This article throws light upon the top three marketing techniques adopted by companies to increase sales. The techniques are: 1. Cross Selling 2. Upselling 3. Customer Retention.

Marketing Technique # 1. Cross Selling:

Cross-selling is the action or practice of selling among or between established clients, markets, traders, etc. or the action or practice of selling an additional product or service to an existing customer. This article deals exclusively with the latter meaning.

In practice, businesses define cross-selling in many different ways. Elements that might influence the definition might include the size of the business, the industry sector it operates within and the financial motivations of those required to define the term.

Broadly speaking, cross-selling takes three forms. First, while servicing an account, the product or service provider may hear of an additional need, unrelated to the first, that the client has an offer to meet it. Thus, for example, in conducting an audit, an accountant is likely to learn about a range of needs for tax services, for valuation services and others.

ADVERTISEMENTS:

To the degree that regulations allow, the accounts may be able to sell services that meet these needs. This kind of cross-selling helped major accounting firms to expand their businesses considerably. Because of the potential for abuse, this kind of selling by auditors has been greatly curtailed under the Sarbanes-Oxley Act.

Selling add-on services is another form of cross-selling. That happens when a supplier shows a customer that it can enhance the value of its service by buying another from a different part of the supplier’s company. When one buys an appliance, the salesperson will offer to sell insurance beyond the terms of the warranty. Though common, that kind of cross-selling can leave a customer feeling poorly used. The customer might ask the appliance salesperson why he needs insurance on a brand new refrigerator, “Is it really likely to break in just nine months?”

The third kind of cross-selling can be called selling a solution. In this case, the customer buying air conditioners is sold a package of both the air conditioners and installation services. The customer can be considered buying relief from the heat, unlike just air conditioners.

Examples:

ADVERTISEMENTS:

1. A Life Insurance company suggesting its customer sign up for car or health insurance.

2. An wholesale mobile retailer suggesting a customer choose a network or carrier after one purchases a mobile.

3. A television brand suggesting its customers go for a [home theater] of its or another’s brand.

4. A laptop seller offering a customer a mouse, pen-drive, and or accessories. Though most companies want more cross-selling, there can be substantial barriers:

ADVERTISEMENTS:

1. A customer policy requiring the use of multiple vendors.

2. Different purchasing points within an account, which reduce the ability to treat the customer like a single account.

3. The fear of the incumbent business unit that its colleagues would botch their work at the client, resulting with the loss of the account for all units of the firm.

Marketing Technique # 2. Upselling:

Upselling (sometimes ‘up-selling’) is a sales technique whereby a seller induces the customer to purchase more expensive items, upgrades, or other add-on’s in an attempt to make a more profitable sale. Upselling usually involves marketing more profitable services or products but can also be simply exposing the customer to other options that were perhaps not considered previously.

ADVERTISEMENTS:

Upselling implies selling something that is more profitable or otherwise preferable for the seller instead of, or in addition to, the original sale. A different technique is cross-selling in which a seller tries to sell something else.

In practice, large businesses usually combine upselling and cross-selling techniques to enhance the value that the client or clients get from the organization in addition to maximizing the profit that the business gets from the client. In doing so, the organization must ensure that the relationship with the client is not disrupted.

Some examples of up sales include:

a. suggesting a premium brand of alcohol when a brand is not specified by a customer (such as if a customer simply requests a “rum and Coke”).

ADVERTISEMENTS:

b. selling an extended service contract for an appliance

c. suggesting a customer purchase more Ram or a larger hard drive when servicing his or her computer

d. selling luxury finishing on a vehicle

e. suggesting a brand of watch that the customer hasn’t previously heard of as an alternative to the one being considered.

ADVERTISEMENTS:

f. suggesting a customer purchase a more extensive car wash package.

g. Asking the customer to super-size a meal at a fast food restaurant.

How can you Measure Success?

Listed below are some of the most common and popular ways to measure how well a cross-selling and up-selling program is working:

i. Average sales volume for each customer increases measured in dollars or units, sales volume is one way to assess if upselling has occurred.

ADVERTISEMENTS:

ii. Sales breadth expands measured by the number of products or services for each individual

iii. Your aggregate cross selling ratio improves measured by the number of products or services divided by the number of clients.

iv. Customer attrition decreases sometimes higher than normal attrition rates can means that cross-selling and up-selling attempts have been ineffective. High customer attrition can also be due to other factors as well.

Up-Selling and Cross-Selling Should be a Team Effort:

Almost every customer has unmet sales opportunities.

Consider your current customer base and ask yourself these two questions for each of your key accounts:

1. Are there opportunities to up-sell some of the existing products and services that a particular customer buys?

ADVERTISEMENTS:

2. In addition to the existing products/services, are there opportunities to cross-sell some additional products and services?

Keys to Effective Cross-Selling and Up-Selling:

The key to effective cross-selling and up-selling is putting your customers’ needs first by adding value to the customer experience with your related-item suggestions. Cross-selling helps to educate your customers on the depth and variety of what your business has to offer but, above all, don’t use cross-selling carelessly as a forum to simply push more products or services.

One of the most common up-selling techniques is either discounted or free shipping on a specified purchase amount. Encouraging customers to purchase additional items with free shipping or discounts on orders over a specific sales threshold – free shipping for a minimum of $100 in purchases, for example – is a pretty easy way to improve your sales volume incrementally.

If a customer’s order totals $90 and shipping is free on orders over $100, they’ll have much more incentive to find an additional item to purchase to take advantage of your free shipping offer. Be sure, however, that you’re not shooting yourself in the foot with this strategy.

A free shipping promotion should help to improve your sales volume, but more importantly, it should add to your bottom line – increasing your total profit per order. So, be sure to calculate these promotional offers very carefully.

How Should I Implement Cross-Selling?

The most ideal solution is to employ suggestions or recommendations for related products dynamically utilizing a shopping cart platform, if at all possible. Using a shopping cart is, hands down, the easiest way to effectively automate the cross-selling and upselling process. For those site owners who don’t have enough products to justify a shopping cart solution or who simply can’t afford one, cross-selling can be as simple as having links to similar products on your products pages with some copy such as “Customers who bought X also purchased Y.” While this alternative might sound decidedly low-tech, it’s better than not cross-selling at all.

ADVERTISEMENTS:

We’ve provided a list of shopping carts below that offer cross-selling as a feature of their respective platforms:

a. Prostores(dot)com

b. ShoppingCart(dot)com

c. Volusion

d. X-Cart(dot)com

e. InstanteStore(dot)com

ADVERTISEMENTS:

f. EcommerceTemplates(dot)com

Marketing Technique # 3. Customer Retention:

Customer Retention is the activity that a selling organization undertakes in order to reduce customer defections. Successful customer retention starts with the first contact an organisation has with a customer and continues throughout the entire lifetime of a relationship.

A company’s ability to attract and retain new customers, is not only related to its product or services, but strongly related to the way it services its existing customers and the reputation it creates within and across the marketplace.

Customer retention is more than giving the customer what they expect, it’s about exceeding their expectations so that they become loyal advocates for your brand. Creating customer loyalty puts ‘customer value rather than maximizing profits and shareholder value at the center of business strategy’. The key differentiator in a competitive environment is more often than not the delivery of a consistently high standard of customer service.

Customer retention has a direct impact on profitability. Research by John Fleming and Jim As plund indicates that engaged customers generate 1.7 times more revenue than normal customers, while having engaged employees and engaged customers returns a revenue gain of 3.4 times the norm

ADVERTISEMENTS:

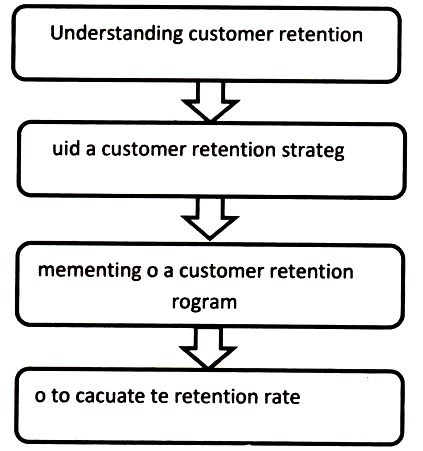

Steps followed for customer retention:

Understanding Customer Retention:

ADVERTISEMENTS:

Those getting started with a customer retention strategy might initially assume that retention rate is based on customer satisfaction. However, several studies have indicated that there is little correlation between customer satisfaction and retention or future purchases, according to customer experience expert Lior Arussy, founder of Strativity Group Inc. In one case, only 17% of satisfied customers of financial institutions claimed that they would not entertain a competing offer.

The real indication for customer retention is not customer satisfaction, but customers’ actions, Arussy said. Repeat business, purchasing ancillary services, recommendations to others, willingness to pay premium price and frequency of purchasing are the indicators of customer retention. These factors can be easily quantified and measured by the dollar value of each action.

Sometimes organizations need to understand that the closest touch point to the customer can help improve customer retention. For example, Arussy received a question from a SearchCRM(dot)com reader who manages a fleet of truck drivers, who was wondering about ways to improve the customer experience.

Arussy advised this fleet manager to embrace the role of his drivers as the “delivery on the promise” professionals, meaning they are the action behind the promises and commitments made by the sales force. As Arussy said, “They are experience creators in every way that they conduct themselves: clothing, appearance, language, etc. They are the face of the company and they can help customer retention rates.”

Arussy’s advice to this reader was to put in place a retention strategy that supports the customer experience. The infrastructure should include training drivers (or any other employees that are interacting with customers) about their role and how they are being perceived by the customers. Arussy encouraged the reader to create incentives and motivation programs to encourage desired behavior as well as performance evaluations that measure how customers rank behavior.

While there may not be a direct correlation between customer satisfaction and customer retention rates, many experts have studied employee retention and how it affects customer retention. A 2007 study on customer experience management by the Strativity Group surveyed 309 global executives and found a number of negative trends. One of the major issues? Only 54% of respondents said their company deserves their loyalty.

“Which is a very dangerous trend,” Arussy said. “If your employees don’t believe in the value of a product or owe you any type of loyalty, trying to win the battle for customers’ hearts, wallets and relationships is impaired.”

Customer retention expert Michael Lowenstein, vice president and senior consultant for customer loyalty management at Harris Interactive, agrees that employee loyalty and engagement has a direct relationship to customer marketplace behavior. He explored employee retention strategies, in an article called, Cowboys and Saloons. Chickens and Eggs. Customers or Employees.

Which Came First? Here’s an excerpt:

“Researchers including James Oakley of Purdue University, Northwestern University’s Forum for People Performance Measurement and Management and relationship experts Dwayne D. Gremler of Bowling Green State University and Kevin P. Gwinner of Kansas State University have found that employee behavior and advocacy regardless of the employee’s level of satisfaction have a direct and profound relationship to the behavior of customers, and also to corporate sales and profitability.

Employees are capable of directly contributing to both customer disappointment and customer delight. It is essential that companies have a research and analysis method that links staff performance engagement directly to customer behavior, so they can hire, train, recognize and reward employees for how they contribute to customer value.”

Build a Customer Retention Strategy:

As Lowenstein points out, customer loyalty is all about driving perceived value, whether that is rational (functional, quality, cost, etc.), emotional (trust, service, communication, information, brand equity, etc.) or a combination of these two dimensions. His advice for building a customer retention strategy? First, identify what leverages top-end customer commitment and advocacy behavior, and then build customer experience around it.

According to Lowenstein’s research on customer retention, there is no standard schedule for how often to communicate with customers to build loyalty. In his research, customers reported an interest in receiving communication from suppliers as long as they could see personal value in each message.

The excerpt below is from an article Lowenstein wrote called Balancing Messaging and Experience:

The CRM ‘Lasagna’ Recipe for Creating Customer Advocacy:

“In CRM, like lasagna, it’s layers of messaging and experience over an extended period; but it has to begin with messaging, i.e., how the brand promise is initially communicated and sustained, and grown, with each succeeding customer engagement and contact. Companies tend to believe that customers gain experience with their enterprises entirely through people, products and services. Largely true, as far as this thinking goes; but organizations often don’t have enough awareness that what is said to customers, and how, where, and when it is said has an equal, if not greater, behavioral impact. Communication is about relevance and trust, two essential elements in the way customers see suppliers. Customers have grown increasingly skeptical of supplier messaging. When considering alternative suppliers or making final purchase decisions, it is now becoming well understood that the principal, previously neglected criteria are intangible, emotional, relationship benefits, with much of what is tangible seen as one-dimensional and expected. This absolutely requires that the meld between messaging and experience is as seamless as possible.”

When it comes to getting started with building a customer loyalty strategy, CRM expert Jim Berkowitz advises businesses to use these six questions as a guide:

1. What are the expectations of our customers and what it will take to exceed them?

2. What differentiates our company in the eyes of our customers?

3. To what extent can we grow our business with our existing customers?

4. How do our interactions with our customers affect their satisfaction and buying behavior?

5. Do we have any customer segments that require different treatment?

6. How loyal is our customer base and how can we improve it?

Implementation of a Customer Retention Program:

A road map for implementing a customer loyalty program should include the following, according to Lowenstein:

a. Appropriate research for identifying the benefits.

b. Testing them for prospective customer interest and effectiveness.

c. Following up with further research once implemented to make certain that the loyalty program’s benefits are working.

d. CRM software can help support customer retention programs if the system captures all customer interactions in a database. According to Lowenstein, CRM software alone can’t guarantee the creation of value — customer centricity, and a single view of the customer across the enterprise, will do that.

To be successful with a customer loyalty program rely on both tangible and intangible (service, convenience, information, etc.) components, experts say. In most programs, a high percentage of customers do not take advantage of loyalty rewards.

Consulting firms can help by researching the effectiveness of each element of the loyalty or retention program, based on its correlation, or contribution, to desired loyalty behavior. For those that don’t have access to this kind of quantitative evaluation, Lowenstein recommends debriefing the redeemers and non- redeemers of a loyalty program to find out why they are/are not redeeming and also to determine what else the company can do to build value.

When evaluating the benefits of a customer loyalty program, companies need to consider whether they will buy an off-the-shelf vendor program or develop a homegrown program. Lowenstein pointed to two resources for off-the-shelf loyalty programs:

1. The Loyalty Guide:

An encyclopedia of loyalty program information published by The Wise Marketer.

2. Epsilon (formerly Frequency Marketing Inc.):

Responsible for the loyalty programs for many large corporations.

How to calculate retention rate:

According to ROI expert Tom Pisello, CEO and President of Alinean, the customer retention rate is calculated by determining the number of customers lost over a period of time compared to repeat customers over the same amount of time. Pisello said, “A customer is one who continues to make purchases, and a lost customer is one who has made purchases, but does not repeat these purchases for some time. The key is to analyze the repeats over a long enough horizon.”

The calculation is:

(Total number of customers minus the number of repeat customers) divided by total number of customers

In environments where users purchase a subscription, the calculation is easier, and can be represented as:

Number of subscribers who cancelled or did not renew during the period divided by the total number of subscribers for the period

As Pisello advised, “The difficult part in this equation is determining the right total number of subscribers to use: the ones at beginning of period, the ones at the end, a peak, or an average over the period.”

Some companies can measure retention rate using their CRM system, since any of the vendors with solid sales modules should offer this capability. Customer service expert Lori Bocklund, founder and president of Strategic Contact, Inc., recommends that companies look for this functionality when evaluating CRM solutions, even though it is unlikely to be the differentiating factor.

“You can also consider performance optimization tools if you want to combine things like save rate with other key performance indicators for an overall scorecard,” Bocklund said. Companies like Witness, Performix, AIM, and Merced offer these types of tools. To measure this, some companies combine data from the CRM system and data from other systems, such as your quality monitoring system, ACD or CTI solution handling contact routing and reporting.

There are no hard and fast rules on calculating customer defection and customer retention, according to Lowenstein. It can depend on the industry or the type of business, since some companies have long-term arrangements with customers.