Everything you need to know about the types of incentives schemes to motivate employees. In words of Burak and Smith, “An incentive scheme is a plan or programmes to motivate individuals for good performance.

An incentive is most frequently built on monetary rewards, but includes a variety of non-monetary rewards or prizes.”

It is responsibility of management to attract and retain the employees, whose performance meet at least minimum levels of acceptability.

In order to motivate employees, the management tries to satisfy their needs. The objective which are used to satisfy needs are called incentives.

ADVERTISEMENTS:

In general, incentives are applicable to all employees of the organisation but only paid to specific employees whose work is above standard.

The types of incentive schemes are broadly classified into two categories:-

1. Individual Incentive Schemes 2. Group Incentive Schemes.

The individual incentives are further sub-divided into:-

ADVERTISEMENTS:

A. Time-Based Individual Incentive Bonus Scheme

B. Output-Based Individual Incentive Bonus Scheme. Some of the time-based individual incentive bonus schemes are:- i. Halsey’s Time-Based Incentive Bonus Plan ii. Rowan’s Time- Based Incentive Bonus Scheme iii Emerson’s Output Plan iv. Bedeaux’s Efficiency Plan.

Some of the output-based individual incentive bonus scheme are:- i. Taylor’s Differential Wage Plan ii. Merrick’s Multiple Piece Rate Plan iii. Gantt’s Task Based Bonus System.

The group Incentive schemes are further sub-divided into:- a. Priestman Plan b. Scanlon Plan c. Productive Bargaining. d. Co-Partnership. e. Profit-Sharing.

Types of Incentive Schemes to Motivate Employees – Individual and Group Incentive Schemes

Types of Incentive Schemes – With Merits and Demerits

According to National Commission on Labour, “Wage incentives are extra financial motivation. They are designed to stimulate human effort by rewarding the person over and above the time related remuneration, for improvements in the present or targeted results.”

ADVERTISEMENTS:

In words of Burak and Smith, “An incentive scheme is a plan or programmes to motivate individuals for good performance. An incentive is most frequently built on monetary rewards, but includes a variety of non-monetary rewards or prizes.”

According to Venkata Ratnam and Srivastava, “A wage incentive scheme is a method of payment for work of an acceptable quality produced over and above a specified quantity or standard.”

Thus, incentives include the monetary and non-monetary rewards given to employees in excess of time based rate for performing exceptionally excellent tasks.

ADVERTISEMENTS:

Incentive plans or incentive schemes are the plans or methods according to which incentives are calculated.

According to incentive plans, a worker gets not only wages at normal rate but along with that he is paid bonus or premium as incentive for good performance.

It is responsibility of management to attract and retain the employees, whose performance meet at least minimum levels of acceptability. In order to motivate employees, the management tries to satisfy their needs. The objective which are used to satisfy needs are called incentives. In general, incentives are applicable to all employees of the organisation but only paid to specific employees whose work is above standard.

Incentive bonus schemes of two types:

A. Individual Incentive Bonus Scheme:

ADVERTISEMENTS:

1. Time-Based Individual Incentive Bonus Scheme:

I. Halsey’s Time-Based Incentive Bonus Plan:

Incentive Bonus based on Time Saved in Performing Standard Task:

Time-based incentive bonus plan was formulated by Frederick A Halsey (1856-1935), a mechanical engineer of America. It is a simple combination of time and piece wage plan.

ADVERTISEMENTS:

Under this plan, bonus is paid to a worker if he performs any task, process or operation in less time than the standard time prescribed for the purpose. There is no bonus if he consumes the standard time in completing the assigned task and even if he completes more than the assigned task. He will only be paid wage calculated as per fixed time rate.

Bonus will become payable to him only if he completes the assigned task in less than the standard time. The bonus in such a case will be calculated at equal to 50% of the value of the time saved. The worker will get the bonus even if he takes more than the standard time in performing another task. Halsey’s plan divides the benefit of increased productivity between the employer and the worker on an equal basis.

Calculation of Bonus under Halsey Plan:

A worker’s bonus and total earnings in the Halsey plan are calculated as follows:

ADVERTISEMENTS:

Bonus = 50% (Timed saved × Time rate)

Total earning = Time rate × Time taken + 50% of

(Time saved x Time rate)

Let us take an illustration. Suppose, time rate is Rs. 30 per hour, and the time allowed (i.e., standard time) for a given task is 7 hours. Now, suppose a worker completes the task in 6 hours. He has saved one hour.

His bonus and total earnings will be calculated as under:

Bonus = 50% (Time saved × Time rate)

ADVERTISEMENTS:

= 50% (1 hour × Rs. 30)

= 50% (Rs. 30.00)

= Rs. 15.00.

Total earnings = 6 hours × Rs. 30.00 + Rs. 15 = Rs. 195.

(a) It is easy to understand and simple to implement.

ADVERTISEMENTS:

(b) It guarantees a minimum wage to all. Thus, untrained or relatively inefficient workers will have nothing to lose.

(c) The benefit resulting from saving in time is equally divided between employer and the worker.

(d) Bonus in respect of each job is not allowed to be adjusted against excess time taken by him on another job.

(e) It encourages workers to improve their performance level.

(a) Efficiency of worker is not fully rewarded. In fact, after a point, he has no incentive to work harder.

ADVERTISEMENTS:

(b) It is not favoured by employers because if the normal wage rate itself is high, payment of bonus will create additional burden for them.

(c) It does not do justice to efficient workers. The time saved is wholly due to their efficiency and hard work, the employer unjustly takes away 50% of the resulting benefit.

II. Rowan’s Time-Based Incentive Bonus Scheme:

Similar to Halsey Plan Except for Difference in Calculation of Bonus:

Time-based incentive bonus plan formulated by James Rowan is similar to the Halsey plan. The only difference is in the method of calculation of bonus. Thus, under Rowan plan, if the worker completes the work in less than the standard time, then in addition to the hourly rate of wage, he receives a bonus equal to that proportion of the wages of time actually taken which time saved bears to the standard time.

Calculation of Bonus and Total Earnings under Rowan Plan:

ADVERTISEMENTS:

The formula for calculation of bonus and total earning under Rowan plan is as follows:

Bonus = Standard time (S) minus Actual time taken (T) divided by Standard time (S) and multiplied by Actual time taken (T) × Hourly rate (R)

Total earning = Actual time taken (T) × Hourly rate (R) + Standard time (S) – Actual time taken (T) divided by Standard time (S) × Actual time taken (T) × Hourly rate (R).

Let us take an example. Suppose, the time rate is Rs. 15 per hour, standard time is 10 hours, and a worker takes 8 hours to complete the task.

The amount of bonus payable and his total earnings would be as follows:

Percentage of Timed saved (2 hours) to Standard time (8 hours) = 2/8 × 100 = 25%

ADVERTISEMENTS:

Therefore, Bonus = 25% of Rs. 30 (i.e., Time taken × Time rate for 6 hours (Rs. 15 × 6) = Rs. 7.50.

Total Earning = 6 hours × Rs. 30.00 + Rs. 7.50 = Rs. 187.50.

(a) Like Halsey plan, Rowan plan provides the worker a guaranteed minimum wage as also an incentive to work better.

(b) It is favoured by employers for the reason that bonus can never reach 100% of the time wage which is likely under the Halsey Plan.

(c) It is preferred by employers because they get a larger share of benefits arising from the time saved, and they can increase production to any limit.

(d) It discourages the worker from over-exerting himself. This is because up to 50% of the standard time saved by him in performing the task, he become entitled to a larger amount of bonus as compared to the Halsey plan, but if he saves more than 50% of the standard time, there is a gradual decrease in the amount of bonus.

(a) Workers find it difficult to understand the calculation of bonus under the Rowan plan. They may suspect the employer’s motive in working the plan.

(b) It lacks simplicity and involves high costs of operation.

(c) It is unjust to efficient workers. This is because it rewards them adequately only to the extent that the time saved by them is 50% of the time allowed. If a worker exceeds this point, the amount of bonus in his case would gradually decline.

III. Emerson’s Output-Based Incentive Bonus Plan:

Guaranteed Minimum Day Wage Plus a Differential Piece Wage:

The incentive bonus plan formulated by Harrington Emerson (1853-1931) is a mix of guaranteed minimum day wage and a differential piece rate. Under it, a certain quantity of output is regarded as standard output. If a worker achieves two-thirds of the standard output, he is treated as an average worker and paid the guaranteed minimum wage, but no bonus. As the quantity of his output crosses the two-thirds mark, he becomes entitled to bonus, which increases progressively as he approaches the standard output.

Main Features of Emerson’s Plan:

The main features of this system may be summarized as follows:

(a) Minimum day wage is guaranteed to each worker.

(b) The standard output fixed in the case of each category of worker is regarded as the sign of 100% efficiency.

(c) A worker becomes eligible for bonus only after his output exceeds two-thirds (66.67%) of the standard output.

(d) The amount of bonus increases in a pre-determined ratio, and it may go up to, and even exceed 100% efficiency level. For different levels of efficiency between 66.67% and 100% of standard output, there are different rates of bonus. A worker producing 100% of the standard output gets 20% over and above the minimum wage rate. For a worker who achieves more than 100% output, in other words, if he produces more than the standard output, there is an extra 10% of the minimum daily wage for every increase of 1% in production.

Calculation of Bonus under Emerson Plan:

Let us take an illustration. Suppose, the standard output for a week of 6 days is 100 units, and the minimum daily wage rate is Rs. 200.00. Now, if a worker produces only 50 units in a week, he will be only paid the guaranteed minimum wage of Rs. 1200.00 (6 days × Rs. 200.00) but no bonus, because his efficiency level is below 66.67% of the standard output.

On the other hand, if he is able to produce 90 units in a week, he will be paid not only the minimum wage of Rs. 1200.00, but also bonus at a predetermined rate (say 10% of the minimum wage). As a result, his total earnings would amount to Rs. 1320.

If the worker produces 100 units, i.e., the standard output, he will get Rs. 1200as minimum day wage plus 20% of the minimum wage, so that his total earning would rise to Rs. 1440.

(a) It is easy to understand and simple to implement.

(b) It provides an incentive even for the beginners and less efficient workers.

IV. Bedeaux’s Efficiency Bonus Plan:

Standard Time Divided into Standard Minutes, Each Minute Called Bedeaux Points, or ‘B’s:

Under the incentive bonus plan formulated by Charles Bedeaux (1886-1944); standard time fixed for a job is divided into standard units, called Bedeaux Points, or simply B’s. These are supplied by experts working in the Bedeaux Company. For determining B’s for each type of work involving different degrees of strain, there is thorough analysis of the work and provision is made for rest period for worker if the work is strenuous.

The B’s earned by a worker is mentioned in his job ticket.

Payment of Minimum Day Wage only Until Worker Reaches 100% Efficiency; Thereafter Worker gets 75% of Bonus and his Foreman, 25%:

A worker is only paid minimum day wages till he reaches 100% efficiency level.

Bonus under this system is calculated as a percentage (usually 75%) of the hourly rate for the time saved. Obviously, bonus is paid in addition to the time rate for the actual time taken.

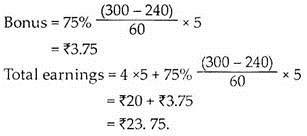

Bonus and total earnings are calculated as per the following formula:

Bonus = 75% (Standard Time – Actual Time Taken) × Hourly Rate

Total Earnings = Time Taken × Time Rate + 75% (Standard Time – Time Taken) × Hourly Rate.

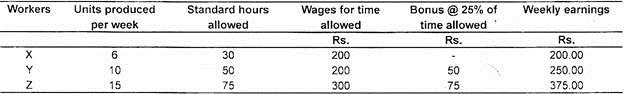

To take an example, suppose 300 B’s (i.e., 5 hours) are regarded as the standard time for a job, and is fixed as the hourly time rate. If a worker takes 4 hours to complete his job, then he will be saving one hour, i.e., 60 B’s.

His bonus and total earnings will be calculated as follows:

Merits of Bedeaux Plan:

(a) The plan assures a minimum wage to all workers, thus eliminating anxiety caused to beginners and less efficient workers.

(b) As foreman gets 25% of bonus, i.e., 25% of wages for the time saved by worker, he motivates workers to achieve higher productivity.

(c) It is especially useful where workers are often shifted from one job to another, carrying different B’s.

(a) The standard task may be too difficult to perform within the given standard time.

(b) Determination of bonus becomes a complex exercise for both management and workers. Management needs to hire clerks to calculate bonus and workers are unable to understand the complexity involved in the process.

(c) Workers dislike 25% of their bonus going to foreman.

(d) If the hourly rate is already too high, the plan loses its incentive value.

2. Output-Based Individual Incentive Bonus Schemes:

I. Taylor’s Differential Wage Plan:

F.W. Taylor’s wage plan is one of the earliest incentive wage plans. It was devised as a part of the scheme of Scientific Management. In essence, it is a piece rate method of wage payment where the rate of payment increases as the worker speeds up his work performance. In this respect, it is different from other incentive bonus schemes under which the rate falls as the work gets completed. The Taylor System offers an even greater incentive than straight piece-rates to the really efficient worker.

Two Piece Rates for Standard and above Standard and another for Below-Standard Performance:

The standard task is set after a careful time and motion study. There are two piece rates—one for below standard performance, and the other for the standard or above-standard performance.

The main features of this scheme are as follows:

(a) There is no guarantee of payment of minimum daily wage.

(b) There is a standard time set for completion of the standard task.

(c) There are two piece rates. If a worker performs the task within the standard time, he is paid at the higher piece rate. If he fails to do so, he receives the lower piece rate.

Let us take an example. Suppose, the standard output is fixed at 10 units a day, and the two piece rates are- (a) Rs. 10.00 per unit for 10 units or more; and (b) Rs. 7 per unit for less than 10 units.

If a worker produces 10 units, he will get Rs. 100 and if he produces 12 units, he will get Rs. 120.00. But in case he produces only 8 units, the lower piece rate of Rs. 7 per unit will be applied to him and he will receive Rs. 56.00 only.

Merits of differential Wage Plan:

(a) It is easy to understand and simple to implement.

(b) It offers an attractive incentive to the efficient workers.

(c) It is favoured by employers because by offering higher rates to efficient workers, they can increase the output.

(d) There is not much impact on the cost of production per unit as there is also increase in the quantity of goods produced.

Demerits of differential Wage Plan:

(a) It strikes at the root of labour unity and solidarity. By paying a higher rate to efficient workers and lower one to less efficient workers, it sows the seeds of division between them. Those who are paid less are obviously jealous of those who are paid more.

(b) It severely punishes the slow and inefficient workers. Even the slightest fall from standard output may drastically reduce their earnings.

(c) It offers no minimum daily wage. In the event, it creates a sense of insecurity among workers.

(d) Because there are two different rates for two different levels of performance, it is not easy to determine the labour costs accurately.

II. Merrick’s Multiple Piece Rate Plan:

Improved Version of Taylor’s Differential Wage Plan:

Merrick’s multiple piece rate plans is less harsh on the beginners or less efficient workers; but it is generous towards the efficient ones. Like Taylor’s plan, here also a standard task is set for workers. The difference is in respect of the number of piece rates. In the Taylor’s plan there are two piece rates, while in Merrick’s there are three.

Average Rate for Less Efficient and Higher Rate for Efficient Workers:

Accordingly, the lowest rate is for beginners and less efficient workers, i.e., those who achieve up to 83% of the standard task. For average workers, who achieve between 83% and 100% of the standard task, there is an average rate which is also referred to as the minimum rate. For efficient workers, who achieve more than the maximum level of standard task, there is a higher rate.

(a) It is easy to understand and simple to operate.

(b) It offers a strong incentive to the more efficient or experienced workers and at the same time, provides the minimum needs of beginners and less efficient workers.

(a) The lines between inefficient, average and efficient workers are rather arbitrarily drawn, a worker achieving up to 83% of the standard output is treated as inefficient worker, but the moment he moves up by just 1%, he becomes an average worker. Likewise, an average worker will be paid like an average worker until he achieves up to 100% of the standard task. He will be paid at the rate prescribed for an efficient worker only when he exceeds 100% of the standard task.

(b) Multiplicity of wage rates makes it impossible to accurately ascertain the labour costs of a project.

III. Gantt’s Task Based Bonus System:

Large Bonus Payment for Hard or Rigorous Tasks:

This system of wage payment is named after H.L. Gantt, an American, who first formulated it. Known as the task bonus system, it offers the worker a large bonus if the standard task is rigorous—usually doubly hard than what is given to an average worker. Another stern feature of the system is that a worker will be denied bonus even if he has missed the target by a negligible margin.

Main Features of Gantt’s System:

The main features of the system are:

(a) It combines three-in-one, i.e., time rate, differential piece rate and bonus.

(b) It guarantees minimum daily wage.

(c) If the standard task is very hard to perform, it demands double the efficiency and diligence as compared to an average worker.

(d) If the standard task is completed within the standard time, the worker becomes entitled to bonus at a high rate. If he does not, he is not paid any bonus.

(e) The bonus is a fixed percentage of the time taken in completing the task.

(f) If a worker accomplishes the standard task within the stipulated time, he is paid a bonus which is usually @ 20% of his time rate. In case his performance is better than the standard, he is paid at a higher piece rate on the whole of his output.

Let us take an example. Suppose, the standard task is set at 10 pieces per week, and the weekly minimum earnings are fixed at Rs. 200. Suppose, the standard time per piece is 5 hours and the piece rate is Rs. 20.00. Suppose further, that bonus is fixed at 25% of the time allowed. Now, see how a worker with different levels of output and timing would be paid under this plan.

Merits of Gantt System of Wage Payment:

(a) It is easy to understand and simple to implement.

(b) It guarantees minimum day wage to all workers, whether efficient or not. However, it offers a strong incentive to efficient workers who are paid a higher rate of bonus.

(c) It induces foreman to exercise better supervision. This is because if workers qualify for bonus, so will the foreman.

(d) It helps management save on high expenditure on overheads.

Demerits of Gantt System of Wage Payment:

(a) If the minimum day wage rates are already high, workers may take it easy and not bother about improving their performance.

(b) There is a wide difference between wages earned by average performers and efficient performers. This may create jealousy and bad blood among them.

(c) It disturbs unity and solidarity of workers.

B. Types of Group Incentive Bonus Schemes:

There are different types of group incentives schemes, important among them being as follows:

This system of wage payment was first used by Priestman’s of Hull in 1917. It is applied to workers who work in groups. It provides for payment of group bonus in addition to the ordinary time wage rate.

For example, if during any year an organization achieves the predetermined standard output, or exceeds the previous year’s output, workers are paid increased wages in the same ratio in which output has increased. Thus, if in 2015, the output per worker-hour was 10 units, and in 2016 it rose to 11 units per worker-hour, the wages in 2016 would be 10% higher as compared to wages paid in 2015.

A plus point of this system is that it inculcates team-spirit among the workers of a group. If the group as a whole works efficiently, it would raise overall output of the organization and in that case all workers would stand to benefit. But it may not motivate individual workers who are more efficient in terms of skills and performance, than others in the group.

Named after Mr. Joseph Scanlon of the United Steel Works of U.S.A., this plan is by far the most popular for sharing gains attributable to increase in productivity. It provides for payment of 1% participating bonus for every 1% increase in productivity. The benefit is extended to all employees, except the top level management.

Under this plan, workers are not paid the entire amount of bonus earned by them in any month. One half of the first 15% of such bonus is set apart for creation of a Reserve Fund and the fund is utilized to neutralize the effects of any fluctuations in labour costs. In case a part of the fund remains unused, it is distributed among workers in the last month of the year and then a new fund is created for the succeeding year.

The management and workers of an organization may reach an agreement under which workers agree to give up negative and wasteful practices such as “go-slow” and “work-to-rule” and, in return, the management agrees to link wages and concessions to resulting increase in productivity.

However, for this scheme to succeed there needs to be a strong workers’ union to motivate its members to honour the agreement. In case there are too many unions and they do not see eye to eye with one another, or if they work under the influence of outsiders, such agreement will have little chance of success.

Under co-partnership arrangement, senior and highly-paid workers are given an option to buy shares of the organization at concessional price and pay for it in instalments. The recently developed concept of sweat equity works along the same lines.

The assumption underlying the co-partnership arrangement or sweat equity is that workers- turned-stakeholders will put in greater effort to make the organization more profitable and gain recognition in the market.

The management, on its part, can cite co-partnership or sweat equity as proof of its benevolence and worker-welfare-oriented outlook.

Merits of Group Incentive Bonus Schemes:

(1) Promotion of Spirit of Cooperation and Team-Spirit:

Group bonus schemes create a ‘one for all and all for one’ feeling among workers. They help one another in performance of the assigned tasks, being aware that this will enable the organization to earn increased profits and distribute a part of it as bonus among workers.

(2) Low Absenteeism among Workers:

Group incentive bonus scheme promotes a spirit of co-operation and team-work among workers. They rarely, if ever, absent themselves from work for fear of criticism from co-workers and a genuine apprehension that their absence from work will harm their individual as well as group interests.

(3) Reduction of Expenditure on Clerical Work:

Group incentive bonus schemes result in saving on expenditure on maintaining records of output of individual workers. This is because the record of output of a group, and not of its individual members, needs to be maintained.

(4) Minimum Expenditure on Supervision of Workers:

Group incentive bonuses schemes help reduce the cost of supervision. In fact, they turn every worker into an alert and active supervisor himself. As it happens, lazy and inefficient workers are better supervised by co-workers, than by a supervisor especially appointed for the purpose.

(5) Beneficial for Indirect Workers too:

Often the coverage of incentive bonus schemes is extended to workers who do not directly contribute to performance of the standard tasks. They are made members of one group of workers or another.

Demerits of Group Incentive Bonus Schemes:

(1) Unfair to Sincere, Efficient and Ambitious Workers:

Group incentive bonus schemes do not discriminate between competent and sincere workers and those who do not pass this test. Sincere hardworking workers have to suffer low amount of bonus because of laziness or inefficiency of their fellow-workers.

(2) Sincere, Hardworking Workers Not Favourably Inclined:

Workers, particularly the hard-working and efficient among them, are not inclined to accept such schemes. Why, they justifiably ask, under-performers should enjoy the right to share in the gains largely attributable to their performer colleagues?

(3) Difficult to Frame a Reasonable Scheme:

It is not easy to determine the amount of incentive bonus for each group and fix the amount of incentive for each group and evolve an acceptable formula for its distribution.

(4) Amount of Bonus Not Sufficiently Motivating:

The amount of bonus per individual may turn out to be too small, and therefore lose its motivational value.

Types of Incentive Schemes – 2 Important Schemes: Individual and Group Incentive Schemes (With Advantages and Disadvantages)

There are following types of Incentive Schemes:

1. Individual Incentive Schemes

2. Group Incentive Schemes, and

These are discussed now in detail:

Type # 1. Individual Incentive Schemes:

Incentives schemes are many and varied. The International Labour Organisation (ILO) classifies all the schemes of payment by results into four categories.

They are:

(i) Incentives schemes where the workers’ earnings vary in the same proportion as output.

(ii) Schemes where earning vary proportionately less than output.

(iii) Schemes where earnings vary proportionately more than output.

(iv) Schemes where earnings differ at different levels of output.

(i) Schemes with Worker’s Earnings Varying in the Same Proportion as Output:

a. The Straight Piece-Work System:

This is perhaps the earliest, most common and simplest system, which may be applied either to individuals or to groups of workers. The worker is paid at a specified rate per unit of output measured in terms of quantity of output, e.g., tons of coal, number or pieces of garments. Direct labour cost per unit thus remains constant, but as output increases above standard, total cost per unit decreases since the incidence of fixed and semi-variable overhead per unit decreases.

The workers’ time rate is guaranteed and with a guaranteed time rate the earnings curve for rates of output below standard is horizontal up to standard output, at which it becomes a straight line having a slope of unity. This means that if there is one per cent increase in output it would results in one per cent increase in earnings.

b. The Standard Hour System:

This system, which is also known sometimes as the standard time, piece-work, or 100 per cent gain sharing system is strikingly similar to the straight piece work, except that here a standard time is allowed to complete a particular job and the worker is paid wages for the standard time, at his time rate if he completes the job in standard or less time. Thus if a man completes in eight hours a job for which die standard time is ten hours, his earnings for this job will amount to ten times his time rate.

On the other hand if he takes more than the standard time to complete the job and there is guaranteed time wages, he will be paid at this rate for the time he actually spent on the job. But if there is no such guaranteed time rate, he will be paid only for the standard time.

(ii) Schemes with Workers’ Earnings Varying Proportionally Less than Output:

These systems are often referred to as sharing plans, because the worker’s earning vary proportionally less than output and the worker shares with his employer the gains or losses resulting from changes in output.

a. Halsey System:

Under this system, a standard time is allowed for a job. For work done in correct time or more, the actual time rate is paid. Thus the minimum wage is guaranteed even if the output falls below standard. If the job is completed in less than standard time, the worker receives as a bonus a payment at his time rate for a specified percentage of the time saved. This percentage may vary anywhere from 30-70% but it is usually fixed at 50%. Hence it is also known as fifty-fifty incentive scheme.

b. Rowan System:

Under this system also a standard time is allowed for a job and a bonus is similarly paid for any time saved. This percentage is equal to the proportion which the time saved forms of standard time.

c. Barth Variable Sharing System:

This system is similar to Rowan and Halsey plans, but does not provide for a guaranteed time rate. The worker’s pay is ascertained by multiplying the standard hour by the number of hours actually taken to do the job, taking the square root of the product and multiplying by the worker’s hourly rate. It is bit difficult to calculate and understood by workers. So not in use much.

(iii) Systems with Worker’s Earnings Varying Proportionally More than Output:

The chief characteristic of these systems is the direct labour cost per unit increase for levels of output above the standard, which is usually set quite high. The worker also shares the savings in overhead costs which result from increased output. The amount of his share depends on the size of the increments in earnings which are payable at different levels of output.

If these increments wore large enough and increased progressively with output, it is obvious that the worker could obtain all the savings in overhead costs. This is not of course, the case where the increment earnings remain the same for each successive increase in output, i.e., where the earnings curve is a straight line.

(iv) Earnings Varying in Proportions which Differ at Different Levels of Output:

Under these systems earnings vary from minimum to maximum at different levels of output. Earnings for one part of the range may vary proportionately less than output and for another part proportionately in die same proportion as output.

a. The Taylor Differential Piece Rate System:

This system developed by F.W. Taylor in 1880 has a low piece rate for output below standard and a higher piece rate for output above standard with a large bonus of 50% of the time rate when standard output is reached. This system therefore penalizes the low worker, but rewards handsomely to workers with a high output.

b. The Merrick Differential Piece Rate System:

This system is a modification of the Taylor system. Merrick suggested three rates instead of two. The one large step is broken into two so as to encourage new and average workers. Straight piece rates are paid up to 83% of the standard output, at which a bonus of 10% of time rate is payable, with a further 10% bonus on reaching standard output. For output above standard high piece rates are paid.

c. Gantt Task System:

The worker is guaranteed his or her time rate for output below standard. On reaching standard output or task which is set at a high level, the worker is entitled to a bonus of 20% of the time wages. For output above task high piece rates are paid.

d. The Emerson Efficiency Plan:

A standard time is established for each job. The efficiency of the worker is determined by dividing the time taken into the standard time. Up to 67% efficiency the worker is paid at this time rate and from this point up to 100% a bonus of 20% is paid. Thereafter an additional bonus of 1% is paid for additional 1% efficiency.

Type # 2. Group Incentive Schemes:

In many cases output of individual workers cannot be measured, but output of a group of workers can be conveniently measured. Under such circumstances group incentive plans are very useful.

The main purpose of introducing group and collective bonus system is to ensure production and to obtain better productivity. Group work creates a sense of mutual cooperation amongst workers, since the nature of work is inter-dependent Because of inter-dependence of work, workers and supervisors keep a watch over the work of another thereby ensuring good and speedy work. Group and collective bonus system proves very much beneficial for workers to whom no incentive wages can be given individually.

Absence of this inter-dependence may cause differences of opinion amongst the workers over the question of distribution of bonus, than that of the slower workers, thus giving rise to some discord. Sometimes equal apportionment or apportionment on the basis of worker’s guaranteed basic wages is the criterion suggested. But it is always advisable to settle the matter of group bonus through discussion with workers concerned so as to leave room for future disputes.

A number of group and collective bonus plans are in vogue:

(i) Priestman’s Production Bonus Plan:

This is a good example of group bonus plan. Usually under this plan, a committee representing the management and the workers’ union sets forth the standard of performance. This task standard is usually set in advance every week or every month. The task standard is set per unit of output either numerically or quantitatively.

Bonus is payable to that department which gives results higher than the standard output Bonus is calculated on the basis of the ratio of excess performance to standard task.

As per formula:

For example, if standard production in a month is 2,000 units and actual output is 3,000 units, the workers will be given a bonus equivalent to 50% for their wages, i.e., 1000/2000 x 100 = 50% of wages.

(ii) Cost Premium Plan:

Under this method if the actual cost of production is less than its standard cost of production a part of the saving is distributed among the workers as bonus. Before introducing this plan, the standard cost of production should be determined very carefully.

The Scanlon plan in the USA steel industry adopts such a plan. Here, a norm is fixed as a percentage between labour cost and production achieved at selling prices. If this percentage is reduced, bonus is paid to all workers.

(iii) Budgeted Expense Bonus:

Under this system bonus is based on the saving in actual total expenditure compared with the total budgeted expenditure. Its application is not limited to direct workers only. But it can be applied to indirect workers and staff too. The percentage of bonus will be pre-determined share of savings in budgeted expenditure.

(iv) Towne Gain Sharing Plan:

This group bonus system was introduced in 1896 by Mr. H. R. Towne in USA. The bonus is calculated on the reduction in costs as compared with a pre-determined standard. One half of the savings is paid to individual workers pro rata with the wages earned. The supervisory staff also receives a part of this bonus. Thus cost reduction is encouraged through their cooperation.

(v) Waste Reduction Plan:

This system provides incentive to workers with a view to reducing material waste to minimum. This bonus system is generally used in industries where cost of material is high. This scheme takes the form of waste reduction as a percentage of standard to pay the incentive.

(vi) Profit-Sharing Plan:

Under this scheme the workers get a share in profits of the undertaking in a predetermined ratio. This share is in addition to their normal wage. This is done with the expectation that the workers will be more cooperative when they get a share in the profits of the company.

The share of profit of the workers may be given under any of the following basic types of profit-sharing plans – (i) Current profits, i.e., in cash or in the form of shares in the company. These shares are called ‘bonus shares’. The form of profit-sharing is also called co-partnership since it gives workers permanent interest in the future of their organisation, (ii) Deferred profits – Worker’s accounts are credited by the profit amount. But the amount is paid either when they retire or under certain circumstances like severance, disability, death, etc. (iii) Combination of (i) and (ii) – Some portion is paid in cash and the balance deferred to be paid subsequently as under (ii).

Advantages of Group Bonus Plans:

(i) The calculation of wages requires less clerical work.

(ii) It increases production, reduces wastage and spoilage.

(iii) Each group enforces its own standards of efficiency and the production of the whole group is checked consequently and there is less supervision and inspection work.

(iv) It fosters cooperation and a team-spirit amongst workers.

(v) It guarantees time wages and hence it is safe from the workers point of view.

Disadvantages of Group Bonus Schemes:

(i) The amount of bonus received by industrial workers is sometimes insignificant so it does not motivate them.

(ii) The difficulty is not only about the amount of bonus but, its basis of distribution also.

(iii) It does not distinguish between efficient and inefficient workers in the group for the purpose of distributing bonus.