In the fast changing financial scenario, it has become imperative for the corporate sector to devise hybrid debt instruments for raising funds from the market. A brief discussion is made here about the hybrid debt instruments of finance.

Hybrid Debt Instrument # 1. Zero Coupon Bond (ZCB):

ZCBs do not pay out any interest prior to maturity. These bonds are sold at a discount because the value from the bond occurs at maturity when the principal is returned to the bondholder along with interest. When such a bond is issued for a very long tenor, the issue price is at a significant discount to the face value. Hence, such bonds are called ‘deep discount bonds’.

A DDB is a form of ZCB. It is issued at a deep/steep discount over its face value. It implies that the interest (coupon) rate is far less than the yield to maturity. The DDB appreciates to its face value over the maturity period. ZCBs do not carry any explicit/coupon rate of interest. They are sold at a discount from the maturity value. The difference between the face value of the bond and the acquisition cost is the gain/return to the investors.

The implicit rate of return/interest on such bonds can be compounded by the equation:

ADVERTISEMENTS:

Acquisition price = Maturity (face) value/(1+ i)n

Where, i = rate of interest

n = maturity period (years)

This is also a means of tax planning because the bonds do not carry any interest, which is otherwise taxable. Companies also find ZCBs quite attractive because there is no immediate interest commitment. On maturity the bonds can be converted into equity shares or non-convertible debentures depending on the requirement of capital structure of a company.

ADVERTISEMENTS:

The main advantage of DDB is that the difference between the sale price and original cost of acquisition will be treated as capital gain, if the investor sells the bonds on stock exchange.

The DDB is safe, solid and liquid instrument. Investors can take advantage of these new instruments in balancing their mix of securities to minimize risks and maximize returns. The unique advantage of DDB is the elimination of investment risk. It allows an investor to lock-in the yield to maturity or keep on withdrawing from the scheme periodically after five years by returning the certificate.

Hybrid Debt Instrument # 2. Strips:

The term ‘STRIPS’ can be expanded as ‘separate trading for registered interest and principal securities’. STRIPS is the process of separating the interest and principal portions of a security, which then may be sold separately in the secondary market. It allows investors additional liquidity while holding government paper since the individual interest and principal components can be traded as separate securities.

These are popular with investors who want to receive a known payment on a specific future date. These are also called ‘zero coupon securities, since the only time an investor receives a payment from STRIPS is on maturity. This is an innovation where separate zero coupon bonds are created out of each cash-flow (interest as well as principal) emanating from a coupon paying security.

ADVERTISEMENTS:

For example, a 10 year bond with a face value of Rs.1,00,000 and a half-yearly interest @ 8% p.a. would result in 21 cash flows – 20 of them being for an amount of Rs.4,000 (half-yearly interest) payable after 6,12,18,24…………… months and one for payment of Rs.1,00,000 (i.e. the principal) at the end of 10 years. Such a bond would be split into 21 zero coupon bonds, each having a different maturity value, and each bond can be traded separately.

Hybrid Debt Instrument # 3. Zero Coupon Convertible Note:

It is an instrument which can be converted into common stock of the issuer. If investors choose to convert they will be required to forego all accrued and unpaid interest. Zero coupon can generally be put to the issuer. This allows the issuer to obtain the advantages of convertible debt without too much dilution of common stock. Like any zero coupon bond the issuer gets a tax deduction for imputed interest, even though no cash is paid until maturity.

Investors are also benefited since they have the opportunity to participate in the underlying stock appreciation. If the appreciation does not materialize investors still have the regular scheme of interest income. There are risk considerations also in view of the fact that prices of zero coupon bonds are much more sensitive to changing interest rates than coupon bonds.

In case if the proposal does not seem to be advantageous to convert, the investor will be left with a relatively low yield to maturity. Since zero coupon convertibles often can be put to the issuer, the issuer may be forced to refinance the debt at a disadvantageous time.

Hybrid Debt Instrument # 4. Secured Premium Notes (SPN):

ADVERTISEMENTS:

SPN is a tradable instrument with detachable warrant against which the holder gets equity share(s) after a fixed period of time. The SPN have feature of medium to long-term notes. With each SPN, a warrant may be attached to it, which will give the holder the right to apply for and get allotment of equity shares after certain period of time by which the SPN will be fully paid-up. The investor can plan his tax affairs to minimize tax burden.

It will be possible to spread interest income evenly over the life of the investment and that the premium as capital gains. For example, those who retire after fifth year of investment can opt for low premium to reduced tax liability. The SPN is a secured debenture, redeemable at a premium over the face value/purchase price.

It resembles a ZIB. There is a lock-in- period for SPN, during which no interest is paid. The holder has the option to sell the SPN back to the issuing company, at par, after the lock-in-period. The redemption is made in installments. The SPN is a tradable instrument. A typical example is the SPN issued by TISCO.

Hybrid Debt Instrument # 5. Step-Up and Step-Down Debentures:

The terms of issue of stepped-up debenture contains that instead of making conversion at one go at the end of the tenure, it has designed the instrument in such a way that the equity component is augmented gradually. For example, the stepped-up debenture has been priced at the face value of Rs.50, with a coupon of 18% p.a. (interest payable half yearly) and a tenure of three years.

ADVERTISEMENTS:

The debt component will be converted into equity in a phased manner over a period of three years from the date of the issue. The conversion will be done at par value, at the rate of 20% at the end of first year and 40% each at the end second and third years.

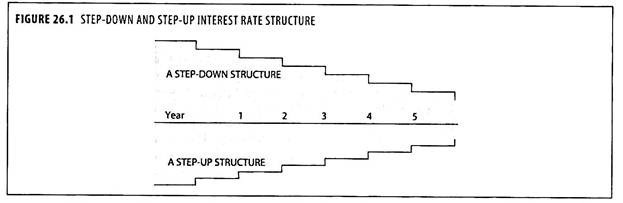

As the scale of business increases, via funding through borrowings, proportional increases in equity should also be brought in. A debt instrument with interest rates that either ascend or descend, reaching up to the highest or lowest level in the terminal year.

Hybrid Debt Instrument # 6. Debt for Equity Swap:

This instrument is an offer from an issuer of debt securities to its debt holders to exchange the debt for the issuer common or preferred stock. The issuer who wishes to offer debt for equity swaps does so with a view to increasing equity capital for the purposes of improving its debt-equity ratio and also enhance its debt raising capacity. It also helps issuers to reduce their interest expenses and enables them to replace it with dividends on stock that are payable at their discretion.

ADVERTISEMENTS:

Investors get attracted because of the potential appreciation in the value of the stock. There are risk considerations in view of the fact swaps may dilute earnings per share of issuer. In addition, dividends are not tax deductible while interest on tax securities is taxable. Further, potential appreciation in the value of the stock may not materialize and in the process investors may have to suffer.

Hybrid Debt Instrument # 7. Junk Bonds:

Junk bonds are corporate bonds with low ratings from a major credit rating agencies. High-rated bonds are called ‘investment grade bonds’; low rated bonds are called ‘speculative-grade bonds’ or less formally called as ‘junk bonds’. A bond may receive a low rating for a number of reasons. If the financial condition or business outlook of the company is poor, bonds are rated speculative-grade.

Bonds are also rated speculative-grade if the issuing company already has large amounts of debt outstanding. Some bonds are rated speculative-grade because they are subordinated to other debt i.e. their legal claim on the firm’s assets in the event of default stands behind the other claim, so called senior debt. Junk bonds are traded in a dealer market rather than being traded in stock exchanges.

Institutional investors hold the largest share of junk bonds. Firms with low credit ratings are willing to pay 3 to 5% more than the investment grade corporate debt to compensate for greater risk. Junk bonds are a high yield security, because of this reason junk bonds are widely used as a source of finance in takeovers and leveraged buy-outs.

ADVERTISEMENTS:

Junk bonds lie between conventional investments as equities and investment-grade bonds. Junk bonds are riskier than investment-grade bonds but less risky than equity. Junk bonds may have cost or tax advantage that allow for some marginal increase in debt. But these advantages are not likely to induce bondholders to invest in junk bonds more recklessly than other safer debt instruments.

Hybrid Debt Instrument # 8. Floating Rate Bonds (FRBs):

Bonds may be issued, instead of a predetermined rate at which coupons are paid, it is possible to structure bonds. Where the rate of interest is reset periodically, based on a benchmark rate. Such bonds whose coupon rate is not fixed, but reset with reference to a benchmark rate, are called FRBs.

Some floating rate bonds also have caps and floors, which represent the upper and lower limits within which the floating rates can vary. To make the government borrowing program attractive in times of rising interest rates, the Reserve Bank of India (RBI) has mooted the introduction of FRBs.

The interest on such bonds is not fixed. It is floating and is linked to a benchmark rate such as interest on treasury bills, bank rate, maximum rate on term deposits. It is typically a certain percentage point higher than the benchmark rate.

The price of FRBs tends to be fairly stable and close to par value in comparison with fixed interest bonds. They provide protection against inflation risk to investors, particularly banks and financial institutions. Usually, banks and primary dealers shun securities in a rising market because a rise in yields means fall in price of the bonds and results in a loss of value.

Dealers say that an FRB carries a variable coupon unlike fixed rate government bonds. These variable coupons are pegged as a spread over a fixed rate like that of the 364 day T-bill or current market yield of the benchmark ten year bond. The Clearing Corporation of India Limited (CCIL) is working on a new issuance and auction format structure for FRBs which is being in built into the negotiated dealing system (NDS) current auction format.

ADVERTISEMENTS:

The auction format will also help price FRBs in the secondary market. CCIL acts as a clearing corporation for government securities and money market deals routed through the RBI. This step is part of complete review of the current auction procedure for government securities aimed at improving efficiency.

The idea is to reduce the time gap between bid submission and declaration of auction results and withdrawal of facility of bidding in physical form. A suggestion to design the secured web system, facilitating direct participation of non-NDS members in auction of government securities, is also being considered.

The interest paid to the floating rate bondholders changes periodically depending on the market rate of interest payable on the gilt-edged securities. These bonds are also called ‘adjustable interest bonds’ or ‘variable rate bonds’.

Hybrid Debt Instrument # 9. Other Hybrid Debt Instruments:

i. Multi-Option Secured Redeemable Convertible Debentures:

Where a debenture gives the holder thereof two or more different options, it may be called a ‘multi-option debenture’. It is a species of debenture. It is essentially a debenture in character and is secured redeemable and convertible into equity shares. Its chief feature is the multi-options available to the investor.

ii. Option Tender Bonds:

ADVERTISEMENTS:

The option tender bonds are bonds with put option which give the bondholders the right to sell back their bonds to the issuers normally at par. Issuers with puts are aimed both at investors who are pessimistic about the ability of interest rates to decline over the long-term and at those who simply prefer to take a cautious approach to their bond buying.

iii. Guaranteed Debentures:

Some businesses are able to raise long-term money because their debts are guaranteed, usually by their parent companies. In some instances the State Governments guarantee the bonds issued by the State Government undertakings and corporation like Electricity Supply Board, Irrigation Corporation etc.

iv. Subordinated Debentures:

A subordinated debenture is an unsecured debt which is junior to all other debts i.e., other debt holders must be fully paid before the subordinated debenture holders receive anything. This type of debt will have a higher interest rate than more senior debt and will frequently have rights of conversion into ordinary shares. Subordinated debt is often called ‘mezzanine finance’ because it ranks between equity and standard debt.

v. Indexed Bonds:

ADVERTISEMENTS:

Fixed income and fixed sum repayments are uneconomic in times of rapid inflation. Indexed bond is a financial instrument which retains the security and fixed income of the debenture but which also provides some safeguard against inflation.

vi. Inflation Adjusted Bonds (IABs):

These are bonds which promise to repay both the principal and the interest, by floating both these amounts upwards or downwards in line with the movements in the value of the specified index of commodity prices (inflation rate).

vii. Credit Wrapping:

It is a technique by which bonds are issued by a company with a poor rating can be shored up with the assistance of an institution with a strong credit rating. It involves the institution agreeing to underwrite a proportion of the amount payable in the event of default at the time of redemption. In many cases it is the only way in which poorly rated companies can issue bonds.

viii. Dutch Auction Notes:

ADVERTISEMENTS:

These are the instruments with a coupon rate that is reset every 35 days based on an auction. These instruments provide long-term funds at short-term rates. After announcing issue of notes, bank or trust company is appointed as auction agent. For coupon rates, auctions are held and bids are received. Notes are allotted to the bidding giving the lowest yield. After every 35 days, coupon payments are made and new bids are asked.

ix. Oil Bonds:

The public sector oil marketing companies in India are selling petrol, diesel, LPG and kerosene at subsidized prices as per the government price ceilings and the resultant subsidy ought to be borne by the government. To compensate the subsidy losses of oil marketing companies, oil bonds are issued by the government to such companies in lieu of cash, mature after five to seven years. The oil bonds will carry coupon rate. But to ease-out liquidity problems, the oil companies prefer to sell out at discount to maturity.

x. Callable Bonds:

Bonds that allow the issuer to alter the tenor of a bond, by redeeming it prior to the original maturity date are called ‘callable bonds’. The inclusion of this feature in the original bond structure provides the issuer the right to fully or partially retire the bond, and is, therefore, in the nature of call option on the bond. Since these options are not separated from the original bond issue, they are also called ’embedded options’.

A call option can be a European option, where the issuer specifies the date on which the option could be exercised. Alternately, the issuer can embed an American option in the bond, providing him to right to call the bond on or any time before a pre-specified date.

ADVERTISEMENTS:

A call option provides an issuer the option to redeem a bond, if interest rates decline and to reissue the bonds at a lower coupon. The investor, however, losses the opportunity to stay invested in a high coupon bond. The call option, therefore, can effectively alter the term of a bond. This carries an additional risk to the investor, in the form of call risk and re-investment risk.

xi. Puttable Bonds:

Flexibility to the lenders is provided by means of Puttable Bonds. Bonds that provide an investor with the right to seek redemption from the issuer, prior to the maturity date, are called puttable bonds.

Put options, embedded in the bond, provides the investor the right to fully or partially sell the bonds back to the issuer either on or before the pre- specified dates. A put option provides the investor the right to sell a low coupon-paying bond to the issuer and invest in higher coupon-paying bond, if interest rates move up. Puttable bonds represent a re-pricing risk to the issuer.