Contents:

- Lecture Notes on Introduction to Financial Management

- Lecture Notes on the Definition of Financial Management

- Lecture Notes on the Evolution of Financial Management

- Lecture Notes on the Importance of Financial Management

- Lecture Notes on Factors Influencing Financial Decisions

Lecture Notes # 1. Introduction to Financial Management:

In our present day economy, finance is defined as the provision of money at the time when it is required. Every enterprise, whether big, medium or small, needs finance to carry on its operations and to achieve its targets. In fact, finance is so indispensable today that it is rightly said to be the lifeblood of an enterprise. Without adequate finance, no enterprise can possibly accomplish its objectives.

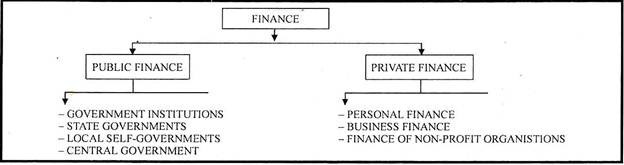

The subject of finance has been traditionally classified into two classes:

ADVERTISEMENTS:

(i) Public Finance; and

(ii) Private Finance.

Public finance deals with the requirements, receipts and disbursements of funds in the government institutions like states, local self-governments and central government. Private finance is concerned with requirements, receipts and disbursements of funds in case of an individual, a profit seeking business organisation and a non-profit organisation.

Thus, private finance can be classified into:

ADVERTISEMENTS:

(i) Personal finance;

(ii) Business finance; and

(iii) Finance of non-profit organisations.

Personal finance deals with the analysis of principles and practices involved in managing one’s own daily need of funds. The study of principles, practices, procedures, and problems concerning financial management of profit making organisations engaged in the field of industry, trade, and commerce is undertaken under the discipline of business finance.

ADVERTISEMENTS:

The finance of non-profit organisation is concerned with the practices, procedures and problems involved in financial management of charitable, religious, educational, social and other similar organisations.

Meaning of Business Finance:

Literally speaking, the term ‘business finance’ connotes finance of business activities.

ADVERTISEMENTS:

It is composed of two words:

(i) Business, and

(ii) Finance.

Thus, it is essential to understand the meaning of the two words, business and finance, which is the starting point to develop the whole concept and meaning of the term business finance.

ADVERTISEMENTS:

The word ‘business’ literally means a ‘state of being busy’. All creative human activities relating to the production and distribution of goods and services for satisfying human wants are known as business. It also includes all those activities which indirectly help in production and exchange of goods, such as, transport, insurance, banking and warehousing, etc.

Broadly speaking, the term ‘business’ includes industry, trade and commerce.

Finance may be defined as the provision of money at the time when it is required. Finance refers to the management of flows of money through an organisation. It concerns with the application of skills in the manipulation, use and control of money. Different authorities have interpreted the term ‘finance’ differently.

However, there are three main approaches to finance:

ADVERTISEMENTS:

(i) The first approach views finance as to providing of funds needed by a business on most suitable terms. This approach confines finance to the raising of funds and to the study of financial institutions and instruments from where funds can be procured.

(ii) The second approach relates finance to cash.

(iii) The third approach views finance as being concerned with rising of funds and their effective utilisation.

Having studied the meaning of the two terms business and finance; we can develop the meaning of the term ‘business finance’ as an activity or a process which is concerned with acquisition of funds, use of funds and distribution of profits by a business firm. Thus, business finance usually deals with financial planning, acquisition of funds, use and allocation of funds and financial controls.

ADVERTISEMENTS:

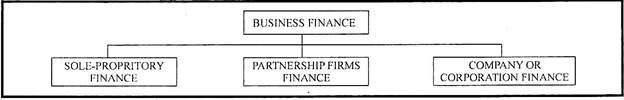

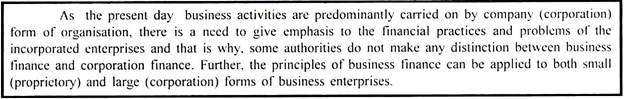

Business finance can further be sub-classified into three categories, viz.;

(i) Sole-propritory finance,

(ii) Partnership firm finance, and

(iii) Corporation or company finance.

The above classification of business finance is based upon the three major forms of organisation for a business firm. In sole proprietorship form of organisation, a single individual promotes, finances, controls and manages the business enterprise. He also bears the whole risk of business.

ADVERTISEMENTS:

A partnership, on the other hand, is an association of two or more persons to carry on as co-owners of a business and to share its profits and losses. It may come into existence either as a result of the expansion of sole-trade business or by an agreement between two or more persons.

The liability of the partners is unlimited and they collectively share the risks of the business. A joint stock company or a corporation is an association of many persons who contribute money or money’s worth to a common stock and employs it in some trade or business and who share profit and loss arising there from.

In the words of Chief Justice Marshall, “a corporation is an artificial being, invisible, intangible and existing only in contemplation of the law. Being a mere creation of law, it possesses only the properties which the charter of its creation confers upon it either expressly or as incidental to its very existence”.

Corporation is a legal entity having limited liability, perpetual succession and a common seal. A corporation is regarded as something different from its owners. The assets of the corporation are owned by it rather than its members and a corporation’s liabilities are the obligations of the corporation, not the owners or the members.

Lecture Notes # 2. Definition of Financial Management:

ADVERTISEMENTS:

Corporation finance or broadly speaking business finance can be defined as the process of rising, providing and administering of all money/funds to be used in a corporate (business) enterprise.

Wheeler defines business finance as, “That business activity which is concerned with the acquisition and conservation of capital funds in meeting the financial needs and overall objectives of business enterprise.”

According to Guthmann and Dougall, “Business finance can be broadly defined as the activity concerned with the planning, raising, controlling and administering the funds used in the business”.

In the words of Prather and Wert, “Business finance deals primarily with raising, administering and disbursing funds by privately owned business units operating in non-financial fields of industry.”

According to the Encyclopedia of Social Sciences, “Corporation finance deals with the financial problems of corporate enterprises. These problems include the financial aspects of the promotion of new enterprises and their administration during early development, the accounting problems connected with the distinction between capital and income, the administrative questions created by growth and expansion, and finally, the financial adjustments required for the bolstering up or rehabilitation of a corporation which has come into financial difficulties”.

Thus, the scope of corporation finance is so wide as to cover the financial activities of a business enterprise right from its inception to its growth and expansion and in some cases to its winding up also. Corporation finance, usually, deals with financial planning, acquisition of funds, use and allocation of funds, and financial controls.

ADVERTISEMENTS:

To sum up in simple words, we can say that financial management as practiced by corporate (business) firms can be called corporation finance or business finance. Finance function has become so important that it has given birth to Financial Management as a separate subject.

Financial management refers to that part of the management activity which is concerned with the planning and controlling of firm’s financial resources.

It deals with finding out various sources for raising funds for the firm. The sources must be suitable and economical for the needs of the business. The most appropriate use of such funds also forms a part of financial management. As a separate managerial activity, it has a recent origin. This draws heavily on Economics for its theoretical concepts.

In the words of Weston and Brigham, “Financial management is an area of financial decision-making, harmonising individual motives and enterprise goals”.

J.F.Bradley defines financial management as, “The area of the business management devoted to a judieious use of capital and a careful selection of sources of capital in order to enable a spending unit to move in the direction of reaching its goals.”

According to J.L. Massie, “Financial management is the operational activity of a business that is responsible for obtainting and effectively utilising the funds necessary for efficient operations.”

ADVERTISEMENTS:

Howard and upon are of the opinion that financial management is the application of the planning and control functions to the finance function.

Lecture Notes # 3. Evolution of Financial Management:

Corporation finance emerged as a distinct field of study only in the early part of this century as a result of consolidation movement and formation of large sized business undertakings. In the initial stages of the evolution of corporation finance, emphasis was placed on the study of sources and forms of financing the large sized business enterprises.

The grave economic recession of 1930’s rendered difficulties in rising finance from banks and other financial institutions. Thus, emphasis was laid upon improved methods of planning and control, sound financial structure of the firm and more concern for liquidity. The ways and means of evaluating the credit worthiness of firms were developed.

The post-World War II era necessitated reorganisation of industries and the need for selecting sound financial structure. In the early 50’s the emphasis shifted from the profitability to liquidity and from institutional finance to day to day operations of the firm. The techniques of analysing capital investment in the form of ‘capital budgeting’ were also developed.

Thus, the scope of financial management widened to include the process of decision-making within the firm.

ADVERTISEMENTS:

The modern phase began in mid-fifties and the discipline of corporation finance or financial management has now become more analytical and quantitative. 1960’s witnessed phenomenal advances in the theory of ‘portfolio analysis’ by Microwitz, Sharpe, Lintner etc. Capital Asset Pricing Model (CAPM) was developed in I970’s.

The CAPM suggested that some of the risks in investments can be neutralised by holding of diversified portfolio of securities. The ‘Option Pricing Theory’ was also developed in the form of the Binomial Model and the Black-Scholes Model during this period. The role of taxation in personal and corporate finance was emphasised in 80’s.

Further, newer avenues of raising finance with the introduction of new capital market instruments such as PCD’s, FCD’s, PSB’s and CPP’s etc. were also introduced. Globalisation of markets has witnessed the emergence of ‘Financial Engineering’ which involves the design, development and implementation of innovative financial instruments and the formulation of creative optimal solutions to problems in finance.

The techniques of models, mathematical programming and simulations are presently being used in corporation finance and it has achieved the prime place of importance. We may conclude that financial management has evolved from a branch of economics to a distinct subject of detailed study of its own.

Lecture Notes # 4. Importance of Financial Management:

Finance is the life blood and nerve centre of a business, just as circulation of blood is essential in the human body for maintaining life, finance is very essential to smooth running of the business. It has been rightly termed as universal lubricant which keeps the enterprise dynamic. No business, whether big, medium or small can be started without an adequate amount of finance.

Right from the very beginning, i.e. conceiving an idea to business, finance is needed to promote or establish the business, acquire fixed assets, make investigations such as market surveys, etc., develop product, keep men and machine at work, encourage management to make progress and create values. Even an existing concern may require further finance for making improvements or expanding the business.

Thus, the importance of finance cannot be over-emphasised and the subject of business finance has become utmost important both to the academicians and practising managers. The academicians find interest in the subject because the subject is still in its developing stage and the practising managers are interested in the subject because among the most crucial decisions of a firm are those related to finance.

The importance of corporation finance (which is a constituent of business finance) has arisen because of the fact that present day business activities are predominantly carried on company or corporate form of organisation.

The advent of corporate enterprises has resulted into:

(i) The increase in size and influence of the business enterprises,

(ii) Wide distribution of corporate ownership, and

(iii) Separation of ownership and management.

The above three factors have further increased the importance of corporation finance. As the owners (shareholders) in a corporate enterprise are widely scattered and the management is separated from the ownership, the management has to ensure the maximisation of owner’s economic welfare.

The success and growth of a firm depends upon adequate return on its investment. The investors or shareholders can be attracted by a firm only by maximisation of their wealth through the application of principles and procedures as laid down by Corporation Finance.

The knowledge of the discipline of Corporation Finance is important not only to the practising managers, but also to others who deal with a corporate enterprise, such as investors, lenders, bankers, creditors, etc., as there is always a scope for the management to manipulate and ‘window dress’ the financial statements.

In the present day capitalistic regime, the size of the business enterprises is increasing resulting into corporate empires empowered with a lot of social and political influence. This makes corporation finance all the more important.

Further, if we refer to corporation finance as the financial management practiced by business firms, the importance of financial management can well be described as the importance of corporation finance.

Financial management is applicable to every type of organisation, irrespective of its size, kind or nature. It is as useful to a small concern as to a big unit. A trading concern gets the same utility from its application as a manufacturing unit may expect.

This subject is important and useful for all types of ownership organisations. Where there is a use of finance, financial management is helpful. Every management aims to utilise its funds in a best possible and profitable way. So this subject is acquiring a universal applicability.

Financial management is indispensable to any organisation as it helps in:

(i) Financial planning and successful promotion of an enterprise;

(ii) Acquisition of funds as and when required at the minimum possible cost;

(iii) Proper use and allocation of funds;

(iv) Taking sound financial decisions;

(v) Improving the profitability through financial controls;

(vi) Increasing the wealth of the investors and the nation ; and

(vii) Promoting and mobilising individual and corporate savings.

Lecture Notes # 5. Factors Influencing Financial Decisions:

There are a number of (both external as well as internal) factors that influence the financial decisions.

A list of the important external as well as internal factors influencing the decisions is given below:

External Factors:

i. State of economy

ii. Structure of capital and money markets.

iii. Requirements of investors

iv. Government policy

v. Taxation policy

vi. Lending policy of financial institutions.

Internal Factors:

i. Nature and size of business

ii. Expected return, cost and risk

iii. Composition of assets

iv. Structure of ownership

v. Trend of earnings

vi. Age of the firm

vii. Liquidity position

viii. Working capital requirements

ix. Conditions of debt agreements.