Among the many methods that have been adopted to apply overhead to production, the most common ones have been dealt below:- 1. Percentage of Direct Labour Cost. 2. Percentage of Direct Material Cost. 3. Prime Cost Percentage Rate. 4. Labour Hour Rate. 5. Machine Hour Rate. 6. Production Unit Method.

Method # 1. Percentage of Direct Labour Cost:

This method makes use of the cost of direct labour charged to a particular product as a basis for setting the overhead rate for the product.

% of direct labour cost=% of overhead (on cost)

= Factory overhead for budget period/Direct labour cost for budget period x 100… (1)

ADVERTISEMENTS:

Advantages:

The method is economical and easy to apply. It reaches its highest degree of efficiency when there is uniformity in wage rates, skills of workers, equipment used, and work performed. The method is employed with advantage when standard costing is used. The method proves to be very useful where the products are manufactured using manual operations.

Disadvantages:

(a) The method ignores variations in equipment used in different production operations. A highly skilled filing operation requiring only hand tools might involve a heavier overhead than a hydraulic forging process, an operation requiring expensive and large equipment.

ADVERTISEMENTS:

(b) The method is inequitable because it applies a greater amount of overhead to jobs performed by workers receiving high wages.

Example 1:

A fabrication concern, for the year 1975-1976 had factory overheads of Rs. 4,000, and the direct labour cost of Rs. 12,000. Find the percentage overhead using percentage of direct labour cost method.

(b) If production order ‘Z’ had a direct labour cost of Rs. 60, find the overhead cost for the production order.

ADVERTISEMENTS:

Solution:

(a) Using equation (1)

% overhead = 4,000/12,000 x 100 = 33 ½ %

(b) Overhead cost for production order ‘Z’

ADVERTISEMENTS:

= 60 x 33⅓/100 = Rs. 20

Method # 2. Percentage of Direct Material Cost:

This method charges an overhead rate commensurate with either the weight or the cost of direct material going into the product.

The method is useful where:

(i) The material and method of manufacture are common to all products,

ADVERTISEMENTS:

(ii) The expenses on direct material constitute the main factor determining total cost (e.g. foundries).

Percentage of direct material cost = % overhead

= Factory overhead for budget period/Direct material cost for budget period x 100…(2)

The method finds applications in the manufacture of cement, paint, sugar, etc. The method does not prove to be accurate when applied where different types of materials, (having wide variation in their prices) go into a product, e.g., manufacture of industrial instruments using gold and platinum along with steel or aluminium. An instrument not having gold or platinum parts will obviously fare better than the other (having them) on the question of incurring overhead costs.

ADVERTISEMENTS:

Example 2:

(a) A sugar mill had its overheads of Rs. 60,000 while it purchased sugarcane worth Rs. 2,40,000. Find the percentage overhead using the percentage of direct material cost method.

(b) If a particular batch had a direct material cost of Rs. 30,000, determine it overheads.

Solution:

ADVERTISEMENTS:

(a) Using equation (2) above

% overhead = 60,000/2,40,000 x 100

= 25% of direct material cost

(b) Overheads = 25/100 x 30,000 = Rs. 7,500.

Method # 3. Prime Cost Percentage Rate:

Prime cost is sum of the direct labour cost and direct material cost. Thus, this method is similar to methods (1) and (2) explained earlier, except that the overhead instead being based on a percentage of either direct material or direct labour, relies upon the two taken together.

Therefore, this method proves to be very useful where both material and labour costs are prominent factors in determining total cost, e.g. in fabrication shops. This method does not account for the differing rates of material and labour and different equipment sizes and capacities used in manufacturing various products.

ADVERTISEMENTS:

Prime cost percentage rate = % overhead

Factory overhead for budget period / Prime cost for budget period x 100 …..(3)

Prime cost method has same disadvantages as possessed by direct material cost and direct labour cost methods.

Example 3:

(a) A fabrication and assembly shop had its total overheads of Rs. 10,000. It used direct material worth Rs. 10,000 and paid Rs. 15,000 as direct labour charges. Calculate the % overhead.

(b) If one product has its prime cost as Rs. 5,000 determines overheads or on cost related to it.

ADVERTISEMENTS:

Solution:

(a) Using equation (3) above

% overhead = 10,000/10,000 + 15,000 x 100 = 40% of prime cost.

(b) overhead (i.e., on cost) = 40/100 x 5,000 = Rs. 2,000.

Method # 4. Labour Hour Rate:

Variations in pay that cause confusion in the direct labour cost basis method are eliminated in the labour hour rate method. In this method, labour hours instead of direct labour cost form the basis for finding percentage overhead. It is more accurate than direct labour cost method.

The direct labour hour rate is calculated as follows:

ADVERTISEMENTS:

The rate per hour of direct labour

= Factory overhead for budget period/Direct labour hours for budget period ….(4)

This method is useful where hand-labour methods exist and where uniformity of rates, workers and conditions is present. Since the majority of factory overhead costs accrue on the basis of time, this method provides the most equitable means of apportioning factory overhead to production.

However, labour hour rate method:

(i) Does not recognize variations in type and size of equipment;

(ii) Necessitates for additional clerical records to be maintained; and

ADVERTISEMENTS:

(iii) Proves to be inaccurate if the factory produces various products involving both manual and machine operations.

Example 4:

(a) A fitting and assembly shop had its factory overheads of Rs. 1,20,000 and the production for the period in terms of direct labour was 24,000 hours. Find the rate per direct labour hour.

(b) If a particular job takes 20 labour hours, calculate the overhead applied.

Solution:

(a) Using equation (4) above,

ADVERTISEMENTS:

Rate per hour of direct labour = 1,20,000/24,000 = Rs.5

(b) Overhead = Rs. 20 x 5 = Rs. 100.

Method # 5. Machine Hour Rate:

In this method, factory overhead costs are applied to production orders on the basis of the number of machine hours required to complete the production,

Machine hour rate

= Factory overhead for budget period / Machine hours for budget period…(5)

This is an accurate and very relevant method because in modern age of mechanisation and automation, the factory overhead resulting from the use of machinery are far in excess of costs from other sources. This method is based upon a study of the actual overhead expenses of the machines used. Factors such as capital investment, depreciation, insurance, repair and maintenance, floor space, power and lighting costs are calculated.

All these (factors) are added together and then divided by the machine hours to give machine rate per hour. Products made on the machine are then charged at this hourly rate on the basis of machining time involved. This method is very useful in concerns where machines constitute a more important and costly element than manual labour.

However, machine hour rate method is not well adapted for industries which desire a single overhead rate for the entire plant and involve a variety of types of hand, bench and machine operations, performed by different grades of workers. Rather, this method is most satisfactorily employed when plants are departmentalized and a rate for each department and in some cases for each machine is required.

Examples 5:

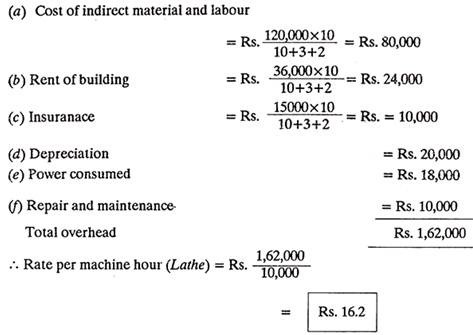

A machine shop has 10 lathes, 6 drill presses and 2 milling machines.

Calculate the machine hour rate for lathes if the factory expenses for a particular period and other data are as follows:

1. Area occupied by lathes 10 m2.

2. Area occupied by drill presses 3 m2.

3. Area occupied by milling machines 2 m2

4. Cost of indirect material and labour Rs. 1,20,000.

5. Rent of building Rs. 36,000.

6. Insurance Rs. 15,000.

7. Depreciation Rs. 20,000 for lathes

Rs. 15,000 for drill presses

Rs. 20,000 for milling machines.

8. Power consumed Rs. 18,000 for lathes

Rs. 6,000 for drill presses

Rs. 900 for milling machines.

9. Repair and maintenance Rs. 10,000 for lathes

Rs. 4,000 for drill presses

Rs.4,000 for milling machines.

10. Machine hours 10,000 for lathe

6,000 for drill presses

2,000 for milling machines.

Solution:

Divide cost of indirect material and labour, rent of building and insurance as per the floor area occupied by different machine tools, for example for lathes:

Method # 6. Production Unit Method:

One of the simplest methods of applying factory overhead to production is on the basis of number of production units such as kgs, tons, thousand feet, hundred litres, etc.

Overhead rate per unit

= Factory overhead for budget period / Production in terms of units for budget period….(6)

It is a simple method and easy to use. It is used in those industries or in one or more production departments of big industries, which employ job order cost methods. This method is preferred for industries manufacturing one type of product, i.e., televisions, refrigerators, etc., of one size only. Since, mostly industries make diversified products, it is more desirable to use a common denominator such as direct labour hours rather than units of production as the basis of calculating overhead.

Example 6:

If the estimated overhead costs of a factory making two band transistor radios is Rs. 8,000 in a particular period and if the number of transistor radios produced during that period is 400, calculate the overhead rate per transistor radio.

(b) If a production order ‘Z’ schedules making 100 such radios, determine the factory overhead to be applied to the production order ‘Z’.

Solution:

Using equation (6) above

Overhead rate per transistor radio

= Rs.8000/400 = Rs. 20.

(b) Factory overhead for production order ‘Z’

= Rs. 20 x 100 = Rs. 2000.