List of Top 8 Fixed Income Products!

Fixed Income Product # 1. Credit Default Swaps (CDS):

Over the past few years, especially at the onset of the global economic recession, when people started to wonder as to what really went wrong, the CDS came into limelight.

CDS is basically in the nature of insurance. It provides a protection to the buyer of CDS against a default on the underlying Fixed Income Security (also called as the reference asset for the CDS).

To buy this protection, the CDS buyer agrees to pay the CDS seller a specified fee while the CDS seller agrees to protect the buyer against losses that may occur in case of a credit event, such as default on the underlying fixed income security.

In spite of being an ‘insurance-like’ product, CDS have one significant difference over a typical insurance. When we buy insurance, we need to have an underlying interest in the thing insured. You can only insure your own house and not your neighbors’ house!

ADVERTISEMENTS:

However, to buy a CDS, a protection against default on an underlying Fixed Income Security, I do not need to own that security at all. Further, there is no limit as to amount of protection that I can buy. I may buy a CDS on the notional value of Rs. 1,00,00,000 of the underlying Fixed Income product while I might actually own only Rs. 10,000 worth of notional value.

This can give rise to undue speculations and the CDS, instead of being a product for ‘hedgers’ has sometimes turned into a product for ‘speculators’. I may perceive that a particular issuer will default on its issue and to exploit this ‘opportunity’, I would buy CDS with the issue being the reference asset.

If there really is a default, I would be ‘compensated’ for the default, based on the notional value upon which I had agreed to buy the CDS. However, if the issuer does not actually default, my loss would be restricted to the fees that I paid for buying the CDS. In fact, it is widely believed that the reason for the fall of American Investment Group (AIG) was that it had made a massive issue of CDS against default of Mortgage Backed Securities (MBS) issued by the Lehman Brothers.

To help you understand the functioning of a CDS, let us take a hypothetical example.

ADVERTISEMENTS:

Suppose you buy a 2-year CDS on a notional value of Rs. 1,00,00,000 (1,000 Bonds, each with face value of Rs. 10,000) of a 10-year bond issued by some issuer, say Issuer A. As a cost of buying the CDS, you will be liable to pay a certain premium. Let us suppose that the premium agreed is 0.50% per annum. Accordingly, you will have to pay Rs. 50,000 (0.50% of Rs. 1,00,00,000) at the beginning of each year.

Now, suppose Issuer A defaults at the end of the year. At the time of default, the bonds are trading at about Rs. 5,000. In such case the seller of CDS will be liable to compensate you with Rs. 50,00,000((Rs. 10,000 – Rs. 5,000) x 1000 bonds) in case the CDS is cash settled or buy those bonds from you for Rs. 1,00,00,000 (Rs.10,000 x 1000 bonds) in case the CDS is delivery settled.

As for CDS in Indian context, the RBI has recently issued certain Guidelines for CDS in corporate bonds.

Some of the key points of these guidelines are as below:

ADVERTISEMENTS:

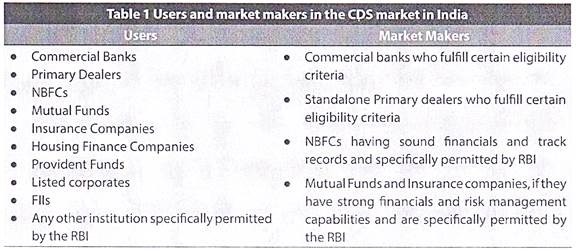

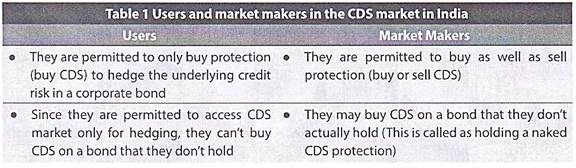

As per the guidelines, there can be two main types of participants in the Indian CDS market:

I. Market maker

II. User

Who can be a ‘Market-Maker’ in CDS?

ADVERTISEMENTS:

I. Commercial Banks

II. Stand-alone Primary Dealers (PDs)

III. Non-Banking Financial Companies (NBFCs) having sound financials and good track record in providing credit facilities

IV. Any other institution specifically permitted by the Reserve Bank

ADVERTISEMENTS:

The market maker would be allowed to quote both buy as well as sell spreads in the CDS market. The RBI has specified several criteria to be fulfilled for being qualified to act as a market maker in the CDS market.

Who can be a User of CDS?

i. Commercial Banks, Primary Dealers, NBFCs,

ii. Mutual Funds, Insurance Companies, Housing Finance Companies, Provident Funds, Listed Corporates,

ADVERTISEMENTS:

iii. Foreign Institutional Investors (Flls)

iv. Any other institution specifically permitted by the Reserve Bank.

An RBI regulated entity shall act as counter-party to all CDS transactions. CDS would be allowed to be issued only in the case of listed corporate bonds as underlying.

‘Users’ of CDS cannot buy CDS for a notional amount greater than the face value of the bonds actually held by them. Further, users cannot buy CDS on a corporate bond that they do not hold.

ADVERTISEMENTS:

In a snapshot, the various functions of a user and a market maker are as below:

Fixed Income Product # 2. Separate Trading of Interest and Principal Securities (STRIPS):

STRIPS are nothing but Zero Coupon Bonds. The difference lies in the fact that they are not specifically issued as a ZCB but are created out of regular interest paying Fixed Income Securities.

Most commonly, STRIPS are created out of dated government securities. If we take into account a 10-year government bond issued today, paying semi-annual interest, there would be a total of 20 cash flows from the security – 19 cash flows comprising of interest and the 20th cash flow usually comprising the final interest installment and the principal repayment. Each of these cash flows, if seen independently, is a potential ZCB. This is exactly the concept of STRIPS.

The interest and principal cash flows are ‘stripped off’ the original security and are traded separately as a zero coupon security. Thus one Government Bond gives birth to 20 new securities.

ADVERTISEMENTS:

The ZCBs created out of the interest component are called ‘Interest Only’ (I0) strips while those created out of the principal component are called as ‘Principal Only'(PO) strips.

Fixed Income Product # 3. Floaters and Inverse Floaters:

A typical Fixed Income Security would have a coupon rate that remains fixed throughout the life of the security. In contrast, a Floater or a Floating Rate Security is a more radical concept in that the coupon rate does not remain constant throughout the term of the security. The coupon rate of a floater is reset at predefined periodic intervals in accordance with some reference rate.

Typically, the coupon rate would be fixed at the prevailing reference rate plus some pre-defined margin.

In India, Floaters are usually designed to have MIBOR or INBMK as the reference rate. In some cases, even the Rate on Treasury Bills may be used as a reference rate. Although Floaters are usually issued with an Interest rate as the reference rate, theoretically, they can be issued using any statistical data as the reference rate. Thus it is possible to design a floating rate security to have its reference rate as an Equity Index like the Nifty, or commodity prices like Crude Oil or even the Inflation Rate.

One important point to remember in the case of floaters is that although the coupon rate gets reset at a pre-defined interval, the exact rate gets known at the beginning of the coupon payment period. This is because, on each reset date, the coupon rate for the next period gets fixed.

For Example, in the case of a floater that resets the coupon every quarter, on a particular reset date, the coupon rate for the next quarter gets fixed. Thus if the reset date is today and the coupon gets reset to 8%, it would mean that at the end of three months from today, you would earn interest at the rate of 8% per annum. Three months later, the coupon rate would get reset again and new rate would apply to the next three month period and so on.

ADVERTISEMENTS:

One outcome of the periodic reset feature of a floater (assuming it is based on Interest Rates) is that the price of a floater would stray little from its par value. The reason for this is that while the prices may deviate freely between reset dates, the coupon rate would itself get reset on the reset date in accordance with the interest rates prevailing in the market. Thus, as the coupon rate gets realigned to the prevailing market rates, the market price would also get realigned to the par value of the security.

To understand the working of a Floater, let us take the example of the Floating Rate Bonds Issued by the Government of India in 2009.

The coupon rate of the bond was calculated based on the following coupon formula:

Equation 1 – Coupon Formula-Floater:

Coupon Rate = Variable Base Rate + Spread

The spread, in this case was fixed by way of auction as -0.01% (negative one basis point)

ADVERTISEMENTS:

I. The variable Base Rate in this case is the average rate of the implied yields in cut-off prices in the auction results of the immediately preceding 6 auctions of the Government of India 364-day Treasury Bills.

II. The coupon rate is reset at half-yearly intervals.

III. As can be seen above, the spread need not always be a positive number. It may also be a negative number which would imply that the coupon rate of the floater would always be lower than the reference rate.

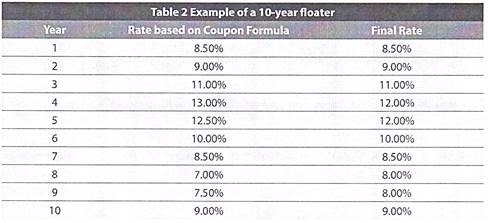

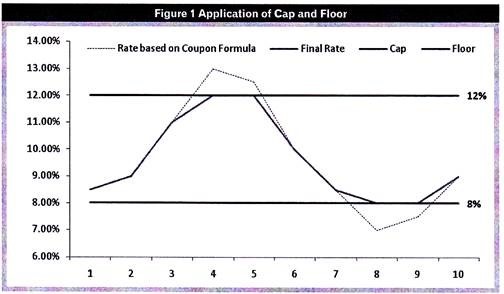

An important aspect of floaters, usually as a part of its issue terms, is the concept of ‘Floors’ and ‘Caps’. Floors and Caps are included as a part of the floater terms to ensure that the coupon rate does not stray away from acceptable levels. If the coupon rate, as determined by the coupon reset formula, goes beyond the cap rate, the coupon rate will be reset at the cap rate. Similarly, if the coupon rate falls below the floor rate, the coupon rate will be reset at the floor rate.

For example, suppose a 10-year floater is issued with a cap and floor of 12% and 8% respectively

The interest rates based on coupon formula and the final rate after application of floors and caps will be as below:

This is also shown in the chart below:

The primary characteristic of a floater is that its coupon rate will move in the direction of the movement in reference rate. It is important to note that even if the spread is a negative value, the coupon rate would still move in the direction of the reference rate. The negative value will only ensure that the coupon rate does not exceed the reference rate.

However, the coupon rate need not always follow the reference rate. The coupon formula may be designed such that the coupon rate may move in a direction inverse to the reference rate. Such a floater is called as an Inverse Floater.

Usually, the formula for an Inverse Floater would be as follows:

Equation 2- Coupon formula – Inverse floater:

ADVERTISEMENTS:

Coupon Rate = Spread – (K x Reference Rate)

For Example, if the Spread is 25% and the reference rate is 7%, while k (defined at the time of issue) is 2, the coupon rate would be reset to 11%. If the reference rate were to increase to 8% on the next reset date, the coupon rate would be reset to 9%.Thus while the reference rate increased, the coupon rate actually decreased.

If you may notice, if the reference rate were to increase to 13% the coupon rate as determined by the coupon reset formula would turn negative. To avoid such absurdities, the use of floors becomes almost mandatory to an inverse floater. On the other hand, the concept of a cap is built into the formula structure of the inverse floater itself.

If we continue with the above example, in an extreme scenario, where the reference rate becomes 0%, the coupon rate will equal the spread rate (25%). Thus, coupon rate cannot exceed the spread rate in the above case.

In Indian context, floaters are not much actively pursued securities. There are some Government Security floaters which are in demand. However, there is not much demand for corporate-issued floaters.

Fixed Income Product # 4. Swaps:

Swap, in simple terms, means exchange. In the case of Investments, swaps are contracts entered into for exchange of benefits. If two parties enter into a swap deal, each party agrees to exchange the benefit it derives from a particular security in favour of the benefit the other (counter-) party derives from some other security.

When the ‘benefit’ swapped is in the nature of interest rates, the swap is called as an Interest Rate Swap.

In a simple (Plain Vanilla) Interest Rate Swap, One party agrees to pay a floating rate of interest to the other party and receive a fixed rate of interest from that other party and the other party agrees for a vice versa payment.

Theoretically, this is similar to one party borrowing money at a floating rate from the other party (so that it has to pay a floating rate of return to the other party) while at the same time lending money at fixed rate to the other party (so that it receives a fixed rate of interest from the other party).

In a plain vanilla interest rate swap, the amounts lent and borrowed are equal and are in the same currency. There is no actual exchange of the principal amount and hence this amount is known as notional principal.

At the inception of the swap, the fixed rate of interest is determined such that the present value today, of the fixed payments is exactly equal to the present value today of the floating rate payments. The fixed rate of interest so determined is called as the swap rate.

Equaling the present values ensures that the swap agreement is of equal value to both parties at the time of inception. Thus, when initiated, neither party gains nor loses in present value terms. However, as the interest rates will change over the term of the swap, the floating rates will change and the swap will turn out beneficial to one of the parties. The benefit gained by one party would be exactly equal to the loss suffered by the other party.

In India, the most prevalent of these swaps are the Overnight Index Swaps (OIS). These are plain vanilla interest rate swaps wherein a fixed rate is swapped for a market determined overnight rate (which is floating). Typically, these OIS are MIBOR (NSE MIBOR obtained from polling) based i.e. a fixed rate is swapped for the overnight MIBOR rate.

The swap can be for a maturity ranging from one month to even ten years. However, it is important to note that in the case of an OIS of a longer period, we swap a long term rate with an overnight rate which typically have very different characteristics and influencing factors.

Fixed Income Product # 5. Swaptions:

As we speak of swaps, let us also discuss another complex instrument which is a mix of swaps and option contracts – swaptions.

Swaption is an option contract that gives to holder of swaption the right to enter into a swap arrangement. Swaptions can be of two types depending on which side of the swap the option holder wishes to take.

Receiver Swaptions are option contracts that give the holder the right to enter into a swap by taking the position of receiver of fixed interest and payer of floating interest. On the other hand, payer swaptions are option contracts that give the holder the right to enter into a swap by taking the position of a payer of fixed interest and receiver of floating interest.

Fixed Income Product # 6. Forward Rate Agreements (FRAs):

A forward contract, in the context of investments, is a contract between two parties wherein one party agrees to sell and the other party agrees to buy a specified security at a future date for a specified price. In the case of equity, forward contracts can broadly be in the nature of individual stock-based or equity index-based.

However, in the case of Fixed Income Securities, forwards can be of three main types:

I. Individual Bond Forwards

II. Bond Index Forwards

III. Interest Rate Forwards

Bond and Bond Index-based Forwards are similar in structure to equity or equity index-based forwards. Let us therefore focus our attention on the unique part of the fixed income space – the interest rate- based forwards. Interest rate-based forward contracts are called as Forward Rate Agreements. In the case of Forward Rate Agreements (FRAs), the underlying is an interest rate and not a security.

Forward Rate Agreements, like any other forward contracts are OTC Contracts. Moreover, since these contracts are non-standardized, the parties to the FRA are usually hedgers – protecting against fluctuating interest rates. The party that enters into a Long Position in an FRA i.e. the party that buys the FRA, is usually a borrower who intends to freeze his interest rate at a particular level.

If the reference rate at the time of contract expiration is in excess of the rate agreed to in the FRA, the buyer will be entitled to a compensation from the seller of the FRA of the extent to which the reference rate exceeds the agreed rate.

However, if the reference rate at the time of contract expiration is lower than the agreed rate, the buyer of the FRA will be liable to compensate the shortfall to the seller. In effect, the buyer would have fixed his interest rate to the agreed rate of the FRA.

Similarly, the party in the short position in FRA i.e. the seller of the FRA is usually a lender that intends to fix the rate of interest earned on a floating rate loan. By entering into a short position, the party in fact freezes its rate of interest at the rate agreed to in the FRA.

Globally, FRAs have a peculiar notation by which they are read and understood in the market. The notation signifies the period of the FRA contract and period until the underlying loan is settled (i.e. the period until the parties will be bound by the agreed interest rate.)

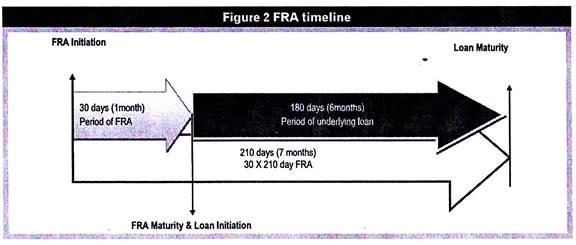

For example, assuming the reference rate used is the MIBOR, an FRA based on MIBOR may be referred to as’30 X 210’FRA. This would mean that the FRA expires in 30 days from today and the underlying loan is to be repaid in 210 days from today. In effect, it means that the FRA is being entered on a 180 day loan (210 days – 30 days) that is to be created after 30 days from today.

A timeline diagram will help you to better understand the concept of FRA notation.

Fixed Income Product # 7. Futures Contracts in the Fixed Income Space:

Before we begin to discuss on futures contracts in the fixed income space let us first orient ourselves with what a futures contract is.

The peculiar characteristics of a futures contract are:

a. It is a standardized contract (unlike a forward contract that can be customized by the parties to suit their needs)

b. It is an exchange traded contract (unlike a forward contract which is an ‘Over the Counter (OTC)’ contract)

c. The clearing house of the exchange usually acts as a counter party to the all the trades thereby eliminating credit risks

d. There is usually a daily settlement of gains and losses through the ‘mark to market’ mechanism

In the case of fixed income securities, futures contracts can be broadly classified into two types:

a. A contract where the underlying is an interest rate (such as LIBOR, MIBOR, yield on a Treasury Bill)

b. A contract where the underlying is a fixed income security (a bond)

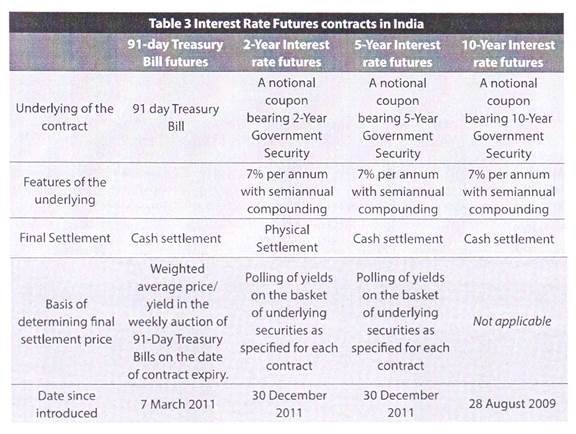

In India, there are currently four different types of Interest rate futures being permitted:

a. Futures on 91-day Treasury Bills

b. Notional coupon bearing 2-Year Government Security

c. Notional coupon bearing 5-Year Government Security

d. Notional Coupon bearing 10-Year Government Security

Some of the key features of each of these securities are as below:

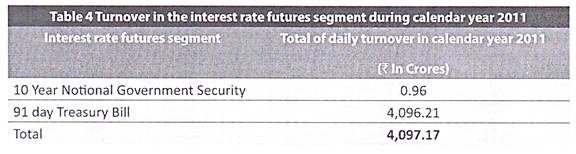

Despite the efforts made by the RBI on promoting interest rate futures, the product has not adequately developed yet in the country.

This is apparent from some of the facts below:

I. There were no open contracts (outstanding and not squared off) in any of the categories of interest rate futures as on 31 December 2011.

II. The total of daily turnover in the Interest rate futures segment during the calendar year 2011 was as below:

Note:

The 2 and 5 year interest rate futures were introduced only on 30 December 2011 and Stock exchanges are yet to introduce the product.

So, these are some of the common ‘sophisticated’ fixed income products currently used in the investment world. You may not really enter into a swap to manage interest rate risk or a CDS to manage credit risks but it is great to know how these products may be used by your Bank or your Insurance Company or may be even your Mutual Fund portfolio manager in managing your investments.

But, before we conclude, we would like to introduce you to another unique fixed income product- a Negative Interest Rate Bond.

Fixed Income Product # 8. Negative Interest Rate Bonds:

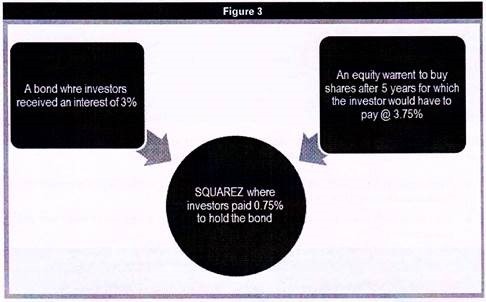

Would you be willing to pay someone for lending him money? That is precisely the concept of a Negative Interest Rate Bond. Such a bond was launched in the United States in 2002 by Warren Buffet in Berkshire Hathaway. The issue was called SQUAREZ.

SQUAREZ was basically two products bundled into one: