Here is a term paper on ‘Debt Instruments of a Company’. Find paragraphs, long and short term papers on ‘Debt Instruments of a Company’ especially written for school and college students.

Term Paper Contents:

- Term Paper on Equity Shares

- Term Paper on Preference Shares

- Term Paper on Sweat Equity Shares

- Term Paper on Non-Voting Shares (NVS)

- Term Paper on Tracking Stocks

- Term Paper on Debentures

- Term Paper on Convertible Debentures

- Term Paper on Zero Interest Bond (ZIBs)

- Term Paper on Equity Warrants with NCDs

- Term Paper on Secured Premium Notes (SPN)

- Term Paper on Deep Discount Bond

- Term Paper on Zero Coupon Convertible Notes

- Term Paper on Junk Bonds

- Term Paper on Mezzanine Debt

- Term Paper on Floating Rate Bonds

- Term Paper on Other Hybrid Debt (Money Market Instrument) Instruments

- Term Paper on Treasury Bills

- Term Paper on Central Government Securities (Gilt-Edged Securities)

- Term Paper on Commercial Paper (CP)

- Term Paper on Certificate of Deposits (CDs)

- Term Paper on Call Money

- Term Paper on Repurchase Agreements

- Term Paper on Interbank Participation Certificate (IBPC)

- Term Paper on Selection of Securities

- Term Paper on Valuation of Warrants

- Term Paper on Valuation of Bonds

- Term Paper on Products of Financial Engineering

Term Paper # 1. Equity Shares as a Money Market Instrument:

An equity interest in a company may be said to represent a share of the company’s assets and a share of any profits earned on those assets after other claims have been met.

ADVERTISEMENTS:

The equity shareholders are the owners of the business; they purchase shares, the money is used by the company to buy assets, the assets are used to earn profits, which belong to the ordinary shareholders.

After satisfying the rights of preference shares, the equity shares shall be entitled to share in the remaining amount of distributable net profits of the company.

The dividend on equity shares is not fixed and may vary from year to year depending upon the amount of profits available.

The rate of dividend is recommended by the board of directors of the company and declared by shareholders in the annual general meeting.

ADVERTISEMENTS:

Equity shareholders have a right to vote on every resolution placed in the meeting and the voting rights shall be in proportion to the paid-up capital.

Term Paper # 2. Preference Shares as Money Market Instrument:

Preference shares is a hybrid security because it has features of both ordinary shares and bonds.

Preference shareholders have preferential rights in respect of assets and dividends.

In the event of winding up the preference shareholders have a claim on available assets before the ordinary shareholders.

ADVERTISEMENTS:

In addition, preference shareholders get their stated dividend before equity shareholders can receive any dividends.

The dividends on preference shares are fixed and they must be declared before a legal obligation exists to pay them.

The fixed nature of dividend is similar to that of interest on debentures and bonds.

The declaration feature is similar to that of equity shareholders dividends.

ADVERTISEMENTS:

Term Paper # 3. Sweat Equity Shares as Money Market Instrument:

A company can issue sweat equity shares to its employees or directors at discount or for consideration other than cash for providing know-how or making available rights in the nature of intellectual property rights or value addition etc., on the following conditions:

The issue of sweat equity shares is authorized by a special resolution passed by the company in the general meeting.

The resolution specifies the number of shares, current market price, consideration, if any, and the class or classes of directors or employees to whom such equity shares are to be issued.

ADVERTISEMENTS:

The company is entitled to issue sweat equity shares only after completion of one year from the date of commencement of business.

The equity shares of the company must be listed on a recognized stock exchange.

The issue of sweat equity shares must be in accordance with the regulations made by SEBI in this behalf.

An unlisted company can issue sweat equity shares in accordance with the prescribed guidelines made for this purpose.

ADVERTISEMENTS:

All the limitations, restrictions and provisions relating to equity shares shall be applicable to sweat equity shares.

Term Paper # 4. Non-Voting Shares (NVS) as Money Market Instrument:

NVS is an innovative instrument for raising funds, although prevalent in many developed countries for years.

NVS are closely akin to preference shares which do not carry any voting rights nor is the dividend payable predetermined.

ADVERTISEMENTS:

However, unlike preference capital, NVS do not carry a predetermined dividend.

The payoff to the investor for the assumption of higher risk levels and the compensation for loss of control is high rate of dividends payable to them.

NVS can be found useful by companies which are shy of exposure over leveraged companies, new companies and closely held companies.

It may find favour with small investors, non-resident Indians, overseas corporate bodies, mutual funds etc.

The investor gains in terms of higher dividends, purchase at advantageous low price, liquidity and capital appreciation.

Term Paper # 5. Tracking Stocks as Money Market Instrument:

ADVERTISEMENTS:

Dr JJ Irani headed for the expert committee constituted by the Government on Company Law has recommended a novel instrument called ‘tracking stocks’ for introduction in the Indian Capital Market.

A tracking stock is a type of common stock that ‘tracks’ or depends on the financial performance of a specific business unit or operating division of a company, rather than the operations of the company as a whole.

As a result, if the unit or division performs well, the value of tracking stocks may increase, even if the company’s performance as a whole is not up to mark or satisfactory. The opposite may also be true.

A tracking stock is a special type of stock issued by a publicly held company to track the value of one segment of that company.

By issuing a tracking stock, the different segments of the company can be valued differently by the investors.

Tracking stocks are issued by a parent company in order to create a financial vehicle that tracks the performance of a particular division or subsidiary.

ADVERTISEMENTS:

Tracking stocks carries divided rights tied to the performance of a targeted division without transferring ownership or control over the divisional assets.

Term Paper # 6. Debentures as Money Market Instrument:

Debentures are the most popular form of debt capital. Basically, a debenture represents a superior and refined form of the age-old promissory note.

Debentures are raised for long-term capital needs.

As in the case of any debt, the debentures have two fundamental features of periodic payment of interest and repayment at a specified point of time.

Debentures include debenture stock, bonds and any other securities of a company whether constituting a charge on the assets of a company or not as defined in the Companies Act, 1956.

ADVERTISEMENTS:

This is an inclusive definition and amounts to borrowing of monies from the holders of debentures on such terms and conditions subject to which the debentures have been issued.

This is a debt instrument and is the commonest method of raising loan capital, as part of project financing.

Term Paper # 7. Convertible Debentures as Money Market Instrument:

A convertible debenture is a bond that can be converted at the option of the holder or at agreed date into equity shares of the same enterprise.

A company may also issue convertible debentures (CDs) in which case an option is given to the debenture holders to convert them into equity or preference shares at stated rates of exchange after a certain period.

Such debentures once converted into shares cannot be reconverted into debentures.

ADVERTISEMENTS:

The ratio of exchange between the convertible security and equity shares are normally stated in the prospectus or issue documents although the conversion terms are not necessarily constant over time because of inclusion ‘step-ups’ clause in the conversion price at periodic intervals.

The conversion may be total or partial.

This gives rise to partly convertible debentures (PCDs), fully convertible debentures (FCDs) and non- convertible debentures (NCDs).

CDs may be fully or partly convertible.

In case of FCDs, the entire face value is converted into shares at the expiry of specified period(s).

In case of PCDs only the convertible portion is converted into shares at the end of the specified period and non-convertible portion is redeemed at the end of certain specified period.

ADVERTISEMENTS:

NCDs do not confer any option on the holder to convert the debentures into shares and are redeemed at the expiry of specified period(s).

CDs, whether fully or partly convertible, may be converted into shares at the end of specified period or periods in one or more stages.

The company should get a credit rating of debentures done by credit rating agency.

CDs are listed on stock exchanges.

Valuation of Convertible Debentures:

Convertible debentures are debentures that are exchangeable into ordinary shares at the option of the holder and under specified terms and conditions.

The following terms are used in connection with convertible:

i. Convertible Price:

This is the price at which debenture may be converted into shares.

ii. Conversion Ratio:

This is the number of shares for which each debenture may be converted. For example, every debenture holder holding one debenture of Rs.100 each is entitled for 10 equity shares of Rs.10 each on conversion. The conversion ratio is 10:1 i.e., 10 equity shares for every one debenture will be exchanged.

iii. Conversion Premium:

The conversion price is always fixed at a figure above the market price of the shares at the time of issuing the debentures. The conversion premium indicates the amount by which the current share price at the time of the issue of the convertible debentures would have to rise to reach the conversion price. For example, at the date of convertible debentures issued the share price is Rs.20 and the conversion price is fixed at Rs.28. Here in this case, the price of shares is raised by Rs.8, the conversion premium will be = Rs.8/Rs.20 × 100 = 40%.

iv. Conversion Value:

The conversion value of a stock is obtained by multiplying the conversion ratio by current share price. For example, an investor who holds a fully convertible debenture of Rs.100 which can be convertible into 5 equity shares of Rs.20 each. The present market value of the shares is quoted at Rs.30, then the conversion value of his debenture is 5 × Rs.30 = Rs.150 and he has made a gain on his investment of Rs.50.

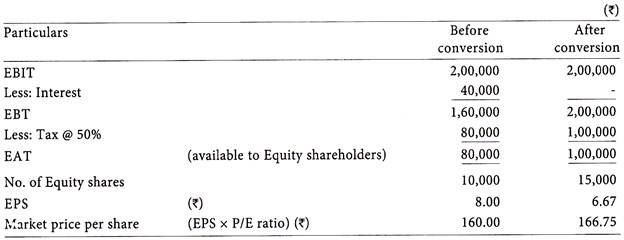

Illustration 1:

Nihar Ltd. is contemplating conversion of 8% convertible debentures of Rs.1,000 each. At present, it has 500 such debentures outstanding. The market price of the debenture is Rs.1,080. The debenture indenture provides that one debenture will be converted for 10 shares. The price earning ratio before redemption is 20:1 and anticipated price earning ratio after redemption is 25:1.

The number of shares outstanding prior to redemption was 10,000. Earning before interest and taxes amounted to Rs.2,00,000. The company is in the 50% tax bracket. Should the company convert its debentures into shares?

Solution:  Recommendation – After the conversion of debentures into shares, the convertible debenture holder can increase his wealth by Rs.587.50 (i.e., market price of 10 shares Rs.1,667.50 – market price of one debenture Rs. 1,080). With the conversion debentures, the market value of shares will also increase from Rs.160 to Rs.166.75. Hence, in the interest of the company and in the interest of debenture holders, the company can convert its debenture into equity shares.

Recommendation – After the conversion of debentures into shares, the convertible debenture holder can increase his wealth by Rs.587.50 (i.e., market price of 10 shares Rs.1,667.50 – market price of one debenture Rs. 1,080). With the conversion debentures, the market value of shares will also increase from Rs.160 to Rs.166.75. Hence, in the interest of the company and in the interest of debenture holders, the company can convert its debenture into equity shares.

Term Paper # 8. Zero Interest Bond (ZIBs) as Money Market Instrument:

ZIBs refer to those bonds which are sold at discount from their eventual maturity value and have zero interest rate.

These certificates are sold to the investors for discount.

The difference between the face value of the certificate and the acquisition cost is the gain to the investors.

The investors are not entitled to any interest and are entitled to only repayment of principal sum on the maturity period.

The individual investors prefer ZIB because of lower investment cost and low rate of conversion to equity if ZIBs are fully or partly convertible bonds.

This is also a means of tax planning because the bonds do not carry any interest, which is otherwise taxable.

Companies also find ZIB quite attractive because there is no immediate interest commitment.

On maturity the bonds can be converted into equity shares or non-convertible debentures depending on the requirement of capital structure of a company.

Term Paper # 9. Equity Warrants with NCDs as Money Market Instrument:

Equity warrant is a piece of paper attached to a non-convertible debenture which gives the buyer or holder right to apply for and acquire an equity share at a future date.

Benefits to Corporates:

1. The equity warrant increases the marketability of debentures and reduces the need for the efforts of brokers/sub-brokers by way of private placement.

2. The opportunity of receiving equity shares at a future date is a great attraction for investors, particularly in case of blue-chip companies.

3. Lesser dependence on financial institutions for subscribing to the security.

4. Wider dispersal of equity and lesser risk of takeover bids. The share can be bought by management through intermediaries.

5. Provides an effective tool for long-term planning of capital structure to minimize cost of capital.

Benefits to Investors:

1. Assured rate of interest over life on non-convertible debentures.

2. There is no extra cost of equity warrant but it has high price, depending on the financial performance of the company.

3. When the market is dampen in its response to the new issues, equity warrants can be added attraction for investors to apply for the issues, offering equity warrants with their securities.

Term Paper # 10. Secured Premium Notes (SPN) as Money Market Instrument:

SPN is a tradable instrument with detachable warrant against which the holder gets equity share(s) after a fixed period of time.

The SPN have feature of medium to long-term notes.

With each SPN, a warrant may be attached to it, which will give the holder the right to apply for and get allotment of equity shares after certain period of time by which the SPN will be fully paid-up.

The investor can plan his tax affairs to minimize tax burden.

It will be possible to spread interest income evenly over the life of the investment and that the premium as capital gains. For example, those who retire after fifth year of investment can opt for low premium to reduced tax liability.

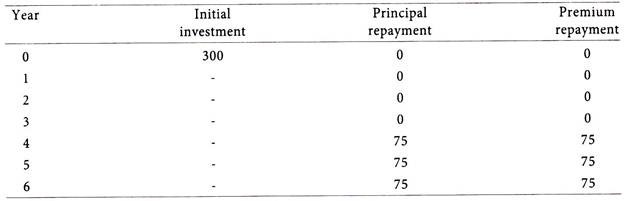

Illustration 2:

Infoway Ltd. issues SPNs, each SPN is of the face value of Rs.300. No interest will accrue on the instruments during the first three years after allotment.

Subsequently, the SPN will be repaid in four equal installments as follows:

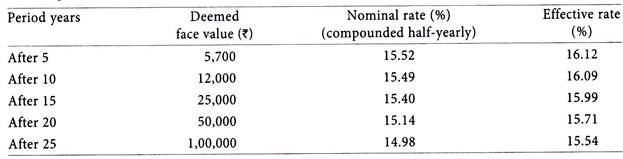

Term Paper # 11. Deep Discount Bond as Money Market Instrument:

The IDBI for the first time issued Deep Discount Bond (DDB). For a deep discount price of Rs. 2,700 an investor gets a bond with a face value of Rs.1 lakh. The DDB appreciates to its face value over the maturity period of 25 years. The unique advantage of DDB is the elimination of investment risk. It allows an investor to lock-in the yield to maturity or keep on withdrawing from the scheme periodically after five years by returning the certificate.

The deemed face value of IDBI’s DDB is as under:  The main advantage of DDB is that the difference between the sale price and original cost of acquisition will be treated as capital gain, if the investor sells the bonds on stock exchange. The DDB is safe, solid and liquid instrument. Investors can take advantage of these new instruments in balancing their mix of securities to minimize risks and maximize returns.

The main advantage of DDB is that the difference between the sale price and original cost of acquisition will be treated as capital gain, if the investor sells the bonds on stock exchange. The DDB is safe, solid and liquid instrument. Investors can take advantage of these new instruments in balancing their mix of securities to minimize risks and maximize returns.

Term Paper # 12. Zero Coupon Convertible Notes as Money Market Instrument:

It is an instrument which can be converted into common stock of the issuer.

If investors choose to convert they will be required to forego all accrued and unpaid interest.

Zero coupons can generally be put to the issuer.

This allows the issuer to obtain the advantages of convertible debt without too much dilution of common stock.

Like any zero coupon bond the issuer gets a tax deduction for imputed interest, even though no cash is paid until maturity.

Investors are also benefited since they have the opportunity to participate in the underlying stock appreciation.

If the appreciation does not materialize investors still have the regular scheme of interest income.

There are risk considerations also in view of the fact that prices of zero coupon bonds are much more sensitive to changing interest rates than coupon bonds.

In case if the proposal does not seem to be advantageous to convert, the investor will be left with a relatively low yield to maturity.

Since zero coupon convertibles often can be put to the issuer, the issuer may be forced to refinance the debt at a disadvantageous time.

Term Paper # 13. Junk Bonds as Money Market Instrument:

Junk bonds are corporate bonds with low ratings from major credit rating agencies.

High-rated bonds are called ‘investment grade bonds’; low rated bonds are called ‘speculative-grade bonds’ or less formally called as ‘junk bonds’.

A bond may receive a low rating for a number of reasons.

If the financial condition or business outlook of the company is poor, bonds are rated speculative- grade.

Bonds are also rated speculative-grade if the issuing company already has large amounts of debt outstanding.

Junk bonds are traded in a dealer market rather than being traded in stock exchanges. Institutional investors hold the largest share of junk bonds.

Firms with low credit ratings are willing to pay 3 to 5 per cent more than the investment grade corporate debt to compensate for greater risk.

Junk bonds are a high yield security, because of this reason junk bonds are widely used as a source of finance in takeovers and leveraged buy-outs.

Junk bonds lie between conventional investments as equities and investment-grade bonds.

Junk bonds are riskier than investment-grade bonds but less risky than equity.

Junk bonds may have cost or tax advantage that allow for some marginal increase in debt.

Term Paper # 14. Mezzanine Debt as Money Market Instrument:

Mezzanine debt is the most common form of subordinate debt.

It is some-times called ‘second tier debt’.

It is an unsecured subordinate debt, where the lender also receives some rights to acquire equity.

It is also referred to as ‘bridge capital’.

It provides an additional layer of financing between the senior debt and the company’s debt.

In case of insolvency of a company, the mezzanine lender stands in line behind the senior lender.

Mezzanine financing may be an attractive way to borrow funds beyond the amount that secured lenders will loan.

The rate of interest charged by the lender for such subordinate debt is generally higher than that charged on senior debts.

Also, the term of the loan is less than that of the senior debt.

Mezzanine debt is generally supplied by commercial banks, venture capital funds, private investors, insurance companies and single-purpose mezzanine funds.

The mezzanine debt is generally raised to finance opportunities in improving infrastructure, acquisition of business, asset purchase, capital restructuring, mergers and acquisitions to achieve higher returns over the interest on mezzanine debt.

Term Paper # 15. Floating Rate Bonds as Money Market Instrument:

Such bonds whose coupon rate is not fixed, but reset with reference to a benchmark rate, are called floating rate bonds.

Some floating rate bonds also have caps and floors, which represent the upper and lower limits within which the floating rates can vary.

To make the government borrowing programme attractive in times of rising interest rates, the Reserve Bank of India (RBI) has mooted the introduction of Floating Rate Bonds (FRBs).

Usually, banks and primary dealers shun securities in a rising market because a rise in yields means fall in price of the bonds and results in a loss of value.

Dealers say that an FRB carries a variable coupon unlike fixed rate government bonds.

These variable coupons are pegged as a spread over a fixed rate like that of the 364 day T-bill or current market yield of the benchmark ten-year bond.

The idea is to reduce the time gap between bid submission and declaration of auction results and withdrawal of facility of bidding in physical form.

A suggestion to design the secured web system, facilitating direct participation of non-NDS members in auction of government securities, is also being considered.

The interest paid to the floating rate bondholders changes periodically depending on the market rate of interest payable on the gilt-edged securities.

These bonds are also called ‘adjustable interest bonds’ or ‘variable rate bonds’.

Term Paper # 16. Other Hybrid Debt (Money Market Instrument) Instruments:

1. Multi-Option Secured Redeemable Convertible Debentures:

Where a debenture gives the holder thereof two or more different options, it may be called a ‘multi-option debenture’. It is a species of debenture. It is essentially a in character and is secured redeemable and convertible into equity shares. Its chief feature is the multi-options available to the investor.

2. Callable Bond:

A callable bond is a bond which the issuer has the right to call in and pay off at a price stipulated in the bond contract. The price the issuer must pay to retire a callable bond when it is called is termed as ‘call price’. The main advantage in callable bond is the issuers have an incentive to call their existing bonds if the current interest rate in the market is sufficiently lower than the bond’s coupon rate. Usually the issuer cannot call the bond for a certain period after issue.

3. Option Tender Bonds:

The option tender bonds are bonds with put option which give the bondholders the right to sell back their bonds to the issuers normally at par. Issuers with puts are aimed both at investors who are pessimistic about the ability of interest rates to decline over the long-term and at those who simply prefer to take a cautious approach to their bond buying.

4. Guaranteed Debentures:

Some businesses are able to raise long-term money because their debts are guaranteed, usually by their parent companies. In some instances the State Governments guarantee the bonds issued by the State Government undertakings and corporation like Electricity Supply Board, Irrigation Corporation etc.

5. Subordinated Debentures:

A subordinated debenture is an unsecured debt which is junior to all other debts i.e., other debt holders must be fully paid before the subordinated debenture holders receive anything. This type of debt will have a higher interest rate than more senior debt and will frequently have rights of conversion into ordinary shares. Subordinated debt is often called ‘mezzanine finance’ because it ranks between equity and standard debt.

6. Indexed Bonds:

Fixed income and fixed sum repayments are uneconomic in times of rapid inflation. Indexed bond is a financial instrument which retains the security and fixed income of the debenture but which also provides some safeguard against inflation.

7. Inflation Adjusted Bonds:

Inflation adjusted bonds (IABs) are bonds which promise to repay both the principal and the interest, by floating both these amounts upwards or downwards in line with the movements in the value of the specified index of commodity prices (inflation rate).

8. Credit Wrapping:

Credit wrapping is a technique by which bonds are issued by a company with a poor rating can be shored up with the assistance of an institution with a strong credit rating. It involves the institution agreeing to underwrite a proportion of the amount payable in the event of default at the time of redemption. In many cases it is the only way in which poorly rated companies can issue bonds.

9. Strips:

The term ‘STRIPS’ can be expanded as ‘separate trading for registered interest and principal securities’. STRIPS is the process of separating the interest and principal portions of a security, which then may be sold separately in the secondary market. It allows investors additional liquidity while holding government paper since the individual interest and principal components can be traded as separate securities. These are popular with investors who want to receive a known payment on a specific future date. These are also called ‘zero coupon securities, since the only time an investor receives a payment from STRIPS is on maturity.

10. Oil Bonds:

The public sector oil marketing companies in India are selling petrol, diesel, LPG and kerosene at subsidized prices as per the government price ceilings and the resultant subsidy ought to be borne by the government. To compensate the subsidy losses of oil marketing companies, oil bonds are issued by the government to such companies in lieu of cash, mature after five to seven years. The oil bonds will carry coupon rate. But to ease-out liquidity problems, the oil companies prefer to sell out at discount to maturity.

11. Call and Put Option in Debenture Issue:

(a) Call Option:

A call option gives a liberty to the issuer of the debenture to pay back the amount earlier to the redemption date at a predetermined price (strike price) with in the specified period. In case the option is not exercised the debenture continues.

(b) Put Option:

A put option gives a right to investors to demand back the money earlier to the redemption date at a predetermined price (strike price) with in the specified period.

Term Paper # 17. Treasury Bills as Money Market Instrument:

The treasury bills issued by the government are called as T-bills’.

T-bills are one of the most important instruments in virtually all the money markets in the world.

T-bills are issued by the government for periods ranging from 14 days to 364 days through regular auctions.

The treasury bills are instruments that finance the short-term requirements of the Government.

They are highly liquid instruments having an active secondary market and are issued at a discount to face value.

Since they are issued at a discount, the return for the investor is the difference between the maturity price and the issue price.

They are highly liquid instruments and demand is largely from banks, financial institutions and corporations.

Fundamentally, T-bills are short-term instruments issued by RBI on behalf of the Government of India to tide over short-term liquidity shortfalls.

T-bills market is much more liquid than that for dated Government of India securities because of shorter tenure of T-bills.

Treasury bill is a short-term money market instrument as well as a short-term security by which the Government raises finance to meet its short-term requirements.

The investment in the treasury bill is reckoned for the purpose of statutory liquidity reserve (SLR) requirements.

The periodicity of the T-Bills is 14 days, 28 days, 91 days, 182 days and 364 days.

Periodically, Reserve Bank of India comes out with the T-Bills auctions, whereas only in the case of 91 days T-Bills, the amount is notified.

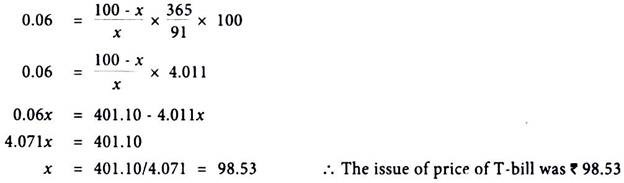

Illustration 3:

RBI sold a 91-day T-bill of face value of Rs.100 at an yield of 6%. What was the issue price?

Solution:

Issue price of T-bill is at discounted value and redeemed at face value.

Maturity period 91 days

Face value Rs.100

Yield rate 6% or 0.06

Let the issue of T-bill be ‘x’.

Then,

Term Paper # 18. Central Government Securities (Gilt-Edged Securities) as Money Market Instrument:

The websters dictionary defines gilt-edged as something of ‘the highest’ or ‘best quality’ and guild as the thin layer of gold applied in the process of gilding.

The government securities/bonds, the world over, are known as ‘gilt-edged securities’.

This is due to the near risk less nature of government debt.

The maturity pattern of Government of India securities has gone through a sea change over the years.

There is a greater emphasis on medium and long-term securities now, as compared to the short-term securities earlier.

The ownership of the gilt-edged securities being largely limited to the banking system in India.

The return on gilt-edged securities is much lower than virtually all other forms of investment.

The Central Government issues securities for terms ranging from 1 year to 10 years either at a fixed rate or through auction.

They are relatively less liquid than treasury bills and demand is mainly from banks.

The types of Central Government securities that have evolved recently include:

(i) Issue of stock through auction ushering in a new treasury culture enabling development of bidding skills amongst market participants.

(ii) Issue of stock with pre-announced coupon rates (e.g., fixed rate bonds).

(iii) Issue of stock with variable coupon rates (e.g., floating rate bonds).

(iv) Issue of zero coupon bonds (issued at discount).

(v) Issue of capital index bonds (to hedge against inflation).

(vi) Issue of stock in conversion of maturing treasury bill/dated securities (converted stocks).

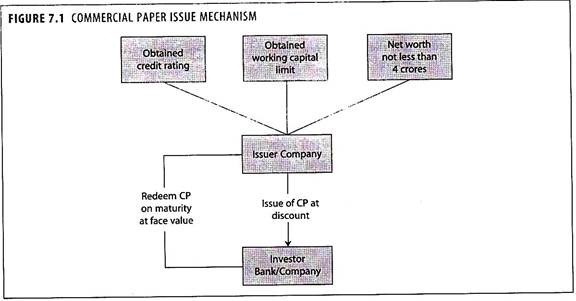

Term Paper # 19. Commercial Paper (CP) as Money Market Instrument:

CP is a debt instrument for short-terra borrowing, that enables highly-rated corporate borrowers to diversify their sources of short term borrowings and provides an additional financial instrument to investors with a freely negotiable interest rate.

CP was initially meant to be used by the corporate borrowers having good ranking in the market as established by a credit rating agency to diversify their sources of short-term borrowings at a rate which was usually lower than the bank’s working capital lending rate.

Later on, Primary Dealers (PDs) and Satellite Dealers (SDs) were also permitted to raise funds through the issue of CP.

CP does not originate from any specific self-liquidating trade transactions like commercial bills which generally arise out of specific trade or commercial transactions.

CP can be issued by companies either directly to the investors or through banks/merchant bankers (called dealers).

CP is a form of usance promissory note, negotiable by endorsement and delivery.

It is issued at a discount determined by the issuer company.

The discount varies with the credit rating of the issuer company and the demand and supply position in the money market.

Features of Commercial Paper:

1. CP is a short-term money market instrument comprising usance promissory note with a fixed maturity value.

2. It is a certificate evidencing an unsecured corporate debt of short-term maturity.

3. CP is issued at a discount to face value basis but it can also be issued in interest bearing form.

4. The issuer promises to pay the buyer some fixed amount on some future period but pledges no assets, only his liquidity and established earning power, to guarantee that promises.

5. CP can be issued directly by a company to investors or through banks/merchant bankers.

Advantages and Disadvantages of Commercial Paper:

Advantages:

1. The advantage of CP lies in its simplicity. It involves hardly any documentation between the issuer and investor.

2. The issuer can issue CP with the maturities tailored to match the cash flow of the company.

3. A well-rated company can diversify its sources of finance from banks to short-term money markets at somewhat cheaper cost.

4. The companies which are able to raise funds through CP become better known in the financial world and are thereby placed in a more favourable positions for raising such long-term capital.

5. The CP provides investors with returns than they could get from the banking system.

6. CP facilities securitization of loans resulting in creation of secondary market for the paper and efficient movement of funds providing cash surplus to cash deficit entities.

Disadvantages:

1. Its usage is limited to only blue-chip companies.

2. Issuance of CP bring down the bank credit limits.

3. A high degree of control is exercised on issue of CP.

4. Standby credit may become necessary.

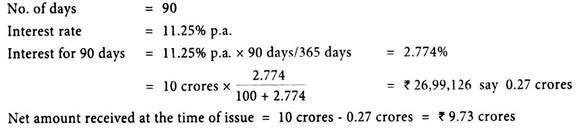

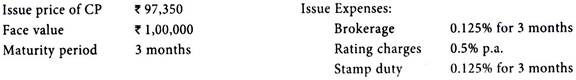

Illustration 4:

X Co. Ltd. issued Commercial Paper as per following details:

What was the net amount received by the company on issue of Commercial Paper?

Solution:

Let us assume that the company has issued Commercial Paper worth Rs.10 crores

Illustration 5:

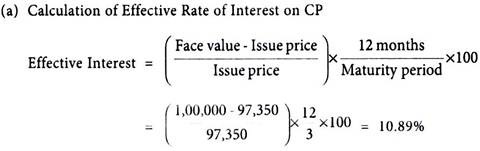

From the following particulars, calculate the effective interest p.a. as well as the total cost of funds to ABC Ltd., which is planning a CP issue:

Solution:

Term Paper # 20. Certificate of Deposits (CDs) as Money Market Instrument:

The scheme of CDs was introduced by RBI as a step towards deregulation of interest rates on deposits.

Under this scheme, any scheduled commercial banks, cooperative banks excluding land development banks, can issue CDs for a period of not less than three months and up to a period of not more than one year.

The financial institutions specifically authorized by the RBI can issue CDs for a period not below one year and not above 3 years duration.

CD, can be issued within the period prescribed for any maturity.

The various features of CDs are as follows:

(i) CDs can be subscribed by an individual, as well as, by an institution.

(ii) CDs are money market instruments in the form of Usance Promissory Notes issued at a discount and are negotiable in character. There is a lock-in-period of 15 days, after which they can be sold.

(iii) The minimum size of the deposit is Rs.5 lakhs and thereafter in multiples of Rs.5 lakhs.

(iv) The rate of interest is determined freely by the parties to the transaction.

(v) The instrument is to be stamped according to the rates prescribed by the Indian Stamp Act.

(vi) Premature closure of CDs is not permitted and buy-back of the CDs is prohibited.

(vii) The CDs should fall due for payment on a working day. In case the due date falls on a holiday, the payment is to be made on the previous working day.

(viii) No advance can be taken against the security of the CDs.

(ix) There is no limit for investment in CDs by the banks.

(x) Due to the negotiable character of the CD, the same could be sold after the lock-in-period, thus enabling the investing bank to create liquidity. This instrument is useful to the corporate for parking their surplus short-term bonds.

The CDs issued by DFIs can be coupon bearing.

The discount rates of CDs are market determined.

The maturity period ranges from 91 days for the CDs issued by banks, 1 to 3 years for those issued by DFIs.

CDs can be issued in multiples of Rs 5 lakhs subject to a minimum investment of Rs.25 lakhs.

The primary investors are retail customers and corporate with surplus funds.

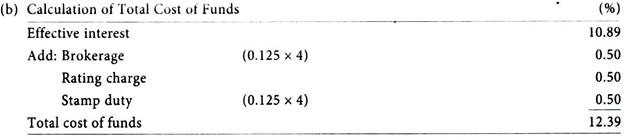

Rate of Interest on CDs:

As this instrument is issued at discount, the rate of interest is calculated as rear-end rate on the basis of calculations as follows:

Illustration 6:

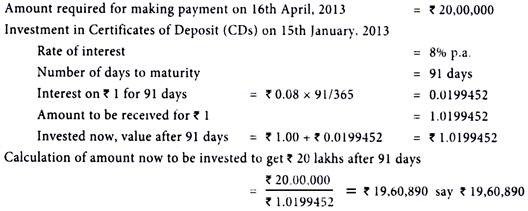

P Co. has 10 make payment of Rs.2 million (Rs.20 lakhs) oil 16th April, 2013. It has a surplus money today i.e., 15th January, 2013 and the company has decided to invest in Certificate of Deposit (CDs) of a leading nationalized bank at 8% p.a. What money is requited to be invested now?

Solution:

Term Paper #

21. Call Money as Money Market Instrument:

Call money refers to that transaction which is received or delivered by the participants in the call money market and where the funds are returnable next day.

The call money transactions are also referred to as ‘overnight funds’.

Notice money on the other hand is a transaction where the participants will take time to receive or deliver for more than two days but generally for a maximum of fourteen days.

In both the cases the transaction is unsecured.

Therefore, as a prudential measure, a counter-party exposure limits are listed according to which the lender lends money.

In short, resorting to the call/notice money transactions reflect temporary mismatch of funds during the short period of one to fourteen days.

The participants, who have surplus, lend their money to shed the mismatch for the relative period.

The participants who are short of funds would borrow funds for the relative period.

The rate at which the funds will be deployed or borrowed will be determined on the basis of the market conditions at a given point of time.

When the market is highly liquid, the funds would be easily available whereas the funds will be difficult to obtain in a tight money market conditions.

The rates are low in an easy money or liquid market and the rates would be high in a tight money market.

Term Paper #

22. Repurchase Agreements as Money Market Instrument:

Repurchase agreements are simply called as ‘repos’ arise when one party sells a security to another party with an agreement to buy it back at a specified time and price.

Repos are active between the commercial banks.

In a ready forward deal or repos transaction, a bank avails itself of funds against the pledge of securities.

Basically it is pledge transaction, with the bank committing itself to buy back the security, therefore, paying back the amount borrowed on pledge at a mutually agreed price after a specified period.

This period ranges between one and 14 days.

The difference between the sale and buyback price is the interest cost.

The basic advantage of a repo is that a collateral security is offered to the lender eliminating counterparty risk, especially in a volatile market.

Repo is a risk free short term instrument for balancing short-term liquidity needs.

Banks have often resorted to ready forward deals among themselves, as also with Discount and Finance House of India (DFHI) and Securities Trading Corporation of India (STCI) to overcome short-term funds mismatches.

At present, the RBI permits repos between banks, cooperative banks and eligible institutions, i.e., the DFHI and the STCI.

Term Paper #

23. Interbank Participation Certificate (IBPC) as Money Market Instrument:

IBPC is another short term money market instrument by which the banks can raise money or deploy short-term surplus.

IBPC are of two types such as:

(a) On risk sharing basis and

(b) Without risk sharing, and they can only be issued by the scheduled commercial banks.

The minimum period shall be 91 days with maximum of 180 days for IBPC on risk sharing basis and in case of non-risk sharing basis, it is limited to 90 days.

The maximum participation in loan under IBPC would be 40% of the amount outstanding or the limit sanctioned, whichever is lower. However, participation should be only in ‘standard asset’.

Documents to be executed by the borrowers in favour of the issuing banks, which shall include a clause that it should have liberty to shift at its discretion, without notice to the borrower, of a part or portion of the outstanding to another participating bank.

Interest rates are determined between issuing bank and the participating bank.

The issuing bank and the participating bank have to enter into participation contracts in the prescribed format.

IBPC are not transferable and they cannot be redeemed before the due date.

On the date of maturity, the issuing bank have to make payment of the IBPC along with agreed rate of interest to the participating bank.

Term Paper #

24. Selection of Securities:

A company proposing to raise resources has various instruments of securities.

However a proper choice has to be made keeping in view the following important aspects, namely:

1. Voting rights of the holders of the security proposed to be issued vis-a-vis existing holding of the promoters of the company.

2. A proper structuring of capital with debt-equity mix, keeping in view the regulations of the stock exchange for enlistment of the securities to be issued.

3. The purpose for which the capital is to be raised – whether for setting up a new project or for meeting working capital requirements, etc.

4. Preference by the prospective investors for investment in shares and/or debentures.

5. Annual servicing cost to the company for servicing the capital or debentures.

6. Financial burden to the company as to a charge on pre-tax profits.

7. Financial advantage to the company in the form of capitalization of interest on the security issued till the project goes into commercial production thus enabling it to claim fiscal incentives by way of depreciation, investment allowance etc.

Term Paper #

25. Valuation of Warrants:

A warrant is a long-term security usually, attached to a bond or preferred stock, that gives the holder the right to buy a fixed number of a company’s common shares at a price that is higher than the stock’s current market price.

A warrant is a long-term security that gives its owner the right to buy a specified amount of common stock at a fixed price for a fixed period of time.

The fixed price at which the stock can be purchased is at a substantial premium to the market value of the stock at the time the warrant was issued.

There is usually a waiting period-typically a year before the owner can exercise the warrant.

Most warrants expire within 5 to 10 years, although some companies have issued perpetual warrants.

Warrants are rarely issued as stand-alone securities to the public.

Most often, they are issued attached to a new bond or preferred stock.

The combination of the new security and the warrant is often referred to as a unit and is designed to sweeten or increase the marketability of the speculative new issue.

When it is issued, a warrant usually has no intrinsic worth.

It becomes valuable only when and if the market price of the common stock moves above the fixed price at which the warrant permits the investor to buy the stock.

For example, a company has common shares outstanding that are trading in the market at Rs.20 per share. The company issues a preferred stock with a five-year warrant that gives shareholders the right to purchase additional common shares at Rs.35. If the price of the common stock rises to Rs.50 per share during the five- year period, the warrant has intrinsic value of Rs.15 per share (Rs.50 – Rs.35). In case where the warrant can be detached from the security, you can sell the warrant in the market and take the profit.

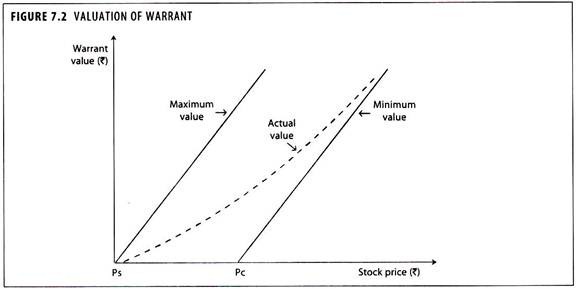

The value of a warrant is calculated as follows:

Condition – Minimum value of warrant

(Ps > Pc) – Ps – Pc × N

Ps ≤ Pc – 0

Where, Ps = Current market price for the equity shares

Pc = Exercise price of the warrant

N = Number of equity shares per warrant (Generally N = 1)

Generally the actual market value of the warrant will be greater than the minimum value. The maximum value of the warrant is (Ps × N). The difference between the actual price of a warrant and its minimum value is the premium over minimum value.

The speculative value of the warrant, referred to as the premium value, is a function of the following factors:

(i) The potential leverage the warrant provides, which is a function of the ratio of the stock price to the warrant price. The greater the potential leverage is, the larger the premium.

(ii) The length of time to maturity the longer the time to maturity is, the larger the premium.

(iii) The price volatility of the underlying stock: the greater the price volatility of the stock is, the larger the premium.

(iv) The dividend paid by the stock, which is an inverse relationship; the larger the dividend is, the smaller the premium.

In the short-run the warrant price and share price move in line with each other. In long-term, the price of the warrant and the premium will depend on:

(i) The length of time before the warrants may be exercised.

(ii) The current price of the shares compared with the exercise price, and

(iii) The future prospects of the company.

As the exercise period approaches, the premium will disappear. During the exercise period there should be no premium because, if there were one, it would be cheaper to buy the shares directly rather than via the warrant.

Illustration 7:

The present market value of equity shares is Rs.80 and the exercisable price of the warrant is Rs.60 per share. An investor is holding a warrant entitled to purchase 50 equity shares. Calculate the minimum value of the warrant.

Solution:

Value of Warrant = (Ps – Pc) × N = (Rs.80 – Rs.60) × 50 = Rs.20 × 50 = Rs.1,000

Advantages of Warrants:

Advantages to the Company:

1. Warrants themselves do not involve the payment of any interest or dividends. When they are initially attached to loan stock, interest rate on the loan stock will be lower than for a comparable straight debt.

2. Warrants make a loan stock issue more attractive and may make an issue of unsecured loan stock possible where adequate security is lacking.

3. They provide a means of generating additional equity funds in the future without any immediate dilution in earning per share.

Advantages to the Investor:

1. As warrants provide no income all profits are in the form of capital gains which will be attractive.

2. There is potential for a high, profit on a relatively low initial outlay.

Term Paper #

26. Valuation of Bonds:

The value of an asset is the present value of the expected returns from the asset during the holding period. An investment in stocks is expected to provide a stream of returns during the holding period and it is necessary to discount this stream of expected returns at the expected rate of return to determine the value of the securities.

1. Bond Yield:

The reward for investing in a bond is the interest payment and the premium on redemption. If the bond is issued at discount, then the extent of the discount also constitutes a reward for the investor. Bond yield refers to the rate of return the initial investor will earn if he holds the bond till its maturity. This is computed by laying down the cash flow structure across the life of the bond and computing its internal rate of return.

2. Yield to Maturity (YTM):

This indicates the rate of return an investor who buys the bond in the market today earns if he holds the bond till maturity. This is computed by laying down the cash flow structure from the date of purchase to the maturity of the bond and then computing its IRR. Bond yield is the same as YTM except that the phrase is used with reference to the investment made at the time of issue.

If a bond offers a rate of return which is less than the market rate, it would start quoting at a discount. If the bond offers a coupon which is greater than the market rate, it would start quoting at a premium. If it offers a coupon exactly equal to the market rate it will continue to trade at par.

3. Stream of Expected Returns:

An estimate of the future returns expected from an investment encompasses not only the size but the form, time pattern and uncertainty of returns. The return will be in the form of interest on loan stock and dividends on shares. The time pattern of returns is important in calculation of present value of expected returns.

4. Required Rate of Return:

The required rate of return on an investment is determined by:

(i) The company’s real risk free rate of return.

(ii) The expected rate of inflation during the holding period, and

(iii) A risk premium.

The valuation of bond is easier than the valuation of common stock because the pattern of returns and repayment period is known beforehand.

Generally the terms of payment of bond will consist of the following:

(i) Interest payments every six months.

(ii) The payment of the principal at the end of the maturity period.

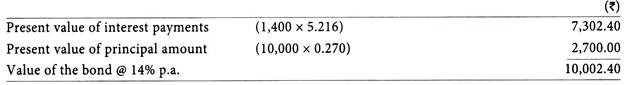

Illustration 8:

In 2013, Meridian Ltd. has issued bonds of Rs.10,000 each due in the year 2013 with a 14% p.a. coupon rate payable at the end of each year during the life of the bond. Calculate the present value of the bond.

Solution:

Yearly receipt of interest = Rs.1,400

Present value of Rs.1 received annually for 10 years @ 14% p.a. is 5.216

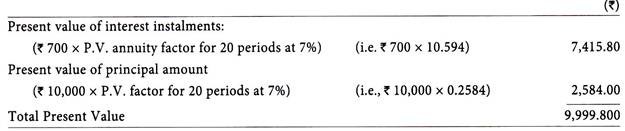

Illustration 9:

Suppose, the bonds issued in above illustration, on which interest is payable half yearly. Then calculate the present value of the bond.

Solution:

Half yearly receipt of interest = Rs.700

No. of periods = 20 at half interest @ 7%

Most large and medium sized companies finance some portion of their fixed assets with long-term debt. This may be in the form of either secured bonds or unsecured debentures. The term bond is often used to denote any type of long-term debt security. The valuation of bonds by ascertaining its future cash flows which includes the interest payments as well as principal repayment.

Most large and medium sized companies finance some portion of their fixed assets with long-term debt. This may be in the form of either secured bonds or unsecured debentures. The term bond is often used to denote any type of long-term debt security. The valuation of bonds by ascertaining its future cash flows which includes the interest payments as well as principal repayment.

The value of bond mature within finite period of time is determined with the help of the following formula:

V = Present value of bond

I = Annual interest payment

n = Number of years to maturity

F = Face value of bond

The formula can be summarized as follows:

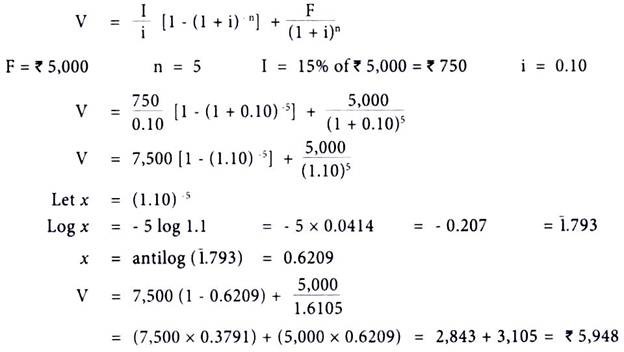

Illustration 10:

A bond with a face value of Rs.5,000 matures at the end of 5 years, the rate of interest on the bond being 15% p.a. paid annually. Find the present value of the bond so as to yield a return of 10% p.a.

Solution:

Term Paper #

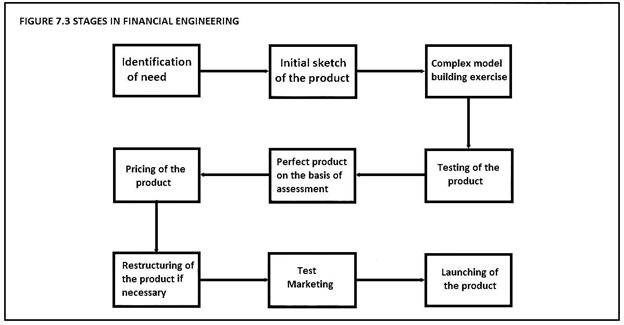

27. Products of Financial Engineering:

Engineering is the practical application of mathematical or scientific principles to solve problems or design useful products or services.

Financial engineering involves the design, development and implementation of innovative financial instruments and process and the formulation of creative solutions to problems in finance.

Financial engineering may be defined as the design and redesign of financial instruments like derivatives and other products to structure cash flow to achieve the desired financial goals, which inter alia, includes improvement of return and/or risk characteristics in tune with the changing environment of market, taxation, legal or general economy.

One of the essential characteristics of financial engineering products is ‘innovation’.

Financial engineering like any other engineering has brought several new products and solutions to the market.

It has completely changed the financial market today. Its main contribution is to split the risk and return into several components and allow investors of financial markets to decide the combination that is most suitable to them.

Such innovations are seen in bonds, equity derivatives and also in other fields like merger, acquisition and corporate restructuring.

A Financial Engineer works within given physical and budgetary constraints.

He tries to answer the questions like:

(i) Will the instrument deliver the desired result, even if the market moves in an erratic manner?

(ii) How will it withstand the financial earthquakes like default from one counter party? Etc.

Factors Contributing to Financial Engineering:

i. Tax advantage.

ii. Reduce transaction cost.

iii. Reduces agency cost.

iv. Risk reallocation.

v. Increased liquidity.

vi. Level and volatility of interest rates.

vii. Level and volatility of prices.

viii. Academic work.

ix. Accounting benefits.

x. Technological development and other factors.

Features of Financial Engineering:

1. A document in the nature of bond or debenture with warrants, entitling shares after a certain period, issued at discount or at par.

2. The aforesaid document may be convertible, partly-convertible, or non-convertible.

3. Conversion may be compulsory, or at the option of holder, of certain portions, or redeemable at various intervals.

4. Conversions are to be made at a predetermined price or at a price to be determined by the company, and at a certain ratio.

5. Interest rates are within the band of administered rates for long-term deposits and or slightly higher than the minimum cap on working capital loan.

6. Lock-in periods may be stipulated.

7. Complexity for the investor in comprehending his rate of return on investment and the cash inflows, the present value thereof.

The successes of the foregoing instruments are based on the following presumptions:

(i) Share prices will increase, thus conversion being at a premium, no fund-flow on such transfer is involved.

(ii) Decrease in earnings per share due to increased number of shares arising on conversion, will be offset by the reduced incidence of interest and increased profit after tax.

(iii) The instruments should be actively traded at the exchanges.