This article throws light upon the four main stages involved in execution and management of a project. The stages are: 1. Project Planning 2. Appraisal of Projects 3. Implementation of the Project 4. Review and Control of the Project.

Execution and Management of Project: Stage # 1.

Project Planning:

Project planning refers to the formulation of plans of an undertaking to build up new production capacities or to diversify its business activities or to extend its existing capacities. It is essentially the first and foremost stage in the execution of a project. The success in implementation of a project depends to a great extent on proper planning of the project.

The planning stage involves:

ADVERTISEMENTS:

(i) Identification, evaluation and determination of the desired project,

(ii) Determination of the size and cost of the project,

(iii) Determination of the time frame for the execution of the project

(iv) Determination of the proposed means of financing or the capital structure; and

ADVERTISEMENTS:

(v) Preparing the project report. The first four steps involved in planning of projects are in fact the prerequisites for the preparation of a project report.

Project Report:

A project report is a written document of various activities to be undertaken by a firm and their technical, financial, economic and social viabilities. In other words, a project report spells out the reasons of allocating resources of the firm to the production of specific goods and services.

Objectives of Preparing a Project Report:

ADVERTISEMENTS:

While finalising a project, it is very essential for the entrepreneur to know the complete details of the various aspects of the project. The financial institutions proposing to meet the financial requirements of the project also require complete information about the financial, economic and technical feasibility of the project. To meet these requirements, a document known as project report is prepared.

A project report serves the following purposes:

(i) It enables an entrepreneur to compare different investment proposals and select most suitable project for him.

(ii) It helps the entrepreneur in seeking financial assistance from financial institution and banks.

ADVERTISEMENTS:

(iii) It identifies various constraints in the implementation of a project as regards resources, viz., financial, technical, manpower, etc. well in advance.

(iv) It helps the financial institutions, proposing to provide finance for the project, to make appraisal as regards to its financial, economic and technical feasibility.

Contents of a Project Report:

A project report usually contains the details regarding the following aspects of the project:

ADVERTISEMENTS:

(i) Market and marketing.

(ii) Size of the project.

(ii) Project engineering dealing with technical aspects of the project.

(iv) Location and Layout of the project.

ADVERTISEMENTS:

(v) Building

(vi) Details regarding plant, machinery and equipment’s.

(vii) Production capacity.

(viii) Work schedules, and

ADVERTISEMENTS:

(ix) Details of the Cost of the project, including.

(a) Cost of Land;

(b) Cost of building;

(c) Cost of research and development;

(d) Cost of plant and machinery;

(e) Cost of furniture and fittings;

ADVERTISEMENTS:

(f) Cost of auxiliary services;

(g) Cost of patents, trade marks, etc.;

(h) Cost of preliminary expenses including interest charges during pre-operative stage;

(i) Margin money for working capital, etc.

(x) Proposed financing of the project;

(xi) Organisational Structure; and

ADVERTISEMENTS:

(xii) Profitability of the project, etc.

Execution and Management of Project: Stage # 2.

Appraisal of Projects:

The term’ project appraisal’ refers to a detailed evaluation of the project to determine its technical, economic and financial viabilities.

Such appraisal is done at two stages:

(i) At project identification stage by the entrepreneur or the promoter, and

(ii) At financing stage by the financial institutions.

ADVERTISEMENTS:

The promoter makes the appraisal to select the most suitable project for him and then he submits the project to the financial institutions for obtaining the necessary finances.

The experts of the financial institutions make minute appraisals of the project to evaluate:

(i) Financial viability

(ii) Economic necessity, and

(iii) Technical feasibility.

(i) Financial Viability:

ADVERTISEMENTS:

No financial institution would sanction the financing of a project unless it is satisfied about the financial viability of the project. The financial institutions evaluate the project with the help of projected financial statements prepared for a number of years.

Various tools of financial analysis, such as ratios, funds flow and cash flow statements, etc. are also used for this purpose. The evaluation relates not only to profitability but also to cash flows to determine the capacity of the firm to pay interest charges and repayment of debt installments.

The main points which are considered by financial institutions and require a mention here are as follows:

(a) The total estimated cost of the project should be complete and reasonable;

(b) The suggested financing arrangement should be comprehensive and ensure availability of funds as and when required;

(c) The estimates regarding operating cost and earnings should be realistic;

ADVERTISEMENTS:

(d) A sufficient provision for contingencies should be made;

(e) The debt equity ratio should be within the prescribed limits;

(f) Interest coverage, i.e., profit after tax but before interest should be at least 2-3 times the fixed interest changes;

(g) Debt-service coverage should be at least 1.5 times.

(h) The project should start earning within a reasonable time and the gross Profit Ratio, Net Profit Ratio, Return on Capital employed, etc. should be satisfactory;

(i) The break-even point should be reasonable and well within the reach of the firm in normal circumstances.

(ii) Economic Necessity:

It is not only the financial or commercial viability which is important, but also the economic necessity of the project. The financial institutions have to ensure that investments are made in the desired channels as per the objectives of the plan and the project financed contributes towards the overall economy.

The main factors which are considered to evaluate economic necessity of the project are as follows:

(a) The extent to which the project is expected to contribute to the national exchequer;

(b) The employment potential;

(c) The development of the area; and

(d) The containment of atmospheric and other pollutions.

(iii) Technical Feasibility:

No project can be approved unless it is technically feasible to run the same.

The following are the main considerations to evaluate the technical feasibility of a project:

(a) The project must be located at a place where raw material, labour, transport facilities and market are available;

(b) The technology to be used must have been tested to give the desired result;

(c) The availability of technical know-how;

(d) The specifications of plant and machinery and the record of its suppliers;

(e) Plant layout;

(f) Construction and installation schedules;

(g) The arrangements for effluent disposal;

(h) If the technology is imported, the training of personnel; and

(i) Selection of technical collaborators; etc.

The All -India Financial Institutions have developed common application forms for use of entrepreneurs seeking financial assistance form them. This considerably helps them in obtaining necessary information and in making appraisal of the project.

Execution and Management of Project: Stage # 3.

Implementation of the Project:

After the appraisal of the project has been completed and the necessary finances tied up, the next crucial stage in the execution of the project is the actual implementation of the project. The project manager has to ensure that the project is implemented as per the cost frame and time frame as envisaged at the planning and appraisal stage.

Cost overruns and delays in implementation schedule have to be minimised to avoid problems leading to sickness of the project. Various techniques such as project cost sheet, bar charts, network techniques, i.e. PERT and CPM, etc., help in completing the project 011 schedule with the desired cost frame, the two most useful techniques of project management ,i.e. PERT and CPM have been discussed below.

Network Techniques (PERT AND CPM):

Network analysis is the synthesis of two most useful Techniques of project management, namely Program (Project) Evaluation Review technique and Critical Path Method evolved independently during 1956- 57. PERT was first developed as a management tool for coordination and early completion of Polaris Ballistic Missile Project in U.S.A., resulting in a reduction of 30% time in project execution.

A contemporary of PERT is CPM and was developed in connection with maintenance and construction work. Du Pont engineers were able to cut down time for maintenance from 125 to 93 hours. Also J.E. Kelley and Morgan R. Walker are the two most responsible persons for the birth of CPM.

CPM and PERT are useful at several stages of project management starting from early planning stages, when various alternative programmes or procedures are being considered to the scheduling phase, when time and resources schedules are laid out, to final stage in operation, when used as control device to measure actual planned progress.

Both the techniques, PERT and CPM use ‘network’ and “critical path’ as the basic tool of project management and both are very helpful in completing a project on schedule by coordinating different jobs involved in its completion. But there is a difference in these two techniques. PERT is event oriented while CPM is activity oriented.

In PERT there is allowance for uncertainty unlike that of CPM. In CPM there is only one estimate of time and the emphasis is on cost. Normally, PERT is used when high precision is required in time estimates without considering the cost implications and CPM is used where the emphasis is on trade-off between costs and completion date for the large projects.

However, this difference has almost faded and both these tools have merged together to provide a single tool of management control. Its various forms include ‘PERT Time’ for reducing the duration of a project, ‘PERT Cost’ for controlling the cost of the project and ‘PERT Resources’ for optimum allocation of resources.

The Process of Network Analysis (PERT and CPM):

Every project consists of a number of jobs, events or activities. These techniques define and intensify these jobs or activities, integrate them by arranging them in proper sequence which is necessary for timely completion of the project.

A graph or a picture, called network, is then drawn portraying each of the activities and showing the predecessor and successor relationships among them. Such a ‘picture’ shows which jobs to come first and which has to come later. It also shows the time for completion of the project.

The following are the various steps involved in the process:

1. Identify the jobs, events or activities.

2. Arrange the jobs in logical sequence.

3. Draw the network.

4. Record timing of events and total expected time of the project.

5. Highlight the critical path.

6. Updating and crashing of a project

The technique can be followed with the help of the following illustration:

Illustrative Example:

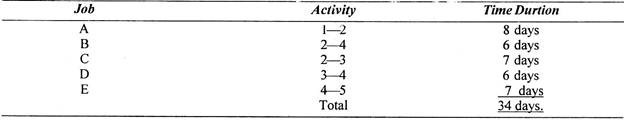

Find out the earliest possible time for completing a project from the following information as regards the jobs involved in the project with their time duration.

Solution:

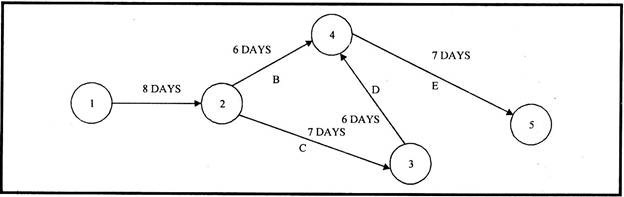

From the given data, we can draw the following network diagram:

In the above diagram, the jobs have been shown in the form of arrows leading from one circle on the diagram to the other; e.g., the arrow connecting circles 1 and 2 represents job A, and so on. All the activities have been reduced to a network diagram together with the information as regards to time required for the completion of different, jobs.

In the above diagram, there are two paths-the first connect circles 1, 2, 4, and 5 and take 21 days; the second path connects circles 1, 2, 3, 4, and 5 and takes 28 days. The longest path, called the critical path takes 28 days and hence the minimum time required to complete the project will be 28 days.

In order to ensure that the project is completed within this time, attention will have to be given to this path since any delay in time on any job or activity in this path will delay the completion of the project. In case the completion time is to be reduced, steps will have to be taken to reduce the time required for various activities of this path.

Advantages of Network Technique:

i. It aids the management in planning, scheduling and controlling the activities of projects.

ii. It helps in ascertaining time schedules.

iii. It helps in guiding and directing team efforts more effectively.

iv. It permits planning in advance and indicates the future trouble spots in advance.

v. It aids in handling uncertainties regarding time schedules, coordination of various activities and controlling the cost involved.

vi. It encourages discipline.

vii. It identifies most critical elements and thus more attention can be paid on those activities.

Execution and Management of Project: Stage # 4.

Review and Control of the Project:

The successful execution of a project requires regular and continuous review and control of the project. It is essential to review the project not only after the implementation of the project but also to review it continuously right from the planning stage to implementation and completion of the project.

During the planning stage a project has to be reviewed for correctness of financial and other variables provided in the plan. At implementation stage the review and control is required to ensure that the plans are achieved as desired within the stipulated time and cost frame.

The process of control involves four major steps as given below:

(i) Setting of control standards.

(ii) Measurement of actual performance.

(iii) Comparing, actual performance with the standards so as to find out deviations, if any, and also to determine the causes of deviations.

(iv) Taking the corrective action.