Here is a compilation of essays on ‘Mutual Funds’ for class 9, 10, 11 and 12. Find paragraphs, long and short essays on ‘Mutual Funds’ especially written for school and college students.

Essay on Mutual Funds

Essay Contents:

- Essay on the Meaning of Mutual Funds

- Essay on How to Setup a Mutual Fund?

- Essay on the Parties to Mutual Fund

- Essay on the Types of Mutual Fund Schemes

- Essay on the Performance of Mutual Funds

- Essay on the Criteria in Selection of Mutual Fund

- Essay on the Benefits of Mutual Fund Investments

- Essay on the Drawbacks of Mutual Fund Investments

1. Essay on the Meaning of Mutual Funds:

ADVERTISEMENTS:

Mutual fund is a mechanism for pooling the resources by issuing units to the investors and investing funds in securities in accordance with objectives as disclosed in offer document.

Investments in securities are spread across a wide cross-section of industries and sectors and thus the risk is reduced.

Diversification reduces the risk because all stocks may not move in the same direction in the same proportion at the same time.

Mutual fund issues units to the investors in accordance with quantum of money invested by them.

ADVERTISEMENTS:

Investors of mutual funds are known as ‘unit holders’.

The profits or losses are shared by the investors in proportion to their investments.

The mutual funds normally come out with a number of schemes with different investment objectives which are launched from time to time.

A mutual fund is required to be registered with SEBI which regulates securities markets before it can collect funds from the public.

ADVERTISEMENTS:

Basically, mutual funds are functioning as a financial institution to mobilize resources from various investors to invest them in financial assets, since the average investor does not have the necessary resources, time, knowledge and expertise to participate in today’s complex and volatile investment markets.

Mutual funds ensure its participants a professional management for portfolio selection, diversifies the investment in large number of companies and selects various forms of securities viz., shares, debentures and bonds.

2. Essay on How to Setup a Mutual Fund?

A mutual fund is set up in the form of a trust, which has Sponsor, Trustees, Asset Management Company (AMC) and Custodian.

ADVERTISEMENTS:

The trust is established by a Sponsor or more than one Sponsor who is like promoter of a company.

The Trustees of the mutual fund hold its property for the benefit of the unit holders.

Asset Management Company (AMC) approved by SEBI manages the funds by making investments in various types of securities.

Custodian, who is registered with SEBI, holds the securities of various schemes of the fund in its custody.

ADVERTISEMENTS:

The Trustees are vested with the general power of superintendence and direction over AMC.

Trustees monitor the performance and compliance of SEBI regulations by the mutual fund.

SEBI regulations require that at least two thirds of the Directors of Trustee company or Board of trustees must be independent i.e. they should not be associated with the sponsors. Also, 50% of the directors of AMC must be independent.

All mutual funds are required to be registered with SEBI before they launch any scheme.

ADVERTISEMENTS:

ADVERTISEMENTS:

3. Essay on the Parties to Mutual Fund:

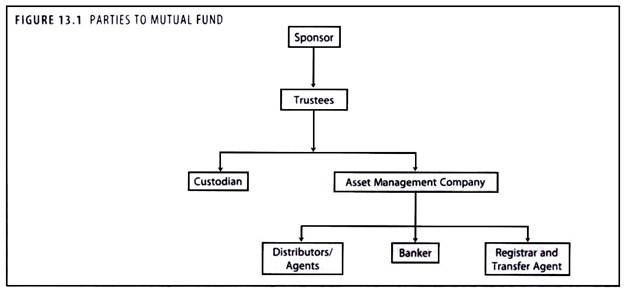

The parties involved in the formation and working of the mutual funds is shown in figure 13.1:

Sponsor:

ADVERTISEMENTS:

1. Akin to the promoter of the company.

2. Establishes the Mutual fund.

3. Gets it registered with SEBI.

4. Forms a Trust and appoints Board of Trustees.

5. Contribute at least 40% of the net-worth of the Asset Management Company.

Trustees:

ADVERTISEMENTS:

1. Board of Trustees holds the property of mutual fund on behalf of unit holders.

2. Appoint Asset Management Company and ensure that all the activities of the AMC are in accordance with the SEBI regulations.

3. Appoint the Custodian of the fund.

4. Accountable for funds and property of the respective schemes.

A. Custodian:

1. Holds the fund’s securities in safekeeping.

ADVERTISEMENTS:

2. Settles securities transactions of the fund.

3. Collects interests and dividends paid on securities.

4. Records information on stock splits and other corporate actions.

B. Asset Management Company (AMC):

1. Floatation of various mutual fund schemes matching the requirements of investing public.

2. Management of mutual funds in accordance with SEBI regulations.

ADVERTISEMENTS:

3. For carrying out asset management activities.

4. AMC charges fee to the schemes it manages within the ceiling prescribed under regulations.

i. Distributors/Agents:

1. Sells units on behalf of the fund.

2. Distributors comprise of banks, non-banking financial companies and other distribution companies, individuals constitute the agency force.

ii. Banker:

ADVERTISEMENTS:

1. Facilitates the financial transactions.

2. Provides remittance facilities.

iii. Registrars and Transfer Agent:

1. Maintains records of unit holders’ accounts and transactions.

2. Receives funds from the investing public and allot units.

3. Disburses the fund to the unit holders.

ADVERTISEMENTS:

4. Handles communication with the unit holders.

5. Provides unit holder transactions services.

4. Essay on the Types of Mutual Fund Schemes:

The mutual fund schemes can be classified into the following classes:

1. Open-Ended Scheme:

These schemes do not have a fixed maturity period. An open-ended fund sells and repurchases units at all times at a price linked to Net Asset Value (NAV). These schemes are available for subscription and repurchase on a continuous basis. The key feature of these schemes is liquidity.

2. Close-Ended Schemes:

A close-ended fund makes a one-time sale of a fixed number of units during the initial offer period. These schemes has a stipulated maturity period. The fund is open for subscription only during a specified period at the time of launch of the scheme. In order to provide an exit route to the investors, some close-ended funds give an option of selling back the units to the mutual fund through periodic repurchase at NAV related prices through listing on stock exchanges. These mutual funds schemes disclose NAV generally on weekly basis.

3. Interval Schemes:

These combine the features of open-ended and close-ended schemes which may be traded on the stock exchange any time or will be open for sale or redemption during predetermined intervals at NAV related prices.

4. Debt Funds (Income Funds):

The aim of income funds is to provide regular and steady income to investors. Debt funds invest in debt instruments issued by governments, private sector companies, banks and financial institutions. Such funds are less risky compared to equity schemes. These funds are not affected by the fluctuations in equity markets.

5. Diversified Debt Funds:

A debt fund that invests in all the available types of debt securities, issued by entities across all the industries and sectors is a properly diversified debt fund. A diversified debt fund has the benefit of risk reduction through diversification.

6. Focused Debt Funds:

These funds have a narrower focus, with less diversification in their investments. A substantial part of the portfolio is invested in debt instruments and is therefore more income- oriented and inherently less risky than equity funds. The narrow focus funds have greater risk than diversified debt funds.

7. High Yield Debt Funds:

The debt funds reduce the default risk by investing in securities with high credit rating. But these funds don’t earn high yields. High yield debt funds, however, seek to earn higher returns by investing in debt instruments that are considered below ‘investment grade’.

8. Assured Return Funds:

The most popular variant of assured return funds is the monthly income plans. Returns are indicated in advance for all of the future years of these close-ended schemes. In assured return scheme, the shortfall, if any, is borne by the Sponsors/Asset Management Companies (AMCs).

In these funds the investors have to normally lock-in their funds for the term of the scheme or at least a specified period such as three years. These schemes may be considered to be the lowest risk type within the debt funds category, but they are not entirely risk-free.

9. Fixed Term Plans:

These schemes are essentially closed-ended in nature. The scheme issues a fixed number of units for each series only once and closes the issue after an initial locking period, like a close- ended scheme offering, the maturities are ranging from three months to 18 months. No exit or entry is allowed in between.

10. Equity Funds:

The equity funds invest the entire amount in equity shares of different companies.

11. Growth Funds:

The aim of growth funds is to provide capital appreciation over the medium to long-term over a three to five-year period. Growth funds invest in companies whose earnings are expected to rise at an above average rate. Growth funds are less volatile than funds that target aggressive growth.

12. Specialty Funds:

These funds invest in only predetermined portfolio of securities. Most of the specialty funds tend to be concentrated funds and are more volatile than diversified funds.

13. Sector Funds:

The fund’s portfolio consist of investment in only one industry or sector of the market such as Information technology, Telecommunications, Pharmaceuticals. The returns in those funds are dependent on the performance of the respective sectors. These funds may give higher returns, but they are more risky compared to diversified funds.

14. Foreign Securities Funds:

These funds invest in equities in one or more foreign countries thereby achieving diversification across the country’s borders. They carry foreign exchange rate risk and their performance depends on the economic conditions of the countries they invest in.

15. Mid-Cap or Small-Cap Equity Funds:

These funds invest in shares of companies with relatively lower market capitalization than that of big, blue-chip companies. They are more volatile than other funds. But these funds may be having aggressive-growth.

16. Diversified Equity Funds:

These funds seek to invest substantially in equities, leaving a small portion in liquid money market securities. These funds seek to reduce the sector specific risks through diversification.

17. Equity Index Funds:

These funds replicate the portfolio of a particular index such as the BSE Sensitive Index, S&P CNX Nifty etc. These schemes invest in securities in the same weightage comprising of an index. NAV of such schemes would rise or fall in accordance with the rise or fall in the index, though not exactly by the same percentage due to some factors known as ‘tracking error’. These funds take only the overall market risk, while reducing the sector and stock specific risks through diversification.

18. Equity Income or Dividend Yield Funds:

These funds mainly invest in shares of companies whose dividend payout is higher. They aim at capital appreciation, as well as, high level of current income through dividends.

19. Balanced Funds:

The aim of balanced funds is to provide both growth and regular income as such schemes invest both in equities and fixed income securities in the proportion indicated in their offer documents.

20. Money Market or Liquid Funds:

These funds provide easy liquidity, preservation of capital and moderate income. These schemes invest exclusively in safer short-term instruments such as treasury bills, certificates of deposit, commercial paper and interbank call money, government securities etc. Returns on these schemes fluctuate much less compared to other funds.

21. Gilt Funds:

These funds invest exclusively in government securities. Government securities have no default risk. NAV of these schemes also fluctuate due to change in interest rates.

22. Tax Savings Funds:

These schemes offer tax rebate to the investors under specific provisions of the Income-tax Act, 1961 e.g. Equity Linked Savings Scheme (ELSS). Pension schemes launched by mutual funds also offer tax benefits.

23. Offshore Funds:

These funds will have non-residential investors and are regulated by the provisions of the foreign countries where these funds are registered.

24. Asset Management Mutual Funds:

These funds have special characteristics of dealing with assets other than securities. These funds can acquire various assets and give them on lease basis to needy lessees.

25. Asset Allocation Funds:

The proportion of money to be invested in a particular class of asset is predefined. The fund manager is given the flexibility to shift towards equity when equity market is expected to do well and to shift towards debt when the debt market is expected to do well.

26. Commodity Funds:

The commodity funds devise scheme in investing in different commodities directly or through shares of commodity companies or through commodity futures contracts. These funds may invest in a single commodity or a commodity group.

27. Real Estate Funds:

These funds would invest in real estate directly, or may fund real estate developers or lend to them or buy shares of housing finance companies or may even buy their securitized assets.

28. Funds of Funds:

A fund of funds invests in other mutual funds. Availability of fund of funds to an investor helps him select the right funds from a variety of schemes offered by different asset management companies.

29. Floating Rate Fund:

These funds are very popular abroad. These are the kinds of funds, which provide a hedge to the investors against volatile interest rates. These funds primarily make investments in floating rate debt instruments.

30. Bond Index Funds:

Like an equity index fund, in a bond index fund investments are in the instruments comprising the underlying bond index in the same proportion with an objective of replicating the returns on the same.

31. Theme Funds:

A theme fund invests in sectors surrounding a theme. For example, the technology theme may be taken to include IT services, telecom, media and entertainment sectors. But the central theme remains the same. Similarly, infrastructure can be taken to include sectors such as construction, capital goods, power and power equipment and so on.

32. Global Funds:

Mutual fund houses in India can mobilize rupee funds from Indian residents for investments abroad. These are global funds which may invest in foreign countries, elsewhere India, as made it clear in the offer document. This will enable diversification of country risk, but such investments are prone to currency risk. The global funds are aimed for high net-worth individuals and not for small investors.

33. Area Funds:

The funds may have, at the international level, investments in securities of specified areas e.g., Japan Fund, Thailand Fund or South Korea Fund. These funds provide access to foreign investors into domestic securities of these countries.

34. Load and No-load Funds:

Marketing a new mutual fund scheme involves initial expenses. These expenses are recovered from the investors in different ways.

Three typical Ways Used are:

(i) Entry Load:

At the time of entry into the fund/scheme, by deducting certain percentage of investment amount.

(ii) Exit Load:

At the time of exit from the fund/scheme, by deducting a specified amount from the redemption proceeds payable to the investor.

(iii) By charging the fund/scheme with a fixed amount each year, during a specified number of years. These funds/schemes are also called as ‘no load fund’.

35. Mother and Mirror Funds:

Both the terms refer to in the context of global funds.

A fund house in India when investing its funds in a foreign country will have three choices:

(i) Invest independently based on its own assessment of the market, or

(ii) Simply follow the mother fund that is the scheme belonging to the same fund house which then would be mirroring the investment pattern of the mother fund, or

(iii) Plug into the mother fund by simply and passively investing in the units of the mother fund.

The investments of a mirror fund faithfully mirrors the investments of another fund house.

5. Essay on the Performance of Mutual Funds:

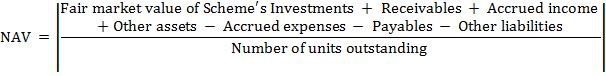

1. Net Asset Value:

The performance of a particular scheme of a mutual fund is denoted by net asset value (NAV).

The ‘net asset value is the market value of the assets of the scheme minus its liabilities.

The per unit NAV is the net asset value of the scheme divided by the number of units outstanding on the valuation date.

i. Sale Price:

It is the price paid when amount is invested in a scheme. It is also called ‘offer price’, it may include a sales load.

ii. Repurchase Price:

It is the price at which a close ended scheme repurchases its units and it may include a back-end load. This is also called ‘bid price’.

iii. Redemption Price:

It is the price at which open ended schemes repurchase their units and close ended schemes redeem their units on maturity. Such prices are NAV related.

Mutual funds invest the money collected from the investors in securities markets.

NAV is the market value of the securities held by the scheme.

Since market value of securities changes every day, NAV of a scheme also varies on day to day basis.

The NAV per unit is the market value of securities of a scheme divided by the total number of units of the scheme on any particular date.

For example, if the market value of securities of a mutual fund scheme is Rs.200 lakhs and the mutual fund has issued 10 lakhs units of Rs.10 each to the investors, then the NAV per unit of the fund is Rs.20. NAV is required to be disclosed by the mutual funds on a regular basis – daily or weekly – depending on the type of scheme.

NAV is the rupee value of one unit of a scheme of the fund.

NAV is calculated as follows:

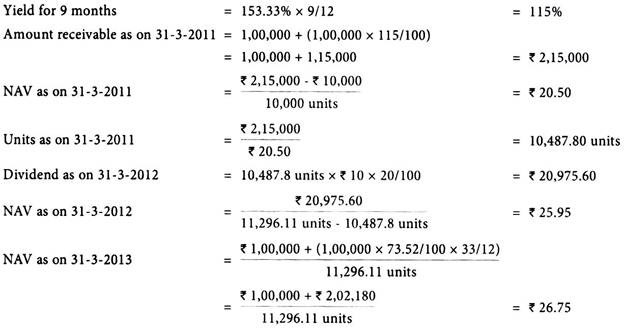

Illustration 1:

Mr. X on 1.7.2010, during the initial offer of some Mutual Fund invested in 10,000 units having face value of Rs.10 for each unit. On 31.3.2011 the dividend operated by the M.F. was 10% and Mr. X found that his annualized yield was 153.33%. On 31.12.2012, 20% dividend was given. On 31.3.2013 Mr. X redeemed all his balance of 11,296.11 units when his annualized yield was 73.52%. What are the NAVs as on 31.3.2011, 31.12.2012 and 31.3.2013?

Solution:

2. Entry Load and Exit Load:

A Load Fund is one that charges a percentage of NAV for entry or exit. Each time one buys or sells units in the fund, a charge will be payable.

This charge is used by the mutual fund for marketing and distribution expenses.

Suppose the NAV per unit is Rs.10 if the entry as well as exit load charged is 1%, then the investors who buy would be required to pay Rs.10.10 and those who offer their units for repurchase to the mutual fund will get only Rs.9.90 per unit.

The investors should take the loads into consideration while making investment as these affect their yields/returns.

Efficient funds may give higher returns in spite of loads. A no-load fund is one that does not charge for entry or exit.

It means the investors can enter the fund/scheme at NAV and no additional charges are payable on purchase or sale of units.

Mutual funds cannot increase the load beyond the level mentioned in the offer document.

Any change in the load will be applicable only to prospective investments and not to the original investments.

In case of imposition of fresh loads or increase in existing loads, the mutual funds are required to amend their offer documents so that the new investors are aware of loads at the time of investments.

A load is a sales fee charged by the fund.

SEBI has notified that no entry load would be charged for applications received directly by asset management companies on the internet or at collection centers.

In other words, the entry load will be waived if applications are not routed through distributors, agents or brokers.

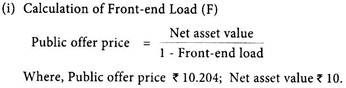

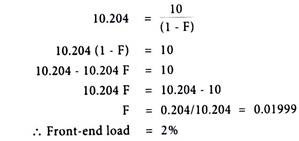

Calculation of Front-end Load or Entry Load:

Calculation of Back-end Load or Exit Load:

Illustration 2:

Examples showing the calculation of entry load and exit load are given below:

Entry Load:

Charged at the time of entering into the scheme. The entry load percentage is added to the NAV at the time of allotment of units.

For example, if an open-end fund’s per unit is Rs.11 with front load of 2%. The price at which an investor can buy a unit is Rs.1.22

In other words, Rs.100 would buy units = (Rs.100 – Rs.2)/11 = 8.9 units.

Exit Load:

Charged at the time of redeeming, transfer between schemes. The exit load percentage is deducted from the NAV at the time of redemption or transfer between schemes.

For example, if the redemption price is Rs.10.70, with a back-end load of 2%, the exit load charged by the fund amounts to Rs.0.21

So, the net sale proceeds will be Rs.10.70 – Rs.0.21 = Rs.10.49

In other words, sale of 50 units would not fetch 50 units × Rs.10.70 = Rs.535 but only 50 units × Rs.10.49 = Rs.524.5.

Illustration 3:

The unit price of TSS Scheme of a mutual fund is Rs.10. The public offer price (POP) of the unit is Rs.10.204 and the redemption price is Rs.9.80.

Calculate:

(i) Front-end Load, and

(ii) Back-end Load.

Solution:

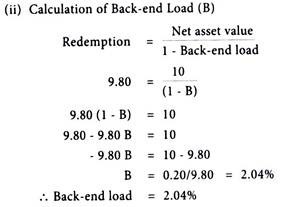

3. Return on Investment:

The investor who invests in mutual fund units can receive returns in the following two ways:

1. Capital Appreciation:

Profit earned on sale of units at a higher NAV than the original cost.

2. Income Distribution (Dividend):

When a fund makes a profit on its investment, this profit will be given to investor as a dividend which can be reinvested in the fund or retain it in the form of cash.

The formulas for calculation of return, required return and effective yield of mutual fund investment are given below:

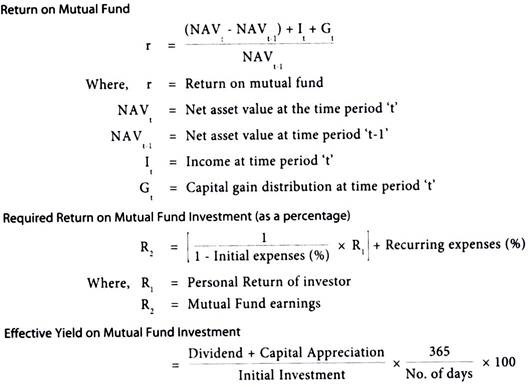

Illustration 4:

A mutual fund that had a net asset value of Rs.10 at the beginning of month -1 made income and capital gain distribution of Rs.0.05 and Rs.0.04 per share respectively during the month, and then ended the month with a net asset value of Rs.10.03. Calculate monthly return.

Solution:

Calculation of Monthly Return on Mutual Fund:

Illustration 5:

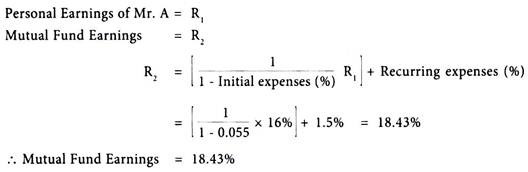

Mr. A can earn a return of 16 per cent by investing in equity shares on his own. Now he is considering a recently announced equity based mutual fund scheme in which initial expenses are 5.5 per cent and annual recurring expenses are 1.5 per cent. How much should the mutual fund earn to provide Mr. A, a return of 16 per cent?

Solution:

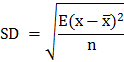

4. Standard Deviation of Return of Fund:

Standard deviation looks at funds volatility in terms of rise and fall in its returns.

Maximum volatility in a security is the riskiest, considering the unevenness it brings about in its performance.

Standard deviation of a fund measures this risk by measuring the degree to which the fund fluctuates in relation to its mean return.

The average return of a fund over a period of time.

The fund with higher standard deviation is more riskier because it fluctuates widely between negative and positive returns with in a short period.

To determine how well a fund is maximizing its returns received for its volatility, you can compare the fund to another with a similar investment strategy and similar returns.

The fund with the lower standard deviation would be more optimal because it is more maximizing the return received for the amount of risk acquired.

Standard deviation is a measure of dispersion in return. It quantifies the degree to which returns fluctuate around their average.

A higher value of standard deviation means higher risk.

Standard deviation allows portfolios with similar objectives to be used to compared over a particular time frame. It can also be used to gauge much more risk a fund in one category has as compared to the other.

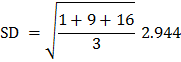

Illustration 6:

PQR Fund has made a return of 13%, 15% and 8% respectively for 1st, 2nd and 3rd year.

Calculate standard deviation of the return of the fund.

Solution:

(12 – 13)2 = 1

(12 – 15)2 = 9

(12 – 8)2 = 16

When used to measure the volatility of the performance of a security or a portfolio of securities, standard deviation is generally calculated for monthly returns over a specific time period- usually 36 months.

The monthly deviation can be annualized as follows:

= Monthly Standard Deviation × Square Root of 12

Sharpe Ratio:

This ratio describes how much return is receiving for the extra volatility that an investor endure for holding a riskier asset.

An investor always need to be properly compensated for the additional risk he undertakes for not holding a risk-free asset.

This risk adjusted return is called as ‘sharp ratio’.

This ratio name after William Sharpe, the proponent of the ratio.

The Sharpe ratio measures ‘reward to variability’:

Where:

S = Sharp ratio of the fund

RP = Annualized average rate of return of the fund

Rf = Annualized risk-free rate of return

σp = Standard deviation of average return of the fund

This ratio is also known as ‘reward to variability ratio’.

It measures the risk premium earned per unit to total risk.

Risk premium is excess expected return over risk-free return and total risk involved in funds is standard deviation of expected return from the funds.

When we compare position of two or more funds, a fund with higher Sharpe ratio gets a better rank.

Sharpe ratio is a risk-adjusted measure of return used to evaluate the performance of a portfolio.

The ratio helps to make the performance of one portfolio comparable to that of another portfolio by making an adjustment for risk.

A fund with a higher Sharpe ratio in relation to another is preferable as it indicates that the fund has higher risk premium for every unit of standard deviation risk.

A ratio of more than or equal to 1 is good, more than or equal to 2 is very good, and more than or equal 3 is excellent.

Sharpe ratio broken down into three components, asset return, risk-free return, and standard deviation of return.

After calculating the excess return, it is divided by the standard deviation of the risky asset to get its Sharpe ratio.

The objective of the Sharpe ratio is to observe how much additional return is receiving for accepting additional volatility of holding the risky asset over a risk-free asset – the higher the better.

Illustration 7:

XYZ Ltd. has got 12.04% as annualized standard deviation. The annualized return for the same fund is 16.8% and the average yield on one-year Treasury paper is 6.8%. Calculate Sharpe ratio of the fund.

Solution:

Sortino Ratio:

Sortino ratio was developed by Frank A Sortino to differentiate between good and bad volatility in the Sharpe ratio.

This differentiation of upwards and downwards volatility allows the calculation to provide a risk- adjusted measure of a security or fund’s performance in a clearer and comprehensive way.

It does not misses on the upward price changes and unlike standard deviation it does not discriminate between up and down volatility.

The Sortino ratio is similar to the Sharpe ratio, except it uses downside deviation for the denominator instead of standard deviation.

Treynor Ratio:

Treynor ratio developed by Jack Treynor, measures returns earned in excess of that which could have been earned on a risk less investment per each unit of market risk.

The Treynor measure adjusts excess return for systematic risk.

It is computed by dividing a portfolio’s excess return, by its beta:

Where:

T = Treynor ratio

Rf = Risk-free return

RP = Portfolio return

βP = Portfolio beta

Treynor ratio is a risk-adjusted measure of return based on systematic risk.

It is similar to the Sharpe ratio with the difference being that the Treynor ratio uses beta as the measurement of volatility.

It is known as the ‘reward-to-volatility ratio’.

For a completely diversified portfolio one without any unsystematic risk, the two measures give identical risk, because the total variance of a completely diversified portfolio is its systematic variance.

A poorly diversified portfolio could have a high ranking on the basis of Treynor ratio and a low ranking on the basis of Sharpe ratio.

The difference in ranking is due to difference in diversification.

Illustration 8:

For an ABC Fund, the portfolio return is 16.2% and risk-free return is 5.5%. The beta of the portfolio is 1.2. Calculate Treynor ratio of the fund.

Solution:

This indicates that the fund has generated 0.09 percentage point above the risk-free return for every unit of systematic risk.

6. Essay on the Criteria in Selection of Mutual Fund:

1. Fund Manager’s Track Record:

The fund manager should have a proven track record as efficient fund management is able to create confidence in the mind of the investor.

2. Portfolio Quality:

If the poor quality investments don’t backfire, a fund might generate high returns. High credit ratings of investments, means that the fund is investing in low risk instruments, indicating portfolio safety.

3. Number of Retail Investors and Average Holding Size:

It is easier to deploy and manage a small fund but even if a few investors leave it, a small fund could be in trouble.

4. Size of Fund:

Critical mass gives access to opportunities not available to smaller funds.

5. Weighted Average Maturity:

Longer maturities hedge against downward movement in interest rates while it could lose out on short-term upswings in interest rates. Short maturities protect against rising interest rates.

6. Sudden Change in Portfolio or NAV:

This might be a case of a revamp of the portfolio for good but also beware that it might suddenly be open to more risk due to a change in investments.

7. Dividend Frequency:

Tax-free dividends are good for those looking for regular returns but frequent dividends can hinder capital growth through redeployment.

7. Essay on the Benefits of Mutual Fund Investments:

1. Professional Management:

The funds are managed by skilled and professionally experienced managers with a backup of a research team.

2. Portfolio Diversification:

Mutual funds generally invest in a well-diversified portfolio of securities which reduces the risk. This enables even small investors to hold a diversified investment portfolio.

3. Professional Management:

The funds are managed by a highly skilled and professionally experienced manager with a backup of a research team. Small investors cannot hire such professionals, but can get the benefit through investing in mutual funds.

4. Liquidity:

Investors hold those shares or bonds which they cannot sell as per their convenience and intention. But an investor who have made investment in mutual funds can liquidate the investment by selling the units back to the MF (open-ended funds) or in the open-market (close-funds).

5. Reduction in Transaction Costs:

A direct investor into shares bears the entire cost of investing such as brokerage charge and custody of securities. Investing through a MF gives the benefit of economies of scale, the MFs incur lesser costs because of larger volumes, a benefit passed on to their investors.

6. Convenience and Flexibility:

MFs offer many investor services that a direct market investor cannot get. Investors can easily transfer/switch their holdings from one scheme to another within the same MF. They can also invest or withdraw their money at regular intervals in most open-ended schemes.

7. Transparency:

The investors also get updated information about the funds. There is also transparency with respect to the information pertaining to the schemes, with all the facts and figures being disclosed as required by the regulator.

8. Safety:

Mutual funds all over the world are highly regulated and in India all mutual funds are registered with SEBI. Mutual funds are strictly regulated as per the mutual fund regulations which provide excellent investor protection.

9. Low Cost of Management:

No mutual funds can increase the cost beyond prescribed limits of 2.5% maximum and any extra cost of management is to be borne by the AMC.

10. High Returns:

Over a medium to long-term investment, investors always get higher returns in mutual funds as compared to other avenues of investment.

11. Convenient Administration:

There are no administrative risks of share transfer etc. as many of the mutual funds offer services in a demat form which save investors’ time and delays.

8. Essay on the Drawbacks of Mutual Fund Investments:

1. No Control over Costs:

An investor in a mutual fund has no control over the overall cost of investing. He pays investment management fees as long as he owns units in the fund. Commission is usually a certain percentage of investment, payable irrespective of the rise or decline of the fund value.

2. No Tailor made Portfolios:

Skilled or professional investors build their own portfolios of shares, bonds and other securities with a clear objective. Investing through mutual funds means transfer of this function to the fund managers. High net-worth individuals or large corporate investors may find this be a constraint in achieving their objectives.

3. Difficulty in Selection of Fund:

A large variety of mutual fund schemes often makes the choice difficult for a common investor. One may need professional advice in selecting the most appropriate scheme.

4. Fund Manager’s Shifting Loyalties:

Performance of funds could be severely affected by shift of fund managers or their loyalties.