The following points highlight the thirteen main aspects of options. The aspects are: 1. Calendar Spread 2. Calculation of Premium on Options 3. Intrinsic Value of an Option 4. In the Money, at the Money and Out of the Money Options 5. Time Value of Option 6. Types of Covered Call 7. Put-Call Ratio 8. Open Market 9. Liquidating Option Positions 10. Marking to Market 11. Put-Call Parity Theory and a Few Others.

Aspect # 1. Calendar Spread:

A calendar spread entails selling options with a near-month expiry, against the purchase of options for the same underlying and at the same strike price in the far month. This strategy can be used when you have neutral outlook on the underlying asset (index or stock) in near term (i.e. till such time the current month contract expires) and have a moderately bullish or bearish view on the same underlying over the far month.

For instance, if you are selling a calendar spread on Nifty, it will imply that you have a more or less neutral outlook on the index this month, but a fairly bullish or bearish outlook the next month.

Calendar spreads come with a limited risk and high reward potential – limited risk, because the sold option is backed by the long option in the far month. The calendar spread is the simultaneous sale and purchase of either calls or puts with the same strike price but different expiration months.

ADVERTISEMENTS:

A calendar spread is created by taking simultaneously two positions:

1. A long position in a futures series expiring in any calendar month,

2. A short position in the same futures as stated in point (a) but for a series expiring in any month other than in point (a) above.

Examples of Calendar Spreads:

ADVERTISEMENTS:

Long June Nifty Futures – Short July Nifty Futures

Short July Nifty Futures – Long August Nifty Futures

A spread position must be closed by reversing both the legs simultaneously. The reversal of point (a) above would be a sale of June Nifty Futures while simultaneously buying the July Nifty Futures.

Aspect # 2. Calculation of Premium on Options:

Options premium is not fixed by the exchange. The fair value/theoretical price of an option can be known with the help of pricing models and then depending on market conditions, the price is determined by competitive bids and offers in the trading environment. An option’s premium/price is the sum of intrinsic value and time value.

ADVERTISEMENTS:

If the price of underlying stock is held constant, the intrinsic value portion of an option premium will remain constant as well. Therefore, any change in the price of the option will be entirely due to a change in the option’s time value.

The time value component of option premium can change in response to a change in the volatility of the underlying, the time to expiry, interest rate fluctuations, dividend payments and the immediate effect of supply and demand for both the underlying and its option.

Aspect # 3. Intrinsic Value of an Option:

The intrinsic value of an option is defined as the amount by which an option is in the money, or the immediate exercise value of the option when the underlying position is marked-to-market.

For a Call Option:

ADVERTISEMENTS:

Intrinsic value = Spot price – Strike price

For Put Option:

Intrinsic value = Strike price – Spot price

The intrinsic value of an option must be a positive number or zero. It can’t be negative. For a call option, the strike price must be less than the price of the underlying asset for it to have intrinsic value. For a put option, the strike price must be greater than the underlying asset price for it to have intrinsic value.

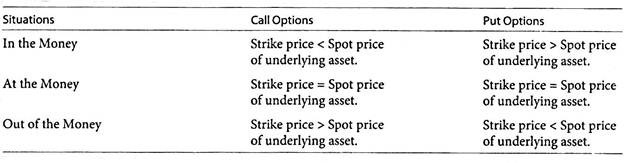

Aspect # 4. In the Money, at the Money and Out of the Money Options:

ADVERTISEMENTS:

1. An option is said to be ‘at the money’, when the option’s strike price is equal to the underlying asset price. This is true for both puts and calls.

2. A call option is said to be ‘in the money’ when the strike price of the option is less than the underlying asset price. For example, a Nifty call option with strike of 1900 is ‘in the money’, when the spot Nifty is at 1930, as the call option has value. The call option holder has the right to buy a Nifty at 1900, no matter by what amount the spot price exceed the strike price with the spot price at 2100, selling Nifty at this higher price can make a profit.

3. A call option is said to be ‘out of money’ when the strike price is greater than the underlying asset price. Using the earlier example of Nifty call option, if the Nifty falls to 1820, the call option no longer has positive exercise value. The call option holder will not exercise the option to buy Nifty at 1900 when the current price is at 1820 and allow his ‘option’ right to lapse.

A put option is in-the money when the strike price of the option is greater than the spot price of the underlying asset. For example, a Sensex put at strike of 6400 is in the money when Sensex is at 6100. When this is the case, the put option has value because the put option holder can sell the Sensex at 6400, an amount greater than the current Sensex of 6100. Likewise, a put option is out of the money when the strike price is less than the spot price of underlying asset.

ADVERTISEMENTS:

In the above example, the buyer of Sensex put option won’t exercise the option when the spot price is at 5900. The put no longer has positive exercise value and therefore in this scenario, the put option holder will allow his option right to lapse.

The aforesaid different situations of options are shown below:

Aspect # 5. Time Value of Option:

The time value of an option represents the amount that options buyers are willing to pay, over and above the intrinsic value. Options have time value because in the time between the purchase of the option and its expiration, the price of the underlying stock may change in a way favourable to the option holder.

ADVERTISEMENTS:

The longer the time to expiration, the greater the time value of option. Time value is the amount, option buyers are willing to pay for the possibility that the option may become profitable prior to expiration due to favourable change in the price of the underlying. An option loses its time value as its expiration date nears. At the expiration, an option is worth only its intrinsic value. Time value cannot be negative.

Aspect # 6. Types of Covered Call:

Calls are called covered by owning the underlying security and puts are called covered with a short position in the underlying security while owning the asset. In other words, it is called covered position when option position is opened by selling an option and at the same time owning an equivalent position in the underlying security.

Covered call and covered put are the main types of covered options.

1. Covered Call:

A covered call is an option contract, where an investor owns a security. They are covered calls as long as the investor owns sufficient number of shares of the security for each call that is sold. The sold calls are covered because they can be exercised by selling the security to the covered call option holder at the strike price of call options.

2. Covered Put:

ADVERTISEMENTS:

A covered put is an option contract where an investor has a short position in a security and sells puts on that security, they are covered puts as long as the investor is short on sufficient number of shares of the security for each put is sold. The sold puts are covered because they can be exercised by buying the security to close out the short position to the covered put option holder at the strike price of the put options.

Aspect # 7. Put-Call Ratio:

The put-call ratio (PCR) is the ratio of trading volume of put options to call options. Changes in this ratio are indicative of the prevailing market sentiment. For instance, a higher PCR, which arises when put volumes are relatively higher than that of call, is indicated by a higher PCR, which arises when put volumes are relatively higher than that of call, is indicated by a higher PCR and further signals a bearish sentiment.

On the contrary, increase in volumes of call options, can largely be assumed as an indicator of a build-up in bullish sentiment. The traders use put option to fix a sell price for their securities when they anticipate a fall in price. A rise in put volumes is an indicator of bearish mood in the market.

Markets are driven more by emotions than fundamentals in the short-term, which is reflected by the significantly low or high PCR. PCR above one indicates a higher put volume vis-a-vis call volumes.

For Indian stock markets the optimum level of PCR can be taken at 1.5, since in Indian markets puts are used more for hedging than speculation and PCR above or below 1.5 level can be taken as an indicator of over bought or oversold market.

Aspect # 8. Open Market:

Open market is the total number of open contracts on a security, including the number of future contracts or options contracts that have not been exercised, expired or fulfilled by delivery. In other words, open interest means the number of contracts outstanding for a given option or futures contract.

ADVERTISEMENTS:

Any significant increase or decrease in open interest can be safely assumed as an indicator of changing market sentiment on the underlying stock. Changes in open interest can be considered as a good indicator of the flow of money into the derivatives market.

However, on a stand-alone basis, they don’t give away sufficient clues on the direction of the likely move in the underlying. The changes in the open market should be read along with the change in price of the underlying.

If the open interest has risen in tandem with the underlying price in the markets, it can be safely construed as a bullish signal. The addition of open interest signals the entry of new money into that particular stock or index. When the price of the underlying has risen, it can be assumed that new money has been used to create fresh long positions.

The increasing open interest in falling prices is a bearish signal. The addition of open interest on the back of falling prices suggests that the new money which is entering that particular stock or index derivative has been used to create fresh shorts.

The fall in the open market interest in rising prices can be interpreted that market participants are squaring off or closing their existing positions. The fall in the open interest in falling prices can be attributed to the forced closing of long positions by traders. This mean, the fall in the stock of the index could have bottomed out and an uptrend may be in the offing.

Aspect # 9. Liquidating Option Positions:

When a trader buys an option, he can exit the trade in one of three ways:

ADVERTISEMENTS:

1. Sell the option and collect whatever the premium is:

If the premium is more than what is initially cost plus the commission, there’s a profit. If the premium is less, it’s a loss, but keeping some money is better than losing all the money.

2. Exercise the option, covering it into a futures position:

The broker must be notified before options expire. Not all options have an automatic exercise provision. Therefore, an in-the-money option that expires without any action taken, loses the buyer money (a seller somewhere will be very happy).

An option can be exercised if the trader feels the market will continue to move favourably to the trader’s position or an option can be exercised if the trading in the option is not very liquid. The trader, in this case feels he can exercise and then liquidate the futures more economically than selling his option position.

3. Ride the option into the dust:

ADVERTISEMENTS:

Let it expire worthless, especially if getting out will cost more than the premium is worth.

When a trader sells an option, he or she can exit the trade by buying the option back. If the premium is higher, the option seller has lost money. The option seller cannot exercise his or her option.

Aspect # 10. Marking to Market:

Marking to market is the practice of recording the price or value of an asset to reflect its current market value rather than its book value. It implies the process of recording the investments in traded securities (shares, debt instruments, derivatives etc.) at a value, which reflects the market value of securities on the reporting date.

Marking to market essentially means that at the end of a trading session, all outstanding contracts are repriced at the settlement price of that session, unlike the forward contracts, the futures contracts are repriced every day.

Any loss or profit resulting from repricing would be debited or credited to the margin account of the broker. It provides an opportunity to calculate the extent of liability on the basis of repricing. All outstanding contracts are appraised at the settlement price of that session is called as ‘marking to market’.

This means adjusting the margin accounts of both the parties. A member incurring cost should make payment of profit to the counter party and the value of future contracts is set to zero at the end of each trading session. The daily settlement payments are known as ‘variation margin’ payments.

Aspect # 11. Put-Call Parity Theory:

ADVERTISEMENTS:

The put-call parity is the relationship between the price of the European call option and put option, when they have the same strike price and maturity date, namely that a portfolio of long a call option and short a put option is equivalent to a single forward contract at the strike price and expiry.

This is because if the price at expiry is above the strike price, the call will be exercised, while it is below, the put will be exercised. Thus, in this case, one unit of the asset will be purchased for the strike price, exactly as in a forward contract.

Theory C + PV of EP = SP + P

Where, C = Call option premium

EP = Exercise price

SP = Current stock price

P = Put option premium

Problem 1:

Gesco Ltd. has both European call and put options traded on NSE. Both options have same exercise price of Rs.40 and both expire in 6 months. Gesco does not pay any dividend. The call and the put are currently selling for Rs.8 and Rs.2 respectively. The risk-free rate of interest is 8% p.a.

What would be the stock price of Gesco Ltd.? [Given: PVIF (8%, 1/2 year) = 0.9615]

Solution:

According to call-put parity:

C – P + S – PV (E)

Where, C = Cost of call option i.e. Rs.8

P = Cost of put option i.e. Rs.2

S = Current price of underlying asset’?

PV (E) – PV of strike price i.e. 40 x 0.9615

The stock price of Gesco Ltd.

S = C-P + PV (E) = 8.2 + 40 x 0.9615 = Rs.44.46

Aspect # 12. Open Interest:

Open interest is the number of contracts outstanding, the total number held by buyers or sold short by sellers on any given day. The open interest number gives you the total number of longs and the total number of shorts, since in commodity futures the short interest is always equal to the long interest. Each long is either willing to accept delivery of a particular commodity, or to offset his (her) contract(s) at some time prior to the expiration date.

Each short is either willing to make delivery or to offset his (her) contract(s) prior to the expiration date. With this in mind, you can plainly see that open interest is a measurement of the willingness of longs and shorts to maintain their opposing position in the marketplace. It is a quantitative measurement of this difference of opinion.

Open interest numbers go up or down based on how many new traders are entering the market and how many old traders are leaving. Open interest goes up by one, when one new buyer and one new seller enter the market. This act creates one new contract. Open interest goes down by one when a trader who is long closes out one contract with someone who is already short.

Since this contract is now closed out, it disappears from the open interest statistics. If a new buyer buys from an old buyer (who is selling out) total open interest remains unchanged. If a new seller buys back or covers from a new seller entering the market, open interest also does not change. The old bear had to buy to cover, with the other side of this transaction being a sell by the new bear.

Problem 2:

Let’s look at a typical example. If one day heating oil has a total open interest of 50,000 contracts, and the next day it rises to 50,100 this means 100 new contracts were created by 100 new buyers and 100 new sellers. Or perhaps 10 new net buyers and sellers of 10 contracts each, or whatever it takes net to create the new 100.

Of course, during that day many people closed out, many entered, but the net result was the creation of new open interest. 50,100 shorts and 50,100 longs at the end of the day. Theoretically, one short who had 100 contracts sold could have taken the opposing side of 100 others who each bought one, but the short and long interests are always the same on any particular day.

Aspect # 13. Stack Hedging or Strip Hedging:

For longer term hedging programs like two year loan with provision for three monthly rollover-complicated strategies like ‘stack hedging’ and ‘strip hedging’ can be employed. In a stack hedge the total number of contracts needed to hedge the loan is purchased for the month of the first roll over date.

At that date, the remaining number of contracts necessary is purchased for the next roll over date. The process will continue. In the case of a strip hedge each three months segments of the loan are considered as separate entities. Future contracts are purchased for each rollover date at the very outset of the loan.