After reading this article you will learn about maintaining accounts of your farm business.

Book-Keeping:

In agricultural business management the role of farm records. Book keeping, maintaining accounts and analysis of the records of the farm is of immense importance because business should reveal what the entrepreneur has incurred as cost, what return is he getting and how much profit is being generated from the efforts of the owner of the business.

Therefore, it is of utmost importance that whatever transactions have undergone must be accurately recorded, books of accounts be maintained, the record be analysed and the picture of the business be crystal clear. There is a famous saying in Hindustani which is interpreted, “First record whatever has been given out and if there is any error it must be realised from the records.”

First of all we shall study the principles and practices of Book-keeping. Book keeping is defined as, “as the art of applying the principles of science of accountancy in keeping the book of accounts.”

Another definition says, “Book keeping is the art as well as the science of recording in books of business transactions in the regular and systematic manner so that their nature and extent and financial effect can be readily ascertained at any time.”

Advantages of Book-Keeping:

There are advantages of the science of book keeping:

1. Avoids mistakes, misunderstanding and lasses.

2. Details in receipts and expenditures are known.

3. The results of the years farming are ascertained.

4. The actual financial position is known at the end of the year.

5. Financial position of the business person could be compared with the neighbours.

6. Administration and economy is better understood and business habits are acquired.

7. In case of any legal dispute records become the source of evidence.

Essentials of a Proper Record:

1. Records must be only facts and recorded accurately and in details.

2. For the future reference the entries must be clear so that its nature could be easily certained.

3. The books should be so arranged that the total result of the transactions or a series of transactions, within a given period may be easily determined.

4. The system of account keeping must be such that the amount of labour involved may not be out of proportion to the result obtained.

Types of book keeping depends on:

1. Type and size of business.

2. Kinds of information sought.

3. Time that could be devoted.

A good system should be simple, accurate and provide for consistent treatment of like items and like situations. However, the record should certain a properly described and dated account of what is taken in and what is paid out.

There are two types of accounts:

1. Financial accounting (Farm, business book keeping):

The financial accounting sets forth income, expenditure and profit and loss of the business as a whole that is the complete unit. The accounts profit and loss, balance sheet at the end of the year show the standing of the business in relation to the farmer and agri-businessman and the other parties concerned.

2. Cost accounting:

a. Full cost accounting:

Sets forth income and expenditure and profit and loss of the business as a whole as well as each department, enterprise, each product or commodity as a separate unit. An account is kept for each enterprise or department and from them income and expenditure pertaining to that unit (enterprise) which is debited and credited in its respective accounts.

Details records are kept for each input used in crop or livestock enterprise and their output. Profits and loss of each enterprise and farm as a whole and balance sheet of whole business is prepared. The advantage which accrues is that detail is obtained for the business.

b. Single Enterprise Accounting:

In the single enterprise accounting details for only one enterprise is recorded but that balance sheet for the farm as whole is prepared. This has advantage of simplicity and a detailed of a particular enterprise is available for research.

Systems of Book Keeping:

There are two systems of Book Keeping:

(i) Single entry system,

(ii) Double entry system.

(i) Single Entry System:

Reduces the work in keeping record and each item of sales or expenditure is recorded once.

These are organised as:

Inventory

Crops or livestock records

Account payable and receivable.

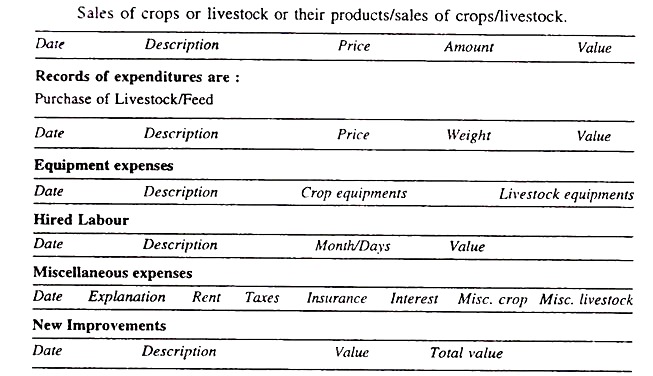

Records of Income are:

Sales of crops or livestock or their products/sales of crops/livestock.

(ii) Double Entry System:

In this system the recording of transactions is in two-fold aspects, that is, two entries are made for each transaction in the same set of books, one being a debit entry and the other a credit entry.

Business transactions:

This is dealing in money or goods with persons wherein some benefit is given as well as taken. The cross dealing is in equal amount. These consist of paying or receiving, buying or selling.

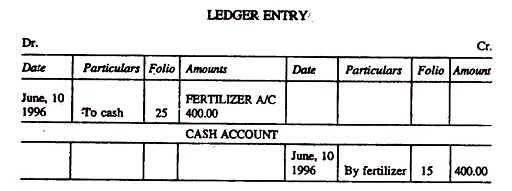

Entry:

This is an act of writing a transaction in a book of account. In the Debit (Dr) entry is made on the left hand side and credit (Cr) on the right hand side. For example, the business manager bought goods worth Rs. 400 from fertilizer and paid in cash.

Here two accounts are affected one is cash account and the other fertilizer account. Since the good came in it is a gain to business but the cash is gone from the business and thus is a loss to the business. The former will be debited whereas the later will be credited.

Theory of Double Entry System:

This is a two-fold aspects of transaction. Two parties are involved one giving benefit and the other receiving benefit. Thus, two accounts are affected in each transaction. In the above example, the two accounts are: Fertilizer account which is gaining and the cash account which is losing.

In the case of fertilizer account the value of stock of fertilizer has increased by Rs. 400.00 and in the cash account Rs. 400.00 is given out that is lost to the business. So, the former account is debited and the later is credited. The entries are made in the two sides viz. debit side and credit side of the ledger book.

The principles involved are:

As the business transaction there are two distinct sides giving benefit and receiving the same benefit by respective parties:

(i) Transactions are entered in two accounts,

(ii) Dr. and Cr. are between account in the same set of books.

(iii) Dr. entry should be equal to Cr. entry.

The double entry system has certain advantages:

i. Personal and impersonal aspects of the records are entered.

ii. Day to day record is maintained.

iii. Any account could be checked.

iv. Arithmetical accuracy of account by trial balance method is verified.

v. Business progress or regress is checked through purchase and sales opening and closing of stock at any period.

vi. Preparation of trading account helps in finding out the anticipated gross profit.

vii. At the end of the trading period by raising the nominal account and loss could be realised. This will help to realise the reason.

viii. The comparison of accounts for different periods the cause of extravagancies be known.

ix. Traders financial position can be known by working out the balance sheet with the help of assets, liabilities and proprietor’s capital.

x. Frauds could be prevented.

Classification of Accounts:

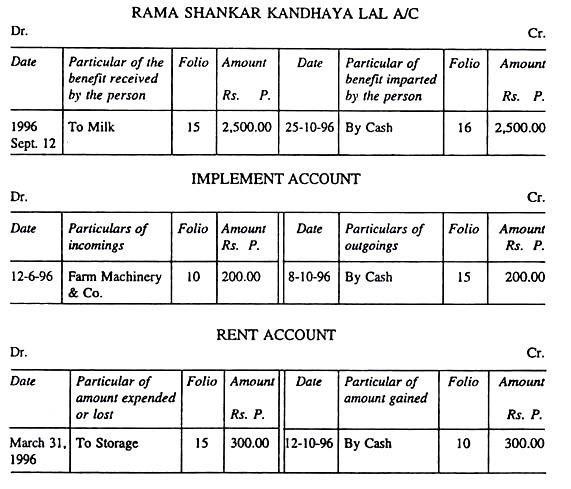

(a) Personal Account:

This is an account of a person or firm with whom the trader deals e.g., Rama Shankar’s account, Hindustan Machinery a/c.

(b) Real or Property Account:

An account of each property or possession dealt in by the trader in his business, e.g., Implement account, Milk a/c.

(c) Nominal or Fictitious Account:

This is an account of each head of expenditure or source of income, e.g., Discount account, Interest a/c.

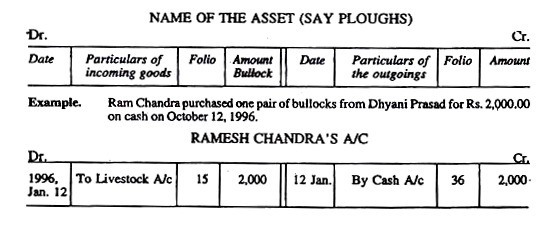

Formats:

Heads of Accounts in Farming Business:

1. Capital account

2. Private or drawing a/c

3. Cash a/c

4. Land a/c or land improvement a/c

5. Building a/c

6. Machinery or implement a/c

7. Office fixture or furniture a/c

8. Livestock a/c

Accounts of Expenses:

These are the expenses involved in operating farm business. These involve costs of production, viz., rent, wages, land revenue or rent, discount, seed, fertilizer, manures, feed, commission, general account.

Accounts of Income:

Income on the farm comes by the sales of farm products like interest, rent and discount.

Farm Produce Account Comprises of:

Crop produce a/c

Livestock product a/c, Dairy, Poultry, meat, miscellaneous a/c

Miscellaneous receipt a/c.

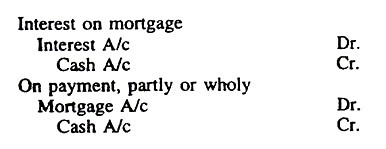

Interest on Investments:

Rent on land or buildings, discount on prompt payment.

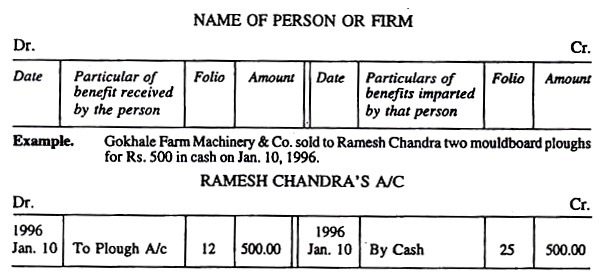

Personal Account:

It records trader’s dealings, with person or firms. A separate account is opened of each person or firm and by recording therein particulars of all transactions in cash or goods etc. It may have taken place between the dealer and the person, the former can readily ascertain at any time the amount owing to or by that person to him.

There are two types of balances: Debit balance and Credit balance.

The Debit Balance:

On a personal account would indicate that the person in question has received more benefits than he has imparted to the trader and that he owes to the trader the amount of the balance.

Credit Balance:

The balance at the credit side is more than debit would indicate that the person owes the amount shown in credit balance to the trader.

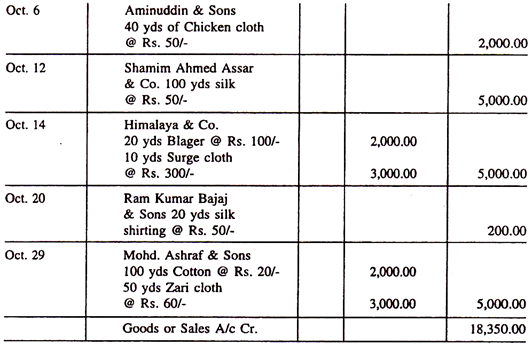

Real or Property Account:

It records the dealing in or with property assets or possessions. A separate account is kept for each class of property such as cash, stock, plants, machinery, furniture’s, etc., so that by recording there in particulars of such assets received or given away, the trader can ascertain the value of each asset on hand on any particular date.

Debit Balance:

On an asset or real account on any date would mean the value of the particular asset in hand on that date.

Credit Balance:

There is no credit balance except sold for profit.

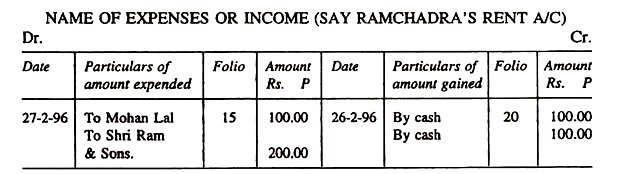

Nominal or Fictitious Account:

It records a trader’s expenses or gains a separate account is opened for each head of expenditure or income such as, rent, salaries, wages, discount, commission interest, stationary, cartage, discount etc., so that the trader can see the amount expended, lost or gained under each headings.

Example:

Ram Chandra received Rs. 200 from Shri Ram & Sons for the use of his godown on 25 February, 1996. Again Ram Chandra paid Rs. 100 to Mohan Lai for the use of storage capacity in his godown. On Feb. 27,1996.

Debit Balance:

A nominal account would mean that the expenses or loss under that particular head has exceeded the income or gain from that head and would then represent a loss.

Credit Balance:

Just the opposite of debit balance. Nominal or Fictitious propriety account which record the gains or losses, also the net worth of the trader, and which supply the result of the trading, such as trading account, Profit and Loss a/c, or the sub-divisions thereof, as trade or general expenses, interest, discount, wages, bad debits depreciation, repairs, rewards, rent, taxes, etc.

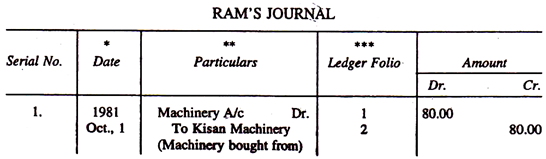

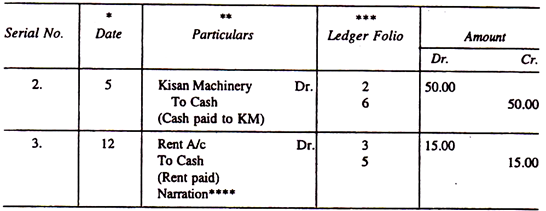

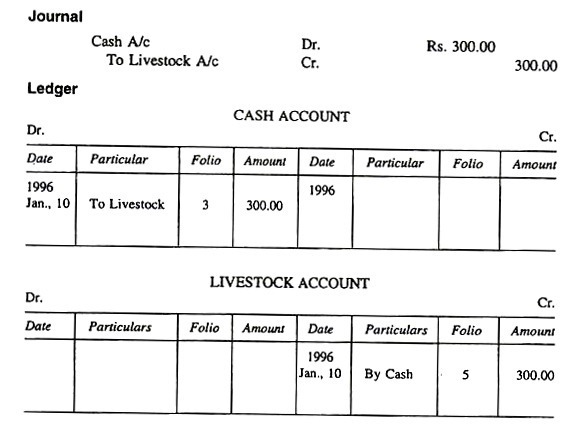

The Journal:

The Journal is used for recording transactions which cannot conveniently be passed through the books of original entry, such as opening or closing entries, transfer entries (taking an item from one account to another), interest, depreciations, and bad debts etc. The word journal means daily record. It is a book of original entry.

All transactions are entered as Dr. and Cr. and are strictly in order of dates so that they may be easily posted or transferred to the ledger and used for ready reference. Thus, journal is a subsidiary book and helps main book—the ledger.

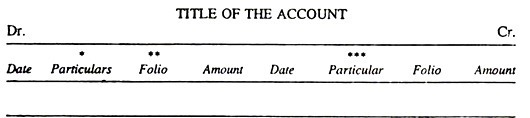

The format of a journal

Date:

It is the chronological record of entries in ascending orders of days.

Particulars:

Particular column enters the name or titles of the ledger accounts which are to be debited and credited in relation to each transaction journalized.

Ledger Folio:

Gives the page number of the ledger on which the posting has been done from the journal.

Narration:

Records briefly and clearly for the purpose the entry has been made.

Theory of Journalizing:

In double entry system every transaction is entered into two accounts, debit side receiving or debtor a/c and credit side of giving (giving or creditor) a/c.

Points to be kept in view while journalizing:

1. Every transaction is treated separately.

2. Debitor is written first and word Dr. is written against it.

3. Creditor is written below the debtor a little towards right to the debtor and is preceded by the word ‘To’. No. Cr. is put against it.

4. Narration is written at the bottom of the creditor entry telling the purpose for which the payment is made.

5. C/o (Carried over) of the total of the first page for entry in the next page. C/o is written at the bottom of the first page.

6. B/f (Brought forward) is written on the next page after the preceding page is filled and the total is entered in the fresh page.

7. The totals of the Dr. and Cr. columns should be equal.

8. The totals of the journal are not posted in the ledger.

Rules for Journalizing:

1. All transactions, every entry of Dr. must have a Cr. entry, in order to comply with the principles of double entry system. Therefore, each transaction is taken separately and two questions must be answered: viz.,

(a) What account are concerned?

(b) Which of them is Dr. and which is Cr.?

2. Real and Personal Accounts:

(a) Value coming into or received by an account is Dr.

(b) Value going out or paid by an account is Cr.

3. Nominal or Proprietary Accounts:

(a) All costs, expenses, changes or loss or deductions from capital are Dr.

(b) All gains or profits or additions to capital are Cr.

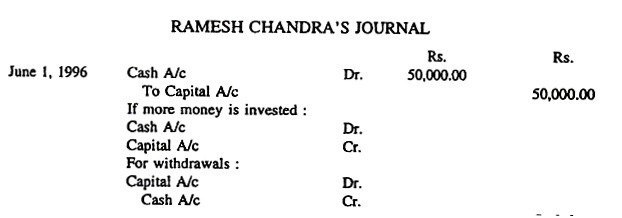

Capital Account and Opening Entries:

Is the one when a person starts a business either by his own money or by borrowed one. In order to start his books, he would require to open an account in his ledger, and head, it as, “Capital Account” and credit it with the amount paid in, at the same time debiting his cash book to complete the double entry.

The Capital Account, therefore, represent the position of the proprietor to his business. Capital is the difference between Assets and Liabilities. Opening entries are made in the journal.

Investment of capital

Capital is the wealth invested in business when the business is started for the first time:

It is credited to the capital a/c.

Cash a/c is debited.

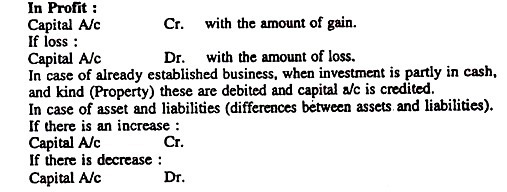

When at the end of the year, the balance, difference between profit & loss is transferred to capital a/c.

N.B.:

The farmer becomes a creditor to the business because capital has increased by that amount. Capital account is an impersonal a/c but taken as a personal a/c because he is a creditor of the business for the amount of capital invested and debtor for the amount withdrawn for his personal or household expenditure.

These all are Opening Entries.

Private or Drawing Account:

Private expenses of the proprietor are treated quite separately from the business expenses.

Receipt by the Household:

All amount withdrawn, cash or kind Dr.

Supplied by Household:

(i) Meals, tiffin’s to servants.

(ii) Family labour.

(iii) Use of household for storage, etc.

The value (Rs.) of these supplies is the Dr. of these viz.,

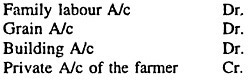

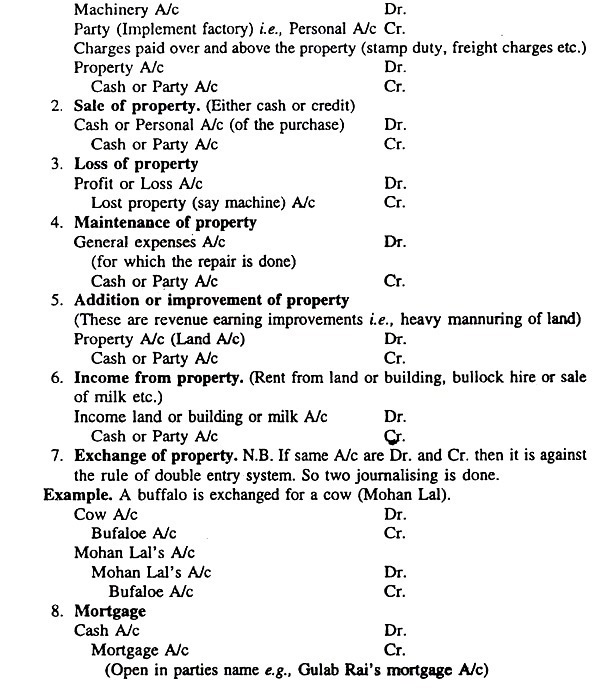

Real or Property Account:

1. Purchase of property:

(Machine, building, plants, livestock, implements etc.)

The Balance of Payment:

Balance of mortgage is liability in B/S

Property mortgaged is Asset in B/S

(Because amount of mortgage shown is amount shown deducted)

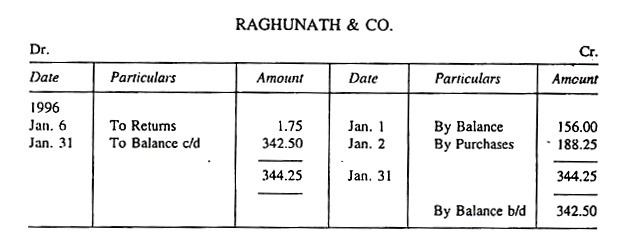

Ledger:

The ledger is the principal book of accounts in which personal, real or property. Nominal and Fictitious accounts are opened and entry is made from the journal.

Ledger Defined:

Ledger is a book of account in which provision is made for summation and classification of all the debits and credits recorded in the book of original entry. Ledger is a book of record of secondary entry prepared from the original journal recorded in chronologically Journal information is organised classified and summarised.

Format:

Again, there are two sides in the ledger. The left side is called Debit (Dr.) side and the entry made in this side is called debit entry—the side of the value received.

The right side of the ledger is called the Credit side and the entry made is credit entry—the side meant for value given out.

Every transactions entered into ledger affects two accounts in the ledger; one receives and the other gives.

Posting:

It is an act of separately transferring each entry from the journal or other book of original entry to the account that such entry affects in the ledger. When the transaction is posted from the journal into the ledger it is entered in the same column in the ledger. Thus, posting is the process of transferring items from journal to their proper account in the ledger.

Rules for Preparing Ledger:

1. Every debit entry must have a corresponding credit entry and vice versa.

2. Every debit entry is recorded by a word ‘To’ and credit entry by a word

‘By’:

3. Debit account receives and credit account gives.

4. Names of accounts in particular columns are inter changed method of starting the ledger:

(a) Pages of the ledger are numbered.

(b) Division of pages.

(c) Name of the account is written on top, in the middle of the page.

(d) Arrangement of accounts is as follows:

(i) Capital or Drawing A/c.

(ii) Real accounts. Cash, bank, work-stock, cattle, goat, sheep, machinery, implement building, land, improvements, A/cs etc.

(iii) Nominal accounts. Crop, dairy produce, feeding stuff, wages, rent, seed, manures, land revenue, rates, interest, depreciation, general expenses A/cs.

(iv) Personal accounts. Accounts of debtors and creditors.

5. Indexing in alphabetical order.

6. Posting—All debit items are posted first and then credit items to avoid mistakes.

Functions of a Ledger:

1. Sorts out or classify items appearing in the journal and other subsidiary books.

2. It keeps the entire transactions relating to that account in a condensed form.

3. Find out the combined effects of entries for each individual account, also for the entire business.

4. Permanent record for future references in regard to debtor and creditor.

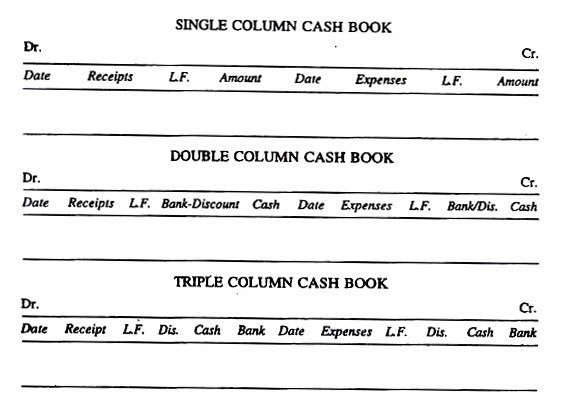

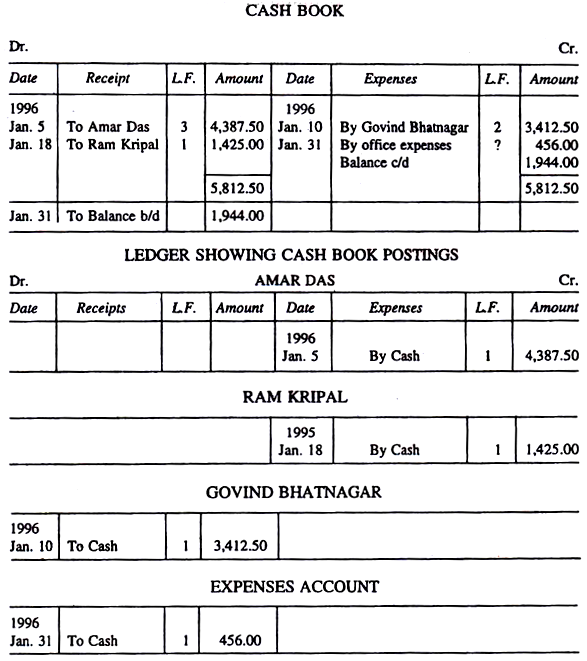

Cash Book:

Cash Book:

The cash book is a principal book of entry specially when there are numerous entries to be made under the cash account, it is a separate book. It is like ledger and is bound register. The cash book is meant for recording the receipt and payment of money whether in coins, notes, cheques, postal order, bank draft etc.

The cash book though separately maintained is an integral part of ledger. It is in fact of ledger account for cash a real account. Thus, when an entry is made in the cash book one side of the double entry is thereupon completed. On the Dr. side the cashier enters the cash received and on the Cr. side all the payments made.

Dr. and Cr. pages face each other. The entry of receipts is made on the Dr. side giving the dates, the name of the firm by whom the firm is credited (the business) for what the firm has paid, and the amount. The credit side, sometimes called the ‘Contra’ (a Latin term) which means opposite or against, on the other side.

Since the firm cannot pay more than what it receives the credit side can never exceed the debit side. Reconciliation statement are made which means the difference of the total of two sides which is shown by the content of the cash box.

Different Forms of Cash Book:

The form of cash book depends on the nature of the business and the manner in which cash is dealt with.

1. Single Column Cash Book:

With one cash column.

2. Double Column Cash Book:

Two money columns on each side one cash and the other bank or one cash the other discount column.

3. Three Column Cash Book:

Three money columns on each side viz., discount, cash and bank.

Posting in the Cash Book:

Cash account is not opened in the ledger, so entry in the cash book forms half the entry of the double entry system. In order to complete the entry in the other half entry is made on the opposite side of the account concerned in the ledger according to:

(a) Every item entered in the Dr. side of the cash book is entered in the Cr. side of the ledger under the account mentioned in Dr. of the cash book in particular column, by cash and vice versa.

(b) No posting is made in the ledger for the item of opening balance of the cash book (as it is made from the journal so double entry is already made).

Procedures for Writing Cash Book:

(i) Receipt Side:

From the receipt book counterfoil.

(ii) Payment Side:

From voucher or muster roll, and acquittance roll.

(iii) Balancing:

Dr. side – Cr. side = the amount of cash in hand and it is inserted on the credit side as “By balance c/d” (carried down). Then again totaled and ruled off.

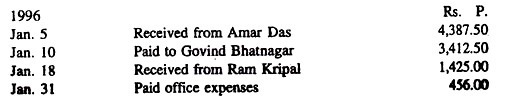

Example:

Explanation:

The difference between the total cash received (Dr. side) and the total payments (Cr. side) represent the balance i.e. cash amount in hand.

The balance of Dr. and Cr. side is entered in the credit side to make each side equal and then brought down as shown to the opposite side as balance in hand. And vice versa.

The balance, if any, must always fall on the Dr. side, because more cash cannot be paid out than what has been received.

The entries on the Dr. side of the cash book are posted to the Cr. side of the proper accounts in the ledger as “By cash” the cash book folio is written in the ledger; and ledger folio in the cash book.

The amount entered on the Cr. side are posted on the Dr. side of the proper accounts in the ledger as “To cash” with the folio inserted as before.

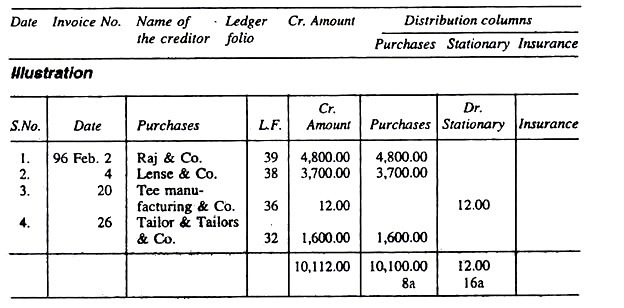

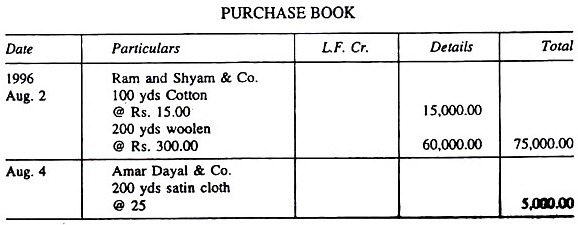

Purchase Day Book:

Purchase Journal:

Purchase journal is a book of original entry in which are recorded all incoming invoices received from creditors that are not immediately paid. This is later transferred to ledger.

Formats of Purchase Journal:

Postings:

The persons named in the purchase book of the firm are firm’s creditors, as the amount is posted to the credit side of their personal account in the ledger and enter the date, By Goods, Folio and Amount. As the total of the purchase book represents Goods coming in or purchases it must be posted monthly in the debit side of the Goods or Purchases accounts by entering the date, “To Sundries” P.L. Folio and Amount.

Another Illustration:

Here the total only of a purchase book needs posting to the Goods or Trading Account. No need having its ledger posting.

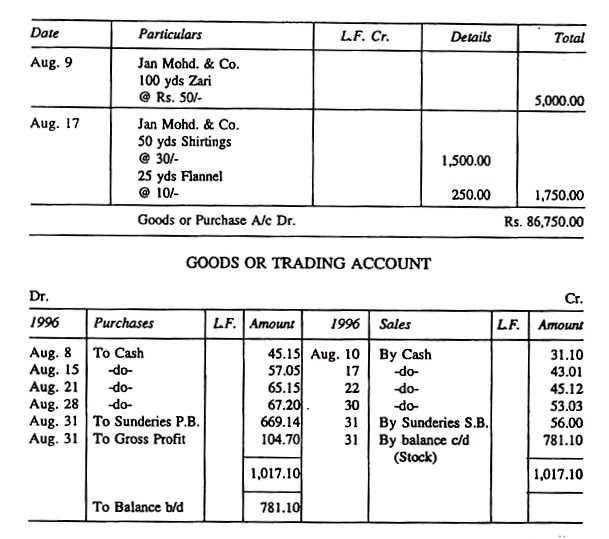

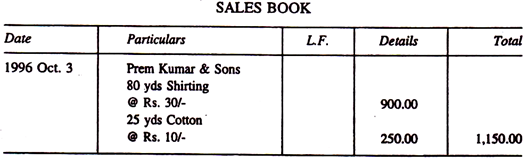

Sales Day Book:

Sale Journal:

The sales journal is a book of original entry in which are recorded all charges against the customer. From here they are posted to ledger, and not recorded in the journal first.

Here the daily record of particulars of goods sold as credit as well as for cash where the debtor’s name is given.

Example:

The Sales Book should Specify:

Date of Sale:

The name and address of the buyers; Cost of the goods and the quantity, name class and price.

Trial Balance:

Trial balance is a list of the balances in a ledger on any given date. These balances are of cash, bank and petty cash, of course, is included as they are strictly ledger account balances. Dr. and Cr. balances are entered in separate columns.

Another definition is that it is a statement of debit and credit balances extracted from the ledger with a view to test the arithmetical accuracy of the books.

The very fundamental basis of running a trial balance is that in double entry system every debit must have a corresponding credit. Debit and credit should equalize.

Trial balance forms a connecting link between the ledger accounts and the final accounts. Its agreement is a special check on the accuracy of ledger postings.

Provisions of the Trial Balance:

1. That both the aspects of each transaction have been recorded.

2. That the books are arithmetically correct or accurate.

In case there is a disagreement in both credit and debit balances there must be an error which must be traced and rectified. But trial balance is not a conclusive proof of accuracy because there may be some errors in the books remaining undisclosed through the Dr. and Cr. tally.

The following errors are not disclosed by the trial balance:

1. Errors of original entry.

2. The correct amount posted in wrong columns.

3. Compensating errors.

4. Complete commission of a transaction from the books.

When Dr. and Cr. balances do not agree the following procedure should be adopted to locate the errors:

1. Check the additions of the trial balance.

2. Check the extractions of the balances so as to ensure that no error has occurred and that no balances have been omitted.

3. Check the additions in the ledger account, cash book etc.

4. Check the additions in the subsidiary books.

5. Check the postings from the subsidiary books to the ledger.

Closing Entries of Trial Balance:

The next step after trial balances is to close the ledger.

Definition of the Balance:

A balance of an account is the difference between the totals of the Dr. and Cr. sides.

A Dr. balance is the result when a debit side exceeds the credit side.

A credit balance is the result when the credit side exceeds the debit side.

Debit balances represent either assets or losses.

Credit balances represents the liabilities or gains.

In balancing the accounts, care must be taken to distinguish between Real Account, Personal Account or Nominal Account.

Real and Personal accounts are ruled off and the balances are carried down.

Real accounts contain a record of tangible property, and being assets, the balance carried down is always a Dr. balance.

Real accounts are ruled off and the balance brought down to the next period.

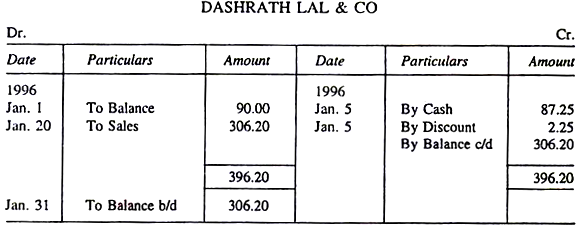

Example:

Bringing down the balances of an account periodically does not alter the state of the account, but it shows the position of the account at a glance.

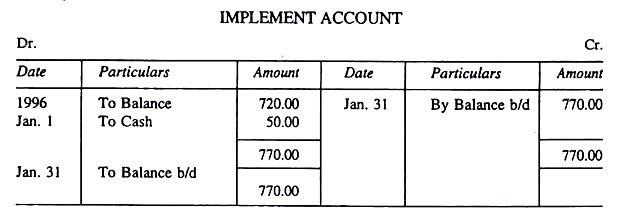

Personal Account:

It is ruled off as the real account, and any balance (which may be either a Dr. or a Cr.) is carried down.

A credit balance in a Personal Account represents a liability i.e., Raghunath & Co. are creditors for Rs. 342.50; Gulam Ahmed & Co. owes Raghunath & Co. Rs. 342.50.

A debit balance in a Personal Account represents an asset:

The above account shows that Dashrath Lai & Co. is a debtor for Rs. 306.20; Dashrath Lai & Co. owes to Gulam Ahmed & Co. Rs. 306.20.

Nominal Account:

The nominal accounts are income and expenses accounts. The closing of account is done with a view to summarise operation for the year and to transfer income and expenses account to Profit and Loss account.

All nominal accounts are balanced into P & L a/c:

(a) The balance if is loss and is transferred to Dr. side of the P & L a/c.

(b) The Cr. balance is a gain and is transferred to Cr. side of the P & L account.

If the nominal account shows Dr. balance—It is closed by inserting by P & L a/c on credit side.

If the nominal account is Cr. balance—It is closed by inserting to P & L a/c on debit side.

(a) Balancing Nominal Account of the Consumables:

The consumables are manures and fertilizers, seeds, feeding stuffs, plant protection chemicals etc. The left over Stock is valued (valuation is done) at the end 9f the year. The valued stuff is entered on the credit side of the account concerned as “By valuation”.

The balance of the two sides of this account after insertion of valuation is carried to P & L a/c. The account of the value of stock in hand at the end appears as Asset in the Balance Sheet.

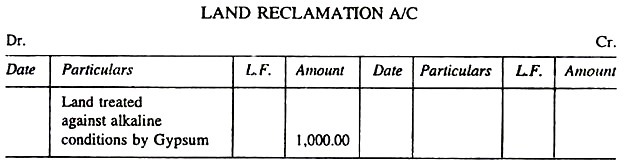

(b) Nominal A/C Involving Improvements:

These items are expenditures on road, fencing, drainage system and irrigation channels etc. These items are expenses and are debited to General Expense a/c that is there is a change in P & L a/c of the year in which it is incurred.

In ease of, heavy investments. It is capitalized and debited to their respective accounts and written ax within the number of years each is expected to remain useful.

Example:

Since the permanent improvement lasts for some years, therefore, the amount is apportioned into the years of usefulness and transferred to P. & L. A/c of those years as debit. The balance is treated as Asset temporarily and carried forward and likewise apportioned to the year that derived the unexpired portion of the benefit.

The Orchard A/c:

The expenses involved in planting an orchard is capitalized i.e., charged to the orchard A/c till it starts giving returns.

In case of inter-planting in orchard the expenses are charged to Orchard a/c and income or receipt from the inter crop is credited to the Orchard a/c.

Balancing Capital and Private Account:

Capital a/c is left till all the other accounts are closed and P & L A/c is prepared as the capital account has to receive the balance of the P & L A/c.

The balance of the private account is also transferred to the capital A/c

Capital and Private accounts are balanced as in case of personal a/c.

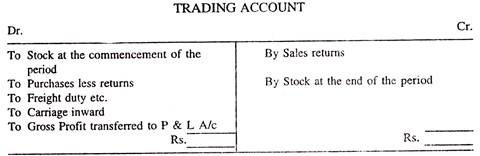

Trading Account:

Profit and Loss account of a trading concern in usually divided into two sections – viz-, Trading Account, Profit and Loss account. The trading account is so framed as to show the gross profit and is transferred to the second section which is Profit and Loss account proper.

Gross Profit is defined as the difference between costs of goods that have been sold and the proceeds of their sales. Without any deduction as the expense of distribution and general establishment charges. In trading account it is, therefore, necessary to include all items of charges directly affecting the costs of goods sold.

It is equally necessary to see that all forms of the accounts once adopted should be adhered to, so that the gross profit for period may be arrived at an uniform basis for the purpose of comparison etc.

The advantages being:

1. What per cent of profit has been earned by buying and selling goods.

2. This percentage gives valuable guide for fixing prices in future and a check on the cost of material and labour.

Items going to Debit and Credit sides of the Trading Account:

Debit items:

1. Stock on hand at the commencement of the period.

2. Total purchases made during the period less value of returns outward.

3. Direct charges, that is, such expenses as add directly to the costs of the goods purchased, such as freight, duty, clearing charges, dock dues, carriage, inwards and cartage.

1. Total sale made during the period less the value of returns inwards.

2. Stock on hand at the end of the period.

The excess of the credit total over debit total is called the Gross Profit, that is, the excess realised in the sale over the purchase prices of goods sold, and this is transferred to Profit and Loss account.

Advantages of Trading Accounts:

1. It shows the gross result arising from the buying and selling of goods.

2. It enables the comparison to be made of the purchases, sales, and stock of the period with similar items of the preceding period, and thus help to detect the weak spots of the business.

3. It provides means for ascertainment of the ratio of gross profit and turnover, in order to find out how far the anticipated results have been achieved.

4. It affords a check on the percentage which direct expenses bear to the gross profit.

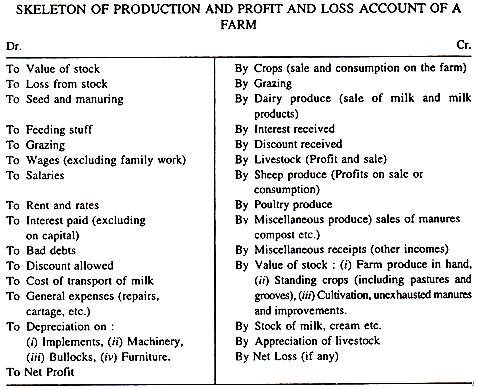

Profit And Loss Account:

The function of Profit and Loss account is to enable the trader to ascertain the net profit or net loss resulting from the business transaction during a given period.

In farming we call Profit and Loss account “Production or Profit and Loss A/c”. The profit and loss is a nominal account and therefore is the balances of all nominal accounts and are carried out to it.

The Gross Profit as shown by the Trading Account would be transferred to the credit side of the Profit and Loss A/c. On the credit side of the Profit or Loss account would also be shown other items of miscellaneous income such as Interest, Commission, Discount, Dividend, Profit on exchange, Rent received etc.

On the debit side would be set out all the expenses incidental to the carrying on the business, such as office rent, salaries, insurance, advertising, printing and such other expenses or losses as may have arisen in the course of earning the above income.

‘Die balance or differences of debit and credit is the final result of the farmer’s operations for the period and is either net profit or net loss which is carried to the capital account. The net loss is carried to the debit side of the capital account by formal entry crediting profit and loss account and debiting the capital account, as the capital is reduced by the amount of the loss; Net profit is transferred to the credit of the capital account by an entry debiting Profit and Loss account and crediting capital account, as the capital is increased by the amount of the profit.

Points to have while constructing Profit and Loss account.

1. That only such items of income and expenses which properly belong to the business are included on each side of the account.

2. That the items include pertaining to the trading period under review.

3. That each item of income or expenditure is shown under its appropriate head.

4. That there is proper grouping and classification of items.

5. That the whole account is constructed upon a consistent basis from year to year so as to admit of useful comparison.

Forms of Profit and Loss account:

It varies with the nature of the business, information sought. The account should be so drawn up as to disclose the fullest information at a glance, as also to enable the easy comparison to be made of the various expenses and the source of income with similar items of the previous year’s record.

Uses of the Profit and Loss Account:

1. Financial result is ascertained for the working year.

2. The true nature and extent of expenses or loss arranged under various headings and the sources of income are known.

Items to be included in the Profit and Loss Account:

1. All operating expenses (other than investment) whether actually paid or not.

2. All the farm income (other than receipts from the sale of articles which formed the part of the equipments) that is, farm produce, dairy produces, poultry produce, fisheries produces etc., increase in the value of livestock during the given period or year, whether actually received or not.

3. The profits from the sales of farm produce held over from previous year.

4. The estimated value of goods produced and still held for future sale or use on the farm.

5. The value of farm produce supplied to the household of the farmer.

6. The value of farm produce of the current year given as wages or fed to livestock during the year if it is also shown into account.

Balance Sheet:

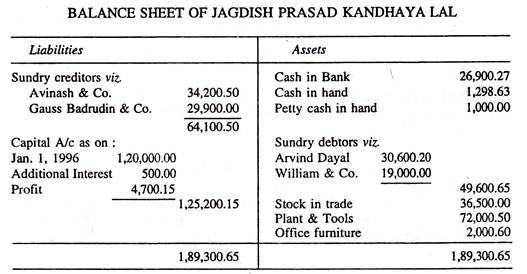

Having ruled off the Ledger, and compiled the Trading a/c, Profit and Loss account and ascertained the net profit and added to capital account, the final step is to prepare, from the remaining balances, an independent statement called the Balance Sheet which will show the trader’s financial position at the date of balancing the books.

The Balance Sheet is, therefore, a statement at a given date showing on the one side the trader’s property and possessions, and on the other liabilities, represents the capital of the business.

Or

Balance Sheet is a statement setting fourth the various assets and liabilities as well as the capital of the business at a given date.

It is a second trial balance or a classified summary of the debit and credit balances, which remain in the books after transferring the items to Profit and Loss account, with sides reversed.

Assets means the entire possessions and property of every description which the business owns at any particular date. They are the debit balances of Profit and Loss account, and real accounts, balances of certain nominal accounts, and such as payments made in advance and outstanding debtors of accrued income and also included among the assets. An asset is, therefore, something of value which either belong to the business or is owned to it by someone else.

Liabilities are the total debits owed to others at any particular date. They are credit balances of real (bills payable) accounts and Personal Accounts, and Capital Accounts. The amount of outstanding expenses such as wages remaining unpaid on the date of closing, and income received in advance such as hire of implements received for an unexpired period, etc. are also included among the liabilities.

Assets and liabilities are in classified form:

Assets are recorded on the right hand side and Liabilities on the left hand side.

Balance Sheet is a statement not an account. Therefore, no To or By or Dr. and Cr. are used.

Dr. Balances consist of Assets.

They are:

1. Cash in hand or in bank.

2. Plant and tools.

3. Office furniture’s.

4. Stock of goods.

5. Debit due to customers.

Cr. balances consists of liabilities.

They are:

1. Sums due to creditors.

2. Proprietor’s capital account.

In case of private drawings in B.S. it is shown as a deduction from the capital account.

Explanation:

On Jan. 1,1996 Jagdish Prasad Kandhaya Lai began with Rs.1,20,000 as capital, to which a sum of Rs.500 was added for interest and charged to the business expenses.

Proving the book:

If the capital of capital account after the net profit or loss transferred to it is equal to the capital of B.S. it is proved.

It does not exhibit true financial position of the business as it is not on market price of asset and then may be price fluctuations but it is not a serious one.