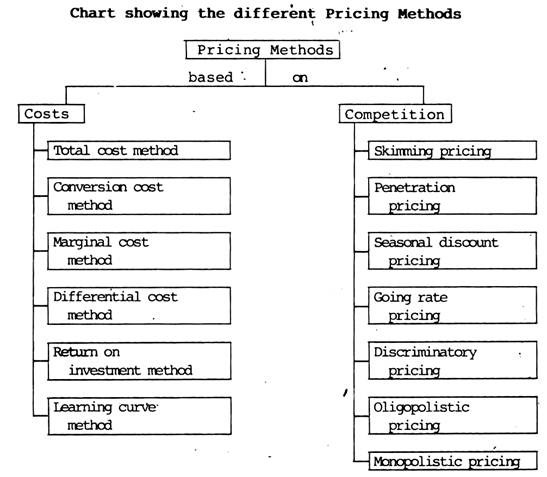

The different methods adopted for pricing the products can be classified into two major groups as charted below:

ADVERTISEMENTS:

Pricing Methods Based on Costs:

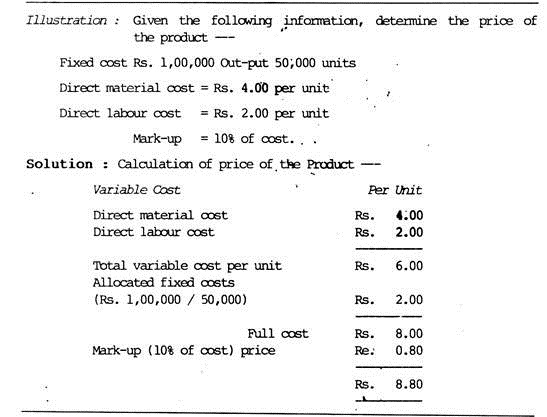

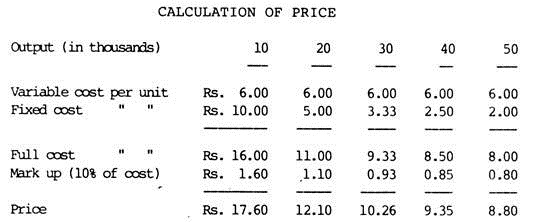

1. Total Cost or Full Cost Method of Pricing:

The selling price is fixed on the basis of total costs. Total cost may be historical cost or standard cost. The method assumes that a price must cover all the costs of making and selling the product plus a fair profit margin.

The full cost pricing is very widely used in modern business particularly for cost-plus contracts and new products which have no established market, and in normal trade conditions for long-time planning. Under this method price of the product is determined by adding fixed percentage mark-up to the full cost of the product, i.e., variable cost plus allocated share of the fixed cost.

ADVERTISEMENTS:

The fixed percentage mark-up varies from firm to firm depending upon the desired rate of return on capital employed and return for the risk of the enterprise. The mark-up percentage is established by product grouping and is calculated to yield the company an adequate profit return from operations at normal capacity and with normal product (sales) mix.

The problem illustrated here seems to be a simple one but for the allocation of fixed cost and determination of mark-up percentage.

For allocating fixed costs it is necessary to determine the volume (No. of units) over which fixed cost is to be allocated. With a given mark-up, the price of the product will vary with a variation of the volume over which fixed costs are to be allocated.

ADVERTISEMENTS:

ADVERTISEMENTS:

This will be clear from the following illustration:

ADVERTISEMENTS:

It is obvious from the above illustration that fixed cost permits mark-up per unit and price falls with increase in volume. Thus, the problem becomes a problem of deciding the volume on which fixed costs are to be allocated. This volume may not coincide with the volume of sales and the problem is further complicated.

The concept of normal volume car expected, volume, as against capacity volume, is generally applied for allocation of fixed cost. But this does, net solve the problem completely. Normal or expected volume could be worked out fairly satisfactorily in case of established products, while they are not so easy to work in case of a new product. Thus, intuition, bias and judgement find a significant vote in full cost pricing.

The problem of mark-up is also complicated. Mark-up is to cover return on capital as well as return oh risk. For an established product, mark-up can be reasonably accurately worked out to achieve the objectives, because the normal or expected volume is a matter of historical experience.

In case of new product, a uniform rate of mark-up at all expected volumes may have a depressing effect on sales at lower volumes, and at higher volume may deprive the concern of the chance to en-cash consumer responses, if the product introduced is of common use.

ADVERTISEMENTS:

Where the product introduced is a novelty, higher mark-up percentage at low volume may help to maximise the profits. From the above discussion, we may say that varying mark-up rates of varying volumes are preferable over uniform mark-up rate at all volumes.

Merits:

(1) It is simple and easy, especially where normal or expected volume can be worked out with reasonable accuracy.

(2) It permits a close approximation of the classical “just price”, based on “fair profit margin” after all costs are covered.

ADVERTISEMENTS:

(3) It is the logical way to maximise profits in the long run.

(4) It is sometimes the safest course in pricing, especially for large firms where prices are pivotal and profits conspicuous.

Demerits:

(1) It ignores the demand of the product and the factor of competition, and assumes a state of satisfactory performance. Other competitors by being mare organised and efficient can produce the same product at a lower cost and thus able to offer lever price.

(2) The costs usually employed convey a degree of precision which is not real because of the arbitrary nature of allocation of common costs.

(3) It is based on a concept of historical cost that is frequently not relevant to the pricing decision. Pricing should be based on future costs, not current or past costs, and in many pricing decisions only incremental costs are relevant.

ADVERTISEMENTS:

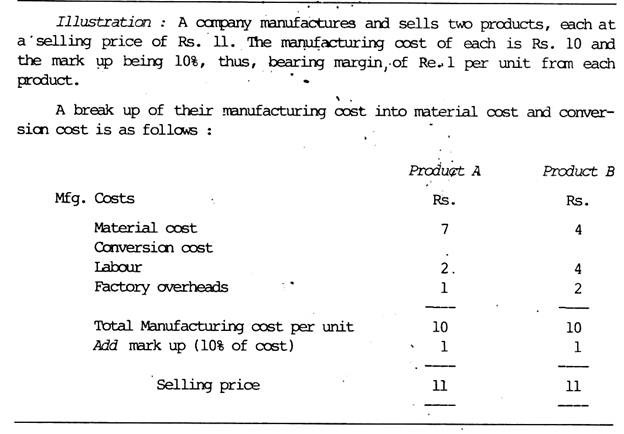

2. Conversion Cost Method of Pricing:

It is a variation of the full cost pricing method. In this method costs do not include non-manufacturing costs, i.e., selling and administration costs. Non-Manufacturing costs are to be included in the mark-up percentage. Conversion cost pricing attempts to direct the sales efforts to those products whose conversion costs (labour cost and factory overheads) are least.

This method is based on the concept that profit should be related to the efforts or services performed, i.e. value added in the form of efforts and facilities crystallised into the product without considering material.

Since the conversion costs of A (Rs. 3) is half than the conversion cost of B (Rs. 6), profits can be maximised if efforts are made to sell A more than B, although per unit mark-up is the same.

ADVERTISEMENTS:

This method can be employed in contracts where material is supplied by the buyer and the contractor is allowed a profit based on ‘conversion cost’.

3. Marginal cost Method of Pricing:

This is also known as Break-even Pricing or Target Profit Pricing or Contribution Approach to Pricing. This is based on the argument that a company must generate sufficient gross margin or contribution to fixed expenses which is more than sufficient to pay for the fixed expenses.

Any surplus represents profit. Obviously this approach gives recognition to the existence of variable costs of production and sales, and treats excess of revenue over such variable costs as the margin or contribution available both for fixed costs, as well as profits. According to this, raw materials and variable production costs should be marked up to give the desired amount of contribution.

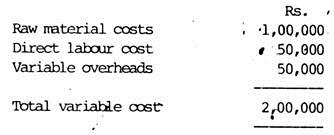

The mathematics can be illustrated by a simple example:

If the objective contribution is Rs, 50,000 than a mark-up of 25% (50,000×100/2, 22.000) this method, will be much more than the mark-up under full cost method for the obvious reason that the mark-up in this case has to provide for both fixed costs as well as profits, while it has to cater for only profits in the later case.

ADVERTISEMENTS:

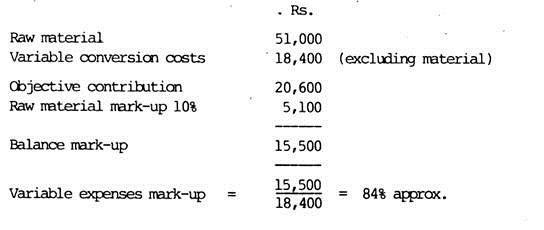

‘Sometimes, two mark-up rates are used, one to mark-up material costs and another to mark-up variable conversion and selling costs.

The obvious advantage in this case is that judicious pricing is possible by having a low mark-up of highly priced raw material and the high mark-up for low variable conversion costs. This becomes all the more important in modern day big manufacturing industries which generally have low variable conversion costs.

An example of this type is given below:

Net income will be calculated by deducting fixed costs from objective contribution.

ADVERTISEMENTS:

In case it is desired not to mark-up the material, it is possible under this method to mark-up on the variable expenses, excluding material.

It has been already said that the mark-up under this method is to provide both for fixed costs as well as profit. The mark-up amount is known as contribution, which is also the difference between sales revenue and variable costs. A price which provides maximum contribution in given situations will be preferred, because larger will be the profits.

As such, this pricing method is of great value in the following pricing situations:

(1) Where additional sales may be made, at reduced price, over and above variable costs, to special customers, i.e., private brand business, or under another trade name, etc.

(2) Where idle plant capacity can be utilized only at reduced prices and in other than regular outlets.

(3) Under circumstances where’ the added sales at reduced prices do not create problems in the regular market place.

ADVERTISEMENTS:

(4) Selecting most profitable business when capacity is limited.

(5) Evaluating proposals for change in selling’ price or terms of trade.

Merits:

It has been argued by various writers that this approach to pricing is distinctly more effective because of the two emerging characteristics of modern business:

(1) The increasing prevalence of multi-product (and multi-process and multi-market) concerns and,

(2) The dominating force of innovation of business. Full costing has been left behind by these new features of modern industry.

This method has the following merits:

(1) It helps in making the price policy more differentiated and more flexible than the full cost pricing.

(2) It dispenses away with the problem of allocation of fixed costs even at different volumes.

(3) It is easier and involves lesser calculations than in full cost pricing.

(4) Since it is based on variable costs, and variable costs can be predicted with a greater degree of accuracy, it gives more realistic prices.

(5) It is easily understandable by the management.

(6) It is specially useful in practical pricing decisions, i.e., accept or reject order, or raising or leering pricing, pricing for different classes of customers, etc.

(7) Although it is specifically useful in short-run pricing situation, it can also be applied to overall pricing for long-run profit and growth.

Demerits:

Marginal cost approach to pricing is criticised on the following grounds:

(1) The concept of variable costs is not easily and clearly understood by executives.

(2) It is not easy to break down some items of overhead costs into fixed and variable parts in water-tight fashion.

(3) The mark up figure gives an impression of large profits which may not be true in most cases.

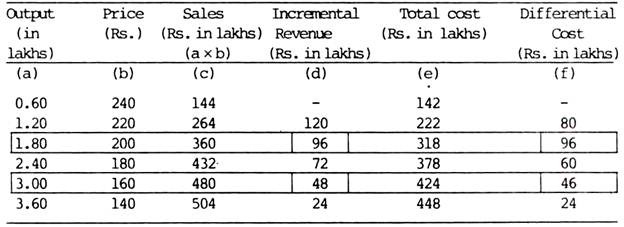

4. Differential Cost Method of Pricing:

Under this method of pricing, differential costs are the net increase or decrease in total costs due to increase or decrease in the volume of output or level of production activity. These are also known as marginal or incremental costs.

These costs are determined by deducting the total cost at lever level from that of a higher level. Differential costs are usually determined in anticipation of future costs and are incorporated in the form of flexible budgets.

The differential costs analysis facilitates the following managerial decisions in the areas of pricing:

(i) Determination of the sale price and the volume of output,

(ii) Acceptance of an offer of additional sales at a price below the current price, and

(iii) Differentiation of prices in the different markets.

It is advantageous to increase output as long as the incremental revenue is more than or equal to differential cost. In the above example, it appears that profit will be maximum at the output level of 3 lakhs since up-to this level of output the incremental revenue is still higher than the differential costs. So the sale price should be fixed at Rs. 160/- and the level of output to be achieved at the price is 3 lakh units.

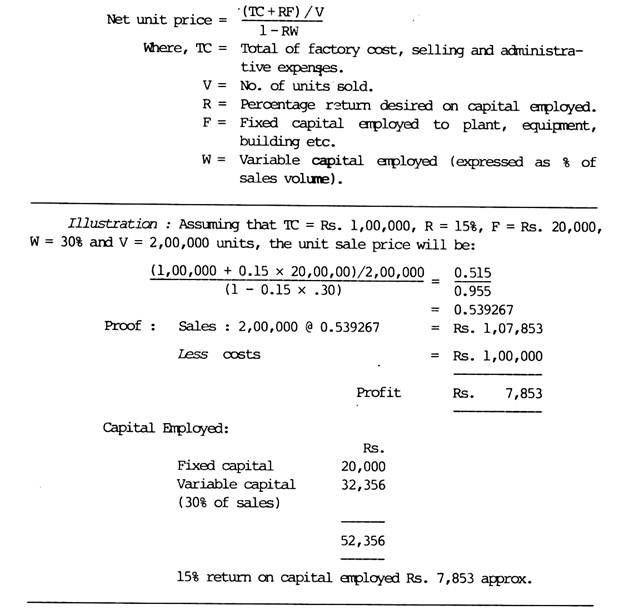

5. Investment Method of Pricing:

Establishing prices based on this method is another variant of full cost pricing method. Once full cost is determined the desired rate of return on capital employed in financing the production and sale is used to work out the mark-up figure to arrive at sales price.

The following formula is suggested for calculating unit sales price under this method:

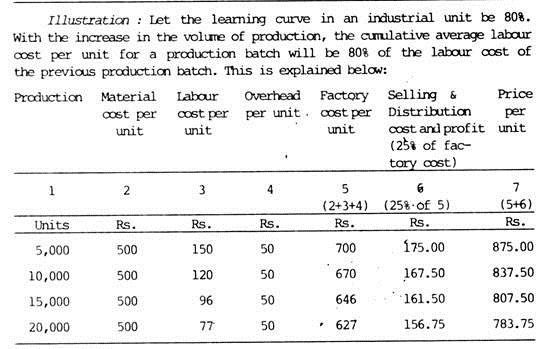

6. Learning Curve Method of Pricing:

This pricing method is based on the concept of production efficiency achieved due to longer run of manufacture and repeat operations. With the increase of volume of production, the workers gain efficiency and the cost of initial setting-up gets distributed over the large production volume, thereby the unit product cost declines.

Pricing Methods Based on Competition:

1. Skimming Pricing Method:

This refers to a pricing policy which sets relatively high prices at the outset and successively offers lower prices as the market expands at later stages.

The idea behind this pricing policy, is that the introduction of a new product with a high price ‘is an. efficient way to segment the markets with different price elasticities of demand. The initial high price can serve to skim the cream off those segments which are less sensitive to price. Subsequent price reductions reach customers with higher elasticities and enlarge the size of the market.

A higher price at the initial stage of market penetration can achieve a larger sales volume and a higher sales revenue. This higher sales revenue ensures profit maximisation and provides a good base for sound financing necessary for the production expansion and promotional activities during the later stages of the market development.

2. Penetration Pricing Method:

This method refers to a pricing policy of setting a relatively low initial price with an intention to help the product penetrate into the markets to hold a position. This method is just opposite to the skimming pricing method.

This pricing strategy is adopted when there seems to be no distinctive classes of customers with different price elasticities, and when advantages of mass production drastically reduce costs, and when the product’s distinctiveness i.e. protection from the competitors is likely to be short-lived.

This strategy aims at capturing the market at the very outset and in case of a competitive product, aims, at capturing the major share of the market, and discourages the competitors to enter.

3. Seasonal Discount Pricing Method:

This is a type of pricing strategy to promote sales by offering special discounts during certain seasons. This policy is found to be followed by the manufacturers of air conditioners, refrigerators, electric fans, etc.

4. Going-Rate Pricing Method:

This method refers to a pricing policy whereby the prices are fixed in consideration of the prices of competitors and the firm’s costs: This is like ‘follow the leader’ i.e. price leadership. It is quite popular because it is easy to avoid competition and make reasonable profits. Under this method, prices are fixed near about the prices of the leaders.

This pricing policy does not have any scientific basis like considerations of cost and marketing factors. Small firms usually follow this pricing strategy on the considerations that the big firms have determined the prices carefully and scientifically, and that the general consumers are price conscious.

5. Discriminatory Pricing Method:

This method of pricing refers to a policy of following different prices for different customers based on their ability to pay or place of customers. It involves “selling a product or service at two or more prices and the difference in price is not based on difference in costs”, according to Philip Kotler.

6. Oligopolistic Pricing:

An oligopolistic competition, by definition, refers to “a market in which there are a few sellers who are highly sensitive to each other’s pricing and marketing strategies”. In other words, each seller in the market has a significant effect on the market price and each seller considers the likely effect of price changes on the competitors.

The life cycle of a product and corresponding market stage play a great role in this pricing policy. During the later stage of market growth or early stage of market maturity of a product of perishable distinctiveness, an oligopolistic pricing situation develops.

7. Monopolistic Pricing:

A monopolistic competition, by definition, refers to “a market in which many buyers and sellers trade over a range of prices rather than a single market price” (Philip Kotler).

This state of competition offers a greater degree of flexibility in the pricing strategy as such, market is characterised by:

(i) Large number of competitors, and

(ii) Price change by any one competitor tends to have little effect on other competitors.

While pursuing a price reduction strategy under of” monopolistic competition, the marketing management of a company must consider the possibility that too drastic a reduction may set off a price war throughout the whole industry.

In addition to the above pricing methods and policies, the marketers adopt the different pricing strategies depending upon the varying circumstances and conditions of product-market scope.

These are discussed below in brief:

(i) Psychological Pricing:

It is “a pricing approach which considers psychology of prices and not simply the economics-the price is used to say something about the product” (Philip Kotler). This policy involves fixing prices much above what is commonly thought of without reference to cost. For example, a silk saree of Bangalore or Mysore may cost Rs. 1,500/ but its price can be Rs. 3,000/- or Rs. 4,000/- because of perceived value for the customer.

(ii) Geographical Pricing:

This pricing policy refers to fixing one price for the product for the entire market. For example, Wilt-edge Blades carry one price throughout India though transport costs vary from region to region.

Similarly, Sunlight soap or Palmnolive soap have only one uniform price throughout India. The policy of geographical pricing may also involve different prices for different regions by considering what is called ‘Basing-point pricing’ or ‘zone pricing’.

According to Philip Kotler:

Basing-point pricing is. “a geographic pricing strategy in which the seller designates a city as’ a basing point and charges all customers the freight cost from that city to the customer location, regardless of the city from which the goods are actually shipped.”

Zone pricing is “a geographic pricing strategy in which a company sets up two or more zones all customers within a zone pay the same total price and this price is higher in the more distant zones.”

(iii) Sealed-Bid Pricing:

This refers to a “selling price based on how the firm thinks competitors will price rather than on its own costs or demand—used when a company bids for jobs.” It is a kind of competition- ‘based pricing.

(iv) Promotional Pricing:

This refers to “temporarily pricing products below the list price, and sometimes even below cost, to increase short-run sales” (Philip Kotler).

(v) By-Product Pricing:

This refers to “setting a price for by-products in order to make the main product price more competitive” (Philip Kotler).

(vi) Optimal Product Pricing:

This refers to “the pricing, of optimal or accessory products along with the main product” (Philip Kotler).

Conclusion:

In all these pricing methods, policies and strategies, a marketing manager should keep an eye on:

(1) The competitor’s price changes,

(2) The changes in the cost of production,

(3) The need to build market share,

(4) The need for reasonable profits, and

(5) The need for flexible pricing rather than rigid pricing.

The prices must respond to changes in the external and internal environment. But competition has .a major impact in price policy.

According to Philip Kotler, a company’s target market and positioning objectives influence the pricing strategy.

The pricing objectives of a company should include the consideration of current-profit maximisation, market share leadership and product quality leadership; “The consumers decide whether the company has set the right price. The consumer weighs the price against the perceived values of using the product if the price exceeds the perceived values, consumers will not buy the product.”

Philip Kotler further observes “consumers compare a product’s price to the prices of the competitors’ products and a company must learn the price and quality of competitors’ offers and use them as a starting point for its own pricing.”

It will be seen, therefore, that while different methods of pricing are followed, it is difficult to say which is the best one because different situations warrant different methods.

Pricing policy must be based on clear-cut pricing objectives and marketing strategy. It must be rational, flexible and oriented to competitor’s policy. The prices should be revised from time to time and should never be rigid.

But too frequent price changes are not good. Even during inflation, prices should be stable. Just because one or two competitors raise their prices, a company should not follow suit because it harms public interest and public image.