There are various kinds of financial instruments to raise foreign currency funds. FCCB and GDR/ADR are explained below:

Financial Instrument # 1. Foreign Currency Convertible Bonds:

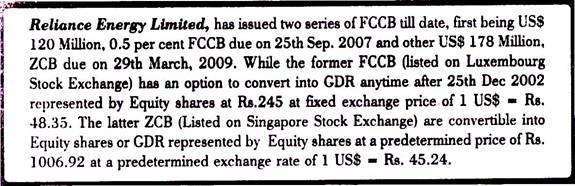

FCCB are debt instruments issued in a currency with an option to convert them in equity shares of the issuing company, if the investor chooses to do so, at a pre-determined strike rate. FCCB are also referred as FCCN (Foreign Currency Convertible Notes) by some issuers. Bonds of foreign countries are called by various names in International markets. For example in US, overseas bond listed with SEC are called Yankee Bonds, while they are referred to as Bulldog Bonds (in U.K.) and Samurai Bonds (in Japan).

Advantages to Companies:

ADVERTISEMENTS:

i. It gives them an opportunity to access foreign capital market and raise capital at low rate.

ii. The FCCB acts like a bond as well as equity instrument. Like bonds it makes regular interest and principal payments, but these also gives the bond holder the option to convert bond into equity

iii. It is a low cost debt as the interest rates given to FCC Bonds are normally 30-50 percent lower than the market rate because of its equity component

iv. Conversion of bonds into stocks takes place at a premium price to market price. Conversion price is fixed when the bond is issued. So, lower dilution of the company stocks

ADVERTISEMENTS:

Advantages to Investors:

i. Guaranteed payments on bonds.

ii. They can take advantage of appreciation in the company’s stock and convert the bonds into equity

iii. The bonds are redeemable at maturity if not converted

ADVERTISEMENTS:

iv. Easy marketability due to conversion feature.

Disadvantages of FCCBs:

i. FCCBs means creation of more debt and thus more coupon payment in foreign exchange

ii. In case of convertible bond, the interest rate is very low (around 3-4%) but there is an exchange risk on interest as well as principal if the bonds are not converted into equity

ADVERTISEMENTS:

iii. If the equity price increases, the investors will go for conversion. The companies will have to convert them into equity, leading to dilution in promoter holding as well as earnings.

iv. The FCCBs will be shown as debt in the balance sheet till it is redeemed or converted into equity

Taxation of FCCBs:

i. Until the conversion option is exercised, all the interest payments on the bonds, is subject to deduction of tax at source at the rate of 10%

ADVERTISEMENTS:

ii. Tax exercised on dividend on the converted portion of the bond is subject to deduction of tax at source at the rate of 10%

iii. If Foreign Currency Convertible Bonds (FCCB) is converted into shares it will not give rise to any capital gains liable to income-tax in India

iv. If Foreign Currency Convertible Bonds (FCCB) is transferred by a non-resident investor to another non-resident investor it shall not give rise to any capital gains liable to tax in India

Financial Instrument # 2. Global Depository Receipts (GDRs) and American Depository Receipts (ADRs):

Every publicly traded company issues shares – and these shares are listed and traded on various stock exchanges. Thus, companies in India issue shares which are traded on Indian stock exchanges like BSE (The Stock Exchange, Mumbai), NSE (National Stock Exchange), etc. These shares are sometimes also listed and traded on foreign stock exchanges like NYSE (New York Stock Exchange) or NASDAQ (National Association of Securities Dealers Automated Quotation).

ADVERTISEMENTS:

But to list on a foreign stock exchange, the company has to comply with the policies of those stock exchanges. Often, the policies of these exchanges in US or Europe are much more stringent than the policies of the exchanges in India. This deters these companies from listing on foreign stock exchanges directly.

But many good companies get listed on these stock exchanges indirectly – using ADRs and GDRs.

Process of Listing Indirectly:

A company deposits a large number of its shares with a bank located in the country where it wants to list indirectly. The bank issues receipts against these shares, each receipt having a fixed number of shares as an underlying (usually 2 or 4).

ADVERTISEMENTS:

These receipts are then sold to the people of this foreign country and anyone who are allowed to buy shares in that country. These receipts are listed on the stock exchanges. They behave exactly like regular stocks – their prices fluctuate depending on their demand and supply, and depending on the fundamentals of the underlying company.

These receipts, which are traded like ordinary stocks, are called Depository Receipts. Each receipt amounts to a claim on the predefined number of shares of that company. The issuing bank acts as a depository for these shares – that is, it stores the shares on behalf of the receipt holders.

Difference between ADR and GDR:

Both ADR and GDR are depository receipts, and represent a claim on the underlying shares. The only difference is the location where they are traded.

If the depository receipt is traded in the United States of America (USA), it is called an American Depository Receipt, or an ADR.

If the depository receipt is traded in a country other than USA, it is called a Global Depository Receipt, or a GDR.

ADVERTISEMENTS:

Note:

ADRs and GDRs are not for investors in India – they can invest directly in the shares of various Indian companies. But the ADRs and GDRs are an excellent means of investment for NRIs and foreign nationals wanting to invest in India. By buying these, they can invest directly in Indian companies without going through the hassle of understanding the rules and working of the Indian financial market – since ADRs and GDRs are traded like any other stock, NRIs and foreigners can buy these using their regular equity trading accounts.

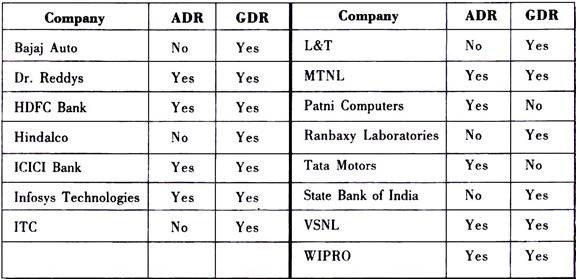

Below is a list of some of the Indian companies that have issued ADRs and/or GDRs: