Other than banks, Post Office schemes are the most commonly invested contractual-return products in the fixed income world.

The various investment avenues offered by Post Office in India include: 1. Recurring Deposits 2. Time Deposits 3. Monthly Income Schemes 4. National Savings Certificates (NSCs) 5. Senior Citizen Savings Scheme.

We will briefly discuss the features of each one of them.

1. Post Office Recurring Deposit Account:

The Post Office Recurring Deposit Account is similar to a recurring deposit account offered by any Bank.

ADVERTISEMENTS:

The features of this deposit account are as follows:

i. Interest and Tenure:

a. Five Years Term

b. 8% Interest Rate

ADVERTISEMENTS:

c. Quarterly Compounding

d. You will earn Rs. 738.62 for a Rs. 10 Deposit Account (one in which you invest Rs. 10 each period for 5 years)

ii. Investment Limits:

a. Minimum Investment per period- Rs. 10

ADVERTISEMENTS:

b. Maximum Investment per Period- Unlimited

c. Investment amount should be in multiples of Rs. 5

iii. Withdrawal:

a. One withdrawal allowed after one year

ADVERTISEMENTS:

b. Maximum amount of withdrawal: 50% of the balance

2. Post Office Term Deposit Account:

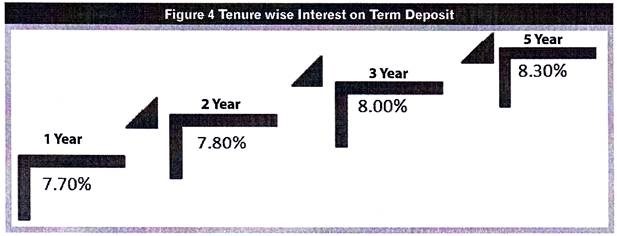

i. Interest and Tenure:

a.The Interest is calculated each quarter but credited only once in a year.

ADVERTISEMENTS:

b. The deposit is cumulative-interest paying in nature.

ii. Investment Limit:

a.Minimum Investment- Rs. 200

b. Maximum Investment- Unlimited

ADVERTISEMENTS:

c. Investment amount should be in multiples of Rs. 200

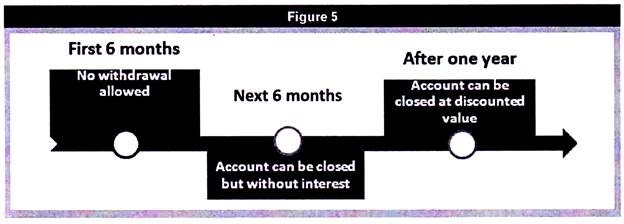

iii. Withdrawal:

(Only for 2-year, 3-year and 5-year Accounts)

3. Post Office Monthly Income Account:

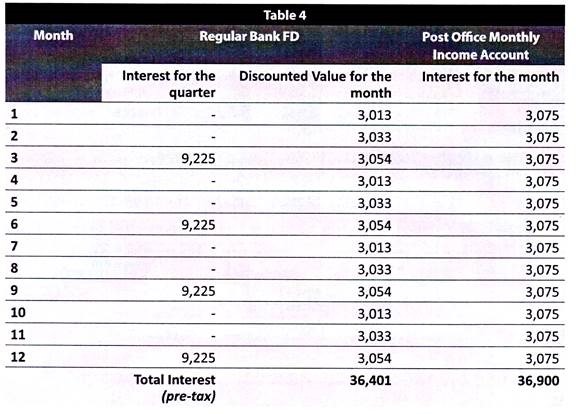

If the Post Office Term Deposit was like a cumulative interest paying Fixed Deposit offered by a Bank, the Post office Monthly Income Account is like a regular interest paying Deposit, with interest payment being made monthly. There is a fundamental difference though.

ADVERTISEMENTS:

If the Bank were to pay interest at more frequent intervals than at every quarter, it would have to do so at discounted value of the quarterly interest. On the other hand, in the case of the Post Office Monthly Income Account, the monthly interest amount is simply the annual interest amount divided by twelve.

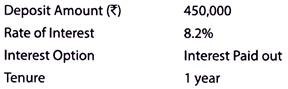

To help you understand what difference this can make in your interest earnings, let us take a case example:

We will take the same parameters and apply it to a regular Bank FD and also to a Post office Monthly Income Account.

As you can see, the difference in method of calculation of interest can make a difference in the interest amount for the year.

ADVERTISEMENTS:

Some of the features of the Post Office Monthly Income Account are as below:

i. Interest and Tenure:

a. 8.2% per annum

b. Payable monthly

c. Tenure of 5 years

ADVERTISEMENTS:

ii. Investment Limit:

a.Minimum Investment- Rs. 1,500

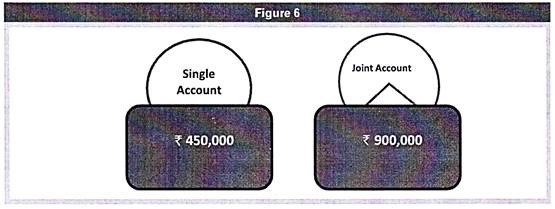

b. Maximum Investment- (See figure below)

c. Investment amount in mulitples of Rs. 1500.

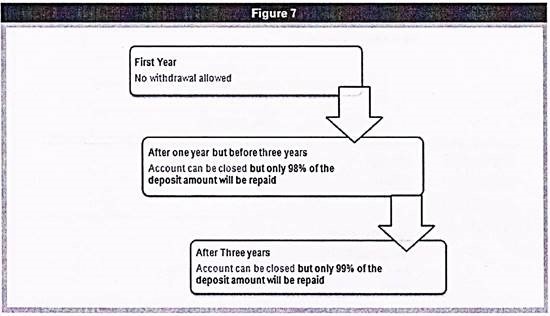

iii. Withdrawal:

4. National Savings Certificates (NSCs):

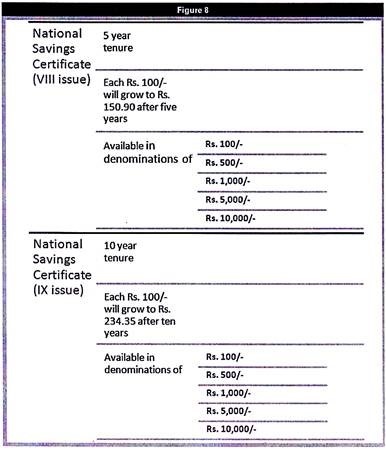

NSC is another investment option offered by the Post Office. It is an alternative to investing in cumulative Term Deposit Schemes.

Given below is the summary of two investment issues available for investment in the NSCs:

5. Senior Citizen Savings Scheme:

The Post Office also offers an additional investment option meant exclusively for senior citizens. It is like a regular interest paying term deposit, but with a higher interest rate. Interest is paid out at the end of each quarter (March 31, June 30, October 31 and December 31)

For the purpose of this scheme, a senior citizen means any person of the age of 60 years or more. The scheme also applies to those individuals who are of the age of 55 years or more and who have received retirement benefits on retirement. Such individuals can invest in this scheme within one month of receipt of the retirement benefits.

Some of the specific features of this scheme are as follows:

ADVERTISEMENTS:

i. Interest and Tenure:

a. The interest rate is 9%.

b. Interest is paid at the end of each quarter.

c. Maturity period is 5 years.

ii. Investment Limit:

a.Minimum investment amount Rs. 1,000/-

ADVERTISEMENTS:

b. Maximum Investment amount Rs. 15,00,000/-

c. Investment should be in multiples of Rs. 1,000/-

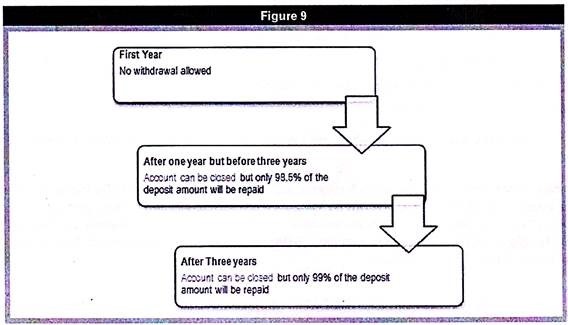

iii. Withdrawal: