There are two alternative criteria available for ascertaining future economic benefits of an investment proposal, (i) accounting profit, and (ii) cash flows. The term ‘accounting profit’ refers to the figure of profit as determined by the Income statement or Profit and Loss Account, while ‘ cash flow’ refers to cash revenues minus cash expenses.

The difference between these two criteria arises primarily because of certain non-cash expenses, such as depreciation, being charged to profit and loss account. Thus, the accounting profits have to be adjusted for such non-cash charges to determine the actual cash inflows.

In fact, cash flows are considered to be better measure of economic viability as compared to accounting profits for the following reasons:

(1) The appropriate objective of a firm is not to maximise profits, rather it is to maximise the shareholder’s wealth which depends upon the present value of cash flows available to them and not the accounting profits. In the opinion of O. Maurice Joy, “cash flows are a theoretical better measure of the net economic benefits or costs associated with a prospective project.”

ADVERTISEMENTS:

His argument is that the firm is really interested in estimating the economic value of a proposed investment project. This economic value is related to the economic outflows (costs) and inflows (benefits) associated with the project. Only cash flows describe the cash transactions that the firm will experience if the project is accepted.

The firm must pay for a purchased asset with cash, and this cash outlay represents a foregone opportunity to use the cash in other productive economic alternatives. Consequently, the firm should measure the future net benefit (revenues minus costs) in cash terms also. Now, if accounting practices were attuned to reporting cash transactions there would be no problem.

But standard financial accounting practices are oriented more toward allocating investment costs across useful economic life than in ascribing costs at point of incurrence. Thus, when the firm makes a new investment, traditional accounting procedures spread out the initial investment by capitalising it over the life of the asset and then reducing future net benefits by subtracting an annual depreciation charge.

But this accounting treatment does not reflect the original need for cash at the time of investment, nor does the accounting treatment reflect the actual size of the net cash inflows or outflows in later years.

ADVERTISEMENTS:

Only cash flows reflect the actual cash transactions associated with the project, and since investment analysis is concerned with the question:

Are future economic inflows sufficiently large to warrant the initial investment? Only the cash flow method is appropriate for investment decision analysis.

(2) The second reason for considering cash flows to be a better measure of economic viability as compared to accounting profits pertains to accounting ambiguities in determining net profits.

There are many ambiguities that arise in accounting profit approach on account of various accounting practices regarding method of valuation of inventory, allocation of costs, method of depreciation and amortization of various other expenses.

ADVERTISEMENTS:

Thus, different net profits may be arrived at under different accounting practices and procedures. But, there will be only one set of cash flow associated with the project. The cash flow approach, thus, avoids the accounting ambiguities and is a better measure as compared to the accounting profit approach.

(3) The third reason in favour of cash flow approach is its recognition of time value of money. It recognises the time value of money by considering the actual cash inflows and outflows. On the other hand, usual accounting practices consider revenues when earned and expenses when incurred on the accrual basis rather than when cash is actually effected.

It may, sometimes amount to only paper profits if the revenue (sale) is not realised. Therefore, from the view point of investment analysis, the cash flow approach is the only appropriate method.

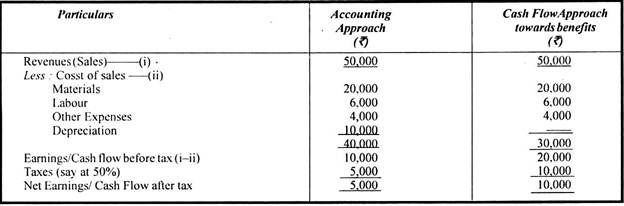

The difference between the cash flow approach and accounting profit approach can further be illustrated with the help of following example:

The above example illustrates that the actual benefits under cash flow approach are more than the accounting profit approach by Rs. 5000 because of the non-cash charge of depreciation amounting to Rs. 10,000 under the accounting approach.