After reading this article you will learn about Price of a Product:- 1. Introduction to Price 2. Objectives of Price 3. Importance 4. Market Price 5. Price as a Measure of Value 6. Policies 7. Yardsticks Used in Pricing a Product 8. Determination Process 9. Leadership 10. Psychological Pricing 11. Principles.

Contents:

- Introduction to Price

- Objectives of Price

- Importance of Price

- Market Price

- Price as a Measure of Value

- Policies of Price

- Yardsticks Used in Pricing a Product

- Determination Process of Price

- Leadership in Price

- Psychological Pricing

- Principles of Price

1. Introduction to Price:

Pricing governs the very feasibility of any marketing programme because it is the only element in a marketing mix accounting for demand as well as income or revenue. All other elements in a marketing mix such as promotion and distribution are cost elements.

ADVERTISEMENTS:

Price is a fine mechanism to convert into rupees and paise the perceived value of a product to a customer at a point of time. Price of a product consists of a physical product plus the bundle of expectations or satisfactions of a consumer or user of a product. Price must be equal to the total amount of benefits (physical, economic, social and psychological benefits).

We have a kind of price equation, where:

Money Price = Bundle of Expectations

Bundle of expectation or sifting points are:

ADVERTISEMENTS:

i. Physical product,

ii. Brand name;

iii. Package and label,

iv. Product benefits,

ADVERTISEMENTS:

v. Delivery,

vi. Warranty,

vii. Service after sale,

viii. Credit, and so on.

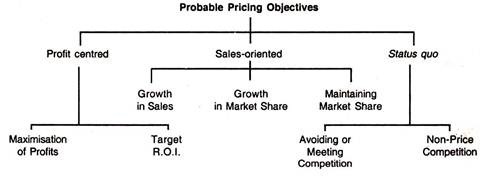

2. Objectives of Price:

ADVERTISEMENTS:

A variety of economic, social and other objectives are duly considered while determining the price of a product.

These are:

i. Return on Investment:

ADVERTISEMENTS:

A business organisation must have minimum return on its investment e.g., 10 to 20% after tax in the long-run.

ii. Profit Target:

A business unit may fix a profit target either in total rupees or as a percentage of sale while fixing the sale price. It is a short-run objective.

iii. Sales Growth:

ADVERTISEMENTS:

A sale-oriented concern may prescribe a certain sales volume and sales turnover for each year.

iv. Competition:

Price may be used as a weapon of competition to meet or eliminate competition in dose course. We may have a price war among rivals.

v. Market Share:

ADVERTISEMENTS:

Price can be employed to maintain or improve a share of the market, e.g., minimum market share of 30%

vi. Liquidity:

An enterprise may seek to make maximum profit and as soon as possible to improve cash flow so that it will enjoy financial liquidity.

vii. Product Image:

A firm may keep a higher price for a high quality product and enhance the quality image of the product.

viii. Social Needs:

ADVERTISEMENTS:

A firm may desire to meet unsatisfied social wants by keeping a low price deliberately for a certain period.

3. Importance of Price:

Price is a matter of vital importance to both the seller and the buyer in the market place. In a money economy without prices there cannot be marketing. Price denotes the value of a product or service expressed in money. Only when a buyer and a seller agree on price, we can have exchange of goods and services leading to transfer of ownership.

In a competitive market economy, price is determined by free play of demand and supply. The price will move forward or backward with changing supply and demand conditions. The going market price acts as a basis for fixing the sale price. Rarely an individual seller can dishonour the current market price.

In a free market economy we have freedom of, contract, freedom of enterprise; free competition and right to private property. Price regulates business profits, allocates the economic resources for optimum production and distribution.

ADVERTISEMENTS:

Thus, price is the prime regulator of production, distribution and consumption of goods. Price influences consumer purchase decisions. It reflects purchasing power of currency. It can determine the general living standards.

In essence, by and large, every facet of our economic life is directly or indirectly governed by pricing. This is literally true in our money and credit economy. Pricing decisions interconnect marketing actions with the financial objectives of the enterprise.

Among the most important marketing variables influenced by pricing decisions are:

i. Sales volume,

ii. Profit margins,

iii. Rate of return on investment,

ADVERTISEMENTS:

iv. Trade margins,

v. Advertising and sales promotion,

vi. Product image,

vii. New product development.

The selling price plays a unique role in business because the price level:

i. Controls the sales volume and the firm’s market share,

ADVERTISEMENTS:

ii. Determines the total sales revenue (Sales revenue = Sales volume × Unit price),

iii. Regulates the rate of return on investment (R.O.I) and through R.O.I, price influences sales profitability,

iv. Creates an impact on unit cost in mass production.

Low price increases total sales turnover and ultimately mass production through economies of scale leads to the lower unit cost of production. Low price induces also efficiency in production and marketing.

Henry Ford stated:

“Our policy is to reduce the price, extend operations and improve the product.”

ADVERTISEMENTS:

Therefore, pricing policy plays a very important role in the design of the marketing mix. Pricing strategy, determines the firm’s position in the market vis-a-vis its rivals. Marketing effectiveness of pricing policy and strategy should not suffer merely on account of cost and financial criteria.

4. Market Price:

The market price is the price determined by the free play of demand and supply. The market price of a product affects the price paid to the factors of production rent for land, wages for labour, interest for capital and profit for enterprise.

In this way price becomes a prime or basic regulator of the entire economic system, because it influences the allocation (distribution) of these resources (factors or production). For example, when the price of a commodity has a rising tendency, we shall have higher wages attracting more labour, higher interest attracting more capital, and so on, in the industry in which prices are rising.

Conversely, under falling prices, low interest and low profits will reduce the availability of labour, land, capital and risk-takers in a free market economy. Prices direct and control production and consumption.

Since market price is determined in an impersonal way through the general relations of demand and supply, the individual seller has no control over the market price and the actual market price at any given time may be above or below the cost of individual sellers.

Market price is indicated by published prices, market reports, etc. A seller will have to change his output to adjust with the current market price in order to secure maximum gains or minimise his losses.

5. Price as a Measure of Value:

Economic theory of price has a few simple assumptions regarding products and buyer behaviour. Buyer’s tastes and preferences are considered as given (constant). Buyer is considered essentially a rational human being.

The marketing concepts like brand image, brand loyalty and benefits segmentation are outside the scope of price theory. Hence, in practice, the classical price theory, saying price determines value of the product, is not true.

Marketers have recognised the importance of perception, learning and altitudes creating psychological reactions to price, at least in consumer goods. The social and psychological factors must be recognised in the evaluation of pricing decisions.

The social psychological influences are responsible to support the consumer’s inclination to use price as an indication of quality for certain products, e.g., cosmetics, jeweler)’, and clothing. Such products have concealed values and benefits which the consumer cannot evaluate rationally or on objective basis.

Consumer does not have physical clues or guides suggesting product quality in many cases and social psychological dimensions may dominate in the consumer behaviour. Under such situations, price is the most handy available indicator of product quality and value for many customers.

Buyers believe in the implicit subjective process, viz., ‘If it costs more, it must be better’ Marketers are bound to exploit buyer’s emotions, preferences and habits.

Charm pricing is another psychological dimension of pricing. Accepted pricing conventions have a charm fob the consumer, e.g., price like Rs.9. 90 sounds better than value than Rs.10.

Price lining is another psychological dimension of pricing accounting for a common marketing practice.’For example, a reasonable price range for a new Television set is between Rs.2500/- and Rs.4500/- for most people. Only handful of buyers would seriously consider purchasing the T. V. set costing Rs.6500/- or more, and a new T.V. set costing less than Rs.2000/- would generate doubts and suspicions.

The consumer answers the question (Is it worth it) in terms of the familiar equation:

Satisfaction = Benefit – Cost

The price is the cost part of the equation.

The reasons for the inability of price to determine the perceived; value of the product are:

i. There are considerable differences in the market information available to consumers.

ii. We have significant differences in the bargaining power of consumers.

iii. In large parts of the retail market, we have non-price competition replacing price competition.

The purpose of non-price competition is also to make sales or demand curve less sensitive to price and the price of an article might be raised without adverse effect on sale (demand has become less price elastic due to promotion). The higher price compensates for promotion costs incurred in stimulating demand.

6. Policies of Price:

Price is an important element in the marketing mix. Arrival at the right selling price is essential in a sound marketing mix. Right price can be determined through pricing research and by adopting the test market techniques.

A price policy is the standing answer to the firm to recurring problem of pricing. It provides guidelines to the marketing manager to evolve appropriate pricing decisions. We have three-alternatives in fixing the price of our products

i. Price in Line:

The sale at current market price is desirable under free competition and when a traditional or customary price level exists. It is preferable when product differentiation through branding is minimum, buyers and sellers are well-informed, and we have a free market economy.

Under such conditions price loses its importance as a weapon of competition and sellers have to adopt other means of non-price competition, e.g., branding, packaging, advertising, sales promotion, credit, etc., to capture the market.

ii. Market-Plus:

The sale above the market prices under free competition is profitable only when your product is distinctive, unique and it has prestige or status in the market. Customer is inclined to put a greater value on the product if the package is very good or the brand is well-known.

Otherwise, it will be a lulling price policy, specially if the customer is price-conscious. Reputed brands have higher prices. Price of a product is associated with value, quality, durability, performance, service after sale, credit, and many Other attributes.

Product-differentiation through branding introduces monopoly element in pricing and established brands can afford higher prices without reducing volume of sales. In foreign countries, such as the U. S. A. and the U. K. almost all consumer goods are branded and large national concerns have used branding as an instrument of monopoly.

iii. Market-Minus:

The sale below the market price, particularly at the retail level is profitable only to large chain stores, self-service stores and discount houses. Tense large retailers can sell well-known nationally advertised brands 10 to 30% below the suggested retail prices, list prices or fixed resale paces by the manufacturers.

If you have lower costs because your product is of inferior quality, you may have to fix lower price. Similarly, you may prefer lower price, without promotion expenses but which your rivals are undertaking on a large-scale. Lower price is a substitute for sale promotion. Prices of national brands are higher as there is heavy expenditure on advertising and sale promotion to maintain the brand loyalty.

iv. Right Pricing:

In the long run the best pricing policy in a competitive market is the market-based method of pricing. Such a price policy will prevent price war, and assure normal profits.

v. Non-price Competition:

The seller should rely more on non-price factors to capture the consumer demand. At present in many countries business firms avoid price reduction as a means of competition. With or without price competition, increasing emphasis is being given on the various non-price weapons of competition.

Non-price competition devices are:

(i) Branding,

(ii) Attractive packaging,

(iii) Service after sale,

(iv) Liberal credit,

(v) Free home delivery,

(vi) Money-back guarantee (return of goods),

(vii) Sales promotion,

(viii) Advertising,

(ix) Personal salesmanship,

(x) Product improvements and innovations.

(xi) Buy-back provision.

Price is not the sole determinant of purchasing. Besides fair price, consumers demand better services, better quality and reliability, fair trade practices, personalized relation with sellers, quality guarantee, credit, etc. Non-price factors are important selling points, in addition to price, Non-price competition tends to increase as buyers put more stress upon fashion, variety, style, finish and service than on price.

Conditions Favouring Higher Prices:

(i) Higher sales promotion expenditure,

(ii) Production as per order,

(iii) Initially small market is preferred,

(iv) Sales turnover is slow,

(v) Good many ancillary services are needed,

(vi) Goods are durable and

(vii) Package is unique.

Conditions Favouring Lower Prices:

(i) Little sales promotion is necessary,

(ii) We have mass- production,

(iii) We are ready for mass-distribution and we want larger market-share,

(iv) Sales turnover is quick, i.e., fast selling is anticipated,

(v) Very few or no additional services are needed,

(vi) There is no special package, and

(vii) We have perishable goods demanding quick clearance.

Skim the Cream Price (High Pricing):

A manufacturer introducing a new product may adopt this pricing strategy deliberately to build up the image of quality and prestige for his new product. In the earlier stages of product life cycle, a strategy of high price associates with heavy expenditure on promotion, and at the later stage of the product life cycle, a strategy of lower prices with normal promotional expenditure pays a rich dividend.

Reasons for High Price Policy:

There are a few reasons supporting skim the cream pricing for a new and unique product in its introduction stage:

(i) In the initial stage we have less elastic demand. Price is less important in purchase decisions here are buyers who are not sensitive to price and they do not mind higher price. As the product is new and distinctive, there is little competition.

(ii) When entry of rivals is difficult, costs are certain, life-cycle is short, we prefer higher price.

(iii) Skimming price enables the firm to take the cream of the market, at a higher price and then it may attempt to appeal price-sensitive sections of the market by adopting penetration, i.e., lower price.

(iv) High initial price can protect the firm to take the cream of the market, at a high price and then it can be easily lowered. Reverse is not practical.

(v) High initial price can keep demand within limit of your productive capacity.

There are two disadvantages of skim the cream price:

(i) It attracts competition.

(ii) If entry is easy, this policy is risky.

Penetration Pricing (Low Pricing):

The approach is favourable under the following conditions:

i. Product has greater elasticity of demand.

ii. Mass-production provides substantial reduction in unit cost of production.

iii. Very strong competition is expected soon after the product enters the market.

iv. High-income section of the population is lot adequate.

We have bulk of the population in the middle and lower income group.

Reasons for Low Pricing:

When product has long life cycle, it has a class market, entry into the market is easier and demand is elastic, penetration price is always preferable as rivals are discouraged to enter the market and you can establish a strong hold on the market share, accidentally making future entry of rivals difficult. The only disadvantage of this pricing is you may have excess demand within a short period.

7. Yardsticks Used in Pricing a Product:

There are a number of factors affecting the price range of a product:

i. Cost of production and distribution. It sets the floor price or power limit as sale below costs in the long-run means failure for the seller.

ii. Market competition and the prices of rival products. It sets upper limit for setting the sale price in a competitive market.

iii. Consumer reaction and response.

iv. Middleman reaction and response.

v. Prices of substitute products.

vi. Government laws and regulations.

vii. Amount of expected saving to the owner, e.g., if a new invention will save a buyer Rs. 6,000/- per year, he is willing to pay a higher price for the product.

8. Determination Process of Price:

i. Estimate the total demand for your product. It will depend on the expected price. Experienced wholesalers/retailers can evaluate our product. Prices of comparable rival products can guide us in pricing.

We can conduct regular survey of potential buyers. We can determine the expected price in a few test markets by trying different prices in different test markets and comparing the results with a controlled market in which price is not altered. Such a trial and error method can be followed. Once we know the expected prices, we can compute sales volume at several prices.

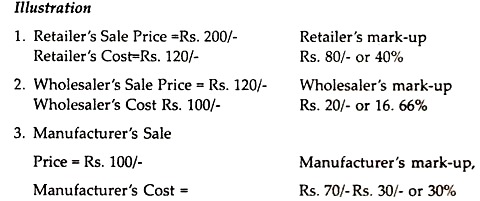

ii. The most appropriate method is the cost-plus mark up method, usually called cost- plus method. It is very suitable for wholesalers and retailers:

Cost of goods + Operating expenses + Profit Margin = Price of product

iii. Anticipate competitive reaction. Competition is a crucial factor in price determination. Seller does not operate in a vacuum. If the area of operation is easy (i.e., entry into the market is easier), profit prospects are immense, and it is quite obvious that the threat of competition is considerable.

iv. Determine the share of the market you expect at the expected price. Higher initial price may be fixed if you anticipate a smaller share, whereas if you expect a much larger market share, you will have to prefer relatively lower prices. Proper pricing strategy is evolved to reach the market target either through skimming price or through penetration price or through a compromise i.e., fair trading, or fair price.

The Cost-plus Method of Pricing (Mark-up Pricing):

This method is considered the best approach to pricing. It is based on the seller’s per unit cost of the product plus an additional margin of profit.

There are four items in determining the sale price:

i. Cost of producing/ acquiring goods.

ii. Cost of operating/selling expenses.

iii. Interest, depreciation etc.

iv. Expected profit margin mark-up.

The mark-up is indicated as a percentage of the cost of goods. The mark-up as a percentage of selling price is a very common practice particularly in retail trade.

The mark-up is calculated on the sale price at each level. The producer’s sale price is Rs. 100/- per unit. The consumer’s price is Rs.200/- per unit. The difference of Rs.100/- is accounted by retailer’s or Rs.80/-and wholesaler’s mark-up of Rs.20/- per unit. We have a wide price difference when there are many middlemen between the producer and the consumer. Each mark-up is bound to inflate the ultimate retail price.

One-Price Policy:

A fair and fixed price policy in line with normal market price and offering normal profit is the best pricing policy. There is no question of negotiation or bargaining. No favouritism is shown to any buyer. It gains customer confidence. It is very suitable for self-service retailing, mail order selling and large retail stores.

Variable-Price Policy:

Under variable-price or negotiated price policy, seller can discriminate between buyers. Large and valuable customers are offered lower price and better discounts. It can attract customers. For costly and durable goods, price may be negotiable.

However, it can lead to price war and unhealthy competition. Managerial control is also less on selling cost and on profits. It reduces confidence. It is not equitable. It creates ill will and may spoil seller’s reputation.

9. Leadership in Price:

In every industry, today, we have a few dominant business enterprises who act as leaders for setting the price by others. When the leader raises or lowers the price, all others usually follow the lead.

The non-leading firms have no other practical alternative but to follow the leader in their price-fixing. In many consumer goods industries we do come across one or a few price leaders and the market price is dictated by them.

10. Psychological Pricing:

It is used to create an illusion of a bargain. It is a popular practice of setting the prices at odd points, e.g., Rs.17.95, Rs.49.00, Rs.990 etc. The policy is followed usually in consumer goods industry, e.g., Bata Shoe Company has psychological pricing in shoe prices.

Prices of consumer durables such as cars, refrigerators, etc., are usually fixed in odd amounts. Such Principles of Management a pricing strategy is bead on the belief that a buyer is mentally prepared to pay a little less than the rounded figure, e.g., Rs.10.85 instead of Rs.11 for a product. Even prices create an impression that the product is of high quality. Thus, pricing can create expected motivation.

11. Principles of Price:

There are two principles in pricing. One is called cost of service principle and another is called value of service principle. The second one is also termed as charging what the traffic will bear. It points out demand price. It is usually adopted by railways in our country. Professionals like doctors, lawyers, chartered accountants, consultants, etc., adopt this principle of charging what the customer will bear.

They charge their fees on the basis of ability to pay and the cost factor is secondary in their charges. In business particularly in commodity markets we do not have such a price discrimination based on the customer’s ability to pay.

A monopolist, of course, can afford to adopt this principle to maximise his profits. In a sense, such pricing renders justice to customers. Dual pricing of sugar in India is based on this principle of ability to pay. Electricity company also has different rates for domestic and industrial customers.