Definition of Budgetary Control:

Welsch has defined budgetary control as “the use of budgets and budgeting reports throughout the period to coordinate, evaluate and control day-to-day operations in accordance with the goals specified by the budget.”

According to H.S. Wheldon, “By budgetary control, every items of actual cost is so controlled by vigilant supervision as to make it conform, as nearly as possible, to the predetermined standards. It has resulted in the elimination of waste and excess costs in every suitable instance where budgetary control has been properly instituted.”

Budgetary control is a useful management control device.

It performs the following important functions:

ADVERTISEMENTS:

1. Budgets present the objectives, plans and programmes of the enterprise and express them in financial and/or quantitative terms in the organisation.

2. Budgets serve as job descriptions. They define the tasks, which have to be performed at various levels in the organisation.

3. Budgetary control involves continuous comparison of actual results with the planned ones and taking corrective actions in the organisation.

Budgets are not only a means of control; they also help the managers in performing other functions of management. Budgeting is closely associated with planning, organising and directing. It also helps in pointing deviations from the planned results. When these deviations are reported to manager, he can control them in time in the organisation.

Objectives of Budgetary Control:

The main purpose of budgetary control is to enable the management to conduct the business in the most efficient manner in the organisation.

ADVERTISEMENTS:

According to John Blocker, “Budgetary control is planned to assist the management the allocation of responsibilities and authority, to aid in making estimates and plans for future, to assist in analysis of various between estimated and actual results and to develop basis of measurement or standards with which to evaluate the efficiency of operations.”

In other words, the budgetary control device in the organisation encompasses practically the whole range of management activities right from planning and policy formulation to the final function of control over various activities of the manufacturing enterprise.

Budgetary control has the following specific objectives:

1. Planning:

ADVERTISEMENTS:

Budgets are the plans to be pursued during the designed period of time to attain certain objectives in the organisation. Budgetary control will force the management at all levels to plan various activities well in advance in the organisation.

Budgets are generally drawn on the basis of forecasts made about market forces, supply conditions and consumer’s preferences in the organisation. This help in making and revising business policies in the organisation.

2. Control:

ADVERTISEMENTS:

Budgetary control is an important instrument of managerial control in any enterprise. Budgetary control helps in comparing the performance of various individuals and departments with the predetermined standards laid down in various budgets.

Budgetary control reports the significant variations from the budgets to the top management in the organisation. Since separate budgets are prepared for each department becomes easier to determine the weak points and the sources of waste of time, money and resources.

3. Coordination:

Budgetary control involves the participation of a master budget, which helps in bringing effective coordination among different departments of a business enterprise in the organisation. It force the executive to make plans as a group in the organisation. Delays involved in the red tapism and discussing matters with one another sets procedural wrangles aside.

4. Increase in Efficiency:

Budgetary controls lay down the standards of production, sales, costs and overheads taking into consideration various internal and external factors. This compels and stimulates every department to attain maximum efficiency over the use of men, machine, material, methods and money.

5. Financial Planning:

ADVERTISEMENTS:

Budgets are generally expressed in financial terms in the organisation. They provide the estimates of expenditures and revenues in the organisation. This helps the management to make plans about the flow of cash in such a way that it would never run short of working capital in the organization. Cash budget is also useful to convince the financial institution that their loans will be paid back in time.

Benefits of Budgetary Control:

Business enterprises can obtain the following advantages from efficient system of budgetary control:

1. Budgeting is an all inclusive management tool. It integrates and ties together various organisational activities in the organization right from planning to controlling.

2. Budgets provide standards against which actual performance can be measured. This helps in taking corrective action, which is an important part of controlling.

ADVERTISEMENTS:

3. Budgets are an important tool to coordination in the organisation. In preparation of various budgets, knowledge, skill and experience of many executives are combined and business plans are reduced into concrete numerical terms in the organisation. This leads to proper coordination of the efforts of various departments of the enterprise in the organisation.

4. Budgeting in the organisation helps in reducing unproductive operations by minimizing waste of resources. Budgets are prepared after considerable thought and are directed towards certain aims and objectives.

5. Budgeting in the organisation makes financial planning and control easy. The ultimate effect of budgeting is the thorough examination and scrutinizing the financial aspect of the business enterprise. This helps in optimum use of financial resources of the enterprise.

6. Budgetary control in the organisation facilities ‘control by exception’. It helps in focusing the time and effort of the managers upon areas, which are most important for the survival of the organisation.

ADVERTISEMENTS:

7. Budgeting in the organisation is an important device for fixing the responsibility of various positions. The persons occupying various positions can be made to understand their responsibilities with the help of budgets.

Limitations of Budgetary Control:

1. Too much emphasis on budgeting in the organization may bring about rigidity in the enterprise. It may deprive the managers of the flexibility they require in managing their departments.

2. Budgeted estimates in the organisation are generally based on the price level at a particular period of time. These estimates may become useless when there is either inflation or depression in the market.

3. Sometimes budgets in the organization are tested as an end in themselves. Some people may be extra cautious to function within the boundaries of budget figures rather than achieving the enterprise objectives.

4. A budget, which allows liberal expenditure, may be used to hide inefficiency. For instance, a department may be inefficient even though its expenses are within the budget limits in the organisation.

5. Budgetary control in itself does not prevent deviation from appearing. It neither ensures satisfactory results nor control automatically in the organisation. A deliberate effort has to be made in this direction in the organisation.

ADVERTISEMENTS:

6. Budgetary control in the organisation requires expenditure of time, money and effort. Moreover, it is not easy to prepare various kinds of budgets in the organisation because of obvious difficulties in forecasting to be used in budgeting.

Essential of Effective Budgetary Control:

Following are requirements of a good system of budgetary control: in the organisation

1. Quick Reporting:

A good system of budgetary control in the organisation requires the establishment of such procedures, which will provide reports on the performance of various operations. The reports should reach the persons concerned with the implementation of budgets without any delay so that quick actions may be taken wherever necessary in the organization.

2. Detailed Organization Structure:

There should be a detailed organization structure with precisely designed authorities, responsibilities and lines of communication so that everybody in the organisation understands the significance of objectives in detail.

3. Frequent Comparison:

There should be frequent comparison between budget estimates and operating results in the organisation. Alford and Beatty are of opinion that careful analysis of both operating results and budget estimates is the essence of budgetary control in the organisation.

ADVERTISEMENTS:

4. Definite Plan:

There should be comprehensive planning in the enterprise. All the operations in the organisation should be planned in clear terms. The administration of the budgets should also be properly planned in the organisation. It must be pre-determined who is to be held responsible for the implementation of budget in the organisation.

5. Responsibility Matched by the Authority:

Those assigned with the responsibility to implement the budgets should also be given the necessary authority to achieve the budgeted targets in the organisation. Lack of sufficient authority will make the implementation of budgets ineffective in the organisation.

6. Participation:

The purpose of budgetary control is to achieve coordination of various functions of the business in the organisation. Therefore, it is essential that participation up to the lowest level in the enterprise be ensured to make the people committed to the budgets. Everybody in the organisation should understand his role in achieving the budgeted targets.

7. Support of the Management:

The top management in the organisation supports a good system of budgetary control. Top management in the organisation should take the preparation of budgets and their implementation seriously in order to achieve the objectives of the enterprise.

8. Flexibility:

ADVERTISEMENTS:

Budgets should not be rigid, but flexible enough to allow altering or remodelling in the light of any change in circumstances in the organization. Budgets are a means to an end. They must be flexible to achieve the desired objectives in the organisation. A good system of budgetary control allows sufficient flexibility to the persons concerned with the implementation of budgets in the organisation.

Precautions in the Use of Budgets:

Following precautions could be taken while preparing and using budgets for the purpose of managerial planning and control:

1. Estimates are not too high to be attained in the organisation.

2. Budgets are not prepared and installed hurriedly in the organization.

3. Administration and supervision of the operations are not insufficient in the organisation.

4. Organisational structure is not defective in the organisation.

ADVERTISEMENTS:

5. Accounting and cost systems are not inadequate in the organisation.

6. Statistics of past operations are not inadequate and unreliable in the organisation.

7. Results are not expected in too short period in the organisation.

Control through Costing:

Costing is concerned with cost determination and indicates what is the approximate cost of a process or a product under existing conditions in the organisation. Control though costing involves the control over costs in the light of certain predetermined costs usually known as standard costs in the organisation. Standard costs are predetermined operation costs computed to reflect quantities, prices and level of operations in the organisation.

Control through standard costing involves the following steps:

1. The standards are fixed for different components of cost separately in the organisation.

ADVERTISEMENTS:

2. Determining the actual costs to make a comparative study in the organisation.

3. A comparison between standard costs and actual costs is made in order to find out the variation between the two in the organization.

4. If the variation is beyond the specified limit, an attempt is made to locate the reasons for such a variation in the organisation.

5. In the light of the reasons identified, further course of action is planned so that in future there is no such variation in the organisation.

Break-Even Analysis:

The break-even analysis is basically concerned with the cost-volume-profit relationships in the organization. It magnifies a set of relationships of fixed costs, variable costs, price, level of output and sales mix to the profitability of the organisation.

The cost ingredients of the breakeven analysis are:

a) Fixed Cost,

b) Variable costs, and

c) Total costs.

Fixed costs are the costs, which generally remain constant and are independent of production levels. For example, cost of plant and machinery, cost of capital, and administrative salaries etc.

Variable costs are related to production and change with the production level. For example material costs, labour costs, maintenance and replacement of the parts costs etc.

Total costs are simply the sum of fixed costs and the variable costs associated with production.

The break-even point can be calculated by two different procedures:

(i) Algebraic break-even analysis.

(ii) Graphical break-even analysis.

Algebraic Break-Even Analysis:

The break-even point is the point at which no profit or loss. Mere Total Cost will be equal to total revenue (TC-TR). The break-even point can be computed by using the following formula.

BEP = TFC / (P-VC) Where,

BEP = Level of production in units at which the organisation breaks even.

TFC = Total fixed cost of production.

P = Sale price per unit of the product.

VC = Variable cost associated with each unit produced and sold.

Example: production of good has incurred a total fixed cost of Rs. 200,000. Variable costs of each product is Rs. 10, and net sales price of the product has been established at Rs. 20.

So the BEP = TFC/(P-VC) = 200,000/(20-10) = 20,000 units.

If the manufacturer sells 20,000 units, there will not be any profit or loss.

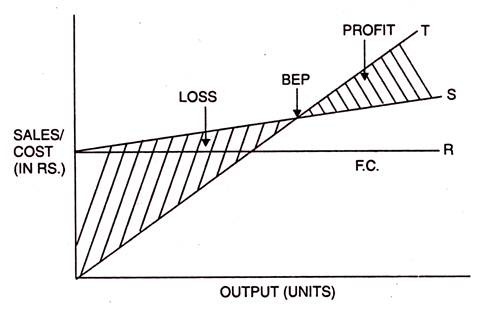

Graphical break-even Analysis:

In the geographical break-even analysis, a graph is constructed which shows all critical elements and their relationship. Here BEP will be achieved at which the total costs line and total revenue line are crossed each other. It can be shown as follows, take above example.

PQ represents the fixed cost and QR is the straight line, which shows fixed cost. (Amount Rs. 200,000). QS represent the total costs which is the combination of variable cost and fixed costs. PT represents the total revenue line.

Statistical Data:

Statistical analysis of the innumerable aspects of a business operation is important to control in the organization. Analysis in terms of averages, percentages, ratios, correlation provides help for control in the organisation. Such areas of control are production planning and control, quality control, inventory control etc., in the organisation.

Audit:

Internal audit, now coming to be called operational audit, is an effective tool of managerial control in the organisation. Internal audit feeds managers with a continuous supply of control information in the organisation. By measuring performance and evaluating results in the light of the standard, internal audit makes suitable recommendations for managerial actions in the organisation.

Personal Observation:

There are certain kinds of impression and information that can be conveyed only through face-to-face contact, personal observation and conversation in the organisation. When a man is now to the job, a supervisor will like to watch his work more closely than he would that of an experienced operator in the organisation.

Managers, in the organisation after all, have responsibility of achieving organisational objectives whatever control devices they use.

Profit and Loss Control:

It implies control through comparison and analysis of profit or loss of different departments or divisions or branches of the organisation, a separate pro-forma profit and loss statement is prepared for each product line or branch. The actual expenses and revenues are then compared with the estimates. Any deviations are analysed and suitable corrective actions are taken.

This method serves as a tool of forward control by enabling management to take measures of obtaining the desired results. But this method involves much paper work and duplication of accounting records. It is a time- consuming, expensive exercise. This method assumes that, there is enough decentralization of authority, but in practice many concerns do not decentralize authority.

Overall Control Criteria:

This method evaluates management’s total efforts. It is important in the case of large enterprises which have several autonomous units located in different parts of the country. Controlling overall performance is advantageous in that it encourages a manager to see the forest, not simply the trees.

The following are the tools of overall controlling:

1. Budgeting summaries, which are a resume of all individual budgets.

2. Written and comparative reports from different departments.

3. Inter-firm comparisons.

4. Internal audit reports.

5. Ratio analysis indicating trends in the profitability, liquidity and solvency of the business.

6. Value analysis used to judge relationship between cost and function of any product, material or service.

7. Control through key results areas example market position, productivity, product leadership, executive development etc.

Return on Investment:

Control through Return on Investment (ROI):

The efficiency of an organisation by the amount of profit it earns in relation to the size of its investments, popularly known as return on investment in the organisation. This technique does not emphasize absolute profit for judging the efficiency of an organization as a whole or of a division there of rather the amount of profit is related with the amount of facilities or capital invested in the organization or the division.

The goal of a business, accordingly, is not to optimize profit, but to optimize returns on capital invested for business purposes in the organisation.

Management Information Systems:

In an Industry in order to perform the control function effectively, managers need information accurately and timely to monitor progress toward their goals and turn plans into reality. Unless right information is given, managers in the organisation cannot stay on track or anticipate potential problems or decide corrective actions.

The information given is useful only when it is relevant, accurate, timely and right quantity. For that a formal system for the collection, processing, storage and retrieval of data is required to managers in the organization.

MIS is defined as the term as a system used to provide management with needed information on a regular basis. When data are analyzed and processes they become information. E.g., Library. It is a formal system for providing management with accurate and timely information necessary for decision-making.

Information is the life-blood of an organisation, particularly in the case of systems approach management in the organisation. Information can be defined as the knowledge communicated by others or obtained from investigation or study.

Management information system can be defined as the system of providing needed information to each manager at the right time in right form and relevant one, which aids his understanding and stimulates his action in the organisation.

Kennevans defines MIS as “organised method of providing past, present and projection information related to internal operations and external intelligence in the organisation. It supports the planning, control and operational functions of an organisation by furnishing uniform information in the proper time frame to assist the decision making process.”