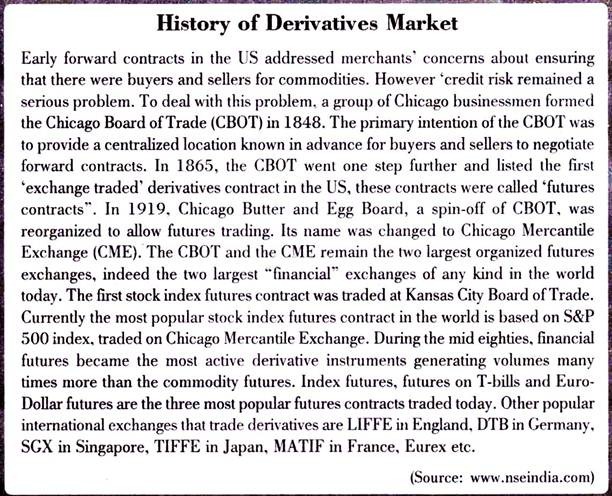

Here is an essay on ‘Derivatives’ for class 11 and 12. Find paragraphs, long and short essays on ‘Derivatives’ especially written for college and management students.

Essay on Derivatives

1. Essay on the Introduction to Derivatives:

With the expansion of business opportunities, the business organizations are exposed to high risk. This can be attributed to increased volatility in asset prices in financial markets, integration of national financial markets with the international markets, competition, and increased reliance on capital markets for long term funds.

This risk can be reduced or modified with the help of derivatives. Consequently, derivatives are basically used as a hedging tool to protect against risks. Though derivatives basically serve as a hedging tool, it is also used to speculate by taking a position in anticipation of a market movement.

ADVERTISEMENTS:

What are Derivatives?

Derivatives are assets whose value is determined from the value of some underlying assets. The underlying assets may be equity, commodity or currency. The most important types of derivatives are Forwards, Futures, Options, and Swaps.

Derivatives can be traded over the counter or on an exchange. Derivatives traded on exchange are standardized contracts and they generally go through the Clearing Corporation. Derivatives traded over the counter are not standardized, are privately negotiated and do not go through Clearing Corporation.

In the Indian context the Securities Contracts (Regulation) Act, 1956 (SC(R)A) defines “derivative” to include:

ADVERTISEMENTS:

i. A security derived from a debt instrument, share, loan whether secured or unsecured, risk instrument or contract for differences or any other form of security.

ii. A contract which derives its value from the prices, or index of prices, of underlying securities.

Derivatives are securities under the SC(R)A and hence the trading of derivatives is governed by the regulatory framework under the SC(R)A.

Participants in the Derivatives Market:

ADVERTISEMENTS:

i. Hedgers face risk associated with the price of an asset. They use futures or options markets to reduce or eliminate this risk.

ii. Speculators wish to bet on future movements in the price of an asset. Futures and options contracts can give them an extra leverage; that is, they can increase both the potential gains and potential losses in a speculative venture.

iii. Arbitrageurs are in business to take advantage of a discrepancy between prices in two different markets. If, for example, they see the futures price of an asset getting out of line with the cash price, they will take offsetting positions in the two markets to lock in a profit.

ADVERTISEMENTS:

ADVERTISEMENTS:

2. Essay on the Types of Derivatives:

1. Forward Contract:

Forward contract made today between a buyer and seller to exchange the commodity or instrument for cash at a predetermined future date at a price agreed upon today.

The price specified in the forward contract is referred to as the Delivery Price and the time specified is referred to as the Delivery Date. A forward contract is settled at maturity. The seller of the contract delivers the specified asset to the buyer of the contract on the specified delivery date in return for payment of the specified price.

ADVERTISEMENTS:

Thus, in a forward market, the contract is initiated at one time but the performance occurs at a subsequent time. Though the terms of the contract, such as price, delivery date and quantity and quality of the asset are specified at the time of initiating the contract, but actual payment and delivery of the asset occur later. The asset may be a commodity such as wheat, gold, etc. or a financial asset such as equity shares of a company, or foreign currency like US Dollars.

We enter into Forward contracts in our day to day life.

For example:

When a customer intends to buy a new car, that is not readily available, he books the car by paying a deposit to the car dealer. The car dealer also enters into a commitment to deliver the car on the future specified date.

ADVERTISEMENTS:

While entering into this contract, the customer (buyer) and the car dealer (seller) would decide on the following features of the car (underlying asset):

(a) The colour of the car

(b) The model of the car (e.g. basic, middle version or top end model with all facilities)

(c) The date of delivery

ADVERTISEMENTS:

(d) The on-road price of the car (with details of registration, etc.)

(e) The place at which delivery will be made

(f) The details of the accessories with the car

(g) The details of other services provided by the dealer

(h) The financing details of the customer

To summarize, the salient features of forward contracts are:

ADVERTISEMENTS:

(a) They are bilateral contracts and hence exposed to counter-party risk.

(b) Each contract is custom designed, and hence is unique in terms of contract size, expiration date and the asset type and quality.

(c) The contract price is generally not available in public domain.

(d) On the expiration date, the contract has to be settled by delivery of the asset.

(e) If the party wishes to reverse the contract, it has to compulsorily go to the same counter-party, which often results in high prices being charged.

Advantages of Forwards:

ADVERTISEMENTS:

(a) It is an ideal tool for hedging the risk arising from price fluctuations of underlying assets.

(b) The terms of the exchange are determined by mutual agreement to suit the convenience of the two counter parties, as compared to future contracts

(c) It can be tailor-made to meet the requirements of the two parties to the contract, in terms of the size of the contract as well as the date of forward delivery.

Disadvantages of Forwards:

i. It Involves Credit Risk or Default Risk:

In a forward contract, there is no mechanism to prevent default by the seller or the buyer, since it is a private agreement between two parties. There is a high temptation to default, in case of loss to any of the party. If the actual spot price is higher than the forward price, the buyer of the forward contract is in an advantageous situation because he gets the asset at a cheaper price than the prevailing market price.

ADVERTISEMENTS:

The seller of the future contract is in a disadvantageous situation because he has to deliver the asset at a price which is lower than the current market price. So, the seller would be tempted to default. The same default may be possible in case of the buyer also, because he will be in a disadvantageous situation if the actual spot price is lower than the forward price.

Example:

An Indian importer has to pay its US supplier after 3 months, say $100,000. He expects an appreciation in US dollar currency which is trading at Rs. 45. So, he enters into a forward contract with a forex dealer to buy $100,000 after 3 months at Rs. 46. After 3 months, the market price of $ is Rs. 44. Now, the importer may be tempted to default because he can save Rs. 200,000 {$100,000 × (Rs. 46-Rs. 44)} by buying $ in the market instead of the forex dealer.

ii. Forward Contracts are Illiquid:

A forward contract cannot be cancelled except with the consent of both the counter parties. It is a private agreement between the two parties. The obligations of a counter party cannot be transferred to a third party. The contract has to be settled at maturity through fulfillment of mutual obligations of both the parties. Thus, a forward contract has no liquidity and no marketability.

Since Forwards have inherent disadvantages, future contracts explained below are used extensively. Nevertheless, forwards are still used by international traders, around the globe, to cover foreign exchange risk exposure.

ADVERTISEMENTS:

2. Futures Contract:

It is a financial security, issued by an organized exchange to buy or sell a commodity, security or currency at a predetermined future date at a price agreed upon today. Futures contract have been designed to remove the disadvantages of forwards.

The details of a forward contract are negotiated between the parties to the contract, whereas, futures are standardized by the exchange. The negotiation in case of futures is done only for price; all other terms like underlying asset, its quality, the contract size, the delivery place and time are decided by the exchange.

Futures contracts are broadly grouped into two types: commodity futures and financial futures. In a commodity future, the underlying asset would be a commodity such as wheat, cotton, gold, silver, etc. In a financial future, the underlying asset would be stocks, bonds, currencies, etc.

Important Terms in Future Contracts:

(a) Long Position:

ADVERTISEMENTS:

The act of buying a futures contract is referred as taking a long position on the contract.

(b) Short Position:

The act of selling a futures contract is referred as taking a short position on the contract.

(c) Trading Volume:

The buyer takes a long position on the contract for a particular price and the seller takes a short position on the same contract at the same price, it generates trading volume of one contract.

(d) Spot Price:

The price at which an asset trades in the spot market.

(e) Futures Price:

The price at which the futures contract trades in the futures market.

(f) Contract Cycle:

The period over which a contract trades. The index futures contracts on the NSE have one-month, two-months and three-months expiry cycles which expire on the last Thursday of the month. Thus a January expiration contract expires on the last Thursday of January and a February expiration contract ceases trading on the last Thursday of February. On the Friday following the last Thursday, a new contract having a three- month expiry is introduced for trading.

(g) Expiry Date:

It is the date specified in the futures contract. This is the last day on which the contract will be traded, at the end of which it will cease to exist.

(h) Contract Size:

The amount of asset that has to be delivered under one contract. Also called as lot size.

(i) Open Interest:

Open Interest is the total number of outstanding contracts that are held by market participants at the end of the day. For each seller of a futures contract there must be a buyer of that contract. Thus a seller and a buyer combine to create only one contract.

Calculation of Open Interest:

Each trade completed on the exchange has an impact upon the level of open interest for that day. This can be explained as for example, if both parties to the trade are initiating a new position (one new buyer and one new seller), open interest will increase by one contract. If both traders are closing an existing or old position (one old buyer and one old seller) open interest will decline by one contract.

The third and final possibility is one old trader passing off his position to a new trader (one old buyer sells to one new buyer). In this case the open interest remains unchanged.

(j) Clearing House:

It is the clearing house which arranges for the delivery of the asset and the payment of money to the counter parties. Normally, the two parties to a transaction are located far apart and may not even know each other. This creates the risk of default and uncertainty of performance. To resolve this problem, each futures exchange has its own clearing house.

The clearing house is a well-capitalized financial institution that guarantees contract performance to both parties. As soon as the trade position is created, the clearing house interposes itself between the buyer and the seller. At this point, the original buyer and seller have obligations to the clearing house and no obligations to each other.

(k) Margins:

It is a deposit to be made to the clearing house by the parties entering into a futures contract. The seller has to deliver the asset to the clearing house and the buyer has to make payment to the clearing house, since the clearing house is responsible for the fulfillment of their obligations. If any of the parties default, the clearing house has to bear the losses. So, it prescribes a margin system for trading in futures. There are three types of margins.

a. Initial Margin (Performance Margin):

Each transaction calls for a good faith deposit known as initial margin, to be posted with the broker. The minimum amount of initial margin required is set by the exchange based on the price volatility of the underlying product. The amount is fixed as a percentage of the base value of the futures contract, ranging from 5% to 25%. This percentage will depend on the risk involved in the underlying asset.

b. Maintenance Margin:

The buyer and the seller are expected to maintain a minimum balance, known as maintenance margin, in their margin accounts throughout the duration of the contract. If the balance in the maintenance margin account drops below the maintenance margin level, a margin call is issued by the exchange to the party concerned.

c. Variation Margin:

The value of a contract position is settled every day. For example, if a contract price increases, the party with long position would receive cash equal to the value of the gains, while the party with short position would have to pay in funds equal to the value of the losses. This pay in and pay out of funds is called as variation margin.

(l) Marking to Market:

The futures contract is revalued daily on the basis of the market price prevailing each day. When the market price of the underlying asset declines, the buyer (long position) of the contract suffers a loss to the extent of the decline and the seller (short position) of the contract gains.

The decline in the value of the futures contract is debited to the margin account of the buyer and credited to the margin account of the seller. Exactly opposite happens, when the market price of the underlying asset increases.

This process is referred as Marking to market. If the trading party does not have the required funds in its margin account, the exchange issues a margin call to the party concerned. Additional funds have to be deposited by the concerned party to bring the margin account in line with the initial margin. If these funds are not deposited on time, then exchange cancels the contract and recovers the loss from the defaulting party.

Example:

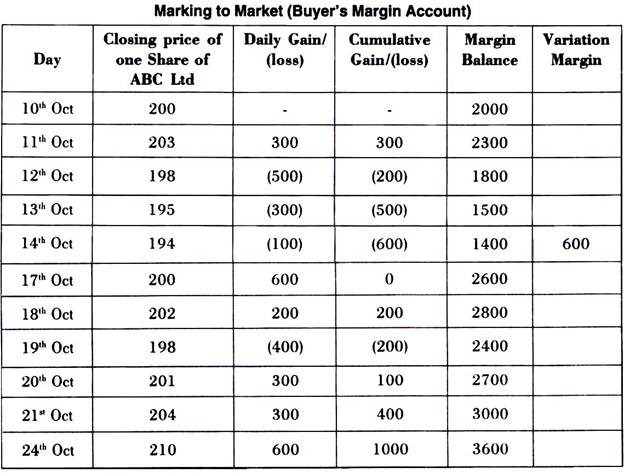

The following are the details of a futures contract for equity shares of ABC Ltd:

1. Contract size = 100 shares

2. The investor buys one November future contract of ABC Ltd at Rs. 200 per share on 10th October, Monday.

3. Value of contract = Rs. 200 ×100 shares = Rs. 20,000

4. Initial margin = 10% = Rs. 2000

5. Maintenance margin = 75% of initial margin = Rs. 1500

From the above table, it is clear that the margin call is made whenever (14th Oct) the maintenance (variation) margin falls below the required limit. On 24th Oct, the profit is Rs. 1000 (Rs. 3600 + Rs. 2600).

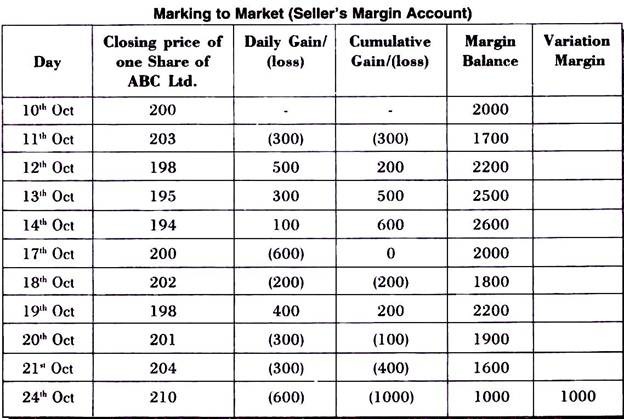

Compute the seller’s margin account considering the same example above. If the investor sells one November future contract of ABC Ltd at Rs. 200 per share on 10th October, Monday

From the above table, it is clear that the seller lost Rs. 1000 (Rs. 2000 – Rs. 1000). It represents the gain of the buyer.

(m) Closing the Futures Contract:

A futures contract can be settled in two ways:

i. The first method is through the exchange of the asset and the cash on the delivery date.

ii. The second method is through cash settlement which is effected by entering into a reverse trade on any day before the delivery date

(n) Underlying Assets:

i. Agricultural commodities such as wheat, cotton, sugar, coffee, etc.

ii. Precious metals and minerals such as gold, silver, coal, etc.

iii. Foreign currency such as dollar, euro, etc.

iv. Stock market indices

v. Equity shares.

(o) Index Futures:

When a stock market index (say, S & P, CNX, Nifty) is used as an underlying asset to create a futures contract, it is known as Index Futures. Index futures have been trading across the globe since long, but it was introduced in India in the year 2000. An index future cannot be settled by delivery of the index, so settlement is done by payment or receipt of cash. Investors may use index futures for hedging their risk, while speculators may use them for making gains from the movement of underlying stock indices,

(p) Valuation of Future Contract:

In derivative securities, continuous compounding is used.

i. In case of a non-dividend paying stock, the following formula is used. F = Sen

ii. In case of income paying asset (like dividend on stock and interest on bond), the following formula is used.

F = (S – D)ert

iii. In case of income in form of percentage (yield), the following formula is used.

F = Se(r-y)t

iv. Formula for finding the present value of dividend / interest

PV of Income = FV of Incomexe-rt

D = D1xe-rt

Where,

F = Theoretical futures price

S = Value of the underlying index

r = Cost of financing (using continuously compounded interest rate) or rate of interest (MIBOR)

t = Time till expiration

e = 2.7183

D = Dividend / Interest paying securities = Use Present value of income

y = Dividend yield in %

3. Options Contract:

It is a type of a contract between two parties when one person grants the other person the right to buy (or sell) a specific asset at a specific price within a specific time period, in exchange for some compensation.

Some of the Important Terms of Option Contracts are as follows:

(a) Option Buyer:

The person who has received the right (no obligation) and thus has a decision to make is known as the option buyer. The option buyer pays for the right.

(b) Option Writer (Seller):

The person who has sold the right to the buyer and has the obligation to respond to buyer’s decision is known as option writer. The option writer receives money for selling the right.

(c) Option Price/Premium:

Option price is the price which the option buyer pays to the option seller. It is also referred to as the option premium.

(d) Expiration Date:

The date specified in the options contract is known as the expiration date, the exercise date, the strike date or the maturity.

(e) Strike Price:

The price specified in the options contract is known as the strike price or the exercise price.

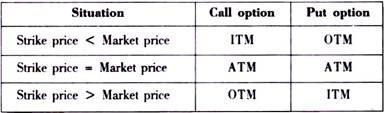

(f) In-the-Money (ITM) Option:

An in-the-money (ITM) option is an option that would lead to a positive cash flow to the holder if it were exercised immediately. Example, when a call has a strike price that is less than the market price of the underlying equity; it has a positive value and is known as ITM option. In case of put option, it is ITM when its strike price is greater than the market price of the underlying equity.

(g) At-the-Money (ATM) Option:

An at-the-money (ATM) option is an option that would lead to zero cash flow if it were exercised immediately. Example, a call and put option, both are ATM, if the strike price is equal to market price.

(h) Out-of-the-money (OTM) Option:

An Out-of-the-money (OTM) option is an option that would lead to a negative cash flow to the holder if it were exercised immediately. Example, when a call has a strike price that is more than the market price of the equity; the call has no ‘real’ value and is known as on OTM option. In case of put option, it is OTM when its strike price is less than the market price of the underlying equity.

(i) Index Options:

These options have the index as the underlying asset. Some options are European while others are American. Like index futures contracts, index options contracts are also cash settled,

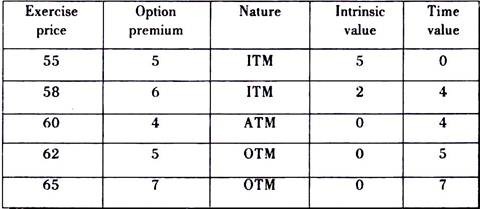

(j) Intrinsic Value:

An option’s premium consists of two parts; intrinsic value and time value. Intrinsic value represents the extent to which the option is in the money (ITM) if it is in the money. This means that in respect of options that are at the money or out of the money there is no intrinsic value i.e. intrinsic value cannot be negative.

(k) Time Value:

It is the difference between option premium and intrinsic value and is the premium paid for the time value of money. Time value falls with time and falls to zero on the expiration date. It cannot be negative.

Example:

Suppose the current market price of a stock is Rs.60 and the exercise price and premium of the call option of the stock is given below:

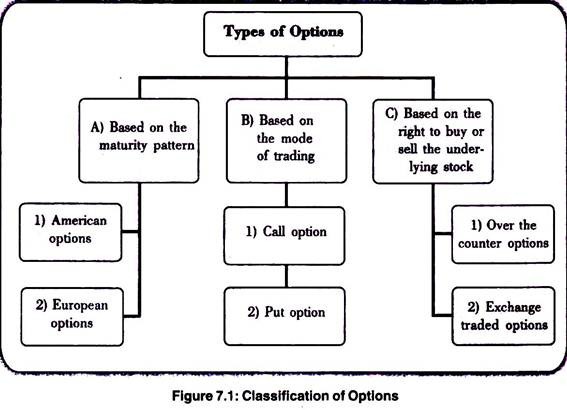

Types of Options:

The Options could be classified based on different criteria as displayed in figure 7.1.

(A) Based on the Maturity Pattern of Options, Option Contracts are Categorized into:

1. American Options:

An American option can be exercised any time up to and including the expiry date.

2. European Options:

A European option can be exercised only on the maturity date or the expiry date of the option.

(B) Based on the Mode of Trading, Options can be Categorized into:

1. Over the Counter (OTC) Option:

OTC options result from private negotiations between two parties (typically, a financial institution like bank or broker and a client). The contract may be of any amount, any financial instrument, at any agreed price, having any expiry date. These are tailor made contracts depending on the requirements of the parties. OTC options are very extensively used in case of hedging foreign exchange transaction risk.

2. Exchange Traded Options:

This type of options are bought and sold on organized exchanges. They are standardized as to the amount and exercise price of the underlying instrument, the nature of the underlying instrument and the expiry dates. Only the option prices (premium) are decided by demand and supply.

(C) Based on the Right to Buy or Sell the Underlying Stock, the Two Basic Types of Options are:

1. Call Option:

A call option gives the holder the right but not the obligation to buy an asset by a certain date for a certain price.

2. Put Option:

A put option gives the holder the right but not the obligation to sell an asset by a certain date for a certain price.

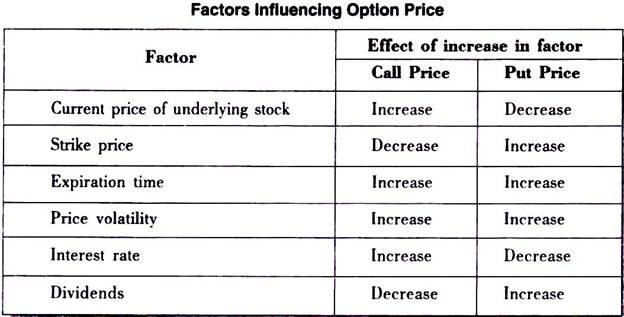

Factors Determining Option Price:

In purchasing an option, the amount paid by the buyer to the option writer is called as premium or option price.

The following factors determine the option price:

1. Volatility:

The more the volatility in the stock, the more are the chances of making money. In case of highly volatile stocks, the option buyer makes profit when price of underlying asset fluctuates considerably, with the risk limited to only the premium paid on the option.

The seller has to take the risk of unlimited losses with the returns limited to the premium received. Thus, the seller is reluctant to write an option unless he is paid more premiums. This leads to higher premium on options of more volatile stocks.

2. Expiration Time:

The longer the time to expiry, higher would be the value of the option. The odds of a stock making a profitable move increase with time. As time goes by, value of a stock option decreases, and decline usually occurs at a faster pace.

3. Striking Price:

The striking price remains the same during the entire life of the option contract. The nearer this striking price is to the market price of the underlying stock, the greater the buyer’s chances of making money on the option contract. In case of call option, the value of option will decline as the strike price increases. In case of put option, the value of option will increase as the strike price increases.

4. Dividends:

During the life of an option, the company may declare dividends. The value of the call option decreases and the value of the put option increases as dividends are paid on the underlying stocks.

5. Interest Rates:

Increase in interest rate will increase the value of a call option and reduce the value of a put option.

6. Current Value of Underlying Stock:

As the option derives its value from the value of the underlying stock, it is directly proportional to the current value of the underlying stock.

Advantages of Options:

1. Leverage:

With a very small amount (in the form of option premium), the investor can get an exposure to huge returns with the loss limited to the amount of premium paid.

2. Time:

Unlike stop-loss orders, options do not shut down when the market closes. Options do not get executed like stop loss orders, during catastrophic loss in the market. They give you insurance 24 hours a day, seven days a week. This is something that stop orders can’t do. This is why options are considered a dependable form of hedging.

3. More Strategic Alternatives:

Options are a very flexible tool. Options allow you to create unique strategies to take advantage of different characteristics of the market – like volatility and time decay.

4. Risk/Reward Ratio:

Some strategies, like buying options, allows you to have unlimited upside with limited downside.

5. Low Capital Requirements:

Options allow you to take a position with very low capital requirements. Someone can do a lot in the options market with Rs. 5,000 but not so much with Rs. 5,000 in the stock market.

Disadvantages of Options:

1. Lower Liquidity:

Many individual stock options don’t have much volume at all. Only few most popular stocks or stock indices will be traded in the options market. Even if they are traded, the investor may not get all combinations of strike price and exercise price.

2. Higher Spreads:

Options tend to have higher spreads because of the lack of liquidity. This means it will cost you more in indirect costs when doing an option trade because you will be giving up the spread when you trade.

3. Higher Premiums:

Options trades will cost you more in case of volatile conditions in the market.

4. Complicated:

Options are very complicated to beginners. Most beginners, and even some advanced investors, think they understand them when they don’t.

5. Time Decay:

When buying options you lose the time value of the options as you hold them. There are no exceptions to this rule.

6. Less Information:

Options can be a pain when it is harder to get quotes or other standard analytical information like the implied volatility.

4. Swaps:

A swap is a contractual agreement between two parties to exchange a stream of payments in future according to specified terms.

Common types of swap include:

1. Currency Swap:

Simultaneous buying and selling of a currency to convert debt principal from the lender’s currency to the debtor’s currency.

2. Debt Swap:

Exchange of a loan (usually to a third world country) between banks.

3. Debt to Equity Swap:

Exchange of a foreign debt (usually to a Third World country) for a stake in the debtor country’s national enterprises (such as power or water utilities).

4. Debt to Debt Swap:

Exchange of an existing liability into a new loan, usually with an extended payback period.

5. Interest Rate Swap:

Exchange of periodic interest payments between two parties (called counter parties) as means of exchanging future cash flows.

The most common type is an interest rate swap and currency swap.

Interest Rate Swap:

An interest rate swap is a contractual agreement entered into between two counterparties under which each agrees to make periodic payment to the other for an agreed period of time based upon a notional amount of principal.

The principal amount is notional because there is no need to exchange actual amounts of principal in a single currency transaction. There is no foreign exchange component to be taken account of. Equally, however, a notional amount of principal is required in order to compute the actual cash amounts that will be periodically exchanged.

Example:

A company, X Ltd. with the highest credit rating, AAA, will pay less to raise funds under identical terms and conditions than a less creditworthy company, Y Ltd with a lower rating, say BBB. Y Ltd has a better borrowing profile in the short maturities than they do in the long maturities. X Ltd. (with more creditworthy status) have a comparative advantage raising money in the longer maturities.

The interest rate swap gives the less creditworthy entity a way of borrowing fixed rate funds for a longer term at a cheaper rate than they could raise such funds in the capital markets by taking advantage of the entity’s relative advantage in raising funds in the shorter maturity instruments like commercial papers.

Currency Swaps:

A currency swap is an agreement between two parties to exchange the principal loan amount and interest applicable on it in one currency with the principal and interest payments on an equal loan in another currency.

These contracts are valid for a specific period, which could range up to ten years, and are typically used to exchange fixed-rate interest payments for floating- rate payments on dates specified by the two parties.

Since the exchange of payment takes place in two different currencies, the prevailing spot rate is used to calculate the payment amount. Such a financial instrument is used as a hedge against foreign exchange rate risk.

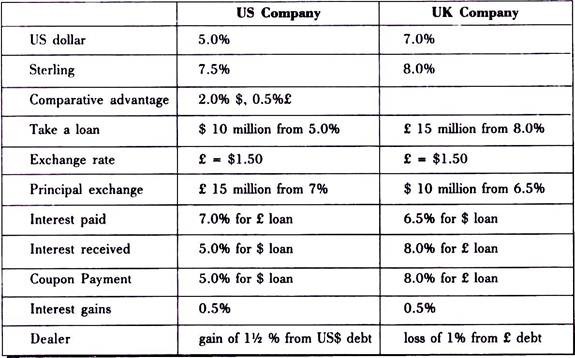

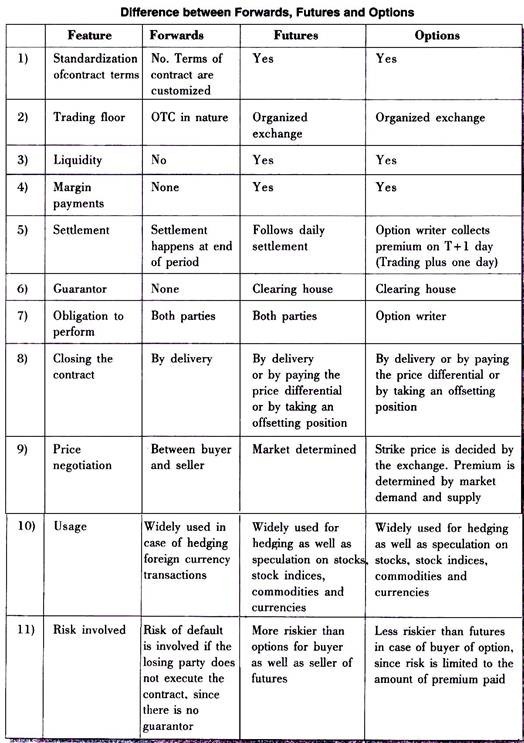

The above table shows that a US company is able to borrow from low fixed rates in US bond market. On the other side, a UK company is also able to raise low fixed rates funds from UK bond market.

In case of both the companies wish to raise funds denominated by other country’s currency, first, each will borrow from its own domestic market by using the comparative advantage. Second, via fixed-to-fixed swap each will be able to raise lower cost of their funds in terms of foreign currency. However, the case is such that the US company’s credibility is better in each market, the swap transaction would be as it is shown in the above Table.

Example:

The table illustrates that the US Company has a comparative advantage in both bond markets, but it will also prefer swap. Because by sharing the gain among the parties, the US Company, the UK Company and the dealer, each of them may raise funds with lower costs. Therefore, each company borrows from the domestic markets and exchanges the principals from the rate of 7.0% for sterling and 6.5% for US dollar.

3. Essay on the Derivatives Market in India:

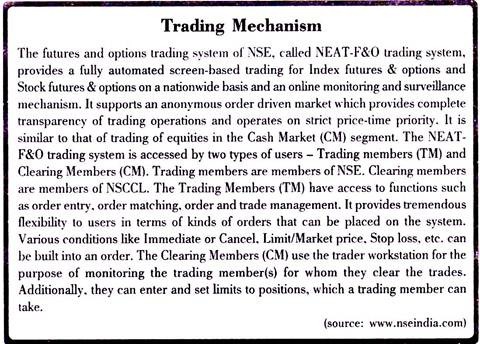

The derivatives trading on the NSE commenced with S & P CNX Nifty Index futures on June 12, 2000. The trading in index options commenced on June 4, 2001 and trading in options on individual securities commenced on July 2, 2001. Single stock futures were launched on November 9, 2001. Today, both in terms of volume and turnover, NSE is the largest derivatives exchange in India.

Currently, the derivatives contracts have a maximum of 3-month expiration cycles. Three contracts are available for trading, with 1 month, 2 months and 3 months expiry. A new contract is introduced on the next trading day following the expiry of the near month contract.

4. Essay on the Taxation of Profit/Loss on Derivative Transaction in Securities:

Income or loss on derivative transactions which are carried out in a “recognized stock exchange” is not taxed as speculative income or loss. Thus, loss on derivative transactions can be set off against any other income during the year. In case the same cannot be set off, it can be carried forward to 8 subsequent assessment years and set off against any other income of the subsequent year. The securities transaction tax paid on such transactions is eligible as deduction under Income-tax Act, 1961.