Installing a project passes through different phases depending upon the type type of project. For the purpose of study let us consider that a project passes through following phases: 1. Project Identification 2. Project Preparation or Formulation 3. Project Appraisal 4. Negotiations 5. Project Approval 6. Project Planning 7. Project Implementation.

Phase # 1. Project Identification:

First phase of the project is concerned with identifying projects which have high priority, possible to finance the project, and the users are interested in the project. These projects must also moot a prima-facie test of feasibility i.e. it is viable from technical and financial paint view. Cost of the project should be less than the expected benefits.

Project ideas emerge during analysing problems, conducting macro-economic and social analysis, pressure from local people etc. The project is then identified so as to provide the basis for appropriate development strategy. Identification is a mixture of both formal and informal processes.

Following are the four aspects which are examined starting from the identification stage and continue in greater and greater details during subsequent stages.

ADVERTISEMENTS:

These are attended to the extent needed at that particular stage:

i. Functional aspects:

This includes operational and civil structural plans.

ii. Location and site:

ADVERTISEMENTS:

This includes climate, topography, environment, geology, accessibility, infrastructure, hydrology, social, economical and political aspects. Availability of water supply, electricity, construction material, land, labour etc.

iii. Construction aspects:

This includes design, technical requirements etc.

iv. Operational aspects:

ADVERTISEMENTS:

Project management, maintenance, revenue and expenditure, operational safety and health.

Phase # 2. Project Preparation (Project Formulation):

Project, formulation is done in following two phases:

1. Preliminary Project Study:

In this phase preliminary information related to project are collected and analysed to help the decision maker to decide, whether it is desirable to apply more resources to take up detailed study.

ADVERTISEMENTS:

This is a preliminary report prepared for taking decision whether a feasible study should be undertaken or not. The report consists of rough determination of the utility of the project, a rough engineering estimated cost, potential funding sources, expected revenues from the project after its completion, broad location etc.

This also indicates engineering and profitability aspects as compared to other similar projects already executed, the data already available with different agencies are utilised in preparing the report. If the results are clearly unfavourable, further work on the project is abandoned.

If the result of the report are found to be favourable and lies within the policy of the government, further steps are initiated for carrying out the feasibility study.

To know whether the report is favourable, following factors need greater emphasis:

ADVERTISEMENTS:

(а) Demand:

Demand estimates are based on satisfying overall national or regional demand. The regional demand influences the location and size of the project/projects that will need to be constructed. Existing projects or services need to be considered for knowing the demand and location for the project.

(b) Preliminary technical feasibility:

Various alternative ways for technical and engineering solutions are assessed from the point of view of location, civil structures, inter-linkages with other projects and resources etc.

(c) Alternative locations:

Various alternative locations of the project/projects or services should be given in the report mentioning merits and demerits of each.

(d) Preliminary economic feasibility:

This is based on comparison with similar other existing projects. If past experience is not available advice of experts and consultants can be sought. The cost of the existing projects help in deciding the approximate estimate of the project by making adjustment of the price rise or other factors affecting the price.

ADVERTISEMENTS:

(e) Benefits:

The project may be beneficial for the local public or for national or regional level, which may help in boosting the production or services or to satisfy social needs.

(f) Methods of implementation:

At this stage it should also be indicated as to how the project can be implemented and whether the agency has sufficient skill, experience and resources needed for implementation.

(g) Implementation:

Based upon the assessment of the different alternatives, a favourable alternative should be recommended giving justification for its selection.

ADVERTISEMENTS:

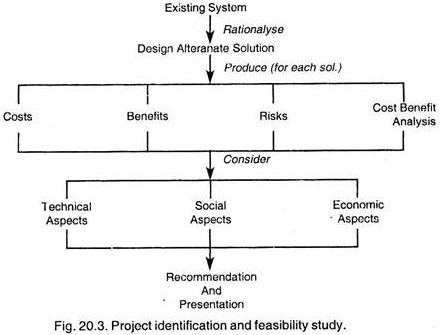

2. Feasibility Study:

This is a detailed study conducted considering all relevant elements so as to help the decision maker to decide whether the project should be taken up, postponed or abandoned.

The purpose of this study is to examine that:

(i) The project objectives are realistic,

(ii) The recommendations made in the preliminary project formulation stage are technically sound,

(iii) It is beneficial from financial, economical, and social point of view,

ADVERTISEMENTS:

(iv) The project is feasible from social, cultural, political, administrative and ecological point of view.

Feasibility study of the project is the most exhaustive of all the planning stages. As stated above a project is systematically examined in depth at this stage for various aspects like a technical, financial, economical, commercial, social, managerial and organisational.

Feasibility study must consider following points in the report:

(i) Project need or project justification:

Project need or project justification, objectives and goals. Data about the industry and project in particular.

(ii) Analysis of existing conditions:

ADVERTISEMENTS:

This should give details of existing conditions/facilities from the point of view of human resources, social conditions, and infrastructure of facilities already available.

(iii) Demand and supply analysis:

Demand and supply analysis and project contribution to fill the gap between demand and supply.

(iv) Technical analysis:

Various technical aspects related to the project should be analysed. The aspects considered should be: process to be adopted, methods of production, equipment to be used, raw materials, fuel, power and water requirements, selection of location and its justification (from the point of view of availability of raw materials, utilities, transportation, manpower etc.), selection of size and its justification, site plan, basic design of civil structure, surveys, construction phasing and schedule.

The report should also mention about the alternative technologies available and the description of the selected technologies with justification (this should include availability of know-how, cost etc.).

ADVERTISEMENTS:

(v) Social impact considerations:

Existing social and environmental conditions and the impact of project should be studied and described in the report. This study should include impact on population, natural resources, land, and economical condition of the people residing in the area, social, cultural and environmental aspects.

(vi) Financial aspects:

Total investment to be made on the project, giving break up for individual major items like land, building, plant and machinery, payment of wages, cost of materials etc. should be planned in a phased manner. During operation of the project i.e. after its construction, a study for expenditure on operation and maintenance, and income from it should be made; any yearly expenditure v/s revenue estimates are drawn.

Financial viability of the object is considered by knowing pay-back period and return on investment. Pay-back period shows the number of years required to get investment back, while return on investment indicates the average rate of revenue (return) on project investment.

Source of funds and their adequacy and arrangements to be made for securing finances should also be described in feasibility study.

ADVERTISEMENTS:

Financial analysis is carried out primarily to deal with the interpretation of the data incorporated in the proforma financial statements of the project and the presentation of the data in a form in which it can be utilised for a comparative appraisal of the projects.

It is concerned with the development of the financial profile of the project and to find out whether the project is attractive enough to secure funds needed and whether the project will be able to generate enough economic values to achieve the objectives for which it is sought to be implemented.

(vii) Economical aspects:

After knowing the financial aspects, the study should indicate whether the project is economical or not.

(viii) Implementation details:

The report should give details about implementation schedules, organisation structure required for implementation, administrative arrangements, manpower recruitment detail etc.

Points to be included in the Feasibility Study:

Following points should invariably be included in the feasibility report:

1. Government policy in respect of industry, of which the project is under consideration.

2. Specifications of the output and technique of production.

3. Capacity (production).

4. Alternative locations.

5. Preliminary estimates of revenue, costs capital and operating.

6. Marketing analysis.

7. Raw material investigation, i.e. specification and source of supply.

8. Estimation of material, energy and other input costs.

9. Requirement of equipment with their type, capacity, cost and source of supply.

10. Know-how of the production.

11. Site investigation.

12. Details of building, structure of project, yard facilities with their type, size and cost.

13. Lay out.

14. Category wise labour requirement and labour costs.

15. Estimation of working capital, phased expenditure and cash flow requirements.

16. Profitability.

17. How to sort out environmental problems.

18. Resources available to complete the project.

Phase # 3. Project Appraisal:

Feasibility report is examined by different agencies from their respective view. The government agencies give more emphasis on socio-economical aspects, while the financial institution will critically examine its technical feasibility and financial viability along with managerial competence of the organisation undertaking the project.

Project appraisal is the most important phase of the project work, because it provides a comprehensive review of all aspect of the project, and is the culmination of the preparatory work.

Appraisal is therefore an analysis ex-ante i.e., although the project has not been put into operation, the cost, benefits of the project is estimated to arrive at the decision to take up the project (i.e. an investment decision). Project appraisal, is therefore an aid to investment decision, which becomes all the more important when resources are limited or scarce like: capital, foreign exchange, land and manpower.

Aspects Considered for Project Appraisal:

Following major aspects are generally considered in the process of project appraisal:

1. Technical.

2. Institutional.

3. Financial and economical.

4. Time.

5. Investment criteria.

6. Capital rationing.

7. Efficiency and equity.

8. Environment.

9. Sensitivity analysis.

(1) Technical Aspects:

It has to be ensured that project is soundly designed and appropriately engineered. Appraisal is done for technical alternatives considered, solutions proposed and expected results. Technical appraisal is a review of the cost estimates, and the engineering and other data on which they are based.

It also reviews proposed procurement arrangement. Potential impact of the project on the human and physical environment is also examined. Technical appraisal also concern with the layout, technology to be adopted, feasibility of achieving the implementation schedule and likelihood of achieving the production level expected.

(2) Institutional Aspects:

Institutional appraisal considers, whether the entity is properly organised, and its management is adequate to perform the job, whether local facilities are utilised effectively, or whether any changes in policy or in institution are required to achieve the project objectives.

(3) Financial and Economical Appraisals:

Financial appraisal is done to ensure that there are sufficient funds to cover the costs for implementing the project. For a revenue-producing enterprise, financial appraisal is concerned with its financial viability. Financial appraisal is also concerned with recovering investment and operating costs from project beneficiaries.

Project appraisal based on economic analysis is done from the point of view of society, which aims at efficient allocation of resources, while financial analysis considers the project as an independent entity. Financial analysis therefore is a micro level appraisal of the project.

Economic analysis of alternative project designs serves to select the one that contributes most of the development objectives of the country. Economical appraisal studies the project for the sector, the strengths and weaknesses of sectorial institutions and key government policies.

When project appraisal for investment decision is carried out it is considered as a part of an overall scheme of economic development. In project appraisal, we examine the difference in the position of inputs and outputs with and without the project, thus identifying the costs and benefits of the project.

The project incurs expenses on capital investment, operation and maintenance, purchase of raw material, payment of wages and services etc. In addition, project has to pay taxes, duty, and fee, repay the loan with interest, and allow depreciation. The project gets its return for sale of goods and services and also receives subsidy (if allowed by government).

Thus there are two types of costs and benefits i.e. one which involves use/production of goods and services, and another which involves the transfer of resources from project to government or any other institution or individual or vice-versa, e.g., depreciation, interest, taxes, subsidies etc. These transfers of resources are included in the financial analysis, while not included in the economical analysis as they do not use up resources or generate output.

In Financial appraisal objective of the project is to maximise the profit, while in economical appraisal objective of the project is to contribute towards the achievement of national objectives i .e. increase of income, development of backward areas, employment, reduction of poverty etc.

(4) Time Value:

Since cost and benefits do not accrue at the same time, the project appraisal technique has to reduce benefits and costs to a common time dimension. Time involves sacrifices in the present over the future.

The normal expectations are that benefits accruing in the future should be sufficient to compensate for the sacrifices in the present. The compensating factor is known as interest. The interest is used to convert the benefits and costs to a common time dimensions.

(5) Investment Criteria:

Based on financial and economical analysis next step is investment decision. This decision is based on the exercise to find out the return which would be available on capital resources invested.

Investment decisions are taken considering the following factors:

(a) Alternative use of resources.

(b) Life span of the project.

(c) Whether the project is from individual or from society point of view.

(d) Costs and returns accruing at different points of time.

For taking investment decisions, following investment criteria’s are considered:

(a) Payback period.

(b) Rate of return on investment.

(c) Net Present Value (NPV).

(d) Benefit Cost Ratio (BCR).

(e) Internal Rate of Return (discounted cash flow).

The criteria mentioned at b, c and d above, measure the preference for present over the future, and therefore time value of money is essence of these criteria. In all these criteria the discount rate is the key factor. NPV gives an absolute measure of benefits (in terms of rupees), while BCR gives benefits per rupee of investment.

Thus both these are inter-related. Internal Rate of Return (I.R.R.) is a function of the relationship of the project’s estimated costs and benefits over a period of time. Thus, higher I.R.R. indicates that benefits are higher than the costs involved over a period of time. Therefore, time is an important element in investment decision.

(6) Capital Rationing:

Since resources are generally available in limited quantity and therefore need to be rationed amongst competing demands and priorities. In open market, and for a private firm, the funds come from outside the firms or projects internal resources, on which they have to pay high rate of interests. Therefore supply of and demand of capital determines the cost of capital.

(7) Efficiency and Equity:

The value of the project depends not only on the benefits generated (efficiency criteria) by the project, but also on the distribution of these benefits (equity criteria).

An economy which is facing the problem of unequal income distribution, and has also the objective of additional income generation for the rapid growth of economy, cannot entirely rely on the fiscal measures, and income redistribution needs to be corrected at the time of income generation i.e. in this case at the time of project selection.

(8) Environment:

In project appraisal, social effects are also taken into account while considering the implications of projects undertaken either by private or public authorities. Such intangible social costs and benefits, though not measurable have an important bearing, and hence should be high-lighted. Effect of the projects on environment has assumed great importance. Therefore, these are required to be cleared from the ecological angle.

(9) Sensitivity Analysis:

Since the future is not certain and involves uncertainties and risk, the costs and benefits projected may turn out to be wrong. This may lead to wrong decision about the selection of the project. If the project can stand the test of changes in future, affecting costs and benefits, the project qualifies for selection. The sensitivity analysis is aimed to avoid overestimation or under-estimation of the costs and benefits of the project.

In order to avoid these, the project analyst, examine as to how these estimates have been arrived at. The sensitivity analysis, therefore remove the bias and try to present a realistic picture of the costs and benefits of the project. In project appraisal, it is better to consider as many elements of uncertainty as possible in the costs and benefits sides.

Phase # 4. Negotiations:

In the next stage of the project cycle, discussions take place between the project authorities and financial institutions/Government departments to ensure success of the project.

Phase # 5. Project Approval:

After going through the stage of project appraisal at various levels, and holding discussions, project is approved by the government.

Phase # 6. Project Planning:

Before starting a project its planning is done. Planning a project is very important task and should be taken up with great care, as the efficiency and economy of the whole project largely depends upon its planning. While planning a project, each and every detail should be worked out in anticipation and should be considered carefully considering all the relevant provisions in advance.

Projects are planned for creating physical facilities within time and cost to meet predetermined needs and objectives. These projects are non-repetitive and comprise of several aspects e.g. technical, financial, commercial, economical, social, managerial etc. The project require physical resources like land, plant and equipment, building, money, manpower etc., and consists of functional elements like design, engineering, procurement, erection etc.

Since this is done before the actual construction of the project, it is sometimes called as pre- construction project plan. This helps in effective use of resources and draws detailed plan of implementation of the project in a smooth and economical way.

It includes the plan for resource mobilisation at a particular time of requirement and its effective utilisation. (The resources may be men, materials, money and machines. In other words the resources should be available in right quantity, at right time and at right places) delegation of appropriate responsibilities, powers and authorities to various persons and departments, their relationship is decided, plans are developed and translated into activities and tasks, estimates are made more precise and accurate.

Internal administration system, information system, accounting and financial system, monitoring procedures, execution system, time schedule on C.P.M./P.E.R.T. networks are drawn.

These time schedules are supported by manpower, financial and physical resource plans, equipment procurement and installation plans are drawn. Arrangements for finances as per cash flow plans are made and agreements are made with the financial institutions for timely receipt of loans.

Phase # 7. Project Implementation:

Next stage in the project cycle is actual implementation of the project for its construction and operation. For proper project implementation, emphasis should be on action as per planning. For this purpose organisation set-up and sound project management system should be established so as to manage the project in a rational and scientific manner, following the latest management principles, tools and techniques.

During the implementation stage of the project, there is need for continuous monitoring to ensure project implementation as per time and cost schedules. For effective monitoring it is essential to have a good speed and reliability of communication system and establish the dependable information system.