The following article will guide you about how to calculate entry load and exit load on mutual funds.

A Load Fund is one that charges a percentage of NAV for entry or exit. That is, each time one buys or sells units in the fund, a charge will be payable. This charge is used by the mutual fund for marketing and distribution expenses. Suppose the NAV per unit is Rs.10 if the entry as well as exit load charged is 1%, then the investors who buy would be required to pay Rs.10.10 and those who offer their units for repurchase to the mutual fund will get only Rs.9.90 per unit.

The investors should take the loads into consideration while making investment as these affect their yields/ returns. However, the investors should also consider the performance track record and service standards of the mutual fund which are more important.

Efficient funds may give higher returns in spite of loads. A no-load fund is one that does not charge for entry or exit. It means the investors can enter the fund/scheme at NAV and no additional charges are payable on purchase or sale of units.

ADVERTISEMENTS:

Mutual funds cannot increase the load beyond the level mentioned in the offer document. Any change in the load will be applicable only to prospective investments and not to the original investments. In case of imposition of fresh loads or increase in existing loads, the mutual funds are required to amend their offer documents so that the new investors are aware of loads at the time of investments.

A load is a sales fee charged by the fund. SEBI has notified that no entry load would be charged for applications received directly by asset management companies on the internet or at collection centres. In other words, the entry load will be waived if applications are not routed through distributors, agents or brokers.

Calculation of Front-End Load or Entry Load:

Calculation of Back-End Load or Exit Load:

Examples showing the calculation of entry load and exit load are given below:

1. Entry Load:

Charged at the time of entering into the scheme. The entry load percentage is added to the NAV at the time of allotment of units.

ADVERTISEMENTS:

For example, if an open-end fund’s per unit is Rs.11 with front load of 2%. The price at which an investor can buy a unit is Rs.11.22. In other words, Rs.100 would buy units = (Rs.100 – Rs.2)/11 = 8.9 units.

2. Exit Load:

Charged at the time of redeeming, transfer between schemes. The exit load percentage is deducted from the NAV at the time of redemption or transfer between schemes.

For example, if the redemption price is Rs.10.70, with a back-end load of 2%, the exit load charged by the fund amounts to Rs.0.21. So, the net sale proceeds will be Rs.10.70 – Rs.0.21 = Rs.10.49

ADVERTISEMENTS:

In other words, sale of 50 units would not fetch 50 units x Rs.10.70 = Rs.535 but only 50 units x Rs.10.49 = Rs.524.5

Problem:

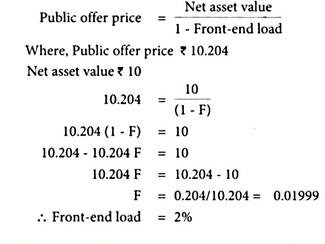

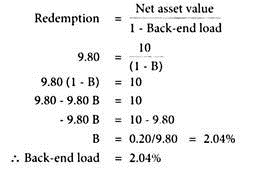

The unit price of TSS Scheme of a mutual fund is Rs.10. The public offer price (POP) of the unit is Rs.10.204 and the redemption price is Rs.9.80.

Calculate:

ADVERTISEMENTS:

(i) Front-end Load, and

(ii) Back-end Load.

(i) Calculation of Front-End Load (F):

(ii) Calculation of Back-End Load (B):