Essay on International Trade!

Trade is a “convenience” factor that helps in the movement of goods and services between the producers and the consumers. The consumer is the end point of various activities that are performed to give shape to products of utilities, but numerous activities converge at the point of production to pass through specific “process”.

These activities need not be from one source but from a multiple of sources. The management of the converging activities is price and delivery related. Price and delivery are the two deciding factors for the selection and beginning of the incoming and outgoing business operations.

The application of logistics trims the operations for maximization of returns to the producers and suppliers as well as they generate value for money to the consumers. This general explanation when applied internationally gives rise to the international trade.

ADVERTISEMENTS:

There is another associated word “Foreign Trade” which directly refers to the movement of goods and service from the country and to the country, which in other words means the import and export.

The history of the international business can be traced back to the times when sea going boats were used for searching newer lands. The practice was common amongst the Indians, Greeks, and Egyptians.

The movement was further strengthened when the era of Olympics was introduced, it used to be a four year event in which the local traders and visitors from the near and far lands mingled to exchange goods. In those days the event could be the equivalent of present day trade fairs.

By the fifteenth century the lands of the Asian continents were known to all the powers of the world as the most promising one for natural resources and material wealth.

ADVERTISEMENTS:

That was the time when the English and the Dutch explorers travelled to far off lands in Asia. That was perhaps the beginning of the present phase of international trade. Both these countries were eager to build their empires and expand trade with the newly discovered/acquired lands.

May 2nd, 1670 was a day very important for the British Empire and India because on this day the British East India Company was formed which later would lay the foundation of the British Empire in India. The industrial revolution in the west fueled the fire for increased trade between the nations of the west and the rest of the world.

The trade until these periods used to be the exotic products and jewelry, but the industrial revolution brought the manufactured goods to the world consumers and thus began the journey towards the materialistic expansion of world trade where goods and bullion were traded in great earnest.

Industrial revolution also brought another demand factor in the west and that was the search for the raw materials. It was this search that linked the Asian sub-continent with the west and a phase of colonization started. Most of the raw material producing Asian and African nations came under the dominance of one power or the other.

ADVERTISEMENTS:

The Indian sub-continent was the most severely affected as it was very rich in the minerals and ores, besides the agro-products and spices. During this period the direction of the trade was the investment, management and finished good from the west and raw materials from east.

But the system so evolved was based on repression and suppression, and the relations were codified as the masters and subjects. These very sentiments gave birth to the feeling of nationalism and were also a sign of the beginning of a new era where trade will be governed by the national pride and not by the dictates from the crown or the masters in faraway lands.

The two world wars are perhaps the results of such deep-rooted divergent sentiments of suppression and nationalism. This pattern continued for a long time till the time of the World War 1.

Between the forties and sixties a number of nations gained independence not only from the colonial rules but also from the one sided trade pattern. That was the time of economic independence and self-governance in all matters of government and foreign trade.

ADVERTISEMENTS:

The death of colonization was the birth of a new phase in the trade pattern where international trade was considered as an essential tool for the economic development.

This development was strengthened further by the new inventions and innovations on the known inventions to make a number of products of “convenience” where convenience was directly associated with the time saving and multiplicity of jobs to be performed.

The economic might coupled with the technological advances transformed the western powers into the category of developed nations. To this exclusive club some of the Asian nations like Japan also joined. (G-8).

The period between 1950 to 70 was a period when the power of finance was used to the hilt by the developed nations and they created a new phase of international trade where economic dependence was forced upon the nations to toe the line or else be left out. The finance and technology playing dominant role in creating goods for mass consumption dominate the international trade pattern during this period.

ADVERTISEMENTS:

The machine culture was born. The direction of trade was also mainly of the same pattern as was found during the colonial era, the finished goods dominated exports from the west and imports were in the form of raw material and/or intermediaries.

The major differentiating factor was the net value addition to the products traded. The value addition by the developing nations to the primary goods or other intermediate products was nowhere nearer to the value addition achieved by the developed nations.

The economic dependence was used to the hilt by the developed nations as the most important tool of their foreign policy. The newly emerged nations came forward to the western nations for capital and technology in exchange for liberal concessions in taxation and repatriation of profits.

The “value addition” has been the criteria for the developed nations in the international trade cycle for such a long time that it is not noticed now as something different but trade has been intensely affected by this factor.

ADVERTISEMENTS:

The birth of the Asian tigers is but the result of this phenomenon. This bug also affects the positioning of the products and technology. The ASEAN nations have maximized the situation and even dominated the world trade as the epic centre of growth.

That was the time when the Japanese global trading houses became the centre of world trade and a symbol of Japanese domination and expansion. The tools used by them were very simple, they used the power of information and communication and rode on the easy availability of unlimited finance to dominate the world till about late eighties and beginning of nineties.

The beginning of nineties saw one of the most formidable changes in world trade. The power of the Japanese global trading houses suddenly ceased with the emergence of the Internet and reorganization of the financial sector.

The net result was that Japan went into a long cycle of recession, which continued till the end of this millennium. This affected the international trade as well besides affecting the trade of the countries under their influence including the tiger economies.

ADVERTISEMENTS:

The global trade in the developed countries is still dominated by the technology and management expertise of the corporations and they also dominate the global trade in services. The introduction of the Internet has acted like a force multiplier- effect on their economy. But it has also propelled the economies of the developing nations as well.

In the new equation of global trade balance the countries of the Asian continent are showing faster pace as compared to the western companies. India and China are the two most successful examples. But this is a generalization because the energy that fires the movement (demand) is still with the developing nations.

The technology, finance, product innovation, management, and the internet are causing a new movement in the global trade, where globalization has become the benchmark of development and WTO is providing the direction to this sense of internationalization of the means of production, distribution, and consumption.

The coming years will witness a new revolution in global trade and commerce in the form of e-commerce. Though it is passing through the teething problems (cyber laws) but is an indicator of the things to come in next 5 to 10 years’ time.

The international trade in all its colours is going to ride and expand as never before on the robust shoulders of e-commerce where differentiation of small and big headquarter and branch, national and international boundaries is bound to diminish if not disappear.

The international and foreign trade is a very strong motivating force, both constructive and destructive. In the constructive role it helps the nations to develop their economy and life standards of its citizens, but in its destructive role it brings wars and conflicts with hidden elements of conquest of land and resources.

ADVERTISEMENTS:

If we look back at the history, we will find the end results of all the wars big or small, always leading to the direct or indirect conquest or control of the land (markets) and resources (materials).

The international trade was the most powerful tool of territorial expansion of the powerful trading countries. The countries of the Asian sub-continent had suffered the impact of perpetual wars due to their natural resources and plenty of agricultural and flat land, which became the root cause of colonialization.

Take the case of India, its natural resources became its biggest enemies, one after the other warlords came for material wealth or the land that produced the wealth.

The British were the last before India and many other countries that were under colonial rules, achieved independence. The newly emerged countries took time to take stock of things at home and soon realized the importance of foreign trade as vital for their economic development.

The Second World War was perhaps a turning point in our history when nations realized its importance and accorded highest national priority to build up massive foreign trade as their prime objective.

The road to international trade was not an easy task, there were numerous hurdles in the form of trained professionals, topical literature, and governmental policies. There was a time when the international business was confined to a few privileged corporations or the governments but now there is a sea change not only at the academic level but also in practice and application.

ADVERTISEMENTS:

The roles played by GATT, ICC, WB and finally WTO, are commendable. These world bodies have created conductive environments under which every nation feels the importance of all other nations and a sense of interdependence has creeped up in their consciousness.

We are now living in a world of interdependence that promotes and supports not only the best but guides others who are not the best. Productivity efficiency and quality are the hallmark of individual excellence and global presence and expansion of the corporate sector.

The old ways are giving up the strongholds to new concepts and conventions. The world trade once thrived on the shoulders of the Global Trading Organizations peaking up during the eighties with their mastery over the information and communication tools that served as the pillars of strength. But since 1990-91 their pillars were crushed under the weight of the new system that developed with internet and e-commerce.

The changes were not limited to the said two fronts but the banking system and payment methods too witnessed drastic changes. The concept of universality of knowledge and ease of instant communications supported with well-developed and highly versatile financial system has forced them to re-define their corporate objectives.

As the world is opening up in to fair and free market system, it is bound to affect the traditionally protected sectors of industry and commerce. The two world wars were enough to let the warring nations realize what they lost in wars and what they must do to reconstruct the damage done.

It was this feeling which lead to the formation of the United Nations Organization about 51 years ago to work collectively for the better future for all. Since then the world has witnessed tremendous changes in all spheres of human life.

ADVERTISEMENTS:

The changing socio-economic pattern has on the one hand created problems but on the other hand has also created new opportunities. The gradual decline of the government control over trade has opened up a real competitive market place.

The changing work culture ethics are but the gifts of our recent past to the present generation. But the change, which has transformed the world in a most significant way, is the global trade and trading practices. This change was initiated when GATT was formed and it was cemented further when WTO was solemnized on 1st January 1995.

The pressure of the global trade especially after WTO is so great that national policies can get affected if they are hurdles to the global free flow of the trade. The foreign direct investment can make or break local or even national economies. Economic policies, which are contrary to market expectations, can result in drastic counter moves by global market forces.

The telecommunication revolution has brought the continents much closer and global trade has taken the maximum advantage out of it. With e-commerce getting into stride the world is bound to be shrunk and unified into a single market accessible at the touch of a button right from the tabletop PC.

Internet is going to stay and become the single medium for communication information covering all spheres of business activities with cutting edge price advantages for the global consumers.

Still the importance of the nation states will not diminish and will remain at the central core of the global economic, social and political system. In the coming years these cores have to be unified with more transparency, openness and determination to work together for a better and safer future for the mankind.

Importance of International Trade:

The impact of foreign trade is felt not only in the socio-economic aspect of the society but also in the quality, style, and contents of the governance of the government.

ADVERTISEMENTS:

There are three main reasons for international trade to be so important an issue that every nation of the world gives it the highest level of importance:

(i) It is related to relative business and cultural study and exchange.

(ii) It is related to economic development and means of domination.

(iii) It is an extension of foreign policy.

In the present context, the study of the topic gives us information on the business and cultures of different countries, it helps us to understand their nature, social behaviour, how they decide, when they decide, what is their decision making process, how they import/export, what they import/export, from where they import/export, what are their supporting laws for internal and external trade.

ADVERTISEMENTS:

It helps us to understand the markets and people of different countries and cultures in a better way so that we can react/interact with them for the profitable exchange of goods and services. The way business is done in China and the way it is done in USA present two poles-apart cases in the conduct of business.

The US Trade & Commerce Department regularly issues reports not only on China but on many other countries so that the American companies wanting to do business with those countries get familiar with the domestic cultures, people, business practices and governing laws, market potentials, opportunities, and what the US government will do to help them expand their business in those countries, and most important of all how to get things done in those countries.

Similarly the Japan External Trade Organization (JETRO), which is a body under the Ministry of International Trade & Industry (MITI), makes and publishes similar reports that are accessible to the Japanese corporate houses for the expansion of business.

They also publish reports on market potential in Japan for the foreigners as to how to do business in Japan. In both the cases the area of operations is not limited to trade & industry but also to cultural and social level as well.

The international trade is also directly related to the economic development and the quality of life in a given country. The expanding foreign trade brings in the most wanted hard currency.

The infusion of further capital in the market enhances the reach and colour of the domestic industry to attract more capital inflow and the cycle repeats all over again. The government revenue account swells enabling it to divert funds not only for nation building but also to uplift the life quality of its citizens.

Business and Government are not two different identities, they are just for each other, the government decides the rules and the industry plays by these rules, and this can also work in the reverse direction if it is in the benefit of the nation.

The economic development of any country, company, and individual is dependent on how and in what way one can expand and consolidate operations. It is in this context that government frame export and investment friendly policy to give boost to the foreign trade front.

The expansion of trade is the expansion of contacts, expansion of communications and commitments, it brings people closer, it opens the doors to host of other supportive activities like tourism, hotel, banking, investment, technology exchange etc.

All these activities directly and indirectly affect the government for if the policies adopted are conducive, there will be expansion, and if the policies are restrictive there will be stagnation and retardation.

To understand its role (foreign trade) as an extension of “foreign policy”, just review the trade relations between USA and China, between Russia and other east European nations, between France and the nations under their colonial rule, between India and United Kingdom, between India and Japan, between Japan and the pacific rim countries especially the tiger economies.

The synthesis of your study will point to one important conclusion, that if you want to dominate any country expand your trade and make them dependent on your markets for survival.

Make their economies flourish when you have the market boom and let them hit the bottom when you have recession or your policy focus changes direction and orientation. When you use your economic muscle as an extension of dominance, turn blind eye to any wrong giving unless such acts are directed at you.

This game is not limited for the big players; even the smaller players (developing countries) too have their role cut out to suit the needs of region specifics. The weight of the foreign trade does gets reflected in the national behaviour so long the arena is limited to favour and disfavors, likes and dislikes, dos and don’ts.

But the moment sense of confrontation comes to play as an extension of the national pride; the situation suddenly and drastically changes. The examples are the USA and Vietnam, China and Taiwan, South Korea and North Korea, India and Pakistan.

Under such volatile situations the foreign trade loses its importance and gives way to political pulls and pressures. These are but stages of discomfort for humans, and it is the nature of humans to be comfortable, to be at peace, to be caring and compassionate, to be generous and friendly.

The period of discomfort is also the period when trade suffers the most. It is in our nature not to continue to suffer. The period of discomfort between the nations is also the period of fact finding of what causes discomfort. If this was not so then USA might not be re-visiting Vietnam to help them rebuild the nation, Japan, as a nation will not feel sorry for the war atrocities in China and Korea.

The situation at the other hot spots will change for the good, because it is not in our nature to be uncomfortable for a long time. The first thing that emerges when situation becomes comfortable, or tends to become comfortable is the resumption of trade.

Japan was devastated by the allied forces and USA had to drop the only two atomic bombs ever dropped on civilian population, but it was USA again which came up to help Japan stand up again as a nation and the war time bitter enemies became the two largest trading partners.

The history of the nations of the European Union was written in blood, the nations that were forever at war with each other realized what they had lost and so emerged the Union, the largest single trading block with common laws and currency.

There could be many answers to the question that what united them, but trade was perhaps the most viable answer, it not only united them into one force internally but also presented to the rest of the world as the most powerful common market.

Understanding the Fundamentals of International Trade:

Enough has been written already on the theoretical part of the international trade, a number of macro and micro economic theories on trade and associated activities are available which explain What, Why, When, and How of the trade, using numerous empirical studies and devilling on most complex and critical formulation and computation, to find the answers to some basic questions; like why there is international trade, what causes it, what depresses it, what will happen if this happens, what was the past and what is the present heading in what direction in future.

This theoretical aspect looks good for the academicians but for a practical person who participates on the real life operational basis there are certain other considerations for viewing the global trade as a continuing phenomenon, there are certain operational fundamentals based on logic and experience. These are the perceptions based on commonsense and causes that always produce results.

Perceptions because he perceives and assumes them to be true without applying any logical reasoning or marketing laws but take them to be true, commonsense because the one who ventures in the overseas (or domestic) markets experiences them as the very basics of ground rules whether applied in the overseas trade or domestic trade, and causes because when applied to business practice they tend to produce results.

Fundamentals:

i. Nobody can produce for everybody, nobody can be present everywhere, and always there are areas left open for your entry.

ii. Buyers are sellers also, (One’s demand is other’s supply).

iii. With every price cut, the quality, and performance levels tend to improve.

iv. “Eat or be Eaten”.

Explanation:

Nobody can produce for everybody.

No matter how big a manufacturer is, it is just not possible for him to manufacture for every customer in the world. Every manufacturer has a definite client base, which is very fundamental to his survival. Generally it is the home base.

The moment he starts to venture outside, he does so by keeping one leg firmly rooted in the home market. The competitors too know this fact, it will be the home base that they would target to dislodge him from the specific overseas market.

The concept of home base can get transplanted if the manufacturer sets up manufacturing units in the overseas markets and use them as the base for supplying to his other manufacturing and or assembling units in different countries.

But in this exercise the line of control gets stretched out. There is a limit to what elongation that can be safely absorbed otherwise it snaps. The manufacturers know this fact so they keep the logistics very much in consideration.

The logistics, home base, overseas markets; they all indicate the presence of markets where one specific manufacturer is fighting to survive and not to dominate, his domination is always under challenge by his competitors who fight for their share of the market.

In the above consideration we have assumed there is competition. There can be situations where there is no competition or least competition. Then one manufacturer starts dominating the market. This is what happened when Microsoft dominated the computer operating systems (Windows 95, 98, 2000 etc.).

They monopolized the world markets in such a way that it became impossible for others to survive and sustain their business of competing and compatible operating systems. The result is that Microsoft is currently facing lawsuits in the US Courts. The situation of “Monopoly” is not encouraged under any law of any country, it is considered unethical and damaging to the health of the concerned industry.

“Competition” is the health of any given market, it gives birth to innovations and inventions, and it brings quality in service and product at lesser cost to the consumer. If it is so then how is it possible that any country can afford to support monopoly to one manufacturer! The answer is “No”. There is always room in any given market for your product and/or service.

The important point is how you identify that segment and make your approach. In any given overseas market, there are competitors already operating for a long time before you tried to make entry. The market concerned will have segregation in the consumer’s profile.

There will be areas of high potential, medium potential and low potential. Similarly there will be products suitable for each segment. A manufacturer is basically concerned for the net returns he gets on his investment in the market. So he tries to maximize it by targeting some specific segments of the market and not the whole of the market.

If he stretches his resources to cover the entire market, then his returns would be affected as he would be spending available resources on some segments that give him lesser returns but consume his time and money to service them. This affects the focus of the manufacturer for those segments. These very segments that provide comparatively lesser returns are the areas of weaknesses.

When you want to enter any overseas market you have to identify the areas of weaknesses and/or areas left out by the manufacturer as non-profitable for his operations. Because these very areas would provide you the beachhead for making an entry and starting operations.

If nothing seems to work for you in the given market that is neither you can identify an empty pocket, nor you can identify the areas of weaknesses of the existing manufacturers/suppliers, then the only option left for you is to associate with them. This association can be either at the input stage (in the form of component and sub-assemblies supply) or at the out-put stage (sub-contracting, marketing, joint ventures, financial investment etc.).

Buyers are sellers also, (One’s demand is other’s supply):

This is one of the important factors to understand for the conduct of international business, especially if you are involved in global trading and dealing with industrial goods. Let us consider some cases to understand the concept clearly.

Case no. 1: Manufacturer of Ball pens (Consumer goods)

1a. As a manufacturer he would be purchasing or importing (input stage);

Plastic raw material,

Inks

Tips

Stainless steel clips

Packing material.

1b. As a manufacturer/supplier he would be selling or exporting (output stage);

Ball Pens

1c. As a manufacturer-supplier/exporter he would be using services of;

Bankers (credits)

Freight forwarders

Insurance Ad agencies

Wholesalers and retailers

Importers/Exporters and distributors

Market research

Research and Development

Case no. 2. Manufacturer of Refrigerators (Consumer durable)

2a. As a manufacturer he would be purchasing or importing (input stage);

Steel sheets

Compressors

Copper tubings

Molding plastics

Insulation material

Sealents

Refrigeration gases

Cutting tools and bits

Nuts and bolts

Electrical wiring

Electrical switches

Electrical bulbs

Paints.

2b. As a supplier he would be selling or exporting (output stage);

Refrigerators.

2c. As a manufacturer-supplier/exporter he would be using services of;

Bankers (credits)

Freight forwarders

Insurance

Ad agencies

Wholesalers and retailers

Importers/Exporters and distributors

Market research

Research and Development.

Case no. 3. Manufacturer of Valves (industrial products)

3a. As a manufacturer he would be purchasing or importing (input stage);

Raw Steel material for casting operation

Plastic moulds

Actuating motors

Components

Cutting, grinding, polishing and measuring tools

Paints

3b. As a supplier he would be selling or exporting (output stage);

Valves

Components

3c. As a manufacturer-supplier/exporter he would be using services of;

Bankers (credits)

Freight forwarders

Insurance

Ad agencies

Wholesalers and retailers

Importers/Exporters and distributors

Market research

Research and Development.

In the above three cases, we notice that irrespective of whether you are consumer, consumer- durable, or industrial goods manufacturer you are doing both the activities of buying and selling or imports and exports. In addition you utilize several services to procure, process, and market your products.

In this case the difference in the import and export activities is the nature of the goods involved. The items to be imported are the raw materials and other consumables; the items to be exported are the finished goods. For both activities you use the services of various agencies for the movement of your material and goods.

Each of the activity mentioned in the above three cases is business activity. For a global trader it means business against each of the said activities, but for a manufacturer-exporter you would be doing one of the main activities.

Either you would be exporting the finished goods or one of the items (or more) of the input stage. If you are in the service industry (case 1,2 and 3 item c), you could be offering the same to the overseas or even domestic manufacturers for the export markets.

The international business is composed of manufacturers/suppliers for the above goods and services. If we see them collectively they are composed of interdependent and related buyers and sellers or importers and exporters.

The classification into imports and exports is done from the point of reference, what is the export for one company/country, is the import for the other company/country. Together they constitute the International Trade or business.

With every price cut, the quality and performance levels tend to improve:

This may sound strange but it is true, in highly competitive global markets the pressure of competitors compels the manufacturers not only to cut prices but also to increase the quality and performance. There are certain manufacturers that take pride in their quality and they insist upon selling quality rather than products.

But these isolated situations cannot be generalized for the entire trading community. The logical approach to any competitive situation is to fight on the price front, but side by side improve the quality and performance of your products and use these parameters as your sales tools. Price alone cannot sell, but if supported by said two factors it gains strength to knock off competition.

There is a school of thought that support “price for quality”. It means higher the price better will be the quality. It assumes that quality is directly proportionate to quantity. They neglect the third dimension of the equation, it is the performance.

Every product is a means of “convenience”, which is related to the required performance. It is the performance that is directly related to the convenience factor of any product. Reliability in performance is judged by the proper organization of the quality components.

Price = Quality + Performance + Components……………………… 1

Price’ = Quality’ + Performance’ + Components’…………………. 2

In this equation, (no. 1 is yours, no.2 is that of your competitor) the quality is what the customer requires; performance is what you as the manufacturer can offer. In this situation we are neglecting the influence of logistics. Let us assume it is same for both parties.

In a competitive market the fights tend to filter down to price level, the quality and performance levels have tendency to level off in a tight situation, no manufacturer would spend more than what is required to meet certain quality levels as demanded in the market or that goes with the product (consumer and consumer durable goods).

What is left now is the component “segment”. It is very unlikely that two manufacturers would be tapping the same sources for components, in-fact each has its own dedicated/ traditional supply sources. Depending on the type of goods involved this segment constitutes 60 to 70 % of the total cost of the goods.

As said above, the performance of the final product would depend on the quality of the components. Given the material, processing, inspection, testing each component tends to give similar performance, but there are components that give similar performance over longer periods of time.

The selection of such components is the secret behind the extra punch that can be stored in your performance. How you do it is totally up to your approach to the business and your association with the component suppliers.

Take the case of automobile manufacturers, electronic goods manufacturers, consumer durable goods manufacturers, or all such manufacturers who depend heavily on the components suppliers, spend time and money to continuously upgrade the quality and performance of the components and side by side devise ways and means to cut the production costs.

The production cost of any product has two elements, one direct and the other indirect. The direct element is just the additive of various costing factors that add up to give you the final price. This price has little flexibility and is generally used by the manufacturers for price negotiations.

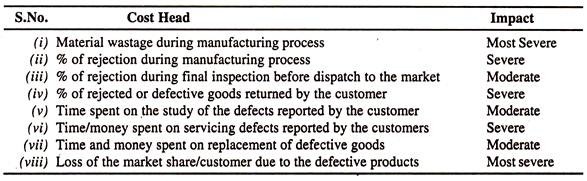

But the indirect costing elements are those that you cannot see but they too add up substantially to the final cost of the product. These indirect elements are described on next page with comments on their anticipated impact.

In the above table, the influence of the impact on the organization is referred to as most severe, severe, and moderate. Highest percentage of loss at the time of production (cost addition) is reported by the material loss.

How much material is consumed to make one product is not very important, what is important is how much material is wasted to make one product. It is the waste percentage that has to be controlled to cut costs.

There are very few Indian companies which ever bother to do the after sales customer audits. The ball stops at the factory doors when the goods are delivered to the distribution chain, domestic or overseas.

Currently we are discussing the overseas markets where the customers are highly volatile, (they fly off at the first hint of problems). In such markets it is not only your quality, but the durability of the quality is also under acid test. Your competitors make your problem more complex when you have to fight for your market share.

The last point in the above table indicates the loss of the customer or the market share going down, due to the cumulative effect of the other seven points. In international business, the export contract has lesser importance than the customer. The lost contract can come again but if the customer is lost he will not only go forever but will also take away some of your customers who are under his social/family influence.

If you can control and rationalize the impact of the above eight items on your price, there is no doubt at all that you can improve your quality and performance even by cutting the price to beat the competition.

Quality will improve with the rationalization and selection of the components that give extended quality

Performance will improve due to extended quality (decrease in the failure rate)

Price line will be pulled down when you perform meticulously by taking due precautions against the above eight points. The time and money saved in return can be enough to kill your competitor.

“Eat or Be-eaten”—The survival game:

In business one can never be stationary in performance, either you go up or go down. If a business stops growing then it starts to deteriorate in comparison to the competitors. The thumb rule of business is “competitors never sleep”.

They may pretend to do so but in-fact they are always gearing up for the forward leap. There is always a chance to cut, share, eat up, or be eaten up by the rivals in the international markets, in business terminology these are referred to as the expansion, merger and acquisition.

These are the corporate games played at the national and international levels, to some extent the law of the jungle is observed, the fittest survives and the weaker is gulped up by the more powerful players. The domestic games are less risky and significant as compared to those at the international market level.

Expansion:

There are two main reasons for expansion, either to service larger markets, or to lower the cost of production, in both cases the firm is trying to reduce the impact of competition or creating conditions adverse to the competitors in a given market.

The beginning of this process starts from the time the firm decides to explore the overseas markets for its products and services. It involves two phases, the direct action, and the indirect action. In the direct action phase all the initiative is generated at the organizational level.

In the indirect phase all the actions originate in the overseas markets where a potential importer may inquire for goods/services/technology/Jt venture etc. These two phases supplement each other, like the import and export business.

The difference between these two phases is that in the first phase all the fieldwork and decision-making is done by you and in the second phase it is done by the party making the contact.

The expansions in the overseas markets involve time and distances (assuming the marketability of the product/service has been confirmed earlier). Time and Distance are crucial to the profitable survival of the business and to make a logical decision distribution logistics play vital role.

Questions like; to procure or produce, where to locate the production-at the home country or near to the target market, whether to setup an assembly shop or to produce locally, if to produce locally then whether to go alone or to tie up with local party, whether to license local party or to set up joint venture etc.; have to be answered perfectly keeping in view the net results and objectives of expansion.

All the above activities are preliminary phase of expansion in the overseas markets, they provide the beachhead from where the party enters and cuts its market share of the existing potential. The beachhead activities are followed up by the consolidation phase when the firm tries to streamline its operations and maximize on the given opportunities.

While the firm is doing these exercises the competitors do not sit and watch, they complement each move with their own move to nullify the advantage. This is the time when the ambitious firms move into second phase of expansion.

In this phase they tend to identify the areas from where the competition is coming, sometimes it comes directly and sometimes indirectly. Direct competition is the one where the competitor is sitting in the same market with you, and the indirect competition is the one in which the competitor or controlling organization is sitting in a third country.

In order to overcome this direct and/or indirect competition the firms resort to mergers and acquisitions, these are two routes for quicker market expansion that may lead to domination if the actions are properly planned and executed.

Merger:

In the case of mergers the resulting business does not change in any way, in case where the product differentiation is not visible and competing products are not perfect substitute to one and other, the merger may increase the localized competition amongst the competing products.

Under such conditions the merged firms control the production and price to their advantage depending on the level of competition. But in case of the differentiated products the companies have to see that their products have the consumer’s first or second choice that is the products have dedicated customer base.

Under such conditions the merged firms can use price differentiation for increasing profitability. Elevating the price of the premium product and decreasing the price of the product that falls under “second choice” does this. The loss on price increase (if any) is easily compensated by increased sales of the second choice product.

As mentioned earlier in this section, the competitor never sleeps, so the challenge posed by the merger will be countered by the competitors through repositioning of their products. Pepsi and Coca-Cola have been doing it for years against one and the other.

The decision for merging compatible firms from the market is a very delicate and time-consuming factor. There are several points to be considered before the merger decision is finally taken, like,

General aspect:

Operational sequence.

The first step is to assess the market potential in the target markets.

The second step is to know the worth of your company in terms of size, industry position, customer base, growth potential, competitiveness, product mix, financial position and market share.

The third step is to know similar position of the firm that is targeted for merger.

The fourth step is to know the background of the targeted firm for merger, especially their financial position (liabilities), assets, legal aspect, ownership/management style, caliber of the staff, anticipated resistance especially from the key officials etc.

The fifth step is to evaluate the competitor’s market share and future plans.

The sixth step is to time the merger, the best time is when your stocks are at peak value and those of the target firm on the lean side.

The last step is the timing of the media blitz for the new formation for customer orientation and benefits to be offered to them by the merged companies.

Specific aspect:

Self-examination.

Are we ready for expansion?

What benefits we can gain by this merger?

Is there no other option?

Do we have the ability to manage the new formation most effectively?

What will be the reaction of our key staff to the merger?

Will the organizational culture play any role in this merger, will the firm to be merged fit into our organizational culture?

Will it involve firing or retaining of staff of the other company? How will they react to such decisions and how best we can implement them.

Can we achieve our corporate goals through this merger? (Market share, profitability, creation/ enhancement of new customer base, growth rate, public image etc.)

Lastly can we manage efficiently and profitably the new formation?

Acquisition:

In the case of acquisition there may be change/addition in the product line or the service offered, in many cases the resulting company has supportive role for the total organizational efforts in the market. It is a far more difficult proposition than merger.

i. The firms going through this route have to know their:

i. Strengths and weakness

ii. Priorities

iii. Strategic planning for the future growth

Are we looking for a business similar to ours or want to diversify.

Are we looking for a business with smaller volume of trade but higher profitability?

Do we have enough funds to use as collateral for financing?

Do we have enough management strength to handle the new company?

Will this acquisition in any way damage or enhance our relationship with shareholders, business partners, and customers?

Are we clear about the new marketing strategy?

Will the acquisition help us to capture specific market segment or enhance our market share in general?

Do we know the current competitors and future competitors?

What will be the effect on our distribution channels after acquisition? Can we manage it?

What will be the impact of acquisition on our product liability coverage in overseas markets?

What will be the impact on our existing R&D activities?

B. Besides they must be crystal clear as to what they are looking for in the other firm that they intend to acquire:

i. Product,

ii. Brand,

iii. Market share,

iv. Technology,

v. Equipment,

vi. Real-estate,

vii. Technical and skilled staff, management system etc., and

viii. Geographical location.

In addition to the above two sets of queries, the firm must get data on the prospective candidates for acquisition. Covering following points:

(i) Assets and liabilities of the prospective candidates

If they have suffered (of course they must have otherwise why they should be the candidates) than what were the reasons

Poor management?

Poor customer relations

Hidden losses not projected in the balance sheets

What is the customer base (dependent on few or many customers)

What is their suppliers base? (dependent on one or many suppliers)

What role the key persons play in the management of the company? Is company totally dependent on them or are they disposable?

Do they have any legal action going or pending or anticipated against them?

Do they have any environmental pollution problem? If so, do they have remedial alternative or not? If not then is this the main reason for their selling off the unit?

The best candidates are those who fit into your frame “A”, meet most of the requirements mentioned in “B”, and positively qualify on “C”. If there are more than two candidates shortlist them for negotiation. While conducting negotiations pay attention to following points;

i. Be clear in your objective to be achieved.

ii. Form a team of advisors (highly trusted ones)

iii. Prepare data bank on what you need and on your prospective candidates

iv. Target a price best suited for your requirements let it be the ceiling level

v. Make arrangements for funds for closing the deal

vi. Negotiate without taking any risk from the candidates in any form

vii. Review the negotiated terms and select the best (without disclosing identity)

viii. Call for re-negotiation to all, but target on the best selected one

ix. Check the renegotiated terms

x. Open negotiations with the best one and extract the best deal

xi. Have the agreement prepared, sign and seal it before leaving the negotiation table.

As said in the beginning, mergers and acquisition are the last phases in the development and expansion, as such it is most advisable for the firms exploring the international markets to attempt this route only after they have established themselves in specific markets and are familiar with the local laws, industry, market, government and lastly with the culture.

There is very common practice in large business organizations to station their future managers in the specific markets for extended period like 6 months or one year so that he gets used to the local culture and customs of the people besides the industry and the government. This background knowledge helps the organization in smooth and profitable operations when business channels are established.

According to the WTO Report 2000 the global FDI flow increased by 25% (US $ 800 billion) out of which USA attracted largest share at US $ 130 billion. Cross border merger and acquisition was mainly responsible for this situation.