This article will guide you about how to calculate return on investment with the help of an example.

Investment may refer to capital employed, total assets or owner’s equity or net worth. Again capital employed may be gross capital employed or net capital employed. Also, return may be pre-tax return or after-tax return.

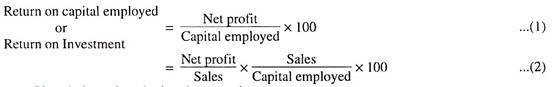

Return may be expressed in terms of net profit or operating profit. Therefore:

(i) Return on investment may be computed in any one or more manners the businessman likes, but its interpretation must always be with reference to the context and terminology adopted as explained above.

ADVERTISEMENTS:

(ii) Numerator and denominator of a ratio must always be uniform, implying thereby that the base must be common and there must be a correct matching of capital employed and earnings.

Return on Investment (ROI) is also known as Return on capital employed, Return on Assets, Rate of Return, Capital yield etc.

In simple terms:

If capital employed taken is gross then

ADVERTISEMENTS:

Gross capital employed = Fixed assets + current assets

And, net capital employed = Gross capital employed – Current liabilities

The concept of Net profit may be:

ADVERTISEMENTS:

(a) Net profits after taxes

(b) Net profits after interest and taxes, and

(c) Net profits after (taxes + interest – tax savings).

ADVERTISEMENTS:

Example:

Calculate Rate of Investment from the following data:

Sales = Rs. 1,80,000

Profit = Rs. 18,000

ADVERTISEMENTS:

Investment or capital employed = Rs 90,000

Solution:

Return on Investment or capital employed:

18,000/90,000 x 100 = 20%

ADVERTISEMENTS:

Capital turnover = 1,80,000/90,000 = 2times

Net profit ratio = 18000/1,80,000 x 100 = 10%

Return on capital employed = 2 x 10% = 20%