In this article we will discuss about various terms of contract of the project taken up by a company.

Risks in Contract-Contractor Angle:

Risk factor in contracts plagues both the contractor and contractee. In fact a contract is considered as an instrument for the transfer of risk from the contractee to the contractor.

The risks a contractor faces normally for which he seeks protection are as under:

1. Possibility of owner terminating the contract before the work is completed.

ADVERTISEMENTS:

2. Whether payments will be made promptly.

3. Chances of enforced idleness and consequent work holdup.

4. Owner’s willingness to carry minimum obligations.

5. Owner changing the scope of works upsetting schedule and estimates.

ADVERTISEMENTS:

6. Chances of change in work quantities and specifications affecting his rates significantly.

7. Time overruns for reasons accountable to owner.

8. Possibility of getting reimbursed for extended work duration.

9. Owner’s failure/delay i.e. handing over site for execution, providing the drawings and inputs as per agreement.

ADVERTISEMENTS:

10. Compensation for escalation in prices.

11. Penalty for failures beyond contractor’s control.

12. Delay in owner’s taking over possession after completion of work.

13. Owner honouring extra claims.

ADVERTISEMENTS:

14. Possibility of different interpretations of scope of work and responsibilities between contractor and owner.

15. Uncertainty of a smooth cash flow during the project duration.

16. Chances of making a reasonable profit.

Various professional institutions such as the National Association of Consulting Engineers in India have devised standard contract documents to provide appropriate protections against risks to both the parties of a contract. It is advisable for the parties to use such a standard contract document instead of preparing one on their own.

Risks in Contract-Owner’s Angle:

ADVERTISEMENTS:

The owner as well as the contractor is equally concerned with risk factors in a contract. The owner runs the risk of not having his production unit at all. As such, the owner seeks more and more protection specially when there is no insurance coverage.

Finance insurance policies cover only small risks. The contact document should therefore provide more protection to the uncovered risks. Standard contracting procedures have been laid down, which if followed would cover most of the risks in a contract. Risk and uncertainty though considered as different in theory, no such distinction is made between these two in practice.

Following are considered as risks from the owner’s point of view:

1. Ability of the contractor to carry out work according to specification.

ADVERTISEMENTS:

2. Contractor remaining with the work until completion and adherence to the time schedule.

3. Completing the work within the contracted price, performance level of contractor’s resources, flexibility in adopting to changing requirements – cooperation with other parties, post-operative care on completion of the project and protection to the owner from liabilities both during and after the project is completed.

Pre-Qualification of Contractor:

While awarding a contract, particularly if it is of high value and very large, it is customary to determine whether the contractor to whom the job is to be entrusted is capable of handling. For this purpose tender notifications are issued giving wide publicity calling for details such as name of the purchaser/engineer, outline of the project, enquiry issue and tender submission dates, instructions for applying for prequalification and submission date for the contractor’ prequalification data.

A prequalification document is issued on request to a contractor seeking information on the organization, experience in the intended type of work, availability of resources like managerial, technical, labour and plant, and also asks for financial statements.

ADVERTISEMENTS:

The contractor desirous of prequalification responds to the questionnaire giving details justifying his qualification. The data supplied to the contractors are evaluated for the preparation of a short list.

These selections of a contractor for inclusion in the short list of tenders are made on the basis of the following:

1. Similar experience earlier and his performance reports for previous contracts.

2. Past turnover and present financial commitments to ensure fund availability for execution of contract.

3. Availability of necessary infrastructure, adequate technical manpower, construction equipment for satisfactorily executing the assignment.

4. Credibility in terms of his associations with other agencies including foreign agencies, job performance and relationship with customers as well as present commitments to ensure that they will not interfere with this undertaking the proposed contract.

ADVERTISEMENTS:

The short-listed contractors are informed about their selection and their confirmation obtained regarding their response to the tender.

Types of Contract Payments:

A contractee is more concerned with the responsibility aspects of a contract. Whereas a contractor’s important concern i.e. a contract is getting prompt payments.

The types of contract payments could be brought broadly under the following category:

Lumpsum Contracts:

1. Lumpsum:

Fixed price arrived at by way of competitive bidding

ADVERTISEMENTS:

2. Negotiated Lumpsum:

A fixed price is negotiated with the contractor selected on consideration other than price

Cost Plus Contracts:

(a) Cost plus % fee – For service, supply and turnkey project

(b) Cost plus fixed fee

(c) Cost plus with guaranteed maximum

ADVERTISEMENTS:

(d) Cost plus with guaranteed maximum and incentive (also known as target cost contracts)

(e) Fixed rate contract

In both (c) and (d), escalation clause must be included to protect the contractor from developments beyond his control.

Item Rate Contracts:

A detailed schedule of items giving brief description of the work or supplies with approximate quantity and rate against each item are specified in the contract.

Convertible Contracts:

ADVERTISEMENTS:

Work is on cost-plus basis till scope of work can be defined and later converted to Lumpsum.

Hybrid Contracts:

Combination of any of the above such as:

1. Lumpsum + item rate

2. Lumpsum + cost plus

3. Lumpsum + fixed rate

ADVERTISEMENTS:

The choices of the alternatives are based on compulsions and mutual agreements. It is not always the economic considerations, which weigh the selection. A contractor offering for accepting lumpsum payments has to guard against contingencies to take care of unknown factors.

The type of contract payment is dependent on several factors like state of art of the contract, availability of contractors, critical nature of the contract, ongoing economic activity, workload of contractors, in-house capability of the contractee etc.

Liquidated Damages Clause:

LD clause is generally a part of the total contract agreement between the supplier/contractor and the project owner. The significance of the clause is to protect the project authorities from any undue delays in supply of the materials/ execution of contracts which would tramper the project activities and result in time over-runs.

In order to prevent such risks of performance on the part of suppliers, the LD clause enables the authorities to purchase the items as agreed from any other supplier in the event of the supplier’s inability to supply and to meet all the costs of damages (including additional costs in procuring higher prices that may have to be paid and costs of delayed project).

Likewise, in the event of any undue delays on the part of the contractor in executing the project, this clause enables the project owner to engage alternative contractor and get the work done and recover the additional costs involved, damages, if any, including costs of delayed project – both committed and uncommitted from the contractor.

Normally, the liquidated damages per week range from 0.5 to 5% of the contract value, not strictly as a penalty, in that sense, but more as a means of meeting the additional costs purchasing the materials or getting the works executed through alternative suppliers/contractors and to meet the liabilities that are likely to arise due to delays in supplying the products/services from the project.

Milestone Payment Plan:

This is basically a plan for making payments during the execution of the work on reaching a predetermined and agreed ‘Milestone’ of the project. It is necessary that the contractor gets some payment at periodic intervals spanning the project on his accomplishing some major tasks or milestone events.

Usually the contractor is required to provide detailed project schedule charts indicating the major milestones, critical events and when they are likely to be achieved. These are mutually discussed between the employer and the contractor, agreed upon and frozen after making any changes to be in line with the construction program envisaged by the employer.

The administration of the Milestone payment plan has to be done with care and promptitude so that once an amount is due to the contractor, as per the plan, the money is paid without any delay, lest the non-payment or delay may act as a disincentive to the contractor in completion of the project. Delays in payment constitute one of the main reasons for time and cost over-runs of projects.

Retention Money:

Retention money is generally considered as a contractual safeguard and not as a cheap source of finance. This is part of the amount of money due to a contractor for executing the contract during the project implementation. In general, the money due to a contractor is not released in lump sum, instead is paid in several instalments depending on progress of work.

Generally the payment schedule is as follows:

1. 10% of the contract amount with the order

2. 80% of the contract amount on work completed, on delivery (progress payments)

3. 5% of the remaining amount on take over and the balance 5% on final acceptance.

While fixing the level of retention money, one should consider that no higher amount is retained than what is reasonable necessary. Thus, retention money is some % of the bill value, which is retained by the project authorities at the time of making progress payments.

In general, retention money may be released, after the completion of the project or after the maintenance period (defects liability period). Percentage deduction towards retention varies from organization to organization and usually ranges from 5% to 10% of the bill amount.

Running Account Bills:

Running Account Bills (R/A Bills) are drawn on the project authorities by the contractors to recover costs of a cumulative work. The amounts so remitted against R/A bills would be adjusted against work bills or Invoice submitted at the end of pre-agreed milestones and balance payment, if any, is made to the contractor.

The purpose of a R/A Bill is to facilitate the contractor in getting necessary funds in time so that work need not be suspended for want of necessary funds. In a way, this would also help the project authorities to make quick payments, since normally verification of work bills/invoices takes considerable time due to the measurement and quality checks that need to be made before bills are passed.

Secondly, it would reduce the burden of paying a heavy amount at a time at the end of the project. Contractors also will not have a chance to delay the work and blame the authorities, since money will be made available through R/A bills.

Main Directions in Purchase Order or Work Order:

The main directions to vendors and contractors are passed in the form of purchase orders and work orders. They not only provide directions but also ensure that these are on record. Where directions are decided in meetings, a record of the proceedings in the form of minutes of meeting must be drawn and signed by attending parties.

A vendor or contractor may not agree for value engineering review, unless provided for in the purchase order or work order. There are many such directions which must be included in these documents before they are issued as orders. No new stipulations would be accepted by the vendor or contractor easily unless these documents contain enabling provisions and incorporated so therein. Negotiated or mutually agreed changes would prove expensive, if not provided properly in the purchase order or work order.

The various categories of directions are:

(a) Technical direction

(b) Commercial direction

(c) Managerial direction

(d) Administrative direction

The most important direction is the technical direction. Systems and item specifications, scope and standard drawings, performance specifications, record note of agreed variations etc. included in a contract document are the technical direction given before awarding a contract.

Review and approval of vendor drawings, issue of approval for construction drawings and inspection of completed works would provide the technical direction after the contract has been awarded. General purchase conditions or general conditions of contract cover commercial directions of standard nature.

Other directions regarding schedule of delivery, sequence of delivery, packing and marking, insurance, destinations, mode of transport, and method of invoicing are normally spelt out to avoid any confusion in these matters.

Managerial directions would basically deal with the data, drawings, schedules, reports, meetings and the various systems and procedures the vendors and contractors must follow for effective management of the part of the project in their scope.

Directions for value engineering, design reviews, scheduling and monitoring, project reviews, organisation and manpower are also provided under this head to ensure better execution of the contract and proper coordination with other vendors and contractors. While technical and commercial directions are fairly common features of a purchase/works order, managerial directions are latest decisions in purchase orders and work orders.

Routing of the correspondence, drawings and documents, security, personnel administration, appointment of sub- vendors or contractors, inspection notice, change notice etc., many of which are also covered in the general conditions of contract constitute administration directions.

Specific directions would have to be provided if general conditions do not make any mention of the same. It is in this context that selecting vendors and contractors who are reputed not only for their technical capability but also for technical service such as promptness in supply of data and drawings becomes relevant, since it is practically impossible to provide all directions in work orders and purchase orders.

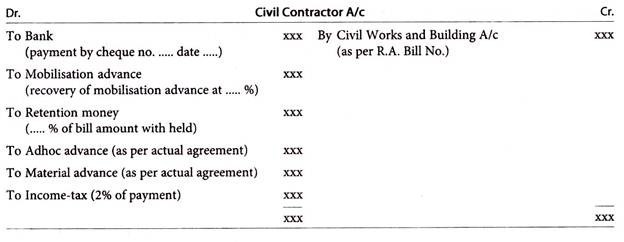

Payments and Deductions to Civil Contractor:

Table may be drawn considering payment column first and then deduction columns.

Payments:

(a) Normal R.A. Bill No. 1, 2 to n

(b) Advance (mobilisation)

(c) Secured advance

(d) Material advance

(e) Adhoc advance against progress

Deductions:

(a) Adjustment of:

i. Mobilisation advance

ii. Secured advance

iii. Material advance

iv. Adhoc advance

(b) Cement value

(c) Steel

(d) Water charges

(e) Electricity charges

(f) Rent for staff house and office

(g) Mobile equipment like crane, dozer hiring charges

(h) Income-tax

(i) Sales tax, if any

(j) Contract tax

Earnest Money and Earned Value Commitment:

1. Earnest Money:

It is a deposit money asked by the project authority to deposit along with the bid. It generally varies from 2% to 3% of the bid value. Earnest money is refundable in the event the tenderer does not succeed. Earnest money gives protection to project authority in the event the selected bidder backs out.

2. Earned Value Commitment:

It is the value of commitment corresponding to budgetary allocation for the same commitment. Example: A pump is ordered for Rs.50 lakhs but its budgetary allocation is Rs. 30 lakhs. Hence, committed value is Rs.50 lakhs and earned value of commitment is Rs.30 lakhs.