As in other persuasive letters, the primary purpose of a collection letter is to get action in this case, payment. A secondary goal is to maintain a customer’s goodwill. Like other persuasive letters, collection letters are generally written inductively; but they are shorter.

Normally, customers know what they owe (detailed information is not necessary); and they expect to be asked for payment (no need for an attention-getter and no need for an apology). If a letter is short, its main point (pay is expected) stands out vividly.

Compared with a long letter, a short letter has a greater chance of being read in its entirety. In a long letter, the main point could end up in the skipped-over portion or may have to compete for attention with minor points.

Since slow-to-pay customers may not respond to the first attempts at collection, businesses that use collection letters normally use a series (if the first letter doesn’t bring a response, a second letter is sent, then a third, and so on). An effective series of collection letters incorporates the following characteristics: timeliness, regularity, understanding and increasing stringency.

ADVERTISEMENTS:

1. Timeliness:

A collection writer should not put off sending a letter. The longer debtors are given to pay, the longer they will usually take. Effective collection efforts should be made promptly, and they should encourage payment by certain dates.

2. Regularity:

ADVERTISEMENTS:

Never let the obligation out of the debtor’s mind. A regular system for mailings impresses on debtors the efficiency of collection practices.

3. Understanding:

This involves adaptability and skill in human relations. The collection series must be adaptable to the nature of the debtor. Good-pay risks should probably be given more time to pay than debtors with poor-pay reputations. Many debtors have very good reasons for not having paid on time. They should be given every opportunity to meet their obligations or to explain why they are unable to do so.

Understanding also influences the regularity of the collection series. Letters should not be sent so close together that the debtor won’t have a chance to pay before the next letter arrives. And no one likes to receive a collection letter after the bill has been paid.

ADVERTISEMENTS:

If Increasing Stringency:

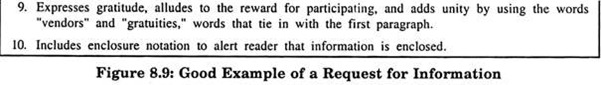

The fourth characteristic of the collection series is increasing stringency in letter tone as the seriousness of the delinquency increases. Most collection authorities classify the letters in the series according to the names that describe the seriousness of the problem. We can call this the collection series.

The number of letters in a collection series varies with the collection philosophy of the company and the nature of the debtor. Companies will have to write as many letters as necessary to collect the money – until legal action is required.

The following stages are used:

ADVERTISEMENTS:

(1) Reminder,

(2) Inquiry,

(3) Appeal,

(4) Strong appeal or urgency, and

ADVERTISEMENTS:

(5) Ultimatum.

Figure 12.10 illustrates the steps in a typical collection series.

Reminder:

Many people will pay promptly when they receive a bill. Soon after the due date, a typical reminder will usually bring in most of the remaining accounts. The reminder is typically a duplicate of the original statement with a rubber-stamped notation saying “second notice,” “past due,” or “please remit.”

ADVERTISEMENTS:

To send a collection letter at this stage would be risky for goodwill. The assumption is that the obligation has been overlooked and will be paid when the reminder is received. Very often companies will use two or three reminders before moving to the letter-writing stage.

Inquiry:

After sending the normal number of reminders without success, companies resort to letters. To increase efficiency, many organizations use form letters that may be generated automatically by the computer or by a collector.

In all letters at the inquiry stage, the assumption must be that something has prevented the debtor from paying. The aim is to get some action from the customer, in the form of either a check or an explanation.

ADVERTISEMENTS:

Follow these guidelines for writing effective inquiry letters:

1. Because reminders have failed to bring payment, something is wrong.

2. Action on the part of the debtor is necessary. Either a payment or an explanation is expected.

3. With empathy, think and write positively.

4. Make it easy for the debtor to reply, but do not provide excuses for nonpayment.

ADVERTISEMENTS:

One letter of helpful inquiry is sufficient because additional letters may give the debtor the idea that you will continue to wait. You must increase stringency by reducing the proportion of helpful talk as you proceed from one stage to the next.

Appeal:

By writing a short letter restricted to one appeal, a collection writer:

(1) Increases the chances that the entire letter will be read;

(2) Places emphasis on the appeal used; and

(3) Reserves something new to say if an additional letter is needed. Typically, the following types of appeals are used:

ADVERTISEMENTS:

i. Fair Play:

Collectors often appeal to the debtor’s sense of cooperation, loyalty, and honesty. For example, “The mutual contract we entered into was based on two things. The first was our ability to make delivery as agreed. The second was your ability to pay as agreed. We kept our part of the agreement, and the only way to complete the agreement is for you to send a cheque for Rs. 15,000 today.”

ii. Closure:

People gain satisfaction from concluding that which they have begun. In a business transaction, payment is the final step: “Send your cheque for Rs. 15,000 today so that we can mark your account ‘paid in full’.”

iii. Pride:

Many people wish to preserve their reputation: “You must be proud of your excellent credit rating. Let us help you retain that rating by keeping your account in our ‘preferred file,’ Mr. Kumar.”

ADVERTISEMENTS:

iv. Fear:

Collectors know that many people fear loss of credit privileges loss of possessions, and the possibility of litigation. For example, “so that you can continue to offer your customers the quality merchandise they demand, you must safeguard your good credit report. To do so, please send your cheque for Rs. 15,000 today”.

Concentrate on one appeal. Multiple-appeal letters don’t provide time or space to develop a single appeal properly. Appeals in this stage intimidate only slightly, if at all. Typically, fear appeals are reserved for the strong-appeal or ultimatum letters.