Everything you need to know about reconciliation of cost and financial accounts. The word ‘Reconcile’ means to tally, conciliate, harmonize, bring together or equate.

The term reconciliation applies to the reconciliation of the results of the business profit or loss as shown by the financial accounting records and the cost accounting records.

When cost accounts and financial accounts are maintained separately, the profit shown by one set of books may not agree with that of the other set.

In such a situation, it is necessary to reconcile the results (profit/loss) shown by two sets of books. Such reconciliation proves arithmetical accuracy of data, explains reasons for the difference in the two sets of books and affords reliability to them.

ADVERTISEMENTS:

Learn about:-

1. Reasons for Reconciliation 2. Procedure for Reconciliation 3. Need for Reconciliation

4. Memorandum Reconciliation Account or Statement 5. Causes or Reasons for Difference in Results as Per Financial Accounts and Cost Accounts.

Reconciliation of Cost and Financial Accounts: Reasons for Reconciliation, Procedure, Need and Statement of Reconciliation

Reconciliation of Cost and Financial Accounts – Causes of Difference and Preparation of Reconciliation Statement or Memorandum Reconciliation Account

Causes of Difference between the Results Shown by the Cost Accounts and Financial Accounts:

Following are the main causes of difference between the results shown by the cost accounts and the financial accounts:

ADVERTISEMENTS:

1. Estimates and Actuals:

The cost can be computed either on actual or estimated basis. Since cost accounts are meant to function as a control device it will be appropriate to adopt estimated costing or preferably standard costing system while preparing cost accounts. Estimates or standards can be nearer to the actuals but in most cases they cannot be the same. This necessarily means that the profit shown by the cost accounts is bound to be different from the profit shown by the financial accounts.

Following are some of the important items the costs of which may be different in financial books and costing books:

(a) Direct Materials:

ADVERTISEMENTS:

The estimated or standard cost of the direct materials purchased or consumed in the production process may be different from the actual costs. This difference will be due to change in price or quantity or both.

(b) Direct Labour:

The estimated or standard cost of direct labour may be different from the actual costs because of differences in wage rates or hours of work or both. Sometimes, workers might have to be paid more due to increased dearness allowance, pay revision, bonus etc. This will cause difference between the profits shown by the two sets of books.

(c) Overheads:

ADVERTISEMENTS:

In cost accounts the recovery of overheads is generally based on estimates while in financial accounts the actual expenses incurred are recorded. This results in under-or over-recovery of overheads.

The under-recovery or over-recovery of overheads may be carried forward to the next period or may be charged by a supplementary rate (positive or negative) or transferred to costing Profit and Loss Account. In case the under-recovery or over-recovery of overheads has been carried forward to the next period, the profit as shown by the costing books will be different from the profit as shown by the financial books. Such variation may be due to over-or-under charging of factory, office or selling and distribution overheads.

(d) Depreciation:

Different methods of charging depreciation may be adopted in cost and financial books. In financial books depreciation may be charged according to fixed installment method or diminishing balance method etc. while in cost accounts machine hour rate or any other method may be used. This is also an item of overheads and may be one of the reasons of difference between the overheads charged in financial accounts and overheads charged in cost accounts.

ADVERTISEMENTS:

2. Valuation of Stocks:

(a) Raw materials – In financial accounts stock of raw materials is valued at cost or market price, whichever is less, while in cost accounts stock can be valued on the basis of FIFO or LIFO or any other method. Thus, the figure of stock may be inflated in cost or financial accounts.

(b) Work-in-progress – Difference may also exist regarding mode of valuation of work-in-progress. It may be valued at prime cost or factory cost or cost of production. The most appropriate mode of valuation is at factory cost in cost accounts. In financial accounts work-in-progress may be valued after considering a part of administrative expenses also.

(c) Finished goods – Under financial accounts, stock of finished goods is valued at cost or market price whichever is lower. In cost accounts, finished stock is generally valued at total cost of production. If the circumstances warrant, prime cost or factory cost may also be taken as the basis for valuing the stock of finished goods.

ADVERTISEMENTS:

Thus, mode of valuation of stocks gives rise to different results in the two sets of books. Greater valuation of opening stocks in cost accounts means less profit as per cost accounts and vice versa. Greater valuation of closing stocks in cost accounts means more profit as per cost accounts and vice versa.

3. Items Included in Financial Accounts Only:

There are certain items which are included in the Financial Accounts but not in the Cost Accounts.

These include the following:

ADVERTISEMENTS:

(a) Appropriation of profits e.g., provision for taxation, transfer to reserves, goodwill, preliminary expenses written off.

(b) Purely financial charges e.g., losses on sale of investments; penalties and fines, expenses on transfer of company’s office.

(c) Purely financial incomes e.g., interest received on bank deposits, profits made on the sale of investments, fixed assets, transfer fees received etc.

4. Items Included in Cost Accounts Only:

There are certain notional items which are excluded from the financial accounts but are charged in the cost accounts:

(i) Charge in lieu of rent where premises are owned.

ADVERTISEMENTS:

(ii) Depreciation on an asset even when the book value of the asset is reduced to a negligible figure.

(iii) Interest on capital employed in production but upon which no interest is actually paid (this will be the case when the firm decides to include interest in the overheads).

The above items will reduce the profits in Cost Accounts as compared to that in Financial Accounts.

5. Abnormal Gains and Losses:

Abnormal gains or losses may completely be excluded from cost accounts or may be taken to costing profit and loss account. In financial accounts such gains and losses are taken to profit and loss account. As such, in the former case costing profit/loss will differ from financial profit/loss and adjustment will be required. In the latter case, there will be no difference on this account between costing profit or loss and financial profit or loss.

Therefore, no adjustment will be required on this account. Examples of such abnormal gains and losses are abnormal wastage of materials e.g., by theft or fire etc., cost of abnormal idle time, cost of abnormal idle facilities, exceptional bad debts, abnormal gain in manufacturing through processes (when actual production exceeds normal production).

ADVERTISEMENTS:

The need for reconciliation will not arise in case of a business where Integral or Integrated Accounting System is in use as there will be only one set of books both for financial and costing records. But where there are separate sets of books, reconciliation is imperative.

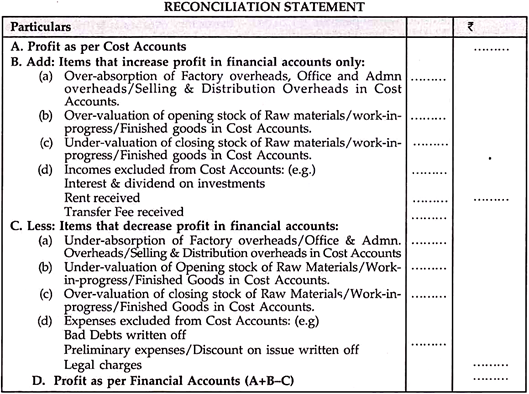

Preparation of Reconciliation Statement or Memorandum Reconciliation Account:

A Reconciliation Statement or a Memorandum Reconciliation Account should be drawn up for reconciling profits shown by the two sets of books. Results shown by any sets of books may be taken as the base and necessary adjustment should be made to arrive at the results shown by the other set of books.

The technique of preparing a Reconciliation Statement as well as a Memorandum Reconciliation account is discussed below:

The preparation of reconciliation statement involves the following steps:

(1) Profit as per any set of books (cost or financial) may be taken as the base. This is as a matter of fact the starting point for determining the profit as shown by the other set of books after making suitable adjustments taking into consideration the causes of difference.

(2) The effect of the particular cause of difference should be studied on the profits shown by the other set of books.

ADVERTISEMENTS:

(3) In case, the cause has resulted in an increase in the profit shown by other set of books, the amount of such increase should be added to the profit as per the former set of books which has been taken as the base.

(4) In case, the cause has resulted in a decrease in the profit shown by other set of books, the amount of such decrease should be subtracted from the profit as per the former set of books which has been taken as the base.

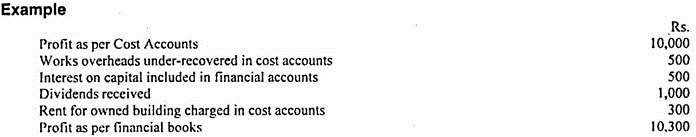

There is a difference of Rs. 300 between the profit as shown by the financial books and the profit as shown by the cost books.

A reconciliation statement can be prepared to reconcile, on the following basis, the profits shown by two sets of books:

1. Profit as per cost accounts may be taken as the base. In other words, the profit as shown by the financial books can be found out if suitable adjustments are made in this figure of profit after taking into account the above causes of difference.

ADVERTISEMENTS:

2. Works overheads have been charged more in financial accounts than those in cost accounts. This means profit as shown by the financial accounts is less than the profit as shown by the cost accounts by Rs. 500 (the amount of under-recovery). Since profit as per cost accounts has been taken as the base, the amount of Rs. 500 should be subtracted from this base profit to arrive at the profit as shown by the financial accounts.

3. The inclusion of interest on capital as an expense has resulted in decrease in profits as shown by financial books. In other words, the profit as shown by the cost books is more than the profit as shown by the financial books by Rs. 500 (the amount of interest). The amount should, therefore, be subtracted from the base profit.

4. Dividend received has been credited in financial books. This means the profit as shown by the financial books is more than the profit as shown by the cost books by Rs. 1,000. The amount should, therefore, be added to the profit as shown by the cost books,

5. No charge is made in financial books for rent on owned buildings. The amount has however been charged in the cost books. It means the profit as shown by the financial books is higher than the profit as shown by the cost books by this amount. The amount, therefore, should be added to the profit as shown by the cost books.

The reconciliation statement may now be conveniently presented in the following form:

In case, in the above example, the cost accounts show a loss of Rs. 10,000, in place of a profit, the amount of loss should be put in the ‘minus’ column. The reconciliation statement should then be prepared on the same pattern assuming that there is a profit in place of there being a loss.

ADVERTISEMENTS:

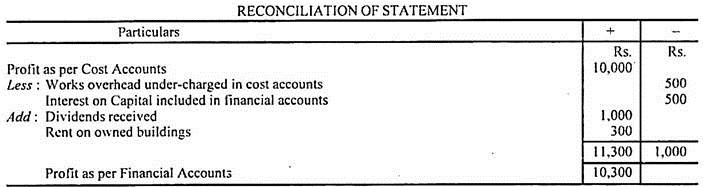

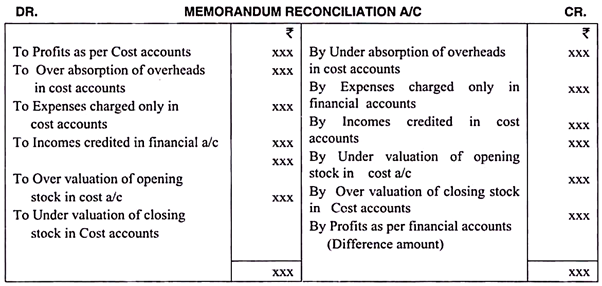

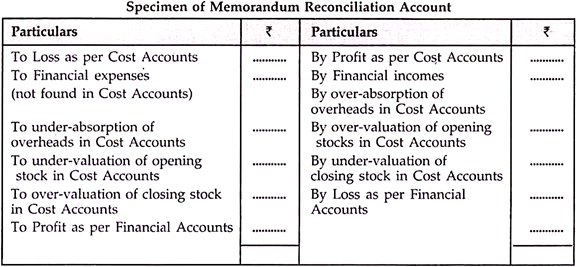

Preparation of Memorandum Reconciliation Account:

The memorandum reconciliation account can be prepared on the same lines as a reconciliation statement, the only difference is that in the former ‘Dr.’ denotes’-‘ while ‘Cr.’ denotes ‘+’.

Taking the above example, the memorandum reconciliation account will appear as follows:

Importance of Reconciliation Statement:

In case separate set of books are maintained for costing and financial transactions, usually there will be a difference between profit shown by cost accounts and profit shown by financial accounts. However, it is also possible, per chance, that the overall profit shown by two sets of books is the same. Nevertheless all cases, the results shown by both the set of books are to be reconciled to identify the causes of difference (if any) and to establish accuracy of both the sets of books.

Reconciliation of Cost and Financial Accounts – Need, Procedure for Reconciliation and Causes of Difference between Profit Shown by Cost and Financial Accounts

Need for Reconciliation:

When cost accounts and financial accounts are maintained separately, the profit shown by one set of books may not agree with that of the other set. In such a situation, it is necessary to reconcile the results (profit/loss) shown by two sets of books. Such reconciliation proves arithmetical accuracy of data, explains reasons for the difference in the two sets of books and affords reliability to them.

Causes of Difference between Profit Shown by Cost Accounts and Financial Accounts:

There are certain items, which appear in financial books only and not recorded in cost accounting books. Similarly, there may be some items, which appear in cost accounts only and do not find place in the financial books.

The following items of expenditures/losses appear only in financial books:

1. Interest on bank loans, mortgage, debentures, etc.

2. Expenses on stamp duty, discount and other expenses relating to issue and transfer of shares and debentures.

3. Fines and penalties.

4. Loss on sale of fixed assets.

5. Loss on sale of investments.

The following items of incomes/gains are recorded in the financial books only:

1. Interest received on bank deposits and other investments.

2. Dividend received on investment in shares.

3. Rental income, etc.

4. Fees received on issue and transfer of shares, etc.

5. Profit on sale of fixed assets

6. Profit on sale of investments.

Besides the above, there are special or abnormal items of expenditure and income, which are not included in the cost of production. If they are included, cost ascertainment will not be correct.

These are:

1. Excessive or avoidable rejections.

2. Defective work and spoilage.

3. Heavy losses of stores.

4. Loss due to theft or pilferage.

5. Loss on account of natural calamities.

6. Abnormal idle time.

7. Unexpected large incomes and other abnormal gains.

Other reasons for the difference between the results of two sets of books are:

1. Wages – Often in cost accounts, direct wages are charged on the basis of predetermined rates whereas in financial accounts actual expenditure on wages is recorded.

2. Overheads – In cost accounts, overheads are generally absorbed on the basis of a predetermined overhead rate whereas in financial accounts actual expenditure on overheads is recorded.

3. Depreciation – Depreciation may be charged on different bases in financial and cost accounts. For example, in financial accounts, it may be charged according to written down value method recognized by the Income Tax Act whereas in cost accounts it may be charged on the basis of the life of the machine in terms of production hours.

4. Valuation of Closing Stock – Different methods of valuation of closing stock adopted in cost and financial accounts also cause difference between the results of two sets of books. In financial accounts, the method generally followed is cost or market price, whichever is less, while in cost accounts only cost is the basis.

5. Notional Charges – Sometimes, notional charges such as interest on capital, rent for own premises, salary of owner-manager, etc. are included in cost accounts. But they do not appear in financial accounts, as there are no actual out go on these items.

Procedure for Reconciliation:

The following procedure may be followed for reconciliation:

1. Ascertain items, which appear in financial accounts but not in cost accounts.

2. Ascertain items that appear in cost accounts only but not in financial accounts.

3. Determine the extent of difference between actual indirect expenses as recorded in financial books and the amount of overheads recovered in cost books.

4. Compare the figures of valuation of stock of raw materials, work-in- progress, stores and finished goods as shown in cost accounts and financial accounts and ascertain the amount of difference.

5. Ascertain other items, which are shown in cost as well as financial accounts but differ in value.

6. Prepare Reconciliation Statement, which is also called Memorandum Reconciliation Statement.

7. Start with the profit as per cost accounts and reach the profit as per financial accounts.

8. Add or deduct, as the case may be, items which differ from financial accounts, and items which are recorded in financial accounts and not in cost accounts. A brief explanation may be given in respect of each addition or deduction.

9. All items of expenditures/losses, which appear in financial accounts but not in cost accounts will be deducted and all items of income/gains appearing in financial accounts but not in cost accounts will be added. Reverse will be the treatment of items appearing in cost accounts but not appearing in financial accounts.

In the same way adjustment will be made for difference between any items appearing in both the accounts. For example, expenses overcharged in cost accounts will be added to and expenses undercharged in cost accounts will be deducted from the profit as per cost accounts to arrive at the profit as per financial accounts.

10. If reconciliation statement is started with profit as per financial accounts and ended with profit as per cost accounts, the above additions and deductions will be reversed.

11. After making necessary additions and deductions, the resultant figure is profit as per financial accounts.

12. The above reconciliation may be carried out by preparing a memorandum reconciliation account

13. In case of a memorandum reconciliation account, profit as per cost accounts will be the first item on the credit side and items that are added in the reconciliation statement will also appear on the credit side. All the items, which are deducted in the reconciliation statement, will be written on the debit side. The balancing figure will be profit as per financial accounts.

Reconciliation of Cost and Financial Accounts – With Specimen of Reconciliation Statement and Memorandum Reconciliation Account

There are mainly two system of maintaining cost accounts namely:

(1) Integral System:

Under this system one set of accounts is operated which contains both financial and cost accounts. In such a system there is no need to prepare a separate reconciliation statement to reconcile the cost and financial profits,

(2) Non-Integral System of Accounting:

Under this system, separate cost and financial accounts are maintained. Hence the profit or loss disclosed by the two sets of accounts may differ. In such cases, it becomes necessary that cost and financial accounts are reconciled. If it is not reconciled, the two sets of accounts would provide conflicting information on the basis of which unwise policy decision may be taken.

Need for Reconciliation:

The need for reconciliation of profits as per Financial Accounts and profits as per Cost Accounts arises due to the following reasons:

(1) Numerical Accuracy – Reconciliation of cost and financial accounts help in checking the arithmetic accuracy of two sets of accounts.

(2) Standardisation – In the long ran standardization is achieved in policies relating to valuation of stock, depreciation or appreciation and absorption of overheads.

(3) Knowing the reasons – Reconciliation reveals the reasons for difference in profits or losses between cost and financial accounts.

(4) Effective internal control – It becomes easier for management to take effective decisions after knowing the reasons for the changes in profits/loss by reconciling the cost and financial accounts.

Reasons for Differences in Profit or Loss Shown by Cost Accounts and Profit or Loss Shown by Financial Accounts:

The causes of / reasons for differences between profit shown by financial accounts and cost accounts are:

(a) Pure financial charges included in financial accounts but excluded from cost accounts.

(b) Appropriation of profits included in financial accounts, but not included in cost accounts.

(c) Pure financial incomes and profits included in financial accounts, but not included in cost accounts.

(d) Notional charges included only in cost accounts, but not in financial accounts.

(e) Under or over absorption of overheads.

(f) Abnormal wastage/efficiency in respect of materials and labour.

(g) Difference in the rate of/methods of depreciation adopted in the two sets of accounts.

(h) Difference in the bases of stock valuation etc.

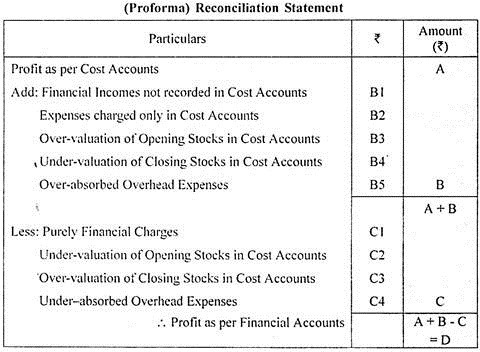

Reconciliation Statement:

Reconciliation means tallying the profits/losses reveled by both set of accounts. Reconciliation Statement is a statement which shows the reasons for the differences between profit and losses as shown by the cost accounts with that of the profits/losses as shown by the financial accounts.

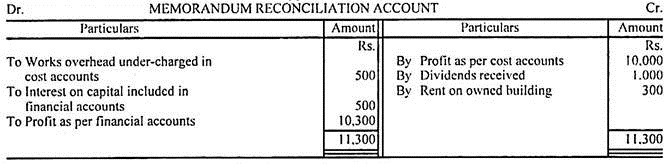

Preparation of Reconciliation Statement:

The reconciliation statement is prepared as under:

If loss is given as per cost accounts, then the above additional items should be deducted and deduction items should be added.

Memorandum Reconciliation A/c:

The reconciliation of profit or losses shown by the cost accounts and financial accounts can also be represented in for form of an account. Such an account is called Memorandum Reconciliation a/c.

It is prepared as under:

Other points to be observed:

(a) If depreciation charged is given separately as per cost accounts and financial accounts, then depreciation charged in cost accounts should be added and deprecation charged in financial accounts should be deducted.

(b) Stores adjustments (Cr.) should be added to cost profits and stores adjustments (Dr.) should be deducted from cost profits.

(c) The following items are considered as pure financial expenses. Example- Interest on capital, cash discounts, commission, loss on sale of assets, capital expenditure. These should be deducted from costing profits.

The following items are considered as pure financial incomes. Example- Interest on bank deposits and loans and investments, Dividend received, Profit on sale of investments and other fixed assets, Share transfer fees received, etc. These should be added to costing profits.

Reconciliation of Cost and Financial Accounts: Reasons for Difference in Profit Figures, Methods and Procedures for Reconciliation

Under Non-integrated Accounting System, two separate sets of books of accounts are kept and maintained – one, based on the principles of Financial Accounting and the other, on Cost Accounting principles. Both sets are maintained independent of each other. Of course, both sets of books of accounts are maintained on the basis of Double Entry Principles. Further, the vouchers and other documents which form the basis for recording the transactions are also same.

In spite of this, both the sets of accounts reveal or report, normally, different amounts of profit. That means, the amount of profit revealed by one set of accounts usually does not agree with the profit figure shown by another set of accounts. There is, therefore, a need for reconciliation between two results shown by the two sets of books of accounts. Reconciliation also helps to check the accuracy in recording both the sets of accounts.

Because, under Non-integrated Accounting System, both Financial and Cost Accounting report different amounts of profit. If they are reconciled properly, then it shows that both the sets of accounts are kept properly and accurately. On the other hand, if the two profit figures cannot properly be reconciled, then it reveals some error in one set of books or the other or in both.

Hence, W. W Bigg opines, although in most cases the Cost and Financial Accounts are kept entirely distinct, it is imperative that they be rendered capable of re-conciliating one with the other. If this were not possible, little reliance could be placed on the accuracy of Cost Accounts.

Further, as H. G. Wheldon views, no system is complete unless it is linked up with the Financial Accounts that the results shown by both Cost and Financial Accounts may be reconciled. Hence, Reconciliation facilitates internal control. For the purpose of reconciliation, it is necessary to know the reasons as to why both report different amounts of profit.

Reasons for Difference in Profit Figures:

The important reasons as to why both the Cost and Financial Accounts report different amounts of profit are summarized below:

1. Inclusion of Certain Items only in Financial Accounts:

Inclusion of Certain Items only in Financial Accounts but not in Cost Accounts also is the most important reason causing the difference in the profit figures reported by Cost and Financial Accounts.

These items may broadly be classified into three categories as:

i. Purely Financial Income Items,

ii. Purely Financial Expenses, and

iii. Items of Appropriation of Profit.

i. Items of Purely Financial Income:

a. Rent received on letting out the Building,

b. Profit on sale of Fixed Assets and Investments,

c. Transfer Fees received,

d. Interest received on Bank Deposits and Loans granted,

e. Dividend received on Investments, etc.

The amounts of the above items shall be added to Costing Profit or shall be deducted from Financial Accounting Profit while reconciling.

ii. Items of Purely Financial Expenses:

a. Loss on sale of Fixed Assets and Investments,

b. Interest on Bank Loan, Mortgage Loan and on Debenture Capital (if it is not treated as cost in cost books of accounts),

c. Penalties and Damages,

d. Discount on Debentures,

e. Cost relating to issue of Shares and other Securities, and expenses of company’s Share Transfer Office,

f. Writing-off of Goodwill, Preliminary Expenses, Patents, Underwriting Commission, Debenture Discounts, etc.

The amounts of the above items shall be subtracted from Costing Profit or shall be added to Financial Accounting Profit while reconciling.

iii. Items of Appropriation of Profit:

a. Tax,

b. Transfers to Reserves,

c. Payment of Dividend, etc.

The amounts of the above items shall be subtracted from the Costing Profit or shall be added to Financial Accounting Profit while reconciling.

2. Inclusion of Few Items only in Cost Accounts:

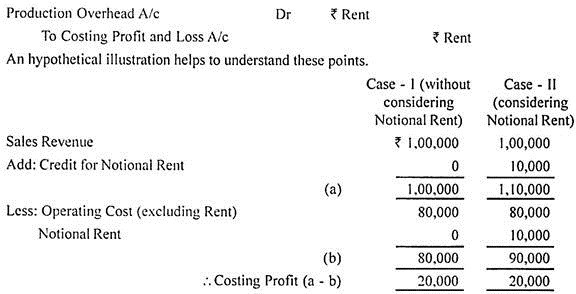

Inclusion of Few Items only in Cost Accounts but not in Financial Accounts is another reason for the difference in the reported profit figures. But this is not true. Because, these items which are very few are of the nature of Notional Charges. The items are interest on owned capital, rent on owned building, etc. These items do not affect the Costing Profit (even if they are considered while computing costs) as they are of the nature of transfer entries.

For example, if (notional) rent on owned building is considered in Cost Accounts, it is only for ascertaining cost but not profit.

Because, soon after the consideration of rent on owned building for cost ascertainment, a corresponding credit is given to the Costing Profit and Loss Account as below:

Therefore, these notional items do not require any adjustment in the reconciliation process as they do not either increase or decrease Costing Profit. But care should be taken to find out whether the above corresponding credit entry is passed or not. If it is not passed, then the amount of notional charges shall be added to Costing Profit or it shall be subtracted from Financial Accounting Profit.

3. Diverse Accounting Treatments:

Diverse Accounting Treatments of some of the items in Cost Accounts and Financial Accounts is another important reason for the difference in the reported profit figures.

A few such items are analysed below:

i. Adoption of different bases for valuation of raw materials, work-in progress and finished goods for Cost Accounts and for Financial Accounts results in different amounts of profit. For instance, inventories should be valued for Financial Accounting purposes in accordance with the Generally Accepted Accounting Principles (GAAPs). But for Cost Accounts, any of the issue and valuation rates (such as FIFO, LIFO, etc.,) may be used. Hence, the difference in the value of inventories. This results in the difference in the reported profit figures.

ii. Use of one depreciation method for Cost Accounts and another method for Financial Accounts also results in the difference in the reported profit figures.

iii. Recovery of, and over- or under-absorbed, overhead expense is another reason. Because, in Financial Accounts, actual overhead expenses are charged. But in Cost Accounts, normally, overhead expenses are recovered at the pre-determined rate. Hence, the overheads absorbed is normally different from overhead expenses incurred.

This results in over- or under-absorption of overhead expenses. If these over- or under-absorbed overhead expenses were not transferred to Costing Profit and Loss Account while computing Costing Profit, it results in the difference in the profits.

Like this, a number of factors are responsible for the difference in the profit figures reported by Cost Accounts and Financial Accounts. Hence, these factors should be properly considered while reconciling the profit figures.

Methods and Procedure of Reconciliation:

Once the reasons for the difference in profits are identified, then it is very easy to reconcile the Cost and Financial Accounts or to prepare the Reconciliation Statement. The important steps in the process of reconciliation are three.

They are:

1. Ascertainment of profit as per Financial Accounting (by preparing Profit and Loss Account in the Financial Books)

2. Ascertainment of Profit as per Cost Accounting (by preparing Income Statement or Costing Profit and Loss Account in the Cost Books), and

3. Reconciliation of both the profits (by preparing a Reconciliation Statement which explains the difference in profits between the two sets of book).

There are two methods to reconcile the Cost and Financial Accounts.

They are:

1. Reconciliation Statement, and

2. Memorandum Reconciliation Accounts.

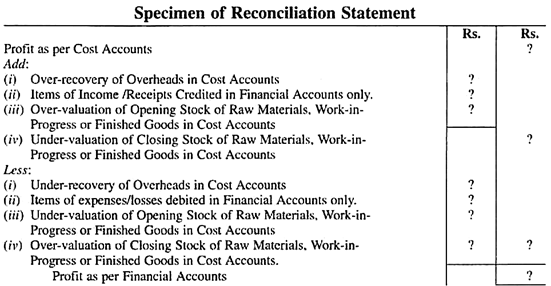

1. Reconciliation Statement:

Under the first method, a Reconciliation Statement is prepared by following the following procedure:

i. Decide about the Starting Item – Whether the Statement shall be commenced with profit as per Cost Accounting or Financial Accounting. Because, the nature of adjustments in the form of deductions and/or additions depends upon this point. For the purpose of explaining the type of adjustments, it is assumed that the Statement is started with ‘Profit as per Cost Accounts’.

ii. Add –

i. Items of Income and Gains under-recorded or not recorded in Cost Accounts.

ii. Items of Expenses and Losses over-charged in Cost Accounts

iii. Amount of Over-valuation of Opening Stocks in Cost Accounts

iv. Amount of Under-valuation of Closing Stocks in Cost Accounts.

iii. Less –

i. Items of Expenses and Losses under-charged in Cost Accounts

ii. Items of Incomes and Gains over-recorded in Cost Accounts

iii. Amount of Under-valuation of Opening Stocks in Cost Accounts

iv. Amount of Over-valuation of Closing Stocks in Cost Accounts.

iv. The resulting Profit (i.e., 1.1 + 1.2 – 1.3) represents the amount of profit as per Financial Accounts. If the Reconciliation Statement is started with the ‘Profit as per Financial Accounts’, the above adjustments (1.2 and 1.3) are to be reversed. The resulting profit (i.e., 1.1 -1.2 + 1.3) is the amount of profit as per Cost Accounts.

2. Memorandum Reconciliation Accounts:

This is the second method of reconciliation which is done in the form of an Account. As this Account is only a memorandum account, it does form a part of the Double-Entry System. The amount of profit as per Cost Accounts which is the starting point appears on the credit side of the Account and on the same credit side; all the items which shall be added to Costing Profit appear. All the items which shall deduct from the Costing Profit appear on the debit side of the Account.

The balancing figure denotes the amount of profit as per Financial Accounts. If the amount of profit as per Financial Accounting is used as the base, it appears on the debit side of the Memorandum Account. Items of additions and deductions do not change. The balancing amount represents the profit as per Cost Accounting.

A specimen form of the Account is presented below:

Problems pertaining to reconciliation may be categorized into five broad categories as presented below:

1. Problems requiring the computation of profit under both Cost and Financial Accounts before they are reconciled.

2. Problems which require the computation of profit under one method and reconciling it with the given profit as per another Accounting.

3. Problems which furnish the profit as per one set of accounts and require the computation of profit as per another set through reconciliation.

4. Problems which furnish the profit figures under both the systems and require only reconciliation of these.

5. Preparation of Memorandum Reconciliation Account.

Reconciliation of Cost and Financial Accounts: Need for Reconciliation, Preparation of Reconciliation Statement and Memorandum Reconciliation Account

Need for Reconciliation:

The word ‘Reconcile’ means to tally, conciliate, harmonize, bring together or equate.

The term reconciliation applies to the reconciliation of the results of the business profit or loss as shown by the financial accounting records and the cost accounting records.

In a concern where both financial and cost accounting systems are separately maintained, the profit or loss for a certain year is shown by each of them. Ideally both the systems must show the same amount of profit or loss, but in a practical situation, the amounts of profit according to these systems generally differ. This however does not mean that these systems are faulty, both the systems are fool-proof.

It is for this reason that the profit or loss according to these two systems has to be reconciled. Reconciliation is equating one with the other.

Reconciliation is necessary for the following reasons:

1. To identify the reasons that causes difference between the profits and to ensure that there are no mistakes.

2. To ensure accuracy of arithmetic and the following of the principles of both the systems.

3. To enlighten the management about the reasons which cause a difference between the profits.

4. To bring about a better co-ordination and understanding between Cost and Finance Accounts wings of the organization.

5. To standardize certain procedures followed in these systems such as stock valuation methods of depreciation, treatment of overheads, valuation of assets etc.

Reasons for Differences in Profit or Loss Shown by Cost Accounts and Profit or Loss Shown by Financial Accounts:

Items such as opening stock, purchases, expenses – both direct and indirect, sales, other incomes etc., that take place in a business organization are the same whether they are applied under Cost Accounts and Financial Accounts. Therefore the profit or loss as shown by them also must be the same.

If these amounts are different from each other, the following are the reasons:

1. Items Considered Only in Financial Accounts:

Some items of incomes and expenses are considered in Financial Accounts only, on account of the nature of these items. These items never find a place in Cost Accounts. If such items are expenses, the profit as per Financial Accounts alone gets reduced and in case of such items being incomes, the profit as per Financial Accounts also gets increased.

The following are such items:

(i) Purely financial expenses, loss on sale of fixed assets, investments, discount and underwriting commission on the issue of shares and debentures, interest on borrowings, debentures, penalties and fines, damages paid, donations and charities, share transfer fee paid.

(ii) Appropriation of profit, income tax, dividends paid, transfer to reserves, provision for bad debts.

(iii) Amortization of fictitious and intangible assets, goodwill, patents, copyrights, discount and underwriting commission on the issue of shares and debentures, preliminary expenses, formation expenses, advertisement expense etc.

(iv) Incomes of a purely financial nature, rent, interest, dividend, transfer fees received, profit on sale of fixed assets, brokerage, commission etc.

2. Items Considered Only in Cost Accounts:

Some items of incomes and expenses are considered in Cost Accounts only, on account of the nature of these items. These items never find a place in Financial Accounts. If such items are expenses, the profit as per Cost Accounts alone gets reduced and in case of such items being incomes, the profit as-per Cost Accounts alone gets increased.

The following are such items-

Notional expenses- Interest on own capital, rent of owned premises, salary of the proprietor, excess depreciation etc.

3. Absorption of Overheads:

Absorption of overheads means inclusion of these overheads in the calculation of total cost of production. Overhead expenses in Financial Accounts are included/absorbed based on their actual amounts but in Cost Accounts, overhead expenses are included/absorbed at pre-determined rates.

(i) Factory overheads actually paid and considered in Financial Accounts could be Rs.10, 000/- and the same is absorbed in Cost Accounts as 10% of direct wages. If the direct wages paid are Rs.1, 20,000/-, the factory overheads @10% amounts to Rs.12, 000/-. Thus, this expenditure is taken at Rs.2, 000/- excess in Cost Accounts. As a result of this, the profit shown by Cost Accounts would be Rs.2, 000/- lesser than that as shown by Financial Accounts.

(ii) Factory overheads actually paid and considered in Financial Accounts could be Rs.10, 000/- and the same is absorbed in Cost Accounts as 10% of direct wages. If the direct wages paid are Rs.90, 000/-, the factory overheads @10% amounts to Rs.9, 000/-. Thus, this expenditure is taken at Rs.1, 000/- less in Cost Accounts. As a result of this, the profit shown by Cost Accounts would be Rs.1, 000/- greater than that as shown by Financial Accounts.

4. Valuation of Stock:

The stock of materials under Financial Accounts is valued at the lesser of their cost price or market price. In Cost Accounts however, the value of stock depends on the method adopted for pricing material issues such as FIFO, LIFO, Average etc. Therefore the stock according to Cost Accounts is invariably different from that of Financial Accounts.

Higher the value of closing stock, higher the profit and vice versa in case of opening stock. This renders the profits according to Cost Accounts and Financial Accounts different.

5. Unusual Profits and Losses:

Several unusual/abnormal gains and losses such as excess wastage, abnormal idle time etc., are taken directly to the Costing Profit and Loss Account under Cost Accounts. This makes the profits as per Cost Accounts and Financial Accounts to differ.

6. Depreciation:

Depreciation under Financial Accounts is charged according to one of the methods such as straight line method, diminishing balance method etc. at a predetermined rate. Depreciation under Cost Accounts is charged based on actual usage of the assets according to machine hours, production hours etc. As a result of this the amounts of depreciation under these two systems of Accounts will never be the same. This makes these two profits different.

Reconciliation of these two profits becomes necessary even when the Financial Accounts and Cost Accounts are independently maintained in computers. This is because; the above mentioned reasons will still operate and cause a difference between the two profits.

The difference between the profits and preparation of the reconciliation statement itself can be avoided by preparing ‘integrated accounts’. Both the – Cost Accounting as well as Financial Accounting transactions are maintained in a single self-contained ledger called the Integrated Ledger under this system.

Preparation of Reconciliation Statement and Memorandum Reconciliation Account:

Reconciliation Statement:

This statement is prepared to reconcile the profits shown as per Cost Accounts and Financial Accounts. This statement is similar to the bank reconciliation statement.

Therefore, in a reconciliation statement to reconcile Costing and Financial Accounting profits, one of the profits (or loss) is taken first as the base. Of the reasons causing a difference, a few reasons’ amounts are added and a few such amounts are deducted to arrive at the other profit (or loss).

Once a profit (or loss) is taken as a base, each reason has to be analyzed in the context of profit (or loss) taken as the base. The amounts of all the reasons which have reduced the base profit/loss taken first have to be added back. The Amounts of all the reasons which have increased the base profit (or loss) which has been taken first, have to be subtracted from the base profit (or loss) taken first. The final answer will be the profit (or loss) as per the other system of books.

Specimen of a reconciliation statement:

In case of ‘Loss’, the amount shall appear as a minus item.

In case the reconciliation statement is started with profit as per financial accounts, the above order gets reversed.

Memorandum Reconciliation Account:

Reconciliation of the profits of Cost Accounts and Financial Accounts can be done by preparing a Reconciliation Account also.

This account structurally is similar to a ledger account prepared under financial accounts, except for the date columns on both sides.

The base profit (according to either Cost Accounting or Financial Accounting) is taken as the first item on the credit side. All the amounts to be added to the base profit are credited and all the amounts to be deducted from the base profit are debited to the account. The balancing figure (closing credit balance) is the profit as per the other set of books.

This account is prepared only to reconcile the profit as per Cost Accounting and Financial Accounting and as such is not a part of the financial accounting cycle. Therefore it is called a memorandum account.

Specimen of Memorandum Reconciliation Account:

Reconciliation of Cost and Financial Accounts – Reasons for Difference, Steps and Methods of Preparation

When accounts are maintained under non-integrated (interlocking) system, two profit figures will be there – one in the cost ledger and another in the financial ledger. While differences (other than errors) arise between financial accounts profit and cost accounts profit, the ‘Cost Ledger Control Account’ (in the cost ledger) and ‘Financial Ledger Control Account’ (in the financial ledger) will not ‘interlock’ (i.e., will not be equal and opposite).

The differences between cost accounts profit and financial accounts profit may arise, where items are appearing only in one set of books (i.e., either in the financial accounts or in the cost accounts). As there will be two different profit figures, periodic reconciliation will be required. Reconciliation can be done either in Statement form or in Memorandum Account form.

Reasons for Difference in Profit:

There are three reasons, in general, for the differences in profit:

1. Items shown only in the financial accounts.

2. Items shown only in the cost accounts.

3. Same Items Treated Differently in the Financial Accounts and the Cost Accounts.

1. Items Shown Only in the Financial Accounts:

There are many items which appear in the financial accounts but not in the cost accounts. These items may be related to expenses or incomes. All the items of expense will reduce the profit of the financial accounts and similarly, all the items of income will increase the profit of the financial accounts.

The major items are as follows:

The following items will fall under this category:

(a) Loss on sale of fixed assets;

(b) Loss on exchange of fixed assets;

(c) Loss on sale of investments;

(d) Loss on exchange difference (foreign currency);

(e) Amortisation of fictitious assets (e.g., writing-off of preliminary expenses, discount on issue of shares or debentures, etc.);

(f) Amortisation of intangible assets (e.g., writing-off of goodwill, copyrights, licence fees, etc.);

(g) Fines and penalties.

(h) Interest on bank loans and mortgages.

(ii) Purely Financial Incomes:

The following items will fall under this category:

(a) Profit on sale of fixed assets;

(b) Profit on exchange of fixed assets;

(c) Profit on sale of investments;

(d) Profit of exchange difference (foreign currency);

(e) Income from investment;

(f) Dividend received from subsidiaries;

(g) Government subsidies;

(h) Share transfer fees;

(i) Rent received from let-out property.

The following items will fall under this category:

(a) Loss of stock / assets by fire, flood etc (uninsured);

(b) Loss due to theft;

(c) Windfall gain (e.g., government incentive for less emission of carbon).

There are many items which are debited to financial accounts at the time of calculating profit.

These are:

(a) Income tax;

(b) Proposed dividends;

(c) Transfer to reserves;

(d) Donations and charities.

2. Items Shown Only in the Cost Accounts:

There are very few items which appear in the cost accounts but not in the financial accounts. These items are notional in nature (i.e., they do not involve payment in cash or kind). An organisation may choose to record it in the cost accounts to reflect ‘Loss of benefit’.

Common items are:

(i) Notional rent; and

(ii) Interest on capital.

Notional rent and interest on capital are sometimes charged to factory overhead to ensure that management take into consideration those expenses which might normally be expected to be included at the time of arriving at the cost of product/service. For example, where the factory is owned by the company, no rent is payable.

Because of this, the factory overhead will be lower than if rent was payable. The cost of product will lower and the benefit may be transferred to the customer by way of lower price. Many argue that notional rent should be included in the cost of production as it is a factor of production.

There are two methods of recording notional rent in cost books:

Factory Overheads Control Account … Dr.

To Notional Rent Provision A/c

The Notional Rent Provision Account will be carried forward as a reserve account in the cost ledger. As there will be no corresponding entry in the Financial Accounts (as there is no outflow of cash), notional rent will be an item of reconciliation.

(a) Factory Overheads Control Account … Dr.

To Notional Rent Account

(b) Notional Rent A/c … Dr.

To Costing Profit and Loss Account

In this case also there will be no corresponding entry in Financial Accounts.

Here, it should be observed that notional rent will not become an item of reconciliation because the credit to Costing Profit and Loss Account cancels out the effect of debit entry in Factory Overheads Control Account.

3. Same Items Treated Differently in the Financial Accounts and the Cost Accounts:

There are many items which are treated differently in the cost accounts and financial accounts.

Some of these important items are:

(i) Stock valuation

(ii) Depreciation

(iii) Absorption of overheads

Inventory (raw materials, WIP and finished goods) may be valued differently in the financial accounts and in the cost accounts. For example, in the financial accounts inventories are to be valued as per AS-2 where, only FIFO and Weighted Average methods are allowed, however, in the cost account, the management may follow LIFO method for valuation of inventories. Therefore, a difference in profits will arise because of using different methods of valuation.

Depreciation method adapted in the financial accounts may not be same as in the cost accounts. For example – In the financial accounts depreciation could be charged on ‘straight line’ basis but in the cost accounts it is charged on a ‘unit of production’ basis. This will produce different profit figures in financial accounts and cost accounts.

(iii) Absorption of Overheads:

In the financial accounts actual overhead expenses are debited to Profit and Loss Account. However, in the cost accounts overheads are recovered at a pre-determined rate. Overhead incurred and absorbed may be different. This will cause a difference in reported profits (when under / over absorbed overhead is transferred to next period).

Preparation of Profit Reconciliation Statement:

Profit Reconciliation Statement is a statement which contains a complete and satisfactory explanation of the differences in profit as per cost accounts and financial accounts. It is just a procedure to prove the profit of other books (cost / financial). It is not a part of the double entry system.

Generally, reconciliation of profit is made in statement format. However, some organisations do it through preparation of Memorandum Profit / Loss Account. In the examination, generally, items of reconciliation are given along with the profit as per Cost Accounts or Financial Accounts. In some cases, profit as per both the accounts are given.

We will discuss the procedures for reconciliation of profit under two headings:

(1) When profit / loss as per cost accounts is given; and

(2) When profit / loss as per financial accounts is given.

(1) When Profit as per Cost Accounts is Given:

If we start reconciliation statement with profit as per Cost Accounts, we are to ascertain the impact of each item (causing a difference) on the profit of financial accounts. In other words, we will have to see whether a particular item increases or decreases the profit as per financial accounts. Now, add those items which increase the profit of financial accounts as compared to the profit of cost accounts. For example, ‘Purely Financial Incomes’ like –

(i) Profit on sale of investments;

(ii) Profit on sale / exchange of fixed assets;

(iii) Government subsidies;

(iv) Share transfer fees;

(v) Dividend received from subsidiaries;

(vi) Income from investments; and so on

Also add over-absorption of overheads, over-valuation of opening stock as per cost accounts, under valuation of closing stock as per cost accounts.

Deduct those items which decrease the profit of financial accounts. For example – Purely Financial Expenses, like –

(i) Loss on sale of fixed assets;

(ii) Loss of sale of investments;

(iii) Goodwill, preliminary expenses written-off;

(iv) Fines and penalties;

(v) Interest on bank loans and mortgage;

(vi) Loss on exchange difference of foreign currency;

(vii) Bad debts written-off.

Also deduct, under-absorption of overheads, under valuation of opening stock as per cost accounts, over valuation of closing stock as per cost accounts, etc.

(2) When Profit as per Financial Accounts is Given:

If we start reconciliation statement with profit as per Financial Accounts, we are to ascertain the impact of each item (causing a difference) on the profit of cost accounts. In other words, we will have to see whether a particular item increases or decreases the profit as per cost accounts.

Now, add those items which increase the profit of cost accounts as compared to financial accounts. For example, ‘Purely Financial Expenses’ which have been debited to Financial Profit / Loss Account.

Also add under-absorption of overheads, under-valuation of opening stock as per cost accounts, overvaluation of closing stock as per cost accounts, etc.

Deduct those items which increase the profit of financial accounts as compared to cost accounts. For example, Purely Financial Incomes which have already been credited to financial accounts.

Also deduct over-absorption of overheads, over-valuation of opening stock as per cost accounts, undervaluation of closing stock as per cost accounts.

Preparation of Memorandum Reconciliation Account:

The reconciliation of profit can be done either in Statement format or in Memorandum Account format. Here we will discuss the preparation of Memorandum Reconciliation Account.

The concept is same in both cases, but in Memorandum Reconciliation Account, presentation will be in ‘T’ Account form. However, this account is not a part of the double entry system.

Generally, the following steps are followed for preparation of the Memorandum Reconciliation Account:

Step 1 – Draw a Memorandum Account in a sheet of paper.

Step 2 – Write down profit as per cost accounts on the credit side of the Memorandum Account.

Step 3 – Debit the following items –

(i) Purely Financial Expenses

(ii) Under-absorption of overheads as per cost accounts

(iii) Under-valuation of opening stock as per cost accounts

(iv) Over-valuation of closing stock as per cost accounts

Step 4 – Find out the balance of the Memorandum Reconciliation Account. If it is a debit balance, it represents profit as per Financial Accounts. If it is a credit balance, it represents loss as per Financial Accounts.

Reconciliation of Cost and Financial Accounts – Meaning, Need, Reconciliation of Costing and Financial Results, Memorandum Reconciliation Account

In a business concern, cost accounts and financial accounts can be maintained on the basis of non-integral system or integral system of accounting. Under non-integral system of accounting, cost accounts and financial accounts are maintained separately. Cost accounts are maintained by Cost Accountant as per the principles of cost accounting to ascertain the total and per unit cost of products and jobs at different stages of production or execution.

Financial accounts are maintained by financial accountant as per the principles of financial accounting to record the day-to-day transactions of a business with a view to find out their net effect on the profitability and financial position of the business.

Thus, the aims, objects, principles and the methods of maintaining cost accounts and financial accounts are not the same. As such, the profit shown by cost accounts may not agree with the profit shown by financial accounts. The conflicting information provided by these two sets of accounts may not be helpful in taking correct policy decisions.

Thus, the system of costing should be capable of reconciliation with financial accounts. Since the cost accounts, largely dependent upon estimates, comprise a detailed analysis of financial expenditure and unless such analysis is reconciled with financial accounts, cost accounts cannot be relied upon. In this connection, H.J. Wheldon is of the opinion that “no system is complete unless it is linked up with financial accounts so that the results shown by both cost and financial accounts may be reconciled.”

Meaning of Reconciliation:

Reconciliation may be expressed as the process of tallying the working results or profits as shown by cost accounts with that of financial accounts. According to Eric L. Kohler — “Reconciliation is the determination of the items necessary to bring the balances of two or more related accounts or statements into agreement. Efforts are also made to judge the arithmetical accuracy of the profits revealed by two different sets of books.”

Thus, reconciliation of cost accounts and financial accounts involves the process of identifying and accounting for the items which have led to the difference in working results as shown by cost accounts and financial accounts. The reconciliation is made in an analytical form presented in the shape of a statement (known as Reconciliation Statement) or a memorandum account (known as Memorandum Reconciliation Account).

Need for Reconciliation:

The necessity for reconciliation of cost accounts and financial accounts arises due to the following reasons:

(i) Reconciliation assists in ascertaining the accuracy and reliability of the various sets of books of account maintained in a business concern.

(ii) It facilitates internal control since it discloses the reasons for the variation in profit or loss in an analytical manner.

(iii) It assists in effecting co-operation and co-ordination between costing office and accounting office,

(iv) It helps in formulating proper policies regarding overhead absorption, depreciation and stock valuation.

Causes of Disagreement of Results Shown by Cost Accounts and Financial Accounts:

Under the non-integral system of accounting, when cost accounts and financial accounts are maintained separately, the documents used for ascertaining the amount of expenditure to be charged in respect of some of the items, are the same (e.g., cost of materials used and the cost of labour paid are to be ascertained with the help of Material Requisitions and Wages Sheets respectively), yet there may arise a difference in the profit (or loss) as shown by the two sets of accounts, due to one or more of the following reasons –

1. Under/Over-Absorption of Overhead:

The financial accounts comprise the actual expenditure in respect of the factory, office, administration, and selling and distribution overheads whereas the cost accounts comprise an approximate charge in respect of these items on the basis of past records or pre-determined absorption rate. As such, overheads are generally under/ over-absorbed in cost accounts.

2. Items of Receipts/Income Shown in Financial Accounts Only:

The following items of receipts and income are shown or included in financial accounts but excluded from cost accounts –

(a) Interest and discount received.

(b) Rent received.

(c) Dividend received.

(d) Commission received.

(e) Transfer fees received.

(f) Profit from the sale of fixed assets and investments.

3. Items of Expenses/Losses Shown in Financial Accounts Only:

The following items of expenses and losses are charged in financial accounts but are not shown in cost accounts –

(a) Interest allowed on loan.

(b) Interest on capital.

(c) Cash discount allowed.

(d) Interest paid on debentures.

(e) Expenses and losses on issue of shares and debentures.

(f) Loss on sale of fixed assets and investments.

(g) Items of appropriation of profit i.e., income tax paid or provision for income tax, transfer to reserves, dividends paid on shares etc.

(h) Preliminary expenses written off.

(i) Goodwill written off.

(j) Donations and charity paid.

4. Items of Abnormal Profit/Loss Included in Financial Accounts Only:

There are various items of abnormal profit/loss which are included in financial accounts but are excluded from cost accounts.

These items are:

(a) Cost of abnormal loss of materials.

(b) Cost of abnormal idle time of workers.

(c) Cost of abnormal saving of materials.

(d) Exceptional bad debts.

(e) Penalties and fines paid for violation of Government rules and regulations.

5. Items of Expenses Included in Cost Accounts Only:

The following items of expenses are recorded in cost accounts only and are not considered in financial accounts –

(a) Notional rent for owned premises.

(b) Depreciation on assets which do not carry any book value in financial accounts.

6. Difference in the Basis for Charging Depreciation on Assets:

The methods for calculating depreciation on fixed assets in cost accounts and financial accounts may differ leading to a difference in working results. In financial accounts, depreciation is generally provided on the basis of diminishing balance (written-down value) method or original cost method. But in cost accounts, machine hour rate or production unit method of depreciation may be followed.

7. Difference in Bases for Valuation of Stock:

The stock of raw material in financial accounts is valued at cost price or market price, whichever is less, while in cost accounts, it is valued by adopting any of the methods like FIFO, LIFO, AVERAGE price methods etc. The stock of work-in- progress for the purpose of cost accounts may be valued on the basis of prime cost or factory cost while in financial accounts, it is valued by taking into account, a part of office and administration expenses.

The stock of finished goods in financial accounts is valued on the basis of cost price or market price, whichever is less, while in cost accounts, it is valued on the basis of actual cost.

Reconciliation of Costing and Financial Results:

Where there is a difference between the results of working as disclosed by cost accounts and as disclosed by financial accounts, the following steps should be taken to locate the reasons for such difference –

1. The extent of the difference between actual indirect expenses as recorded in financial accounts and the charges made in cost accounts should be ascertained.

2. A schedule of all expenses and losses which have been included in the Trading and Profit and Loss Account but not in cost accounts should be prepared.

3. A schedule of all income and profit which have been credited to Profit and Loss Account but excluded from cost accounts should be prepared.

4. A schedule of all items which have been included in cost accounts but excluded from financial accounts should be prepared.

5. The basis on which stocks of raw materials, work-in-progress and finished goods have been valued for balance sheet purposes must be ascertained and compared with the valuations appearing in cost accounts and their difference must be ascertained.

6. Lastly, all items which have been included in cost accounts as well as financial accounts but differ in value should be ascertained.

After the discrepancies have been located, a Reconciliation Statement should be prepared by starting with profit as disclosed by cost accounts.

The following items should then be added to the profit as per cost accounts:

(i) Indirect expenses (factory, office and administration and selling and distribution) over-absorbed or over-recovered in cost accounts or under- absorbed in financial accounts.

(ii) Items of receipts shown in the financial books but not in cost accounts.

(iii) Over-valuation of opening stock (of raw material, work-in-progress or finished goods) in cost accounts.

(iv) Under-valuation of closing stock (of raw material, work-in-progress or finished goods) in cost accounts.

(v) Items of abnormal efficiency (abnormal saving) shown in financial books but not in cost accounts.

The following items should be deducted from profit as per cost accounts:

(i) Under-absorption of indirect expenses in cost accounts or over-absorption in financial accounts,

(ii) Items of expenses shown in the financial accounts but not in cost accounts.

(iii) Under-valuation of opening stock (of raw material, work-in-progress or finished goods) in cost accounts,

(iv) Over-valuation of closing stock in cost accounts.

After making the above adjustments, the profit as per cost accounts will agree with the profit as per financial accounts.

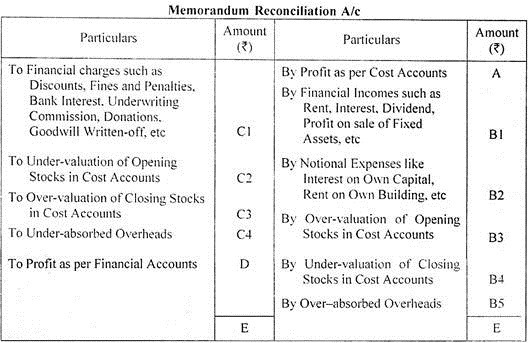

Memorandum Reconciliation Account:

Reconciliation of Cost Accounts and Financial Accounts may also be presented in the form of an account prepared on memorandum basis. Such an account is known as “Memorandum Reconciliation Account”. The amount of profit as per cost accounts is shown on the credit side of this account.

The various items to be added to the profit as per cost accounts, are credited to the Memorandum Reconciliation Account and the items to be deducted from profit as per cost accounts, are debited to it. The difference between the two sides of the account will reveal the amount of profit or loss as per financial accounts. The specimen of a Memorandum Reconciliation Account may be given as follows –