After reading this article you will learn about the calculation of various overheads:- 1. Obsolescence 2. Interest on Capital 3. Idleness 4. Repairs and Maintenance.

Obsolescence:

Suppose a factory owner purchases a machine for his production shop but after some duration a better machine comes in the market, whose production rate is very high and is much economical. Although the old machine is efficient but becomes out of fashion and uneconomical due to the new better machine which has come in the market.

This is known as “Obsolescence”. Consideration of this fact is of much importance and some money should also be set aside from the profits for this cause.

Hence “Obsolescence” is the depreciation of existing machinery or asset due to new and better invention, design, equipment or processes etc.

ADVERTISEMENTS:

It is very difficult problem for estimator to provide for the on cost on obsolescence, because nobody can say when a revolutionary change is coming in the market. But it is a general practice to reduce the life of machine so as to account the effect of obsolescence. Hence the depreciation and obsolescence charges are calculated on the reduced life.

Suppose an estimator expects the life of machine as 20 years then the depreciation rate will be 100/20 = 5%. By considering obsolescence also, its life may be taken as 15 years. Then the combined depreciation and obsolescence charges will be 100/15 = 6.66% instead of 5%. Therefore, the difference 6.66 – 5.00 = 1.66% will be obsolescence charges.

The other causes of depreciation are physical decay, accidents, deferred maintenance and neglect, inadequacy etc.

Interest on Capital:

While preparing cost account, interest on capital invested is also considered. The rate of interest is that, which would have been available, if that capital is deposited in some bank. By charging the interest, cost of product increases and the profit seems to be lesser.

ADVERTISEMENTS:

Interest should be charged on the products produced, because:

(i) Real profit is not received until interest on capital is charged. Because manufacturer gets an amount equal to interest even when he does not work.

(ii) The stocks of raw and finished products cost more, because of the rent and interest on the blocked money.

(iii) If the capital is borrowed for business, then the interest has to be paid. Similarly, if manufacturer himself provides capital, he should be credited by a sum equal to the interest.

ADVERTISEMENTS:

Some manufacturers do not charge the interest on the invested capital.

They have the following points to advocate their views:

(i) As interest is also a part of the profit, it should not be charged separately.

(ii) It is charged to show less profit to deceive the consumer and to increase the cost of product.

ADVERTISEMENTS:

(iii) It complicates clerical work.

Idleness:

Idleness in an industry may be of the following two kinds:

(i) Idleness of machines.

(ii) Idleness of workers.

ADVERTISEMENTS:

This idleness is discussed as under:

1. Idleness of Machines:

This is the time, when machines remain without doing any useful work. Idleness of machine may be due to several reasons.

Following are some of them:

ADVERTISEMENTS:

(a) Mechanical Reasons:

Examples of such reasons are breakdown of machines, power failure, accident etc.

(b) Bad Planning:

Machine may remain idle due to bad planning. Reasons for such idleness are not engaging the machines to their full capacities, providing more machines or lack of supervision.

ADVERTISEMENTS:

2. Idleness of Workers:

In this category worker remains idle but he is paid for this duration also.

The idleness of the worker may be due to some of the following reasons:

(a) Labour:

In this category workers do not perform useful work due to their personal reasons e.g., due to lockouts, strikes, accidents, natural calls etc.

(b) Mechanical:

ADVERTISEMENTS:

Examples of mechanical reasons when worker remains free, are power failure, breakdown of machines etc.

(c) Supervisory:

Due to poor supervision, sometimes worker wastes his time for waiting to receive the instructions from supervisor. Sometimes workers waste their time in gossiping or wandering here and there unnecessarily because of poor supervision.

An estimator used to fix the percentage for the idleness effect on the basis of his past experience. He should also consider all the above factors causing idleness.

Repairs and Maintenance:

Every machine requires maintenance for increasing its life and to keep the machine in good condition and to remove unnecessary delays in production. For maintenance, machines are cleaned, lubricated and checked thoroughly from time to time and to replace the worn out parts. Manufacturer’s instructions for machine maintenance should be carried out properly.

Repair is the process of bringing the defective machines into efficient working condition. Every machine has to be repaired sometimes or the other during the course of its useful life. Some money has to be spent on the maintenance and repairs. For determining overheads this expenditure should also be considered.

ADVERTISEMENTS:

Problem:

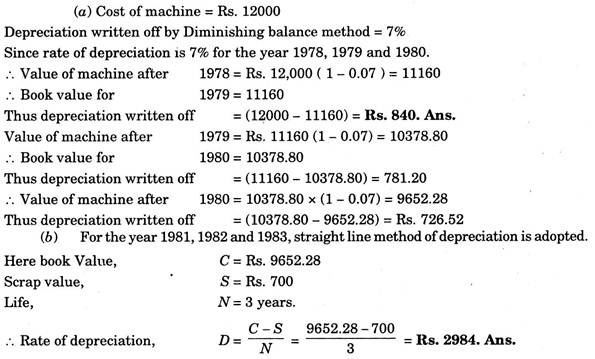

On January 1, 1978 X, Y, Z Co. purchased a machine costing Rs.12,000. For the year 1978, 1979 and 1980 depreciations were written off @ of 7% on the diminishing balance method. In 1980 it was revealed that the life of machine would last only till 1983. Hence for the remaining years the depreciation was written off in such a way so as to realize Rs.700 at the end of 1983.

Find:

(a) How much depreciation was written off each year?

(b) In last three years, what was the rate of depreciation (if the straight line method was adopted).

Solution: