The put option gives the buyer the right, but not the obligation, to sell a given quantity of the underlying asset at a given price on or before a given date. The put option gives the buyer the right to sell the underlying asset at the exercise price up to the date of the contract. The seller of put option is known as ‘writer’.

He has no choice regarding the fulfillment of the obligations under the contract. If the buyer wants to exercise his put option, the writer must purchase at exercise price. For this asymmetry of privilege, the buyer of put option must pay the writer, the option price called as ‘premium’.

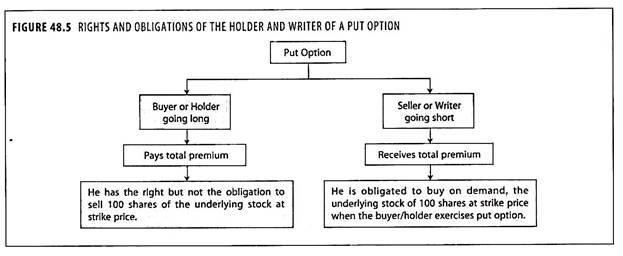

Rights and Obligations in Put Option:

The rights and obligations of the buyer and writer of a put option are explained in figure 48.5.

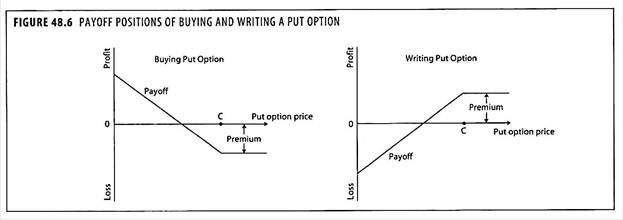

Payoff Positions in Put Options:

The payoff positions of buying a put and writing a put are given in figure 48.6.

Buying a Put:

The buyer of a put option pays the option premium for the right to sell the underlying asset at the exercise price. If at expiry the asset price is below the exercise price ‘C’, the buyer will exercise the option, gives the asset and receive the exercise price. If the asset price is at or above the exercise price, the put option will be abandoned and the buyer will incur a loss equal to the option premium.

Writing a Put:

ADVERTISEMENTS:

The put writer receives the premium for bearing the risk of having to take the underlying asset at the exercise price. If the market price of asset is below the exercise price at expiry, the writer will incur a loss because he will have to pay the exercise price but will only be able to resell the asset at the lower market price. If the asset is above the exercise price at expiry, the buyer will abandon the put option and the writer will make a profit equal to the option premium received.

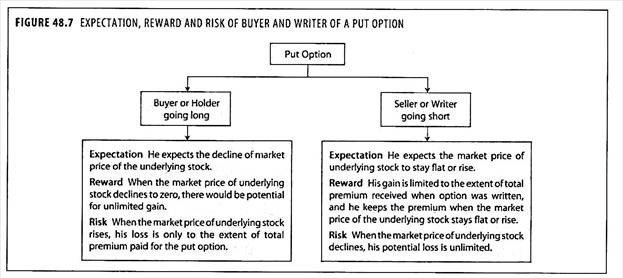

Expectation, Reward and Risk in Put Option:

The expectation, reward and risk of holder and writer of a put option are given in figure 48.7.