In this article we will discuss about interest cover and income gearing in a company.

Interest Cover:

This ratio is calculated to analyse the company’s ability to meet interest obligations. It is expressed as number of times interest earned. It is measured as a ratio of profit before interest and tax to interest charges.

The more the number of times interest earned, safer the position of debt providers.

Income Gearing:

ADVERTISEMENTS:

The inverse of interest cover is called ‘income gearing’, indicating the proportion of pre-tax earnings committed to prior interest charges.

The lower the percentage indicates the company’s ability to meet interest obligation in time.

Problem 1:

ADVERTISEMENTS:

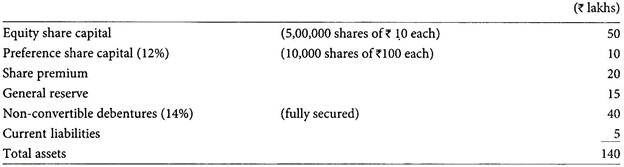

Quick Fix Ltd’s balance sheet shows the following structure of finance for the year ended 31st March, 2016.

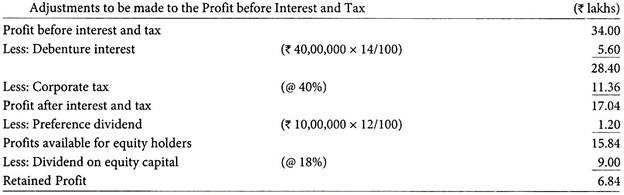

The profit earned during the year before interest payments and tax (@ 40%) amounted to Rs.34 lakhs Board of Directors recommend a dividend @ 18% on equity shares.

You are required to calculate:

ADVERTISEMENTS:

(a) Capital gearing ratio,

(b) Income gearing ratio.

Solution:

The gearing ratio is small and the company’s financial risk is lesser.

This shows sufficient cushion for payment of interest to the debenture holders.

ADVERTISEMENTS:

Problem 2:

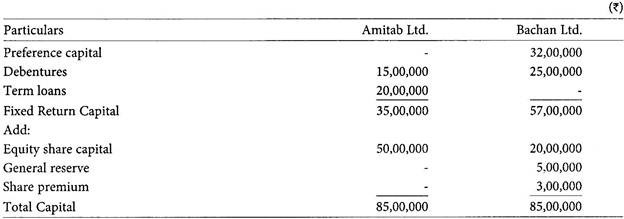

Amitab Ltd’s capital structure on 31-3-2016 includes 5,00,000 equity shares of Rs.10 each, 10,000 debentures of Rs.150 each carrying 15% rate of interest and term loan of Rs.20,00,000 repayable in 7 year period with 18% rate of interest.

Bachan Ltd’s balance sheet shows the following capital structure:

2,00,000 Equity shares of Rs.10 each

ADVERTISEMENTS:

32,000 Preference shares of Rs.100 each (12%)

General reserve of Rs.5,00,000

Share premium account Rs.3,00,000

25,000 14% Fully secured Non-convertible debentures of Rs.100 each

ADVERTISEMENTS:

From the above data you are required to calculate the leverage of both the firms and compare with each other.

Solution:

Analysis:

It is seen from the above calculations that Amitab Ltd.’s leverage is low as compared to Bachan Ltd.’s leverage and hence its financial risk is less as compared to Bachan Ltd.