This article throws light upon the top three types of control methods in an organisation. The types are: 1. Non-Quantitative Methods of Control 2. Quantitative Control Techniques 3. Using Budgets and Budgetary Control.

Type # 1. Non-Quantitative Methods of Control:

Non-quantitative methods of control are those which are used by managers in performing other managerial functions, viz., planning, organising, staffing and leading (directing). In general, these lead to control of overall performance of an organisation. Most of these techniques are directed towards controlling employees’ attitudes and performance.

For controlling overall organisational performance, the following techniques are frequently and widely used:

(1) Observation,

ADVERTISEMENTS:

(2) Periodic or ‘spot’ inspections,

(3) Oral and written reports,

(4) Performance evaluations, and

(5) Discussion between the manager and employees involved in performing an activity.

ADVERTISEMENTS:

The general purpose of these measures is to supervise or lead the work force.

A few other management systems and methods that are used for control purposes include management by objectives (MBO), management by exception (MBE), and management information systems (MIS).

Type # 2. Quantitative Control Techniques:

These techniques are based on specific data and quantitative methods to measure and correct the quantity and quality of output.

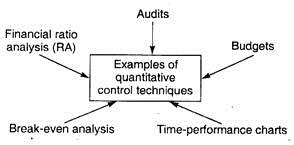

The techniques widespread today, as shown in Fig. 18.1, are the following:

ADVERTISEMENTS:

1. Budgets such as:

(i) The regular operating, capital expenditure, sales and cash budgets; and

(ii) Specialized budgets such as planning-programming-budgeting systems (PPBS), zero- base budgeting (ZBB), and human resource accounting (HRA).

2. Control Centres.

ADVERTISEMENTS:

3. Audits such as:

(i) Internal audits,

(ii) External audits, and

(iii) Management audits.

ADVERTISEMENTS:

4. Ratio analysis (RA).

5. Break-even (BE) analysis.

6. Time-preference charts and techniques such as:

(i) The Gantt chart,

ADVERTISEMENTS:

(ii) Programme Evaluation and Review Technique (PERT) and

(iii) The Critical Path Method (CPM).

Fig. 18.1 : Quantitative Control Techniques

Type # 3. Using Budgets and Budgetary Control:

ADVERTISEMENTS:

The primary financial control for every organisation is the budget. The budget is the most widely used technique of control in both business and government. A budget is both a plan and a control inasmuch as the preparation of budgets is an integral part of the planning process and the budget itself is the end point of the planning process, that is, the statement of plans.

In fact, some managers even refer to their budgetary controls as profit plans.

A budget is an estimate of income or expenses for a specific time period (say, a year, a quarter, or a month); and the particular estimates it contains become the standards against which future performances will be measured and evaluated.

If revenues (income) drop, expenditures should probably be curtailed. On the contrary, if actual expenditures exceed the expected figures, either additional revenue must be generated or expenditures have to be reduced.

Budgets usually require input from those whose activities will be funded and they, in turn, will control the budgets. Grassroots budgeting asks each manager to project his(her) unit’s need for funds in specific categories — such as wages, salaries; supplies, etc. As these projections move up the management hierarchy, they are consolidated and become the budgets for even larger units within the organisation.

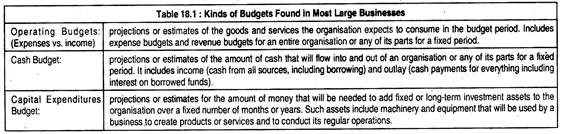

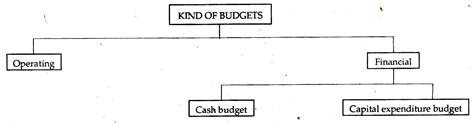

The three major varieties of budgets prepared in most large organisations are described in Table 18.1. These budgets are representative of an organisation’s comprehensive budgeting programme.

Capital expenditures budget programme has two broad components as shown below:

Operating budgets include expense and revenue budgets for an entire organisation or any of its parts for a fixed period of time.

Financial budgets are represented by the cash and capital expenditure budgets, which furnish detail about two things:

(1) Where the organisation intends to spend its money;

and

ADVERTISEMENTS:

(2) Where this money will come from.