Here is an essay on ‘Life-Cycle-Cost Analysis of a Project’ for class 9, 10, 11 and 12. Find paragraphs, long and short essays on ‘Life-Cycle-Cost Analysis of a Project’ especially written for school and college students.

Essay on Life-Cycle-Cost Analysis

Essay Contents:

- Essay on the Definition of Life-Cycle Cost Analysis

- Essay on the Applications of Life-Cycle Cost Analysis

- Essay on the Formula of Life-Cycle Cost Analysis

- Essay on Comparison between Simple Pay Back and Life Cycle Cost Assessment

- Essay on the Advantages of Life-Cycle Cost Analysis

- Essay on the Disadvantages of Life-Cycle Cost Analysis

ADVERTISEMENTS:

Essay # 1. Definition of Life-Cycle Cost Analysis:

Life-cycle cost analysis (LCCA) is a method for evaluating all relevant costs over time of a project, product or measure. The LCC method takes into account first costs, including capital investment costs, purchase and installation costs; future costs, including energy costs, operating costs, maintenance costs, capital replacement costs, financing costs and any resale, salvage or disposal cost over the life-time of the project, product or measure.

Time Adjustments:

Adjustments to place all dollar values expended or received over time on a comparable basis are necessary for the valid assessment of a project’s life-cycle costs and benefits. Time adjustment is necessary because a dollar today does not have equivalent value to a dollar in the future. There are two reasons for this disparity in value. First, money has real earning potential over time among alternative investment opportunities and future revenues or savings always carry some risk.

ADVERTISEMENTS:

Thus an investor will require a premium or extra return for postponing to the future the spending of that dollar. Second, in an inflationary economy, purchasing power of money erodes over time. Thus a person would demand more than a dollar at some future time to obtain equivalent purchasing power to a dollar held today.

The process of converting streams of benefits and costs over time in the future back to an equivalent ‘present value’ is called discounting. A discount rate is used in special formulas to convert future values. When future values are expressed in current (nominal) dollars, where inflation is included in the future values, a market (nominal) discount rate is used. It takes into account both inflation and the earning potential of money over time.

When future values are expressed in real (constant dollar) terms, where general price inflation has been stripped out, a real discount rate is used. It takes into account only the earning potential or money over time. Both approaches yield identical results as long as you use real discount rates in discounting constant-dollar future amounts and market discount rates in discounting current-dollar future amounts.

Choices among energy-savings projects can be made either by estimating for each alternative project a stream of life-cycle costs and savings relative to a ‘base case’ and computing the net present value (NPV) of that stream (looking for the maximum NPV) or by calculating the present value of each project’s life-cycle cost and choosing the alternative (including ‘do nothing’) that yields the minimum present-value life-cycle cost (PVLCC).

ADVERTISEMENTS:

ADVERTISEMENTS:

Essay # 2. Applications of Life-Cycle Cost Analysis:

Projects may be compared by computing the LCC for each project, using the formula above and seeing which is lower. The alternative with the lowest LCC is the one chosen for implementation, other things being equal.

The LCC method can be applied to many different kinds of decisions when the focus is on determining the least-cost alternative for achieving a given level of performance. For example, it can be used to compare the long-run costs of two building designs; to determine the expected savings of retrofitting a building for energy or water conservation, whether financed or agency-funded; to determine the least expensive way of reaching a targeted energy use for a building; or to determine the optimal size of a building system.

In addition to the LCC formula shown above, there are other methods for combing present values to measure a project’s economic performance over time, such as Net Savings, Savings-to-investment ratio, adjusted internal rate of return or discounted payback.

ADVERTISEMENTS:

Discounted Payback (DPB) and Simple Payback (SPB):

Discounted payback (DPB) and simple payback (SPB) measure the time required to recover initial investment costs. The payback period of a project is expressed as the number of years just sufficient for initial investment costs to be offset by cumulative annual savings.

DPB is the preferred method of computing the payback period for a project because it requires that cash flows occurring each year be discounted to present value to adjust for the effect of inflation and the opportunity cost of money. The SPB does not use discounted cash flows and therefore ignores the time value of money, making it a less accurate measure than the DPB.

In practice, the DPB or SPB is used to measure the time period required for accumulated savings to offset initial investment costs. Any costs or savings incurred during the remainder of the project life-cycle are ignored. The DPB and the SPB are therefore not appropriate measures of life-cycle cost effectiveness and should be used only as screening tools for qualifying projects for further economic evaluation.

ADVERTISEMENTS:

ADVERTISEMENTS:

Essay # 3. Formula of Life-Cycle Cost Analysis:

To find the total LCC of a project, sum the present values of each kind of cost and subtract the present values of any positive cash flows such as a resale value.

Thus, where all dollar amounts are converted to present value by discounting, the following formula applies:

Life-cycle cost = first cost + maintenance and repair + energy + water + replacement – salvage value

ADVERTISEMENTS:

ADVERTISEMENTS:

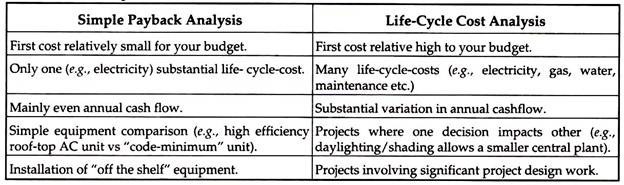

Essay # 4. Comparison between Simple Pay Back and Life Cycle Cost Assessment:

For relatively less expensive, simpler projects and measures, calculating the simple payback (SPB) can be enough to make a sound decision. SPB is how long it will take for cumulative energy savings and other benefits to equal or ‘payback’ your initial investment. It is calculated by dividing the dollar cost of the project by the dollar benefits. But for more costly and complicated investments, doing a Life-Cycle Cost Analysis (LCCA) is necessary to make a sound decision.

As the term implies, LCCA is a financial decision making method that considers first cost, and all costs and benefits over the lifetime of the project. This is also called a ‘total cost of ownership’ approach. It is powerful, worth learning, and relatively simple to understand. Below are the advantages and disadvantages of each.

Advantages of Simple Payback:

ADVERTISEMENTS:

i. A simple way to screen relatively low-cost measures based on payback (or return on investment (ROI) which is 1 divided by the simple payback.)

ii. Easier to communicate to a non-technical audience

Disadvantages of Simple Payback:

i. You can’t compare complex projects and measures where costs and savings vary in both magnitude and timing (e.g. a condensing boiler and a standard boiler).

ii. Does not account for benefits and costs after the equipment has been paid back, so it can disadvantage projects with long useful lives (e.g. a high efficiency chiller with a 20 year life).

iii. It does not account for (1) maintenance, interest on loans, and disposal costs; (2) time value of money, and; (3) volatility of utility costs.

ADVERTISEMENTS:

ADVERTISEMENTS:

Essay # 5. Advantages of Life-Cycle Cost Analysis:

i. Helps you compare projects ‘apples to apples’ financially even if they have different timing and magnitude of costs and savings.

ii. Provides you with a more complete financial picture by considering first cost, and all costs and benefits over the entire lifetime of the project.

iii. Enables you to compare different combinations of measures and choose the one that will maximize your savings and financial return.

iv. Reduces your investment risk by projecting a more complete picture of the future.

Essay # 6. Disadvantages of Life-Cycle Cost Analysis:

ADVERTISEMENTS:

i. Is harder to learn and apply.

ii. Getting input data can be challenging.

When to use LCCA versus simple payback:

Here is a simple decision table for which to use:

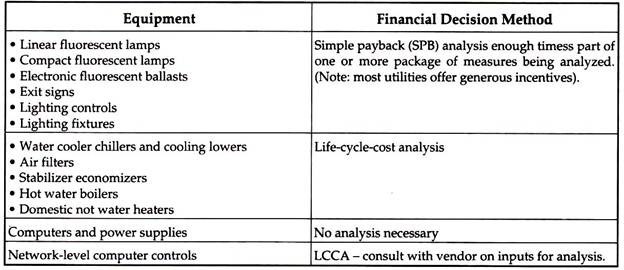

Following is a table of equipment and general guidelines for whether SPB or LCCA is a good financial decision method: