Currency options is “a contract giving the buyer the right but not the obligation to exchange a specified amount of one currency into another specified currency on or before a specified date at a specified rate of exchange. The buyer (holder) of the option pays a ‘premium’ to its writer (seller)”.

An option is a contract that gives the holder the right, but not the obligation, to buy (call) or sell (put) a specified underlying instrument at a fixed price called the ‘strike or exercise price’ before, or at, a future date. The option-holder has to compensate the writer (the issuer of the instrument) for this right, and the cost borne is called the ‘premium’ or ‘option price’.

The premium should be adequate for the risk borne by the writer and yet, from the holder’s point of view, must be worth paying. If the option contains a provision to the effect that it can be exercised any time before the expiry of the contract, it is termed as ‘American contract’. If it can be exercised only on the expiry date, it is termed a ‘European contract’.

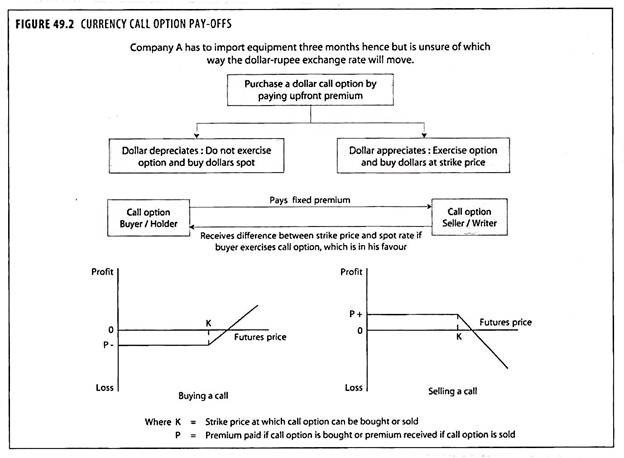

Currency options can be used for hedging currency exposures when a corporate is not sure which way the currency is going to move. By entering into a currency option contract, the company gets the best of both worlds: its downside is restricted to the premium that it pays, and it enjoys an unlimited upside.

ADVERTISEMENTS:

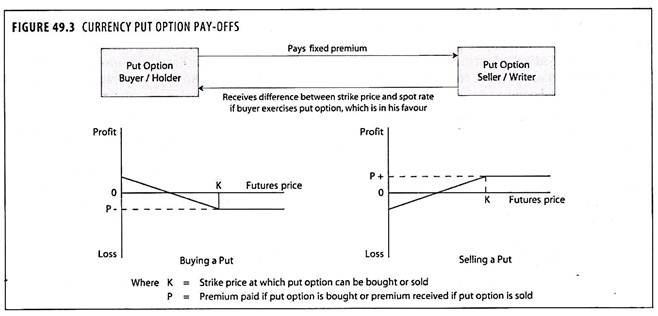

For the buyer of a currency option, the gains are unlimited and the losses are limited. For the writer of the currency option, the losses are unlimited and the gains are limited to the extent of the premium he gains.

The value of a currency option consists of two components:

1. The intrinsic value, or the amount by which an option is in the money:

A call option whose exercise price is below the current spot price of the underlying instrument, or a put option whose exercise price is above the current spot price of the underlying instrument, is said to be in-the-money.

ADVERTISEMENTS:

2. The extrinsic value, or the total premium of an option less the intrinsic value:

It is also known as the ‘time value’ or ‘volatility value’. As the expiry time increases, the premium on an option also increases. However, with each passing day, the rate of increase in the premium decreases. Conversely, as an option approaches expiry, the rate of decline in its extrinsic value increases. This decline is known as the ‘time decay’. Therefore, the more volatile a currency, the higher will be its option value.

Currency options are basically rights given to the buyers of foreign currency to buy or sell a specific amount of foreign currency at a specific exchange rate (the strike price) till a specific date when the contract expires. Currency options may be entered either for a put or a call. A put option gives the right to sell a foreign currency whereas a call option gives a right to buy foreign exchange.

ADVERTISEMENTS:

This depends upon the position that is required under a specific situation by the party entering into an option market. A put option is required when the party requires foreign exchange. By buying a put option the party sells the domestic exchange to procure the right amount of foreign exchange at a specified rate.

The reverse is done, when payment is needed to be done by the party. A call option is entered so that foreign exchange can be bought by exchanging the domestic currency. When potential of upside is limited since forward contracts are tied to a particular rate, options grant the holder the right – not the obligation – to buy or sell the asset at a specified price known as the ‘exercise price’.

An exporter due to receive Deutsche marks (DM) three months from now can hedge against the risk of its depreciation by buying a three-month DM put option. If, contrary to expectations, the DM appreciates, the exporter will not be denied the windfall gains since the option does not have to be exercised. Effectively, the put sets a floor on the DM to be received.

Conversely, a company that has to make a DM payment can insure against its appreciation

by purchasing DM call options. This caps the cost of the DM to be paid. Naturally, this flexibility does not come free. Options, unlike forwards, require the payment of a premium upfront.

ADVERTISEMENTS:

The downside risk (i.e. the risk of loss) is unlimited when selling or writing the call and put options. Therefore, buying of call or put options is suggested for hedging commercial transaction, since this limits the downside risk for a company to the loss of premium paid for the option.

Benefits to Buyer of Currency Option:

By purchasing the currency option, the buyer can obtain the benefits as follows:

ADVERTISEMENTS:

1. The buyer knows his worst position since his downside risk is limited.

2. The buyer knows the maximum cost at the outset, since he has to pay premium plus funding cost on making upfront payment.

3. The buyer can choose the amount, the strike price and the expiry date of his choice.

4. The buyer need not commit to exchange currency at strike price and can also allow the option to lapse, if it is in his favour.

ADVERTISEMENTS:

5. The options can be taken out at any time.

6. If agreed at the outset there may be more than one delivery date, for specified amounts, to hedge a series of currency exposures with one option contract.

7. Options are available even for small amounts and in all major currencies.

8. The buyer can adopt strategy suitable to his business needs.

ADVERTISEMENTS:

9. The option can be sold back to writer for fair value at any time.

10. The options can be better used in case of uncertainty of cash flows, since the risk is limited to the extent of premium paid only.

Drawbacks of Currency Option:

The major drawbacks of currency options are as follows:

1. Options must be paid for immediately as and when they were bought.

2. There is a lack of negotiability for tailor made options.

ADVERTISEMENTS:

3. Traded options are not available in all currencies, although they can be obtained for the major currencies.

4. The buyer can adopt strategy to suit his requirements.

5. It is very costly to hedge through currency options, since nearly the cost would be equivalent to 5% of the total amount of foreign exchange covered.

6. There is no limit to potential cost to the writer, who in return only receives the premium.

7. There is a chance that buyer may forget to exercise the option.

Standard & Poor’s Currency Indices:

ADVERTISEMENTS:

Standard & Poor’s has launched two real-time currency indices on Indian and Chinese currency that provide investors with exposure to emerging economic superpowers that currently lack a liquid currency futures market. The S&P Indian Rupee Index and the S&P Chinese Renminbi Index are the first in what will be a series of real-time currency indices launched by Standard & Poor’s in 2008.

S & P is the first index provider to offer this type of index on a global basis. S & P is the first major index provider to venture into the Currency Beta space-another sign of S&P’s breadth of asset class coverage. Neither market has liquid currency futures, so S&P has innovated by using non- deliverable forward contracts.

The indices will provide information on the currencies and the costs of hedging positions in a convenient and consistent form. Given the appreciation in currencies of these two trading powers, these indexes and index – linked products will provide a transparent hedging mechanism for trade participants in the local markets.

A Chinese or Indian exporter sells services to US in dollars. If the rupee or yuan rises, they suffer. Now they can hedge in an exchange listed, transparent framework without worrying about futures markets, liquidity of contracts, over-the-counter transactions etc. This is the first ever way for US retail investors to get access to currencies of two emerging economic superpowers-China and India.