The types of pricing strategies can be studied under the following heads: 1. Cost-Oriented Pricing Strategies 2. Demand-Oriented Pricing Strategies 3. Competition-Oriented Pricing Strategies 4. Other Pricing Strategies.

The various strategies that can be used to determine the price of the product are:- 1. Premium Pricing 2. Penetration Pricing 3. Economy Pricing 4. Price Skimming 5. Psychological Pricing 6. Product Line Pricing.

7. Pricing Variations 8. Mark-Up Pricing 9. Cost-Plus Pricing 10. Breakeven Pricing 11. Rate of Return on Investment Pricing 12. Marginal Cost Pricing 13. Price Bundling 14. Below Competition Pricing.

15. Above Competition Pricing 16. Parity Pricing 17. Backward Pricing 18. Bid Pricing 19. Pre-Emptive Pricing 20. Extinction Pricing 21. Economy Pricing 22. Optional Product Pricing 23. Captive Product Pricing.

ADVERTISEMENTS:

24. Geographical Pricing 25. Value Pricing 26. Discriminate Pricing 27. Conspicuous Pricing 28. Customer Expectations-Based Pricing 29. Promotional Pricing and a Few Others.

Different Types of Pricing Strategies in Marketing

Types of Pricing Strategies – Premium Pricing, Penetration Pricing, Economy Price, Price Skimming, Psychological Pricing, Product Line Pricing and Pricing Variations

Type # 1. Premium Pricing:

A ‘premium strategy’ uses a high price, but gives good product/service in exchange. It is fair to customers, and, more importantly, customers see it as fair. This could include food bought from Marks & Spencer, or designer clothes, or a Jaguar car. We should remember that customers for consumer goods are often amateurs.

They do not really know how to judge value. They build up a perception of such value, and sometimes use price to help establish levels of ‘quality’. If you saw a new Jaguar car on offer at your local garage with a sign saying ‘half price offer’ you might be suspicious about what you are being offered. If the offer were a Zil, which is a Russian luxury limousine, you might perhaps have less scepticism if it were offered at half price. But then you would worry about servicing and reliability.

An industrial buyer could have more knowledge of the technical characteristics of his purchases. In many cases tight specifications on the performance of machinery are used for buying in this area. But not all industrial purchases are professionally assessed, although no-one should underestimate the ability of customers to assess value.

ADVERTISEMENTS:

Nevertheless, sometimes the benefits of a product need to be presented in a way that will help a buyer to make a buying decision. Remember, marketing is about making it easier for the customer to say ‘yes’.

In considering which car a company should use for its sales force, the car fleet manager might consider the lowest total cost over the life of 70,000 miles. It might be the resale value of a Ford Mondeo which gained it a superior rating to an equivalent car from another supplier. The car fleet buyer might be a professional, but might still require help to appreciate the total value of what is offered to him.

Even when evaluating relatively inexpensive products such as wood glue, some people view a higher price as a measure of the quality to expect from the product.

Type # 2. Penetration Pricing:

‘Penetration’ pricing is the name given to a strategy that deliberately starts offering ‘super value’. This is done to gain a foothold in a market, using price as a major weapon. It could be because other products are already well established in the market, maybe at high prices. Alternatively, penetration pricing could be used as an attempt to gain a major share of a new market. It can also deter competitors who see no profit in the market.

ADVERTISEMENTS:

As time goes on and the product is established, prices can be raised nearer market levels. Alternatively, the supplier’s cost could come down as volume increases. In this case the consumer benefits by a continuation of the low prices.

Penetration pricing must be used carefully as it is very difficult to raise prices to catch up with the market levels. There are many examples of products launched at a low price, but which lost significant sales volume when prices rose. It is sometimes possible to offer customers an initial discount to gain business provided you make it clear prices will rise later. Building societies have been offering discounted mortgages to first time buyers at reduced rates for the first twelve months. But after that they rise to commercial rates.

Type # 3. Economy Price:

‘Economy’ pricing is a deliberate strategy of low pricing. It could be that you are offering a ‘no frills’ product/service, with a price reflecting this. However, before such a product is launched, it is important to decide the position it will have in the marketplace. That position is how you want your customers to perceive it. A product that competes purely on price is vulnerable to attack from more established products.

This happened when Sir Freddie Laker launched his ‘Sky Train’ trans-Atlantic flights in the 1970s. Competitors such as British Airways, Pan Am, and others, reduced some of their prices. Laker found he could not sustain his flights profitably as passengers chose the most convenient of the cheap flights available. Laker went bankrupt, although later the receivers for his company claimed damages from other airlines. More recently ‘Peoples Express’, an American carrier, has also suffered from an unsustainable economy policy.

ADVERTISEMENTS:

The Victorian philosopher John Ruskin (1819-1900) once said:

It is unwise to pay too much, but it is unwise to pay too little. When you pay too much, you lose a little money that is all. When you pay too little, you sometimes lose everything, because the thing you bought was incapable of doing the thing you bought it to do.

The common law of Business Balance prohibits paying a little and getting a lot. It can’t be done. If you deal with the lowest bidder, it is as well to add something for the risk you run. And if you do that, you will have enough to pay for something better.

Of course, there is legislation, such as the Sale of Goods Act, which demands that a product must be fit for the purpose for which it is sold. Nevertheless, Ruskin’s point is taken sensibly from a customer’s position, and all suppliers would do well to take heed of it.

Type # 4. Price Skimming:

ADVERTISEMENTS:

Customers won’t pay if they don’t think they are getting value. However there are times when high prices and large margins are appropriate. It is certainly easier to reduce prices than to raise them. A policy of ‘price skimming’ is often used for products at the introductory stage.

Here the price is initially pitched high, which gives a good early cash flow to offset high development costs. If the product is new, and competition has not appeared, then customers might well pay a premium to acquire a product which is offering excellent features. The launch of many home computers showed this pattern.

As competitors came into the market, and new features were added by the new entrants, prices dropped for all products. Another market with high margins is the drug market. The prescription drug market uses fairly cheap basic ingredients. The cost of developing medicines is high, and made even higher by the cost of testing, and gaining approval, from the regulatory bodies.

The prices are high when new drugs are launched and they are protected by patents. When the patent runs out, ‘generic’ drugs come in to compete and prices fall. This official monopoly, based on the legal protection of a patent, is a reflection of the unique effort in developing a new drug. It is certainly justified by the costs involved.

Type # 5. Psychological Pricing:

ADVERTISEMENTS:

‘Psychological’ pricing is designed to get customers to respond on an emotional, rather than rational, basis. It is most frequently seen in consumer markets, having less applicability in industrial markets. The most common is the use of prices such as 99 pence or £9.95 which can be seen in many retail outlets. We all know that 99 pence is £1.00 less 1 penny, and £9.95 is £10 less 5 pence. You might like to consider why such prices are used.

In some markets companies are over-sensitive about price levels. Cadbury’s were conscious of this with their bar chocolate. To maintain prices, as raw material costs rose, they reduced the thickness of the chocolate blocks. The result was thin chocolate bars. Rowntrees spotted this and decided Cadbury’s had gone too far. Rowntrees saw an opportunity for a chunky product. Yorkie was launched with great success.

Type # 6. Product Line Pricing:

‘Product-line’ pricing is a strategy which involves all products offered. There may be a range of normal price points in a market. A supplier might decide to design a product suitable for all price levels, offering opportunities for a range of purchases. For instance, a basic Mars Bar retails for about 25p, a multipack of three bars 65p (Sainsbury), and a multipack of snack size Mars Bars at £1.59 (Sainsbury).

The price points are 25p, 65p and £1.59. (These prices were correct in the summer of 1994. You should check the prices now, and see how each price level fits into the range of Mars products available.)

Type # 7. Pricing Variations:

ADVERTISEMENTS:

‘Off-peak’ pricing and other variants, such as early booking discounts, stand-by prices and group discounts are used in particular circumstances. They are all well known in the travel trade but it is also appropriate to use different prices such as these in other industries. You could argue that an off-peak journey, say a rail journey to London one Tuesday afternoon, is not the same ‘product’ as one during the morning rush period. In the customer’s eyes it is a different product.

If you have to be in London by 9.00 am you cannot travel in the afternoon. Certainly, ‘stand-by’ prices represent a different product as there is no guarantee of travel. The opposite is an early booking price which not only ensures travel is reserved, but can offer the supplier a guarantee of a known demand.

Types of Pricing Strategies – Cost-Oriented Pricing, Demand-Oriented Pricing, Competition-Oriented Pricing and Other Pricing Strategies

Before explaining pricing strategies for determining the price of a product, it is necessary that the difference between pricing policy and pricing strategy must be clearly understood.

Pricing policy means a policy determined for normal conditions of the market. Pricing strategy is a policy determined to face a specific situation and is of temporary nature. Thus, a policy sets the rules and directions for normal conditions while a strategy sets the rules and directions for a specific situation.

The following are the various strategies that can be used to determine the price of the product:

1. Cost-Oriented Pricing Strategies:

Under cost pricing the marketer primarily looks at production costs as the key factor in determining the initial price. This method offers the advantage of being easy to implement as long as costs are known.

ADVERTISEMENTS:

But one major disadvantage is that it does not take into consideration the target market’s demand for the product. This could present major problems if the product is operating in a highly competitive market where competitors frequently alter their prices.

There are several types of cost pricing including:

i. Markup Pricing:

This pricing method used by many resellers, who acquire products from suppliers, is one in which final price is determined by adding a certain percentage to the cost of the product. For many resellers, such as – retailers, who purchase thousands of products it is far easier to use a markup pricing approach due to its simplicity than it would be to determine what the market is willing to pay for each product.

Resellers differ in how they use markup pricing with some using the markup on cost method and others using the markup on selling price method. We will demonstrate each using an item that costs a reseller Rs. 50 to purchase from a supplier.

a. Markup on Cost:

ADVERTISEMENTS:

Using this method price is determined by simply multiplying the cost of each item by a predetermined percentage then adding the result to the cost. A major general retailer, such as Walmart, may apply a set percentage for each product category (e.g., women’s clothing, automotive, garden supplies, etc.,) making the pricing consistent for all like-products. Alternatively, the predetermined percentage may be a number that is identified with the marketing objectives (e.g., required 20% ROI).

The calculation for markup on cost is:

Item Cost + (Item Cost x Markup Percentage) = Price

50 + (50x.30) = 65

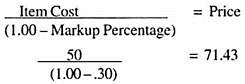

b. Markup on Selling Price:

Many resellers, and in particular retailers, discuss their markup not in terms of markup on product cost but as a reflection of price.

ADVERTISEMENTS:

The calculation for markup on selling price is:

Amongst the factors that influence the choice of the mark-up percentage are as follows:

(1) Nature of the market – A mark-up should reflect the degree of competition in the market (what do the close competitors do?)

(2) Bulk discounts – Should volume orders attract a lower mark-up than a single order?

(3) Pricing strategy – E.g., skimming, penetration

ADVERTISEMENTS:

(4) Stage of the product in its life cycle – Products at the earlier stages of the life cycle may need a lower mark-up percentage to help establish demand.

ii. Cost-Plus Pricing:

In the same way markup pricing arrives at price by adding a certain percentage to the product’s cost, cost-plus pricing also adds to the cost by using a fixed monetary amount rather than percentage. For instance, a contractor hired to renovate a homeowner’s bathroom will estimate the cost of doing the job by adding their total labor cost to the cost of the materials used in the renovation.

The homeowner’s selection of ceramic tile to be used in the bathroom is likely to have little effect on the labor needed to install it whether it is a low-end, low priced tile or a high- end, premium priced tile. Assuming most material in the bathroom project are standard sizes and configuration, any change in the total price for the renovation is a result of changes in material costs while labor costs are constant.

The advantages of using cost plus pricing are:

a. Easy to calculate

ADVERTISEMENTS:

b. Price increases can be justified when costs rise

c. Price stability may arise if competitors take the same approach (and if they have similar costs)

d. Pricing decisions can be made at a relatively junior level in a business based on formulas

The main disadvantages of cost plus pricing are often considered to be:

a. This method ignores the concept of price elasticity of demand – it may be possible for the business to charge a higher (or lower) price to maximise profits depending on the responsiveness of customers to a change in price;

b. The business has less incentive to cut or control costs – if costs increase, then selling prices increase. However, this might be making an “inefficient” business uncompetitive relative to competitor pricing;

c. It requires an estimate and apportionment of business overheads. For example, total factory overheads need to be calculated and then allocated in some way against individual products. This allocation is always arbitrary.

iii. Breakeven Pricing:

Breakeven pricing is associated with breakeven analysis, which is a forecasting tool used by marketers to determine how many products must be sold before the company starts realizing a profit.

Like the markup method, breakeven pricing does not directly consider market demand when determining price, however it does indicate the minimum level of demand that is needed before a product will show a profit. From this the marketer can then assess whether the product can realistically achieve these levels.

The formula for determining breakeven takes into consideration both variable and fixed costs as well as price, and is calculated as follows:

For example, assume a company operates a single-product manufacturing plant that has a total fixed cost (e.g., purchase of equipment, mortgage, etc.,) per year of Rs.3,000,000 and the variable cost (e.g., raw materials, labor, electricity, etc.,) is Rs.45.00 per unit. If the company sells the product directly to customers for Rs. 120, it will require the company to sell 40,000 units to breakeven.

Again we must emphasize that marketers must determine whether the demand (i.e., number of units needed to breakeven) is realistically attainable. Simply plugging in a number for price without knowing how the market will respond to that figure means that this method has little value.

iv. Rate of Return on Investment Pricing:

The “return on investment” pricing method determines the price of a product based on the target return on the amount invested in a product.

The use of a targeted return on investment to determine price has the following advantages:

a. Consistent with other performance measures – e.g., Return on Investment

b. A suitable method for market leaders which are able to set a price which competitors follow

c. A relevant pricing method for new products – particularly those which have a substantial investment.

The method does, however, have some disadvantages:

a. With new products, there is an inherent uncertainty about what the achieved sales volume will be – which in turn will be influenced by the price chosen

b. Some investment may be common to several products or product groups (e.g., an extension to a factory; investment in new development facilities). This raises the question of how to apportion investment amongst products.

v. Marginal Cost Pricing:

With Marginal Cost Pricing (also known as Variable Cost Pricing), a price is set in relation to the variable costs of production (i.e., ignoring fixed costs and overheads).

The objective is to achieve a desired “contribution” towards fixed costs and profit.

Contribution per unit can be defined as – selling price less variable costs

Total contribution can be calculated as follows:

Contribution per unit vs Sales Volume

The resulting profit in a business is, therefore –

Total Contribution less Total Fixed Costs

Prices are set using variable costing by determining a target contribution per unit.

This reflects:

a. Variable costs per unit

b. Total fixed costs

c. The desired level of target profit (i.e., contribution less fixed costs)

d. Sales volume required therefore = 468,750 (£1,875,000 / £4)

The advantages of using a variable/marginal costing method for pricing include the following:

a. Good for short-term decision-making;

b. Avoids having to make an arbitrary allocation of fixed costs and overheads;

c. Focuses the business on what is required to achieve break-even.

However, there are some potential disadvantages of using this method:

a. There is a risk that the price set will not recover total fixed costs in the long term. Ultimately businesses must price their products that reflects the total costs of the business;

b. It may be difficult to raise prices if the contribution per unit is set too low

2. Demand-Oriented Pricing Strategies:

Demand-based pricing is any pricing method that uses consumer demand – based on perceived value – as the central element. In some industries, firms will actually try to construct the demand curve. This is not easy when a firm manufactures a product in many different sizes and packages.

There are several types of demand pricing including:

i. Price Skimming:

Charge a high price because you have a substantial competitive advantage. However, the advantage is not sustainable. The high price tends to attract new competitors into the market, and the price inevitably falls due to increased supply. Manufacturers of digital watches used a skimming approach in the 1970s. Once other manufacturers were tempted into the market and the watches were produced at a lower unit cost, other marketing strategies and pricing approaches are implemented.

The practice of ‘price skimming’ involves charging a relatively high price for a short time where a new, innovative, or much-improved product is launched onto a market. The objective with skimming is to “skim” off customers who are willing to pay more to have the product sooner; prices are lowered later when demand from the “early adopters” falls.

The success of a price-skimming strategy is largely dependent on the inelasticity of demand for the product either by the market as a whole, or by certain market segments. High prices can be enjoyed in the short term where demand is relatively inelastic.

In the short term the supplier benefits from ‘monopoly profits’, but as profitability increases, competing suppliers are likely to be attracted to the market (depending on the barriers to entry in the market) and the price will fall as competition increases.

The main objective of employing a price-skimming strategy is, therefore, to benefit from high short-term profits (due to the newness of the product) and from effective market segmentation.

There are several advantages of price skimming:

a. Where a highly innovative product is launched, research and development costs are likely to be high, as are the costs of introducing the product to the market via promotion, advertising etc. In such cases, the practice of price-skimming allows for some return on the set-up costs.

b. By charging high prices initially, a company can build a high-quality image for its product. Charging initial high prices allows the firm the luxury of reducing them when the threat of competition arrives. By contrast, a lower initial price would be difficult to increase without risking the loss of sales volume.

c. Skimming can be an effective strategy in segmenting the market. A firm can divide the market into a number of segments and reduce the price at different stages in each, thus acquiring maximum profit from each segment.

d. Where a product is distributed via dealers, the practice of price-skimming is very popular, since high prices for the supplier are translated into high mark-ups for the dealer.

e. For ‘conspicuous’ or ‘prestige goods’, the practice of price skimming can be particularly successful, since the buyer tends to be more ‘prestige’ conscious than price conscious. Similarly, where the quality differences between competing brands is perceived to be large, or for offerings where such differences are not easily judged, the skimming strategy can work well. An example of the latter would be for the manufacturers of ‘designer-label’ clothing.

ii. Penetration Pricing:

Penetration pricing involves the setting of lower, rather than higher prices in order to achieve a large, if not dominant market share. This strategy is most often used businesses wishing to enter a new market or build on a relatively small market share.

This will only be possible where demand for the product is believed to be highly elastic, i.e., demand is price-sensitive and either new buyers will be attracted, or existing buyers will buy more of the product as a result of a low price.

A successful penetration pricing strategy may lead to large sales volumes/market shares and therefore lower costs per unit. The effects of economies of both scale and experience lead to lower production costs, which justify the use of penetration pricing strategies to gain market share. Penetration strategies are often used by businesses that need to use up spare resources (e.g., factory capacity).

A penetration pricing strategy may also promote complimentary and captive products. The main product may be priced with a low mark-up to attract sales (it may even be a loss-leader). Customers are then sold accessories (which often only fit the manufacturer’s main product) which are sold at higher mark-ups.

Before implementing a penetration pricing strategy, a supplier must be certain that it has the production and distribution capabilities to meet the anticipated increase in demand.

The most obvious potential disadvantage of implementing a penetration pricing strategy is the likelihood of competing suppliers following suit by reducing their prices also, thus nullifying any advantage of the reduced price (if prices are sufficiently differentiated the impact of this disadvantage may be diminished).

A second potential disadvantage is the impact of the reduced price on the image of the offering, particularly where buyers associate price with quality.

iii. Price Bundling:

Offer a product, options and customer service for one total price. May unbundled price, i.e. breakdown prices and allow customers to decide what they want to purchase. Here sellers combine several products in the same package. This also serves to move old stock. Videos and CDs are often sold using the bundle approach.

3. Competition-Oriented Pricing Strategies:

How competitors price their products can influence the marketer’s pricing decision. Clearly when setting price it makes sense to look at the price of competitive offerings. For some, competitor’s price serves as an important reference point from which they set their price.

In some industries, particularly those in which there are a few dominant competitors and many small companies, the top companies are in the position of holding price leadership roles where they are often the first in the industry to change price. Smaller companies must then assume a price follower role and react once the big companies adjust their price.

When basing pricing decisions on how competitors are setting their price, firms may follow one of the following approaches:

i. Below Competition Pricing – A marketer attempting to reach objectives that require high sales levels (e.g., market share objective) may monitor the market to insure their price remains below competitors.

ii. Above Competition Pricing – Marketers using this approach are likely to be perceived as market leaders in terms of product features, brand image or other characteristics that support a price that is higher than what competitors offer.

iii. Parity Pricing – A simple method for setting the initial price is to price the product at the price is based on analysis of market research in which customer expectations are measured. The main goal is to learn what customers in an organization’s target market are likely to perceive as an acceptable price. Of course, this price should also help the organization meet its marketing objectives.

Market pricing is one of the most common methods for setting price, and the one that seems most logical given marketing’s focus on satisfying customers. So if this is the most logical approach why don’t all companies follow it? The main reason is that using the market pricing approach requires a strong market research effort to measure customer reaction.

For many marketers it is not feasible to spend the time and money it takes to do this right. Additionally for some products, especially new high-tech products, customers are not always knowledgeable about the product to know what an acceptable price level should be. Consequently, some marketers may forego market pricing in favor of other approaches.

For those marketers who use market pricing, options include:

i. Backward Pricing

ii. Psychological Pricing

iii. Price Lining

i. Backward Pricing:

In some marketing organizations the price the market is willing to pay for a product is an important determinant of many other marketing decisions. This is likely to occur when the market has a clear perception of what it believes is an acceptable level of pricing. For example, customers may question a product that carries a price tag that is double that of a competitor’s offerings but is perceived to offer only minor improvements compared to other products.

In these markets it is important to undertake research to learn whether customers have mentally established a price range or reference price for products in a certain product category. The marketer can learn this by surveying customers with such questions as – “How much do you think these types of products should cost you?”

In situations where a price range is ingrained in the market, the marketer may need to use this price as the starting point for many decisions and work backwards to develop product, promotion and distribution plans. For instance, assume a company sells products through retailers.

If the market is willing to pay Rs. 199 for a product but is resistant to pricing that is higher, the marketer will work backwards factoring out the profit margin retailers are likely to want (say, Rs. 40) and as well as removing the marketer’s profit (say, Rs. 70).

From this, the product cost will remain (199 – 40-70= Rs.89). The marketer must then decide whether they can create a product with sufficient features and benefits to satisfy customers’ needs at this cost level.

ii. Psychological Pricing:

For many years researchers have investigated customers’ response to product pricing. Some of the results point to several interesting psychological effects price may have on customers’ buying behavior and on their perception of individual products.

We stress that certain pricing tactics “may” have a psychological effect since the results of some studies have suggested otherwise. But enough studies have shown an effect that this topic is worthy of discussion.

a. Odd-Even Pricing:

One effect dubbed “odd-even” pricing relates to whole number pricing where customers may perceive a significant difference in product price when pricing is slightly below a whole number value. For example, a product priced at Rs. 299.95 may be perceived as offering more value than a product priced at Rs. 300.00.

This effect can also be used to influence potential customers who receive product information from others. Many times a buyer will pass along the price as being lower than it is either because they recall it being lower than the even number or they want to impress others with their success in obtaining a good value.

For instance, in our example a buyer who pays Rs. 299.95 may tell a friend they paid “a little more than Rs. 200” for the product when in fact it was much closer to Rs. 300.

b. Prestige Pricing:

Another psychological effect, called prestige pricing, points to a strong correlation between perceived product quality and price. Prestige Pricing refers to the practice of setting a high price for a product, throughout its entire life cycle – as opposed to the short term ‘opportunistic’, high price of price ‘skimming’. This is done in order to evoke perceptions of quality and prestige with the product or service.

For products for which prestige pricing may apply, the high price is itself an important motivation for consumers. As incomes rise and consumers become less price sensitive, the concepts of ‘quality’ and ‘prestige’ can often assume greater importance as purchasing motivators.

Thus advertisements and promotional strategies focus attention on these aspects of a product, and, not only can a ‘prestige’ price be sustained, it also becomes self-sustaining.

iii. Price Lining:

Marketers must appeal to the needs of a wide variety of customers. The difference in the “needs-set” between customers often leads marketers to realization that the overall market is really made up of a collection smaller market segments.

These segments may seek similar products but with different sets of product features, which are presented in the form of different models (e.g., different quality of basketball sneakers) or service options (e.g., different hotel room options).

Price lining or product line pricing is a method that primarily uses price to create the separation between the different models. With this approach, even if customers possess little knowledge about a set of products, customers may perceive they are different based on price alone.

The key is whether the prices for all products in the group are perceived as representing distinct price points (i.e., enough separation between each). For instance, a marketer may sell a base model, an upgraded model and a deluxe model each at a different price.

If the differences in features for each model is not readily apparent to a customer, such as differences that are inside the product and not easily viewed (e.g., difference between laptop computers), then price lining will help the customer recognize that differences do exist as long as the prices are noticeably different.

Price lining can also be effective as a method for increasing profitability. In many cases the cost to the marketer for adding different features to create different models or service options does not alone justify a big price difference. For instance, an upgraded model may cost 10% more to produce than a base model but using the price lining method the upgraded product price may be 20% higher and thus more profitable than the base model.

The increase in profitability offered by price lining is one reason marketers introduce multiple models, since it allows the company to not only satisfy the needs of different segments but also presents an option for a customer to “buy up” to a higher priced and more profitable model

4. Other Pricing Strategies:

i. Bid Pricing:

Not all selling situations allow the marketer to have advanced knowledge of the prices offered by competitors. While the Internet has made researching competitor pricing a relatively routine exercise, this is not the case in markets where bid pricing occurs.

Bid pricing typically requires a marketer to submit a price to a potential buyer that is sealed or unseen by competitors. It is not until all bids are obtained and unsealed that the marketer is informed of the price listed by competitors.

Bid pricing occurs in several industries though it is a standard requirement when selling to local, national and international governments. In these situations the marketer’s pricing strategy depends on the projected winning bid price, which is generally the lowest price.

However, price alone is only the deciding factor if the bidder meets certain qualifications. The fact that marketers often operate in the dark in terms of available competitor research, makes this type pricing one of the most challenging of all pricing setting methods.

ii. Pre-Emptive Pricing:

Pre-emptive pricing is a strategy which involves setting low prices in order to discourage or deter potential new entrants to the suppliers market, and is especially suited to markets in which the supplier does not hold a patent, or other market privilege and entry to the market is relatively straightforward.

By deterring other entrants to the market, a supplier has time to –

a. Refine/develop the product

b. Gain market share

c. Reduce costs of production (through sales/ experience effects)

d. Acquire name/brand recognition, as the ‘original’ supplier.

iii. Extinction Pricing:

Extinction pricing has the overall objective of eliminating competition, and involves setting very low prices in the short term in order to ‘under-cut’ competition, or alternatively repel potential new entrants.

The extinction price may, in the short term, be set at a level lower even than the suppliers own cost of production, but once competition has been extinguished, prices are raised to profitable levels. Only firms dominant in the market, and in a strong financial position will be able survive the short-term losses associated with extinction pricing strategies, and benefit in the longer term.

The strategy of extinction pricing can be used selectively by firms who can apply it either to limited geographical markets (making up any losses by increasing prices in other geographical markets), or to certain product ‘lines’. In the latter case, the low price of a product at one end of the product range might attract new purchasers to the product line, and sales of different, more profitable items might increase.

iv. Economy Pricing:

This is a no frills low price. The cost of marketing and manufacture are kept at a minimum. Supermarkets often have economy brands for soups, spaghetti, etc.

v. Optional Product Pricing:

Companies will attempt to increase the amount customer spend once they start to buy. Optional ‘extras’ increase the overall price of the product or service. For example airlines will charge for optional extras such as – guaranteeing a window seat or reserving a row of seats next to each other.

vi. Captive Product Pricing:

Where products have complements, companies will charge a premium price where the consumer is captured. For example a razor manufacturer will charge a low price and recoup its margin (and more) from the sale of the only design of blades which fit the razor.

vii. Geographical Pricing:

Geographical pricing is evident where there are variations in price in different parts of the world. For example rarity value, or where shipping costs increase price.

viii. Value Pricing:

This approach is used where external factors such as recession or increased competition force companies to provide ‘value’ products and services to retain sales e.g., value meals at McDonalds.

Types of Pricing Strategies: Geographical, Discriminate & Promotional Pricing Strategies

Type # 1. Value and Skimming Pricing:

The embryonic stage refers to such products that are newly introduced in the market and their recognition with the consumers is yet to be established. The value pricing may be an appropriate strategy to practise with the new products. It is also known as skimming the market. In this process, a high price is set for the product to ‘cream off all available demand.

The price is maintained for some time, to allow the customers who regard the product as important to ‘upgrade’ themselves into the high price bracket. In a broad sense, it is the product segmentation. However, the value pricing approach would prove advantageous only when enough product awareness is created among the consumers through advertisements, demonstrations and effective consumer services. In the long run such an approach would create a specific group of customers or consumer segment for the product.

For instance, the electronic products of some companies like BPL-Sanyo and Philips among the capital goods and some of the household consumable goods such as packed food and condiments coming from capital-intensive units constitute such consumers segments for their products.

The advantage of a high profit under the value pricing approach is anticipated in the long run when there is consumer segmentation for the product with a high recognition. However, in this approach, the selling cost may shoot up making the profit margin low in the initial stages. In value pricing, another important factor to be considered is the territorial characteristics – low purchasing power or high purchasing power consumer segments or rural and urban.

In the former, where the marginal propensity of consumption and income level of consumers are low, the value pricing, with a high product price and selling cost would not be a profitable approach. In such areas, where there are low-income group consumers, the product segmentation can be done formulating the ‘dumping policy’ at a low price.

The price of the product can be raised to the maximum in coherence with the consumers’ purchasing and paying capacity in the long run, after the product gets proper consumer recognition and makes headway in the market. Under such circumstances, the selling cost will however be lower as compared to the overhead costs.

If the customer’s economics are understood, it is possible to estimate the benefit of purchasing the product or service. Company management should be asking itself, “What is the highest price that can be charged such that the customer is better off after buying from us?” The value added pricing can be explained as a company provides transportation and disposal services for infectious medical waste from small generators, such as doctors and blood banks.

As the regulatory and enforcement climates have stiffened, customers have become increasingly sensitive to the problems associated with proper disposal of this material. Unlike the competitors, who primarily price by the pound of material removed, the company may charge a fixed fee per container. In some cases we get more than what our competition would get and in other cases we don’t. Overall we get a premium price for our service, but what the company is selling to our customers is a quality service and, ultimately, peace of mind.

Skimming pricing is the strategy of establishing a high initial price for a product with a view to “skimming the cream off the market” at the upper end of the demand curve. It is acc6mpanied by heavy expenditure on promotion.

A skimming strategy may be recommended under the following business conditions:

i. When the nature of demand is uncertain,

ii. When a company has expended large sums of money on research and development for a new product,

iii. When the competition is expected to develop and market a similar product in the near future, or

iv. When the product is very innovative and market is expected to mature very slowly.

Under these circumstances, a skimming strategy has several advantages. At the top of the demand curve, price elasticity is low. Besides, in the absence of any close substitute, cross-elasticity is also low. These factors, along with heavy emphasis on promotion, tend to help the product make significant inroads into the market. The high price also helps the segment market.

One may also turn to a penetration strategy with a view to achieving economies of scale. Savings in production costs alone may not be an important factor in setting low prices because, in the absence of price elasticity, it is difficult to generate sufficient sales.

Finally, before adopting penetration pricing, one must make sure that the product fits into the lifestyles of the mass market. How low the penetration price should be differs from case to case. There are different types of prices used in penetration strategies- restrained elimination prices, promotional prices, and keep- out prices.

Dow Chemical Company stresses penetration pricing. It concentrates on lower-margin commodity products and low prices, builds dominant market share, and holds on for the long haul. Texas Instruments also practices penetration pricing. Texas Instruments starts by building a large plant capacity. By setting the price as low as possible, it hopes to penetrate fast and gain a large market share.

Penetration pricing reflects a long-term perspective in which short-term profits are sacrificed in order to establish sustainable competitive advantage. Penetration policy usually leads to above-average long-run returns that fall into a relatively narrow range. Price skimming, on the other hand, yields a wider range of lower average returns.

Type # 2. Pricing with Demand Curve:

This approach may be followed for pricing the products that already exist in the market and are mature with regard to sales realization in the open market condition. In this process, unlike getting customers to upgrade themselves and form segments, the pricing approach calls for widening the market, matching the product price with product demand. In this process, a high price may be set initially, but there is a scaling down of the price and mopping up of all available demand at each price level.

The likely demand at various price levels is difficult to estimate but, the implications pertaining to the results of sample survey can be used in pricing. The sales estimates may represent the demand schedule and in a firm, even with these points the curve can be drawn.

Some preconditions may be reviewed to estimate the demand of the product, such as:

(i) Number of potential buyers

(ii) Propensity to purchase and of sales, and

(iii) Product attributes to attitude building.

The demand curve has implications of these preconditions. If the price is changed there is a movement along with the demand curve and if any of the preconditions of demand changed, there is a scope of shift in the demand curve to the higher or lower side. In case the demand for the product is elastic, the price should not be kept high for any product.

Pricing strategies are subject to the very nature of the product. If it is a core product made tangible without enough scorching expenditure, it can be priced at higher margins, as any close competitor does not encounter it. Marketing of such products depends on the pricing strategies suitable at every level of the distribution network.

Type # 3. Penetration Pricing:

This policy may be adopted to penetrate the market as quickly as possible to secure cost advantages through pushing products in high volume. In case, new products of similar qualities, which exist in the market, have to be introduced for crash sales in the market, the price may be derived in relation to its competitive products. The important issue to be kept in view is the anticipated selling cost and the volume of sales to determine the prices.

The penetration price always needs to be little lesser than the price of the existing products similar to it. The penetration price is conceptually an artificial pricing approach to push the product in the market. The real price may be fixed later in the process to assess the demand elasticity of the product in the primary and subsequent markets.

Penetration pricing is the strategy of entering the market with a low initial price so that a greater share of the market can be captured. The penetration strategy is used when an elite market does not exist and demand seems to be elastic over the entire demand curve, even during early stages of product introduction. High price elasticity of demand is probably the most important reason for adopting a penetration strategy.

The penetration strategy is also used to discourage competitors from entering the market. When competitors seem to be encroaching on a market, an attempt is made to lure them away by means of penetration pricing, which yields lower margins. A competitor’s costs play a decisive role in this pricing strategy because a cost advantage over the existing manufacturer might persuade another firm to enter the market, regardless of how low the former margin may be.

Type # 4. Geographical Pricing:

It is the strategy to exercise a discriminatory pricing policy across the various territorial market segments. The marketer who serves a number of distinct regions can adopt this policy without creating psychological barriers either to the customers or distributors in purchasing and selling the products.

This strategy is largely backed by the concept of ‘skimming in’ and ‘skimming off’ price setting. A marketer can choose relatively a lower price for the product in the segments where the customer density is high but the purchasing power is low. On the contrary, a higher price may be fixed in the segments of high purchasing power where ‘skimming off’ strategy can be implemented. In setting up both the price standards, the marketing objective should remain intact and the overall orientation of the marketing managers has to remain the same.

Type # 5. Conspicuous Pricing:

The skimming approach implies in this pricing policy where the price of the product is kept higher than its substitutes in order to make it conspicuous, so the product may be recognized as a symbol of social status. An example of Jewellery watches may be cited in this context that serve as a status product for the customers.

Type # 6. Psychological Pricing:

This approach makes the customer feel that he is paying a relatively lower price for the product. To stimulate such a view the price is fixed in integral values very close to the round numeric values, e.g., prices of Bata shoes Rs 499/-, shirts in UK £ 3.99. Such a price structure gives the customer a materialistic satisfaction in buying the product.

Type # 7. Value-Added Pricing:

In this price determining process, the company takes care of the value of its by-products in the principal product and prices them accordingly. Such approaches are generally applicable for evolving price strategies of semi-processed products like meat, oilseeds, milk, chemicals, etc.

Type # 8. Complementary Product Pricing:

The prices of the principal products are dependent on the pricing pattern of associated products, and vice-versa. It is logical that the prices of the complementary products should be lower, e.g., film of camera, battery of camera, etc., or else the customers may withdraw the principal product from use.

Type # 9. Price Discounts:

This is one of the most popular strategies adopted by the private companies in order to attract the consumer towards their stocks and increase sales by offering a discount on the price of the products either on selected or all items in accordance with the business state of the organization. The discounts are offered in terms of cash, kind or discount vouchers, facilitating the customers to buy the products of the company for the amount discounted.

The government-supported organizations offer following discounts:

i. Cash discounts

ii. Quantity discounts

iii. Discount in kind

iv. Trade discounts

v. Seasonal discounts

vi. Institutional discounts

vii. Grant-in-aid discounts

viii. Allowances

ix. Stock clearing discounts

A company may offer a discount either by making the customer pays less than the prescribed price of the product or set a strategy to provide additional quantity of products on the pre-set price. Such transactions refer to cash and quantity discounts. A customer’, when offered with complementary products for the principal product, refers to the policy of discount in kind, e.g., batteries with a toy set.

The trade discounts are incentives to the distributors for the promotion of sales. The seasonal discounts on prices are related to the customers’ demand for the product at a particular time. For example, during festivals, clothes are in high demand and generally are offered at seasonal discounts to boost sales. The Handloom societies, patronized by the Government of India, also offer seasonal discount subject to the availability of grant-in-aid for sales from the government.

On the bulk procurement of products, an institutional discount on the set price is offered by the companies to keep up the customer relationship. The company, however, may decide to offer a clearance sale discount on prices to ease inventory blockade and expenditure.

It also helps an organization to refill the product-line with products or demand at par with fashion or time. The sales personnel of the company also get some benefit as a token or recognition for the service rendered in terms of price discount on selected products to keep their morale high in the future too.

Type # 10. Discriminate Pricing:

A company modifies its pricing strategy for the products according to the customer-segments, product forms, product-image, location and time. These approaches are to be decided on the basis of the competition prevailing in the market. However, a marketing manager has to keep his corporate objectives in view, before discriminating the price in several forms stated above.

Type # 11. Promotional Pricing:

Under specific circumstances, companies will temporarily price their products below the list price to promote sales. In this process, sometimes, risk is taken by the companies to fix the price even below the cost. There are many forms of promotional pricing strategy.

They are:

i. Loss leader pricing,

ii. Special event pricing, and

iii. Low financing.

In this strategy, there always remains a threat of copying by competitors. Thus, such a policy should not be recommended for a long period of time.

Pricing is a logical proposition keeping in view the competitive products in the market. A company has to determine the price on the basis of internal economics pertaining to business objectives, targets, marketing policies and profit targets and external forces like the demand and strategies of competitive products.

Type # 12. Mark-Up Pricing:

It is an elementary pricing method that is exercised by adding mark-up standard to the cost of the product. There are considerable variations in mark-ups among the different products. Thus, this methodology is not considered to be scientific. However, mark-up pricing remains popular for several reasons- (i) it is a cost plus exercise and appears to be fairer for both customers and sellers, (ii) sellers opine that this approach is simple and (iii) price competition is minimized.

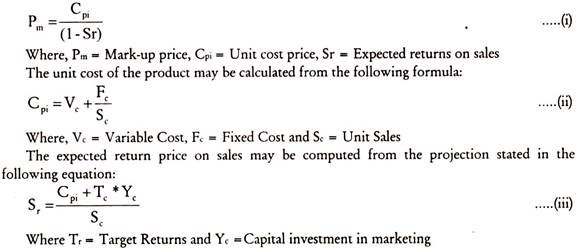

The mark-up price may be calculated using the formula as below:

The mark-up price can be calculated substituting the values of unit cost and expected returns drawn from equation (ii) and (iii) in the equation (i).

Type # 13. Cost-Plus Pricing:

Cost-plus pricing looks inward and examines the company’s cost and expense structures to determine how much has to be added to the cost of a product to achieve a desired level of profitability. Most industries have rules of thumb that are often used to set prices. These rules of thumb are the cumulative results of the performance of many industry participants over a time and should not be dismissed lightly.

It is the rare company who can revolutionize the cost structure of a competitive market. Quite often these rules of thumb are expressed in terms of a profit margin (the “plus”) to the cost of the goods being sold. For a high tech start up, 80% gross profit margins are often necessary. This means that if the product costs $20 to produce, the selling price for that product should be $100. It is imperative to find out what these rules of thumb are for the particular industry.

Activity-based costing (ABC) also referred to as activity-based accounting and transaction- based costing, is a concept you will probably learn in a managerial accounting course and hear about it in a production and operations management course. Basically it is a method of allocating costs to products and services. If ABC is used effectively, it is a great tool for planning and control.

A company should identify the major activities in a process/department/operation/system and may create cost pools, as groups of activities need to be allocated together. Selecting cost drivers should follow. The number of cost drivers used will probably rely on trade-offs. Too few may reduce accuracy while too many may increase complexity. After determining the cost drivers, the rate should be calculated. The rates are then applied to the respective cost drivers for each product/service that are under consideration. The overhead cost per unit can then be derived when the total product units divide the total cost for the product.

Type # 14. Customer Expectations-Based Pricing:

Another approach is to price to the customer expectations. Experienced purchasers of products and services have general ranges and frames of reference for pricing expectations. Prices that are inconsistent with these expectations may be rejected without consideration. A low price may be associated with an inferior product or service, thereby being unacceptable to particular customers.

A high price may be beyond what another buyer considers reasonable for his/her expectations of the product’s benefits. Ultimately prices should be set according to what the market will bear. This will be influenced by competitive actions, customer expectations, and the company’s cost structure. No final pricing decisions should be made until a breakeven analysis has been performed which considers fixed costs, variable costs, and volume.

Types of Pricing Strategies – For New Products and Established Products

Price Strategies for New Products:

1. Skimming Pricing:

Setting a relatively high price during the initial stage of a product’s life cycle.

a) To serve customers who are not price conscious while the market is at the upper end of the demand curve and competition has not yet entered the market.

b) To recover a significant portion of promotional and research and development costs through a high margin.

a) Heavy promotional expenditure to introduce product, educate consumers, and induce early buying.

b) Relatively inelastic demand at the upper end of the demand curve.

c) Lack of direct competition and substitutes.

a) Market segmented by price-conscious and not so price conscious customers.

b) High margin on sales that will cover promotion and research and development costs.

c) Opportunity for the firm to lower its price and sell to the mass market before competition enters.

Setting a relatively low price during the initial stages of a products life.

Objective:

To discourage competition from entering the market by quickly taking a large market share and by gaining a cost advantage through realizing economies of scale.

a) Product must appeal to a market large enough to support the cost advantage.

b) Demand must be highly elastic in order for the firm to guard its cost advantage.

a) High sales volume and large market share.

b) Low margin on sales.

c) Lower unit costs relative to competition due to economies of scale.

Price Strategies for Established Products:

A. Maintaining the Price Objectives:

a) To maintain position in the marketplace (i.e., market share, profitability, etc.)

b) To enhance public image.

a) Firm’s served market is not significantly affected by changes in the environment.

b) Uncertainty exists concerning the need for results of a price change.

c) Firm’s public image could be enhanced by responding to government requests or public opinion to maintain price.

a) Status quo for the firm’s market opinion.

b) Enhancement of the firm’s public image.

Objectives:

a) To act defensively and cut price to meet the competition.

b) To act offensively and attempt to beat the competition.

c) To respond to a customer need created by a change in the environment.

a) Firm must be financially and competitively strong to fight in a price war if that becomes necessary.

b) Must have a good understanding of the demand function of its product.

Expected Results:

Lower profit margins (assuming costs are held constant). Higher market share might be expected, but this will depend upon the price change relative to competitive prices and upon price elasticity.

Objectives:

a) To maintain profitability during an inflationary period.

b) To take advantage of product differences, real or perceived.

c) To segment the current served market.

a) Relatively low price elasticity but relatively high elasticity with respect to some other factor such as – quality or distribution.

b) Reinforcement from other ingredients of the marketing mix; for example, if a firm decides to increase price and differentiate its product by quality, then promotion and distribution must address product quality.

a) Higher sales margin.

b) Segmented market (price conscious, quality conscious, etc.).

c) Possibly higher unit sales, if differentiation is effective.

A. One-Price Strategy:

Charging the same price to all customers under similar conditions and for the same quantities.

Objectives:

a) To simplify pricing decisions.

b) To maintain goodwill among customers.

a) Detailed analysis of the firm’s position and cost structure as compared with the rest of the industry.

b) Information concerning the cost variability of offering the same price to everyone.

c) Knowledge of the economies of scale available to the firm.

d) Information on competitive prices; information on the price that customers are ready to pay.

a) Decreased administrative and selling costs.

b) Constant profit margins.

c) Favorable and fair image among customers.

d) Stable market.

Charging different prices to different customers for the same product and quantity.

Objective:

To maximize short-term profits and build traffic by allowing upward and downward adjustments in price depending on competitive conditions and how much the customer is willing to pay for the product. Requirements – Have the information needed to implement the strategy.

Usually this strategy is implemented in one of four ways:

a) By market,

b) By product,

c) By timing,

d) By technology.

a) A customer-value analysis of the product.

b) An emphasis on profit margin rather than just volume, and

c) A record of competitive reactions to price moves in the past.

a) Increased sales, leading to greater market share.

b) Increased short-term profits.

c) Increased selling and administrative costs.

d) Legal difficulties stemming from price discrimination.

Product Line – Pricing Strategy:

Pricing a product line according to each product’s effect on and relationship with other products in that line, whether competitive or complementary.

To maximize profits from the whole line, not just certain members of it.

Requirements:

a) For a product already in the line, strategy is developed according to the products contributions to it’s pro rata share of overhead and direct costs.

b) For a new product, a product/market analysis determines whether the product will be profitable. Pricing is then a function of costs, profit goals, experienced, and external competition.

a) Well-balanced and consistent pricing schedule across the product line.

b) Greater profits in the long term.

c) Better performance of the line as a whole.

Pricing Strategy to Build Market Share:

Setting the lowest price possible for a new product.

To seek such a cost advantage that it cannot ever be profitably overcome by any competitor.

Requirements:

i. Enough resources to withstand initial operating losses that will be recovered later through economies of scale

ii. Price-sensitive market.

iii. Large market.

iv. High elasticity of demand.

a) Start-up losses to build market share.

b) Creation of a barrier to entry to the industry.

Versioning is popular with services or technical products, where you sell the same general product in two or three configurations. A trial or very basic version may be offered at low or no cost, for example, with upgrades or more services available at a higher price.

Value Based Pricing – Shifting From Cost to Value-Based Pricing:

The normally quoted price to end users is known as the list price. This price usually is discounted for distribution channel members and some end users.

There are several types of discounts, as outlined below:

i. Quantity discount – offered to customers who purchase in large quantities.

ii. Cumulative quantity discount – a discount that increases as the cumulative quantity increases. Cumulative discounts may be offered to resellers who purchase large quantities over time but who do not wish to place large individual orders.

iii. Seasonal discount – based on the time that the purchase is made and designed to reduce seasonal variation in sales. For example, the travel industry offers much lower off-season rates. Such discounts do not have to be based on time of the year; they also can be based on day of the week or time of the day, such as – pricing offered by long distance and wireless service providers.

iv. Cash discount – extended to customers who pay their bill before a specified date.

v. Trade discount – a functional discount offered to channel members for performing their roles. For example, a trade discount may be offered to a small retailer who may not purchase in quantity but nonetheless performs the important retail function.

vi. Promotional discount – a short-term discounted price offered to simulate sales.

Many organizations today use a cost-plus approach as the main source to set prices. Such a pricing approach can result in missed value capture opportunities and loss of margins when the product value delivered to customer ends up being for more than the actual cost to produce.

Common victim of these practices are new product or service innovations. Once price is communicated in the market, it frames customer perceptions about the product and in many cases these perceptions or price levels cannot be reversed easily.

On the flip side there are also cases where product pricing based on cost-plus results in a price that is way out of line versus the rest of the market. As a result, companies are putting too much burden of cost recovery in price resulting in too high a price and subsequent losses in volume.

More generally, what is omitted in the cost-plus approach is that pricing is not looked at strategically. It is not simply an instrument to recoup one’s costs or undercut one’s competition. The goal is to capture and convey the value generated for the customer. An important way to capture more value is done by aligning pricing to value.

Segmented pricing is a great example, meaning setting different prices to different audiences with justifiable differences in offerings. Whereas, today, cost-plus pricing leads mostly to the “one-price-fits-all situation – an intrinsically flawed strategy that does not take into account different values created and pricing sensitivities of different consumers.

Value based pricing goes beyond traditional pricing, practices and has gained a lot of momentum over the past 10 years, especially in business to business environments.

Value based pricing helps companies improve revenue and profitability by better management of the value they deliver to their customers and treating pricing as a strategic decision and ensuring that it is aligned with other marketing and business domains.