This article throws light upon the three main types of cash book that can be maintained in a farm business. The types are: 1. Cash Book with Cash and Discount Columns 2. Cash Book with Cash and Bank Columns 3. A Cash Book with Bank and Discount Column 4. Petty Cash Book.

1. Cash Book with Cash and Discount Columns:

The discount allowed is entered along with cash received or paid to a party on the same time and on the same side of the book, although in different columns.

Rules for making entry in the discount columns:

1. The amount of discount received i.e., allowed by others is entered in the credit side of the discount column.

ADVERTISEMENTS:

2. The amount of discount allowed to debtors by the business is entered on the Dr. side of the discount column.

Rules for Posting from Discount Columns:

1. Each item appearing in the discount column on the Dr. side is posted to the Cr. side of the respective personal account in the ledger (along with the accompanying cash payment).

2. Items appearing in discount column on Cr. side is posted to Dr. side of the respective personal account (along with accompanying cash received).

ADVERTISEMENTS:

While posting into the ledger the amounts of cash received and discount allowed to a person are added together and entered in the credit side of the personal account with “By cash and discount,” or “By cash” etc. or “By sundries”. Similarly cash paid out is put into the Dr. side as “To cash” and “discount”, “To cash” etc. or “By sundries”.

3. At the end of month or starting period, the total of the discount column on the Dr. side is posted to the Dr. side of the discount account (or discount allowed account) in the ledger as “To sundries” or “To sundry debtors”.

4. The total of the discount column on the Cr. side is posted to the Cr. side of the discount account (or discount received account) in the ledger as “By sundries” or “By sundries creditor”.

Balancing:

ADVERTISEMENTS:

Totals of the discount columns are now carried forward as they are posted to discount account in the ledger. At the end of the year the discount account is transferred to the P & L A/c.

Cash Discount Defined:

It is an allowance made by the receiver of cash to the payer for prompt payment. It is necessary to record it in the place where cash transaction is recorded.

2. Cash Book with Cash and Bank Columns:

1. Cash and bank transactions are entered side by side and kept running together at the same page both the balances are ascertained conveniently by this method.

ADVERTISEMENTS:

N.B.:

Money withdrawn from the bank by means of a cheque is treated as cash for accounting purposes.

Enterprises:

Cash (including cheques received) paid into the bank are regarded as payment from cash on the one hand and as receipt by the bank on the other.

ADVERTISEMENTS:

Therefore two entries are made in the cash book:

(a) One on the credit side in the cash column to show its payment.

(b) The other on the debit side in the bank column to its receipt in the bank. This completes the double entry, no ledger posting is required. These are known as ‘Contra’ or ‘Cross’ entries and are denoted by alphabet ‘C’ or ‘Con.’ in the ledger folio column.

2. When bills are paid into the bank, only one entry is made on the Dr. side of the bank column.

ADVERTISEMENTS:

3. When the money is drawn from the bank by cheques: Two entries are made (a) Credit entry in the bank column—showing money withdrawn from bank, (b) Dr. entry in cash column—to receipt in the farm office. This is marked Con (Contra) in the ledger folio column to facilitate posting of the remaining entries.

4. When payment is made in favour of others by drawing a cheque on the bank only one entry is made on the credit side of the bank column, as money will be paid through the bank.

Posting:

1. When contra entries are made in the cash book no further entry is made in the ledger as the entries have been completed, (items 1 and 3 as above).

ADVERTISEMENTS:

2. No posting is made to the ledger for balance also.

3. If one entry is made on the Dr. side in the Bank column, as in the case of bills paid into the bank, other corresponding entry is made in the ledger in Bill receivable accounts in the credit side, as “By Bank” or “By Bank for Collection.”

4. If one entry is made on the credit side in the bank column, as in the case of payment made by drawing cheques in favour of others, the corresponding entry is made in the ledger in their relative personal A/cs on the debit side as “To Bank”.

Balancing:

After balancing the balance is brought down to the other side. The difference of the bank column may be either the balance at the bank or overdraft i.e., an amount overdrawn. The closing bank balance is carried forward to the next period and is written as first item.

At the close of the year, the cash and bank balances are taken direct from the cash book to the Trial Balance and the Balance Sheet.

3. A Cash Book with Bank and Discount Column:

ADVERTISEMENTS:

When all receipts are sent to the bank and payment are made by cheques except payment for the Petty Cash expenditure, the cash book will have bank and discount columns. In such a case the Petty Cash Book is maintained separately for entering petty cash disbursements.

Entries:

a) All amounts received (per carbon copy of the receipt book) are entered in the Dr. side of the Bank Column.

b) All amounts paid away by cheques (as per counter foil of the cheque book) are entered on the Cr. side of the bank column.

c) When cheque is drawn for the Petty Cash expenses, it is entered on the Cr. side of the bank column.

Posting:

ADVERTISEMENTS:

All items in the bank column are posted to the opposite side of the Ledger Accounts and no Contra entries has to be made. The amount of Petty Cash is posted to the Dr. side of a separate Petty Cash Book.

Balancing:

Balancing is done the same way as in the case of Cash and Discount Column.

4. Petty Cash Book:

A separate book of account called Petty Cash Book is maintained for recording cash payments for the current expenses. This is done to avoid the principal cash book from being overcrowded by small payments.

This account is handled by the clerk who should make payment for small figures like carriage, freight, stamps, entertainment of customers over a bottle of coke or a cup of tea, stationary etc. A small amount, say hundred rupee is paid by cheque for this purpose to the clerk concerned.

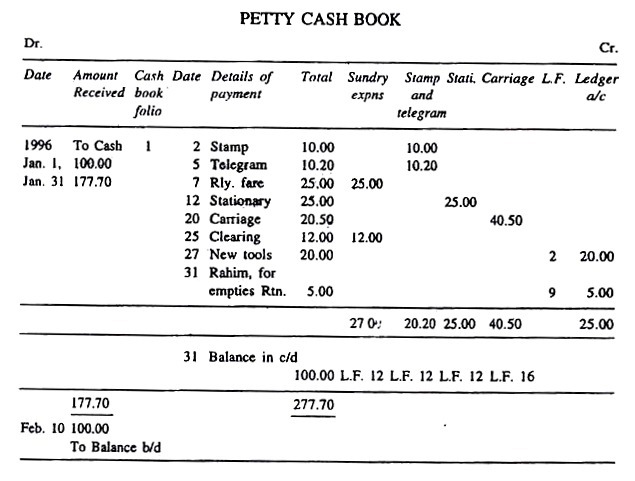

He maintains the account as shown below:

ADVERTISEMENTS:

Format of Petty Cash Book:

The book is ruled with suitable analysis columns to show expenditures on each item of expenses e.g., postage, stationary, carriage etc. The petty cashier receives a cheque for a small sum estimated to take care of such expenses.

The cashier enters the amount to Cr. side of the Petty Cash Book (Bank column) “By Petty Cash” and inserts in folio column the petty cash folio. As payments are made the petty cashier enters the items in the total column of the petty cash book and extends the amount to the appropriate analysis column, as shown in the format.

At the end of the month the petty cashier balances his petty cash book, and makes a summary of his disbursements, takes it, together with vouchers, to the cashier, who after checking them, draws a cheque for the months payment, which according to the petty cash book shown here amounts to 177.70, which exceeds Rs. 100.00 but in the next cheque an amount of Rs. 200.00 shall be issued for the petty cash payment purpose.