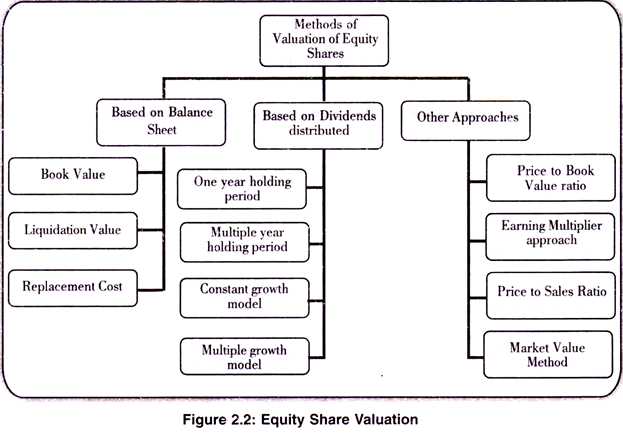

Following are the most common methods used for equity valuation:

Method # 1. Based on Balance Sheet:

i. Book Value:

ADVERTISEMENTS:

It is the net worth of a company divided by number of outstanding shares. Net worth is equal to paid-up equity capital plus reserves and surplus minus losses.

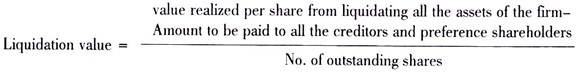

ii. Liquidation Value:

Liquidation value is different than a book valuation. In that it uses the value of the assets at liquidation, which is often less than market and sometimes book. Liabilities are deducted from the liquidation value of the assets to determine the liquidation value of the business. Liquidation value can be used to determine the bare bottom benchmark value of a business.

iii. Replacement Cost:

ADVERTISEMENTS:

Replacement costs provide an alternative way of valuing a company’s assets. The replacement, or current, cost of an asset is the amount of money required to replace the asset by purchasing a similar asset with identical future service capabilities. In replacement cost, assets and liabilities are valued at their cost to replace.

Method # 2. Based on Dividends:

i. One Year Holding Period:

As per this model, the investor intends to purchase now, hold it for one year and sell it off at the end of one year. Thus, the investor would receive dividend of one year as well as the share price at the end of year one.

ADVERTISEMENTS:

To value a stock, we have to first find the present discounted value of the expected cash flows.

Where,

Po = the current price of the stock

ADVERTISEMENTS:

D1 = the dividend paid at the end of year 1

ke = required return on equity investments (Discounting factor)

P1 = the price at the end of period one

Let ke = 12%, Div = 0.16 and P1 = Rs.60.

Po = Rs. 53.71

If the stock was selling for Rs. 53.71 or less, the share should be purchased

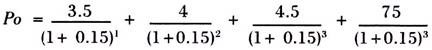

ii. Multiple Year Holding Period:

As per this model, an investor may hold the shares for a number of years and sell it off at the end of it. Thus, he receives dividends for these periods as well as market price of the share after it.

Where,

Po = the current price of the stock

D1, D2, D3……. Dn = annual dividend paid at the end of year 1, 2, 3…n

ke = required return on equity investments (Discounting factor)

ADVERTISEMENTS:

Pn = the price at the end of period n

For example:

If an investor expects to get Rs.3.5, Rs.4 and Rs.4.50 as dividend from a share during the next 3 years and hopes to sell it off at Rs.75 at the end of the third year, and if required rate of return is 15%, the present value of the share will be

iii. Constant Growth Model (Gordon’s Share Valuation Model):

As per this model, dividends will grow at the same rate (g) into the indefinite future and the discount rate (k) is greater than growth rate

Where,

k = discount factor

g = growth rate

Do = current dividend

D1 = Dividend at end of year one

For example:

ADVERTISEMENTS:

Alembic Company has declared a dividend of Rs. 2.5 per share for the current year. The company has been following a policy of enhancing its dividends by 10% every year and is expected to continue its policy in future also. The investor’s required rate of return is 15%. The value of the share will be

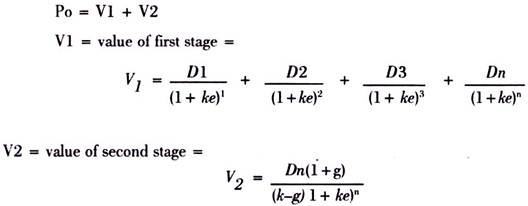

iv. Multiple Growth Model (Also called as the Two Stage Growth Model):

The constant growth model has a very unrealistic assumption of constant growth. The growth may take place at varying rates. In the multiple growth model, the future time period is viewed as divisible into two different growth segments, the initial extraordinary growth period and the subsequent constant growth period.

Where,

ADVERTISEMENTS:

Po = the current price of the stock

D1, D2, D3……. Dn = annual dividend paid at the end of year 1, 2, 3…n

ke = required return on equity investments (Discounting factor)

g = constant growth rate of dividends at the start of the second stage

For example:

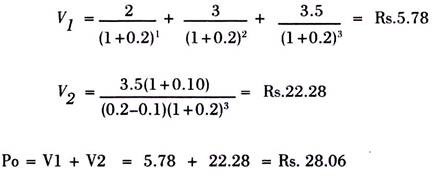

Hindalco paid a dividend of Rs.1.75 per share during the current year. It is expected to pay a dividend of Rs.2 per share during the next year. Investors forecast a dividend of Rs.3 and Rs.3.5 per share respectively during the two subsequent years. After that, it is expected that annual dividends would grow at 10% per year into an indefinite future. The investor’s required rate of return is 20%.

Method # 3. Other Approaches:

i. Price to Book Value Ratio:

The book value of a company is the value of the net assets expressed in the balance sheet. Net assets means total assets minus intangible assets and liabilities. This ratio gives the investor an idea of how much he is actually paying for the share.

ii. Earnings Multiplier Approach:

Under this approach, the value of equity share is estimated as follows:

Po = EPS × P/E ratio.

ADVERTISEMENTS:

Where,

EPS = Earning Per share

P/E ratio = Price Earning Ratio

P/E ratio = Market price per share / earnings per share

iii. Price to Sales Ratio:

It is calculated by dividing a company’s current stock price by its revenue per share for the recent twelve months. This ratio reflects what the market is willing to pay per rupee of sales.

iv. Market Value Method:

This method is used only in case of listed companies, since they have a market value.

Market value of a company = No. of shares outstanding × market price per share