Everything you need to know about methods of preparing a cash budget. Cash budget is one of the most important budgets prepared by an enterprise as every transaction ultimately resolves itself into cash.

It contains estimates of cash inflows and outflows for a period of time in future.

Cash budget portrays the projecting of cash receipts and disbursements from all sources over a particular period of time. It is a summary of expected cash inflows and outflows for a certain time span.

When cash flows are more volatile but predictable, cash budget is prepared more frequently even on a day today basis. On the other hand, when cash flows are stable, cash budget is prepared on monthly basis.

ADVERTISEMENTS:

The methods of preparing a cash budget are:- 1. Receipt and Payment Method 2. Adjusted Profit and Loss Method or Cash Flow Method 3. Balance Sheet Method.

The preparation of a cash budget involves the following steps: 1. Estimating Cash Receipts 2. Estimating Cash Disbursements 3. Determining Financial Needs.

How to Prepare a Cash Budget: Procedure, Methods and Steps

How to Prepare a Cash Budget? – 3 Methods of Preparing Cash Budget: Receipts and Payment Method, Cash Flow Method and Balance Sheet Method

Cash budget can be prepared by any of the following three methods:

(1) Receipt and Payment Method

ADVERTISEMENTS:

(2) Adjusted Profit and Loss Method or Cash Flow Method

(3) Balance Sheet Method

1. Receipt and Payment Method:

Under this method all Cash receipts and disbursements for the enterprise for a budget period are estimated. Thereafter, all estimated cash receipts are added to the opening balance of cash and all estimated cash payments are deducted from this to arrive at the closing balance of cash.

While preparing a cash budget under this method, the following steps must be taken:

ADVERTISEMENTS:

(a) Determination of the Period of Budget:

Normally a cash budget is prepared for one year but it may also be prepared monthly, quarterly or half yearly, depending on the need of the business. For seasonal industries it may be prepared for a particular season. Therefore, before preparing a cash budget it is necessary to take a decision regarding the period of the budget.

(b) Estimating the Cash Receipts:

The second step is to estimate the cash receipts from various sources during the period. The major sources of cash receipts are cash sales, collection from debtors, income from investments, receipts from issue of shares and debentures etc.

ADVERTISEMENTS:

The principal source of cash for a business is sales. Therefore, the accuracy of cash budget depends on accuracy of sales forecast. The management, on the basis of past experience, may forecast the amount of sales for cash and for credit. Timing of cash inflow from credit sales depends on terms of sale and customer’s past behaviour in paying their debts. Although the timing of cash inflow from customers cannot be predicted very accurately, the management can make a fair estimate of cash inflow by studying the debt paying habits of its customers.

For example, if the past experience shows that 20% sales are for cash and 80% sales are on credit and that the collection from debtors is made after two months, and if the total sales for the month of January are estimated at Rs.5 lac, 20% i.e., Rs. 1 lac will be received in January and the balance Rs.4 lac will be received in March.

(c) Estimating the Cash Payments:

The third step is to estimate the cash payments that may be made during the period. Payments may be made for cash purchases, payment to creditors, payment for wages, payment for office and selling expenses, payment for taxes, and payment for the purchase of assets etc. Probable timing of payment of each of these payments is also estimated on the basis of past experience. For example, if the period of credit allowed by creditors is one month, the payment for the credit purchases of January will be made in the month of February.

ADVERTISEMENTS:

After estimating the amount of cash receipts and cash payments, all estimated cash receipts are added to the opening balance of cash and all estimated cash payments are deducted from this to arrive at the figure of closing balance of cash.

2. Adjusted Profit and Loss Method:

In this method, the cash forecast is prepared by adjusting the amount of profits shown by the forecasted statement of profit and loss. All non-cash expenses shown in the forecasted statement of profit and loss (such as depreciation, written off deferred revenue expenditure, written off intangible assets etc.), decrease in current assets, increase in current liabilities, receipts from sale of fixed assets, issue of debentures and shares, opening cash balance are added to the amount of profit shown by the forecasted profit and loss account.

Increase in current assets, decrease in current liabilities, purchase of fixed assets, repayment of Loans, Redemption of shares and debentures and payment of dividends are subtracted from the profit. The resultant figure is closing cash balance.

In other words, cash balance can be forecasted for a period by using the following formula:

ADVERTISEMENTS:

Opening cash balance + Net Profit shown by forecasted statement of profit & loss

+ Non-Cash expenses + Decrease in current assets + Increase in current liabilities

+ Sale of fixed assets + Issue of shares and debentures etc.

– Increase in current assets – Decrease in current liabilities

ADVERTISEMENTS:

– Purchase of fixed assets – Redemption of shares and debentures etc.

= Closing Cash Balance.

This method of preparing cash budget is similar to ‘Cash Flow Statement’. The main point of difference between the two is that the Cash Budget takes into account the estimated figures for the future period, while the Cash Flow Statement considers the actual transactions.

3. Balance Sheet Method:

Under this method, a budgeted or forecasted balance sheet at the end of the next period is prepared taking into account the changes in the values of assets and liabilities (except cash and bank balances). The two sides of the budgeted balance sheet are then balanced.

If the amount of budgeted liabilities exceeds the budgeted assets, the difference will be the estimated cash balance at the end of the budget period. On the contrary, if the amount of budgeted assets exceeds the budgeted liabilities, the difference will be considered as deficiency or shortage of cash balance (or bank overdraft).

Out of the three methods discussed above, the first method is usually found suitable for short-term forecasting of cash while the other two methods are used for long-term forecasting of cash.

Cash Budget – Procedure and Methods (With Specific Consideration of Time-Lag in Cash Budget)

Procedure:

Cash budget is prepared generally by the finance department of the concern and the following procedure is adopted in preparing this budget-

ADVERTISEMENTS:

1. Period of Budget:

First of all it is determined that what will be the period of budget? Theoretically it can be for short-term as well as for long-term but practically it is prepared for short-term. Even in short-term it may be on the basis of year, quarter, month or week but generally it is prepared on quarterly or six-monthly basis and that period is also sub-divided on monthly basis.

2. Estimate of Sources and Inflow of Cash:

It involves the collection of following three types of information-

(a) What will be the sources of cash inflow during a particular period? In addition to cash sales they may include collection from debtors, call money on shares, sale of fixed assets, income from investment, etc.

ADVERTISEMENTS:

(b) How much amount will be received from these sources?

(c) What will be the timing of inflow? For example, credit sales will be realised after one month or 50% of the sales are realised in the month following the sale and the remaining 50% in the second month following.

3. Identification of Application of Cash:

It involves the estimation of cash payments of different items at different times. These items may cover cash purchase, payment to creditors, payment of salary wages and various cash expenses. The estimates of the amounts required for paying off creditors are mainly dependent on the credit policy of the suppliers. However, the business concern may take the advantage of discount allowed by suppliers by making cash payment.

As regards the payments for various expenses, the time-lag in respect of each item should be taken into account on the basis of past experience. It is worth mentioning that such items are not shown in cash budget which do not affect cash flow, such as outstanding expenses, reserve for doubtful debts, etc.

4. Estimate of Cash Balances:

ADVERTISEMENTS:

In this context, first of all the balance of cash on the first day of budget period is determined and thereafter the balance of cash at the end of budget period is estimated on the basis of expected receipts and payments.

The minimum and maximum level of cash balances can also be determined. In such a case if cash balance in any time period is expected to be less than minimum, the difference may be covered by bank overdraft. If it exceeds the maximum level, policy of short-term investment may be adopted for the profitable use of surplus.

5. Determination of the Method of the Budget:

There are various methods for the preparation of cash budget. Hence, it is determined that which method will be adopted. Thereafter the budget is prepared as per method finalised and information’s available.

Methods of Preparation of Cash Budget:

There are three important methods which are generally used in preparation of cash budget.

These methods are:

ADVERTISEMENTS:

(A) Receipts and Payments Methods or Cash Accounting Method,

(B) Budgeted or Projected Balance Sheet Method, and

(C) Cash Flow Method or Project Forecast Method.

(A) Receipts and Payments Method:

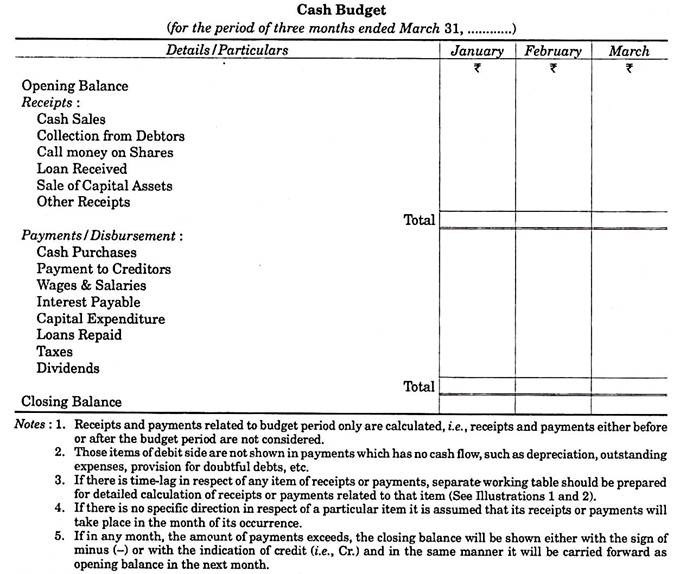

This method is the most simple and widely used method of cash budget. A columnar statement is prepared in this method, in which first column shows items of receipts and payments, whereas other columns show the amount of receipts and payments in each time break-up of budget period. For example, a cash budget is to be prepared for three months from January to March; the following format may be adopted for this purpose-

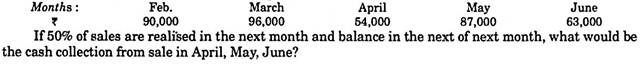

Illustration 1:

ADVERTISEMENTS:

The estimated mostly sale for a company is as follows:

Solution:

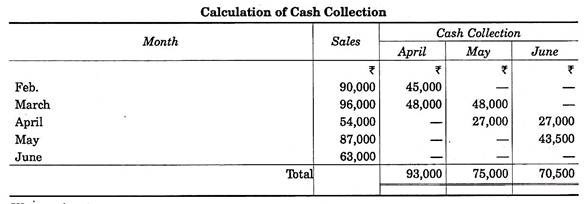

(B) Budgeted or Projected Balance Sheet Method:

Under this method, an effort is made to estimate the position of cash at a particular point of time. For this purpose, a budgeted Balance Sheet is prepared in respect of the last date of budgeted period and an estimate is made of the values of all assets except cash, bank or bank overdraft on that date. Similarly, liabilities, capital, reserves and profit and loss account are also estimated. If the total of liabilities side exceed, the difference is taken to be the end of the period. However, if the asset exceeds the liabilities, it will be a position of bank overdraft.

This method is good for long-term or annual cash forecast but is of limited use for planning and control because it estimates the cash position at a particular point of time only.

Illustration 2:

Priya Limited has Rs.2,00,000 share capital and Rs.24,000 reserve against Rs.1,60,000 invested in fixed assets. Inventories and trade receivables were Rs.16,000 and Rs.52,000 and trade and other trade payables Rs.8,000. To sustain the increase in activity stock level is proposed to be increased by 100% by the end of the year. Machinery worth Rs.15,000 is proposed to be acquired during the year as per capital expenditure budget.

Estimated profit for the year is Rs.30,000 after charging Rs.10,000 depreciation and 50% of profit for taxation. Trade and other trade payables are likely to be doubled. A dividend of 10% is to be paid. Trade receivables are estimated to be outstanding for 2 months. Sales budget shows sales of Rs.2,40,000. Make an estimation of cash position as at the end of the budgeted period.

Solution:

(C) Cash Flow Method or Profit Cash Forecast Method or Adjusted Profit & Loss Method:

This method is based on the technique of cash flow statement. It is generally assumed that profit brings cash into business if there is no change in other assets and liabilities. However, in practice all these items do change and, therefore, adjustments are to be made in finding out the closing balance of cash.

In this method, the cash budget is prepared on the basis of opening cash and bank balances, projected Profit & Loss Account and the balances of various assets and liabilities. According to this method the amount of expected net operating cash profit during the year is added to the opening balance of cash. Thereafter, adjustments are made for expected increases or decreases in current assets and current liabilities as well as for expected payments of tax and dividends. The resulting cash balance is the estimated cash in hand at the end of budget period.

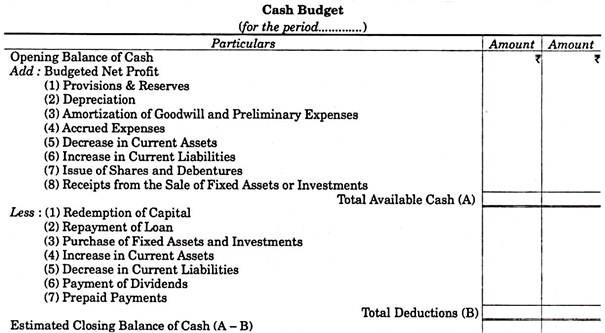

The format of cash budget on the basis of this method may be as follows:

It may be observed that this method of cash budgeting is quite similar to Cash Flow Statement. However, the only difference is that Cash Budget deals with future data whereas Cash Flow Statement is based on historical data.

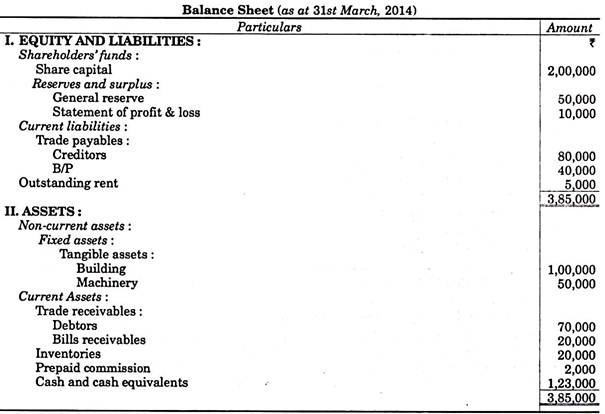

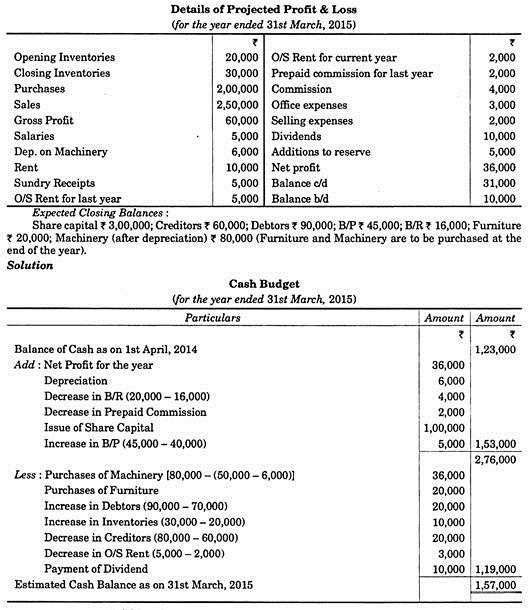

Illustration 3:

The following data are available to you. You are required to prepare a Cash Budget according to adjusted Profit & Loss Method-

Specific Consideration of Time-Lag in Cash Budget:

While preparing cash budget, an important factor in estimating receipts and payments is the factor of ‘Time-lag’, i.e., what will be the difference of time between actual transaction and actual cash flow. It may be noted that the amount is recorded in cash budget not on the basis of actual transaction but on the basis of actual flow of cash.

Some aspects of time-lag can be explained with the help of following examples:

(1) The period of credit allowed to customers is two months. It means that the amount of credit sales made in January will be realised in the month of March and of February in the month of April and so on.

(2) Time-lag in payment of wages is 1/2 month. It means that 1/2 of wages due in January will be paid in January and remaining 1/2 in the month of February.

(3) Time-lag in payment of manufacturing expenses is 1/8. It means that 7/8 of manufacturing expenses due in January will be paid in January and remaining 1/8 in the month of February. It should be observed that the amount of month’s expenditure in the ratio of time-lag would be payable in the next month.

(4) Cash sales are 25% and 50% of the sales are realised in the month following the sale and the remaining 50% in the second month following. It means that if the estimate of sales in the month of January is Rs.80,000, then 25% of it, i.e., Rs.20,000 will be shown as cash sales in the month of January. 50% of credit sales of Rs.60,000, i.e., Rs.30,000 each will be shown as collection from debtors in the month of February and March.

Cash Budget Methods – 3 Steps Involved in the Preparation of a Cash Budget

The cash budget is prepared generally by a finance manager. Since, the cash budget is based on numerous estimates originating throughout the firm; finance manager should consult executives of the firm while preparing the cash budget.

Preparation of the cash budget involves the following steps:

1. Estimating cash receipts

2. Estimating cash disbursements

3. Determining financial needs

Before preparing the cash budget, finance manager must determine the period for which the budget will be prepared. Cash budget period should be decided in the light of stability of the firm’s sales and production.

If the volume of sales and product price are stable, production can be scheduled at more or less constant rate, the period can be quite long even beyond the one-year limit. In case of volatile fluctuations in sale, period of the cash budget should be shortened.

After the determination of the total span of time to be covered, the next step is to formulate the unit into which the total span is to be divided. Monthly periods constitute a convenient unit since they synchronise with the conventional accounting period of a month and because this allows incorporation of seasonal variations in cash flows. Some firm’s even prepare budget on daily basis.

In that case projection of cash inflows and outflows is limited to one month and monthly intervals are used for the remainder of the budget period prepared for this month. The process is repeated for the rest of the months.

Once the budget period has been decided, finance manager starts preparing the budget.

The following steps are involved in preparation of cash budget:

Step # 1. Estimating Cash Receipts:

In predicting cash inflows a finance manager should first of all recognize sources of cash receipts. This is, to a large measure, dependent upon nature of business operations. Generally, a business firm derives cash from cash sales, collections of accounts receivable, income from loan and investments, sale of fixed assets, etc.

In manufacturing and trading concerns, cash sales and collection of receivables constitute the major sources of cash receipts.

Thus, cash budgeting begins with the forecasting of sales. There are two approaches to determination of projected sales. The first among these is internal approach in which salesmen are asked to predict sales for the ensuring budget period. These estimates are made product-wise, area-wise, and month-wise.

The sales manager screens these estimates for the firm. The underlying limitation of this approach is that it overlooks general economic and business conditions that definitely influence the volume of business activity of a firm. This is why many companies employ external approach also.

In this approach, a forecast of economic situation for several years to come and of industry sales during this period is made by economic analysts. Thereafter, an estimate of market share of individual products, prices that are likely to prevail and the likely reception of new products has to be made.

Sales estimates made on the basis of external approach is tallied with that on internal approach and in case of difference between the two, a compromise is reached. In general, external forecast should provide the basis for the final sales forecast. This may be modified by internal forecast. This would lead to more accurate forecast of sales than that based either on internal or external approach.

Once sales estimates have been done finance manager’s job begins. He has to determine cash receipts from sales. He has first to separate cash sales from credit sales taking the historical ratios of cash to credit sales as the basis, allowance being made for anticipated changes in general business trend and other indicated conditions.

If there is no time lag between point of sales and realization of cash, the estimated sales in the sales budget will be shown in the cash budget as the cash receipts from that source.

Problem arises where the firm sells on account. In case of credit sales there will be time lag between point of sales and realization of cash. The actual time lag between the two will depend upon the credit terms, the type of customer and the credit and collection policies of the firm. A finance manager should, therefore, collect data regarding percentage of credit sales collected in 30 days, 60 days, and so forth.

It would be more useful to collect such information from various sales districts or for different classes of customers. The information should be used with considered judgement.

After deciding the time interval between credit sales and collection of receivables, finance manager should also determine the amount that will be collected on accounts. In the light of amount of cash discounts offered by the firm, paying habits of customers and bad debts losses, estimates for amount of collection on accounts, should be made.

Generally, past collection rate is applied to the estimated credit sales for the budget period. The resultant figures are added to the collections outstanding at the beginning of the period in order to obtain the estimated total collections for the period.

In a business firm, cash receipts from other than sales form a negligible proportion. However, estimate of these receipts should also be made. Example of such receipts are interest and dividends from investments, liquidation of such investments, royalties from licensing arrangements with other firm’s for manufacturing a product under its patents.

Flows from these sources are of small magnitude and if there is any inaccuracy in forecasting these flows, it will not have material effect on the overall cash budget.

Step # 2. Estimating Cash Disbursements:

Next step in construction of the cash budget is to predict cash disbursements in different months of the budget period. Generally, a firm makes payments for purchase of raw materials, direct labour, out of pocket expenses, capital additions, retirement of indebtedness and corporate disbursement such as dividends. Budgets for these items certainly provide the basis for estimating the cash requirements.

Estimate of the amount and timing of payment of raw materials or finished goods during a budget period closely follows sales estimates but the relationship is not necessarily a precise one.

A decision to hold larger inventories would call for purchases more than what would be required to meet projected sales; while a decision to cut inventories would make it possible to meet a position of estimated sales out of inventory already held, resulting in less purchase requirements for the forecast period than what would otherwise have been.

At any time, the timing of purchases and payments therefore will not be difficult to estimate on the basis of sales estimate and inventory policy decisions when production schedule and buying programmes have been estimated.

In predicting month wise payments for raw materials and finished goods, finance manager must take separate estimate of cash purchases, purchases on account, the credit terms of the various suppliers supplying goods to the firm and cash discounts offered to enable the prompt payment.

An estimate of paying suppliers on obligations standing on the books at the beginning of the budget period as well as postponing payments on obligations that will originate during the period but will not reach their due or discount dates by its end, should also be made.

Firms paying wages to labourers on piece rate basis can produce the wage bill by simply applying the piece rates to the units of output called for in the production budget, at the same time taking into consideration prospective rise in wage costs in the firm of social security taxes, paid holidays and vacations, payments into company pension, funds, payment for overtime work and such bonuses as may be prescribed by incentive systems in operation.

Where labourers are paid on hourly basis, wage bill can be estimated by multiplying the number of labour hours of various skills required to turn out the units of output as scheduled in production budget by the respective hourly rates and adding in supplemental wage costs of the kinds referred to above.

Among overhead expenses, some expenses like property taxes, property insurance, some of the executives’ salaries and certain kinds of maintenance charges are fixed in character. These fixed expenses are expected to hold up a specific level regardless of variations in volume of business. But fixity in an expense does not mean that it will not change from this year to next year.

Local government may raise their property tax rates and insurance companies raise their rates for property insurance or the forecasting firm may be planning additions to fixed assets which will attract additional property tax and the firm will have to pay insurance cost on this property.

Fixed expense, therefore, means that if a change takes place the new level will prevail regardless of the scale of operation next year. One must, therefore, be careful in estimating fixed overhead expenses.

Estimates of variable expenses by definition are expected to vary in proportion to production of sales. But difficulties cannot be wholly avoided. There are possibilities of future changes in prices and costs that create complication. If the selling prices of the firm’s products are to be lowered with no change in the salesmen commission rate; the fall in total commissions can hardly be expected to be proportional to the fall in unit sales.

Forecasting difficulties in respect of semi-variable expenses emanate from two directions. First, different kinds of expenses in this regard tend to have disproportional patterns of variations in relation to volume of operations. Secondly, changes in prices and rates affect them no less than fixed and variable expenses.

A forecast of lower sales for – the forecast period may be coupled with budgetary provisions for a substantial increase in spending for advertising with a view to preventing further decline in sales.

If the market for the product expands there may arise slight need to increase the advertising expenditure to cover the new portion of the market since sales will themselves increase. If, however, firm is interested to increase its market share, increase in spending becomes inevitable.

At the same time change in advertising expenditure may also be expected in view of the decision for a more extended coverage and also because of expected increase in advertising rates.

Cash requirements for interest and dividend payments, repayment, of loans and retirement of debt, payments for acquisition of fixed assets and non-operating assets such as real estate should be carefully estimated as these relate to manufacturing process, selling efforts and administration.

Step # 3. Determination of Financial Needs:

After estimates for cash inflows and outflows are made, these are combined to obtain the net cash flow or outflow for each month. When the net cash flow is added to the beginning cash balance, the resulting figure gives cash position of the firm.

Given the firm’s cash position of each month finance manager would, keeping in mind the minimum cash requirements of the firm, decide amount that the firm would need to borrow from bank and other short- term sources.

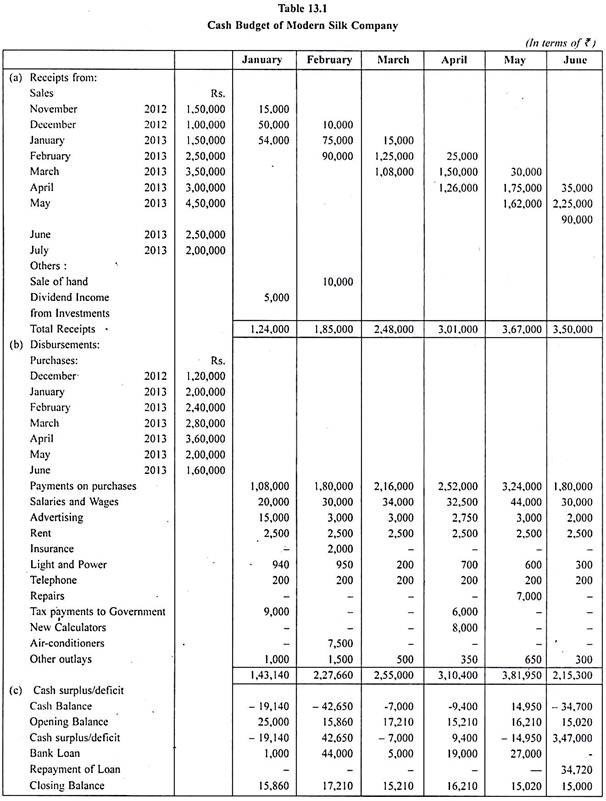

Cash budget of Modern Silk Company for six-month period is illustrated in Table 13.1. Sales are the primary source of cash for this company. Thus, sales for January and February of 2013 are estimated to be Rs.1,50,000 and Rs.2,50,000, respectively.

Sales for November and December of 2012 are also given because part of these previous sales could not be collected until 2013. Historically 40 per cent of the sales for this are for cash, on which a 10 per cent sales discount is offered.

This firm gives a cash discount only on cash purchases. Fifty per cent of the total sales are collected in the second month of the sale. For example, of the 2,50,000 sales in February, Rs. 1,00,000 will be for cash but only Rs. 90,000 will be received in cash because of the 10 per cent discount. Rs. 1,25,000 will be collected in March; the rest Rs. 25,000 will be collected in April. It is assumed here that there will be no bad debts losses.

Other sources of cash receipts are also depicted in the cash budget. Thus, the company expects to receive dividend income from investment of Rs. 5,000 in January, It is also anticipated that the company would sell a plot of land for Rs. 10,000 in February, 2013.

The company buys sufficient inventory in the preceding month to cover sales in the following months. The cost of goods sold averages 80 per cent of each month’s sales (before taking into account purchase discounts).

Thus, in preparation for March’s estimated sales of Rs.3,00,000, the company buys materials of Rs.2,40,000 in February and ends the month of February with this inventory balance.

The supplier of materials sells the goods on terms 10/10 E.O.M., N/30. Hence, when the February purchases are paid for in March, only Rs. 2,26,000 in cash will be expended because of the purchase discount. Other outlays by months are shown in Table 13.1.

Thus, in January, cash payments for wages would be Rs. 20,000, and advertisement expenditure around Rs. 15,000. Other expenditures which are expected to be incurred in different months are also complied in Table 13.1.

When cash receipts and disbursements are combined, resultant figures are added to or subtracted from the opening cash balance for the budget period, company’s cash position is reflected. Thus, it can be noted from Table 13.1 that the beginning cash balance of the company was Rs. 25,000.

The cash deficit in January is expected to be Rs. 19,140. Since, the management has decided to maintain minimum cash balance of Rs. 15,000, the company would need to borrow Rs. 10,000 in this month.

Likewise, cash budget of the company shows that it will have to borrow loan from bank in the first five months of the budget period to cover excess of cash outflow. In the month of June when the company expects to earn for the first time cash surplus of the order of Rs. 3,47,000 the management would repay a portion of the loan taken in the earlier months.

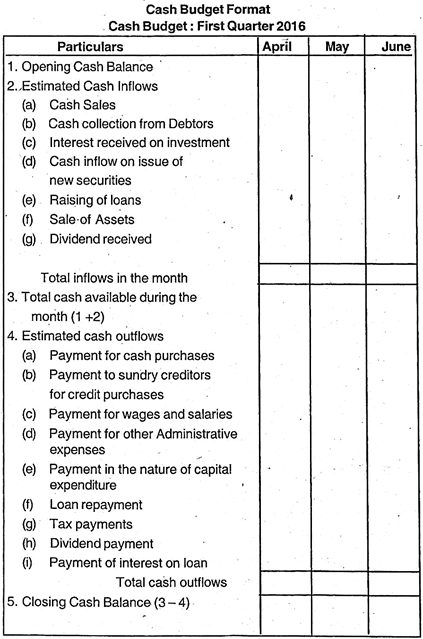

Steps in the Preparation of Cash Budget (With Cash Budget Format)

Cash budget is one of the most important budgets prepared by an enterprise as every transaction ultimately resolves itself into cash. It contains estimates of cash inflows and outflows for a period of time in future.

Cash budget portrays the projecting of cash receipts and disbursements from all sources over a particular period of time. It is a summary of expected cash inflows and outflows for a certain time span. When cash flows are more volatile but predictable, cash budget is prepared more frequently even on a day today basis. On the other hand, when cash flows are stable, cash budget is prepared on monthly basis.

Preparation of Cash Budget:

A Cash Budget is prepared on receipts and payments method. It is the projection of enterprises cash receipts and disbursement for a budget period.

It has two basic components:

1. Estimation of cash receipts, and

2. Estimation of cash payments

Cash receipts included in the cash budget are on the following pattern:

1. Cash Sales

2. Collection from Debtors

3. Interest received on investment and dividend receipts.

4. Sole of marketable securities.

5. Issue of new securities for cash.

6. Raising of loans (borrowings)

7. Proceeds from sale of assets

8. Miscellaneous receipts

The items of cash expenditure are presented as follows:

1. Cash purchases

2. Payments to Sundry Creditors and Bills Payable.

3. Payments for wages and salary, rent and other expenses.

4. Payment in the nature of capital expenditure – Purchase of assets.

5. Purchase of market securities.

6. Loan repayments

7. Tax payments

8. Redemption of securities.

9. Interest payments on bank loan and other borrowings.

10. Dividend payments

11. Miscellaneous payments.

Steps in the Preparation of a Cash Budget:

1. Ascertain opening balance of cash.

2. Estimate cash inflows for the period of cash budget.

3. Estimate schedule of disbursement or cash payments.

4. Ascertain the closing balance of cash. This is found by deducting anticipated cash outflows from the sum of expected cash receipts and opening balance.