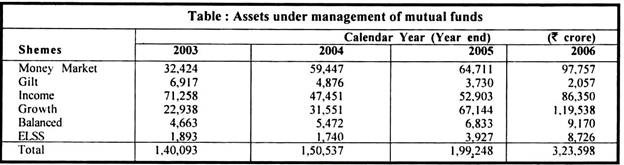

In tandem with an increase in resource mobilisation, assets under management of mutual funds increased by about Rs. 1.24 lakh crore to reach Rs. 3.24 lakh crore in 2006. The transactions of mutual funds in the equity segment of Indian stock exchanges, which amounted to net sales of Rs. 1164 crore in 2004, tuned to net purchase of Rs. 13,436 crore in 2005 and further to Rs. 15,384 crore in 2006.