Contract costing is an extension of job costing system. It follows the same principles as job costing. In contract costing, a separate account is opened for each contract. All cost relating to such contract is debited to the Contract Account.

Contract costing is the costing for big size jobs which are normally called contracts. The basic difference between contract and job is that of size. So, we can say contract costing is a specialized form of job costing. The system of contract costing is applied where big job (contracts) are involved requiring considerable time, activities and money to complete the job.

The objectives of contract costing is to ascertain the cost incurred and to show the profit earned or loss suffered on each contract undertaken after its completion as also from time to time during the period of its execution.

Contents

- Introduction to Contract Costing

- Meaning and Definition of Contract Costing

- Objectives and Features of Contract Costing

- Cost Plus Contract

- Escalation and De-Escalation Clause

- Sub-Contract

- Work Certified and Work Uncertified

- Procedure

- Recording Procedure of Contract Items

- Stages for Preparation of Contract Accounts

- Methods of Charging Depreciation

- Difference between Contract Costing and Job Costing

- Multiple Choice Questions and Answers

Contract Costing: Introduction, Meaning, Definition, Objectives, Features, Advantages, Cost Plus Contract, Sub-Contract, Stages, Difference, MCQ and More

Contract Costing – Introduction

Contract costing is an extension of job costing system. It follows the same principles as job costing. In contract costing, a separate account is opened for each contract. All cost relating to such contract is debited to the Contract Account.

ADVERTISEMENTS:

The objectives of contract costing is to ascertain the cost incurred and to show the profit earned or loss suffered on each contract undertaken after its completion as also from time to time during the period of its execution.

In principle, Contract Costing is similar to Job Costing as it follows the same principles of Job Costing. Contract Costing is, therefore, a type of Job Costing and the entire Contract, instead of Job, constitutes Cost Unit. This method of Costing which is also known as Terminal Costing is applied in industries engaged in the construction of buildings, dams, factory premises, bridges, ships, power houses, etc., and which are carrying out erection of plant and machinery.

Under this method, a separate number is allotted for each contract and all related costs are accumulated for each contract. That means, a separate set of accounts are kept and maintained for each individual contract undertaken by the company. This helps to ascertain the costs incurred revenue and profit earned or loss incurred in each of the contracts.

ADVERTISEMENTS:

Basically, there are two types of contracts. They are, Fixed Price Contracts (with or without Cost Escalation Clause) and Cost plus Contracts.

1. In the case of Fixed Price Contracts, the contractor agrees to complete the work for a fixed contract price.

2. But in the case of Cost plus Contracts, the contractor gets reimbursement, from the contractee, of all allowable or specifically defined costs incurred, plus a percentage of these expenses or a fixed amount.

Contract Costing – Meaning and Definition

Contract costing is the costing for big size jobs which are normally called contracts. The basic difference between contract and job is that of size. So, we can say contract costing is a specialized form of job costing. The system of contract costing is applied where big job (contracts) are involved requiring considerable time, activities and money to complete the job.

ADVERTISEMENTS:

An important variation of job-order costing is contract costing. A contract is a large job. It often extends to more than one financial year. Firms engaged in shipbuilding, civil engineering for roads, bridges or industrial estates, heavy engineering, factory construction etc. employ this method of costing.

According to The Chartered Institute of Management Accountants, London, the term contract costing refers to “The form of specific order costing which applies where work is undertaken to customer’s special requirements and each order is of long duration (compared with those to which job costing applies). The work is usually constructional and in general the method is similar to job costing.”

Contract costing (also known as terminal costing) is a variant of job costing. It contains the basic characteristics of job costing. In fact, a big job is referred to as a contract and the work is carried out at the site of the customer, outside the factory premises. Contract costing is often adopted by builders and civil engineers engaged in construction.

The cost unit in contract costing is the contract itself. In contract costing, a separate account is kept for each contract. Since a greater part of the work is carried out at the contract site itself, power used at site, site vehicles, transportation etc., can be charged directly to the contract.

ADVERTISEMENTS:

Head office expenses and the overheads relating to central stores, are, however, apportioned among the various contracts on some equitable basis, such as percentage of materials, wages, prime cost or a percentage of total contract cost depending on the circumstances.

In the case of contract costing, direct costs account for a very high proportion of the total cost of contract whereas indirect costs constitute only a small proportion of it. One of the significant features of contract costing is difficulty in the cost control.

Because of the scale and the size of the contract and the site, there are frequently major problems of cost control concerning material usage and losses, pilferages, labour supervision and utilization, damage to and loss of plant and tools, etc.

Contract Costing – Objectives and Features

The main objectives of contract costing are:

ADVERTISEMENTS:

(1) To ascertain the cost of each contract separately.

(2) To ascertain the profit or loss on each contract separately.

Contract costing usually shows the following features:

1. As the contracts are of large size, a contractor usually carries out a small number of contracts in the course of a year.

ADVERTISEMENTS:

2. Contracts are carried out away from contractor’s premises.

3. Contracts may continue over more than one accounting period.

4. Cost unit in contract costing is a contract.

5. A separate account is prepared for each contract to ascertain profit or loss on each contract.

ADVERTISEMENTS:

6. Most of the materials are specially purchased for each contract. These will, therefore, be charged direct from the supplier’s invoices. Any materials drawn from the store are charged to contract on the basis of material requisition notes.

7. Nearly all labour will be direct.

8. Most expenses (e.g., electricity, telephone insurance, etc.,) are also direct.

9. Specialist subcontractors may be employed for, say, electrical fittings, welding work, glass work, etc.

10. Plant and equipment may be purchased or hired for the duration of the contract.

11. Payments by the customer (contractee) are made at various stages of the contract based on architect’s certificate for the completed stage. An amount, known as retention money, is withheld by the contractee as per agreed terms.

ADVERTISEMENTS:

12. Penalties may be incurred by the contractor for failing to complete the work within the agreed period.

Some of the other salient features are as follows:

(i) Work is carried out against customers order, and not for maintaining stock for sale.

(ii) Work has to be carried out according to the specification and requirement of the customers.

(iii) Each contract requires particular attention and skill depending upon the specification.

(iv) Every contract does not pass through all the departments. Nature of the contract decides through which departments it will pass.

ADVERTISEMENTS:

(v) There is no standardisation of contract. Each contract is a separate non-standard work.

(vi) Each contract is to be charged with its own costs.

(vii) Work-in-progress at any time depends upon the number of contracts in hand at that time. A separate work-in-progress record is maintained for each contract.

Cost Plus Contract: Advantages and Disadvantages

It is provided in the contract that customer/contractee should pay to the contractor actual cost of manufacture or rendering services plus a stipulated profit. The profit to be paid to the contractor may be a fixed amount or it may be a particular percentage of capital employed.

Cost-plus contract is undertaken when cost of executing a contract cannot be estimated in advance accurately in the absence of a precedent or complete details of work to be done. Sometimes, unstable conditions also necessitate cost-plus contract.

The system of cost audit is generally employed, when Government happens to be the contractee. Generally cost-plus contract is entered into a special type or work like construction work in war, manufacture of a special design of ship or aircraft etc.

ADVERTISEMENTS:

Cost-plus contract usually specifies:

(i) Items to be included in cost.

(ii) Documents to be accepted in support of contractor’s claim.

(iii) How the difference of opinion between the two parties will be settled.

(iv) That the customer reserves the right of cost audit.

Advantages:

ADVERTISEMENTS:

(i) Cost-plus contract assumes that a reasonable profit accrues to the contractor even in uncertain projects.

(ii) It provides ready escalation clauses and thus covers the contractor from fluctuation in price and utilization of elements of production.

(iii) It simplifies the work of offering tenders and quotations.

(iv) The contractor can attempt the projects which cannot be sufficiently detailed in advance from cost point of view due to such reasons as –

(a) project is unique; and

(b) prevailing conditions simply do not permit reliable forecast due to widespread fluctuations.

ADVERTISEMENTS:

(v) The customer is assured of paying only reasonable amount of profit in an uncertain market.

(vi) Since the customer reserves the right to conduct cost audit, he can ensure that he is not being exploited by the contractor.

Disadvantages:

(i) Since contractor is assured of a profit margin, there may not be any incentive for cost reduction by avoiding wastages and effecting economies in production.

(ii) The customer has to pay not only the resultant high cost but also the resultant high profit and thus, customer may have to pay substantially for lack of proper attitude (towards cost and efficiency) on the part of contractor.

(iii) The final price to be paid by customer cannot be exactly ascertained up to the last and may create difficulty for the customer in preparing purchase budget.

Cost-plus contract may ultimately lead to dissatisfaction both to the contractor and the contractee, if proper care is not exercised in preparing cost-plus contract.

Contract Costing – Escalation Clause and De-Escalation Clause

A cost escalation clause is generally provided in large contracts of long duration to safeguard the contractor against any likely changes in the price or usage of materials and labour. If during execution of a contract, the prices of labour or materials increase beyond a certain limit, the contract price will also be increased by an agreed amount. Inclusion of such a term in a contract deed is called an “Escalation clause”.

Though escalation clause generally relates to change in prices of inputs, it may also be extended to increased consumption of materials, labour etc. To receive payment in such cases the contractor must satisfy the contractee that the increased consumption is not due to his inefficiency.

The escalation clause assumes greater importance under inflationary conditions. While drafting this clause adequate care is taken for indicating the basis of calculation for such increase. Norms are generally fixed separately for material and labour.

Additional payment for escalation clause is made only after proper verification of actual expenses, incurred by the contractor.

The escalation clause may also stipulate that in the event of prices declining beyond an agreed level, the contractee would be entitled to a rebate. This is called ‘De-escalation clause’.

Sub-Contract

Sometimes, a contractor may find that it is more economical or less time- consuming to entrust a part of the contract work, specially of a specialised nature, to another contractor. The work so allotted to another contractor is known as ‘sub-contract’.

If there is a sub-contract, the relationship between the contractor and his sub-contractor is that of a contractor and contractee. Accordingly, in such cases, the sub-contractor is responsible and accountable to the contractor in respect of the portion of work entrusted to him.

Usually, jobs such as floor polishing, laying mosaic tiles, sanitary and plumbing work, fabrication of steel, wood-work, etc., are entrusted to subcontractors.

Apart from the reasons for subcontracting specified above, considerations of opportunity cost also govern sub-contracting. Payments for sub-contracting work are made by the contractor to the sub-contractor. All such payments are treated as a direct charge to contract.

Contract Costing – Work Certified and Work Uncertified

Work Certified:

The money consideration payable by the customer or contracted to the contractor for accomplishing the work under the contract is known as the ‘contract price’.

Normally, in the case of a small contract or a contract of a short duration, the contract price is payable by the contracted on completion of the contract. The amount thus received is credited to the contract for ascertaining profit or loss on contract.

In the case of contracts of long duration, the customer is required under the terms of the contract to make progress payments to the contractor throughout the period of work. The amount payable is based on the sales value of work done as certified by the architect.

The architect’s certificate merely confirms that work up to a certain sales value has been completed. The sales value of work completed as certified by the architect is known as ‘work certified’.

At the end of the financial year, the total sales value of work done and certified by the architect is credited to the contract and debited to the contractor’s account. As and when cash is received as progress payment, contractor’s account is credited. For the balance due, the contracted is shown as a debtor.

Work Uncertified:

Work which has been carried out by the contractor but has not been certified by the architect is known as ‘work uncertified.’ Sometimes, work which is complete remains uncertified at the end of the financial year.

The reasons for the same may be –

(a) work not sufficient enough to be certified,

(b) work has not reached the stipulated stage to qualify for certification.

Regardless of the reason, work that is complete but not yet certified by the architect is known as work uncertified. Work uncertified is always valued at cost. At the end of the accounting period, work uncertified is valued at cost and credited to the contract, the debit being given to work-in-progress account.

Procedure for the Determination of Profit or Loss on Contracts under Different Circumstances

The procedure for the determination of profit or loss on contracts under different circumstances may be given as follows:

1. Profit on Completed Contracts:

In case of contracts completed during the accounting year, the full contract price, whether payable in lump sum on the completion of contract or payable by instalments, shall be debited to the Contractee’s Personal Account and credited to the Contract Account.

The difference between the total of the two sides of Contract Account shall be transferred to Profit and Loss Account of the contractor by way of profit or loss.

Sometimes, under the terms of the agreement, the contractor undertakes to rectify the defects, if any, in the contract work which may arise during a specified period (known as Maintenance Period) after the date of the completion of the contract.

The amount of profit or loss on contracts in such a case should be ascertained only after making a sufficient provision for cost of maintenance expected to be incurred during the maintenance period.

2. Profit on Incomplete Contracts:

As a general rule, profits on incomplete contracts should not be taken credit for. A number of arguments are given against the calculation of profits on incomplete contracts. Firstly, the anticipation of profits is against the general accounting principles.

Secondly, the true profit on a contract cannot be ascertained until a contract is finished since a contract which appears to be profitable in its early stages may finally result into a loss on account of unexpected losses. Lastly, income tax will be paid on profits at an earlier date than would otherwise be necessary.

But, it is counter-argued that by including profit on incomplete contracts in the Profit and Loss Account, undue fluctuations in the profits and dividends paid can be avoided. Secondly, some contracts may take several years to complete and if profits are calculated on such contracts on completion, it shall appear that the entire amount of profit has been earned in one year, which is not correct.

Therefore, profits on incomplete contracts should be calculated very cautiously and only a portion of it may be credited to Profit and Loss Account.

The computation of profit on incomplete contracts has two aspects:

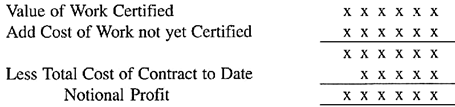

(i) Computation of Notional Profit at the End of the Accounting Period on Incomplete Contract:

For this purpose, the value of Certified Work and cost of Uncertified Work at the end of the accounting period are credited to the Contract Account. The amount of notional profit shall be –

Calculation of Profit/Loss on Contracts:

(ii) Computation of the Proportion of the Notional Profit to be Transferred to Profit and Loss Account:

The entire amount of notional profit at the end of the accounting period is not transferred to Profit and Loss Account. In view of the future uncertainties involved in contract work, only a portion of the notional profit is transferred to Profit and Loss Account and the remaining portion is kept by way of a provision to cover future contingencies.

The following principles are generally followed for the purpose of ascertaining the proportion of notional profit to be transferred to Profit and Loss Account:

(a) Incomplete Contracts with Little Progress:

These are the contracts which have just commenced or where only a small portion of the contract (as a general rule, less than 1/4) has been finished. In case of such contracts, it is not prudent to take credit for any profit made thereon, since it is impossible to see the future position of such contracts clearly.

The entire amount of notional profit on such contracts is kept by way of provision for contingencies and is transferred to the credit of Work-in-Progress Account so as to bring it down to its actual cost.

(b) Incomplete Contracts with Appreciable Progress:

A contract is generally said to have made appreciable progress if at least 1/4 of the contract has been completed.

The proportion of the notional profit to be transferred to Profit and Loss Account in respect of such contracts is computed as follows –

(1) When work certified is 1/4 or more than 1/4 but less than 1/2 of the contract price, the amount of profit to be transferred to Profit and Loss account should be –

= Notional Profit x (1/3) x (Cash Received/Work Certified)

(2) When work certified is 1/2 or more than 1/2 of the contract price, but the contract is not nearing completion, the profit to be transferred to Profit and Loss Account should be –

= Notional Profit x (2/3) x (Cash Received/Work Certified)

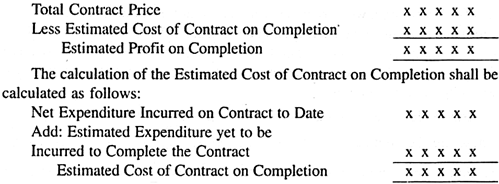

(c) Incomplete Contracts Nearing Completion:

These are the contracts which are nearing completion and the future costs to be incurred on their completion can reasonably be estimated. The amount of profit to be transferred to Profit and Loss Account, in this case, shall be ascertained on the basis of estimated profit.

Estimated Profit, in case of contract nearing completion is the difference between contract price and the total estimated cost of contract on completion and can be ascertained as follows –

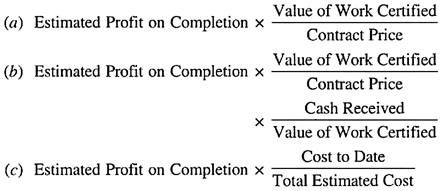

Moreover, only a proportion of the estimated profit is to be transferred to Profit and Loss Account, leaving the balance to guard against future contingencies.

The proportion of estimated profit to be transferred to Profit and Loss Account can be calculated by any of the following formulae –

Loss on Incomplete Contracts:

When an incomplete contract reveals a loss, the whole of the amount of such loss must be charged to the Profit and Loss Account of the accounting year.

Recording Procedure of Contract Items – Material, Labour or Wages, Direct Expenses, Indirect Expenses, Plant & Machinery, Sub-Contracts and Extra Work

The contractor maintains a ledger in which a separate account for each contract is opened. The contract ledger is so ruled as to give maximum information.

The recording procedure for the following items are discussed below:

(i) Materials:

All materials purchased directly for the contract or supplied from the stores are debited to the concerned contract account. Any profit or loss arising from the sale of material, or materials stolen or destroyed by fire, will be transferred to the profit and loss account.

Normal wastage of materials is charged to the profit and loss account. Normal wastage of materials is charged to the contract by inflating the rates of materials.

If any stores items are used for manufacturing tools, the cost of such stores items is charged to the work expenses account. If the contractee has supplied some materials without affecting the contract price, only a note is given about it and no accounting entries are made in the contract account.

(ii) Labour or Wages:

Wages are charged to the concerned contract directly or on the basis of a wage analysis sheet.

(iii) Direct Expenses:

Direct expenses are also charged to the concerned contract directly.

(iv) Indirect Expenses:

Expenses of engineers, surveyors, supervisors, etc., not incurred on any specific contract may be distributed among all the contracts on some suitable basis, such as a percentage of material or labour.

(v) Plant & Machinery:

These can be treated in the following two ways:

(a) The contract account is debited with the full value of the plant when the same is acquired and credited with depreciated value at the end; or

(b) The contract account is debited only with the amount of depreciation.

However method (a) is preferred since it enables to have control over the movement of plants and machinery from one site to another.

(vi) Sub-Contracts:

Sub-contract costs are shown on the debit side of the contract account.

(vii) Extra Work:

If extra work is not substantial, expenses incurred on extra work should be debited to the contract account as ‘cost of extra work’. The extra amount payable by the contractee is to be added to the contract price. However, if extra work is quite substantial, it is better to treat it as a separate contract.

Top 5 Stages Involved in the Preparation of Contract Account

There are different stages in the preparation of contract account:

(i) Different items are indicated in the debit side of the contract account. These items are ‘ direct materials, direct labour, direct expenses, overheads, sub-contract costs, cost of additional work and depreciation on plants and equipment.

(ii) Items credited in the contract account include materials returned to stores, materials transferred to other contracts, surplus materials after completion of the contract, closing balance of plants and equipments, if opening balance was shown on the debit side, theft of materials and plants and equipments etc.

(iii) If contract is complete, then contractor account with contract price is indicated on the credit side of the contract account and gets the balance of contract account. This difference is treated as Profit and Loss on contract account.

(iv) If contract is incomplete, then value of work certified and work uncertified both are shown on the credit side of the contract account and get the difference. On the basis of completion of the contract, certain portion of the balance is transferred to the Profit and Loss Account and rest of the balance carried forward for the contingencies.

(v) Calculation of work in progress is made to show the item on the asset side of the balance sheet.

Contract Costing – Distinct Methods of Charging Depreciation

One of the distinguishing features of a contract is the use of special plant and machinery. Trucks, cranes, concrete mixers, Lorries, floor polishing plant, etc., are normally used in the case of any contract.

The costs of these are capital expenditure. But yet, the usage of these should be reflected in the form of depreciation.

There are two distinct methods of charging depreciation to the contract for using these special items of equipment:

(a) The cost of plant and machinery purchased specifically for a contract is treated as a direct charge to the contract. If existing equipment used previously for any other contract is issued for a specific contract, its written down value is debited to the contract.

When the equipment is no longer required and is transferred to another contract, or to the stores, the original contract is credited with the value arrived at after revaluation of the equipment. The contract would thus bear the charge for depreciation. In other words, the contract gets charged with the loss due to wear and tear of the equipment during its use for the contract.

This method is suitable where plant is used for contracts that take a long time to completion.

(b) Under the alternative method of charging contracts for the use of plant and equipment, an hourly rate is worked out in the same way as the machine hour rate. A cost center is set up for each machine.

An estimate is made of the cost such as maintenance, depreciation, fuel, driver’s wages, etc., to be incurred. The total of these costs is divided by the number of hours that the machine is expected to be used. An hourly rate is thus established and the contracts are charged at this rate for the hours of usage.

This method, which treats plant and machinery as, in effect, hired from outside, is suitable when the equipment is required for short periods and is transferred from one contract to another at frequent intervals.

Difference between Contract Costing and Job Costing

Both the methods belong to the category of specific order costing in which work is executed according to the specifications of customs. Despite these similarities, there are certain differences between job and contract costing.

These are given below:

Difference # Job Costing:

1. A job is small in size.

2. Work under job costing is performed in the workshop of the proprietor.

3. Jobs are completed in shorter durations.

4. The selling price of a job is paid in full after completing a job.

5. In case of job costing, expenses may be direct and indirect.

6. No sub-contracts are given in executing a job.

7. Profit earned on a job is entirely taken to profit and loss account.

8. Cost control in a job is more complicated because each job is different and jobs are mostly not repeated.

Difference # Contract Costing:

1. A contract is big in size.

2. The contract is executed mostly at site.

3. The contract is completed relatively in a much bigger period.

4. In case of a contract, the price is paid in various installments depending upon the progress of the work.

5. In case of contract costing, most of the expenses are direct in nature.

6. While executing a contract, sub-contracts are given.

7. In case of an incomplete contract, only proportionate profit is transferred to profit and loss account depending on the stage of completion of the contract.

8. The accumulation, analysis, allocation, apportionment and control of cost is simplified in contract costing.

Contract Costing – Multiple Choice Questions and Answers

1. Which of the following is an essential feature of a long-term contract?

(a) It has a duration in excess of twelve calendar months.

(b) It is in progress at a financial year-end and has a significant effect on the activity of the contractor for the period under review.

(c) Its completion will require a number of stages each of which must be certified and valued for profit calculation purposes.

(d) It has a duration in excess of six calendar months.

Ans. b

2. Retention monies are best defined as:

(a) Cash withheld by the contractee in order to improve the cash flow of the contractor.

(b) Payments to the contractor where it is desired to secure his services for a future contract.

(c) Cash returned to the contractee if actual profits on a contract are 10% higher than an agreed figure.

(d) Cash withheld by the contractee under the terms of the contract when payments of the value certified are being made.

Ans. d

3. Which of the following is the most appropriate definition of turnover at an intermediate stage in a contract?

(a) The value of work done which leaves the agreed attributable profit when the cost of work certified is subtracted from it.

(b) Cost of work certified to date plus-estimated profit to the end of the contract.

(c) The value of work certified less any foreseeable losses.

(d) Cost of work to date minus the cost of work not certified plus estimated profit to date.

Ans. a

4. Foreseeable losses estimated for a contract should be treated in which of the following ways?

(a) Ignore until they are known to be accurate with reasonable certainty.

(b) Write off immediately that they are estimated.

(c) Write off in the same proportion as any estimated profits are recognised.

(d) Write off only if the work to which they relate is 50% completed.

Ans. b

5. A zero value of attributable profit should be assumed where:

(a) Any foreseeable loss is estimated for a later stage in the contract.

(b) The interim estimated profit is less than 10% of value certified.

(c) The profit outcome of the contract cannot be estimated with reasonable certainty.

(d) The contract is less than 60% completed.

Ans. c

6. A debit balance on the contractee account should be incorporated in the balance sheet as:

(a) A current liability as ‘contract balances outstanding’.

(b) Set-off against contract stock valuation.

(c) Excess payments on account not set off against contract stock value.

(d) In debtors as ‘amounts recoverable on contracts’.

Ans. d