Here is a term paper on ‘Futures Contract’. Find paragraphs, long and short term papers on ‘Futures Contract’ especially written for school and college students.

Term Paper on Futures Contract

Term Paper Contents:

- Term Paper on the Meaning of Futures Contract

- Term Paper on the Types of Futures Contract

- Term Paper on the Important Features of Futures Contract

- Term Paper on the Benefits of Futures Contracting

- Term Paper on the Participants in Futures Market

- Term Paper on the Mechanism in Futures Contracts

- Term Paper on the Determination of Futures Price

- Term Paper on the Basis, Contango and Backwardation

- Term Paper on the Simple Pay Off Positions in Futures

- Term Paper on the Closing Out of Futures Contract

Term Paper # 1. Meaning of Futures Contract:

ADVERTISEMENTS:

The futures contract is traded on a futures exchange as a standardized contract, subject to the rules and regulations of the exchange.

The futures contract relates to a given quantity of the underlying asset and only whole contracts can be traded, and trading of fractional contracts are not allowed in futures contracting.

The terms of the futures contracts are not negotiable.

A futures contract is a financial security, issued by an organized exchange to buy or sell a commodity, security or currency at a predetermined future date at a price agreed upon today.

ADVERTISEMENTS:

The agreed upon price is called the ‘futures’ price.

Futures are exchange traded contracts to sell or buy financial instruments or physical commodities for future delivery at an agreed price.

There is an agreement to buy or sell a specified quantity of financial instrument/commodity in a designated future month at a price agreed upon by the buyer and seller.

The contracts have certain standardized specifications.

ADVERTISEMENTS:

A futures contract provides both a right and an obligation to buy or sell a standard amount of a commodity, security or currency on a specified future date at a price agreed when the contract is entered into.

Term Paper # 2. Types of Futures Contract:

Futures contracts may be classified into two categories:

1. Commodity Futures:

ADVERTISEMENTS:

Where the underlying is a commodity or physical asset such as wheat, cotton, butter, eggs etc.

2. Financial Futures:

Where the underlying is a financial asset such as foreign exchange, interest rates, shares, treasury bill or stock index.

Term Paper # 3. Important Features of Futures Contract:

ADVERTISEMENTS:

i. Standardization:

The important feature of futures contract is the standardization of contract. Each futures contract is for a standard specified quantity, grade, coupon rate, maturity etc.

ii. Clearing House:

An organization called ‘futures exchange’ will act as a clearing house. In futures contract, the obligation of the buyer and the seller is not to each other but to the clearing house in fulfilling the contract which ensure the elimination of the default risk on any transaction.

ADVERTISEMENTS:

iii. Margins:

Since the clearing house undertakes the default risk, to protect itself from this risk, the clearing house requires the participants to keep margin money, normally ranging between 5% to 10% of the face value of the contract.

iv. Time Spreads:

There is a relationship between the spot price and the futures price of contract. The relationship also exists between prices of futures contracts which are on the same commodity or instrument but which have different expiry dates. The difference between the prices of two contracts is known as the ‘time spread’.

ADVERTISEMENTS:

ADVERTISEMENTS:

Term Paper # 4. Benefits of Futures Contracting:

i. Hedging:

The classic hedging application would be that of a wheat farmer forward/futures selling his harvest at a known price in order to eliminate price risk. Conversely, a bread factory may want to buy wheat forward/futures in order to assist production planning without the risk of price fluctuations.

ii. Speculation:

If a speculator has information or analysis which forecasts an upturn in a price, then he can go long on the forward/futures market instead of the cash market, wait for the price rise, and then take a reversing transaction. The use of forward/futures market here gives leverage to the speculator.

iii. Price Discovery:

ADVERTISEMENTS:

Price discovery is the use of forward/futures prices to predict spot price that will prevail in the future. These predictions are useful for production decisions involving the various commodities.

Term Paper # 5. Participants in Futures Market:

i. Hedgers:

Hedgers wish to eliminate or reduce the price risk to which they are already exposed. The hedging function solely focuses on the role of transferring the risk of price changes to other holders in the futures markets.

ii. Speculators:

Speculators are those class of investors who willingly take price risks to profit from price changes in the underlying.

ADVERTISEMENTS:

iii. Arbitraguers:

Arbitraguers profit from price differential existing in two markets by simultaneously operating in two different markets.

Term Paper # 6. Mechanism in Futures Contracts:

The selling and buying of futures contracts is a way of describing commitments, a seller of a future can sell without previously having bought.

In the Commodities Futures Market the Following Conventions Apply:

1. Buy a future to agree to take delivery of a commodity. This will protect against a rise in price in the spot market as it produces a gain if spot prices rise. Buying a future is said to be going long.

ADVERTISEMENTS:

2. Sell a future to agree to make delivery of a commodity. This will protect against a fall in price in the spot market as it produces a gain if spot prices fall. Selling a future is said to be going short.

Term Paper # 7. Determination of Futures Price:

The futures price is determined as follows:

Futures price = Spot price + Cost of carrying.

The spot price is the current price of a commodity will be the aggregate of:

(a) Storage costs,

ADVERTISEMENTS:

(b) Insurance charges,

(c) Transport costs, and

(d) Finance charges.

Apart from the theoretical value, the actual value may vary depending on demand and supply of the underlying at present and expectations about the future. In general, the futures price is greater than the spot price.

In special cases, when cost of carry is negative, the futures price may be lower than spot prices.

Term Paper # 8. Basis, Contango and Backwardation:

ADVERTISEMENTS:

Basis:

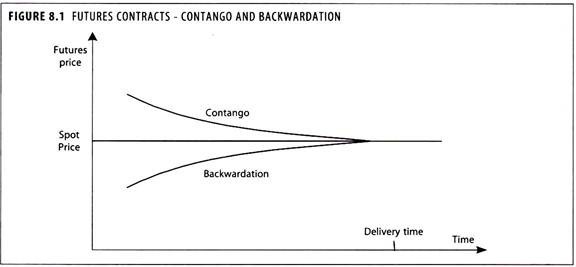

There is a close relationship between spot and futures prices, particularly as the delivery date becomes due. On the delivery date itself, the settlement price is determined by the spot price, but prior to this the future price could be above or below the spot. The difference between spot price and future price is known as ‘basis’.

Basis = Futures price – Spot price

Although the spot price and futures price generally move in line with each other, the basis is not constant. Generally basis will decrease with time. And on expiry, the basis is zero and futures price equals spot price.

Contango:

If the futures price is greater than the spot it is called ‘contango’. Under normal market conditions futures contracts are priced above the spot price. This is known as the ‘contango market’. In this case, the futures price tends to fall over time towards the spot, equalling the spot price on delivery day.

Backwardation:

If the spot price is greater than the futures price it is called ‘backwardation’. Then the futures price tends to rise over time to equal the spot price on the delivery day. These are shown in Figure 8.1.

Term Paper # 9. Simple Pay Off Positions in Futures:

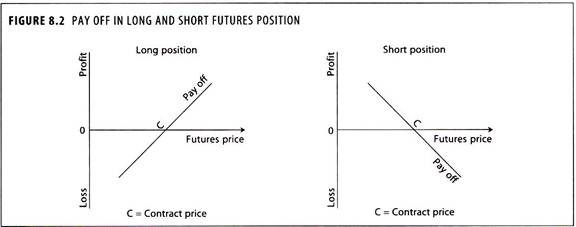

The buyer of a futures contract is said to ‘go long’ the future, whereas the seller is said to ‘go short’. With a long position, the value of the position rises as the asset price rises and falls as the asset price falls. With a short position, a loss ensues if the asset price rises but profits are generated if the asset price falls. The payoffs for buyers and sellers of futures contract are shown in Figure 8.2. The payoffs associated with taking a position in the futures market can be either positive or negative.

i. Buyer’s Payoff:

The buyer of futures contract has an obligation to purchase the underlying instrument at a price when the spot price is above the contract price. The buyer will buy the instrument for the price ‘C’ and can sell the instrument for higher spot price, thus making a profit. When the contract price is above spot price, a loss is made by the buyer of the contract.

ii. Seller’s Payoff:

The seller of the contract makes a profit when the contract price is above the spot price. The seller will purchase the instrument at the spot price and sells at the contract price. The seller makes loss when the spot price is above the contract price.

Illustration 1:

Let us take wheat as an example, assume that the price is Rs.5,000 per ton today, while the price of a ton of wheat to be delivered in three months’ time, is Rs.5,500. The processor who buys grain decides that this is reasonable. He could either buy his physical wheat forward now, or he could hang back from that transaction and buy futures instead. He buys futures at Rs.5,500. Having done so, he can now also commit himself to selling the processed product forward at a known fixed price.

Then assume the harvest fails and wheat prices rise dramatically, to Rs.7,000 per ton. The processor, like everyone else in the market, will have to buy his physical wheat at higher prices. But he is hedged-he has also bought wheat futures at Rs.5,500. Futures markets will now reflect physical market conditions and be trading at, for example, Rs.7,500. Having bought futures at Rs.5,500, he will now sell these at Rs.7,500, ensuring that the higher cost of his physical purchase is offset by gains on his futures contract.

Illustration 2:

Suppose a trader has bagged an order for which he has to supply 2,000 tons of aluminium sheet to the buyer within next two months.

After obtaining the order, the trader is observing a rise of price of aluminium sheet in the open market and, if such a rise continues, the profit margin of the trader may get shrinked, even he may land on a huge loss just because of rise of procurement price of the aluminium sheet. But if the trader under the circumstances purchases aluminium sheet futures, then any loss for the rise of price of aluminium to be bought by the trader for the supply order could be then off-settled against profit on the future contract, and, however, if there is a fall of price, extra profit on fall of price of aluminium sheet can also be offset against cost or loss of future contract. So hedging technique is equivalent of insurance facility against market risk where price is always volatile.

Term Paper # 10. Closing Out of Futures Contract:

A long position in futures, can be closed out by selling futures while a short position in futures can be closed out by buying futures on the exchange.

Once position is closed out, only the net difference needs to be settled in cash, without any delivery of underlying.

Most contracts are not held to expiry but closed out before that. If held until expiry, some are settled for cash and others for physical delivery.