After reading this essay you will learn about interest, annuities and profit.

Interest:

The term “Interest” means periodic payment for the use of “Capital”. It can be seen both from the borrowers’ as well as lender’s point of view. The borrower receives money which forms the capital for production of goods and services. Thus he earns profit by the borrowed capital and it is, therefore, fair that he should pay a part of this profit to the lender in the nature of interest.

It may be defined as ‘the paid money for the use of borrowed capital’.

It may also be defined as ‘the income produced by money which has been loaned’.

ADVERTISEMENTS:

This can be explained by the following example:

Suppose Mr. A comes to Mr. B and desires to borrow Rs.1000 saying he will return it after one year. Mr. B has Rs.1000 in his pocket, in which he had planned to purchase a few luxuries which he does not now possess. He decides that it would not be too bad to go without these luxuries, if Mr. A would promise to pay him something extra for his doing without these personnel pleasures for a year. He thinks that Rs.100 would be a fair price for this year of sacrifice on his part.

He quickly remembers that although he has known Mr. A for some time and believes he is entirely honest. Human nature has its weakness and there is some possibility that Mr. A might run off and not repay what he has borrowed. Also he remembers how many innocent people are killed by accident each year and realizes that this might happen to his friend so that he would not get back his money. He feels that he should also be paid some money for this risk.

He thinks an additional Rs.50 to be paid for this risk. He tells to Mr. A, he will be glad to let him use Rs.1000 for a year, if Mr. A will promise to give him back Rs.1150 at the end of the year. Mr. A agrees to do this, and the deal is made. The extra Rs.150 which Mr. B receives at the end of the year is said to be the interest which is earned from his Rs.1000 investment.

ADVERTISEMENTS:

Interest may be divided into two categories:

(A) Pure interest or net interest or general interest.

(B) Gross interest or commercial interest.

(A) Pure Interest:

ADVERTISEMENTS:

It is one which is same for all exchanges of loans and which involves:

(i) No risk of non-payment.

(ii) No inconveniences, and

(iii) No additional work.

ADVERTISEMENTS:

Suppose a person lends Rs.100 and gets back Rs.106 at the end of one year without involving risk of loss, any inconvenience or additional work, then Rs.6 is the pure interest and Rs.6 per hundred per annum is the rate of pure interest or the general rate of interest.

(B) Gross Interest or Commercial Interest:

It is gross or the total interest earned on the capital under the actual commercial conditions, i.e., conditions involving risk of loss, inconvenience and additional work. Suppose, a person lends Rs.100 and gets back Rs.115 at the end of one year, he has earned gross interest of Rs.15 per hundred per annum.

This gross interest includes the pure interest and the money cost of risk, inconveniences and additional work involved in the transaction. Thus, the rate of gross interest varies with nature of securities, persons involved in deal, time and place.

ADVERTISEMENTS:

The following questions arise in the study of rate of interest:

(a) Why should pure interest be paid at all?

(b) Why are there different rates of gross interest?

(c) Why does the rate of gross interest vary?

ADVERTISEMENTS:

(d) How is interest related with rent?

(c) Reason for Paying Interest:

This question should be seen from the borrower’s points of view and from the lender’s point of view. Thus borrower receives money which forms the capital for production of goods and services. Production brings wealth to the borrower results from the capital borrowed and it is, therefore, fair that he should pay a part of this benefit to the lender on capital in the nature of interest.

The lender of money has accumulated money through abstinence from immediate consumption. It is then justified that this sacrifice be rewarded in the form of interest on capital so accumulated.

ADVERTISEMENTS:

(b) Reasons for Different Rates of Gross Interest:

The rates of gross interest vary with the nature of securities, persons involved in the deal, time, place etc.

The reasons for these different rates are as below:

(i) Differences in risk involved.

(ii) Differences for inconveniences.

(iii) Differences in additional work involved,

ADVERTISEMENTS:

(iv) Differences in cost of investment.

(v) Differences in period of investment.

(vi) Possibility of changes in the value of money.

(c) Reasons for Variations in the Rate of Interest:

The important reasons may be:

(i) New inventions and better methods and techniques of production increase the level of productivity of capital goods. The demand for capital increases and hence the rate of interest increases.

ADVERTISEMENTS:

(ii) Due to certain changes, the durability of capital goods may reduce or the capital goods may become obsolete. Then the demand for replacement increases resulting in increased rate of interest.

(iii) Changes in the general rate of real wages may change the rate of interest. In this case, people can afford to save some more money. If saving is more, rate of interest will fall.

(iv) Changes is saving habits of people may cause corresponding variations in the rate of interest. Thus, if people start saving more money, the rate of interest may fall.

(v) Variation in the rate of interest may take place due to variations in rate at which price index is changing. It has been found that the rate of gross interest is more, if the rate of increase of price index is higher.

Interest in Relation to Rent:

Once the capital has been invested in capital goods the return from the capital goods replaces the interest on the capital. Now this return from capital goods is closely related to the return or the rent on the land. Thus the rent is the surplus earnings on the land, the quantity of land being fixed. Similarly the return on the durable capital goods is in the same nature of surplus earnings and hence is termed as “Quasi rent”.

ADVERTISEMENTS:

Thus corresponding to rent on land we have quasi rent on capital goods.

Theories of Interest:

Any theory of interest should be able to answer the following two factors:

(a) Why interest should be charged, and

(b) Why the rate of interest at any time or any place is? What it is?

The various theories of interest are:

1. Productivity theories of interest.

ADVERTISEMENTS:

2. Abstinence theory of interest.

3. The Austrain theory or Bohm-Bawerle’s theory of interest.

4. Time Preference theory of interest or Fisher’s theory of interest.

5. The Neo-classical theory of interest, and

6. The Liquid Preference theory of interest.

1. Productivity Theory of Interest:

ADVERTISEMENTS:

This theory states that:

(a) Interest on capital is justifiable because of the productivity of capital, and

(b) The rate of interest is proportional to the productivity of capital.

Suppose a person borrows money, invests it on machinery, process goods and earns profits. It means, the borrower is in a position to pay interest on the borrowed capital because he earns through the borrowed money. What should be the rate of interest? This theory states that the rate of interest should be proportional to the productivity of the capital.

2. Abstinence Theory:

This theory suggests that in order to lend capital to borrowers, the creditors shall have to undergo a sacrifice. They abstain from consumption. The rate of interest is a reward to the capitalists for abstaining from the unproductive consumption for wealth to make it available for production.

This abstinence from consumption is regarded as a real sacrifice or cost which deserves a reward in the form of rate of interest. If the lenders consume goods and services, they get pleasure. If they do not, they feel pain of not having that pleasure and, therefore, interest is to be paid.

3. The Austrian Theory:

An Austrian economist, Mr. Bohm Bawerle is the main person to develop this theory.

This theory has three main statements:

(a) Mostly people prefer present consumption of future. A bird in hand is worth two in the bush. People see future needs as something rather vague and unimportant and present needs as something very urgent and definite, they discount the future. According to this theory, interest is the price paid in order to overcome this unreasonable preference for present over future needs.

(b) The capital is productive and the more round-about method of production is adopted, the higher is the productivity of capital. Productivity explains as the willingness to pay interest.

(c) At any time, supply of capital arises from the savings through postponing present consumption while the demand for capital due to greater productivity of round-about process of production involving greater time.

Regarding the rate of interest the theory states that it is determined by the force of demand and supply of capital.

4. Time-Preference Theory:

Prof. Fisher has stated his theory in terms of time preference. According to him interest is the price of time. He says that there is a time-preference for all individuals. They will save different amounts for different periods and for different rates of interest.

Similarly, there will be people who will demand different amounts for different periods for investment. There will be a market of supply of savings and demand for savings but time-preference will alone determine the rate of interest because demand for investment is infinite and, therefore, it is always there. The determining factor is supply of saving which depends on the time-preference of the people.

5. The Neo-Classical Theory:

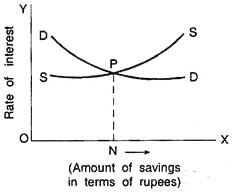

According to this theory the rate of interest brings demand and supply of money for investment into equilibrium with one another This condition is analogous to the condition that at any price of a commodity, the demand for the commodity equals the supply. The interaction of these two forces determines the rate of interest. It can be represented graphically.

Let DD is the demand curve and SS the supply curve saving. P is the point of interaction of both the curves. Therefore, PN is the rate of interest and ON is the quantity of saving supplied and demanded in the market.

6. Liquidity Preference Theory:

Keynes developed this theory which deals with the following three factors:

(i) The nature of interest,

(ii) The necessity of interest, and

(iii) Determination of the rate of interest.

(i) The Nature of Interest:

Keynes says that there is the “real rate” of interest. He defined various commodity rates of interest and the money rate of interest is treated as a particular case of commodity rate. For example, if 5 kg of sugar today may be exchanged for 6 kg of sugar after one year, then the sugar rate of interest is 20%. Different commodities have different commodity rate of interest.

(ii) The Necessity of Interest:

Keynes disagree that the rate of interest determines the amount of savings. According to him, the savings depend on the general level of income of people and their marginal requirement to consume. Having saved some money, an individual has the alternative of either keeping this money which is readily available whenever required or investing it for a definite duration and earning interest. The interest earned is a reward on his savings.

(iii) Rate of Interest:

Keynes states that the rate of interest is determined by the supply and demand for money itself. According to him, if the rate of interest increases, the amount of cash intended to be hoarded by public would fall below the available supply of hoards. A new equilibrium is then reached and the amount of hoards gets reduced. Reverse action takes place, if the rate of interest falls.

Why Interest Varies:

There are several reasons of interest variations.

1. If the productivity as capital goods is the reason for demand for liquid capital, then the demand will increase or decrease according to the changes in productivity. New invention will change the level of productivity and hence rate of interest.

2. Some technical reasons connected with the nature of the capital goods may change the rate of interest. The more rapidly the capital goods wear out or become obsolete, the greater will be the demand for fresh capital to replace them.

3. The changes in the habits of the people to hard capital will affect the rate of interest.

4. The secular changes in the normal expectation of life may cause the rate of interest to vary over long periods. The longer the expectation of life, the lower becomes the rate of interest.

5. The changes in the rate of interest will depend on the level of income of people. If they have just enough to live, they cannot save anything at all, whatever may be the rate of interest.

Interest and Quasi-Rent:

Quasi-rent means the productivity of the capital goods. Whatever return we get from the capital goods is called ‘Quasi-rent’, because it is in the form of surplus. In other words, the returns of real capital goods or assets are called quasi-rent.

The Reasons for Interest:

From the above explanation, it is clear that the interest represents payment for the use of borrowed money, and it represents payment to the lender for several things.

(i) It pays him for foregoing the use of his money during the time the borrower has promised to pay it.

(ii) It is payment for the risk he took in permitting another person to use his money.

He can get interest by loaning money acts as an incentive for him to accumulate capital to lend. Thus interest usually represents payment for several reasons.

In the transaction between Mr. A and Mr. B, Mr. A promised to repay Mr. B the amount he borrowed and in addition agreed to pay a specified rate of interest. Thus, the amount of principal to be repaid and the rate of interest were guaranteed by the borrower.

These are fundamental conditions where interest is involved. Repayment of the principal is guaranteed by the borrower, and the rate of pay for the use of the borrowed funds is specified. In this way there is a clear distinction between interest and profits, since profit arises from the investment of capital in business ventures where there is no guarantee of return of the capital and no assurance as to what if any, the rate of return will be.

The Productivity of Capital:

Some people are afraid as how a person can afford to borrow money to undertake business, when not only the capital but interest must also be repaid. This capital is productive, i.e. equipment which is purchased with the borrowed capital enables the borrower to produce more income than he could without it. lie can thus repay the borrowed money plus interest and still have a net profit which he otherwise would have not been able to earn.

The following example explains this:

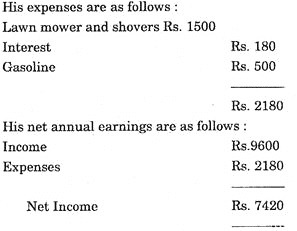

Suppose a gardener earns his living by mowing and otherwise taking care of lawns. Using an ordinary lawn mower and trimming shovers, he takes care of 12 lawns at a fee of Rs.40 per month. His annual income is

40 × 12 × 12 = Rs.5760

He purchases a gasoline-powered lawn mower and some electric trimming shovers. These cost a total of Rs.1500.

He borrowed Rs.1500 at 12% interest. Now with the help of this new equipment he can take care of 20 lawns.

His annual income now is:

20 × 40 × 12 = Rs.9600

While in the first case his earning was Rs.5760. Thus, by borrowing money, he earned Rs.7420 – 5760 = Rs.1660, extra.

The productivity of capital explains why there is a constant interchange of money in business activity. In order to increase our productivity and thereby our standard of living, there has to be a constant flow of capital into business enterprise.

Interest and profit are, therefore, essential factors in making an adequate supply of capital available so that the economy of this country can expand and provide jobs. Unless interest and profit rates are adequate, the necessary capital will not be available from public.

Kinds of Interests:

Interest is of two kinds:

(i) Simple Interest, and

(ii) Compound Interest.

Simple Interest:

Simple interest is directly proportional to time and the total interest is payable at the end of the specified period usually one year. For example, if Rs.2000 are box-rowed for 2 years at 9% interest rate, the interest earned will be

Rs. (2000 × 0.09 × 2) = Rs.360

The interest I is found by the formula,

1 = P × n × i

where

I = Simple interest amount,

P = Principle amount.

i = Rate of Interest and

n = No. of years in the period

If one wishes to know the entire amount, due i.e., (principal + interest).

S = P + I = P (1 + ni)

Interest computed in this way is known as simple interest and the factor (1 + ni) is called the interest factor.

Ordinary Simple Interest:

Usually the unit of time for the interest period is taken as one year and the resulting interest rate is the rate per year. When it is required to compute the interest due for a fraction of one year, it is often the practice to consider 360 days in a year.

Thus, 50 days are equal to 50/360 of one year. Interest calculated on this basis is called “Ordinary simple interest”.

Exact Simple Interest. If the interest is calculated on the basis of 365 days in a year, the result is called “Exact simple interest.”

Compound Interest:

When the interest due at the end of the period becomes a part of the principal and itself earns interest along with the principal, it is called “Compound interest”. Depending upon the length of the interest period, quarterly or so, the formula for compound interest is

S = P (1 + i)n

where S = compound amount.

Here the factor (1 + i)n is called compound amount factor or CAF.

If interest is paid more than once in a year say semi-annually, quarterly or monthly etc. the formula for compound amount factor is

where

i = interest rate per year

n = no. of years in the period

m = no. of periods per year.

Example 1:

Calculate the compound amount when Rs. 2000 are lent at 9% interest rate for 3 years, being compounded semi-annually.

Solution:

No. of periods per year = 2

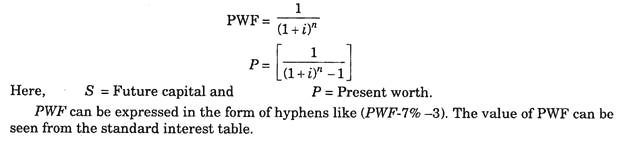

Present Worth:

People wish to determine the value at the present time of a sum of money which will be available at some time in the future. For example, suppose a person purchased a Rs.100 saving bond. The bond states that 10 years from the date of purchase, the government would pay the holder of the bond Rs.100. How much would the bond be worth, at the time of receipt.

Naturally, it would be worth just what was paid in it, say Rs.30. Thus Rs.30 could said to be “present value” of Rs.100 which was to be received 10 years later.

Compound Amount Factor (CAF) is used to determine the future value of present capital. For example, the future value of present capital of Rs.2450. The same thing expressed in the reverse way, it means that the present value of Rs.2450 at 7% interest 3 years back is Rs.2000.

Therefore, the formula in Present Worth Factor (PWF) is written as:

Example 2:

Determine the present value of Rs.5000 due after 5 years at. 9% compound interest rate.

Solution:

The above explained CAF and PWF refer to amounts payable in one single payments (SP), it should, therefore, be called as CAF (SP) and PWF (SP) standing for (1 + i)n, 1/(1 + i)n respectively. In most of the cases payments are made in series of periodical “equal payments”. These are called “Annuities”.

Annuities:

An annuity is a series of equal payments occurring at equal periods of time. It may also be said as “Equal payment or uniform payment series”. In certain business dealings, equal payments are made at the end of equal periods of time and all such accumulated payments are allowed to earn compound interest.

Periods of time may be of any length, say a year and month etc. but periods should be of equal length. Interest is expressed in yearly terms but the actual interest is paid at the end of each equal period. Hire purchase payments, installment buying, L.I.C. premium payments etc. are made by this method.

Features:

These have the following common features:

(i) These involve series of payments.

(ii) All payments are of equal amount.

(iii) Payments occur at equal time intervals.

(iv) All payments are made at the end of periods.

(v) Compound interest is earned on all accumulated payments.

Kinds of Annuities:

1. Capital Recovery Annuity,

2. Present Worth Annuity,

3. Sinking Fund Annuity, and

4. Compound Annuity.

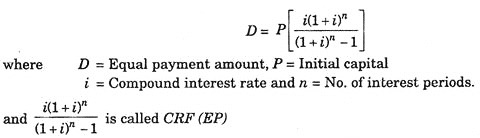

1. Capital Recovery Annuity:

This is applied in case of debt payments where this initial debt or capital is recovered in uniform or equal periodical payments. It is commonly seen in deferred payments, installment purchase etc., in all such cases the seller recovers his capital along with accumulated compensating interest not in open single lump sum payment but in “Periodical equal payments”.

The desired formula for this is:

where CRF (EP) is known as Capital Recovery Factor (Equal Payments).

The values of CRF (EP), can be seen from standard interest tables. These can be expressed through hyphens as [CRF (EP)-8%-7] where 8% means interest rate is 8% per year and the money is borrowed in 7 years.

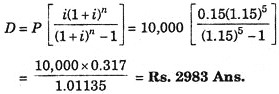

Example 3:

A person took a loan of Rs.10,000 from a bank for 5 years at 15% compound interest. The person wants to pay-off the amount in 5 equal annual installments. Determine the amount of each equal payment.

Solution:

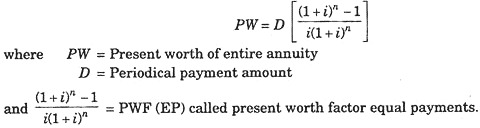

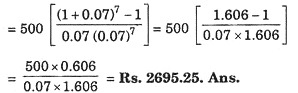

2. Present Worth Annuity:

This is applied in cases of L.I.C. premiums and all other retirement plans. These are usually known as premium annuities, income annuities and other future provisions. The desired formula is

This can be expressed in the form of hyphens as [PWF (eP) 5%-6] means interest rate is 5% on 6 years. The value of PWF-(eP) at different interest rates corresponding to different periods are found in standard interest tables.

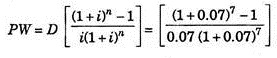

Example 4:

A person wants that his daughter should get a fixed amount of Rs.500 at the end of every year for the coming 7 years, so that they may put today itself in the bank total present worth capital which earning a 7% interest, compounded annuity.

Here

3. Sinking Fund Annuity:

This is applied when a definite sum requires to be collected at a future date by setting aside at equal intervals of time equal amounts ; so that these equal period payments while earning compound interest total up to the desired amount at the desired future date.

Suppose a manufacturing concern wants to open a depreciation reserve fund for machinery replacement by setting apart equal depreciation amounts in the sinking fund.

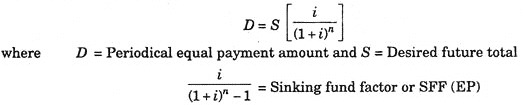

The desired formula is:

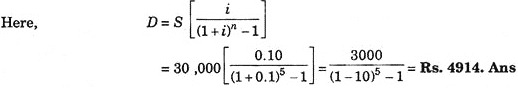

Example 5:

A manufacturing concern desires at the end of 5 years a sinking fund of Rs.30,000. What equal amount should it deposit every year and, earning 10% interest.

Solution:

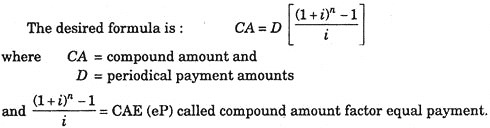

4. Compound Amount Annuity:

In this a person deposits equal amounts at the end of a number of periods and each amount is allowed to earn compound interest per period. This is used in savings deposit schemes and cumulative time deposit schemes.

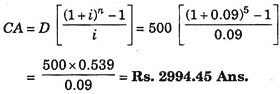

Example 6:

Calculate the total compound amount for a 5 years annuity paying Rs. 500 at every year end, earning interest rate of 9% per year.

Profit:

The profit of a firm equals the total sale proceeds minus the cost of production. It is the residual part of the total sale proceeds left over after paying off all the items of expenditure in the cost of production including rent on land, wages for labour, interest on borrowed capital, salaries of management and organisation etc.

But, out of this profit, later on certain adjustment is to be made. We have to subtract not only actual cost but also certain imputed cost in order to obtain “gross profit”. Owner’s capital and owner’s labour is to be paid although they have not been actually paid.

These cost should be added to the actual costs. In addition, certain tax obligations might have arisen during that year. These can be paid next year also, but to arrive at a correct figure of gross profits we should add those tax payments on the cost side. The value of the existing stock is also obtained and this should also be deducted to obtain the true value of “Gross Profits”.

To obtain “Net Profits”, we are required to make still certain adjustments. From the gross profit, deduct depreciation charges and the cost of new investment during that period.

The final position is called as “Net Profits”. It can be summarised in the following ways:

1. Residue = Actual Receipts during a period-Actual payments made during that period.

2. Gross Profit = Residue-Imputed charges of owner’s labour and capital—Tax obligations—Value of balance stock.

3. Net Profit = Gross Profit-Value of capital equipment added during the period—Depreciation charges.

Theories of Profits:

Various theories of profit have been put forth by different economists to explain the profits.

The important among these are:

1. Risk and Uncertainty theory.

2. Dynamic Approach to the profit theory.

3. Residual theory of Profits.

1. Risk and Uncertainty Theory:

This theory was introduced by Howley and according to him net profit is the residual income of the owner after making payments for all factors of production and is the reward for the risk taken by him. It concludes that profits are due to the risk taken by the owner.

The owner has to bear the risk of losing capital, there are certain risks which cannot be insured. They are known as uninsurable risks. We cannot predict when fashion will change or when new invention will come or when will war outbreak etc. There are unforeseeable changes and hence in value risks which cannot be insured payments made for these uninsurable risks are called ‘profits’.

2. Dynamic Theory of Profits:

Mr. J.B. Clark introduced this theory. According to Clark, the pure profit in a dynamic society is the residual income of the owner after making all payments including rent, wages interest and salary of management.

Such pure profit in the form of residual earning result only in a dynamic society where the changes in population, stock of capital, tastes or fashion, production techniques, management principles etc. occur dynamically. In a static society since there are no such changes, no pure profit may result.

Thus pure profit is a sign of progress. Thus to increase profit an owner may produce a new commodity, popularise it and earn large profit and soon competition sets in, the profit decline. Thus in maintaining pure profits high continuous progress is essential.

3. Rent Theory of Profits:

This theory was introduced by Walker, who considered profit as a form of rent. He says that owner earns profit in the same way as land earns rent.

Marshall has criticized this theory for the following reasons:

(a) Whereas rent on land is in the form of surplus earnings, profit is not.

(b) Land may produce zero or positive rent but never negative rent whereas net profit may be positive, zero or negative.