Alteration in the capital clause of Memorandum of Association of a company may be of the following types: 1. Alteration of Share Capital 2. Reduction in Share Capital 3. Reserve Capital or Reserve Liability 4. Variation of the Rights of Shareholders 5. Reorganisation of Capital.

Under Section 94 of the Companies Act, a company limited by shares may in general meeting, if so authorised by its Articles of Association, alter the capital clause of its Memorandum of Association in any of the following ways:

(i) It may increase its share capital by issuing new shares.

ADVERTISEMENTS:

(ii) It may consolidate and divide all or part of its share capital into shares of a large amount.

(iii) It may convert all or any of its fully paid-up shares into stock or reconvert that stock into fully paid-up shares of any denomination.

(iv) It may sub-divide its shares into shares of lower denomination.

(v) It may cancel those shares which have not been taken by any person and reduce the amount of its share capital.

Procedure:

ADVERTISEMENTS:

The following procedure should be followed for altering the share capital of the company:

(i) Authorised by article:

The right to alter the share capital must be given in the Articles of Association of the company.

(ii) To pass a resolution:

ADVERTISEMENTS:

Alteration can be effected in the capital by passing an ordinary resolution in the general meeting of the company.

(iii) Confirmation of court is not required:

For such an alteration of capital, the confirmation of court is not required.

(iv) Notice to the registrar:

ADVERTISEMENTS:

The company shall give notice of the alterations to the Registrar within 30 days of doing so.

(v) Change by registrar:

The Registrar will record the above notice and make necessary alterations in the memorandum and articles of the company.

(vi) Economic penalty:

ADVERTISEMENTS:

If any default is made in complying with the above provisions, the company and every officer of the company who is in default is punishable with a fine which may extend to fifty rupees for every day the default continues.

(vii) Effect of conversion of shares into stock:

If a company has converted any of its shares into stock, such provisions of the Act as are applicable only to shares shall cease to apply to such shares which have been converted into stock.

(viii) Information of increase in share capital:

ADVERTISEMENTS:

The information must be given to the Registrar within 30 days if the company has increased its authorised capital or, in the case of a company not limited by shares. Notice of the increase must be given to the Registrar even when the new shares may not have been issued to any shareholder, if default is made in complying with the provisions, the company and every officer who is in default is punishable with a fine, which may extend to Rs. 50 for every day the default continues.

A company limited by shares or a guarantee company with a share capital is permitted to reduce its share capital by Section 100 in any of the following ways:

(i) Extinguish or reduce:

By extinguishing or reducing the liability on any of its shares in respect of share capital not paid up.

ADVERTISEMENTS:

(ii) Cancel:

By cancelling any paid-up capital which is lost or unrepresented by available assets.

(iii) Pay off:

By paying off any paid-up capital which is in excess of the needs of the company.

(iv) By Court:

By any other method approved by the court.

Procedure:

ADVERTISEMENTS:

The following procedure is to be followed for effecting a reduction in share capital:

(i) Company limited by shares:

A company limited by shares or a guarantee company with a share capital is permitted to reduce its share capital.

(ii) Authorised by articles:

Reduction in share capital can be effected when it is authorised by Articles of Association of the company. If the articles do not give this power to the company, they may be altered by special resolution to enable the company to reduce its share capital. It is of no avail, where this authority is contained in the memorandum only.

(iii) To pass a special resolution:

ADVERTISEMENTS:

The company must pass a special resolution effecting the reduction in share capital.

(iv) An application to the court:

After having passed the special resolution for reducing the share capital, the company must apply to the court for an order confirming the reduction in share capital. The court must look after the interest of shareholders and creditors.

Interest of Creditors:

The special resolution of the company reducing the share capital must in all cases be confirmed by the court and the court is empowered to enquire into the objection that may be raised by the creditors in that behalf, unless the court directs not to make such an equity.

If the reduction of share capital involves:

(i) Diminution of liability in respect of unpaid share capital; or

ADVERTISEMENTS:

(ii) Payment to the shareholder of any paid up share capital; and

(iii) In any other case is the court so directs, every creditor of the company is entitled to object to the reduction.

Only such creditors are entitled to object the reduction to whom the company owes a debt which would have been provable in the winding up of the company.

The court should settle the list of creditors entitled to object and issue public notices fixing a day or days within which creditors who are entered on such list are to claim to be so entered or to be excluded from the right of objecting to the reduction.

Interest of Shareholders:

Before sanctioning the scheme of reduction of share capital, the court must also look after the interest of shareholders. Court should see that the scheme for reduction of capital is fair and equitable to all kinds of shareholders.

(i) Order confirming the reduction:

ADVERTISEMENTS:

The court may make an order confirming the reduction of share capital on such terms and conditions as it thinks fit, if it is satisfied that every creditor entitled to object has consented to the reduction or that his debt has been discharged or secured by the company.

(ii) To add “and reduced” word to the name of the company:

The court may also order the company to add the words ‘and reduced’ to the name of the company for such period as may be specified in the order, and these words will be deemed to be part of the company’s name for such specified time [Sec. 102].

(iii) Production of court order before the registrar:

The order of the court confirming the reduction must be produced before the Registrar and a certified copy thereof, along with minutes should be filed with him for registration. On such registration by the Registrar, the resolution for reduction of share capital as confirmed by the court takes place. Notice of the registration shall be published in such a manner as the court may direct.

The Registrar shall certify registration of the order and the minutes in hand. The Certificate of Registrar to this effect is a conclusive evidence that all the requirements of the Act regarding the reduction of share capital have been complied with and that the share capital is such as is stated in the minutes. (Sec. 103).

ADVERTISEMENTS:

Once the certificate has been issued by the Registrar, the reduction in share capital cannot be upset towards on the ground that the company had not by its Articles of Association the power to reduce its share capital or the special resolution for reduction was invalid.

Liability of Members on Reduction:

Section 104 of the Act provides for liability of members regarding the reduced shares. A member of the company shall be liable to make the payment of the amount deemed to have been unpaid on his shares, which would be equal to the amount deemed to have been paid up on his shares, and reduced value of shares as fixed by minutes of reduction. But in one case the members may be made liable to pay the original nominal value of shares.

This will happen when a creditor entitled to object to the reduction has been left out of the list of such creditors by reason of his ignorance of the proceedings and the company is unable to pay the amount of his debt. In these circumstances the court may order the members to pay upto the original nominal value of the shares held by them.

Reasons for Reduction in Share Capital:

1. The share capital of the company may be more than enough for its present and future needs, and so, it may return the surplus capital to the shareholders.

2. The paid-up capital of the company is sufficient and it may refrain from calling up the unpaid portion of share money.

3. Some of the capital may in fact have been lost or diminished e.g., share of Rs. 100 may represent assets worth Rs. 50. The company may wish to write off the lost capital.

Reduction under item (1) and (2) will reduce the funds available to the creditors. Reduction under item (3) affects the rights of different classes of shareholders as well as the interest of the members of the public who may be induced to take shares in the company.

Type # 3. Reserve Capital or Reserve Liability:

By Reserve Capital we mean that amount which is not callable by the company except in the event of the company being wound up. The company cannot demand the payment of money on the shares to that extent during its life time. Reserve Capital may be created by means of a special resolution passed by the company in its General Meeting by 3/4th majority of these voting on it.

When once the Reserve Capital has been so created the company cannot alter its Articles of Association so as to make the reserve liability available at any time. The Reserve Capital cannot be charged as security for loans by the creditors. It cannot be turned into ordinary capital without the order of the court. It cannot be cancelled at the time of reduction of capital.

The share capital is divided into different classes of shares which may have different rights attached to them, generally provided from the Articles of Association of the company. If the company wants to change the rights of any class of shareholders, the following procedure has to be followed.

(i) The provision with respect to variation of the rights of shareholders should be there in memorandum or articles of the company. In the absence of any such provision in the memorandum or articles, there should be nothing in terms of issue of shares of that class which prohibits such a variation.

(ii) The written consent of the holders of not less than three-fourths of the issued shares of that class should be obtained or the variation should be sanctioned by special resolution at a separate meeting of the holders of shares of that class [Sec. 106].

Where the rights of shareholders have been varied in pursuance of the above provisions, those who did not consent or vote in favour of the resolution for the variation may apply to the court to have the variation cancelled. Such an application can be made only by persons who held at least ten per cent of the issued shares of that class. The application shall be made to the court within 21 days after passing of the resolution or consent given as the case may be.

After hearing the applicant and any other person interested in the application, the court may if it is satisfied that the variation would unfairly prejudice the shareholders of the class presented by application, disallow the variation and shall, if not satisfied, confirm the variation. On any such application the decision of the court shall be final.

Company must file a copy of the order of the court with the Registrar within thirty days. If default is made a fine of upto Rs. 50 may be imposed. [Sec. 107].

Type # 5. Reorganisation of Capital:

The term arrangement includes a reorganisation of the share capital of the company by consolidation of shares at different classes, or by division of shares into different classes, or by both these methods [Sec. 380 (b)].

When a reorganisation of share capital of a company is proposed:

(i) Between a company and its creditors or any class of them, or

(ii) Between a company and its members or any class of them, the court may order a meeting of creditors or members of the company on an application by the company or by any creditor or members or by a liquidator in case the company is being wound up.

The reorganisation of share capital of a company shall be binding if the scheme is approved by a majority in number representing three fourths in value of the creditors or members, as the case may be present and voting in person or by proxy, where proxies are allowed, and the scheme is sanctioned by court. [Sec. 391].

Issue of Shares at a Discount [Sec. 79]:

Issue of shares at a discount means the issue price of shares is less than their nominal face value.

A company can issue at a discount (i.e., for a consideration less than the nominal value of the shares) subject to the following conditions:

1. Shares to be issued at a discount shall be of a class already issued.

2. The issue of shares at a discount is authorised by a resolution passed by the company in its general meeting.

3. The issue of shares at a discount must be sanctioned by the Company Law Board (CLB).

4. The resolution specifies the maximum rate of discount at which shares are to be issued. No such resolution shall be sanctioned by the Company Law Board if the maximum rate of discount specified in the resolution exceeds ten per cent, unless Board is of the opinion that a higher percentage of discount may be allowed in the special circumstances of the case.

5. One year must have passed since the date at which the company was entitled to commence business.

6. Shares are issued within two months after the date on which the issue is sanctioned by the Company Law Board unless the time is further extended.

7. Other conditions, if any, imposed by the Company Law Board at the time of sanction.

8. Every prospectus relating to the issue of shares shall disclose particulars of the discount allowed on the issue of shares or that amount which has not been written off at the date of the issue of prospectus.

The secretary of the company has also to do all general acts regarding issue of shares at discount in addition to the acts relating to the issue of share as discussed above.

Issue of Share at a Premium [Sec. 78]:

A company can always issue its shares at premium. In this case, the issue price of shares is higher than their nominal or face values. The difference between issue price and face value is called premium. The power to issue shares at a premium need not be given in the articles of the company.

The total premium amount shall be transferred to Share Premium Account which may be applied only for the following purpose and not for others:

1. To issue fully paid bonus shares to the members of the Company.

2. To write off preliminary expenses of the company.

3. To write off the expenses or the commission paid or discount allowed, on any issue of shares or debentures of the company.

4. To provide any premium on redemption of redeemable preference shares or debentures of the company.

In addition to the above acts regarding the issue of shares at a premium, the secretary of the company has also to do all general acts regarding the issue of shares at discount.

Further Issue of Capital Right Issue:

Section 81 of the Companies Act laid down the procedure for further issue of share capital after the first issue. When the shares are issued further by the directors, such further shares are offered to the existing equity shareholders of the company.

The conditions regarding further issue of share capital are as follows:

1. To pass a resolution:

To increase the share capital a resolution must be passed by the board of directors.

The further issue of share capital can take place after two years from the date of formation of the company and one year after allotment whichever is earlier. [Sec. 81(1)].

2. Increase in share capital:

The increase in the share capital must be of subscribed capital and not of authorised.

3. Further shares are offered to existing shareholders:

The further shares must be offered to the equity shareholders in proportion of capital paid by them on their shares.

A notice is being served by the company on the shareholders defining therein the number of shares offered and time which should not be less than fifteen days, must be given to give the acceptance. If the acceptance does not reach within the prescribed time then it is assumed that they do not accept the shares offered.

4. Right of renunciation in favour of others:

Unless the articles of the company otherwise provide the shareholders the right to renounce all or any of them in favour of any person he likes.

5. Power of board to dispose of shares:

When the time expires as given in the notice to shareholders, the board of directors may dispose of the shares in such a manner as they think appropriate. They may offer these shares to outsiders if a special resolution has been passed, then consent of Central Government is to be obtained.

The above provisions do not apply to a private company or in case of public company when increase of share capital takes place due to conversion of debentures or loans into shares.

Right Shares:

As per Section 81 of the Companies Act, when the unissued portion of the authorised capital is not issued earlier but is issued now, then the existing shareholders of the company have a first right to get them. This right is known as right of pre-emption, and the shares which are meant for existing shareholders are known as Right Shares.

The issue of right shares can be made at any time after the expiry of two years from the formation of the company or after the expiry of one year from the first allotment of shares after its formation (Whichever is earlier).

A meeting of board of directors should consider the proposal for right share and the terms of issue. A resolution should be passed in the general meeting of the shareholders for increase in share capital and a copy of resolution should be filed with the registrar within thirty days.

Bonus Shares:

The issue of bonus shares implies the payment of dividend in the form of shares instead of cash. A bonus issue occurs where the company does not distribute the profits and reserve by way of dividend, but retains them and uses them to make the payment for the issue of new fully paid shares. The shares so issued are called bonus shares. In case of bonus shares, shareholders have not to make any payment to the company.

The provisions, regarding the issue of bonus shares, are as follows:

1. The Company is authorised to issue bonus share or not.

2. The permission of ‘Controller of Capital Issues’ regardless of the amount involved should be obtained.

3. A meeting of directors should be held to consider the proposal for bonus issue and the proportion in which the same should be issued.

4. Notices should be issued to the members relating to the meeting.

5. A resolution in the general meeting should be passed. If it is a special resolution, a copy of it should be filed with the Registrar within 30 days.

6. The list of members showing their present shareholding and the number of bonus shares to which they are entitled should be prepared.

7. A public notice regarding the closure of Register of Members and Transfer Books for the purpose of issue of bonus share should be given. .

8. ‘Allotment letters’ to the members alongwith a circular explaining how the allotment has been made should be issued.

9. Necessary entries in the Register of Members should be made.

10 New share certificates should be prepared and issued.

11. Within 30 days of the allotment a ‘Return of Allotment’ should be filed with the Registrar.

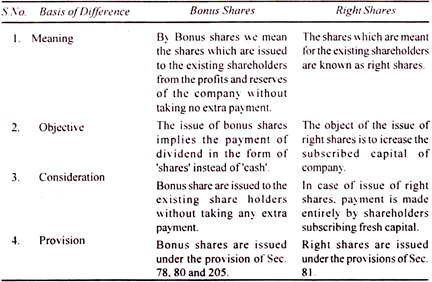

Difference between Bonus Shares and Right Shares:

The points of distinction between bonus and right shares are listed in the following table:

Power of Central Government to Convert Loans into Equity Capital:

The Companies (Amendment) Act, 1963, has empowered the Central Government to direct the conversion of its debentures or loans into Equity Share Capital on such terms and conditions as appear to government to be reasonable in the circumstances of the case, even if the terms of issue of such debentures or loans do not include a term providing for an option for such conversion. The power is to be exercised only if such conversion appears to be necessary in the interest of the public.

In determining the terms and conditions of such conversion the central government shall have due regard:

(i) To the financial position of the company,

(ii) Its liabilities,

(iii) It reserves,

(iv) Its profits during the preceding five years,

(v) The current market price of the company’s shares, and

(vi) The terms of the issue of the debentures or loans.

If the terms and conditions proposed by the government are not acceptable to the company, it may within thirty days, from the date of receiving the said order, or within such extended time as may be granted by the court, prefer an appeal to the court and the decision of the court shall be final and conclusive.

Restriction on Purchase by a Company of its Own Shares:

According to section 77, it is not open to a company, (whether public or private) to purchase its own shares, for it involves a reduction in capital which is not allowed except when the capital of the company is legally reduced in pursuance of Sections 100 to 104 or Section 402. Under Sections 100 to 104, it is provided that a special resolution and sanction of the court are needed for any reduction of share capital.

Section 402 provides that a company can purchase its own shares to relieve and oppressed part of members with a view of prevention of oppression under the order of the court. Any reduction in share capital contrary to these Section is illegal and ultra virus since the preservation of capital is one of the most important aims of the Act. An unlimited liability company is free from the restriction imposed by this section and it can purchase its own shares.

Further, to make this section really effective sub-section (2) provides that no public company, and no private company which is a subsidiary of a public company, can give any financial assistance in any shape towards the purchase of its own shares or of its holding company, except in the following cases:

1. Where a loan is made by a ‘banking company’ in the ordinary course of its business.

2. Where provision of money is made under a scheme (e.g. a pension scheme) to enable trustees to purchase fully paid shares in the company to be held for the benefit of the employees of the company, including salaried directors.

3. Where loans are made by a company to ’employees other than directors’ to enable them to buy fully paid shares in the company to be held by them as beneficial owners. The amount of loan cannot exceed the employee’s salary for a period of 6 months.

It may, however be noted that the above sub-section does not prohibit financial assistance:

(i) By any company (public or private) for the purchase of shares in any of its subsidiary companies, except to the extent restricted by Section 195 and 369 of the Act; and

(ii) By and independent private company to any person, whosoever, for purchasing shares in it.

If a company acts in contravention of the above provisions, the company and every officer who is in default shall be punishable with a fine which may extend to one thousand rupees.