In this article we will discuss about the criteria for selection of business unit managers in a company’s portfolio with the help of BCG matrix.

1. Question Marks:

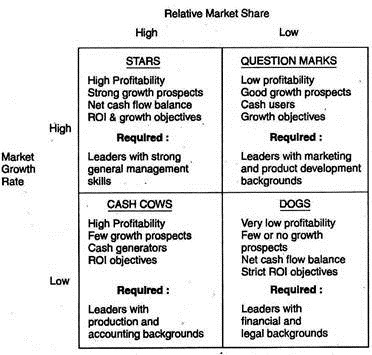

Its primary goal is growth. These businesses require entrepreneurial managers capable of creating new products and developing new markets. For such tasks, individuals with product development, market research, and developmental engineering backgrounds are likely to be especially effective.

2. Cash Cows:

Their mission is profit generation, not growth. Cash cows, thus, need leaders who can minimise costs. A background in production, accounting, or project management is likely to be useful for such individuals.

3. Dogs:

They also have profit as their prime objective. However, they should pursue it even more single-mindedly than cows because they do not have to worry as much about maintaining market share. Dogs, therefore, may need individuals who can oversee the orderly liquidation of their businesses.

ADVERTISEMENTS:

For this task accountant, lawyers, and financial specialists may be the most appropriate. It is important to note that many companies today are attempting to rejuvenate some of their Dog businesses, and at least in a few cases, are assigning their best ‘turnaround’ specialists to these units.

4. Stars:

They have more complex needs than the other three types of business units. They must pursue both growth and profitability with approximately equal emphasis. They, therefore, require managers with a more balanced orientation than the other types in the portfolio. Often, a company will place its best general managers as leaders of these business units.

ADVERTISEMENTS:

The different types of business unit managers, as well as the other characteristics, are summarised in the diagram (BCG Matrix) below:

In this respect, it is important to note that some problems of motivation and performance assessment of business unit managers do arise.

For example:

ADVERTISEMENTS:

(i) The strategic mission of the manager of ‘cash cow’ unit, as far as the corporation is concerned, is to provide cash for investment in the company’s other businesses. In the process, he is being evaluated and rewarded for profit generation and not for investing large sums of cash in new product development, etc.

(ii) Similarly, the consideration of a corporation to liquidate a portion of ‘dog’ unit or selling it entirely will have effect on the ‘dog’ unit’s manager’s psychology and on the morale of his management team particularly when layoffs are resorted to.

These kinds of uncertainties and anxieties often accompany the strategic mission of ‘Cash Cow’ and ‘Dog’ business.

In order to minimise these negative motivational consequences, the following approaches are worthwhile from strategic viewpoints:

ADVERTISEMENTS:

(i) Rotation of managers through different businesses over time so as to make them aware of differing situations and their performances rated accordingly;

(ii) Assign to ‘Dog’ and ‘Cow’ businesses the managers who are on the verge of retirement and thus not concerned with promotional prospects; and

(iii) Assign several businesses with different portfolio designations to a single manager and thereby allow him to manage a business including ‘Cow’ or ‘Dog’ units—which offers opportunities for growth and diversification.

In nutshell, a corporation as a whole must be judicious and careful to see that organisational mismatches do not occur. These informal adjustments help to make portfolio planning an important management tool rather than an isolated intellectual exercise.